As filed with the Securities and Exchange Commission on September 3, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

TENDER OFFER STATEMENT UNDER SECTION 14(d)(1) OR 13(e)(1)

OF THE SECURITIES EXCHANGE ACT OF 1934

Western Asset

Global Corporate Defined Opportunity Fund Inc.

(Name of Subject Company (issuer))

Western Asset Global Corporate Defined Opportunity Fund Inc.

(Name of Filing Person (offeror))

Common Stock

$0.001 Par

Value Per Share

(Title of Class of Securities)

95790C107

(CUSIP Number

of Class of Securities)

MARC A. DE OLIVEIRA, ESQ.

SECRETARY AND CHIEF LEGAL OFFICER

100 FIRST STAMFORD PLACE, 6TH FLOOR

STAMFORD, CONNECTICUT 06902

(203) 703-7026

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications on Behalf of the Person(s) Filing Statement)

Copy to:

David

W. Blass, Esq.

Ryan P. Brizek, Esq.

Simpson Thacher & Bartlett LLP

900 G Street, NW

Washington D.C. 20001

(202) 636-5500

| ☐ |

Check the box if the filing relates solely to preliminary communications made before the commencement of a

tender offer. |

Check the appropriate boxes below to designate any transactions to which this statement relates:

| |

☐ |

third party tender offer subject to Rule 14d-1

|

| |

☒ |

issuer tender offer subject to Rule 13e-4

|

| |

☐ |

going-private transaction subject to Rule 13e-3

|

| |

☐ |

amendment to Schedule 13D under Rule 13d-2

|

Check the following box if the filing is a final amendment reporting the results of the tender offer. ☐

ITEMS 1 THROUGH 9 AND ITEM 11

This Issuer Tender Offer Statement on Schedule TO relates to an offer by Western Asset Global Corporate Defined Opportunity Fund Inc., a

Maryland corporation (the “Fund”), to purchase for cash up to 100% of its issued and outstanding shares of common stock, par value $0.001 per share, for cash at a price per share equal to 100% of the Fund’s net asset value per share

as of the close of regular trading session on the New York Stock Exchange (“NYSE”) on October 1, 2024 (or if the Offer is extended, on the next trading day after the day to which the Offer is extended), upon the terms and subject to

the conditions contained in the Offer to Purchase dated September 3, 2024 and the related Letter of Transmittal, which are filed as exhibits to this Schedule TO. The information set forth in the Offer to Purchase and the related Letter of

Transmittal is incorporated herein by reference with respect to Items 1 through 9 and Item 11 of this Schedule TO.

ITEM 10. FINANCIAL STATEMENTS

(a) The information in the Offer to Purchase in Section 9 (“Selected Financial Information”) is incorporated herein by

reference.

(b) Not applicable.

ITEM 12.

EXHIBITS

(1)

Previously filed on Schedule TO-C via EDGAR on June 11, 2024.

ITEM 13. INFORMATION REQUIRED BY SCHEDULE 13E-3

Not applicable.

2

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and

correct.

|

|

|

| WESTERN ASSET GLOBAL CORPORATE DEFINED OPPORTUNITY FUND INC. |

|

|

| By: |

|

/s/ Jane Trust |

|

|

Name: Jane Trust |

|

|

Title: Chairman, Chief Executive Officer and President |

Dated: September 3, 2024

3

EXHIBIT INDEX

4

Exhibit (a)(1)(i)

OFFER TO PURCHASE

WESTERN ASSET GLOBAL CORPORATE DEFINED OPPORTUNITY FUND INC.

(THE “FUND”)

DATED SEPTEMBER 3, 2024

OFFER TO PURCHASE FOR CASH UP TO 100% OF ITS ISSUED AND OUTSTANDING

SHARES OF COMMON STOCK, PAR VALUE $0.001 PER SHARE (THE “SHARES”), AT 100% OF NET ASSET VALUE PER SHARE

THE OFFER AND WITHDRAWAL RIGHTS WILL EXPIRE AT 5:00 P.M., NEW YORK CITY TIME ON OCTOBER 1, 2024, UNLESS THE OFFER IS EXTENDED.

THIS OFFER TO PURCHASE AND THE ACCOMPANYING LETTER OF TRANSMITTAL (WHICH, TOGETHER WITH ANY AMENDMENTS OR SUPPLEMENTS THERETO, COLLECTIVELY

CONSTITUTE THE “OFFER”) IS BEING MADE TO ALL STOCKHOLDERS AND IS NOT CONDITIONED ON ANY MINIMUM NUMBER OF SHARES BEING TENDERED, BUT IS SUBJECT TO OTHER CONDITIONS AS OUTLINED HEREIN AND IN THE LETTER OF TRANSMITTAL.

NONE OF THE FUND, ITS BOARD OF DIRECTORS, FRANKLIN TEMPLETON FUND ADVISER, LLC (FORMERLY KNOWN AS LEGG MASON PARTNERS FUND ADVISOR, LLC) (THE

“INVESTMENT MANAGER”), WESTERN ASSET MANAGEMENT COMPANY, LLC, WESTERN ASSET MANAGEMENT COMPANY PTE. LTD., WESTERN ASSET MANAGEMENT COMPANY LTD AND WESTERN ASSET MANAGEMENT COMPANY LIMITED (THE “SUBADVISERS”), MAKES ANY

RECOMMENDATION AS TO WHETHER TO TENDER OR NOT TO TENDER SHARES IN THE OFFER. NO PERSON HAS BEEN AUTHORIZED TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATIONS IN CONNECTION WITH THE OFFER OTHER THAN THOSE CONTAINED HEREIN AND IN THE LETTER OF

TRANSMITTAL, AND IF GIVEN OR MADE, SUCH INFORMATION OR REPRESENTATIONS MAY NOT BE RELIED UPON AS HAVING BEEN AUTHORIZED BY THE FUND. THE FUND HAS BEEN ADVISED THAT NO DIRECTOR OR OFFICER OF THE FUND INTENDS TO TENDER ANY SHARES PURSUANT TO THE

OFFER.

THIS TRANSACTION HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION, NOR HAS THE SECURITIES AND

EXCHANGE COMMISSION OR ANY STATE SECURITIES COMMISSION PASSED ON THE FAIRNESS OR MERITS OF SUCH TRANSACTION OR ON THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED IN THIS DOCUMENT. ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL.

BECAUSE THIS OFFER IS LIMITED AS TO THE NUMBER OF SHARES ELIGIBLE TO PARTICIPATE, NOT ALL SHARES TENDERED FOR PURCHASE BY STOCKHOLDERS MAY BE

ACCEPTED FOR PURCHASE BY THE FUND. THIS MAY OCCUR, FOR EXAMPLE, WHEN ONE OR MORE LARGE INVESTORS SEEK TO TENDER A SIGNIFICANT NUMBER OF SHARES OR WHEN A LARGE NUMBER OF INVESTORS TENDER THEIR SHARES IN THIS OFFER.

IMPORTANT

Any

stockholder of the Fund (“Stockholder”) desiring to tender any portion of his or her Shares to the Fund should either (1) complete and sign the Letter of Transmittal in accordance with the instructions in the Letter of Transmittal,

and mail or deliver the Letter of Transmittal with his or her certificates for the tendered Shares if such Stockholder has been issued physical certificates and any other required documents to Computershare Inc. and its wholly owned subsidiary,

Computershare Trust Company, N.A. (together, the “Depositary”), or (2) request his or

1

Exhibit (a)(1)(i)

her broker, dealer, commercial bank, trust company or other nominee to effect the transaction for him or her. Stockholders having Shares registered in the name of a broker, dealer, commercial

bank, trust company or other nominee are urged to contact such broker, dealer, commercial bank, trust company or other nominee if they desire to tender Shares so registered. The Fund reserves the absolute right to reject Shares determined not to be

tendered in appropriate form.

Questions, requests for assistance and requests for additional copies of this Offer to Purchase and the

Letter of Transmittal may be directed to Georgeson LLC (the “Information Agent”) in the manner set forth on the last page of this Offer to Purchase.

If you do not wish to tender your Shares, you need not take any action.

THIS OFFER TO PURCHASE AND THE RELATED LETTER OF TRANSMITTAL CONTAIN IMPORTANT INFORMATION AND YOU SHOULD CAREFULLY READ BOTH IN THEIR

ENTIRETY BEFORE YOU MAKE A DECISION WITH RESPECT TO THE OFFER.

