California Resources Corporation Releases 2023 Sustainability Report Detailing a Year of Progress on Sustainability Initiatives

31 October 2024 - 7:00AM

California Resources Corporation (NYSE: CRC) today announced the

publication of its 2023 Sustainability Report detailing the

Company’s sustainability initiatives and strategy as well as

progress toward its environmental, social and governance (ESG)

goals.

“CRC is committed to supporting the energy

transition, decarbonizing our local economies and helping

California achieve its climate goals,” said Francisco Leon, CRC

President and Chief Executive Officer. “Our 2023 performance

reflects our progress as we continue to reliably deliver

sustainable and affordable energy products critical to our

communities and develop innovative carbon management solutions that

will help meet California’s present and future energy needs.”

“I’m proud of how Carbon TerraVault (CTV), our

carbon management business, expanded in 2023, demonstrating our

commitment to being a premier carbon management solutions provider

and carbon capture and storage leader in California,” said Chris

Gould, CRC Executive Vice President and Chief Sustainability

Officer, and Managing Director, CTV Holdings. “CTV continues to

attract interest from clean energy companies, green capital

providers and federal funding for research and development for

large- and small-scale deployment of carbon capture technologies

that will help mitigate the impacts of climate change and benefit

local communities in California.”

2023 Highlights and

Achievements:

- Total scope 1 and scope 2 carbon

dioxide equivalent emissions reduced 10% from our 2020 baseline;

total scope 1, 2 and 3 emissions reduced 13.4%.

- Completed application process that

led to receiving a “Grade A” certification in 2024 through MiQ’s

Methane Emissions Performance Standard for CRC’s operating assets

in Los Angeles and Orange Counties. This is the first “Grade A”

independently certified gas designation awarded by MiQ to oil and

natural gas operating assets in California and the Rocky Mountain

region. MiQ is a global leader in the transparent certification of

methane emissions data.

- Announced receipt of California’s

first U.S. Environmental Protection Agency draft Class VI well

permits for underground carbon dioxide injection and storage at

CTV’s Elk Hills 26-R reservoir.

- Entered into Carbon Dioxide

Management Agreements with various clean energy companies, which

will allow for the capture and storage of up to nearly 900,000

metric tons of CO2 per year.

- Supported nearly 140 nonprofit

organizations and provided more than $2.5 million in donations

across California that work to positively impact the

communities.

- Continued as a net supplier of both

fresh water and electricity to local communities, providing more

than three times the water to California water districts

(approximately 4.75 billion gallons of treated, reclaimed water in

2023) than consumed in operations.

- Continued to rank among the safest

companies in the United States; in 2023, CRC’s workforce achieved a

better safety performance rating than many non-industrial sectors

according to the U.S. Bureau of Labor Statistics.

For more information about CRC’s sustainability

efforts and to download the 2023 Sustainability Report, please

visit crc.com/esg.

About California Resources

Corporation

California Resources Corporation (CRC) is an

independent energy and carbon management company committed to

energy transition. CRC is committed to environmental stewardship

while safely providing local, responsibly sourced energy. CRC is

also focused on maximizing the value of its land, mineral

ownership, and energy expertise for decarbonization by developing

carbon capture and storage and other emissions-reducing projects.

For more information about CRC, please visit www.crc.com.

Forward-Looking Statements

This document contains statements that CRC

believes to be “forward-looking statements” within the meaning of

Section 27A of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934. All statements other than

historical facts are forward-looking statements, and include

statements regarding CRC's future financial position, business

strategy, projected revenues, earnings, costs, capital expenditures

and plans and objectives of management for the future. Words such

as “expect,” “could,” “may,” “anticipate,” “intend,” “plan,”

“ability,” “believe,” “seek,” “see,” “will,” “would,” “estimate,”

“forecast,” “target,” “guidance,” “outlook,” “opportunity” or

“strategy” or similar expressions are generally intended to

identify forward-looking statements. Such forward-looking

statements are subject to risks and uncertainties that could cause

actual results to differ materially from those expressed in, or

implied by, such statements.

