EXPEDITED REVIEW REQUESTED UNDER 17 CFR 270.0-5(d)

UNITED STATES OF AMERICA BEFORE THE

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

IN THE MATTER OF:

DESTRA MULTI-ALTERNATIVE FUND AND

DESTRA CAPITAL ADVISORS LLC |

|

APPLICATION PURSUANT TO SECTION 6(c) OF THE INVESTMENT COMPANY ACT OF 1940, AS AMENDED (THE “ACT”) FOR AN ORDER GRANTING EXEMPTIONS

FROM SECTION 19(b) OF THE ACT AND RULE 19b-1 THEREUNDER |

Investment Company Act of 1940 File No. 812-

PLEASE SEND ALL COMMUNICATIONS AND ORDERS TO:

Joshua B. Deringer

Faegre Drinker Biddle & Reath LLP

One Logan Square, Ste. 2000

Philadelphia, PA 19103-6996

(215) 988-2959

joshua.deringer@faegredrinker.com

WITH A COPY TO:

Robert A. Watson

C/O Destra Capital Advisors LLC

443 N Willson Avenue

Bozeman, MT 59715

This Application (including Exhibits) consists

of 53 pages

The Exhibit Index is on page 14

As filed with the U.S. Securities and Exchange Commission on October 18, 2024

Destra Multi-Alternative Fund (the “Fund”) and Destra Capital Advisors LLC (“Destra” and together with the Fund (the “Applicants”) hereby submit this application for an order (the “Order”) of the Securities and Exchange Commission (the “Commission”) pursuant to Section 6(c) of the Investment Company Act of 1940, as amended (the “1940 Act”), providing the Fund, and each other closed-end management investment company registered

under the 1940 Act advised or to be advised in the future by Destra, or by an entity controlling, controlled by or under common control (within the meaning

of Section 2(a)(9) of the 1940 Act) with Destra (including any successor in interest1) (each such entity, including Destra, the “Adviser”) that in the future seeks to rely on the Order (such investment companies, together

with the Fund, are collectively referred to herein as the “Funds” and each separately

as a “Future Fund”), an exemption from the provisions of Section 19(b) of the 1940 Act and Rule 19b-1 thereunder, as more fully set forth below (the “Application”).2 The Fund and the Future Funds are hereinafter collectively referred to as the “Funds”

and separately as a “Fund.”

The Fund is organized as a Delaware statutory trust, which is registered under the

1940 Act as a non-diversified, closed-end management investment company and commenced

operations on March 16, 2012. The Fund’s common shares are listed on the New York Stock Exchange (“NYSE”), a national securities exchange as defined in Section 2(a)(26) of the 1940 Act. Although the Fund does not currently intend to issue preferred

shares, the board of trustees of the Fund may authorize the issuance of preferred

shares in the future.

The Fund’s investment objective is to seek returns from capital appreciation and income with an emphasis on income generation. The Fund pursues its investment objective by investing primarily in income-producing

securities, including: (1) public and private real estate securities (including securities

issued by real estate funds), (2) alternative investment funds (“AIFs”), which include business development companies (“BDCs”), funds commonly known as “hedge funds” and other private investment funds, which

may also include funds that primarily hold real estate investments, (3) master limited

partnerships, (4) common and preferred stocks, and (5) structured notes, notes, bonds

and asset-backed securities. The Fund also executes investments in the preceding types

of securities through index-linked or actively managed exchange-traded funds (“ETFs”), mutual funds and closed-end funds (collectively “Underlying Funds”). The Fund

defines AIFs as BDCs, real estate property funds, limited partnerships and limited

liability companies that pursue investment strategies linked to real estate, small

businesses or other investments that serve as alternatives to investments in traditional

stocks and bonds (which could include any type of investment that is consistent with

the investment strategy and not a traditional stock or bond).

Destra, with offices at 443 N Willson Avenue, Bozeman, MT 59715, serves as the investment adviser to the Fund. Destra is registered with the Commission as an investment adviser under the Investment Advisers

Act of 1940, as amended. Subject to the oversight of the board of trustees of the

Fund, Destra is responsible for managing the investment activities of the Fund and the Fund’s business affairs.

| III. | REQUEST FOR EXEMPTIVE RELIEF |

Section 19(b) of the 1940 Act provides that it shall be unlawful in contravention of such rules,

regulations, or orders as the Commission may prescribe as necessary or appropriate

in the public interest or for the protection of investors for any registered investment

company to distribute long-term capital gains, as defined in the Internal Revenue

Code of 1986, as amended (the “Code”), more often than once every twelve months. Rule 19b-1 under the 1940 Act provides that no registered investment company which is a

“regulated investment company” as defined in Section 851 of the Code may make more than (i) one “capital gain dividend,” as defined in Section 852(b)(3)(C) of the Code, in any one taxable year of the company, (ii) one additional

capital gain distribution made in whole or in part to avoid payment of excise tax

under Section 4982 of the Code plus (iii) one supplemental capital gain dividend pursuant to Section 855 of the Code (provided that it does not exceed 10% of the total amount distributed for the taxable year).

| 1 | For the purposes of the requested order, “successor”

is limited to an entity that results from a reorganization into another jurisdiction or a change in the type of business organization. |

| 2 | The only registered closed-end investment company that currently

intends to rely on the Order has been named as an Applicant. Any Fund that may rely on the Order in the future will comply with the terms

and conditions of the Application. |

Applicants believe that Rule 19b-1 should be interpreted to permit a Fund to pay an unlimited number of distributions

on its common and preferred shares (if any) so long as it makes the designation necessary

under the Code and Rule 19b-1 to characterize those distributions as “capital gain dividends” restricted by

Rule 19b-1 only as often as is permitted by Rule 19b-1, even if the Code would then require retroactively spreading the capital gain

resulting from that designation over more than the permissible number of distributions.