Dated September 3, 2024

2

Exhibit (a)(1)(i)

TABLE OF CONTENTS

3

SUMMARY TERM SHEET

This Summary Term Sheet highlights certain information concerning this Offer. To understand the Offer (as defined below) fully and for a more

complete discussion of the terms and conditions of this Offer, you should read carefully this entire Offer to Purchase and the related Letter of Transmittal.

What is the Offer?

Western Asset Global

Corporate Defined Opportunity Fund Inc. is offering to purchase up to 100% of its outstanding Shares, or 14,949,168 Shares, for cash at a price per share equal to 100% of the per share net asset value as of the close of the regular trading session

(normally 5:00 p.m. New York City time) on the New York Stock Exchange (“NYSE”) on October 1, 2024 (or if the Offer is extended, on the next trading day after the day to which the Offer is extended), upon specified terms and subject

to conditions as set forth in the Offer documents. Following the Offer, if less than $50 million of net assets remain in the Fund, the Offer will be cancelled and the Fund will liquidate on or about December 2, 2024.

Are there conditions to the Offer?

The

Offer is subject to certain conditions as described in Section 13 of this Offer to Purchase. Additionally, following the Offer, if less than $50 million of net assets remain in the Fund, the Offer will be cancelled and the Fund will

liquidate on or about December 2, 2024.

When will the Offer expire, and may the Offer be extended?

The Offer will expire at 5:00 p.m., New York City time, on October 1, 2024, unless extended. The Fund may extend the period of time the

Offer will be open by issuing a press release or making some other public announcement by no later than the next business day after the Offer otherwise would have expired. See Section 1 of this Offer to Purchase.

What is the net asset value per Fund Share as of a recent date?

As of August 12, 2024, the net asset value per share was $12.73. See Section 7 of this Offer to Purchase for additional information

regarding net asset values and market prices. As of August 12, 2024, there were 14,949,168 Shares issued and outstanding. During the pendency of the Offer, current net asset value quotations can be obtained from the Information Agent by calling

toll free at (866) 461-7050 between 9:00 a.m. and 9:00 p.m., New York City time, Monday through Friday. You may also call the Fund’s toll free number at (888)

777-0102.

Will the net asset value be higher or lower on the date that the price to be paid for tendered

Shares is to be determined?

No one can accurately predict the net asset value at a future date, but you should realize that net asset

value on the date the purchase price for tendered Shares is to be determined may be higher or lower than the net asset value on August 12, 2024.

How do I tender my Shares?

If your

Shares are registered in your name, you should obtain the tender offer materials, including this Offer to Purchase and the related Letter of Transmittal, read them, and if you should decide to tender, complete a Letter of Transmittal and submit any

other documents required by the Letter of Transmittal. These materials must be received by the Depositary in proper form before 5:00 p.m., New York City time, on October 1, 2024 (unless the Offer has been extended by the Fund, in which case the

new deadline will be as stated in the public announcement of the extension). If your Shares are held by a broker, dealer, commercial bank, trust company or other nominee (e.g., in “street name”), you should contact that firm to obtain the

package of information necessary to make your decision, and you can only tender your Shares by directing that firm to complete, compile and deliver the necessary documents for submission to the Depositary by 5:00 p.m., New York City time, on

October 1, 2024 (or if the Offer is extended, the expiration date as extended). If you are an institution participating in the book-entry transfer facility, you must tender your Shares according to the procedure for book-entry transfer. See

Section 3 of this Offer to Purchase.

4

Is there any cost to me to tender?

No fees or commission will be payable to the Fund in connection with the Offer. However, brokers, dealers or other persons may charge

stockholders a fee for soliciting tenders for Shares pursuant to this Offer. See the Letter of Transmittal.

May I withdraw my Shares after I have

tendered them and, if so, by when?

Yes, you may withdraw your Shares at any time prior to 5:00 p.m., New York City time on

October 1, 2024 (or if the Offer is extended, at any time prior to 5:00 p.m., New York City time, on the new expiration date). Withdrawn Shares may be re-tendered by following the tender procedures before

the Offer expires (including any extension period). See Section 4 of this Offer to Purchase.

How do I withdraw previously tendered Shares?

A notice of withdrawal of tendered Shares must be timely received by the Depositary, and must specify the name of the Stockholder who

tendered the shares, the number of Shares being withdrawn (which must be all of the Shares tendered) and, with respect to share certificates representing tendered Shares that have been delivered or otherwise identified to the Depositary, the name of

the registered owner of such Shares if different from the person who tendered the Shares. See Section 4 of this Offer to Purchase.

May I place

any condition on my tender of Shares?

No.

Is there a limit on the number of Shares I may tender?

No. Following the Offer, if less than $50 million of net assets remain in the Fund, the Offer will be cancelled and the Fund will

liquidate on or about December 2, 2024.

Must I tender all of my Shares for repurchase?

No. You may tender for repurchase all or part of the Shares you own.

If I decline to tender, how will the tender offer affect the Shares I hold?

Your percentage ownership interest in the Fund will increase after completion of the tender offer.

How will the Fund pay for the Offer?

It

is anticipated that the Fund will increase its use of leverage, sell certain portfolio securities and/or use cash on hand to finance the Offer.

If

Shares I tender are accepted by the Fund, when will payment be made?

Payment for tendered Shares, if accepted, will be made promptly

after the termination date of the Offer.

5

Is my sale of Shares in the Offer a taxable transaction for U.S. federal income tax purposes?

For most Stockholders, yes. The sale of Shares pursuant to the Offer by a U.S. Stockholder (as defined in Section 8), other than one who

is tax-exempt, will be a taxable transaction for U.S. federal income tax purposes, either as a sale or exchange, or, under certain circumstances, as a distribution with respect to such Shares. An applicable

withholding agent may withhold U.S. federal income taxes equal to 30% of the gross proceeds payable to a Non-U.S. Stockholder (as defined in Section 8) unless the agent determines that such Non-U.S. Stockholder is eligible for a reduced rate of withholding pursuant to a treaty or that an exemption from withholding is applicable because the gross proceeds are effectively connected with the Non-U.S. Stockholder’s conduct of a trade or business within the U.S. (and, if required by an applicable income tax treaty, are attributable to a U.S. permanent establishment or fixed base maintained by the Non-U.S. Stockholder). See Section 8 of this Offer to Purchase for a more detailed discussion of certain U.S. federal income tax consequences of the Offer. Stockholders are advised to consult their own tax

advisors.

Is the Fund required to complete the Offer and purchase all Shares tendered up to the maximum of 14,949,168 Shares?

Under most circumstances, yes. There are certain circumstances, however, in which the Fund will not be required to purchase any Shares tendered

as described in Section 13 of this Offer to Purchase.

Is there any reason Shares tendered will not be accepted?

In addition to those circumstances described in Section 13 of this Offer to Purchase in which the Fund is not required to accept tendered

Shares, the Fund has reserved the right to reject any and all tenders determined by it not to be in appropriate form. For example, tenders will be rejected if the tender does not include the original signature(s) or the original of any required

signature guarantee(s).

How will tendered Shares be accepted for payment?

Properly tendered Shares, up to the number tendered for, will be accepted for payment by a determination of the Fund followed by notice of

acceptance to the Depositary, which thereafter will make payment as directed by the Fund with funds to be deposited with it by the Fund. See Section 2 of this Offer to Purchase.

What action need I take if I decide not to tender my Shares?

None.

What is the purpose of the Offer?

The Offer is intended to provide Stockholders with an alternative source of liquidity for their Shares and, potentially, to reduce the

discount to net asset value at which the Shares trade. In approving the Offer, the Board considered a number of factors, including: the economic condition of the investment markets; that the Offer could provide liquidity for Stockholders; that the

Offer could enable Stockholders to tender a portion of their Shares at a price that is greater than what they could realize in the secondary market at that time; that the Offer may assist in narrowing the discount to net asset value at which the

Shares trade; and that the Investment Manager recommended the Offer to the Board. The Board also considered the potential impact of the Offer on the Fund’s ability to implement its investment strategies, and achieve its investment objective.

After considering the totality of the factors listed in this paragraph and other factors, none of which standing on its own was dispositive, the Board determined to authorize this Offer. There is no guarantee that the Offer will be accretive to the

Fund’s net asset value.

