0001577526false00015775262025-02-262025-02-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 26, 2025

C3.AI, INC.

(Exact name of Registrant as Specified in Its Charter)

Delaware

(State or Other Jurisdiction

of Incorporation)

1400 Seaport Blvd

Redwood City, CA

(Address of Principal Executive Offices)

001-39744

(Commission File Number)

26-3999357

(IRS Employer Identification No.)

94063

(Zip Code)

(650) 503-2200

(Registrant's Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A Common Stock, par value $0.001 per share | | AI | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 26, 2025, C3.ai, Inc. (the “Company”) issued a press release announcing its financial results for the fiscal third quarter ended January 31, 2025. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information contained in this Item 2.02 and Item 9.01 in this Current Report on Form 8-K, including the accompanying Exhibit 99.1 hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing made by the Company under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filings, unless expressly incorporated by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 104 | | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| C3.ai, Inc. |

| | |

| Dated: February 26, 2025 | | |

| By: | /s/ Thomas M. Siebel |

| | Thomas M. Siebel |

| | Chief Executive Officer and Chairman of the Board of Directors |

C3 AI Announces Fiscal Third Quarter 2025 Financial Results

26% Year-Over-Year Revenue Growth

Dramatically Expanded Strategic Partnerships with Microsoft, AWS, and McKinsey QuantumBlack

C3 Generative AI Makes History with First Ever Agentic AI Earnings Call

REDWOOD CITY, Calif. — February 26, 2025 — C3.ai, Inc. (“C3 AI,” “C3,” or the “Company”) (NYSE: AI), the Enterprise AI application software company, today announced financial results for its fiscal third quarter ended January 31, 2025.

“In the third quarter, C3 AI achieved significant milestones — expanding our global distribution network, advancing our leadership in agentic and generative AI, and delivering total revenue reaching $98.8 million, up 26% year-over-year,” said Thomas M. Siebel, Chairman and CEO, C3 AI. “We believe C3 AI is broadly credited with inventing Enterprise AI. We invented the model-driven agentic Enterprise AI platform. The operative law as it relates to patent law is first to file, and we filed our initial patent on December 16, 2022, and yes, the U.S. Patent for agentic generative AI was awarded to C3 AI. We have the technology, the management team, and the global partner ecosystem — through our dramatically expanded strategic partnerships with Microsoft, AWS, and McKinsey QuantumBlack — we believe we have all the elements in place to indelibly change the face of Enterprise AI.”

Fiscal Third Quarter 2025 Financial Highlights

•Revenue: Total revenue for the quarter was $98.8 million, an increase of 26% compared to $78.4 million one year ago.

•Subscription Revenue: Subscription revenue for the quarter was $85.7 million, constituting 87% of total revenue, an increase of 22% compared to $70.4 million one year ago.

•Subscription and Prioritized Engineering Services Revenue Combined: Subscription and prioritized engineering services revenue combined was $91.4 million, constituting 93% of total revenue, an increase of 18% compared to $77.5 million one year ago.

•Gross Profit: GAAP gross profit for the quarter was $58.3 million, representing a 59% gross margin. Non-GAAP gross profit for the quarter was $68.2 million, representing a 69% non-GAAP gross margin.

•Net Loss per Share: GAAP net loss per share was $(0.62). Non-GAAP net loss per share was $(0.12).

•Cash Balance: $724.3 million in cash, cash equivalents, and marketable securities.

Business Highlights

C3 AI gained momentum with Microsoft to drive increased pilot activity and broadened its global distribution network through a new strategic partnership with McKinsey & Company QuantumBlack.

•The Company closed 66 agreements including 50 pilots, an increase of 72% year-over-year.

•The Company entered into new and expanded agreements with the New York Power Authority, Worley, Flex, Sanofi, Nucor Corporation, Holcim, Shell, ExxonMobil, Liberty Coca-Cola Beverages, GSK, Quest Diagnostics, SmithRx, and Swift, among others.

