As filed with the Securities and Exchange Commission on January 2, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

Civitas Resources, Inc.

(Exact name of registrant as specified in its charter)

| |

Delaware

(State or other jurisdiction of incorporation or organization)

|

|

|

61-1630631

(I.R.S. Employer Identification Number)

|

|

555 17th Street, Suite 3700

Denver, Colorado 80202

(303) 293-9100

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Adrian Milton

Senior Vice President, General Counsel and Assistant Corporate Secretary

Civitas Resources, Inc.

555 17th Street, Suite 3700

Denver, Colorado 80202

(303) 293-9100

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Julian J. Seiguer, P.C.

Bryan D Flannery

Ieuan A. List

Kirkland & Ellis LLP

609 Main Street, Suite 4700

Houston, Texas 77002

(713) 836-3600

Approximate date of commencement of proposed sale to the public:

From time to time after the effective date of this registration statement

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☒

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| |

Large accelerated filer ☒

|

|

|

Accelerated filer ☐

|

|

|

Non-accelerated filer ☐

|

|

|

Smaller reporting company ☐

|

|

|

Emerging growth company ☐

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

PROSPECTUS

CIVITAS RESOURCES, INC.

7,181,527 Shares of Common Stock

This prospectus relates to the offering and resale by the selling stockholder identified herein (the “Selling Stockholder”) of up to 7,181,527 shares (the “Offered Shares”) of common stock, par value $0.01 per share (the “Common Stock”), of Civitas Resources, Inc. (“Civitas,” the “Company,” “we,” “our” or “us”) from time to time in amounts, at prices and on terms that will be determined at the time of the applicable offering. Civitas is not selling any shares of Common Stock under this prospectus, and Civitas will not receive any of the proceeds from the sales of the Offered Shares, but will incur expenses in connection with any offering. See “Selling Stockholder” and “Plan of Distribution” for more information.

The Selling Stockholder may offer and sell the Offered Shares to or through one or more underwriters, dealers and agents, or directly to purchasers, on a continuous or delayed basis. The price at which the Selling Stockholder may sell the Offered Shares will be determined by the prevailing market for the Offered Shares or in negotiated transactions that may be at prices other than prevailing market prices. See “Plan of Distribution” elsewhere in this prospectus for more information about how the Selling Stockholder may sell or otherwise dispose of the Offered Shares. Civitas’ registration of the Offered Shares does not mean that the Selling Stockholder will offer or sell any shares of Common Stock.

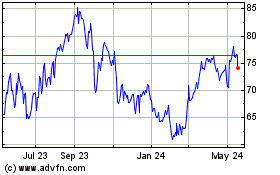

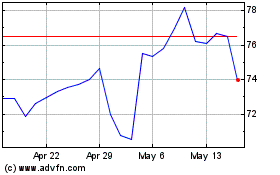

Our Common Stock is listed on the New York Stock Exchange (the “NYSE”) and trades under the symbol “CIVI.” On December 29, 2023, the last reported sale price of our Common Stock on the NYSE was $68.38.

Investing in our securities involves a high degree of risk. You should carefully consider the matters discussed under the section entitled “Risk Factors” on page 2 of this prospectus and included in our periodic reports and other information filed with the Securities and Exchange Commission before investing in our Common Stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is January 2, 2024.

TABLE OF CONTENTS

| |

|

|

|

|

|

ii |

|

|

| |

|

|

|

|

|

iii |

|

|

| |

|

|

|

|

|

iv |

|

|

| |

|

|

|

|

|

vi |

|

|

| |

|

|

|

|

|

1 |

|

|

| |

|

|

|

|

|

2 |

|

|

| |

|

|

|

|

|

3 |

|

|

| |

|

|

|

|

|

4 |

|

|

| |

|

|

|

|

|

6 |

|

|

| |

|

|

|

|

|

8 |

|

|

| |

|

|

|

|

|

8

|

|

|

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-3 that we are filing with the Securities and Exchange Commission (the “SEC”) using a “shelf” registration process. Under this process, using this prospectus and, if required, one or more prospectus supplements, the Selling Stockholder may, from time to time, offer and sell the Common Stock described in this prospectus in one or more offerings.

This prospectus provides you with a general description of the Common Stock that the Selling Stockholder may offer. Each time the Selling Stockholder sells Offered Shares, we will, to the extent required by law, provide a prospectus supplement that contains specific information about the terms of that offering. Prospectus supplements also may add to, update or change information in this prospectus. If there is any inconsistency between the information in this prospectus and any prospectus supplement or any related free writing prospectus that we prepare or authorize, you should rely on the information in the prospectus supplement or related free writing prospectus. You should carefully read this prospectus, any prospectus supplement, any free writing prospectus and the additional information described below under the headings “Where You Can Find More Information” and “Incorporation of Certain Documents by Reference.”

You should rely only on the information contained in or incorporated by reference into this prospectus, any accompanying prospectus supplement or in any related free writing prospectus filed by us with the SEC. We and the Selling Stockholder have not authorized anyone to provide you with different or additional information. If anyone provides you with different or additional information, you should not rely on it.

This prospectus and any accompanying prospectus supplement or free writing prospectus do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the securities described in this prospectus or an offer to sell or the solicitation of an offer to buy securities in any circumstances in which such offer or solicitation is unlawful. You should assume that the information appearing in this prospectus, any accompanying prospectus supplement and any free writing prospectus is accurate as of the date on its respective cover, and that any information incorporated by reference herein or therein is accurate only as of the date of the document incorporated by reference, unless we indicate otherwise. Our business, financial condition, results of operations and prospects may have changed since those dates and may change again.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference in this prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the information requirements of the Exchange Act of 1934, as amended (the “Exchange Act”), and in accordance therewith we file annual, quarterly and current reports, proxy statements and other information with the SEC on a regular basis.

The SEC maintains an Internet site that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC. Our filings with the SEC are available to the public through the SEC’s website at http://www.sec.gov. We make available, free of charge, on or through our website our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, and any amendments to these reports, as soon as reasonably practicable after we electronically file such information with, or furnish such information to, the SEC. You may access these documents on our website at https://civitasresources.com. Information contained on or accessible through our website is not deemed part of this prospectus, other than the documents we have filed with the SEC that are expressly incorporated by reference into this prospectus.

Civitas has filed with the SEC a registration statement on Form S-3 relating to the securities covered by this prospectus. This prospectus is part of the registration statement and does not contain all the information in the registration statement. You will find additional information about us in the registration statement.

