0000009092false00000090922024-10-172024-10-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

_______________________

|

|

|

|

|

Date of Report |

|

|

|

(Date of earliest event reported) |

October 17, 2024 |

|

|

|

|

|

Badger Meter, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Wisconsin |

|

1-6706 |

|

39-0143280 |

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

4545 W. Brown Deer Rd., Milwaukee, Wisconsin 53223

(Address of principal executive offices, including zip code)

(414) 355-0400

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

_______________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock |

BMI |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

Item 2.02 |

Results of Operations and Financial Condition . |

On October 17, 2024, Badger Meter, Inc. (the “Company”) issued a press release announcing its financial results for the third quarter ended September 30, 2024.

A copy of the press release issued by the Company announcing the foregoing is furnished herewith as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits .

(a) Not applicable.

(b) Not applicable.

(c) Not applicable.

|

|

|

|

(d) |

Exhibits . The exhibit furnished herewith is as listed in the accompanying Exhibit Index. |

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

BADGER METER, INC. |

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: October 17, 2024 |

By: |

/s/ Robert A. Wrocklage |

|

|

|

Robert A. Wrocklage |

|

|

|

Senior Vice President – Chief Financial Officer |

|

|

|

|

|

Exhibit 99.1

BADGER METER REPORTS THIRD QUARTER 2024 FINANCIAL RESULTS

Milwaukee, WI, October 17, 2024 - Badger Meter, Inc. (NYSE: BMI) today reported results for the third quarter ended September 30, 2024.

Third Quarter 2024 Highlights

•Total sales of $208.4 million, 12% higher than the prior year’s $186.2 million.

•Operating profit increased 29% year-over-year, with operating profit margins expanding 260 basis points to a record 19.5%.

•Diluted earnings per share (EPS) increased 23% to $1.08, up from $0.88 in the comparable prior year quarter.

•Record cash flow with $45.1 million in net cash provided by operations, which increased 43% year-over-year.

•Increased annual dividend rate by 26% to $1.36 per share, representing the 32nd consecutive year of dividend growth.

“We were pleased with our third quarter financial performance delivering strong sales growth, record operating profit margins and robust cash flow generation. Sales in the quarter continued to benefit from solid demand for our tailorable water management solutions. Notably, we achieved record operating profit margins of 19.5%, the result of favorable sales mix, price/cost management, strong operating execution and continued selling, engineering and administration (SEA) expense leverage,” said Kenneth C. Bockhorst, Chairman, President and Chief Executive Officer. “I greatly appreciate the efforts of our employees across the globe in serving our customers.”

Third Quarter Operating Results

Utility water sales increased 14% year-over-year against a difficult prior year comparison reflecting continued solid adoption across the BlueEdge™ suite of solutions by utility customers. This included increased sales of meters, water quality, pressure and other sensors coupled with ORION® communication endpoints and BEACON® Software as a Service (SaaS).

Sales of flow instrumentation products were flat year-over-year with modest growth in the water-focused end markets generally offsetting declines across the array of de-emphasized applications, globally.

Operating earnings increased 29% year-over-year, with operating profit margins reaching a record 19.5% in the third quarter of 2024, a 260-basis point improvement from the prior year’s 16.9%.

Gross margin dollars increased 15% year-over-year, and gross margin as a percent of sales was 40.2%, an increase of 110 basis points over the comparable prior year period. The gross margin improvement reflects the continued benefits of positive structural sales mix, including strong AMI and software-related sales, as well as ongoing price/cost benefit and solid operating execution.

SEA expenses in the third quarter of 2024 were $43.3 million, $2.0 million higher than the comparable prior year quarter with higher headcount and personnel-related costs. SEA as a percent of sales improved 140 basis points to 20.8% from 22.2% in the comparable prior year quarter as a result of the strong sales.

The tax rate for the third quarter of 2024 was 25.3% compared to 20.3% in the prior year comparable period which included a discrete favorable income tax benefit related to equity compensation transactions. As a result of the above, combined with increased interest income year-over-year, EPS was $1.08, an increase of 23% compared to $0.88 in the comparable prior year period.

Outlook

Bockhorst continued, “As we prepare to close out the year, we remain focused on capitalizing on the durable macro trends benefiting the water industry. By leveraging BlueEdge - our suite of tailorable end-to-end smart water offerings – our expanding customer base is realizing the efficiency, resiliency and sustainability benefits required to best meet their unique water resource management needs.

Taking into account our normalizing backlog, strong bid funnel and constructive order rates, we anticipate delivering high single-digit sales growth rates over the cycle, noting the prevailing unevenness common in the industry. We continue to strive for modest operating profit margin expansion year-over-year, driven by favorable structural sales mix, value-based price/cost management and SEA leverage.

Specific to the fourth quarter, similar to prior years we expect sequentially fewer total operating days given the holiday-shortened activity levels at our customers. Additionally, evolving hurricane recovery activities have the potential to delay Southeast U.S. utility projects in the near term.

Finally, we anticipate continued robust cash flow, with ample cash and credit availability, giving us the financial flexibility to execute our capital allocation priorities as reflected in the recent 26% annual dividend increase.”