•The Company significantly expanded its footprint across State and Local Government, closing 21 agreements across Texas, California, Florida, New Jersey, Indiana, Colorado, Montana, Oregon, Georgia, New Mexico, and Arizona.

•C3 AI’s Federal business had strong execution across the board. The Company entered into new and expanded agreements with the U.S. Department of Defense, the U.S. Air Force, the U.S. Navy, CAE USA, and the Missile Defense Agency.

•C3 AI achieved “Awardable” status on the U.S. Department of Defense’s Chief Digital and Artificial Intelligence Office’s Tradewinds Solutions Marketplace, with the addition of C3 AI Decision Advantage and C3 AI Contested Logistics to Marketplace. The Tradewinds Solutions Marketplace accelerates the technology acquisition process for government agencies, showcasing the best-fit solutions and accelerating procurement.

Partner Network

C3 AI dramatically expanded its strategic partnerships, substantially strengthening its strategic partnership with Microsoft, expanding its relationship with AWS, and establishing a new important alliance with McKinsey & Company QuantumBlack.

•In Q3, the Company closed 47 agreements through its partner network, an increase of 74% year-over-year.

•Microsoft Azure Strategic Alliance

◦C3 AI and Microsoft have, in short order, closed 28 agreements across 9 different industries, a 460% increase quarter-over-quarter. In addition, as of today, the companies are engaged in joint sales campaigns to 621 accounts in Europe, Asia, and North and South America.

◦The joint qualified opportunity pipeline with Microsoft has increased by over 244% year-over-year.

◦Sales cycles with Microsoft have shortened by nearly 20% quarter-over-quarter.

◦In the current quarter, C3 AI and Microsoft are refining a highly tuned closely coordinated joint market sales and service motion. This includes alignment of strategic objectives and target accounts, a regular executive meeting cadence, and expansion of event and enablement activities including jointly hosting executive roundtables, virtual fireside chats, and three-day workshops, where we jointly engage hands-on with customers to bring working enterprise AI applications live in three days.

•C3 AI and AWS dramatically expanded their strategic alliance. Under the expanded agreement, C3 AI and AWS will continue to jointly offer advanced Enterprise AI solutions, focusing on executing a robust go-to-market strategy.

•C3 AI and McKinsey & Company announced a major new strategic alliance, initially showcased at World Economic Forum in Davos. This collaboration combines McKinsey QuantumBlack’s expertise in AI business transformation with C3 AI’s Enterprise AI application leadership to deliver high assurance AI-powered digital transformation at global scale.

Customer Success

With C3 AI, customers across sectors continued to realize significant operational improvements and cost efficiencies — achieving increased reliability, optimized production schedules, optimized supply chain management and enhanced forecasting.

•GSK, a leading global biopharma company, is significantly scaling out the C3 AI Demand Forecasting application across regions and products to enhance its supply chain, ensuring more accurate and efficient delivery of critical medicines and vaccines to patients worldwide. With this AI application, GSK can better predict and respond to market fluctuations, optimize its manufacturing operations, and improve its supply chain visibility to deliver significant cost savings.

•Worley, an engineering and professional services company, has partnered with C3 AI and Microsoft to accelerate supply chain and value chain solutions for the technology solutions business. The initial scale solution focuses on small modular reactors (SMRs), which can be applied to the broader, complex nuclear industry. Worley is using the C3 AI Supply Chain Suite and C3 AI Asset Performance Suite to deliver increased efficiency and refined predictive capabilities for streamlined business practices for itself and to scale up across its lighthouse customers.

C3 Generative AI

C3 AI’s continuous innovation in generative AI to build its growing suite of secure, enterprise-grade solutions drives adoption across industries.

•In Q3, the Company closed 20 C3 Generative AI pilots with Mars, Liberty Coca-Cola Beverages, the U.S. Department of Defense, and others, including various government agencies in New Jersey, Montana, and California.