Any statement made in this prospectus concerning a contract or other document of ours is not necessarily complete, and you should read the documents that are filed as exhibits to the registration statement or otherwise filed with the SEC for a more complete understanding of the document or matter. Each such statement is qualified in all respects by reference to the document to which it refers. You may obtain a copy of the registration statement through the SEC’s website.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The SEC allows us to “incorporate by reference” information into this prospectus, which means that we can disclose important information to you by referring you to another document filed separately with the SEC. The information we incorporate by reference is an important part of this prospectus, and later information that we file with the SEC will automatically update and supersede this information. We incorporate by reference the documents listed below and any future filings we make with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act (other than portions of these documents that are either (i) described in paragraph (e) of Item 201 of Regulation S-K or paragraphs (d)(1)-(3) and (e)(5) of Item 407 of Regulation S-K or (ii) deemed to have been furnished and not filed in accordance with SEC rules, including pursuant to Item 2.02 or Item 7.01 of any Current Report on Form 8-K (including any financial statements or exhibits relating thereto furnished pursuant to Item 9.01), unless otherwise indicated therein), after the date of this prospectus and prior to the termination of this offering. Any statement contained in this prospectus or a document incorporated or deemed to be incorporated by reference herein shall be automatically deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained herein or in any other subsequently filed document that also is incorporated or deemed to be incorporated by reference herein modifies or supersedes such prior statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus. The following documents we filed with the SEC pursuant to the Exchange Act are incorporated herein by reference (other than portions of these documents that are either (i) described in paragraph (e) of Item 201 of Regulation S-K or paragraphs (d)(1)-(3) and (e)(5) of Item 407 of Regulation S-K or (ii) deemed to have been furnished and not filed in accordance with SEC rules, including pursuant to Item 2.02 or Item 7.01 of any Current Report on Form 8-K (including any financial statements or exhibits relating thereto furnished pursuant to Item 9.01), unless otherwise indicated therein):

•

•

our Quarterly Reports on Form 10-Q for the quarter ended March 31, 2023, filed with the SEC on May 3, 2023, the quarter ended June 30, 2023, filed with the SEC on August 2, 2023, and the quarter ended September 30, 2023, filed with the SEC on November 7, 2023;

•

•

our Current Reports on Form 8-K filed with the SEC on January 24, 2023, February 22, 2023, April 6, 2023, June 5, 2023, June 20, 2023, June 20, 2023, June 23, 2023, June 26, 2023, June 29, 2023, August 2, 2023, October 4, 2023, October 4, 2023, October 10, 2023, October 10, 2023, October 10, 2023, October 18, 2023, November 29, 2023, January 2, 2024 and January 2, 2024 and on Form 8-K/A filed with the SEC on September 29, 2023, in each case, excluding Items 2.02 or 7.01; and

•

the description of our Common Stock incorporated by reference to Exhibit 4.1 to our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 filed with the SEC on February 22, 2023, including any amendment or report filed for the purpose of updating such description.

Any statement in this prospectus or incorporated by reference into this prospectus shall be automatically modified or superseded for purposes of this prospectus to the extent that a statement contained herein or in a subsequently filed document that is incorporated by reference into this prospectus modifies or supersedes such prior statement. You should not assume that the information in this prospectus or in any document incorporated by reference is accurate as of any date other than the date on the front cover of the applicable document.

We will provide without charge to each person, including any beneficial owner, to whom a copy of this prospectus is delivered, upon the written or oral request of such person, a copy of any or all of the information incorporated by reference in this prospectus, other than exhibits to such information (unless such exhibits are specifically incorporated by reference into the information that this prospectus incorporates). Requests for such copies should be directed to:

Civitas Resources, Inc.

Attention: Senior Vice President, General Counsel and Assistant Corporate Secretary

555 17th Street, Suite 3700

Denver, Colorado 80202

Phone: (303) 293-9100

amilton@civiresources.com

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, any prospectus supplement, any related free writing prospectus and the documents incorporated by reference herein or therein contain various statements, including those that express belief, expectation or intention, as well as those that are not statements of historic fact, that are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Exchange Act. The words “could,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “may,” “continue,” “predict,” “potential,” “project,” “plan,” “will,” and similar expressions are intended to identify estimates and forward-looking statements, although not all estimates and forward- looking statements contain such identifying words. Our estimates and forward-looking statements are based on our management’s current belief, based on currently available information, as to the outcome and timing of future events, which affect or may affect our businesses and operations.

Without limiting the generality of the foregoing, forward-looking statements contained in this prospectus and in the documents incorporated by reference herein, or contained in any accompanying prospectus supplement or free writing prospectus and in the documents incorporated by reference therein, include statements related to, among other things:

•

our business strategies;

•

reserves estimates;

•

estimated sales volumes;

•

the amount and allocation of forecasted capital expenditures and plans for funding capital expenditures and operating expenses;

•

our ability to modify future capital expenditures;

•

anticipated costs;

•

compliance with debt covenants;

•

our ability to fund and satisfy obligations related to ongoing operations;

•

compliance with government regulations, including those related to climate change as well as environmental, health, and safety regulations and liabilities thereunder;

•

our ability to achieve, reach, or otherwise meet initiatives, plans, or ambitions with respect to environmental, social and governance matters;

•

the adequacy of gathering systems and continuous improvement of such gathering systems;

•

the impact from the lack of available gathering systems and processing facilities in certain areas;

•

oil, natural gas, and natural gas liquid prices and factors affecting the volatility of such prices;

•

the impact of lower commodity prices;

•

sufficiency of impairments;

•

the ability to use derivative instruments to manage commodity price risk and ability to use such instruments in the future;

•

our drilling inventory and drilling intentions;

•

the impact of potentially disruptive technologies;

•

our estimated revenue gains and losses;

•

the timing and success of specific projects;

•

our implementation of standard and long reach laterals;

•

our intention to continue to optimize enhanced completion techniques and well design changes;

•

stated working interest percentages;

•

our management and technical team;

•

outcomes and effects of litigation, claims and disputes;

•

our ability to replace oil and natural gas reserves;

•

our ability to convert proved undeveloped reserves to producing properties within five years of their initial proved booking;

•

our ability to pursue potential future capital management activities such as share repurchases, paying dividends on our Common Stock at their current level or at all, or additional mechanisms to return excess capital to our stockholders;

•

the impact of the loss of a single customer or any purchaser of our products;

•

the timing and ability to meet certain volume commitments related to purchase and transportation agreements;

•

the impact of any pandemic or other public health epidemic, including the COVID-19 pandemic;

•

the impact of customary royalty interests, overriding royalty interests, obligations incident to operating agreements, liens for current taxes, and other industry-related constraints;

•

our anticipated financial position, including our cash flow and liquidity;

•

the adequacy of our insurance;

•

plans and expectations with respect to our recent acquisitions and such anticipated impact of the recent acquisitions on the Company’s results of operations, financial position, future growth opportunities, reserve estimates, and competitive position;

•

the results, effects, benefits, and synergies of other mergers and acquisitions; and

•

other statements concerning our anticipated operations, economic performance, and financial condition.

