Revenues of $2.1 billion, up 14.5%

YoY

Net income of $109.9 million and diluted EPS

of $4.88, up 30% YoY

Adjusted net income of $134.2 million and

adjusted diluted EPS of $5.95, up 36% YoY

EBITDA of $232.9 million and EBITDA margin

of 11.1%, up 180 bps YoY

CACI International Inc (NYSE: CACI), a leading provider of

expertise and technology to government customers, announced results

today for its fiscal second quarter ended December 31, 2024.

“Our second quarter reflected another exceptional period for

CACI. Financial results were strong across the board with

double-digit revenue growth, increased profitability, healthy cash

flow, and growing backlog. In addition, we closed and integrated

the previously announced strategic acquisitions of Azure Summit and

Applied Insight,” said John Mengucci, CACI President and Chief

Executive Officer. “With the momentum we see in our business, we

are again able to raise our fiscal year 2025 guidance, and we are

well on track to achieve the three-year financial targets we

introduced at our Investor Day. Our strategy, capabilities, and

performance position CACI extremely well to continue providing

long-term value for our customers and our shareholders.”

Second Quarter Results

(in millions, except earnings per share

and DSO)

Three Months Ended

12/31/2024

12/31/2023

% Change

Revenues

$

2,099.8

$

1,833.9

14.5

%

Income from operations

$

181.3

$

133.3

36.0

%

Net income

$

109.9

$

83.9

31.1

%

Adjusted net income, a non-GAAP

measure1

$

134.2

$

97.6

37.5

%

Diluted earnings per share

$

4.88

$

3.74

30.5

%

Adjusted diluted earnings per share, a

non-GAAP measure1

$

5.95

$

4.36

36.5

%

Earnings before interest, taxes,

depreciation and amortization (EBITDA), a non-GAAP measure1

$

232.9

$

170.9

36.2

%

Net cash provided by operating activities

excluding MARPA1

$

76.0

$

83.2

-8.7

%

Free cash flow, a non-GAAP measure1

$

66.1

$

67.8

-2.6

%

Days sales outstanding (DSO)2

53

47

(1)

This non-GAAP measure should not be

considered in isolation or as a substitute for measures prepared in

accordance with GAAP. For additional information regarding this

non-GAAP measure, see the related explanation and reconciliation to

the GAAP measure included below in this release.

(2)

The DSO calculations for three months

ended December 31, 2024 and 2023 exclude the impact of the

Company's Master Accounts Receivable Purchase Agreement (MARPA),

which was 7 days and 6 days, respectively.

Revenues in the second quarter of fiscal year 2025 increased

14.5 percent year-over-year, driven by 8.1 percent organic growth.

The increase in income from operations was driven by higher

revenues and gross profit. Growth in diluted earnings per share and

adjusted diluted earnings per share was driven by higher income

from operations, partially offset by increased interest expense and

a higher tax provision. The decrease in cash from operations,

excluding MARPA, was driven primarily by changes in working capital

partially offset by higher earnings.

Second Quarter Contract Awards

Contract awards in the second quarter totaled $1.2 billion, with

approximately 45 percent for new business to CACI. Awards exclude

ceiling values of multi-award, indefinite delivery, indefinite

quantity (IDIQ) contracts. Some notable awards during the quarter

were:

- CACI was awarded a seven-year sole-source contract valued at

more than $131 million to continue to provide advanced data

visualization technology to support the Department of Defense (DoD)

and the Intelligence Community (IC). As a key technology partner to

this undisclosed customer, CACI enables decision superiority by

providing analysts with pattern-of-life data to help find unique

items of interest wherever the mission takes them. This invaluable

asset has assisted in mission planning and battlefield forensics

for nearly two decades.

- CACI was awarded a seven-year single-award contract valued at

more than $238 million to support space technology operations for a

classified national security customer. CACI will provide 24/7

operators, analysts, and engineers with expert technical knowledge

and experience for the Continental United States and Outside the

Continental United States mission centers. As a space technology

solutions provider, CACI protects our nation’s assets and interests

by performing mission operations and data management ensuring space

system optimization and resilience.

Total backlog as of December 31, 2024 was $31.8 billion compared

with $26.9 billion a year ago, an increase of 18.2 percent. Funded

backlog as of December 31, 2024 was $4.1 billion compared with $3.7

billion a year ago, an increase of 10.8 percent.