•C3 AI advances its technology stack with a breakthrough foundation time series embedding model. This innovation enables direct retrieval and reasoning on time series, streamlining the configuration of applications that require sensor data. Key benefits include the automatic identification of anomalies, and the cataloging and retrieval of relevant actions (e.g., relevant past work orders) or expert recommendations.

•SmithRx, a next-generation pharmacy benefits manager, is using C3 Generative AI to streamline member support and enhance customer service. Using C3 Generative AI, call center operators are able to get access to key information, such as member history, drug eligibility, and lower-cost alternatives for customers from across multiple systems. The AI application has significantly reduced call handle times. This efficiency allows SmithRx focus to improve member outcomes, increase member satisfaction, and reduce costs.

C3 Transform 2025

C3 AI will be holding its sixth annual international user’s group conference, C3 Transform, in Boca Raton from March 18–20, 2025. The entire C3 AI board of directors will be actively participating, as will the entire executive team. Customers, partners, and prospects from multiple geographies and a multiplicity of industries will be actively engaged, including leaders across almost every sector. By bringing together C3 AI experts and early adopters who can speak to the value of Enterprise AI, C3 Transform gives customers, partners and prospects the chance to discover exactly how they can use Enterprise AI and generative AI securely and effectively. The C3 Transform agenda is available as part of our FY25-Q3 Investor Supplemental.

Financial Outlook:

The Company’s guidance includes GAAP and non-GAAP financial measures.

The following table summarizes C3 AI’s guidance for the fourth quarter of fiscal 2025 and full-year fiscal 2025:

| | | | | | | | | | | |

| (in millions) | Fourth Quarter Fiscal 2025 Guidance | | Full Year Fiscal 2025 Guidance |

| Total revenue | $103.6 - $113.6 | | $383.9 - $393.9 |

| Non-GAAP loss from operations | $(30.0) - $(40.0) | | $(87.0) - $(97.0) |

A reconciliation of non-GAAP guidance measures to corresponding GAAP measures is not available on a forward-looking basis without unreasonable effort due to the uncertainty regarding, and the potential variability of, expenses that may be incurred in the future. Stock-based compensation expense-related charges, including employer payroll tax-related items on employee stock transactions, are impacted by the timing of employee stock transactions, the future fair market value of our common stock, and our future hiring and retention needs, all of which are difficult to predict and subject to constant change. We have provided a reconciliation of GAAP to non-GAAP financial measures in the financial statement tables for our historical non-GAAP results included in this press release. Our fiscal year ends April 30, and numbers are rounded for presentation purposes.

Conference Call Details

| | | | | |

| What: | C3 AI Third Quarter Fiscal 2025 Financial Results Conference Call |

| When: | Wednesday, February 26, 2025 |

| Time: | 2:00 p.m. PT / 5:00 p.m. ET |

| Participant Registration: | https://register.vevent.com/register/BId3a29d38315445ceac8b1dc16f2068e9 (live) |

| Webcast: | https://edge.media-server.com/mmc/p/h8imsh6j (live and replay) |

| |

| |

Investor Presentation Details

An investor presentation providing additional information and analysis can be found at our investor relations page at ir.c3.ai.

Statement Regarding Use of Non-GAAP Financial Measures

The Company reports the following non-GAAP financial measures, which have not been prepared in accordance with generally accepted accounting principles in the United States (“GAAP”), in addition to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP.

•Non-GAAP gross profit, non-GAAP gross margin, non-GAAP loss from operations, and non-GAAP net loss per share. Our non-GAAP gross profit, non-GAAP gross margin, non-GAAP loss from operations, and non-GAAP net loss per share exclude the effect of stock-based compensation expense-related charges and employer payroll tax expense related to employee stock-based compensation. We believe the presentation of operating results that exclude these non-cash items provides useful supplemental information to investors and facilitates the analysis of our operating results and comparison of operating results across reporting periods.