We have based these forward-looking statements on certain assumptions and analyses we have made in light of our experience and our perception of historical trends, current conditions, and expected future developments as well as other factors we believe are appropriate under the circumstances. They can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. Many such factors will be important in determining actual future results. The actual results or developments anticipated by these forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond our control, and may not be realized or, even if substantially realized, may not have the expected consequences. Actual results could differ materially from those expressed or implied in the forward-looking statements.

Factors that could cause actual results to differ materially include, but are not limited to, the following:

•

the risk factors discussed in Part I, Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2022, in Exhibit 99.2 to our Current Report on Form 8-K filed with the SEC on June 20, 2023, in any accompanying prospectus supplement and in other filings made by us from time to time with the SEC or in materials incorporated herein or therein;

•

declines or volatility in the prices we receive for our oil, natural gas, and natural gas liquids;

•

general economic conditions, whether internationally, nationally or in the regional and local market areas in which we do business, including any future economic downturn, the impact of continued or further inflation, disruption in the financial markets, and the availability of credit on acceptable terms;

•

our ability to identify and select possible additional acquisition and disposition opportunities;

•

the effects of disruption of our operations or excess supply of oil and natural gas due to world health events and the actions by certain oil and natural gas producing countries, including Russia;

•

ability of our customers to meet their obligations to us;

•

our access to capital on acceptable terms;

•

our ability to generate sufficient cash flow from operations, borrowings or other sources to enable us to fully develop our undeveloped acreage positions;

•

the presence or recoverability of estimated oil and natural gas reserves and the actual future sales volume rates and associated costs;

•

uncertainties associated with estimates of proved oil and gas reserves;

•

the possibility that the industry may be subject to future local, state, and federal regulatory or legislative actions (including additional taxes and changes in environmental, health, and safety regulation and regulations addressing climate change);

•

environmental, health, and safety risks;

•

seasonal weather conditions, as well as severe weather and other natural events caused by climate change;

•

lease stipulations;

•

drilling and operating risks, including the risks associated with the employment of horizontal drilling and completion techniques;

•

our ability to acquire adequate supplies of water for drilling and completion operations;

•

availability of oilfield equipment, services, and personnel;

•

exploration and development risks;

•

operational interruption of centralized oil and natural gas processing facilities;

•

competition in the oil and natural gas industry;

•

management’s ability to execute our plans to meet our goals;

•

unforeseen difficulties encountered in operating in new geographic areas;

•

our ability to attract and retain key members of our senior management and key technical employees;

•

our ability to maintain effective internal controls;

•

access to adequate gathering systems and pipeline take-away capacity;

•

our ability to secure adequate processing capacity for natural gas we produce, to secure adequate transportation for oil, natural gas, and natural gas liquids we produce, and to sell the oil, natural gas, and natural gas liquids at market prices;

•

costs and other risks associated with perfecting title for mineral rights in some of our properties;

•

political conditions in or affecting the other producing countries, including conflicts in or relating to the Middle East (including the current events related to the Israel-Palestine conflict), South America, and Russia (including the current events involving Russia and Ukraine), and other sustained military campaigns or acts of terrorism or sabotage;

•

the continuing effects of the COVID-19 pandemic, including any recurrence or worsening thereof;

•

disruptions to our business due to acquisitions and other significant transactions; and

•

other economic, competitive, governmental, legislative, regulatory, geopolitical and technological factors that may negatively impact our businesses, operations, or pricing.

Estimates and forward-looking statements involve risks and uncertainties and are not guarantees of future performance. As a result of the risks and uncertainties described above, the estimates and forward- looking statements discussed in this prospectus, any prospectus supplement, any related free writing prospectus and the documents incorporated by reference herein or therein might not occur and our future results and our performance may differ materially from those expressed in these forward-looking statements due to, including, but not limited to, the factors mentioned above. Because of these uncertainties, you should not place undue reliance on these forward-looking statements.

All forward-looking statements and estimates speak only as of the date they were made, and, except to the extent required by law, we undertake no obligation to update or revise any estimate and/or forward- looking statement because of new information, future events or other factors. Although we believe that our

plans, intentions, and expectations reflected in or suggested by the estimates and forward-looking statements are based upon reasonable assumptions, we can give no assurance that these plans, intentions, or expectations will be achieved because they are subject to several risks and uncertainties and are made in light of information currently available to us. Many important factors, in addition to the factors described in this prospectus, any prospectus supplement, any related free writing prospectus and the documents incorporated by reference herein or therein, may adversely affect our results as indicated in forward-looking statements. You should read this prospectus, any prospectus supplement, any related free writing prospectus and the documents incorporated by reference herein or therein completely and with the understanding that our actual future results may be materially different from what we expect. We disclose other important factors that could cause our actual results to differ materially from our expectations under Part I, Item 1A., “Risk Factors” and elsewhere in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 and in Exhibit 99.2 to our Current Report on Form 8-K filed with the SEC on June 20, 2023. These cautionary statements qualify all forward-looking statements attributable to us or persons acting on our behalf.

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider before deciding to invest in our Common Stock. You should read the entire prospectus carefully, including “Risk Factors” beginning on page 2, “Cautionary Statement Regarding Forward-Looking Statements” beginning on page vi and the documents incorporated by reference, which are described under “Incorporation of Certain Documents by Reference” beginning on page iv, before making an investment decision.