Although CRC believes the expectations and

forecasts reflected in its forward-looking statements are

reasonable, they are inherently subject to numerous risks and

uncertainties, most of which are difficult to predict and many of

which are beyond its control. No assurance can be given that such

forward-looking statements will be correct or achieved or that the

assumptions are accurate or will not change over time. Particular

uncertainties that could cause CRC's actual results to be

materially different than those expressed in its forward-looking

statements include:

- fluctuations in commodity prices, including supply and demand

considerations for CRC's products and services;

- decisions as to production levels and/or pricing by OPEC or

U.S. producers in future periods;

- government policy, war and political conditions and events,

including the military conflicts in Israel, Lebanon, Ukraine, Yemen

and the Red Sea;

- the ability to successfully integrate Aera's business;

- regulatory actions and changes that affect the oil and gas

industry generally and CRC in particular, including (1) the

availability or timing of, or conditions imposed on, permits and

approvals necessary for drilling or development activities or its

carbon management business; (2) the management of energy, water,

land, greenhouse gases (GHGs) or other emissions, (3) the

protection of health, safety and the environment, or (4) the

transportation, marketing and sale of CRC's products;

- the impact of inflation on future expenses and changes

generally in the prices of goods and services;

- changes in business strategy and CRC's capital plan;

- lower-than-expected production or higher-than-expected

production decline rates;

- changes to CRC's estimates of reserves and related future cash

flows, including changes arising from its inability to develop such

reserves in a timely manner, and any inability to replace such

reserves;

- the recoverability of resources and unexpected geologic

conditions;

- general economic conditions and trends, including conditions in

the worldwide financial, trade and credit markets;

- production-sharing contracts' effects on production and

operating costs;

- the lack of available equipment, service or labor price

inflation;

- limitations on transportation or storage capacity and the need

to shut-in wells;

- any failure of risk management;

- results from operations and competition in the industries in

which CRC operates;

- CRC's ability to realize the anticipated benefits from prior or

future efforts to reduce costs;

- environmental risks and liability under federal, regional,

state, provincial, tribal, local and international environmental

laws and regulations (including remedial actions);

- the creditworthiness and performance of CRC's counterparties,

including financial institutions, operating partners, CCS project

participants and other parties;

- reorganization or restructuring of CRC's operations;

- CRC's ability to claim and utilize tax credits or other

incentives in connection with its CCS projects;

- CRC's ability to realize the benefits contemplated by its

energy transition strategies and initiatives, including CCS

projects and other renewable energy efforts;

- CRC's ability to successfully identify, develop and finance

carbon capture and storage projects and other renewable energy

efforts, including those in connection with the Carbon TerraVault

JV, and its ability to convert its CDMAs to definitive agreements

and enter into other offtake agreements;

- CRC's ability to maximize the value of its carbon management

business and operate it on a stand alone basis;

- CRC's ability to successfully develop infrastructure projects

and enter into third party contracts on contemplated terms;

- uncertainty around the accounting of emissions and its ability

to successfully gather and verify emissions data and other

environmental impacts;

- changes to CRC's dividend policy and share repurchase program,

and its ability to declare future dividends or repurchase shares

under its debt agreements;

- limitations on CRC's financial flexibility due to existing and

future debt;

- insufficient cash flow to fund CRC's capital plan and other

planned investments and return capital to shareholders;

- changes in interest rates;

- CRC's access to and the terms of credit in commercial banking

and capital markets, including its ability to refinance its debt or

obtain separate financing for its carbon management business;

- changes in state, federal or international tax rates, including

CRC's ability to utilize its net operating loss carryforwards to

reduce its income tax obligations;

- effects of hedging transactions;

- the effect of CRC's stock price on costs associated with

incentive compensation;

- inability to enter into desirable transactions, including joint

ventures, divestitures of oil and natural gas properties and real

estate, and acquisitions, and CRC's ability to achieve any expected

synergies;

- disruptions due to earthquakes, forest fires, floods, extreme

weather events or other natural occurrences, accidents, mechanical

failures, power outages, transportation or storage constraints,

labor difficulties, cybersecurity breaches or attacks or other

catastrophic events;

- pandemics, epidemics, outbreaks, or other public health events,

such as the COVID-19 pandemic; and

- other factors discussed in Part I, Item 1A – Risk Factors in

CRC's Annual Report on Form 10-K and its other SEC filings

available at www.crc.com.

CRC cautions you not to place undue reliance on forward-looking

statements contained in this document, which speak only as of the

filing date, and the company undertakes no obligation to update

this information. This document may also contain information from

third party sources. This data may involve a number of assumptions

and limitations, and CRC has not independently verified them and

does not warrant the accuracy or completeness of such third-party

information.

Contacts:

| Joanna Park (Investor

Relations)818-661-3731Joanna.Park@crc.com |

Richard Venn

(Media)818-661-6014Richard.Venn@crc.com |

This press release was published by a CLEAR® Verified

individual.

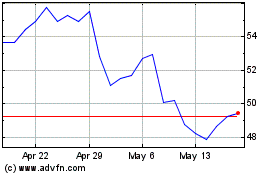

California Resources (NYSE:CRC)

Historical Stock Chart

From Jan 2025 to Feb 2025

California Resources (NYSE:CRC)

Historical Stock Chart

From Feb 2024 to Feb 2025