Please bear in mind that none of the Fund, its Board of Directors, the Investment Manager or the Subadvisers

makes any recommendation as to whether or not you should tender your Shares. Stockholders are urged to consult their own investment and tax advisors and make their own decisions whether to tender any Shares and, if so, how many Shares to tender. The

Fund has been advised that no director or officer of the Fund intends to tender Shares.

6

How do I obtain additional information?

Questions and requests for assistance should be directed to the Information Agent for the Offer, toll free at (866) 461-7050. Requests for additional copies of the Offer to Purchase, the Letter of Transmittal and all other tender offer documents should also be directed to the Information Agent for the Offer. If you do not hold

certificates for your Shares or if you are not the record holder of your Shares, you should obtain this information and the documents from your broker, dealer, commercial bank, trust company or other nominee, as appropriate.

7

TO THE STOCKHOLDERS OF SHARES OF COMMON STOCK OF WESTERN ASSET GLOBAL CORPORATE DEFINED

OPPORTUNITY FUND INC.

INTRODUCTION

Western Asset Global Corporate Defined Opportunity Fund Inc. (the “Fund”), a Maryland corporation registered under the Investment

Company Act of 1940, as amended (the “1940 Act”), as a closed-end, non-diversified management investment company, hereby offers to purchase up to 100% of the

Fund’s outstanding shares of common stock or 14,949,168 shares in the aggregate (the “Offer Amount”) of its common stock, par value $0.001 per share (the “Shares”), at a price (the “Purchase Price”) per

Share, net to the seller in cash, equal to 100% of the net asset value in U.S. Dollars (“NAV”) per Share as of the close of regular trading session on the NYSE on October 1, 2024, or, if the Offer is extended, on the next trading day

after the day to which the Offer is extended, upon the terms and subject to the conditions set forth in this Offer to Purchase and in the related Letter of Transmittal (which together constitute the “Offer”). The depositary for the Offer

is Computershare Inc. and its wholly owned subsidiary, Computershare Trust Company, N.A. (the “Depositary”). The Fund has mailed materials for the Offer to record holders on or about September 3, 2024.

THIS OFFER IS BEING EXTENDED TO ALL STOCKHOLDERS OF THE FUND AND IS NOT CONDITIONED ON ANY MINIMUM NUMBER OF SHARES BEING TENDERED, BUT IS

SUBJECT TO OTHER CONDITIONS AS OUTLINED HEREIN AND IN THE LETTER OF TRANSMITTAL. SEE SECTION 13 OF THIS OFFER TO PURCHASE.

NONE OF THE

FUND, ITS BOARD OF DIRECTORS, FRANKLIN TEMPLETON FUND ADVISER, LLC (FORMERLY KNOWN AS LEGG MASON PARTNERS FUND ADVISOR, LLC) (THE “INVESTMENT MANAGER”), WESTERN ASSET MANAGEMENT COMPANY, LLC, WESTERN ASSET MANAGEMENT COMPANY PTE. LTD.,

WESTERN ASSET MANAGEMENT COMPANY LTD AND WESTERN ASSET MANAGEMENT COMPANY LIMITED (THE “SUBADVISERS”), MAKES ANY RECOMMENDATION AS TO WHETHER TO TENDER OR NOT TO TENDER SHARES IN THE OFFER. NO PERSON HAS BEEN AUTHORIZED TO GIVE ANY

INFORMATION OR TO MAKE ANY REPRESENTATIONS IN CONNECTION WITH THE OFFER OTHER THAN THOSE CONTAINED HEREIN AND IN THE LETTER OF TRANSMITTAL, AND IF GIVEN OR MADE, SUCH INFORMATION OR REPRESENTATIONS MAY NOT BE RELIED UPON AS HAVING BEEN AUTHORIZED BY

THE FUND. THE FUND HAS BEEN ADVISED THAT NO DIRECTOR OR OFFICER OF THE FUND INTENDS TO TENDER ANY SHARES PURSUANT TO THE OFFER.

THIS

TRANSACTION HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION NOR HAS THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE SECURITIES COMMISSION PASSED ON THE FAIRNESS OR MERITS OF SUCH TRANSACTION OR ON THE ACCURACY OR

ADEQUACY OF THE INFORMATION CONTAINED IN THIS DOCUMENT. ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL.

BECAUSE THIS OFFER IS LIMITED AS

TO THE NUMBER OF SHARES ELIGIBLE TO PARTICIPATE, NOT ALL SHARES TENDERED FOR PURCHASE BY STOCKHOLDERS MAY BE ACCEPTED FOR PURCHASE BY THE FUND. THIS MAY OCCUR, FOR EXAMPLE, WHEN ONE OR MORE LARGE INVESTORS SEEK TO TENDER A SIGNIFICANT NUMBER OF

SHARES OR WHEN A LARGE NUMBER OF INVESTORS TENDER THEIR SHARES IN THIS OFFER.

As of August 12, 2024, there were 14,949,168 Shares

issued and outstanding, and the NAV was $12.73 per Share. The Fund does not expect that the number of Shares issued and outstanding will be materially different on the Termination Date (as defined below). Stockholders may contact Georgeson LLC, the

Fund’s Information Agent, toll free at (866) 461-7050 or contact the Fund directly at its toll free number, (888) 777-0102, to obtain the estimated current NAV for

the Shares.

Any Shares acquired by the Fund pursuant to the Offer will become authorized but unissued shares and will be available for

issuance by the Fund without further Stockholder action (except as required by applicable law). Tendering Stockholders may be obligated to pay brokerage fees or commissions or, subject to Instruction 6 of the Letter of Transmittal, transfer taxes on

the purchase of Shares by the Fund. Stockholders may also be subject to other transaction costs, as described in Section 1.

8

1. Terms of the Offer; Termination Date

Upon the terms and subject to the conditions set forth in the Offer, the Fund will accept for payment, and pay for, up to 100% of the

Fund’s outstanding Shares, or 14,949,168 Shares in the aggregate, validly tendered on or prior to 5:00 p.m., New York City time, on October 1, 2024, or if the Offer is extended, on the next trading day after the day to which the Offer is

extended (the “Termination Date”) and not properly withdrawn as permitted by Section 4.

If the number of Shares properly

tendered and not properly withdrawn prior to the Termination Date is less than or equal to the Offer Amount, the Fund will, upon the terms and conditions of the Offer, purchase all Shares so tendered. Except as described herein, withdrawal rights

expire on the Termination Date. If Shares duly tendered by or on behalf of a Stockholder include Shares held pursuant to the Fund’s dividend reinvestment plan, the proration will be applied first with respect to other Shares tendered and only

thereafter, if and as necessary, with respect to Shares held pursuant to that plan. The Fund does not contemplate extending the Offer. Following the Offer, if less than $50 million of net assets remain in the Fund, the Offer will be cancelled

and the Fund will liquidate on or about December 2, 2024.

Stockholders should consider the relative costs of tendering Shares

pursuant to the Offer and selling Shares at the market price with the associated transaction costs.

The Fund expressly reserves the

right, in its sole discretion, at any time or from time to time, to extend the period of time during which the Offer is open by giving oral or written notice of such extension to the Depositary. Any such extension will also be publicly announced by

press release issued no later than 9:00 a.m., New York City time, on the next business day after the previously scheduled Termination Date. If the Fund makes a material change in the terms of the Offer or the information concerning the Offer, or if

it waives a material condition of the Offer, the Fund will extend the Offer to the extent required by rules promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These rules require that the minimum period

during which the Offer must remain open following material changes in the terms of the offer or information concerning the offer (other than a change in price or a change in percentage of securities sought) will depend on the facts and

circumstances, including the relative materiality of such terms or information. During the extension, all Shares properly tendered and not properly withdrawn previously will remain subject to the Offer, subject to the right of a tendering

Stockholder to withdraw his or her Shares.

Subject to the terms and conditions of the Offer, the Fund will pay the consideration offered

or return the tendered securities promptly after the termination or withdrawal of the Offer in accordance with the terms as set forth in Section 2 below. Any extension, delay or termination will be followed as promptly as practicable by public

announcement thereof, such announcement, in the case of an extension, to be issued no later than 9:00 a.m., New York City time, on the next business day after the previously scheduled Termination Date.