However, to obtain certainty for a Fund’s proposed distribution policies (each, a “Distribution Policy”), in the absence of such an interpretation, Applicants hereby request an order pursuant

to Section 6(c) of the 1940 Act granting an exemption from Section 19(b) of the 1940 Act and Rule 19b-1 thereunder. The Order would permit each Fund to make periodic capital gain dividends

(as defined in Section 852(b)(3)(C) of the Code) that include long-term capital gains as frequently as twelve

times in any one taxable year in respect of its shares of beneficial interest (“common shares”) and as often as specified by, or determined in accordance with the terms of, any

preferred shares issued by the Fund.

| IV. | REPRESENTATIONS OF APPLICANTS |

Prior to a Fund’s implementing a Distribution Policy in reliance on the Order, the board of directors

or trustees (the “Board”) of each Fund seeking to rely on the Order, including a majority of the directors

or trustees who are not interested persons of the Fund, as defined in Section 2(a)(19) of the 1940 Act (the “Independent Board Members”), will request, and the Adviser will provide, such information as is reasonably

necessary to make an informed determination of whether the Board should adopt a proposed

Distribution Policy. In particular, the Board and the Independent Board Members will

review information regarding (i) the purpose and terms of the proposed Distribution

Policy; (ii) the likely effects of the proposed Distribution Policy on the Fund’s long-term total return (in relation to market price and net asset value per share

of common shares (“NAV”)); (iii) the expected relationship between the Fund’s distribution rate on its common shares under the proposed Distribution Policy and

the Fund’s total return (in relation to NAV); (iv) whether the rate of distribution is anticipated

to exceed the Fund’s expected total return in relation to its NAV; and (v) any foreseeable material effects

of the proposed Distribution Policy on the Fund’s long-term total return (in relation to market price and NAV).

The Independent Board Members will also consider what conflicts of interest the Adviser

and the affiliated persons of the Adviser and the Fund might have with respect to

the adoption or implementation of the proposed Distribution Policy.

Following this review, the Board, including the Independent Board Members, of each

Fund will, before adopting or implementing any proposed Distribution Policy, make

a determination that the proposed Distribution Policy is consistent with the Fund’s investment objective(s) and in the best interests of the holders of the Fund’s common shares. The Distribution Policy will be consistent with the Fund’s policies and procedures and will be described in the Fund’s registration statement.

In addition, prior to implementation of a Distribution Policy for any Fund pursuant

to the Order requested by this Application, the Board of the Fund shall have adopted

policies and procedures (the “Section 19 Compliance Policies”) pursuant to Rule 38a-1 under the 1940 Act that:

|

1. |

are reasonably designed to ensure that all notices required to be sent to the Fund’s shareholders pursuant to Section 19(a) of the 1940 Act, Rule 19a-1 thereunder and by condition 4 below (each, a “19(a) Notice”) include the disclosure required by Rule 19a-1 and by condition 2(a) below, and that all other written communications by the

Fund or its agents regarding distributions under the Distribution Policy include the

disclosure required by condition 3(a) below; and |

|

2. |

require the Fund to keep records that demonstrate its compliance with all of the conditions

of the Order and that are necessary for the Fund to form the basis for, or demonstrate

the calculation of, the amounts disclosed in its 19(a) Notices. |

The records of the actions of the Board of each Fund will summarize the basis for

the Board’s approval of the Distribution Policy, including its consideration of the factors

described above. These records will be maintained for a period of at least six years from the date of the applicable meeting, the first

two years in an easily accessible place, or for such longer period as may otherwise

be required by law.

Generally, the purpose of a Distribution Policy would be to permit a Fund to distribute

periodically, over the course of each year, an amount closely approximating the total

taxable income of the Fund during the year through distributions in relatively equal

amounts (plus any required special distributions) that are composed of payments received

from portfolio companies, supplemental amounts generally representing realized capital

gains or, possibly, returns of capital that may represent unrealized capital gains.

