Essential Properties Realty Trust, Inc. (NYSE: EPRT; the

“Company”) announced today that it has commenced an underwritten

public offering of 8,000,000 shares of its common stock on a

forward basis in connection with the forward sale agreements

described below.

BofA Securities, Wells Fargo Securities, Truist Securities and

Mizuho are acting as the joint book-running managers for the

offering.

In connection with the offering, the Company expects to enter

into forward sale agreements with BofA Securities, Wells Fargo

Securities, Truist Securities and Mizuho (or affiliates thereof)

(the “forward purchasers”), with respect to 8,000,000 shares of the

Company’s common stock.

The underwriters have been granted a 30-day option, exercisable

in whole or in part from time to time, to purchase up to an

additional 1,200,000 shares of the Company’s common stock. If the

option to purchase additional shares of the Company’s common stock

is exercised, the Company expects to enter into one or more

additional forward sale agreements with the forward purchasers in

respect of the number of shares of the Company’s common stock that

are subject to exercise of the option to purchase additional

shares.

In connection with the forward sale agreements and any

additional forward sale agreements, the forward purchasers (or

their affiliates) are expected to borrow from third parties and

sell to the underwriters an aggregate of 8,000,000 shares of the

Company’s common stock (or an aggregate of 9,200,000 shares of the

Company’s common stock if the underwriters’ option to purchase

additional shares is exercised in full). However, a forward

purchaser (or its affiliate) is not required to borrow and sell

such shares if, after using commercially reasonable efforts, such

forward purchaser (or its affiliate) is unable to borrow such

shares, or if borrowing costs exceed a specified threshold or if

certain specified conditions have not been satisfied. If a forward

purchaser (or its affiliate) does not deliver and sell all of the

shares of the Company’s common stock to be sold by it to the

underwriters, the Company will issue and sell to the underwriters a

number of shares of its common stock equal to the number of shares

that such forward purchaser (or its affiliate) did not deliver and

sell, and the number of shares underlying the relevant forward sale

agreement or such additional forward sale agreement will be

decreased by the number of shares that the Company issues and

sells.

Pursuant to the terms of the forward sale agreements and any

additional forward sale agreements, and subject to its right to

elect cash or net share settlement, the Company intends to issue

and sell, upon physical settlement of the forward sale agreements

and any additional forward sale agreements, an aggregate of

8,000,000 shares of common stock (or an aggregate of up to

9,200,000 shares of common stock if the underwriters’ option to

purchase additional shares is exercised in full) to the forward

purchasers. The Company expects to physically settle the forward

sale agreements and any additional forward sale agreements within

approximately 12 months from the date of the prospectus supplement

relating to the offering.

The Company will not receive any proceeds from the sale of

shares of its common stock by the forward purchasers (or affiliates

thereof). The Company intends to contribute any net proceeds from

the settlement of the forward sale agreements to the Company’s

operating partnership in exchange for OP Units, and the operating

partnership intends to use such net proceeds for general corporate

purposes, including potential future investments.

All of the shares of common stock will be offered pursuant to

the Company’s effective shelf registration statement filed with the

Securities and Exchange Commission (the “SEC”). A preliminary

prospectus supplement and accompanying prospectus relating to the

offering will be filed with the SEC. When available, a copy of the

preliminary prospectus supplement and accompanying prospectus

relating to the offering may be obtained from BofA Securities,

Inc., NC1-022-02-25, 201 North Tryon Street, Charlotte, NC

28255-0001, Attn: Prospectus Department, Email:

dg.prospectus_requests@bofa.com; Wells Fargo Securities, 90 South

7th Street, 5th Floor, Minneapolis, MN 55402, at 800-645-3751

(option #5) or email a request to

WFScustomerservice@wellsfargo.com; Truist Securities, Inc. 3333

Peachtree Road NE, 9th Floor, Atlanta, Georgia 30326, Attn: Equity

Capital Markets or by email at

TruistSecurities.prospectus@Truist.com, or Mizuho Securities USA

LLC, 1271 Avenue of the Americas, 3rd Floor, New York, New York

10020, Attn: Equity Capital Markets, telephone: 1-212-205-7600 or

by emailing US-ECM@mizuhogroup.com, or by visiting the EDGAR

database on the SEC’s web site at www.sec.gov.

This press release does not constitute an offer to sell or the

solicitation of an offer to buy nor will there be any sale of these

securities in any state or other jurisdiction in which such an

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such state or

jurisdiction.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the federal securities laws. When used in this press

release, the words “expect” and “will,” or the negative of these

words, or similar words or phrases that are predictions of or

indicate future events and that do not relate solely to historical

matters, are intended to identify forward-looking statements. You

can also identify forward-looking statements by discussions

regarding strategy, plans or intentions. Forward-looking statements

involve numerous risks and uncertainties and you should not rely on

them as predictions of future events. Forward-looking statements

depend on assumptions, data or methods that may be incorrect or

imprecise. The Company does not guarantee that the transactions and

events described will happen as described (or that they will happen

at all). You are cautioned not to place undue reliance on

forward-looking statements, which speak only as of the date of this

press release. While forward-looking statements reflect the

Company’s good faith beliefs, they are not guarantees of future

performance. The Company undertakes no obligation to publicly

release the results of any revisions to these forward-looking

statements that may be made to reflect events or circumstances

after the date of this press release or to reflect the occurrence

of unanticipated events, except as required by law. In light of

these risks and uncertainties, the forward-looking events discussed

in this press release might not occur as described, or at all.

Additional information concerning factors that could cause

actual results to differ materially from these forward-looking

statements is contained from time to time in the Company’s SEC

filings, including its Annual Report on Form 10-K for the year

ended December 31, 2023. Copies of each filing may be obtained from

the Company or the SEC. Such forward-looking statements should be

regarded solely as reflections of the Company’s current plans and

estimates. Actual results may differ materially from what is

expressed or forecast in this press release.

About Essential Properties Realty Trust, Inc.

Essential Properties Realty Trust, Inc. is an internally managed

REIT that acquires, owns and manages primarily single-tenant

properties that are net leased on a long-term basis to companies

operating service-oriented or experience-based businesses. As of

December 31, 2023, the Company’s portfolio consisted of 1,873

freestanding net lease properties with a weighted average lease

term of 14.0 years and a weighted average rent coverage ratio of

3.8x. In addition, as of December 31, 2023, the Company’s portfolio

was 99.8% leased to 374 tenants operating 588 different concepts in

16 industries across 48 states.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240311247290/en/

Investor/Media: Essential Properties Realty Trust, Inc. Robert

W. Salisbury, CFA Senior Vice President, Head of Capital Markets

609-436-0619 investors@essentialproperties.com

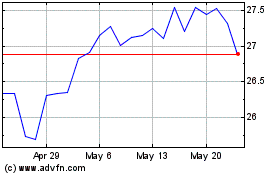

Essential Properties Rea... (NYSE:EPRT)

Historical Stock Chart

From Oct 2024 to Nov 2024

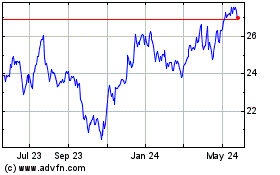

Essential Properties Rea... (NYSE:EPRT)

Historical Stock Chart

From Nov 2023 to Nov 2024