2. Acceptance for Payment and Payment for Shares

Upon the terms and subject to the conditions of the Offer, the Fund will accept for payment, and will pay for, Shares validly tendered on or

before the Termination Date, and not properly withdrawn in accordance with Section 4 promptly after the Termination Date. In all cases, payment for Shares tendered and accepted for payment pursuant to the Offer will be made only after timely

receipt by the Depositary of certificates for such Shares (unless such Shares are held in uncertificated form), a properly completed and duly executed Letter of Transmittal (or facsimile thereof), and any other documents required by the Letter of

Transmittal. The Fund expressly reserves the right, in its sole discretion, to delay the acceptance for payment of, or payment for, Shares, in whole or in part, in order to comply with any applicable law.

For purposes of the Offer, the Fund will be deemed to have accepted for payment Shares validly tendered and not properly withdrawn as, if and

when the Fund gives oral or written notice to the Depositary of its acceptance for payment of such Shares pursuant to the Offer. Payment for Shares accepted for payment pursuant to the Offer will be made by deposit of the aggregate purchase price

therefor with the Depositary, which will act as agent for the tendering Stockholders for purpose of receiving payments from the Fund and transmitting such payments to the tendering Stockholders. Under no circumstances will interest on the purchase

price for Shares be paid, regardless of any delay in making such payment.

9

In the event of proration, the Fund will determine the proration factor and pay for those

tendered Shares accepted for payment as soon as practicable after the Termination Date. However, the Fund expects that it will not be able to announce the final results of any proration or commence payment for any Shares purchased pursuant to the

Offer until at least three business days after the Termination Date.

If any tendered Shares are not accepted for payment pursuant to the

terms and conditions of the Offer for any reason, or are not paid because of an invalid tender, or if certificates are submitted for more Shares than are tendered (i) Shares delivered pursuant to the Book-Entry Delivery Procedure (as defined in

Section 3 below) will be credited to the appropriate account maintained within the appropriate Book-Entry Transfer Facility and (ii) uncertificated Shares held by the Fund’s transfer agent pursuant to the Fund’s dividend

reinvestment plan will be returned to the dividend reinvestment plan account maintained by the transfer agent.

If the Fund is delayed in

its acceptance for payment of, or in its payment for, Shares, or is unable to accept for payment or pay for Shares pursuant to the Offer for any reason, then, without prejudice to the Fund’s rights under this Offer, the Depositary may, on

behalf of the Fund, retain tendered Shares, and such Shares may not be withdrawn, unless and except to the extent tendering Stockholders are entitled to withdrawal rights as described in Section 4 of this Offer to Purchase.

The purchase price of the Shares will equal 100% of their NAV as of the close of regular trading session on the NYSE on October 1, 2024,

or if the Offer is extended, on the next trading day after the day to which the Offer is extended (the “Pricing Date”). Tendering Stockholders may be required to pay brokerage commissions or fees. Under the circumstances set forth in

Instruction 6 of the Letter of Transmittal, Stockholders may be obligated to pay transfer taxes on the purchase of Shares by the Fund.

The Fund normally calculates the NAV of its Shares daily at the close of the regular trading session (normally 5:00 p.m. New York City time)

of the NYSE. On August 12, 2024, the NAV was $12.73 per Share. The Shares are listed on the NYSE. On August 12, 2024, the last sales price at the close of regular trading on the NYSE was $12.58 per Share, representing a 1.18% discount from

NAV. The NAV of the Fund’s Shares will be available daily until the Termination Date, by calling the Fund’s Information Agent, toll free at (866) 461-7050 or through the Fund’s toll free number

at (888) 777-0102.

3. Procedure for Tendering Shares

Stockholders having Shares that are registered in the name of a broker, dealer, commercial bank, trust company or other nominee should contact

such firm if they desire to tender their Shares. For a Stockholder validly to tender Shares pursuant to the Offer, (i) a properly completed and duly executed Letter of Transmittal, together with any required signature guarantees, or in the case

of a book-entry transfer, an Agent’s Message, and any other documents required by the Letter of Transmittal, must be transmitted to and received by the Depositary at one of its addresses set forth on the last page of this Offer to Purchase, and

(ii) either the certificate for Shares must be transmitted to and received by the Depositary at one of its addresses set forth on the last page of this Offer to Purchase or the tendering Stockholder must comply with the Book-Entry Delivery

Procedure set forth in this Section 3, in all cases prior to the Termination Date.

The Fund’s transfer agent holds Shares in

uncertificated form for certain Stockholders pursuant to the Fund’s dividend reinvestment plan. Stockholders may tender such uncertificated Shares by completing the appropriate section of the Letter of Transmittal.

Signatures on Letters of Transmittal must be guaranteed by a firm which is a broker, dealer, commercial bank, credit union, savings

association or other entity and which is a member in good standing of a stock transfer association’s approved medallion program (such as STAMP, SEMP or MSP) (each, an “Eligible Institution”) unless (i) the Letter of Transmittal

is signed by the registered holder of the Shares tendered, including those Stockholders who are participants in a Book-Entry Transfer Facility and whose name appears on a security position listing as the owner of the Shares, but excluding those

registered Stockholders who have completed either the “Special Transfer Instruction” box or the “Special Mailing Instruction” box on the Letter of Transmittal, or (ii) such Shares are tendered for the account of an Eligible

Institution. In all other cases, all signatures on the Letter of Transmittal must be guaranteed by an Eligible Institution. See Instruction 5 of the Letter of Transmittal for further information.

10

Backup Federal Income Tax Withholding. Payments made pursuant to the Offer may be subject

to information reporting. Backup withholding tax (at a rate of 24%) will generally be imposed on the gross proceeds paid to a tendering U.S. Stockholder (as defined in Section 8) unless (i) the U.S. Stockholder provides such U.S.

Stockholder’s taxpayer identification number (employer identification number or social security number) to the applicable withholding agent, certifies as to no loss of exemption from backup withholding and complies with applicable requirements

of the backup withholding rules, or (ii) such U.S. Stockholder is otherwise exempt from backup withholding. Therefore, each tendering U.S. Stockholder should complete and sign the Internal Revenue Service (“IRS”) Form W-9 included as part of the Letter of Transmittal so as to provide the information and certification necessary to avoid backup withholding, unless such U.S. Stockholder otherwise establishes to the satisfaction of

the applicable withholding agent that such U.S. Stockholder is not subject to backup withholding. Certain U.S. Stockholders (including, among others, most corporations) are not subject to these backup withholding requirements. In addition, Non-U.S. Stockholders (as defined in Section 8) are not subject to these backup withholding requirements. In order for a Non-U.S. Stockholder to establish that it is not

subject to backup withholding requirements, such Non-U.S. Stockholder must submit an applicable IRS Form W-8 (generally, an IRS Form

W-8BEN, W-8BEN-E or W-8ECI). Such forms can be obtained from the Depositary. Backup

withholding is not an additional tax and any amounts withheld under the backup withholding rules will be allowed as a refund or a credit against a stockholder’s U.S. federal income tax liability provided the required information is timely

furnished to the IRS.

For a discussion of certain federal income tax consequences to tendering Stockholders, see Section 8.

Withholding for Non-U.S. Stockholders. The tax treatment of a Stockholder’s receipt of

cash pursuant to the Offer depends upon facts which may be unique as to each Stockholder. Therefore, even if a Non-U.S. Stockholder has provided the required certification to avoid backup withholding, an

applicable withholding agent may withhold U.S. federal income tax equal to 30% of the gross proceeds payable to a Non-U.S. Stockholder unless the agent determines that a reduced rate of withholding is

available pursuant to a tax treaty or that an exemption from withholding is applicable because such gross proceeds are effectively connected with the Non-U.S. Stockholder’s conduct of a trade or business

within the U.S. (and, if required by an applicable income tax treaty, are attributable to a U.S. permanent establishment or fixed base maintained by the Non-U.S. Stockholder). In order to obtain a reduced rate

of withholding pursuant to a tax treaty, a Non-U.S. Stockholder must deliver a properly completed and executed IRS Form W-8BEN (for individuals) or Form W-8BEN-E (for entities). In order to obtain an exemption from withholding on the grounds that the gross proceeds paid pursuant to the Offer are effectively connected with the

conduct of a trade or business within the U.S. (and, if required by an applicable income tax treaty, are attributable to a U.S. permanent establishment or fixed base maintained by the Non-U.S. Stockholder), a Non-U.S. Stockholder must deliver a properly completed and executed IRS Form W-8ECI. A withholding agent may determine a Stockholder’s status as a Non-U.S. Stockholder and eligibility for a reduced rate of, or exemption from, withholding by reference to any outstanding certificates or statements concerning eligibility for a reduced rate of, or exemption from,

withholding (e.g., IRS Forms W-8BEN, W-8BEN-E or W-8ECI) unless facts and circumstances

indicate that such reliance is not warranted. A Non-U.S. Stockholder may be eligible to obtain a refund of all or a portion of any tax withheld if such Non-U.S.