The Fund seeks to establish a distribution rate that approximates the Fund’s projected total return that can reasonably be expected to be generated by the Fund

over an extended period of time, although the distribution rate will not be solely

dependent on the amount of income earned or capital gains realized by the Fund for

the year. Under the Distribution Policy of a Fund, the Fund would distribute periodically

(as frequently as twelve times in any taxable year) to its respective common shareholders

a fixed percentage of the market price of the Fund’s common shares at a particular point in time or a fixed percentage of NAV at a particular

time or a fixed amount per share of common shares, any of which may be adjusted from

time to time. It is anticipated that under a Distribution Policy, the minimum annual

distribution rate with respect to the Fund’s common shares would be independent of the Fund’s performance during any particular period but would be expected to correlate with

the Fund’s performance over time. Except for extraordinary distributions and potential increases

or decreases in the final dividend periods in light of the Fund’s performance for an entire calendar year and to enable the Fund to comply with the

distribution requirements of Subchapter M of the Code for the calendar year, each

distribution on the Fund’s common shares would be at the stated rate then in effect. The Board will periodically

review the amount of potential distributions in light of the investment experience

of the Fund, and may modify or terminate a Distribution Policy at any time.

| V. | JUSTIFICATION FOR REQUESTED RELIEF |

Section 6(c) of the 1940 Act provides that the Commission may exempt any person, security or

transaction from any provision of the 1940 Act or of any rule or regulation thereunder,

if and to the extent that the exemption is necessary or appropriate in the public

interest and consistent with the protection of investors and the purposes fairly intended

by the policy and provisions of the 1940 Act. For the reasons set forth below, Applicants

submit that the requested exemption from Section 19(b) of the 1940 Act and Rule 19b-1 thereunder would be consistent with the standards set forth in Section 6(c) of the 1940 Act and in the best interests of the Funds and their respective shareholders.

A. Receipt of the Order would serve shareholder interests

Applicants believe that closed-end fund investors may prefer an investment vehicle

that provides regular current income through fixed distribution policies that would

be available through a Distribution Policy. Allowing a Distribution Policy to operate

in the manner described in this Application would help fill current investor demand

and foster competition in the registered fund market.

An exemption from Rule 19b-1 would benefit shareholders in another way. Common shares of closed-end funds

often trade in the marketplace at a discount to their NAV. Applicants believe that

this discount may be reduced if a Fund is permitted to pay relatively frequent dividends

on its common shares at a consistent rate, whether or not those dividends contain

an element of long-term capital gains. Any reduction in the discount at which the

Fund’s common shares trade in the market would benefit the holders of the Fund’s common shares along with the Fund.

B. The Fund’s shareholders would receive information sufficient to clearly inform them of the

nature of the distributions they are receiving

One of the concerns leading

to the enactment of Section 19(b) and adoption of Rule 19b-1 was that shareholders might be unable to distinguish between frequent

distributions of capital gains and dividends from investment income.3 However, Rule 19a-1 under the 1940 Act effectively

addresses this concern by requiring that distributions (or the confirmation of the reinvestment thereof) estimated to be sourced in part

from capital gains or capital be accompanied by a separate statement showing the sources of the distribution (e.g., estimated net income,

net short-term capital gains, net long-term capital gains and/or return of capital). The same information will be included in each Fund’s

annual report to shareholders and on its Internal Revenue Service (“IRS”) Form 1099-DIV, which will be sent to each

common and preferred shareholder who received distributions during a particular year (including shareholders who have sold shares during

the year).

In addition, each of the Funds will make the additional disclosures required by the

conditions set forth in Part VI below, and each of them will adopt compliance policies

and procedures in accordance with Rule 38a-1 under the 1940 Act to ensure that all required notices and disclosures are sent

to shareholders.

The information required by Section 19(a), Rule 19a-1, the Distribution Policy, the Section 19 Compliance Policies and the conditions listed below will help to ensure that each

Fund’s shareholders are provided sufficient information to understand that their periodic

distributions are not tied to the Fund’s net investment income (which for this purpose is the Fund’s taxable income other than from capital gains) and realized capital gains to date,

and may not represent yield or investment return. Accordingly, subjecting the Funds

to Section 19(b) and Rule 19b-1 would afford shareholders no extra protection. In addition, the Funds will undertake

to request intermediaries, or their agent(s), to forward 19(a) Notices to their customers

and to reimburse them for the costs of forwarding. Such forwarding may occur in any

manner permitted by statute, rule or order or by the staff of the Commission.

C. Under certain circumstances, Rule 19b-1 gives rise to improper influence on portfolio management decisions, with no offsetting

benefit to shareholders

Rule 19b-1, when applied to a Distribution Policy, actually gives rise to one of the concerns

that Rule 19b-1 was intended to avoid: inappropriate influence on portfolio management decisions.

Funds that pay long-term capital gains distributions only once per year in accordance

with Rule 19b-1 impose no pressure on management to realize capital gains at any time when purely

investment considerations do not dictate doing so. In the absence of an exemption

from Rule 19b-1, the adoption of a periodic distribution plan imposes pressure on management

(i) not to realize any net long-term capital gains until the point in the year that

the fund can pay all of its remaining distributions in accordance with Rule 19b-1 and (ii) not to realize any long-term capital gains during any particular year

in excess of the amount of the aggregate pay-out for the year (since as a practical

matter excess gains must be distributed and accordingly would not be available to

satisfy pay-out requirements in following years), notwithstanding that purely investment

considerations might favor realization of long-term gains at different times.

No purpose is served by the distortion in the normal operation of a periodic distribution

plan required in order to comply with Rule 19b-1. There is no benefit in requiring any fund that adopts a periodic distribution

plan either to retain (and pay taxes on) long-term capital gains (with the resulting

additional tax return complexities for the fund’s shareholders) or to avoid designating its distributions of long-term gains as capital

gains dividends for tax purposes (thereby avoiding a Rule 19b-1 problem but providing distributions taxable at ordinary income rates rather than

the much lower long-term capital gains rates). The desirability of avoiding these

anomalous results creates pressure to limit the realization of long-term capital gains

that otherwise would be taken for purely investment considerations.