Our Business

We are an independent exploration and production company focused on the acquisition, development, and production of oil and associated liquids-rich natural gas primarily in the DJ Basin in Colorado and the Permian Basin in Texas and New Mexico. We believe our acreage has been significantly delineated by our own drilling success and by the success of offset operators, providing confidence that our results are repeatable and will continue to generate economic returns. The Company’s primary objective is to maximize shareholder returns by responsibly developing our oil and natural gas resources. To achieve this, Civitas is guided by four foundational pillars that we believe add long-term, sustainable value. These pillars are: generate free cash flow, maintain a premier balance sheet, return free cash flow to shareholders, and demonstrate Environmental, Social, and Governance leadership.

Company Information

We were incorporated under the laws of the State of Delaware on December 2, 2010. Our principal executive offices are located at 555 17th Street, Suite 3700, Denver, Colorado 80202. The telephone number at our principal executive offices is (303) 293-9100. Our website address is https://civitasresources.com. Information on or accessible through our website does not constitute part of this prospectus.

The Offering

This prospectus relates to the possible resale of up to 7,181,527 shares of Common Stock, which were issued by us to the Selling Stockholder, an indirect equityholder of Vencer Energy, LLC, a Delaware limited liability company (“Vencer”), as consideration in connection with our purchase from Vencer of certain oil and gas properties, interests and related assets located in Glasscock, Martin, Midland, Reagan and Upton Counties, Texas (the “Asset Acquisition”), pursuant to that certain Purchase and Sale Agreement, dated as of October 3, 2023, by and between Vencer and the Company (the “PSA”).

In connection with the closing of the Asset Acquisition, on January 2, 2024 (the “Closing Date”), we entered into a registration rights agreement (the “Registration Rights Agreement”) with the Selling Stockholder. See “Selling Stockholder.” Pursuant to the terms of the Registration Rights Agreement, among other things and subject to certain restrictions, we are required to file with the SEC a registration statement on Form S-3 to register the resale of the Registrable Securities (as defined in the Registration Rights Agreement).

The Selling Stockholder will determine when and how it sells the shares of Common Stock offered in this prospectus, as described in “Plan of Distribution.” See “Selling Stockholder” for additional information concerning the Asset Acquisition and the Selling Stockholder. We will not receive any of the proceeds from the sale of the shares of Common Stock being offered pursuant to this prospectus.

RISK FACTORS

Investing in our securities involves significant risks. You should review carefully the risks and uncertainties described under the heading “Risk Factors” contained in our Annual Report on Form 10-K for the year ended December 31, 2022 and in Exhibit 99.2 to our Current Report on Form 8-K filed with the SEC on June 20, 2023, which are incorporated by reference into this prospectus, and under the caption “Risk Factors” or any similar caption in the other documents and reports that we file with the SEC after the date of this prospectus that are incorporated or deemed to be incorporated by reference into this prospectus or that may be included in any applicable prospectus supplement, before making a decision to invest in our securities.

Each of the referenced risks and uncertainties could adversely affect our business, cash flows, operating results and financial condition, as well as the value of an investment in our securities. Such risks and uncertainties are not the only ones we face. Additional risks and uncertainties that are not presently known to us or that we currently believe are immaterial may adversely affect or otherwise materially harm our business, operating results and financial condition and the value of an investment in our securities, and could result in a complete loss of your investment.

USE OF PROCEEDS

We will not receive any proceeds from the sale of the Offered Shares by the Selling Stockholder. All shares of Common Stock offered by this prospectus are being registered for the account of the Selling Stockholder.

SELLING STOCKHOLDER

References to the “Selling Stockholder” in this prospectus mean the entity listed in the table below, and the pledgees, donees, transferees, assignees, successors and others who later come to hold any of the Offered Shares as a result of a transfer not involving a public sale.

This prospectus relates to the possible resale by the Selling Stockholder of up to 7,181,527 shares of our Common Stock. In connection with the closing of the Asset Acquisition, we issued 7,181,527 shares of our Common Stock to the Selling Stockholder. Upon consummation of the Asset Acquisition, we entered into the Registration Rights Agreement. The registration statement of which this prospectus is a part is being filed at the request of the Selling Stockholder pursuant to the Registration Rights Agreement. Under the Registration Rights Agreement, among other things, subject to certain requirements and exceptions, we are required to file with the SEC upon request a “shelf” registration statement on Form S-3 under the Securities Act to permit the resale of the Registrable Securities from time to time as permitted by Rule 415 under the Securities Act (or any similar provision adopted by the SEC then in effect), and to use our commercially reasonable efforts to cause the registration statement to remain effective, and to be supplemented and amended to the extent necessary to ensure that the registration statement is available or, if not available, that another registration statement is available, for the resale of all the Registrable Securities until all of the Registrable Securities have ceased to be Registrable Securities or the earlier termination of the Registration Rights Agreement.

Furthermore, under the Registration Rights Agreement, the Selling Stockholder has demand rights and piggyback registration rights with respect to certain other underwritten offerings conducted by us for our own account or other stockholders of ours. The Registration Rights Agreement contains customary indemnification and contribution obligations of ours for the benefit of the Selling Stockholder and vice versa, subject to certain qualifications and exceptions.

The Selling Stockholder may offer the shares for resale from time to time pursuant to this prospectus. The Selling Stockholder may also sell, transfer or otherwise dispose of all or a portion of its shares in transactions exempt from the registration requirements of the Securities Act or pursuant to another effective registration statement covering those shares. Information about the Selling Stockholder may change over time. As used in this prospectus, “Selling Stockholder” includes the donees, transferees, assignees, successors, heirs, executors, administrators, legal representatives, pledgees and others who may later hold the Selling Stockholder’s interests.

We do not know when or in what amounts the Selling Stockholder may offer shares for sale, and, other than as set forth herein, we currently have no agreements, arrangements or understandings with the Selling Stockholder regarding the sale or other disposition of any of the Offered Shares. Because the Selling Stockholder may offer all, some or none of the shares pursuant to this offering, no definitive estimate as to the number of shares that will be held by the Selling Stockholder after the offering can be provided.