Additional Highlights

- CACI completed its acquisition of Azure Summit Technology, a

provider of innovative, high-performance radio frequency (RF)

technology and engineering, focused on the electromagnetic

spectrum, in an all-cash transaction for $1.275 billion. With the

closing of this transaction, CACI bolsters its market-based

strategy by expanding its software-defined offerings in signals

intelligence (SIGINT), electronic warfare (EW), and intelligence,

surveillance, and reconnaissance (ISR), across multiple domains,

platforms, and customer sets. In particular, this acquisition

expands the breadth of CACI’s reach and insight into maritime and

airborne platforms.

- CACI completed the acquisition of Applied Insight, a Northern

Virginia-based portfolio company of Acacia Group, in an all-cash

transaction. In alignment with CACI’s mission to deliver

distinctive expertise and differentiated technology to meet its

customers’ greatest national security challenges, Applied Insight

delivers proven cloud migration, adoption, and transformation

capabilities, coupled with intimate customer relationships across

the DoD and IC.

- CACI hosted an Investor Day in November, showcasing the

company’s strategy, unique industry position, differentiated

capabilities, and focus on supporting enduring national security

priorities in the markets it serves. President and CEO John

Mengucci, joined by senior leadership, provided deeper insight into

how CACI’s use of software and software-defined technology,

investing ahead of need, and significant synergy between Expertise

and Technology allow the company to more rapidly address critical

customer needs with greater efficiency and flexibility. CACI also

strengthened its investment thesis by presenting three-year

financial targets, reinforcing its commitment to continue driving

growth and shareholder value.

- CACI was recognized by Forbes as one of America’s Best

Companies and one of America’s Most Trusted Companies for 2025,

ranking fourth and seventh, respectively, within the Aerospace and

Defense industry. As one of America’s best companies, CACI achieved

high marks, ranking in the top 15 percent, for public trust,

employee sentiment, and financial strength. CACI was selected as a

most trusted company for its enduring commitment to character,

integrity, and ethics.

- CACI earned 11 prestigious awards in 2024 for being a leader in

veteran hiring and inclusivity. CACI was also recognized for its

dedication to the military community and its commitment to

fostering a welcoming environment where veterans can continue their

mission.

- CACI Chairman of the Board of Directors Michael (Mike) A.

Daniels was presented with the prestigious 2024 National

Association of Corporate Directors (NACD) Directorship 100™ B.

Kenneth West Lifetime Achievement Award at its annual gala in New

York. This award is bestowed to a corporate director with

distinguished service on public, private, and/or nonprofit boards

over an extended period and who has demonstrated the principles of

director professionalism—integrity, mature confidence, informed

judgment, and high-performance standards.

- CACI President and CEO John Mengucci received the 2024

Technology Good Scout Award from the Boy Scouts of America National

Capital Area Council. This award recognizes and honors outstanding

leaders in the technology industry from the greater Washington,

D.C. area who exemplify the values of the Scout Oath and Law in

their daily lives. Mengucci received the prestigious 27th annual

Technology Good Scout Award on Oct. 23 in Tysons, Virginia.

Fiscal Year 2025 Guidance

The table below summarizes our fiscal year 2025 guidance and

represents our views as of January 22, 2025. The increase in our

revenue guidance is driven by higher organic growth

expectations.

(in millions, except earnings per

share)

Fiscal Year 2025

Current Guidance

Prior Guidance

Revenues

$8,450 - $8,650

$8,370 - $8,570

Adjusted net income, a non-GAAP

measure1

$537 - $557

$523 - $543

Adjusted diluted earnings per share, a

non-GAAP measure1

$23.87 - $24.76

$23.24 - $24.13

Diluted weighted average shares

22.5

22.5

Free cash flow, a non-GAAP measure2

at least $450

at least $445

(1)

Adjusted net income and adjusted diluted

earnings per share are defined as GAAP net income and GAAP diluted

EPS, respectively, excluding intangible amortization expense and

the related tax impact. This non-GAAP measure should not be

considered in isolation or as a substitute for measures prepared in

accordance with GAAP. For additional information regarding this

non-GAAP measure, see the related explanation and reconciliation to

the GAAP measure included below in this release.