Stockholder satisfies certain requirements or is otherwise able to establish that no tax or a reduced amount of tax is due (See Section 8). Backup withholding generally will not apply to amounts subject to the 30% or a treaty-reduced rate of

withholding. Non-U.S. Stockholders are urged to consult their own tax advisors regarding the application of U.S. federal income tax withholding, including eligibility for a withholding tax reduction or

exemption, and the refund procedure.

In addition, a Non-U.S. Stockholder (other than an

individual) may be subject to a 30% withholding tax under Sections 1471 through 1474 of the Internal Revenue Code of 1986, as amended (the “Code”), commonly referred to as “FATCA,” unless such

Non-U.S. Stockholder establishes an exemption from such withholding tax under FATCA, typically on IRS Form W-8BEN-E. In such

case, any withholding under FATCA may be credited against, and therefore reduce, any 30% or treaty-reduced rate of withholding as discussed above.

All questions as to the validity, form, eligibility (including time of receipt), payment and acceptance for payment of any tender of Shares

will be determined by the Fund in its sole discretion, which determination shall be final and binding. The Fund reserves the absolute right to reject any and all tenders of Shares it determines not to be in proper form or the acceptance for payment

of which may, in the opinion of its counsel, be unlawful. The Fund also reserves the absolute right to waive any of the conditions of the Offer or any defect or irregularity in the tender

11

of any Shares. No tender of Shares will be deemed to have been validly made until all defects and irregularities

have been cured or waived. None of the Fund, the Investment Manager, the Subadvisers, the Information Agent, the Depositary or any other person shall be under any duty to give notification of any defects or irregularities in tenders, nor shall any

of the foregoing incur any liability for failure to give any such notification. The Fund’s interpretation of the terms and conditions of the Offer (including the Letter of Transmittal and instructions thereto) will be final and binding.

Payment for Shares tendered and accepted for payment pursuant to the Offer will be made, in all cases, only after timely receipt of

(i) certificates for such Shares by the Depositary or book-entry confirmation of delivery of such Shares to the account of the Depositary, (ii) a properly completed and duly executed Letter of Transmittal (or facsimile thereof) for such

Shares, and (iii) any other documents required by the Letter of Transmittal. The tender of Shares pursuant to any of the procedures described in this Section 3 will constitute an agreement between the tendering Stockholder and the Fund

upon the terms and subject to the conditions of the Offer.

The method of delivery of all required documents is at the election and

risk of each tendering Stockholder. If delivery is by mail, registered mail with return receipt requested, properly insured, is recommended.

Book-Entry Delivery Procedure

The

Depositary will establish accounts with respect to the Shares at the Depository Trust Company (the “Book-Entry Transfer Facility”) for purposes of the Offer promptly after the date of this Offer. Any financial institution that is a

participant in any of the Book-Entry Transfer Facility’s systems may make delivery of tendered Shares by (i) causing such Book-Entry Transfer Facility to transfer such Shares into the Depositary’s account in accordance with such

Book-Entry Transfer Facility’s procedure for such transfer and (ii) causing a confirmation of receipt of such delivery to be received by the Depositary (the “Book-Entry Delivery Procedure”). The Book-Entry Transfer Facility may

charge the account of such financial institution for tendering Shares on behalf of Stockholders. Notwithstanding that delivery of Shares may be properly effected in accordance with this Book-Entry Delivery Procedure, the Letter of Transmittal, with

signature guarantee, or an Agent’s Message, and all other documents required by the Letter of Transmittal must be transmitted to and received by the Depositary at the appropriate address set forth on the last page of this Offer before the

Termination Date. Delivery of documents to a Book-Entry Transfer Facility in accordance with such Book-Entry Transfer Facility’s procedures does not constitute delivery to the Depositary for purposes of this Offer.

The confirmation of a book-entry transfer of Shares into the Depositary’s account at the Book-Entry Transfer Facility described above is

referred to herein as a “book-entry confirmation.”

The term “Agent’s Message” means a message transmitted by the

Book-Entry Transfer Facility to, and received by, the Depositary and forming a part of a book-entry confirmation, stating that the Book-Entry Transfer Facility has received an express acknowledgment from the participant tendering Shares through the

Book-Entry Transfer Facility that the participant has received and agrees to be bound by the terms of the Letter of Transmittal and that the Fund may enforce that agreement against that participant.

4. Rights of Withdrawal

Tenders of Shares made pursuant to the Offer may be withdrawn at any time prior to the Termination Date (October 1, 2024), unless extended.

To be effective, a written notice of withdrawal must be timely received by the Depositary at one of its addresses set forth on the last

page of this Offer to Purchase. Any notice of withdrawal must specify the name of the person who executed the particular Letter of Transmittal, the number of Shares to be withdrawn, and the names in which the Shares to be withdrawn are registered.

Any signature on the notice of withdrawal must be guaranteed by an Eligible Institution. If certificates have been delivered to the Depositary, the name of the registered holder and the serial numbers of the particular certificates evidencing the

Shares withdrawn must be furnished to the Depositary. If Shares have been delivered pursuant to the Book-Entry Delivery Procedure set forth in Section 3 of this Offer to Purchase, any notice of withdrawal must specify the name and number of the

account at the Book-Entry Transfer Facility to be credited with the withdrawn Shares (which must be the same name, number, and Book-Entry Transfer Facility from which the Shares were tendered), and must comply with the procedures of the Book-Entry

Transfer Facility.

12

All questions as to the form and validity, including time of receipt, of any notice of withdrawal

will be determined by the Fund, in its sole discretion, which determination shall be final and binding. None of the Fund, the Investment Manager, the Subadvisers, the Information Agent, the Depositary or any other person shall be under any duty to

give notification of any defects or irregularities in any notice of withdrawal nor shall any of the foregoing incur any liability for failure to give such notification. Any Shares properly withdrawn will be deemed not to have been validly tendered

for purposes of the Offer. However, withdrawn Shares may be re-tendered by following the procedures described in Section 3 of this Offer to Purchase at any time prior to the Termination Date.

If the Fund is delayed in its acceptance for payment of Shares, or it is unable to accept for payment Shares tendered pursuant to the Offer,

for any reason, then, without prejudice to the Fund’s rights under this Offer, the Depositary may, on behalf of the Fund, retain tendered Shares, and such Shares may not be withdrawn except to the extent that tendering Stockholders are entitled

to withdrawal rights as set forth in this Section 4.

5. Source and Amount of Funds; Effect of the Offer

The actual cost of the Offer to the Fund cannot be determined at this time because the number of Shares to be purchased will depend on the

number tendered, and the price will be based on the NAV per Share on the Pricing Date (October 1, 2024, unless extended). If the NAV per Share on the Pricing Date were the same as the NAV per Share on August 12, 2024, and if Stockholders tender

100% of the Fund’s outstanding Shares pursuant to the Offer, the estimated payment by the Fund to the Stockholders would be approximately $190,302,909. However, if, following the Offer, less than $50 million of net assets remain in the

Fund, the Offer will be cancelled and the Fund will liquidate on or about December 2, 2024.

The monies to be used by the Fund to

purchase Shares pursuant to the Offer will be obtained from an increase in the Fund’s use of leverage, cash and/or from sales of securities in the Fund’s investment portfolio.

The Offer may have certain adverse consequences for tendering and non-tendering Stockholders.