The following table sets forth, as of the date of this prospectus, the name of the Selling Stockholder, the number of shares of Common Stock that the Selling Stockholder may offer pursuant to this prospectus and the number of shares of Common Stock owned by the Selling Stockholder before and after the offering. Solely for purposes of the table below, we have assumed that the Selling Stockholder will sell all of the Offered Shares and will make no other purchases or sales of Common Stock.

| |

|

|

Shares of Common Stock

Beneficially Owned Prior to

the Offering(1)

|

|

|

Number of Shares

of Common Stock

Being Offered

Hereby

|

|

|

Shares of Common Stock

Beneficially Owned After

Completion of the Offering(1)(2)

|

|

|

Name

|

|

|

Number

|

|

|

Percent(3)

|

|

|

Number

|

|

|

Percent(3)

|

|

|

Vencer Energy Holdings, LLC(4)

|

|

|

|

|

7,181,527 |

|

|

|

|

|

7.1% |

|

|

|

|

|

7,181,527 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

(1)

Beneficial ownership is determined in accordance with the rules of the SEC, pursuant to which a person is deemed to be a “beneficial owner” of a security if that person has or shares voting power, which includes the power to vote or direct the voting of such security, or investment power, which includes the power to dispose of or to direct the disposition of such security. Under these rules, more than one person may be deemed a beneficial owner of the same securities, and a person may be deemed

a beneficial owner of securities as to which such person has no economic interest. Except as otherwise indicated in these footnotes, each of the beneficial owners has, to our knowledge, sole voting and investment power with respect to the indicated shares of Common Stock.

(2)

Assumes that the Selling Stockholder sells all of the shares of Common Stock offered pursuant to this prospectus and will make no other purchases or sales of Common Stock.

(3)

Based on 93,774,901 shares of Common Stock outstanding as of December 29, 2023.

(4)

Vencer Energy Holdings, LLC (“Vencer Holdings”) is the record holder of the shares of Common Stock reported herein. Vitol Holding B.V. is the sole shareholder of Euromin Inc., which is the sole shareholder of Vitol US Holding Co. (“Vitol US”). Vitol US is the sole shareholder of V-US Upstream Co., which is the sole member of Vencer Energy AIV, LLC, which is the majority member of Vencer Holdings. As a result of such relationships, each of the foregoing entities may be deemed to share beneficial ownership of the shares of Common Stock held by Vencer Holdings.

PLAN OF DISTRIBUTION

The Offered Shares are being registered to permit the Selling Stockholder (which as used herein means the entity listed in the table included herein under “Selling Stockholder” and the pledgees, donees, transferees, assignees, successors and others who later come to hold any of the Offered Shares as a result of a transfer not involving a public sale) to offer and sell the Offered Shares from time to time after the date of this prospectus. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale or at negotiated prices.

We will not receive any of the proceeds from the offering by the Selling Stockholder of the Offered Shares. However, pursuant to the Registration Rights Agreement, Civitas will pay the Registration Expenses (as defined therein) associated with the registration and sale of the Offered Shares by the Selling Stockholder. The Selling Stockholder will pay, on a pro rata basis, any Selling Expenses (as defined in the Registration Rights Agreement), which include underwriting fees, discounts and selling commissions.

The Selling Stockholder may use any one or more of the following methods when disposing of the Offered Shares or interests therein:

•

on the NYSE or any other national securities exchange or U.S. inter-dealer system of a registered national securities association on which the Common Stock may be listed or quoted at the time of sale;

•

an over-the-counter sale or distribution;

•

ordinary brokerage transactions and transactions in which a broker-dealer solicits purchasers;

•

one or more underwritten offerings;

•

block trades in which a broker-dealer will attempt to sell the shares as agent, but may position and resell a portion of the block as principal to facilitate the transaction, or in crosses in which the same broker acts as an agent on both sides;

•

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

•

an exchange distribution and/or secondary distribution in accordance with the rules of the applicable exchange;

•

privately negotiated transactions;

•

short sales, whether through a broker-dealer or themselves;

•

through distributions by any Selling Stockholder to its general or limited partners, members, managers affiliates, employees, directors or stockholders;

•

in options transactions;

•

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; and

•

in any combination of the above or by any other legally available means available to and requested by the Selling Stockholder.

The Selling Stockholder may, from time to time, pledge or grant a security interest in some of the shares of Common Stock owned by it and, if the Selling Stockholder defaults in the performance of its secured obligations, the pledgees or secured parties may offer and sell the shares, from time to time, under this prospectus, or under an amendment or supplement to this prospectus amending the list of the Selling Stockholder to include the pledgees, transferees or other successors-in-interest as the Selling Stockholder under this prospectus. In connection with the sale of shares of Common Stock or interests therein, the Selling Stockholder may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of shares of Common Stock in the course of hedging the positions they assume. The Selling Stockholder may also sell shares of Common Stock short and deliver these securities to close out their short positions, or loan or pledge shares of Common Stock to broker-dealers that in turn may sell these securities. The Selling Stockholder may also enter into option or other transactions with broker-dealers or other financial institutions or one or more derivative securities that require the

delivery to such broker-dealer or other financial institution of the Offered Shares, which shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction). The Selling Stockholder also may transfer the shares of Common Stock in other circumstances, in which case the transferees, pledgees or other successors-in-interest will be the selling beneficial owners for purposes of this prospectus.

The Selling Stockholder also may resell a portion of the Offered Shares in open market transactions in reliance upon Rule 144 under the Securities Act, provided that they meet the criteria and conform to the requirements of that rule, or pursuant to other available exemptions from the registration requirements of the Securities Act.

The Selling Stockholder and any underwriters, broker-dealers or agents that participate in the sale of shares of Common Stock or interests therein may be “underwriters” within the meaning of Section 2(11) of the Securities Act. Any discounts, commissions, concessions or profit they earn on any resale of the shares of Common Stock may constitute underwriting discounts and commissions under the Securities Act. If the Selling Stockholder is an “underwriter” within the meaning of Section 2(11) of the Securities Act, then the Selling Stockholder will be subject to the prospectus delivery requirements of the Securities Act. Underwriters and their controlling persons, dealers and agents may be entitled, under agreements entered into by such underwriters, controlling persons, dealers or agents and the Selling Stockholder, to indemnification against and contribution toward specific civil liabilities, including liabilities under the Securities Act.

To the extent required, the shares of Common Stock to be sold, the respective purchase prices and public offering prices, the names of any agents, dealers or underwriters and any applicable discounts, commissions, concessions or other compensation with respect to a particular offering will be set forth in an accompanying prospectus supplement or, if appropriate, a post-effective amendment to the registration statement that includes this prospectus.