•Free cash flow. We believe free cash flow, a non-GAAP financial measure, is useful in evaluating liquidity and provides information to management and investors about our ability to fund future operating needs and strategic initiatives. We calculate free cash flow as net cash used in operating activities less purchases of property and equipment and capitalized software development costs. This non-GAAP financial measure may be different than similarly titled measures used by other companies. Additionally, the utility of free cash flow is further limited as it does not represent the total increase or decrease in our cash balances for a given period.

We use these non-GAAP financial measures internally for financial and operational decision-making purposes and as a means to evaluate period-to-period comparisons. Non-GAAP financial measures are not meant to be considered in isolation or as a substitute for comparable GAAP financial measures and should be read only in conjunction with our condensed consolidated financial statements prepared in accordance with GAAP. Our presentation of non-GAAP financial measures may not be comparable to similar measures used by other companies. We encourage investors to carefully consider our results under GAAP, as well as our supplemental non-GAAP information and the reconciliation between these presentations, to more fully understand our business. Please see the tables included at the end of this release for the reconciliation of GAAP to non-GAAP financial measures.

Other Information

Professional Services Revenue

Our professional services revenue includes service fees and prioritized engineering services. Service fees include revenue from services such as consulting, training, and paid implementation services.

Prioritized engineering services are undertaken when a customer requests that we accelerate the design, development, and delivery of software features and functions that are planned in our future product roadmap. When we agree to this, we negotiate an agreed upon fee to accelerate the development of the software. When the software feature is delivered, it becomes integrated to our core product offering, is available to all subscribers of the underlying software product, and enhances the operation of that product going forward. Such prioritized engineering services result in production-level computer software – compiled code that enhances the functionality of our production products – which is available for our customers to use over the life of their software licenses. Per Accounting Standards Codification (ASC) 606, Prioritized engineering services revenue is recognized as professional services over the period in which the software development is completed.

Total professional services revenue consists of:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended January 31, | | Nine Months Ended January 31, |

| 2025 | | 2024 | | 2025 | | 2024 |

| (in thousands) | | (in thousands) |

| Prioritized engineering services | $ | 5,698 | | | $ | 7,125 | | | $ | 26,008 | | | $ | 20,225 | |

| Service fees | 7,405 | | | 876 | | | 14,028 | | | 5,566 | |

| Total professional services revenue | $ | 13,103 | | | $ | 8,001 | | | $ | 40,036 | | | $ | 25,791 | |

Use of Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. The words “anticipate,” “believe,” “continue,” “estimate,” “expect,” “intend,” “may,” “will” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these words. Forward-looking statements in this press release include, but are not limited to, statements regarding our market leadership position, anticipated benefits from our partnerships, financial outlook, our sales and customer opportunity pipeline including our industry diversification, the expected benefits of our offerings (including the potential benefits of our C3 Generative AI offerings), and our business strategies, plans, and objectives for future operations. We have based these forward-looking statements largely on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs. These forward-looking statements are subject to a number of risks and uncertainties, including our history of losses and ability to achieve and maintain profitability in the future, our historic dependence on a limited number of existing customers that account for a substantial portion of our revenue, our ability to attract new customers and retain existing customers, market awareness and acceptance of enterprise AI solutions in general and our products in particular, the length and unpredictability of our sales cycles and the time and expense required for our sales efforts. Some of these risks are described in greater detail in our filings with the Securities and Exchange Commission, including our Quarterly Reports on Form 10-Q for the fiscal quarters ended July 31, 2024, October 31, 2024, and, when available, January 31, 2025, although new and unanticipated risks may arise. The future events and trends discussed in this press release may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, achievements, or events and circumstances reflected in the forward-looking statements will occur. Except to the extent required by law, we do not undertake to update any of these forward-looking statements after the date of this press release to conform these statements to actual results or revised expectations.

About C3.ai, Inc.