Effect on NAV and Consideration Received by Tendering Stockholders. If the Fund were required to sell a substantial amount of

portfolio securities to raise cash to finance the Offer, the market prices of portfolio securities being sold and/or the Fund’s remaining portfolio securities may decline and hence the Fund’s NAV may decline. If any such decline occurs in

the value of portfolio securities, the Fund cannot predict what its magnitude might be or whether such a decline would be temporary or continue to or beyond the Termination Date (October 1, 2024). Because the price per Share to be paid in the Offer

will be dependent upon the NAV per Share as determined on the Termination Date, if such a decline continued up to the Termination Date (October 1, 2024, unless extended), the consideration received by tendering Stockholders would be reduced. In

addition, the sale of portfolio securities will cause the Fund to incur increased brokerage and related transaction expenses, and the Fund may receive proceeds from the sale of portfolio securities that are less than their valuations by the Fund.

Accordingly, obtaining the cash to consummate the Offer may result in a decrease in the Fund’s NAV per Share, thereby reducing the amount of proceeds received by tendering Stockholders and the NAV per Share for

non-tendering Stockholders.

The Fund will likely sell portfolio securities during the pendency of

the Offer to raise cash for the purchase of Shares. Thus, during the pendency of the Offer, and possibly for a short time thereafter, the Fund will likely hold a greater than normal percentage of its net assets in cash and cash equivalents. The Fund

will pay for tendered Shares it accepts for payment reasonably promptly after the Termination Date of this Offer. Because the Fund will not know the number of Shares tendered until the Termination Date, the Fund will not know until the Termination

Date the amount of cash required to pay for such Shares. If on or prior to the Termination Date, the Fund does not have, or believes it is unlikely to have, sufficient cash to pay for all Shares tendered, it may extend the Offer to allow additional

time to sell portfolio securities and raise sufficient cash.

Recognition of Capital Gains and Ordinary Income by the Fund. As

noted, the Fund will likely be required to sell portfolio securities to finance the Offer. If the Fund’s tax basis for the securities sold is less than the sale proceeds, the Fund will recognize capital gains. The Fund would expect to declare

and distribute any such gains to Stockholders of record (reduced by net capital losses realized during the fiscal year, if any, and any net capital loss carryforwards). In addition, some of the distributed gains may be realized on securities held

for one year or less,

13

which would generate income taxable to the non-tendering Stockholders at ordinary income rates. This recognition and distribution of gains, if any, would

have certain negative consequences; first, Stockholders at the time of a declaration of distributions would be required to pay taxes on a greater amount of distributions than otherwise would be the case; second, to raise cash to make the

distributions, the Fund might need to sell additional portfolio securities thereby possibly being forced to realize and recognize additional capital gains. It is impossible to predict what the amount of unrealized gains or losses would be in the

Fund’s portfolio at the time that the Fund is required to liquidate portfolio securities (and hence the amount of capital gains or losses that would be realized and recognized). As of August 12, 2024, there was net unrealized appreciation

on a book basis of approximately 8,716,033 in the Fund’s portfolio as a whole. Additionally, as of August 12, 2024, the Fund had estimated net capital loss carryforwards, not subject to expiration, of $64,348,447 available for tax purposes

to offset any future capital gains realized by the Fund. Depending on a number of factors, including the participation level of the Offer (which will not be known prior to the termination date of the Offer), the Offer may result in an ownership

change of the Fund for U.S. federal income tax purposes. If there is an ownership change of the Fund, the Fund’s ability to use its net capital loss carryforwards would be subject to an annual limitation based on the value of the Fund’s

equity at the time of the ownership change.

Higher Expense Ratio and Less Investment Flexibility. If the Fund purchases a

substantial number of Shares pursuant to the Offer, the net assets of the Fund (that is, its total assets less its liabilities) will be reduced accordingly. The reduced net assets of the Fund as a result of the Offer will result in a higher expense

ratio for the Fund and possibly in less investment flexibility for the Fund, depending on the number of Shares repurchased.

6. Purpose of the Offer; Plans or Proposals of the Fund

The Board of Directors of the Fund has authorized a tender offer to purchase for cash up to 100% of the Fund’s outstanding Shares, or up

to 14,949,168 Shares, for cash at a price per share equal to 100% of the per share net asset value as of the close of regular trading on the New York Stock Exchange (“NYSE”) on October 1, 2024 (or if the Offer is extended, on the next

trading day after the day to which the Offer is extended), upon specified terms and subject to conditions as set forth in the Offer documents.

The purpose of this Offer is to provide liquidity to Stockholders. The Offer may reduce any market price discount from the NAV of the Shares,

but there can be no assurance that this Offer will result in such a reduction. The market price of the Shares will also be determined by, among other things, the relative demand for and supply of the Shares in the market, the Fund’s investment

performance, the Fund’s dividends and yield, investor perception of the Fund’s overall attractiveness as an investment as compared with other investment alternatives, and current market events. Following the Offer, if less than

$50 million of net assets remain in the Fund, the Offer will be cancelled and the Fund will liquidate on or about December 2, 2024.

The purchase of Shares pursuant to the Offer will have the effect of increasing the proportionate interest in the Fund of Stockholders that do

not tender Shares. Stockholders that retain their Shares may be subject to increased risks due to a reduction in the Fund’s aggregate assets resulting from payment for the Shares tendered. These risks include the potential for greater

volatility in our NAV due to possible decreased diversification. However, the Fund believes that this result is unlikely given the nature of the Fund’s investment program. A reduction in the aggregate assets of the Fund may result in

Stockholders that do not tender Shares bearing higher costs to the extent that certain expenses borne by the Fund are relatively stable and may not decrease if assets decline.

Any Shares acquired by the Fund pursuant to the Offer will become authorized but unissued Shares and will be available for issuance by the

Fund without further Stockholder action (except as required by applicable law or the rules of national securities exchanges on which the Shares are listed).

Except as set forth above, as referred to in connection with the Fund’s Dividend Reinvestment Plan, the Fund does not have any present

plans or proposals and is not engaged in any negotiations that relate to or would result in: (a) other than in connection with transactions in the ordinary course of the Fund’s operations and for purposes of funding the Offer, any

purchase, sale or transfer of a material amount of assets of the Fund or any of its subsidiaries; (b) any material change in the Fund’s present dividend policy, or indebtedness or capitalization of the Fund; (c) changes to the present

Board of Directors or management of the Fund, including changes to the number or the term of members of the Board of Directors, the filling of any existing vacancies on the Board of Directors or changes to any material term of the employment

contract of any executive officer; (d) any other material change in

14

the Fund’s corporate structure or business, including any plans or proposals to make any changes in the Fund’s investment policy for which a vote would be required by Section 13 of

the 1940 Act; (e) any class of equity securities of the Fund being delisted from a national securities exchange or ceasing to be authorized to be quoted in an automated quotations system operated by a national securities association;

(f) any class of equity securities of the Fund becoming eligible for termination of registration pursuant to Section 12(g)(4) of the Exchange Act; (g) the suspension of the Fund’s obligation to file reports pursuant to

Section 15(d) of the Exchange Act; (h) the acquisition by any person of additional securities of the Fund, or the disposition of securities of the Fund; or (i) any changes in the Fund’s Articles of Incorporation, By-Laws or other governing instruments or other actions that could impede the acquisition of control of the Fund. Following the completion of the Offer, the Board of Directors reserves the right to consider whether

a merger or reorganization of the Fund, other extraordinary transaction or restructuring of the Fund’s outstanding senior securities, or any other plans noted above, would be appropriate. No other tender offers are presently contemplated, but

the Board of Directors reserves the right to conduct tender offers in the future.

NONE OF THE FUND, ITS BOARD OF DIRECTORS, THE

INVESTMENT MANAGER OR THE SUBADVISERS MAKES ANY RECOMMENDATION TO ANY STOCKHOLDER AS TO WHETHER TO TENDER OR REFRAIN FROM TENDERING ANY OF SUCH STOCKHOLDER’S SHARES, AND NONE OF SUCH PERSONS HAS AUTHORIZED ANY PERSON TO MAKE ANY SUCH

RECOMMENDATION. STOCKHOLDERS ARE URGED TO EVALUATE CAREFULLY ALL INFORMATION IN THE OFFER, CONSULT THEIR OWN INVESTMENT AND TAX ADVISORS AND MAKE THEIR OWN DECISIONS WHETHER TO TENDER SHARES.