To facilitate the offering of the shares of Common Stock offered by the Selling Stockholder, certain persons participating in the offering may engage in transactions that stabilize, maintain or otherwise affect the price of the Common Stock. This may include over-allotments or short sales, which involve the sale by persons participating in the offering of more shares than were sold to them. In these circumstances, these persons would cover such over-allotments or short positions by making purchases in the open market or by exercising their over-allotment option(s), if any. In addition, these persons may stabilize or maintain the price of the Common Stock by bidding for or purchasing shares of Common Stock in the open market or by imposing penalty bids, whereby selling concessions allowed to dealers participating in the offering may be reclaimed if shares sold by them are repurchased in connection with stabilization transactions. The effect of these transactions may be to stabilize or maintain the market price of the Common Stock at a level above that which might otherwise prevail in the open market. These transactions may be discontinued at any time.

LEGAL MATTERS

The validity of the securities being offered by this prospectus will be passed upon by Kirkland & Ellis, LLP, Houston, Texas. In connection with particular offerings of the securities in the future, and if stated in the applicable prospectus supplement, the validity of those securities may be passed upon for us by Kirkland & Ellis, LLP, Houston, Texas, and for any underwriters or agents by counsel named in the applicable prospectus supplement.

EXPERTS

The financial statements of Civitas Resources, Inc. as of December 31, 2022 and 2021 and for each of the three years in the period ended December 31, 2022, incorporated by reference in this prospectus, and the effectiveness of Civitas Resources, Inc.’s internal control over financial reporting have been audited by Deloitte & Touche LLP, an independent registered public accounting firm, as stated in their reports. Such financial statements are incorporated by reference in reliance upon the reports of such firm given their authority as experts in accounting and auditing.

The consolidated financial statements of Hibernia Energy III, LLC at December 31, 2022 and 2021, and for each of the two years in the period ended December 31, 2022, incorporated by reference in this prospectus and in the registration statement of which this prospectus forms a part by reference to Civitas Resources, Inc.’s Current Report on Form 8-K/A dated September 29, 2023 have been audited by Ernst & Young LLP, independent auditors, as set forth in their report thereon incorporated by reference therein, and incorporated by reference in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

The consolidated financial statements of Tap Rock AcquisitionCo, LLC at December 31, 2022 and 2021, and for each of the two years in the period ended December 31, 2022, incorporated by reference in this prospectus and in the registration statement of which this prospectus forms a part by reference to Civitas Resources, Inc.’s Current Report on Form 8-K/A dated September 29, 2023 have been audited by Ernst & Young LLP, independent auditors, as set forth in their report thereon incorporated by reference therein, and incorporated by reference in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

The consolidated financial statements of Tap Rock Resources II, LLC at December 31, 2022 and 2021, and for each of the two years in the period ended December 31, 2022, incorporated by reference in this prospectus and in the registration statement of which this prospectus forms a part by reference to Civitas Resources, Inc.’s Current Report on Form 8-K/A dated September 29, 2023 have been audited by Ernst & Young LLP, independent auditors, as set forth in their report thereon incorporated by reference therein, and incorporated by reference in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

The historical information relating to our natural gas, oil, and NGL reserves and related future net cash flows and present values thereof related to our properties as of December 31, 2022 included or incorporated by reference in this prospectus, including all statistics and data, was derived from reserve reports prepared by Civitas’ independent reserve engineers, Ryder Scott Company, L.P., as of December 31, 2022. Civitas has included these estimates in reliance on the authority of such firm as an expert in such matters.

Estimates of proved reserves attributable to certain interests of Hibernia Energy III, LLC and Hibernia Energy III-B, LLC as of December 31, 2022 and related information included or incorporated by reference in this prospectus have been prepared based on reports prepared and audited by Netherland, Sewell & Associates, Inc., independent consulting petroleum engineers, and all such information has been so incorporated in reliance on the authority of such experts in such matters.

Estimates of proved reserves attributable to certain interests of Tap Rock AcquisitionCo, LLC, Tap Rock Resources II, LLC, and Tap Rock NM10 Holdings, LLC as of December 31, 2022 and related information included or incorporated by reference in this prospectus have been prepared by Ryder Scott Company, L.P., independent consulting petroleum engineers, and all such information has been so incorporated in reliance on the authority of such experts in such matters.

Estimates of proved reserves attributable to certain interests of Vencer Energy, LLC as of December 31, 2022 and related information included or incorporated by reference in this prospectus have been prepared by DeGolyer & MacNaughton, independent consulting petroleum engineers, and all such information has been so incorporated in reliance on the authority of such experts in such matters.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution.

Set forth below are the expenses (other than underwriting discounts and commissions) expected to be incurred in connection with the issuance and distribution of the securities registered hereby, all of which will be borne by Civitas, except as noted below.

| |

SEC registration fee

|

|

|

|

$ |

73,181.95 |

|

|

| |

Accounting fees and expenses

|

|

|

|

|

*

|

|

|

| |

Legal fees and expenses(1)

|

|

|

|

|

*

|

|

|

| |

Printing expenses

|

|

|

|

|

*

|

|

|

| |

Transfer agent’s fees and expenses

|

|

|

|

|

*

|

|

|

| |

Miscellaneous expenses(1)

|

|

|

|

|

*

|

|

|

| |

Total expenses

|

|

|

|

$ |

73,181.95* |

|

|

*

Estimated expenses are not presently known.

(1)

Pursuant to the Registration Rights Agreement, the Company will pay the Registration Expenses, which are generally the fees and expenses associated with the registration and sale of the Offered Shares by the Selling Stockholder, except Selling Expenses, which include certain fees and expenses of counsel engaged by the Selling Stockholder and stock transfer taxes.

Item 15. Indemnification of Directors and Officers.

Our fourth amended and restated certificate of incorporation (our “Charter”) provides that a director will not be liable to the Company or its stockholders for monetary damages for breach of fiduciary duty as a director, except for liability (1) for any breach of the director’s duty of loyalty to the Company or its stockholders, (2) for acts or omissions not in good faith or which involved intentional misconduct or a knowing violation of the law, (3) under Section 174 of the DGCL for unlawful payment of dividends or improper redemption of stock or (4) for any transaction from which the director derived an improper personal benefit. In addition, if the DGCL is amended to authorize the further elimination or limitation of the liability of directors, then the liability of a director of the Company will be limited to the fullest extent permitted by the amended DGCL.