(2)

Free cash flow is defined as net cash

provided by operating activities excluding MARPA, less payments for

capital expenditures (capex). This non-GAAP measure should not be

considered in isolation or as a substitute for measures prepared in

accordance with GAAP. Fiscal year 2025 free cash flow guidance

assumes approximately $55 million in tax payments related to

Section 174 of the Tax Cuts and Jobs Act of 2017 and an

approximately $40 million cash tax refund related to our method

change enacted in fiscal year 2021. For additional information

regarding this non-GAAP measure, see the related explanation and

reconciliation to the GAAP measure included below in this

release.

Conference Call Information

We have scheduled a conference call for 8:00 a.m. Eastern time

Thursday, January 23, 2025 during which members of our senior

management will be making a brief presentation focusing on second

quarter results and operating trends, followed by a

question-and-answer session. You can listen to the webcast and view

the accompanying exhibits on CACI’s investor relations website at

http://investor.caci.com/events/default.aspx at the scheduled time.

A replay of the call will also be available on CACI’s investor

relations website at http://investor.caci.com/.

About CACI

At CACI International Inc (NYSE: CACI), our 25,000 talented and

dynamic employees are ever vigilant in delivering distinctive

expertise and differentiated technology to meet our customers’

greatest challenges in national security. We are a company of good

character, relentless innovation, and long-standing excellence. Our

culture drives our success and earns us recognition as a Fortune

World's Most Admired Company. CACI is a member of the Fortune 1000

Largest Companies, the Russell 1000 Index, and the S&P MidCap

400 Index. For more information, visit us at www.caci.com.

There are statements made herein that do not address historical

facts and, therefore, could be interpreted to be forward-looking

statements as that term is defined in the Private Securities

Litigation Reform Act of 1995. Such statements are subject to risk

factors that could cause actual results to be materially different

from anticipated results. These risk factors include, but are not

limited to, the following: our reliance on U.S. government

contracts, which includes general risk around the government

contract procurement process (such as bid protest, small business

set asides, loss of work due to organizational conflicts of

interest, etc.) and termination risks; significant delays or

reductions in appropriations for our programs and broader changes

in U.S. government funding and spending patterns; legislation that

amends or changes discretionary spending levels or budget

priorities, such as for homeland security or to address global

pandemics like COVID-19; legal, regulatory, and political change

from successive presidential administrations that could result in

economic uncertainty; changes in U.S. federal agencies, current

agreements with other nations, foreign events, or any other events

which may affect the global economy, including the impact of global

pandemics like COVID-19; the results of government audits and

reviews conducted by the Defense Contract Audit Agency, the Defense

Contract Management Agency, or other governmental entities with

cognizant oversight; competitive factors such as pricing pressures

and/or competition to hire and retain employees (particularly those

with security clearances); failure to achieve contract awards in

connection with re-competes for present business and/or competition

for new business; regional and national economic conditions in the

United States and globally, including but not limited to: terrorist

activities or war, changes in interest rates, currency

fluctuations, significant fluctuations in the equity markets, and

market speculation regarding our continued independence; our

ability to meet contractual performance obligations, including

technologically complex obligations dependent on factors not wholly

within our control; limited access to certain facilities required

for us to perform our work, including during a global pandemic like

COVID-19; changes in tax law, the interpretation of associated

rules and regulations, or any other events impacting our effective

tax rate; changes in technology; the potential impact of the

announcement or consummation of a proposed transaction and our

ability to successfully integrate the operations of our recent and

any future acquisitions; our ability to achieve the objectives of

near term or long-term business plans; the effects of health

epidemics, pandemics and similar outbreaks may have material

adverse effects on our business, financial position, results of

operations and/or cash flows; and other risks described in our

Securities and Exchange Commission filings.

