CION Investments and GCM Grosvenor Announce Launch of the CION Grosvenor Infrastructure Fund with $240 Million Invested in Infrastructure Assets

29 January 2025 - 1:15AM

Business Wire

CION Investments (CION), a leading alternative investment

solutions platform, and GCM Grosvenor, (NASDAQ: GCMG), a global

alternative asset management solutions provider, are pleased to

announce the launch of CION Grosvenor Infrastructure Fund, (“CGIF”

or “the Fund”). At launch, the fund will consist of a $240 million

portfolio invested across 43 infrastructure assets, and $82 million

in additional committed capital. The Fund launch was supported by a

major institutional investor.

CGIF is an evergreen interval fund that allows individual

investors, through their financial advisors, access to GCM

Grosvenor’s institutional private infrastructure platform. The Fund

is priced daily and offers liquidity for up to 5% of the Fund’s NAV

once per quarter.

CGIF’s current portfolio is composed entirely of investments

directly into private assets, across traditional infrastructure

sectors, including transportation, digital, energy and energy

transition and new infrastructure sectors such as supply chain and

infrastructure adjacencies.

CGIF combines CION’s product management and distribution

capabilities with the depth and breadth of GCM Grosvenor’s

infrastructure platform, providing individual investors with access

to a diversified pool of private infrastructure assets through a

fee efficient structure.

GCM Grosvenor is one of the pioneers of private infrastructure

investing, with a 20-year track record and $14.8 billion in

infrastructure assets under management. Driven by the deep

connectivity and experience of its infrastructure platform and

team, GCM Grosvenor has developed into a “partner of choice” for

infrastructure market participants. GCM Grosvenor’s robust sourcing

network and unique deal flow allow for flexible entry points into

assets creating a competitive advantage.

Infrastructure can provide capital appreciation and income and

has distinct characteristics that can help construct portfolios

with potential to meet long term goals. These features can include

transparent cash flows, high barriers to entry, inflation

protection potential, low correlations to other private and public

assets, and potential lower volatility.

Michael A. Reisner and Mark Gatto, co-CEOs of CION, said: “Our

firm’s mission has been to provide individual investors, through

their financial advisors, with access to the private markets. We

believe that the right manager and the right structure are critical

for success in the space. GCM Grosvenor is a proven manager,

infrastructure is an attractive asset class, and CGIF’s interval

fund structure matches the needs of individual investors. The Fund

allows investors to seek to take advantage of the illiquidity

premium in a structure that offers ease of execution and low

minimums.”

Michael Sacks, Chairman and Chief Executive Officer of GCM

Grosvenor, said, “GCM Grosvenor’s approach to infrastructure

combines building a well-diversified portfolio, with a focus on

flexibility and alpha generation. Our powerful sourcing network

provides us a broad range of investment opportunities and different

entry points into such opportunities, allowing us to be selective

and only execute on the investments we believe provide the best

risk / reward profile for investors.”

ABOUT CION INVESTMENTS

CION Investments is a leading open-source provider of

alternative investments designed to redefine the way individual

investors can build their portfolios and meet their long-term

investment goals. CION Investments currently sponsors, among other

products, CION Investment Corporation (NYSE: CION), a leading

publicly listed business development company that currently manages

approximately $2 billion in assets, and also sponsors CION Ares

Diversified Credit Fund, a globally diversified interval fund that

currently manages approximately $6.5 billion in assets.

For more information, please visit www.cioninvestments.com.

ABOUT GCM GROSVENOR

GCM Grosvenor (Nasdaq: GCMG) is a global alternative asset

management solutions provider with approximately $80 billion in

assets under management across private equity, infrastructure, real

estate, credit, and absolute return investment strategies. The firm

has specialized in alternatives for more than 50 years and is

dedicated to delivering value for clients by leveraging its

cross-asset class and flexible investment platform. GCM Grosvenor’s

experienced team of approximately 550 professionals serves a global

client base of institutional and individual investors. The firm is

headquartered in Chicago, with offices in New York, Toronto,

London, Frankfurt, Tokyo, Hong Kong, Seoul and Sydney. For more

information, please visit: gcmgrosvenor.com.

No assurance can be given that any investment will achieve

its objectives or avoid losses. The information is neither an offer

to sell, nor a solicitation of an offer to buy, an interest in any

investment vehicles/accounts managed or advised by GCM

Grosvenor.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250128987226/en/

For more information, please contact:

Susan Armstrong Head of Marketing E:

sarmstrong@cioninvestments.com

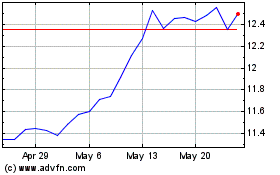

CION Investment (NYSE:CION)

Historical Stock Chart

From Jan 2025 to Feb 2025

CION Investment (NYSE:CION)

Historical Stock Chart

From Feb 2024 to Feb 2025