The Order requested by Applicants would minimize these anomalous effects of Rule 19b-1 by enabling the Funds to realize long-term capital gains as often as investment

considerations dictate without fear of violating Rule 19b-1.

| 3 | See Securities and Exchange Commission 1966 Report to Congress

on Investment Company Growth (H.R. Rep. No. 2337, 89th Cong. 2d Sess. 190-95 (1966)); S. Rep. No. 91-184, 91st Cong., 1st Sess. 29 (1969);

H.R. Rep. No. 91-1382, 91st Cong., 2d Sess. 29 (1970). |

D. Other concerns leading to adoption of Rule 19b-1 are not applicable

Another concern that led to the enactment of Section 19(b) of the 1940 Act and adoption of Rule 19b-1 was that frequent capital gains distributions could facilitate improper fund

share sales practices, including, in particular, the practice of urging an investor to purchase shares of a fund on the basis of an

upcoming capital gains dividend (“selling the dividend”), where the dividend would result in an immediate corresponding reduction in NAV

and would be in effect a taxable return of the investor’s capital. Applicants submit that this concern should not apply to closed-end investment

companies, such as the Funds, that do not continuously distribute shares. Furthermore,

if the underlying concern extends to secondary market purchases of shares of closed-end

funds that are subject to a large upcoming capital gains dividend, adoption of a periodic

distribution plan may help minimize the concern by avoiding, through periodic distributions,

any buildup of large end-of-the-year distributions.

Applicants also submit that the “selling the dividend” concern is not applicable to

preferred shares, which entitles a holder to no more than a specified periodic dividend

and, like a debt security, is initially sold at a price based upon its liquidation

preference, credit quality, dividend rate and frequency of payment. Investors buy

preferred shares for the purpose of receiving specific payments at the frequency bargained

for, and any application of Rule 19b-1 to preferred shares would be contrary to the expectation of investors. There

is also currently a tax rule that provides that any loss realized by a shareholder

upon sale of shares of a regulated investment company that were held for six months

or less will be treated as a long-term capital loss, to the extent of any long-term

capital gains paid on such shares, to avoid the selling of dividends.

E. Further limitations of Rule 19b-1

Subparagraphs (a) and (f) of Rule 19b-1 limit the number of capital gains dividends, as defined in Section 852(b)(3)(C) of the Code, that a fund may make with respect to any one taxable year

to one, plus a supplemental distribution made pursuant to Section 855 of the Code not exceeding 10% of the total amount distributed for the year, plus

one additional capital gain dividend made in whole or in part to avoid the excise

tax under Section 4982 of the Code.

Applicants assert that

by limiting the number of capital gain dividends that a Fund may make with respect to any one year, Rule 19b-1 may prevent the normal

and efficient operation of a periodic distribution plan whenever that Fund’s realized net long-term capital gains in any year exceed

the total of the periodic distributions that may include such capital gains under the rule. Rule 19b-1 thus may force the fixed

regular periodic distributions to be funded with returns of capital4 (to the extent net investment income and realized short

term capital gains are insufficient to fund the distribution), even though realized net long-term capital gains otherwise would be available.

To distribute all of a Fund’s long-term capital gains within the limits in Rule 19b-1, a Fund may be required to make total distributions in excess of the annual amount

called for by its periodic distribution plan or to retain and pay taxes on the excess

amount. Applicants believe that the application of Rule 19b-1 to a Fund’s periodic distribution plan may create pressure to limit the realization of long-term

capital gains based on considerations unrelated to investment goals.

Revenue Ruling 89-815

under the Code requires that a fund that seeks to qualify as a regulated investment company under the Code and that has both common

shares and preferred shares outstanding designate the types of income, e.g., investment income and capital gains, in the same proportion

as the total distributions distributed to each class for the tax year. To satisfy the proportionate designation requirements of Revenue

Ruling 89-81, whenever a fund has realized a long-term capital gain with respect to a given tax year, the fund must designate the required

proportionate share of such capital gain to be included in common and preferred shares dividends. Although Rule 19b-1 allows a fund

some flexibility with respect to the frequency of capital gains distributions, a fund might use all of the exceptions available under

Rule 19b-1 for a tax year and still need to distribute additional capital gains allocated to the preferred shares to comply with

Revenue Ruling 89-81.

The potential abuses addressed by Section 19(b) and Rule 19b-1 do not arise with respect to preferred shares issued by a closed-end fund. Such

distributions generally are either fixed or are determined in periodic auctions or

remarketings or are periodically reset by reference to short-term interest rates rather

than by reference to performance of the issuer, and Revenue Ruling 89-81 determines

the proportion of such distributions that are comprised of the long-term capital gains.