CACI International Inc

Condensed Consolidated

Statements of Operations (Unaudited)

(in thousands, except per share

data)

Three Months Ended

Six Months Ended

12/31/2024

12/31/2023

% Change

12/31/2024

12/31/2023

% Change

Revenues

$

2,099,809

$

1,833,934

14.5

%

$

4,156,698

$

3,684,081

12.8

%

Costs of revenues:

Direct costs

1,402,225

1,255,251

11.7

%

2,816,649

2,528,169

11.4

%

Indirect costs and selling expenses

466,661

409,355

14.0

%

894,607

813,988

9.9

%

Depreciation and amortization

49,625

36,023

37.8

%

84,303

71,270

18.3

%

Total costs of revenues

1,918,511

1,700,629

12.8

%

3,795,559

3,413,427

11.2

%

Income from operations

181,298

133,305

36.0

%

361,139

270,654

33.4

%

Interest expense and other, net

44,066

27,519

60.1

%

68,036

53,090

28.2

%

Income before income taxes

137,232

105,786

29.7

%

293,103

217,564

34.7

%

Income taxes

27,294

21,916

24.5

%

62,988

47,647

32.2

%

Net income

$

109,938

$

83,870

31.1

%

$

230,115

$

169,917

35.4

%

Basic earnings per share

$

4.90

$

3.76

30.3

%

$

10.29

$

7.56

36.1

%

Diluted earnings per share

$

4.88

$

3.74

30.5

%

$

10.21

$

7.50

36.1

%

Weighted average shares used in per share

computations:

Weighted-average basic shares

outstanding

22,414

22,282

0.6

%

22,359

22,464

-0.5

%

Weighted-average diluted shares

outstanding

22,534

22,407

0.6

%

22,537

22,650

-0.5

%

CACI International Inc

Condensed Consolidated Balance

Sheets (Unaudited)

(in thousands)

12/31/2024

6/30/2024

ASSETS

Current assets:

Cash and cash equivalents

$

175,707

$

133,961

Accounts receivable, net

1,200,683

1,031,311

Prepaid expenses and other current

assets

257,005

209,257

Total current assets

1,633,395

1,374,529

Goodwill

4,913,099

4,154,844

Intangible assets, net

1,168,205

474,354

Property, plant and equipment, net

205,597

195,443

Operating lease right-of-use assets

340,729

305,637

Supplemental retirement savings plan

assets

99,461

99,339

Accounts receivable, long-term

15,065

13,311

Other long-term assets

172,948

178,644

Total assets

$

8,548,499

$

6,796,101

LIABILITIES AND SHAREHOLDERS'

EQUITY

Current liabilities:

Current portion of long-term debt

$

68,750

$

61,250

Accounts payable

243,356

287,142

Accrued compensation and benefits

244,789

316,514

Other accrued expenses and current

liabilities

514,582

413,354

Total current liabilities

1,071,477

1,078,260

Long-term debt, net of current portion

2,989,750

1,481,387

Supplemental retirement savings plan

obligations, net of current portion

114,186

111,208

Deferred income taxes

156,128

169,808

Operating lease liabilities,

noncurrent

379,780

325,046

Other long-term liabilities

108,805

112,185

Total liabilities

4,820,126

3,277,894

Total shareholders' equity

3,728,373

3,518,207

Total liabilities and shareholders'

equity

$

8,548,499

$

6,796,101

CACI International Inc

Condensed Consolidated

Statements of Cash Flows (Unaudited)

(in thousands)

Six Months Ended

12/31/2024

12/31/2023

CASH FLOWS FROM OPERATING

ACTIVITIES

Net income

$

230,115

$

169,917

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

84,303

71,270

Amortization of deferred financing

costs

1,291

1,095

Stock-based compensation expense

31,343

22,949

Deferred income taxes

(13,352

)

(25,770

)

Changes in operating assets and

liabilities, net of effect of business acquisitions:

Accounts receivable, net

(51,731

)

(50,642

)

Prepaid expenses and other assets

(12,995

)

(28,703

)

Accounts payable and other accrued

expenses

(27,907

)

90,769

Accrued compensation and benefits

(86,261

)

(124,640

)

Income taxes payable and receivable

5,077

2,879

Operating lease liabilities and assets,

net

(572

)

(4,371

)

Long-term liabilities

1,392

17,099

Net cash provided by operating

activities

160,703

141,852

CASH FLOWS FROM INVESTING

ACTIVITIES

Capital expenditures

(21,400

)

(29,410

)

Acquisitions of businesses, net of cash

acquired

(1,569,388

)

(10,869

)

Other

2,410

1,974

Net cash used in investing activities

(1,588,378

)

(38,305

)

CASH FLOWS FROM FINANCING

ACTIVITIES

Proceeds from borrowings under bank credit

facilities

4,347,000

1,531,500

Principal payments made under bank credit

facilities

(2,824,148

)