Bockhorst concluded, “Our ongoing success is built on our steadfast culture of continuous improvement, enabling our team to execute for customers and drive outperformance for Badger Meter. I remain excited about our ability to deliver shareholder value while we preserve and protect the world’s most precious resource."

Conference Call and Webcast Information

Badger Meter management will hold a conference call to discuss the Company’s third quarter 2024 results today, Thursday October 17, 2024 at 10:00 AM Central / 11:00 AM Eastern time. The listen-only webcast and related presentation can be accessed via the Investor section of our website. Participants can register to take part in the call using this online registration link: https://www.netroadshow.com/events/login?show=e2388dc6&confId=71869

Safe Harbor Statement

Certain statements contained in this news release, as well as other information provided from time to time by Badger Meter, Inc. (the “Company”) or its employees, may contain forward-looking statements that involve risks and uncertainties that could cause actual results to differ materially from those statements. The Company’s results are subject to general economic conditions, variation in demand from customers, continued market acceptance of new products, the successful integration of acquisitions, competitive pricing and operating efficiencies, supply chain risk, material and labor cost increases, tax reform and foreign currency risk. See the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission for further information regarding risk factors, which are incorporated herein by reference. Badger Meter disclaims any obligation to publicly update or revise any forward-looking statements as a result of new information, future events or any other reason.

About Badger Meter

With more than a century of water technology innovation, Badger Meter is a global provider of industry leading water solutions encompassing flow measurement, quality and other system parameters. These offerings provide our customers with the data and analytics essential to optimize their operations and contribute to the sustainable use and protection of the world’s most precious resource. For more information, visit www.badgermeter.com.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BADGER METER, INC. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CONSOLIDATED CONDENSED STATEMENTS OF OPERATIONS |

|

(in thousands, except share and earnings per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

208,438 |

|

|

$ |

186,193 |

|

|

$ |

621,376 |

|

|

$ |

521,152 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales |

|

|

124,560 |

|

|

|

113,470 |

|

|

|

374,952 |

|

|

|

316,179 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross margin |

|

|

83,878 |

|

|

|

72,723 |

|

|

|

246,424 |

|

|

|

204,973 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, engineering and administration |

|

|

43,255 |

|

|

|

41,301 |

|

|

|

127,711 |

|

|

|

119,003 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating earnings |

|

|

40,623 |

|

|

|

31,422 |

|

|

|

118,713 |

|

|

|

85,970 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income, net |

|

|

(2,301 |

) |

|

|

(1,200 |

) |

|

|

(5,689 |

) |

|

|

(2,649 |

) |

Other pension and postretirement costs |

|

|

13 |

|

|

|

32 |

|

|

|

37 |

|

|

|

97 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings before income taxes |

|

|

42,911 |

|

|

|

32,590 |

|

|

|

124,365 |

|

|

|

88,522 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for income taxes |

|

|

10,873 |

|

|

|

6,621 |

|

|

|

30,140 |

|

|

|

20,645 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net earnings |

|

$ |

32,038 |

|

|

$ |

25,969 |

|

|

$ |

94,225 |

|

|

$ |

67,877 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

1.09 |

|

|

$ |

0.89 |

|

|

$ |

3.21 |

|

|

$ |

2.32 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted |

|

$ |

1.08 |

|

|

$ |

0.88 |

|

|

$ |

3.19 |

|

|

$ |

2.30 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares used in computation of earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

29,369,923 |

|

|

|

29,294,886 |

|

|

|

29,351,688 |

|

|

|

29,275,445 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted |

|

|

29,547,928 |

|

|

|

29,473,374 |

|

|

|

29,524,993 |

|

|

|

29,448,475 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BADGER METER, INC. |

|

|

|

|

|

|

|

CONSOLIDATED CONDENSED BALANCE SHEETS |

|

(in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets |

September 30, |

|

|

December 31, |

|

|

2024 |

|

|

2023 |

|

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

258,955 |

|

|

$ |

191,782 |

|

Receivables |

|

93,427 |

|

|

|

83,507 |

|

Inventories |

|

158,517 |

|

|

|

153,674 |

|

Other current assets |

|

18,397 |

|

|

|

13,214 |

|

Total current assets |

|

529,296 |

|

|

|

442,177 |

|

|

|

|

|

|

|

Net property, plant and equipment |

|

73,279 |

|

|

|

73,878 |

|

Intangible assets, at cost less accumulated amortization |

|

48,957 |

|

|

|

53,737 |

|

Other long-term assets |

|

36,328 |

|

|

|

33,964 |

|

Goodwill |

|

115,001 |

|

|

|

113,163 |

|

Total assets |

$ |

802,861 |

|

|

$ |

716,919 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and Shareholders' Equity |