C3.ai, Inc. (NYSE:AI) is the Enterprise AI application software company. C3 AI delivers a family of fully integrated products including the C3 AI Platform, an end-to-end platform for developing, deploying, and operating enterprise AI applications, C3 AI applications, a portfolio of industry-specific SaaS enterprise AI applications that enable the digital transformation of organizations globally, and C3 Generative AI, a suite of domain-specific generative AI offerings for the enterprise.

Investor Contact

ir@c3.ai

C3 AI Public Relations

Edelman

Lisa Kennedy

(415) 914-8336

pr@c3.ai

Source: C3.ai, Inc.

C3.AI, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended January 31, | | Nine Months Ended January 31, |

| 2025 | | 2024 | | 2025 | | 2024 |

| Revenue | | | | | | | |

Subscription(1) | $ | 85,679 | | | $ | 70,400 | | | $ | 240,297 | | | $ | 198,201 | |

Professional services(2) | 13,103 | | | 8,001 | | | 40,036 | | | 25,791 | |

| Total revenue | 98,782 | | | 78,401 | | | 280,333 | | | 223,992 | |

| Cost of revenue | | | | | | | |

| Subscription | 37,799 | | | 32,273 | | | 106,129 | | | 93,644 | |

| Professional services | 2,636 | | | 841 | | | 5,851 | | | 3,399 | |

| Total cost of revenue | 40,435 | | | 33,114 | | | 111,980 | | | 97,043 | |

| Gross profit | 58,347 | | | 45,287 | | | 168,353 | | | 126,949 | |

| Operating expenses | | | | | | | |

Sales and marketing(3) | 61,201 | | | 57,140 | | | 168,969 | | | 150,920 | |

| Research and development | 59,356 | | | 49,480 | | | 167,998 | | | 150,747 | |

| General and administrative | 25,375 | | | 21,213 | | | 66,845 | | | 61,317 | |

| Total operating expenses | 145,932 | | | 127,833 | | | 403,812 | | | 362,984 | |

| Loss from operations | (87,585) | | | (82,546) | | | (235,459) | | | (236,035) | |

| Interest income | 8,677 | | | 9,995 | | | 28,240 | | | 30,597 | |

| Other (expense) income, net | (957) | | | 409 | | | (916) | | | (468) | |

| Loss before provision for income taxes | (79,865) | | | (72,142) | | | (208,135) | | | (205,906) | |

| Provision for income taxes | 336 | | | 489 | | | 865 | | | 863 | |

| Net loss | $ | (80,201) | | | $ | (72,631) | | | $ | (209,000) | | | $ | (206,769) | |

| Net loss per share attributable to Class A and Class B common stockholders, basic and diluted | $ | (0.62) | | | $ | (0.60) | | | $ | (1.64) | | | $ | (1.75) | |

| | | | | | | |

| Weighted-average shares used in computing net loss per share attributable to Class A and Class B common stockholders, basic and diluted | 130,382 | | | 120,486 | | | 127,752 | | | 118,259 | |

| | | | | | | |

(1) Including related party revenue of $10,581 for the nine months ended January 31, 2024.

(2) Including related party revenue of $5,804 for the nine months ended January 31, 2024.

(3) Including related party sales and marketing expense of $810 for the nine months ended January 31, 2024.

C3.AI, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except for share and per share data)

(Unaudited)

| | | | | | | | | | | |

| January 31, 2025 | | April 30, 2024 |

| Assets | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 125,094 | | | $ | 167,146 | |

| Marketable securities | 599,233 | | | 583,221 | |

Accounts receivable, net of allowance of $642 and $359 as of January 31, 2025 and April 30, 2024, respectively | 180,357 | | | 130,064 | |

