UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 6-K

Report of Foreign Private Issuer Pursuant to Rule 13a-16

or

15d-16 of the Securities Exchange Act of 1934

For the month of December 2024

Commission File Number: 001-39928

_____________________

Sendas Distribuidora S.A.

(Exact Name as Specified in its Charter)

Sendas Distributor S.A.

(Translation of registrant’s name into

English)

Avenida Ayrton Senna, No. 6,000, Lote 2, Pal 48959,

Anexo A

Jacarepaguá

22775-005 Rio de Janeiro, RJ, Brazil

(Address of principal executive offices)

(Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F: ý

Form 40-F: o

SENDAS DISTRIBUIDORA

S.A.

Publicly Held Company with

Authorized Capital

CNPJ/MF nº 06.057.223/0001-71

NIRE 33.300.272.909

EXTRACT TO THE MINUTES TO THE

MEETING OF THE BOARD OF DIRECTORS HELD ON DECEMBER 19, 2024

4.

Date, Time, and Place: On December 19, 2024, at 5:00 p.m, held at the headquarters of Sendas Distribuidora SA (“Company”),

located in the City of Rio de Janeiro, State of Rio de Janeiro, at Avenida Ayrton Senna, no. 6.000, Lote 2, Pal 48959, Annex A, Jacarepaguá,

Zip Code 22.775-005.

5.

Call and Attendance: Call notice given in accordance with the rules of procedure and attendance by the totality of members

of the Company's Board of Directors, Messrs. Oscar de Paula Bernardes Neto - Chairman of the Board of Directors, José Guimarães

Monforte - Vice-Chairman of the Board of Directors, Andiara Pedroso Petterle, Belmiro de Figueiredo Gomes, Enéas Cesar Pestana

Neto, Júlio César de Queiroz Campos, Leila Abraham Loria, Leonardo Porciúncula Gomes Pereira and José Roberto

Meister Müssnich.

| 6. | Board: Chairman: Oscar de Paula Bernardes Neto; Secretary: Tamara Rafiq Nahuz. |

7.

Agenda: Analysis and resolution on the voluntary delisting of the Company's American Depositary Shares (“ADSs”),

represented by American Depositary Receipts (“ADRs”) of the New York Stock Exchange (“NYSE”) and

deregistration with the Securities and Exchange Commission of the United States (“SEC”).

5.

Resolutions: The members of the Board of Directors discussed and resolved, unanimously and without reservations, based

on the favorable recommendation of the Company's Finance and Investment Committee, to approve (i) the voluntary delisting of the Company's

ADSs, represented by ADRs, of the NYSE, including the amendment of the Company's ADR Program to Level 1, in order to enable investors

to keep their ADSs and trade them on over-the-counter markets after delisting; and (ii) the deregistration with the SEC, to effect the

termination of the disclosure obligations established by the Securities and Exchange Act, as amended. The decision is based on management's

assessment that maintaining a secondary listing at NYSE is not currently beneficial, given that trading of the Company's common shares

is predominantly concentrated on B3’s segment Novo Mercado, being in line with the Company’s

long-term strategy of maintaining efficient operations, given the low cost characteristic of the Company (“low-cost company”).

Furthermore, it was decided that even after the delisting of the Company's shares of NYSE and its deregistration with SEC are effective,

the Company will voluntarily maintain its current corporate governance practices.

The members of the Board of Directors

unanimously approved, without reservations, the authorization to the Company's Executive Board to carry out all acts and adopt all measures

necessary and/or convenient to operationalize the approval above, including, but not limited to: (i) filing of the Form 25 with the SEC,

with a copy to NYSE, in order to effect the delisting of the ADSs; (ii) filing of the Form 15F with SEC; (iii) obtaining eventual approvals

from any regulatory bodies and authorities, as well as providing the other necessary documents with the bookkeeper, the ADR’s depositary

and NYSE, including measures for changing and/or cancelling the Company’s ADR Program; and (iv) hiring legal advisors and/or other

institutions necessary for mentioned operationalization.

6.

Adjournment: With no further business to discuss, these minutes were drawn up, read, approved and signed by those present.

Chairman: Mr. Oscar de Paula Bernardes Neto; Secretary: Ms. Tamara Rafiq Nahuz. Attending members of the Board of Directors:

Oscar de Paula Bernardes Neto, José Guimarães Monforte, Andiara Pedroso Petterle, Belmiro de Figueiredo Gomes, Enéas

Cesar Pestana Neto, Júlio César de Queiroz Campos, Leila Abraham Loria, Leonardo Porciúncula Gomes Pereira and José

Roberto Meister Müssnich.

Rio de Janeiro, December 19th,

2024.

This minute is a true copy of

the original drawn-up in the proper book.

Tamara Rafiq Nahuz

Secretary

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: December 19, 2024

Sendas Distribuidora S.A.

By: /s/ Vitor Fagá de Almeida

Name: Vitor Fagá de Almeida

Title: Vice President of Finance and Investor Relations

By: /s/ Gabrielle Helú

Name: Gabrielle Helú

Title: Investor Relations Officer

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These

statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances,

industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates",

"expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking

statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies

and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or

results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject

to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements

are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors.

Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

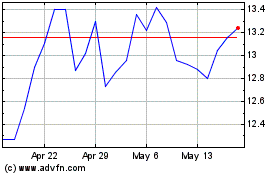

Sendas Distribuidora (NYSE:ASAI)

Historical Stock Chart

From Nov 2024 to Dec 2024

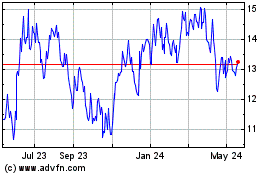

Sendas Distribuidora (NYSE:ASAI)

Historical Stock Chart

From Dec 2023 to Dec 2024