CBL & Associates Properties Announces 6.5% Increase in Common Dividend Distribution to Annual Rate of $0.98 Per Share

26 November 2013 - 8:01AM

Business Wire

Announcement Marks Fourth Consecutive Year

of Common Dividend Increase

CBL & Associates Properties, Inc. (NYSE: CBL) today

announced that its Board of Directors has declared a 6.5% increase

in the quarterly cash dividend for the Company’s Common Stock to

$0.245 per share for the quarter ending December 31, 2013. The

increased quarterly dividend represents an annualized dividend rate

of $0.98 per share compared with the previous annualized dividend

rate of $0.92 per share. The dividend is payable on January 15,

2014, to shareholders of record as of December 30, 2013.

The Board also declared a quarterly cash dividend of $0.4609375

per depositary share for the quarter ending December 31, 2013, for

the Company's 7.375% Series D Cumulative Redeemable Preferred

Stock. The dividend, which equates to an annual dividend payment of

$1.84375 per depositary share, is payable on December 30, 2013, to

shareholders of record as of December 13, 2013.

The Board also declared a quarterly cash dividend of $0.4140625

per depositary share for the quarter ending December 31, 2013, for

the Company's 6.625% Series E Cumulative Redeemable Preferred

Stock. The dividend, which equates to an annual dividend payment of

$1.65625 per depositary share, is payable on December 30, 2013, to

shareholders of record as of December 13, 2013.

About CBL & Associates Properties,

Inc.

CBL is one of the largest and most active owners and developers

of malls and shopping centers in the United States. CBL owns, holds

interests in or manages 155 properties, including 96 regional

malls/open-air centers. The properties are located in 30 states and

total 90.7 million square feet including 10.7 million square feet

of non-owned shopping centers managed for third parties.

Headquartered in Chattanooga, TN, CBL has regional offices in

Boston (Waltham), MA, Dallas (Irving), TX, and St. Louis, MO.

Additional information can be found at cblproperties.com.

Information included herein contains "forward-looking

statements" within the meaning of the federal securities laws. Such

statements are inherently subject to risks and uncertainties, many

of which cannot be predicted with accuracy and some of which might

not even be anticipated. Future events and actual events, financial

and otherwise, may differ materially from the events and results

discussed in the forward-looking statements. The reader is directed

to the Company's various filings with the Securities and Exchange

Commission, including without limitation the Company's Annual

Report on Form 10-K and the "Management's Discussion and Analysis

of Financial Condition and Results of Operations" incorporated by

reference therein, for a discussion of such risks and

uncertainties.

CBL & Associates Properties, Inc.Katie Reinsmidt,

423-490-8301Senior Vice President - Investor Relations/Corporate

Investmentskatie_reinsmidt@cblproperties.com

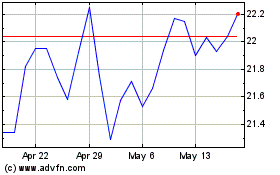

CBL and Associates Prope... (NYSE:CBL)

Historical Stock Chart

From Jun 2024 to Jul 2024

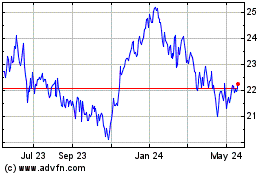

CBL and Associates Prope... (NYSE:CBL)

Historical Stock Chart

From Jul 2023 to Jul 2024