The Applicants also submit that the “selling the dividend” concern is not applicable

to preferred shares, which entitles a holder to no more than a periodic dividend at

a fixed rate or the rate determined by the market, and, like a debt security, is priced

based upon its liquidation value, dividend rate, credit quality, and frequency of

payment. Investors buy preferred shares for the purpose of receiving payments at the

frequency bargained for and do not expect the liquidation value of their shares to

change.

| 4 | These would be returns of capital for financial accounting

purposes and not for tax accounting purposes. |

| 5 | 1989-1 C.B. 226. |

The proposed Order will assist the Funds in avoiding these Rule 19b-1 problems.

F. General

The relief requested is that the Commission permit the Funds to make periodic distributions

in respect of their common shares as frequently as twelve times in any one taxable

year and in respect of their preferred shares as specified by or determined in accordance

with the terms thereof. Granting this relief would provide the Funds with flexibility

in meeting investor interest in receiving more frequent distributions. Implementation

of the relief would actually ameliorate the concerns that gave rise to Section 19(b) and Rule 19b-1 and help avoid the “selling of dividends” problem, which Section 19(b) and Rule 19b-1 are not effective in preventing.

The potential issues under Rule 19b-1 are not relevant to distributions on preferred shares. Not only are such distributions

fixed or determined by the market rather than by reference to the performance of the

issuer but also the long-term capital gain component is mandated by the IRS to be

the same proportion as the proportion of long-term gain dividends bears to the total

distributions in respect of the common shares and consequently the long-term gain

component cannot even be known until the end of the fund’s fiscal year. In these circumstances it would be very difficult for any of the potential

abuses reflected in Rule 19b-1’s restrictions to occur.

In summary, Rule 19b-1, in the circumstances referred to above, is likely to distort the effective and

proper functioning of a Fund’s Distribution Policy and gives rise to the very pressures on portfolio management

decisions that Rule 19b-1 was intended to avoid. These distortions forced by Rule 19b-1 serve no purpose and are not in the best interests of shareholders.

| VI. | APPLICANTS’ CONDITIONS |

Applicants agree that, with respect to each Fund seeking to rely on the Order, the

Order will be subject to each of the following conditions:

1. Compliance Review and Reporting

The Fund’s chief compliance officer will: (a) report to the Fund’s Board, no less frequently than once every three months or at the next regularly

scheduled quarterly Board meeting, whether (i) the Fund and its Adviser have complied

with the conditions of the Order and (ii) a material compliance matter (as defined

in Rule 38a-1(e)(2) under the 1940 Act) has occurred with respect to such conditions; and (b)

review the adequacy of the policies and procedures adopted by the Board no less frequently

than annually.

2. Disclosures to Fund Shareholders

(a) Each 19(a) Notice

disseminated to the holders of the Fund’s common shares, in addition to the information required by Section 19(a) and

Rule 19a-1:

(i) will provide, in a tabular or graphical format:

(1) the amount of the distribution, on a per share of common shares basis, together with

the amounts of such distribution amount, on a per share of common shares basis and

as a percentage of such distribution amount, from estimated: (A) net investment income;

(B) net realized short-term capital gains; (C) net realized long-term capital gains;

and (D) return of capital or other capital source;

(2) the fiscal year-to-date cumulative amount of distributions, on a per share of common

shares basis, together with the amounts of such cumulative amount, on a per share

of common shares basis and as a percentage of such cumulative amount of distributions,

from estimated: (A) net investment income; (B) net realized short-term capital gains;

(C) net realized long-term capital gains; and (D) return of capital or other capital

source;

(3) the average annual total return in relation to the change in NAV for the 5-year period

(or, if the Fund’s history of operations is less than five years, the time period commencing immediately

following the Fund’s first public offering) ending on the last day of the month ended immediately prior

to the most recent distribution record date compared to the current fiscal period’s annualized distribution rate expressed as a percentage of NAV as of the last day

of the month prior to the most recent distribution record date; and

(4) the cumulative total return in relation to the change in NAV from the last completed

fiscal year to the last day of the month prior to the most recent distribution record

date compared to the fiscal year-to-date cumulative distribution rate expressed as

a percentage of NAV as of the last day of the month prior to the most recent distribution

record date.

Such disclosure shall be made in a type size at least as large and as prominent as

the estimate of the sources of the current distribution; and

(ii) will include the following disclosure:

(1) “You should not draw any conclusions about the Fund’s investment performance from the amount of this distribution or from the terms of

the Fund’s Distribution Policy.”;

(2) “The

Fund estimates that it has distributed more than its income and net realized capital gains; therefore, a portion of your distribution

may be a return of capital. A return of capital may occur, for example, when some or all of the money that you invested in the Fund is

paid back to you. A return of capital distribution does not necessarily reflect the Fund’s investment performance and should not

be confused with ‘yield’ or ‘income’”;6 and

(3) “The amounts and sources of distributions reported in this 19(a) Notice are only estimates

and are not being provided for tax reporting purposes. The actual amounts and sources

of the amounts for tax reporting purposes will depend upon the Fund’s investment experience during the remainder of its fiscal year and may be subject

to changes based on tax regulations. The Fund will send you a Form 1099-DIV for the

calendar year that will tell you how to report these distributions for federal income

tax purposes.”

Such disclosure shall be made in a type size at least as large as and as prominent

as any other information in the 19(a) Notice and placed on the same page in close

proximity to the amount and the sources of the distribution.