| Prepaid expenses and other current assets | 26,219 | | | 23,963 | |

| Total current assets | 930,903 | | | 904,394 | |

| Property and equipment, net | 81,910 | | | 88,631 | |

| Goodwill | 625 | | | 625 | |

| Other assets, non-current | 41,703 | | | 44,575 | |

| Total assets | $ | 1,055,141 | | | $ | 1,038,225 | |

| Liabilities and stockholders’ equity | | | |

| Current liabilities | | | |

| Accounts payable | $ | 28,737 | | | $ | 11,316 | |

| Accrued compensation and employee benefits | 48,727 | | | 44,263 | |

| Deferred revenue, current | 32,955 | | | 37,230 | |

| Accrued and other current liabilities | 27,628 | | | 9,526 | |

| Total current liabilities | 138,047 | | | 102,335 | |

| Deferred revenue, non-current | — | | | 1,732 | |

| Other long-term liabilities | 56,917 | | | 60,805 | |

| Total liabilities | 194,964 | | | 164,872 | |

| Commitments and contingencies | | | |

| Stockholders’ equity | | | |

| Class A common stock | 129 | | | 120 | |

| Class B common stock | 3 | | | 3 | |

| Additional paid-in capital | 2,158,686 | | | 1,963,726 | |

| Accumulated other comprehensive income (loss) | 292 | | | (563) | |

| Accumulated deficit | (1,298,933) | | | (1,089,933) | |

| Total stockholders’ equity | 860,177 | | | 873,353 | |

| Total liabilities and stockholders’ equity | $ | 1,055,141 | | | $ | 1,038,225 | |

C3.AI, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

| | | | | | | | | | | |

| Nine Months Ended January 31, |

| 2025 | | 2024 |

| Cash flows from operating activities: | | | |

| Net loss | $ | (209,000) | | | $ | (206,769) | |

Adjustments to reconcile net loss to net cash used in operating activities | | | |

| Depreciation and amortization | 9,215 | | | 9,469 | |

| Non-cash operating lease cost | 270 | | | 656 | |

| Stock-based compensation expense | 174,373 | | | 159,032 | |

| Accretion of discounts on marketable securities | (10,715) | | | (13,238) | |

| Other | 2,158 | | | 110 | |

| Changes in operating assets and liabilities | | | |

Accounts receivable(1) | (52,017) | | | (38,892) | |

Prepaid expenses, other current assets and other assets(2) | 587 | | | (3,379) | |

Accounts payable(3) | 16,916 | | | (4,945) | |

| Accrued compensation and employee benefits | 7,648 | | | 171 | |

| Operating lease liabilities | 1,439 | | | 14,330 | |

Other liabilities(4) | 12,462 | | | 6,296 | |

Deferred revenue(5) | (6,007) | | | (6,546) | |

| Net cash used in operating activities | (52,671) | | | (83,705) | |

| Cash flows from investing activities: | | | |

| Purchases of property and equipment | (2,101) | | | (22,718) | |

Capitalized software development costs | — | | | (2,750) | |

| Purchases of marketable securities | (518,806) | | | (657,431) | |

| Maturities and sales of marketable securities | 514,365 | | | 590,299 | |

| Net cash used in investing activities | (6,542) | | | (92,600) | |

| Cash flows from financing activities: | | | |

| Proceeds from issuance of Class A common stock under employee stock purchase plan | 5,009 | | | 5,055 | |

| Proceeds from exercise of Class A common stock options | 19,648 | | | 11,379 | |

| Taxes paid related to net share settlement of equity awards | (7,496) | | | (10,397) | |

| Net cash provided by financing activities | 17,161 | | | 6,037 | |

Net decrease in cash, cash equivalents and restricted cash | (42,052) | | | (170,268) | |

| Cash, cash equivalents and restricted cash at beginning of period | 179,712 | | | 297,395 | |

| Cash, cash equivalents and restricted cash at end of period | $ | 137,660 | | | $ | 127,127 | |

| Cash and cash equivalents | $ | 125,094 | | | $ | 114,561 | |

| Restricted cash included in other assets, non-current | 12,566 | | | 12,566 | |

| | | |

| Total cash, cash equivalents and restricted cash | $ | 137,660 | | | $ | 127,127 | |

| Supplemental disclosure of cash flow information—cash paid for income taxes | $ | 743 | | | $ | 760 | |