(1,454,313

)

Payment of financing costs under bank

credit facilities

(9,803

)

—

Proceeds from employee stock purchase

plans

6,415

5,848

Repurchases of common stock

(10,352

)

(155,765

)

Payment of taxes for equity

transactions

(35,797

)

(18,061

)

Net cash provided by (used in) financing

activities

1,473,315

(90,791

)

Effect of exchange rate changes on cash

and cash equivalents

(3,894

)

319

Net change in cash and cash

equivalents

41,746

13,075

Cash and cash equivalents, beginning of

period

133,961

115,776

Cash and cash equivalents, end of

period

$

175,707

$

128,851

Revenues by Customer Group

(Unaudited)

Three Months Ended

(in thousands)

12/31/2024

12/31/2023

$ Change

% Change

Department of Defense

$

1,578,733

75.1

%

$

1,358,509

74.0

%

$

220,224

16.2

%

Federal Civilian agencies

433,691

20.7

%

389,942

21.3

%

43,749

11.2

%

Commercial and other

87,385

4.2

%

85,483

4.7

%

1,902

2.2

%

Total

$

2,099,809

100.0

%

$

1,833,934

100.0

%

$

265,875

14.5

%

Six Months Ended

(in thousands)

12/31/2024

12/31/2023

$ Change

% Change

Department of Defense

$

3,113,266

74.9

%

$

2,710,815

73.6

%

$

402,451

14.8

%

Federal Civilian agencies

873,062

21.0

%

797,286

21.6

%

75,776

9.5

%

Commercial and other

170,370

4.1

%

175,980

4.8

%

(5,610

)

-3.2

%

Total

$

4,156,698

100.0

%

$

3,684,081

100.0

%

$

472,617

12.8

%

Revenues by Contract Type

(Unaudited)

Three Months Ended

(in thousands)

12/31/2024

12/31/2023

$ Change

% Change

Cost-plus-fee

$

1,240,213

59.1

%

$

1,102,474

60.1

%

$

137,739

12.5

%

Fixed-price

602,859

28.7

%

519,544

28.3

%

83,315

16.0

%

Time-and-materials

256,737

12.2

%

211,916

11.6

%

44,821

21.2

%

Total

$

2,099,809

100.0

%

$

1,833,934

100.0

%

$

265,875

14.5

%

Six Months Ended

(in thousands)

12/31/2024

12/31/2023

$ Change

% Change

Cost-plus-fee

$

2,520,223

60.7

%

$

2,236,909

60.7

%

$

283,314

12.7

%

Fixed-price

1,078,115

25.9

%

1,021,621

27.7

%

56,494

5.5

%

Time-and-materials

558,360

13.4

%

425,551

11.6

%

132,809

31.2

%

Total

$

4,156,698

100.0

%

$

3,684,081

100.0

%

$

472,617

12.8

%

Revenues by Prime or

Subcontractor (Unaudited)

Three Months Ended

(in thousands)

12/31/2024

12/31/2023

$ Change

% Change

Prime contractor

$

1,862,098

88.7

%

$

1,636,377

89.2

%

$

225,721

13.8

%

Subcontractor

237,711

11.3

%

197,557

10.8

%

40,154

20.3

%

Total

$

2,099,809

100.0

%

$

1,833,934

100.0

%

$

265,875

14.5

%

Six Months Ended

(in thousands)

12/31/2024

12/31/2023

$ Change

% Change

Prime contractor

$

3,742,517

90.0

%

$

3,285,739

89.2

%

$

456,778

13.9

%

Subcontractor

414,181

10.0

%

398,342

10.8

%

15,839

4.0

%

Total

$

4,156,698

100.0

%

$

3,684,081

100.0

%

$

472,617

12.8

%

Revenues by Expertise or

Technology (Unaudited)

Three Months Ended

(in thousands)

12/31/2024

12/31/2023

$ Change

% Change

Expertise

$

925,900

44.1

%

$

849,541

46.3

%

$

76,359

9.0

%

Technology

1,173,909

55.9

%

984,393

53.7

%

189,516

19.3

%

Total

$

2,099,809

100.0

%

$

1,833,934

100.0

%

$

265,875

14.5

%

Six Months Ended

(in thousands)