(b) On the inside front cover of each report to shareholders under Rule 30e-1 under the 1940 Act, the Fund will:

(i) describe the terms of the Distribution Policy (including the fixed amount or fixed

percentage of the distributions and the frequency of the distributions);

(ii) include the disclosure required by condition 2(a)(ii)(1) above;

(iii) state, if applicable, that the Distribution Policy provides that the Board may amend

or terminate the Distribution Policy at any time without prior notice to Fund shareholders;

and

(iv) describe any reasonably foreseeable circumstances that might cause the Fund to terminate

the Distribution Policy and any reasonably foreseeable consequences of such termination.

| 6 | The disclosure in this condition 2(a)(ii)(2) will be included

only if the current distribution or the fiscal year-to-date cumulative distributions are estimated to include a return of capital. |

(c) Each report provided to shareholders of a Fund under Rule 30e-1 under the 1940 Act and each prospectus filed with the Commission on Form N-2

under the 1940 Act, will provide the Fund’s total return in relation to changes in NAV in the financial highlights table and

in any discussion about the Fund’s total return.

3. Disclosure to Shareholders, Prospective Shareholders and Third Parties

(a) The Fund will include the information contained in the relevant 19(a) Notice, including

the disclosure required by condition 2(a)(ii) above, in any written communication

(other than a communication on Form 1099) about the Distribution Policy or distributions

under the Distribution Policy by the Fund, or agents that the Fund has authorized

to make such communication on the Fund’s behalf, to any Fund shareholder, prospective shareholder or third-party information

provider;

(b) The Fund will issue, contemporaneously with the issuance of any 19(a) Notice, a press

release containing the information in the 19(a) Notice and will file with the Commission

the information contained in such 19(a) Notice, including the disclosure required

by condition 2(a)(ii) above, as an exhibit to its next filed Form N-CSR; and

(c) The Fund will post prominently a statement on its (or the Adviser’s) website containing the information in each 19(a) Notice, including the disclosure

required by condition 2(a)(ii) above, and maintain such information on such website

for at least 24 months.

4. Delivery of 19(a) Notices to Beneficial Owners

If a broker, dealer, bank or other person (“financial intermediary”) holds common shares issued by the Fund in nominee name, or otherwise, on behalf

of a beneficial owner, the Fund:

(a) will request that the financial intermediary, or its agent, forward the 19(a) Notice

to all beneficial owners of the Fund’s shares held through such financial intermediary;

(b) will provide, in a timely manner, to the financial intermediary, or its agent, enough

copies of the 19(a) Notice assembled in the form and at the place that the financial

intermediary, or its agent, reasonably requests to facilitate the financial intermediary’s sending of the 19(a) Notice to each beneficial owner of the Fund’s shares; and

(c) upon the request of any financial intermediary, or its agent, that receives copies

of the 19(a) Notice, will pay the financial intermediary, or its agent, the reasonable

expenses of sending the 19(a) Notice to such beneficial owners.

5. Additional Board Determinations

for Funds Whose Common Shares Trade at a Premium

If:

(a) The Fund’s common shares have traded on the stock exchange that they primarily trade on at

the time in question at an average premium to NAV equal to or greater than 10%, as

determined on the basis of the average of the discount or premium to NAV of the Fund’s common shares as of the close of each trading day over a 12-week rolling period

(each such 12-week rolling period ending on the last trading day of each week); and

(b) The Fund’s annualized distribution rate for such 12-week rolling period, expressed as a percentage

of NAV as of the ending date of such 12-week rolling period, is greater than the Fund’s average annual total return in relation to the change in NAV over the 2-year period

ending on the last day of such 12-week rolling period;

then:

(i) At the earlier of the next regularly scheduled meeting or within four months of the last day of such 12-week rolling period, the Board, including a majority of its Independent Board Members:

(1) will request and evaluate, and the Fund’s Adviser will furnish, such information as may be reasonably necessary to make an informed determination of whether the Distribution Policy should be continued or continued after amendment;

(2) will determine whether continuation, or continuation after amendment, of the Distribution Policy is consistent with the Fund’s investment objective(s) and policies and is in the best interests of the Fund and its shareholders, after considering the information in condition 5(b)(i)(1) above; including, without limitation:

| (A) | whether the Distribution Policy is accomplishing its purpose(s); |

|

(B) |

the reasonably foreseeable material effects of the Distribution Policy on the Fund’s long-term total return in relation to the market price and NAV of the Fund’s common shares; and |

|

(C) |

the Fund’s current distribution rate, as described in condition 5(b) above, compared with the

Fund’s average annual taxable income or total return over the 2-year period, as described

in condition 5(b), or such longer period as the Board deems appropriate; and |

(3) based upon that determination, will approve or disapprove the continuation, or continuation after amendment, of the Distribution Policy; and

(ii) The Board will record the information considered by it, including its consideration of the factors listed in condition 5(b)(i)(2) above, and the basis for its approval or disapproval of the continuation, or continuation after amendment, of the Distribution Policy in its meeting minutes, which must be made and preserved for a period of not less than six years from the date of such meeting, the first two years in an easily accessible place.