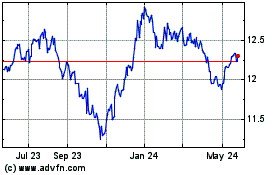

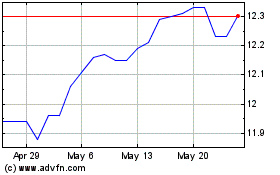

7. NAV and Market Price Range of Shares; Dividends

The Shares are traded on the NYSE. The following table sets forth for the fiscal quarters indicated the NAV (as of the last day of each of such

fiscal quarters) and the high and low NYSE Market Price per Share:

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fiscal Quarter Ended |

|

High |

|

|

Low |

|

|

Net Asset

Value |

|

| April 30, 2022 |

|

$ |

16.97 |

|

|

$ |

14.01 |

|

|

$ |

14.69 |

|

| July 31, 2022 |

|

$ |

15.03 |

|

|

$ |

13.29 |

|

|

$ |

14.24 |

|

| October 31, 2022 |

|

$ |

14.50 |

|

|

$ |

11.15 |

|

|

$ |

12.63 |

|

| January 31, 2023 |

|

$ |

14.01 |

|

|

$ |

11.76 |

|

|

$ |

13.82 |

|

| April 30, 2023 |

|

$ |

13.63 |

|

|

$ |

12.08 |

|

|

$ |

13.04 |

|

| July 31, 2023 |

|

$ |

12.81 |

|

|

$ |

12.04 |

|

|

$ |

13.14 |

|

| October 31, 2023 |

|

$ |

12.70 |

|

|

$ |

11.21 |

|

|

$ |

11.92 |

|

| January 31, 2024 |

|

$ |

13.04 |

|

|

$ |

11.42 |

|

|

$ |

12.99 |

|

| April 30, 2024 |

|

$ |

12.75 |

|

|

$ |

11.87 |

|

|

$ |

12.42 |

|

| July 31, 2024 |

|

$ |

12.50 |

|

|

$ |

11.90 |

|

|

$ |

12.67 |

|

As of the close of business on August 12, 2024, the Fund’s NAV per Share was $12.73. The tender of

Shares, unless and until such tendered Shares are accepted for purchase, will not affect the record ownership of any such tendered Shares for purposes of entitlement to any dividends payable by the Fund.

8. Federal Income Tax Consequences of the Offer

The following discussion describes certain U.S. federal income tax consequences to U.S. Stockholders and

Non-U.S. Stockholders (each as defined below and collectively, for purposes of this discussion, “Stockholders”) of the exchange of Shares for cash pursuant to the Offer. This summary deals only with

Shares held as capital assets (generally, property held for investment) and does not deal with all tax consequences that may be relevant to Stockholders in light of their particular circumstances or to Stockholders subject to special tax rules

(including, without limitation, partnerships or other pass-through entities (and investors therein), regulated investment companies, real estate investment trusts, dealers in securities or currencies, traders in securities that elect to mark their

holdings to market, financial institutions, tax-exempt organizations, insurance companies, U.S. expatriates, certain former long-term residents of the U.S., persons liable for alternative minimum tax, persons

holding Shares as a part of a hedging, conversion or constructive sale transaction or a straddle, U.S. Stockholders whose functional currency is not the U.S. dollar, or persons who acquired their Shares as compensation or pursuant to employee stock

options or employee benefit plans).

15

Furthermore, the discussion below is based upon the Code, U.S. Treasury regulations, administrative rulings and

pronouncements and judicial decisions, as of the date hereof, all of which may be repealed, revoked or modified, possibly with retroactive effect, so as to result in U.S. federal income tax consequences different from those discussed below. This

summary does not address all aspects of U.S. federal income taxes and does not address any United States tax considerations (e.g., estate or gift tax) other than United States federal income tax considerations, the consequences of any alternative

minimum tax, the Medicare contribution tax on net investment income, special tax accounting rules that apply to certain accrual basis taxpayers under Section 451(b) of the Code or any foreign, state, local or other tax considerations that may

be relevant to Stockholders in light of their particular circumstances. Stockholders should consult their own tax advisors concerning the U.S. federal income tax consequences of participating in the Offer in light of their particular situations as

well as any consequences arising under other U.S. federal laws or the laws of any other taxing jurisdiction.

If a partnership (or other

entity or arrangement treated as a partnership for U.S. federal income tax purposes) holds Shares, the tax treatment of a partner will generally depend upon the status of the partner and the activities of the partnership. If you are a partnership or

a partner of a partnership holding Shares, you should consult your tax advisors.

As used herein, a “U.S. Stockholder” means a

beneficial owner of Shares that is, for U.S. federal income tax purposes, (i) an individual who is a citizen or resident of the U.S., (ii) a corporation (or any other entity treated as a corporation for U.S. federal income tax purposes) created

or organized in or under the laws of the U.S. or any state thereof or the District of Columbia, (iii) an estate the income of which is subject to U.S. federal income taxation regardless of its source or (iv) a trust if it (x) is

subject to the primary supervision of a court within the U.S. and one or more U.S. persons have the authority to control all substantial decisions of the trust or (y) has a valid election in effect under applicable U.S. Treasury regulations to

be treated as a U.S. person. A “Non-U.S. Stockholder” is a beneficial owner of Shares that is neither a U.S. Stockholder nor a partnership (or other entity or arrangement treated as a partnership for

U.S. federal income tax purposes).

Stockholders who do not participate in the Offer will not incur any U.S. federal income tax as a

result of the exchange of Shares for cash by other Stockholders pursuant to the Offer.

U.S. Stockholders. An exchange of Shares

for cash in the Offer will be a taxable transaction for U.S. federal income tax purposes. As a consequence of the exchange, a tendering U.S. Stockholder will, depending on such U.S. Stockholder’s particular circumstances, be treated either as

recognizing gain or loss from the sale or exchange of the Shares or as receiving a distribution from the Fund. Under Section 302(b) of the Code, an exchange of Shares for cash pursuant to the Offer generally will be treated as a sale or

exchange for U.S. federal income tax purposes if the exchange: (a) results in a complete termination of the U.S. Stockholder’s interest in the Fund, (b) results in a substantially disproportionate redemption with respect to the U.S.

Stockholder or (c) is not essentially equivalent to a dividend with respect to the U.S. Stockholder. In determining whether any of these tests has been met, Shares actually owned, as well as Shares considered to be owned by the U.S. Stockholder

by reason of certain constructive ownership rules set forth in Section 318 of the Code, generally must be taken into account.

The

sale of Shares pursuant to the Offer will result in a “complete termination” of a U.S. Stockholder’s interest in the Fund if either (i) all Shares actually and constructively owned by the U.S. Stockholder are exchanged for cash

pursuant to the Offer or (ii) all Shares actually owned by the U.S. Stockholder are exchanged for cash pursuant to the Offer and the U.S. Stockholder is eligible to waive, and effectively waives, the attribution of all stock in the Fund

constructively owned by the U.S. Stockholder in accordance with the procedures described in Section 302(c)(2) of the Code.

The sale

of Shares pursuant to the Offer generally will result in a “substantially disproportionate” redemption with respect to a U.S. Stockholder if (i) the percentage of the Fund’s then outstanding Shares actually and constructively

owned by the U.S. Stockholder immediately after the sale (treating all Shares purchased by the Fund pursuant to the Offer as not outstanding) is less than 80% of the percentage of the Fund’s then outstanding Shares actually and constructively

owned by the U.S. Stockholder determined immediately before the sale (treating all Shares purchased by the Fund pursuant to the Offer as outstanding) and (ii) immediately following the sale the U.S. Stockholder actually and constructively owns

less than 50% of the total outstanding Shares.

16

The sale of Shares pursuant to the Offer generally will be treated as “not essentially

equivalent to a dividend” with respect to a U.S. Stockholder if it results in a “meaningful reduction” in the U.S. Stockholder’s proportionate interest in the Fund’s stock. Generally, even a small reduction in the percentage

ownership interest of a stockholder in a publicly held corporation (such as the Fund) whose relative stock interest is minimal and who exercises no control over the corporation’s business should constitute a meaningful reduction.

Proration may affect whether the sale of Shares pursuant to the Offer will meet any of the three tests under Section 302(b) of the Code

described above. Contemporaneous dispositions or acquisitions of Shares by a U.S. Stockholder or related individuals or entities may also be deemed to be part of a single integrated transaction and may be taken into account in determining whether

any of the three tests under Section 302(b) of the Code have been satisfied.