| Supplemental disclosures of non-cash investing and financing activities: | | | |

| Purchases of property and equipment included in accounts payable and accrued liabilities | $ | 527 | | | $ | 2,475 | |

| Right-of-use assets obtained in exchange for lease obligations (including remeasurement of right-of-use assets and lease liabilities due to changes in the timing of receipt of lease incentives) | $ | 1,016 | | | $ | 1,858 | |

| | | |

| | | |

| | | |

| | | |

| Vesting of early exercised stock options | $ | 251 | | | $ | 406 | |

(1)Including changes in related party balances of $12,444 for the nine months ended January 31, 2024.

(2)Including changes in related party balances of $(810) for the nine months ended January 31, 2024.

(3)Including changes in related party balances of $248 for the nine months ended January 31, 2024.

(4)Including changes in related party balances of $(2,448) for the nine months ended January 31, 2024.

(5)Including changes in related party balances of $(46) for the nine months ended January 31, 2024.

C3.AI, INC.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(In thousands, except percentages)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended January 31, | | Nine Months Ended January 31, |

| 2025 | | 2024 | | 2025 | | 2024 |

| Reconciliation of GAAP gross profit to non-GAAP gross profit: | | | | | | | |

| Gross profit on a GAAP basis | $ | 58,347 | | $ | 45,287 | | $ | 168,353 | | $ | 126,949 |

Stock-based compensation expense (1) | 9,504 | | 8,983 | | 26,223 | | 26,492 |

Employer payroll tax expense related to employee stock-based compensation (2) | 356 | | 405 | | 883 | | 1,243 |

| Gross profit on a non-GAAP basis | $ | 68,207 | | $ | 54,675 | | $ | 195,459 | | $ | 154,684 |

| | | | | | | |

| | | | | | | |

| Gross margin on a GAAP basis | 59% | | 58% | | 60% | | 57% |

| Gross margin on a non-GAAP basis | 69% | | 70% | | 70% | | 69% |

| | | | | | | |

| Reconciliation of GAAP loss from operations to non-GAAP loss from operations: | | | | | | | |

| Loss from operations on a GAAP basis | $ | (87,585) | | $ | (82,546) | | $ | (235,459) | | $ | (236,035) |

Stock-based compensation expense (1) | 62,652 | | 54,983 | | 174,373 | | 159,032 |

Employer payroll tax expense related to employee stock-based compensation (2) | 1,789 | | 1,773 | | 4,151 | | 5,547 |

| Loss from operations on a non-GAAP basis | $ | (23,144) | | $ | (25,790) | | $ | (56,935) | | $ | (71,456) |

| | | | | | | |

| Reconciliation of GAAP net loss per share to non-GAAP net loss per share: | | | | | | | |

| | | | | | | |

| Net loss on a GAAP basis | $ | (80,201) | | $ | (72,631) | | $ | (209,000) | | $ | (206,769) |

Stock-based compensation expense (1) | 62,652 | | 54,983 | | 174,373 | | 159,032 |

Employer payroll tax expense related to employee stock-based compensation (2) | 1,789 | | 1,773 | | 4,151 | | 5,547 |

| Net loss on a non-GAAP basis | $ | (15,760) | | $ | (15,875) | | $ | (30,476) | | $ | (42,190) |

| | | | | | | |

| GAAP net loss per share attributable to Class A and Class B common shareholders, basic and diluted | $ | (0.62) | | | $ | (0.60) | | | $ | (1.64) | | | $ | (1.75) | |

| Non-GAAP net loss per share attributable to Class A and Class B common shareholders, basic and diluted | $ | (0.12) | | | $ | (0.13) | | | $ | (0.24) | | | $ | (0.36) | |

| Weighted-average shares used in computing net loss per share attributable to Class A and Class B common stockholders, basic and diluted | 130,382 | | | 120,486 | | | 127,752 | | | 118,259 | |