6. Public Offerings

The Fund will not make a public offering of the Fund’s common shares other than:

(a) a rights offering below NAV to holders of the Fund’s common shares;

(b) an offering in connection with a dividend reinvestment plan, merger, consolidation, acquisition, spin off or reorganization of the Fund; or

(c) an offering other than an offering described in conditions 6(a) and 6(b) above, provided that, with respect to such other offering:

(i) the Fund’s annualized distribution rate for the six months ending on the last day of the month ended immediately prior to the most recent distribution record date7, expressed as a percentage of NAV as of such date, is no more than one percentage point greater than the Fund’s average annual total return for the 5-year period ending on such date;8 and

(ii) the transmittal letter accompanying any registration statement filed with the Commission in connection with such offering discloses that the Fund has received an order under Section 19(b) to permit it to make periodic distributions of long- term capital gains with respect to its common shares as frequently as twelve times each year, and as frequently as distributions are specified by or determined in accordance with the terms of any outstanding shares of preferred shares as the Fund may issue.

| 7 | If the Fund has been in operation fewer than six months, the

measured period will begin immediately following the Fund’s first public offering. |

| 8 | If the Fund has been in operation fewer than five years, the

measured period will begin immediately following the Fund’s first public offering. |

7. Amendments to Rule 19b-1

The requested Order will expire on the effective date of any amendment to Rule 19b-1 that provides relief permitting certain closed-end investment companies to make periodic distributions of long-term capital gains with respect to their outstanding common shares as frequently as twelve times each year.

The Commission has recently granted substantially the same relief as that sought herein

in Saba Capital Income & Opportunities Fund II and Saba Capital Management, L.P., Investment Company Act Release Nos. 35277 (July 5, 2024) (notice) and 35288 (July 31, 2024) (order); High Income Securities Fund, et al., Investment Company Act Release Nos. 34373 (September 9, 2021) (notice) and 34395 (October 5, 2021) (order); First Eagle Global Opportunities Fund and First Eagle Investment Management, LLC, Investment Company Act Release Nos. 34397 (October 12, 2021) (notice) and 34416 (November 9, 2021) (order); Mainstay CBRE Global Infrastructure Megatrends Fund, et al., Investment Company Act Release Nos. 34372 (September 3, 2021) (notice) and 34390 (September 29, 2021) (order); DoubleLine Opportunistic Credit, et al., Investment Company Act Release Nos. 34328 (July 13, 2021) (notice) and 34353 (August 9, 2021) (order); Vertical Capital Income Fund and Oakline Advisors, LLC, Investment Company Act Release Nos. 33505 (June 12, 2019) (notice) and 33548 (July 9, 2019) (order); Putnam Managed Municipal Income Trust, et al., Investment Company Act Release Nos. 33449 (April 17, 2019) (notice) and 33474 (May 14, 2019) (order); Macquarie Global Infrastructure Total Return Fund Inc., et al., Investment Company Act Release Nos. 33389 (March 5, 2019) (notice) and 33436 (April 2, 2019) (order); Special Opportunities Fund, Inc. and Bulldog Investors, LLC, Investment Company Act Release Nos. 33367 (February 4, 2019) and 33386 (March 4, 2019); Vivaldi Opportunities Fund and Vivaldi Asset Management, LLC, Investment Company Act Release Nos. 33147 (July 3, 2018)(notice) and 33185 (July 31, 2018) (order); The Swiss Helvetia Fund, Inc., et al., Investment Company Act Release Nos. 33075 (April 23, 2018)(notice) and 33099 (May 21, 2018)(order); The Mexico Equity & Income Fund, Inc. and Pichardo Asset Management, S.A. de C.V., Investment Company Act Release Nos. 32640 (May 18, 2017)(notice) and 32676 (June 13, 2017)(order); RiverNorth DoubleLine Strategic Opportunity Fund, Inc. and RiverNorth Capital Management

LLC, Investment Company Act Release Nos. 32635 (May 12, 2017)(notice) and 32673 (June 7, 2017)(order); Brookfield Global Listed Infrastructure Income Fund Inc., et al., Investment Company Act Release Nos. 31802 (September 1, 2015) (notice) and 31855 (September 30, 2015)(order); and Ares Dynamic Credit Allocation Fund, Inc., et al., Investment Company Act Release Nos. 31665 (June 9, 2015) (notice) and 31708 (July 7, 2015)(order).

All of the requirements for execution and filing of this Application on behalf of

the Applicants have been complied with in accordance with the applicable organizational

documents of the Applicants, and the undersigned officers of the Applicants are fully

authorized to execute this Application. The resolutions of the Board of Trustees of

the Fund, authorizing the filing of this Application, required by Rule 0-2(c) under the 1940 Act, are included as Exhibit A to this Application. The verifications

required by Rule 0-2(d) under the 1940 Act are included as Exhibit B to this Application.

Pursuant to Rule 0-2(f)

under the 1940 Act, Applicants state that their address is 443 N Willson Avenue Bozeman, MT 59715 and that all written

communications regarding this Application should be directed to the individuals and addresses indicated on the cover page of this

Application.

Applicants desire that the Commission issue the requested Order pursuant to Rule 0-5 under the 1940 Act without conducting a hearing.