12/31/2024

12/31/2023

$ Change

% Change

Expertise

$

1,914,165

46.1

%

$

1,727,635

46.9

%

$

186,530

10.8

%

Technology

2,242,533

53.9

%

1,956,446

53.1

%

286,087

14.6

%

Total

$

4,156,698

100.0

%

$

3,684,081

100.0

%

$

472,617

12.8

%

Contract Awards

(Unaudited)

Three Months Ended

(in thousands)

12/31/2024

12/31/2023

$ Change

% Change

Contract Awards

$

1,168,955

$

2,199,671

$

(1,030,716

)

-46.9

%

Six Months Ended

(in thousands)

12/31/2024

12/31/2023

$ Change

% Change

Contract Awards

$

4,508,590

$

5,268,914

$

(760,324

)

-14.4

%

Reconciliation of Net Income to Adjusted Net

Income and Diluted EPS to Adjusted Diluted EPS (Unaudited)

Adjusted net income and Adjusted diluted EPS are non-GAAP

performance measures. We define Adjusted net income and Adjusted

diluted EPS as GAAP net income and GAAP diluted EPS, respectively,

excluding intangible amortization expense and the related tax

impact as we do not consider intangible amortization expense to be

indicative of our operating performance. We believe that these

performance measures provide management and investors with useful

information in assessing trends in our ongoing operating

performance, provide greater visibility in understanding the

long-term financial performance of the Company, and allow investors

to more easily compare our results to results of our peers. These

non-GAAP measures should not be considered in isolation or as a

substitute for performance measures prepared in accordance with

GAAP.

(in thousands, except per share data)

Three Months Ended

Six Months Ended

12/31/2024

12/31/2023

% Change

12/31/2024

12/31/2023

% Change

Net income, as reported

$

109,938

$

83,870

31.1

%

$

230,115

$

169,917

35.4

%

Intangible amortization expense

32,442

18,426

76.1

%

50,449

36,792

37.1

%

Tax effect of intangible amortization1

(8,197

)

(4,699

)

74.4

%

(12,746

)

(9,383

)

35.8

%

Adjusted net income

$

134,183

$

97,597

37.5

%

$

267,818

$

197,326

35.7

%

Three Months Ended

Six Months Ended

12/31/2024

12/31/2023

% Change

12/31/2024

12/31/2023

% Change

Diluted EPS, as reported

$

4.88

$

3.74

30.5

%

$

10.21

$

7.50

36.1

%

Intangible amortization expense

1.44

0.82

75.6

%

2.24

1.62

38.3

%

Tax effect of intangible amortization1

(0.37

)

(0.20

)

85.0

%

(0.57

)

(0.41

)

39.0

%

Adjusted diluted EPS

$

5.95

$

4.36

36.5

%

$

11.88

$

8.71

36.4

%

FY25 Guidance Range

(in millions, except per share data)

Low End

High End

Net income, as reported

$

444

---

$

464

Intangible amortization expense

124

---

124

Tax effect of intangible amortization1

(31

)

---

(31

)

Adjusted net income

$

537

---

$

557

FY25 Guidance Range

Low End

High End

Diluted EPS, as reported

$

19.73

---

$

20.62

Intangible amortization expense

5.51

---

5.51

Tax effect of intangible amortization1

(1.37

)

---

(1.37

)

Adjusted diluted EPS

$

23.87

---

$

24.76

(1)

Calculation uses an assumed full year

statutory tax rate of 25.3% and 25.5% on non-GAAP tax deductible

adjustments for December 31, 2024 and 2023, respectively.

Note: Numbers may not sum due to

rounding.

Reconciliation of Net Income to Earnings

Before Interest, Taxes, Depreciation and Amortization (EBITDA)

(Unaudited)

The Company views EBITDA and EBITDA margin, both of which are

defined as non-GAAP measures, as important indicators of

performance, consistent with the manner in which management

measures and forecasts the Company’s performance. EBITDA is a

commonly used non-GAAP measure when comparing our results with

those of other companies. We define EBITDA as GAAP net income plus

net interest expense, income taxes, and depreciation and

amortization expense (including depreciation within direct costs).