Section 145 of the DGCL provides that a corporation may indemnify directors and officers as well as other employees and individuals against expenses, including attorneys’ fees, judgments, fines and amounts paid in settlement in connection with specified actions, suits and proceedings whether civil, criminal, administrative, or investigative, other than a derivative action by or in the right of the corporation, if they acted in good faith and in a manner they reasonably believed to be in or not opposed to the best interests of the corporation and, with respect to any criminal action or proceeding, had no reasonable cause to believe their conduct was unlawful. A similar standard is applicable in the case of derivative actions, except that indemnification extends only to expenses, including attorneys’ fees, incurred in connection with the defense or settlement of such action and the statute requires court approval before there can be any indemnification where the person seeking indemnification has been found liable to the corporation. The statute provides that it is not exclusive of other indemnification that may be granted by a corporation’s certificate of incorporation, bylaws, disinterested director vote, stockholder vote, agreement or otherwise.

Our Charter contains indemnification rights for our directors and our officers. Additionally, our seventh amended and restated bylaws (our “Bylaws”) provides that we will indemnify and advance expenses to any officer or director to the fullest extent authorized by the DGCL and that persons who are not directors or officers may be similarly indemnified for service to the Company to the extent authorized by our board of directors.

We have obtained directors’ and officers’ insurance to cover our directors, officers and some of our employees for certain liabilities. Further, we have entered into written indemnity agreements with our

directors and executive officers. Under these agreements, if a director or officer makes a claim of indemnification to us, either a majority of the independent directors or independent legal counsel selected by the independent directors will review the relevant facts and make a determination regarding whether the officer or director has met the standards of conduct under Delaware law that would permit (under Delaware law) and require (under the indemnity agreement) us to indemnify the officer or director.

The foregoing is only a general summary of certain aspects of Delaware law, our Charter and our Bylaws dealing with indemnification of directors and officers, and does not purport to be complete. It is qualified in its entirety by reference to the detailed provisions of Section 145 of the DGCL, our Charter and our Bylaws.

Item 16. Exhibits.

| |

Exhibit

No.

|

|

|

Description

|

|

| |

2.1†

|

|

|

Purchase and Sale Agreement, dated as of October 3, 2023, by and between Vencer Energy, LLC, as seller, and Civitas Resources, Inc., as buyer (incorporated by reference to Exhibit 2.1 to Civitas Resources, Inc.’s Current Report on Form 8-K, File No. 001-35371, filed on October 4, 2023).

|

|

| |

4.1

|

|

|

Fourth Amended and Restated Certificate of Incorporation of Civitas Resources, Inc., dated as of June 3, 2023 (incorporated by reference to Exhibit 3.1 to Civitas Resources, Inc.’s Quarterly Report on Form 10-Q, File No. 001-35371, filed with the Commission on August 2, 2023).

|

|

| |

4.2

|

|

|

Seventh Amended and Restated Bylaws of Civitas Resources, Inc. (incorporated by reference to Exhibit 3.1 to Civitas Resources, Inc.’s Current Report on Form 8-K, File No. 001-35371, filed with the Commission on June 5, 2023).

|

|

| |

4.3

|

|

|

Registration Rights Agreement, dated as of January 2, 2024, by and among Civitas Resources, Inc. and the persons identified on Schedule I thereto (incorporated by reference to Exhibit 10.1 to Civitas Resources, Inc.’s Current Report on Form 8-K, File No. 001-35371, filed on January 2, 2024).

|

|

| |

5.1*

|

|

|

|

|

| |

23.1*

|

|

|

|

|

| |

23.2*

|

|

|

|

|

| |

23.3*

|

|

|

|

|

| |

23.4*

|

|

|

|

|

| |

23.5*

|

|

|

|

|

| |

23.6*

|

|

|

|

|

| |

23.7*

|

|

|

|

|

| |

23.8*

|

|

|

|

|

| |

23.9*

|

|

|

|

|

| |

24.1*

|

|

|

|

|

| |

107*

|

|

|

|

|

†

Certain schedules and similar attachments have been omitted pursuant to Item 601(a)(5) of Regulation S-K. Civitas Resources, Inc. agrees to furnish a supplemental copy of any omitted schedule or attachment to the SEC upon request.

*

Filed herewith.

Item 17. Undertakings.

(a)

The undersigned registrant hereby undertakes:

(1)

To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i)

To include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii)

To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the SEC pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

(iii)

To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

provided, however, that paragraphs (a)(1)(i), (a)(1)(ii) and (a)(1)(iii) of this section do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the SEC by the registrant pursuant to Section 13 or Section 15(d) of the Exchange Act, that are incorporated by reference in this registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of this registration statement.

(2)

That, for the purpose of determining any liability under the Securities Act, each such post- effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3)

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4)

That, for the purpose of determining liability under the Securities Act to any purchaser:

(i)

Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(ii)

Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5) or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof; provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration

statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

(5)

That, for the purpose of determining liability of the registrant under the Securities Act to any purchaser in the initial distribution of the securities, the undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i)

Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

(ii)

Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

(iii)

The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and

(iv)

Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

(b)

The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in this registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c)

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Denver, State of Colorado, on January 2, 2024.

| |

|

|

|

CIVITAS RESOURCES, INC.

|

|

| |

|

|

|

By:

|

|

|

/s/ Adrian Milton

Name:

Adrian Milton

|

|

| |

|

|

|

|

|

|

Title:

Senior Vice President, General Counsel and Assistant Corporate Secretary

|

|

POWER OF ATTORNEY

Each person whose signature appears below hereby appoints Marianella Foschi and Adrian Milton, and each of them, severally, as his or her true and lawful attorney or attorneys-in-fact and agent, with full power of substitution and resubstitution, for him or her and in his or her name, place and stead, in any and all capacities, to sign any and all amendments to this registration statement (including all post-effective amendments and registration statements filed pursuant to Rule 462 promulgated under the Securities Act of 1933, as amended), and to file the same with all exhibits thereto, and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorney-in-fact and agent full power and authority to do and perform each act and thing requisite and necessary to be done, as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that said attorney-in-fact and agent, or his or her substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities and on the dates indicated.