For the foregoing reasons, Applicants respectfully request that the Commission issue

an order under Section 6(c) of the 1940 Act exempting the Funds from the provisions of Section 19(b) of the 1940 Act and Rule 19b-1 thereunder to permit each Fund to make distributions on its common shares consisting

in whole or in part of capital gain dividends as frequently as twelve times in any

one taxable year so long as it complies with the conditions of the Order and maintains

in effect a Distribution Policy with respect to its common shares as described in

this Application. In addition, Applicants request that the Order permit each Fund

to make distributions on its preferred shares (if any) that it has issued or may issue

in the future consisting in whole or in part of capital gain dividends as frequently

as specified by or determined in accordance with the terms thereof. Applicants submit

that the requested exemption is necessary or appropriate in the public interest, consistent

with the protection of investors and consistent with the purposes fairly intended

by the policy and provisions of the 1940 Act.

| Dated: October 18, 2024 |

Destra Multi-Alternative Fund |

| |

|

|

| |

By: |

/s/ Robert A. Watson |

| |

Name: |

Robert A. Watson |

| |

Title: |

President |

| Dated: October 18, 2024 |

Destra Capital Advisors LLC |

| |

|

|

| |

By: |

/s/ Robert A. Watson |

| |

Name: |

Robert A. Watson |

| |

Title: |

President |

EXHIBITS TO APPLICATION

The following materials are made a part of the Application and are attached hereto:

| DESIGNATION |

|

DOCUMENT |

| Exhibit A |

|

Resolutions of the Board of Trustees of Destra Multi-Alternative Fund |

| |

|

|

| Exhibit B |

|

Verifications |

| |

|

|

| Exhibit C |

|

Marked copy of the Applicants’ application showing changes from the application of Saba Capital Income & Opportunities Fund II and Saba Capital Management, L.P. (File No. 812-15561), an application identified by the Applicants as substantially identical under Rule 0-5(e)(3).

Marked copy of the Applicants’ application showing changes from the application of First Eagle Global Opportunities

Fund, et al. (File No. 812-15260), an application identified by the Applicants as

substantially identical under Rule 0-5(e)(3).

|

EXHIBIT A

Resolutions of the Board of Trustees of

Destra Multi-Alternative Fund

RESOLVED, that the officers of Destra Multi-Alternative Fund (the “Fund”) be, and each hereby is, authorized to prepare, execute and submit, on

behalf of the Fund, an exemptive application to the Securities and Exchange Commission

for an order pursuant to Section 6(c) of the Investment Company Act of 1940, as amended (the “Act”), for an exemption

from Section 19(b) of the Act and Rule 19b-1 under the Act to permit the Fund to make periodic capital gain dividends (as

defined in Section 852(b)(3)(C) of the Internal Revenue Code of 1986, as amended) that include long-term

capital gains as frequently as twelve times in any one taxable year in respect of

its common shares of beneficial interest and as often as specified by, or determined

in accordance with the terms of, any preferred shares of beneficial interest issued

by the Fund; and be it further

RESOLVED, that the appropriate officers of the Fund be, and each hereby is, empowered and

directed to prepare, execute and file such documents, including any amendments thereof,

and to take such other actions as he or she may deem necessary, appropriate or convenient

to carry out the intent and purpose of the foregoing resolution, such determination

to be conclusively evidenced by the doing of such acts and the preparation, execution,

and filing of such documents.

EXHIBIT B

Verifications of Destra Multi-Alternative Fund and Destra Capital Advisors LLC

The undersigned states that he has duly executed the attached application dated October 18, 2024 for and on behalf of Destra Multi-Alternative Fund in his capacity as President of such entity and that all actions by the holders and other bodies necessary to authorize

the undersigned to execute and file such instrument have been taken. The undersigned

further states that he is familiar with such instrument, and the contents thereof,

and that the facts therein set forth are true to the best of his knowledge, information

and belief.

| By: |

/s/ Robert A. Watson |

|

| Name: |

Robert A. Watson |

|

| Title: |

President |

|

The undersigned states that he has duly executed the attached application dated October 18, 2024 for and on behalf of Destra Capital Advisors LLC in his capacity as President of such entity and that all actions by the holders and other bodies necessary to

authorize the undersigned to execute and file such instrument have been taken. The undersigned further states that he is familiar with such instrument, and the contents thereof,

and that the facts therein set forth are true to the best of his knowledge, information

and belief.

| By: |

/s/ Robert A. Watson |

|

| Name: |

Robert A. Watson |

|

| Title: |

President |

|

EXHIBIT C

Marked copies of the Application showing changes from the final versions of the two

applications identified as substantially identical under Rule 0-5(e)(3).

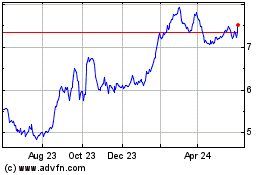

Destra Multi Alternative (NYSE:DMA)

Historical Stock Chart

From Jan 2025 to Feb 2025

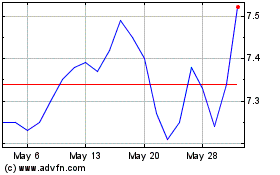

Destra Multi Alternative (NYSE:DMA)

Historical Stock Chart

From Feb 2024 to Feb 2025