We consider EBITDA to be a useful metric for management and

investors to evaluate and compare the ongoing operating performance

of our business on a consistent basis across reporting periods, as

it eliminates the effect of non-cash items such as depreciation of

tangible assets, amortization of intangible assets primarily

recognized in business combinations, which we do not believe are

indicative of our operating performance. EBITDA margin is EBITDA

divided by revenue. These non-GAAP measures should not be

considered in isolation or as a substitute for performance measures

prepared in accordance with GAAP.

Three Months Ended

Six Months Ended

(in thousands)

12/31/2024

12/31/2023

% Change

12/31/2024

12/31/2023

% Change

Net income

$

109,938

$

83,870

31.1

%

$

230,115

$

169,917

35.4

%

Plus:

Income taxes

27,294

21,916

24.5

%

62,988

47,647

32.2

%

Interest income and expense, net

44,066

27,519

60.1

%

68,036

53,090

28.2

%

Depreciation and amortization expense,

including amounts within direct costs

51,564

37,612

37.1

%

87,614

74,501

17.6

%

EBITDA

$

232,862

$

170,917

36.2

%

$

448,753

$

345,155

30.0

%

Three Months Ended

Six Months Ended

(in thousands)

12/31/2024

12/31/2023

% Change

12/31/2024

12/31/2023

% Change

Revenues, as reported

$

2,099,809

$

1,833,934

14.5

%

$

4,156,698

$

3,684,081

12.8

%

EBITDA

232,862

170,917

36.2

%

448,753

345,155

30.0

%

EBITDA margin

11.1%

9.3%

10.8%

9.4%

Reconciliation of Net Cash Provided by

Operating Activities to Net Cash Provided by Operating Activities

Excluding MARPA and to Free Cash Flow (Unaudited)

The Company defines Net cash provided by operating activities

excluding MARPA, a non-GAAP measure, as net cash provided by

operating activities calculated in accordance with GAAP, adjusted

to exclude cash flows from CACI’s Master Accounts Receivable

Purchase Agreement (MARPA) for the sale of certain designated

eligible U.S. government receivables up to a maximum amount of

$300.0 million. Free cash flow is a non-GAAP liquidity measure and

may not be comparable to similarly titled measures used by other

companies. The Company defines Free cash flow as Net cash provided

by operating activities excluding MARPA, less payments for capital

expenditures. The Company uses these non-GAAP measures to assess

our ability to generate cash from our business operations and plan

for future operating and capital actions. We believe these measures

allow investors to more easily compare current period results to

prior period results and to results of our peers. Free cash flow

does not represent residual cash flows available for discretionary

purposes and should not be used as a substitute for cash flow

measures prepared in accordance with GAAP.

Three Months Ended

Six Months Ended

(in thousands)

12/31/2024

12/31/2023

12/31/2024

12/31/2023

Net cash provided by operating

activities

$

126,042

$

71,764

$

160,703

$

141,852

Cash used in (provided by) MARPA

(50,051

)

11,478

(23,841

)

34,645

Net cash provided by operating activities

excluding MARPA

75,991

83,242

136,862

176,497

Capital expenditures

(9,924

)

(15,419

)

(21,400

)

(29,410

)

Free cash flow

$

66,067

$

67,823

$

115,462

$

147,087

(in millions)

FY25 Guidance

Current

Prior

Net cash provided by operating

activities

$

535

$

530

Cash used in (provided by) MARPA

—

—

Net cash provided by operating activities

excluding MARPA

535

530

Capital expenditures

(85

)

(85

)

Free cash flow

$

450

$

445

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250122810137/en/

Corporate Communications and Media: Lorraine Corcoran, Executive

Vice President, Corporate Communications (703) 434-4165,

lorraine.corcoran@caci.com

Investor Relations: George Price, Senior Vice President,

Investor Relations (703) 841-7818, george.price@caci.com

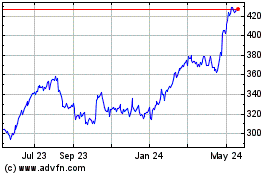

CACI (NYSE:CACI)

Historical Stock Chart

From Jan 2025 to Feb 2025

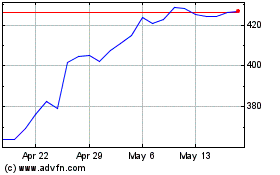

CACI (NYSE:CACI)

Historical Stock Chart

From Feb 2024 to Feb 2025