|

|

|

|

|

|

|

|

|

|

|

Payables |

$ |

77,381 |

|

|

$ |

81,807 |

|

Accrued compensation and employee benefits |

|

29,756 |

|

|

|

29,871 |

|

Other current liabilities |

|

22,026 |

|

|

|

20,270 |

|

Total current liabilities |

|

129,163 |

|

|

|

131,948 |

|

|

|

|

|

|

|

Deferred income taxes |

|

5,108 |

|

|

|

5,061 |

|

Long-term employee benefits and other |

|

77,405 |

|

|

|

63,428 |

|

Shareholders' equity |

|

591,185 |

|

|

|

516,482 |

|

Total liabilities and shareholders' equity |

$ |

802,861 |

|

|

$ |

716,919 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BADGER METER, INC. |

|

|

|

|

|

|

|

|

|

|

|

|

|

CONSOLIDATED CONDENSED STATEMENTS OF CASH FLOWS |

|

(in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

Operating activities: |

|

|

|

|

|

|

|

|

|

|

|

Net earnings |

$ |

32,038 |

|

|

$ |

25,969 |

|

|

$ |

94,225 |

|

|

$ |

67,877 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments to reconcile net earnings to net cash provided by operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation |

|

2,589 |

|

|

|

2,662 |

|

|

|

8,330 |

|

|

|

8,100 |

|

Amortization |

|

5,427 |

|

|

|

4,404 |

|

|

|

15,787 |

|

|

|

12,820 |

|

Deferred income taxes |

|

- |

|

|

|

(25 |

) |

|

|

- |

|

|

|

(401 |

) |

Noncurrent employee benefits |

|

9 |

|

|

|

(52 |

) |

|

|

(12 |

) |

|

|

(274 |

) |

Stock-based compensation expense |

|

1,314 |

|

|

|

1,356 |

|

|

|

4,595 |

|

|

|

3,963 |

|

Changes in: |

|

|

|

|

|

|

|

|

|

|

|

Receivables |

|

13,403 |

|

|

|

(5,352 |

) |

|

|

(9,814 |

) |

|

|

(11,855 |

) |

Inventories |

|

3,889 |

|

|

|

(3,875 |

) |

|

|

(3,367 |

) |

|

|

(27,628 |

) |

Payables |

|

(18,581 |

) |

|

|

4,178 |

|

|

|

(5,242 |

) |

|

|

12,282 |

|

Prepaid expenses and other assets |

|

717 |

|

|

|

(2,299 |

) |

|

|

(7,772 |

) |

|

|

(7,279 |

) |

Other liabilities |

|

4,283 |

|

|

|

4,467 |

|

|

|

6,237 |

|

|

|

14,567 |

|

Total adjustments |

|

13,050 |

|

|

|

5,464 |

|

|

|

8,742 |

|

|

|

4,295 |

|

Net cash provided by operations |

|

45,088 |

|

|

|

31,433 |

|

|

|

102,967 |

|

|

|

72,172 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Investing activities: |

|

|

|

|

|

|

|

|

|

|

|

Property, plant and equipment expenditures |

|

(3,132 |

) |

|

|

(3,014 |

) |

|

|

(8,149 |

) |

|

|

(9,949 |

) |

Acquisitions, net of cash acquired |

|

- |

|

|

|

- |

|

|

|

(3,000 |

) |

|

|

(17,127 |

) |

Net cash used for investing activities |

|

(3,132 |

) |

|

|

(3,014 |

) |

|

|

(11,149 |

) |

|

|

(27,076 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Financing activities: |

|

|

|

|

|

|

|

|

|

|

|

Dividends paid |

|

(9,986 |

) |

|

|

(7,917 |

) |

|

|

(25,862 |

) |

|

|

(21,134 |

) |

Proceeds from exercise of stock options |

|

- |

|

|

|

909 |

|

|

|

751 |

|

|

|

967 |

|

Net cash used for financing activities |

|

(9,986 |

) |

|

|

(7,008 |

) |

|

|

(25,111 |

) |

|

|

(20,167 |

) |

Effect of foreign exchange rates on cash |

|

773 |

|

|

|

(306 |

) |

|

|

466 |

|

|

|

(71 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Increase in cash and cash equivalents |

|

32,743 |

|

|

|

21,105 |

|

|

|

67,173 |

|

|

|

24,858 |

|

Cash and cash equivalents - beginning of period |

|

226,212 |

|

|

|

141,805 |

|

|

|

191,782 |

|

|

|

138,052 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents - end of period |

$ |

258,955 |

|

|

$ |

162,910 |

|

|

$ |

258,955 |

|

|

$ |

162,910 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Contacts

Karen Bauer

(414) 371-7276

kbauer@badgermeter.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

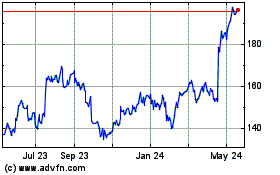

Badger Meter (NYSE:BMI)

Historical Stock Chart

From Dec 2024 to Jan 2025

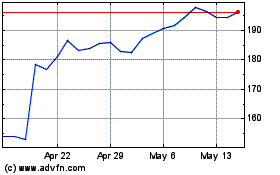

Badger Meter (NYSE:BMI)

Historical Stock Chart

From Jan 2024 to Jan 2025