(1)Stock-based compensation expense for gross profits and gross margin includes costs of subscription and cost of professional services as follows. Stock-based compensation expense for loss from operations includes total stock-based compensation expense as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended January 31, | | Nine Months Ended January 31, |

| 2025 | | 2024 | | 2025 | | 2024 |

| Cost of subscription | $ | 8,563 | | | $ | 8,674 | | | $ | 24,084 | | | $ | 25,244 | |

| Cost of professional services | 941 | | | 309 | | | 2,139 | | | 1,248 | |

| Sales and marketing | 21,860 | | | 17,528 | | | 61,495 | | | 52,533 | |

| Research and development | 19,896 | | | 18,757 | | | 56,326 | | | 52,475 | |

| General and administrative | 11,392 | | | 9,715 | | | 30,329 | | | 27,532 | |

| Total stock-based compensation expense | $ | 62,652 | | | $ | 54,983 | | | $ | 174,373 | | | $ | 159,032 | |

(2) Employer payroll tax expense related to employee stock-based compensation for gross profits and gross margin includes costs of subscription and cost of professional services as follows. Employer payroll tax expense related to employee stock-based compensation for loss from operations includes total employer payroll tax expense related to employee stock-based compensation as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended January 31, | | Nine Months Ended January 31, |

| 2025 | | 2024 | | 2025 | | 2024 |

| Cost of subscription | $ | 329 | | | $ | 392 | | | $ | 818 | | | $ | 1,183 | |

| Cost of professional services | 27 | | | 13 | | | 65 | | | 60 | |

| Sales and marketing | 614 | | | 496 | | | 1,536 | | | 1,964 | |

| Research and development | 578 | | | 738 | | | 1,173 | | | 1,970 | |

| General and administrative | 241 | | | 134 | | | 559 | | | 370 | |

| Total employer payroll tax expense | $ | 1,789 | | | $ | 1,773 | | | $ | 4,151 | | | $ | 5,547 | |

Reconciliation of free cash flow to the GAAP measure of net cash used in operating activities:

The following table below provides a reconciliation of free cash flow to the GAAP measure of net cash used in operating activities for the periods presented:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended January 31, | | Nine Months Ended January 31, |

| 2025 | | 2024 | | 2025 | | 2024 |

| Net cash used in operating activities | $ | (22,020) | | | $ | (39,051) | | | $ | (52,671) | | | $ | (83,705) | |

| Less: | | | | | | | |

| Purchases of property and equipment | (362) | | | (6,087) | | | (2,101) | | | (22,718) | |

| Capitalized software development costs | — | | | — | | | — | | | (2,750) | |

| Free cash flow | $ | (22,382) | | | $ | (45,138) | | | $ | (54,772) | | | $ | (109,173) | |

| Net cash provided by (used in) investing activities | $ | 12,373 | | | $ | 4,098 | | | $ | (6,542) | | | $ | (92,600) | |

| Net cash provided by financing activities | $ | 13,467 | | | $ | 505 | | | $ | 17,161 | | | $ | 6,037 | |

| | | | | | | |

Document and Entity Information

|

Feb. 26, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 26, 2025

|

| Entity Registrant Name |

C3.AI, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39744

|

| Entity Tax Identification Number |

26-3999357

|

| Entity Address, Address Line One |

1400 Seaport Blvd

|

| Entity Address, City or Town |

Redwood City,

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94063

|

| City Area Code |

650

|

| Local Phone Number |

503-2200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A Common Stock, par value $0.001 per share

|

| Trading Symbol |

AI

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001577526

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

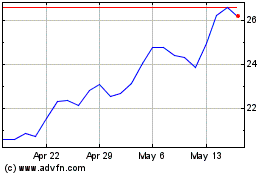

C3 AI (NYSE:AI)

Historical Stock Chart

From Feb 2025 to Mar 2025

C3 AI (NYSE:AI)

Historical Stock Chart

From Mar 2024 to Mar 2025