| |

Signature

|

|

|

Title

|

|

|

Date

|

|

| |

/s/ M. Christopher Doyle

M. Christopher Doyle

|

|

|

President, Chief Executive

Officer and Director

(Principal Executive Officer)

|

|

|

January 2, 2024

|

|

| |

/s/ Marianella Foschi

Marianella Foschi

|

|

|

Chief Financial Officer

(Principal Financial Officer)

|

|

|

January 2, 2024

|

|

| |

/s/ Sandra K. Garbiso

Sandra K. Garbiso

|

|

|

Chief Accounting Officer

and Treasurer

(Principal Accounting Officer)

|

|

|

January 2, 2024

|

|

| |

/s/ Wouter van Kempen

Wouter van Kempen

|

|

|

Chair of the Board

|

|

|

January 2, 2024

|

|

| |

/s/ Deborah Byers

Deborah Byers

|

|

|

Director

|

|

|

January 2, 2024

|

|

| |

Signature

|

|

|

Title

|

|

|

Date

|

|

| |

/s/ Morris R. Clark

Morris R. Clark

|

|

|

Director

|

|

|

January 2, 2024

|

|

| |

/s/ Carrie M. Fox

Carrie M. Fox

|

|

|

Director

|

|

|

January 2, 2024

|

|

| |

/s/ Carrie L. Hudak

Carrie L. Hudak

|

|

|

Director

|

|

|

January 2, 2024

|

|

| |

/s/ James M. Trimble

James M. Trimble

|

|

|

Director

|

|

|

January 2, 2024

|

|

| |

/s/ Howard A. Willard III

Howard A. Willard III

|

|

|

Director

|

|

|

January 2, 2024

|

|

| |

/s/ Jeffrey E. Wojahn

Jeffrey E. Wojahn

|

|

|

Director

|

|

|

January 2, 2024

|

|

Exhibit 5.1

|

To Call Writer Directly:

+1 713 836 3600 |

609 Main Street

Houston, TX 77002

United States

www.kirkland.com |

Facsimile:

+1 713 836 3601 |

| |

|

|

January 2, 2024

Civitas Resources, Inc.

555 17th Street, Suite 3700

Denver, Colorado 80202

Ladies and Gentlemen:

We have acted as special counsel

to Civitas Resources, Inc., a Delaware corporation (the “Company”), in connection with the preparation

of the Registration Statement on Form S-3ASR (as amended or supplemented, the “Registration Statement”)

filed with the Securities and Exchange Commission (the “Commission”) on or about the date hereof under the Securities

Act of 1933, as amended (the “Securities Act”), by the Company. The Registration Statement relates to the sale

from time to time, pursuant to Rule 415 of the General Rules and Regulations promulgated under the Securities Act, of 7,181,527

shares (the “Shares”) of common stock, par value $0.01 per share, of the Company to be sold by a stockholder

of the Company (the “Selling Stockholder”).

In connection with the registration

of the Shares, we have examined originals, or copies certified or otherwise identified to our satisfaction, of such documents, corporate

records and other instruments as we have deemed necessary for the purposes of this opinion, including (i) the Registration Statement

and the exhibits thereto, (ii) the organizational documents of the Company and (iii) the minutes and records of the corporate

proceedings of the Company with respect to the issuance of the Shares.

For purposes of this opinion,

we have assumed the authenticity of all documents submitted to us as originals, the conformity to the originals of all documents submitted

to us as copies and the authenticity of the originals of all documents submitted to us as copies. We have also assumed the legal capacity

of all natural persons, the genuineness of the signatures of persons signing all documents in connection with which this opinion is rendered,

the authority of such persons signing on behalf of the parties thereto and the due authorization, execution and delivery of all documents

by the parties thereto other than the Company. We have not independently established or verified any facts relevant to the opinions expressed

herein, but have relied upon statements and representations of officers and other representatives of the Company and others as to factual

matters.

We have also assumed that:

(i) the Registration

Statement will be effective and will comply with all applicable laws at the time the Shares are offered or sold as contemplated by the

Registration Statement;

(ii) if applicable,

a prospectus supplement or term sheet, as applicable (“Prospectus Supplement”) will have been prepared and filed

with the Commission describing the Shares offered thereby and will comply with all applicable laws; and

(iii) all Shares

will be sold in compliance with applicable federal and state securities laws and in the manner stated in the Registration Statement and,

if applicable, the appropriate Prospectus Supplement.

Based upon and subject to

the foregoing qualifications, assumptions and limitations and the further limitations set forth below, we are of the opinion that, with

respect to the Shares to be offered by the Selling Stockholder pursuant to the Registration Statement, such Shares are validly issued,

fully paid and nonassessable.

Austin Bay Area Beijing Boston Brussels Chicago Dallas Hong Kong London Los Angeles Miami Munich New York Paris Salt Lake City Shanghai

Washington, D.C.

Civitas Resources, Inc.

January 2,

2024

Page 2

Our opinion expressed above

is subject to the qualifications that we express no opinion as to the applicability of, compliance with, or effect of any laws except

the General Corporation Law of the State of Delaware, including the applicable provisions of the Delaware constitution and reported judicial

decisions interpreting these laws.

We hereby consent to the filing

of this opinion with the Commission as Exhibit 5.1 to the Registration Statement. We also consent to the reference to our firm under

the heading “Legal Matters” in the Registration Statement. In giving this consent, we do not thereby admit that we are in

the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations of the

Commission.

We do not find it necessary

for the purposes of this opinion, and accordingly we do not purport to cover herein, the application of the securities or “Blue

Sky” laws of the various states to the sale of the Shares.

This opinion is limited to

the specific issues addressed herein, and no opinion may be inferred or implied beyond that expressly stated herein. This opinion speaks

only as of the date hereof and we assume no obligation to revise or supplement this opinion should the General Corporation Law of the

State of Delaware be changed by legislative action, judicial decision or otherwise after the date hereof.

This opinion is furnished

to you in connection with the filing of the Registration Statement in accordance with the requirements of Item 601(b)(5) of Regulation

S-K under the Securities Act, and is not to be used, circulated, quoted or otherwise relied upon for any other purpose.

| |

Sincerely, |

| |

|

| |

/s/ Kirkland & Ellis LLP |

| |

Kirkland & Ellis LLP |

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM

We consent to the incorporation by reference in this Registration Statement

on Form S-3 of our reports dated February 22, 2023 relating to the financial statements of Civitas Resources, Inc. (the “Company”)

and the effectiveness of the Company's internal control over financial reporting, appearing in the Annual Report on Form 10-K of the Company

for the year ended December 31, 2022. We also consent to the reference to us under the heading “Experts” in such Registration

Statement.

| /s/ Deloitte & Touche LLP |

|

Denver, Colorado

January 2, 2024

Exhibit 23.2

Consent of Independent Auditors

We consent to the reference to our firm under the caption “Experts”