If any of the above three tests under

Section 302(b) of the Code for sale or exchange treatment is met, a U.S. Stockholder will recognize gain or loss equal to the difference between the price paid by the Fund for the Shares purchased in the Offer and the U.S. Stockholder’s

adjusted basis in such Shares. The gain or loss will generally be capital gain or loss. Such capital gain or loss will generally be long-term capital gain or loss if the Shares have been held for more than one year or short-term capital gain or loss

if the Shares have been held for one year or less. However, any loss realized by a U.S. Stockholder on the sale of Shares held by the U.S. Stockholder for six months or less will be treated as a long-term capital loss to the extent of any

distributions or deemed distributions of long-term capital gains received by the U.S. Stockholder with respect to such Shares. The maximum tax rate applicable to capital gains recognized by individuals and other

non-corporate taxpayers is (i) the same as the applicable ordinary income rate for short-term capital gains or (ii) 20% for long-term capital gains. The deductibility of capital losses is subject to

limitations. Generally, gain or loss must be determined separately for each block of Shares (generally, Shares acquired by a U.S. Stockholder at the same cost in a single transaction) the Fund purchases in the Offer. Any loss realized by a U.S.

Stockholder on the sale of Shares pursuant to the Offer will be disallowed to the extent the U.S. Stockholder acquires (including pursuant to the Fund’s dividend reinvestment plan), or enters into a contract or option to acquire, shares that

are substantially identical to such Shares within 30 days before or after the sale. In such a case, the basis of the replacement shares will be adjusted to reflect the disallowed loss.

In addition, under U.S. Treasury regulations directed at tax shelter activity, if a U.S. Stockholder recognizes a loss with respect to the

Shares of $2 million or more for an individual U.S. Stockholder or $10 million or more for a corporate U.S. Stockholder, the U.S. Stockholder must file with the IRS a disclosure statement on IRS Form 8886. Direct holders of portfolio

securities are in many cases excepted from this reporting requirement, but under current guidance, stockholders of a regulated investment company, such as the Fund, are not excepted. Future guidance may extend the current exception from this

reporting requirement to stockholders of most or all regulated investment companies. The fact that a loss is reportable under these regulations does not affect the legal determination of whether the taxpayer’s treatment of the loss is proper.

U.S. Stockholders should consult their tax advisors to determine the applicability of these regulations in light of their individual circumstances.

If a U.S. Stockholder’s sale of Shares pursuant to the Offer does not meet any of the above three tests under Section 302(b) of the

Code for sale or exchange treatment, amounts received by the U.S. Stockholder pursuant to the Offer will be treated as a distribution with respect to the Shares that are sold and will generally be taxable to the U.S. Stockholder as ordinary dividend

income to the extent of such U.S. Stockholder’s allocable share of the Fund’s current or accumulated earnings and profits (as determined under U.S. federal income tax principles). The Fund does not expect any such dividend income to be

eligible for the dividends received deduction allowed to U.S. corporations or for the reduced U.S. federal income tax rates that are currently imposed on certain “qualified dividend income” received by

non-corporate U.S. Stockholders. To the extent that amounts received by a U.S. Stockholder pursuant to the Offer exceed such U.S. Stockholder’s allocable share of the Fund’s current and accumulated

earnings and profits, the excess will first be treated as a non-taxable return of capital, causing a reduction in the adjusted basis of the Shares that are sold, and any amounts in excess of the adjusted basis

will constitute capital gain (as described above). Any remaining adjusted basis in the Shares sold to the Fund by a U.S. Stockholder will be transferred to any remaining Shares held by such U.S. Stockholder.

17

Non-U.S. Stockholders. The U.S. federal income

taxation of a Non-U.S. Stockholder with respect to an exchange of Shares for cash pursuant to the Offer will depend on the tax characterization of the transaction, determined in the same manner as discussed

above for U.S. Stockholders. Generally, if the exchange is treated as a sale or exchange under Section 302(b) of the Code, any gain realized by a Non-U.S. Stockholder will not be subject to U.S. federal

income tax unless (i) such gain is effectively connected with a trade or business carried on in the U.S. by such Non-U.S. Stockholder (and, if required by an applicable income tax treaty, is attributable

to a U.S. permanent establishment or fixed base maintained by the Non-U.S. Stockholder) or (ii) the Non-U.S. Stockholder is an individual who is physically present

in the U.S. for 183 days or more during the taxable year of the exchange and certain other conditions are met. A Non-U.S. Stockholder described in clause (i) above will generally be subject to U.S.

federal income tax on the gain derived from the exchange in the same manner as if the Non-U.S. Stockholder were a U.S. Stockholder. A Non-U.S. Stockholder that is a

corporation may be subject to an additional “branch profits tax” at a rate of 30% (or such lower rate as may be specified by an applicable income tax treaty) with respect to any effectively connected earnings and profits attributable to

such gain (subject to certain adjustments). An individual Non-U.S. Stockholder described in clause (ii) above will generally be subject to U.S. federal income tax at a rate of 30% (or such lower rate as

may be specified by an applicable income tax treaty) on the gain derived from the exchange, which may be offset by certain U.S. source capital losses, even though the Non-U.S. Stockholder is not considered a

resident of the U.S.

If, however, a Non-U.S. Stockholder’s exchange of Shares for cash

pursuant to the Offer does not satisfy any of the above three tests under Section 302(b) of the Code for sale or exchange treatment, amounts received by such Non-U.S. Stockholder pursuant to the Offer

will be treated as a distribution with respect to the Shares that are exchanged. The treatment for U.S. federal income tax purposes of such distribution as a dividend, return of capital, or as gain from the sale of Shares will be determined in the

same manner described above for U.S. Stockholders. In general, and subject to any statutory exemption (for example, the exemption for any “capital gain dividend,” “interest-related dividend,” or “short-term capital gain

dividend”) and the discussion below of effectively connected dividends, any amount that constitutes a dividend for U.S. federal income tax purposes will be subject to U.S. withholding tax at a rate of 30% (or such lower rate as may be specified

by an applicable income tax treaty). The tax treatment of a Stockholder’s receipt of cash pursuant to the Offer depends upon facts which may be unique as to each Stockholder. Therefore, because an applicable withholding agent may not be able to

determine if a particular Non-U.S. Stockholder qualifies for sale or exchange treatment under Section 302(b) of the Code, such agent may withhold U.S. federal income tax equal to 30% of the gross proceeds

payable to such Non-U.S. Stockholder unless the agent determines that a reduced rate of withholding is available pursuant to a tax treaty or that an exemption from withholding is applicable because such gross

proceeds are effectively connected with the Non-U.S. Stockholder’s conduct of a trade or business within the U.S. (and, if required by an applicable income tax treaty, are attributable to a U.S. permanent

establishment or fixed base maintained by the Non-U.S. Stockholder). In order to obtain a reduced rate of withholding pursuant to a tax treaty, a Non-U.S. Stockholder

must deliver a properly completed and executed IRS Form W-8BEN (for individuals) or Form W-8BEN-E (for entities). In order to

obtain an exemption from withholding on the grounds that the gross proceeds paid pursuant to the Offer are effectively connected with the conduct of a trade or business within the U.S. (and, if required by an applicable income tax treaty, are

attributable to a U.S. permanent establishment or fixed base maintained by the Non-U.S. Stockholder), a Non-U.S. Stockholder must deliver a properly completed and

executed IRS Form W-8ECI. Any such effectively connected amounts will generally be subject to U.S. federal income tax (and possibly branch profits tax) in the same manner as effectively connected gains as

described above. A Non-U.S. Stockholder may be eligible to obtain a refund of all or a portion of any tax withheld if such Non-U.S. Stockholder meets one of the

Section 302(b) tests described above or is otherwise able to establish that no tax or a reduced amount of tax is due. Backup withholding generally will not apply to amounts subject to the 30% or a treaty-reduced rate of withholding. Non-U.S. Stockholders are urged to consult their own tax advisors regarding the application of U.S. federal income tax withholding, including eligibility for a withholding tax reduction or exemption, and the refund

procedure.

Under Sections 1471 through 1474 of the Code, commonly referred to as “FATCA,” and administrative guidance, a U.S.

federal withholding tax of 30% generally will be imposed on dividends that are paid to “foreign financial institutions” and “non-financial foreign entities” (as specifically defined under

these rules and whether such institutions or entities hold Shares as beneficial owners or intermediaries), unless specified requirements are met. Because, as discussed above, a withholding agent may treat amounts paid to Non-U.S. Stockholders in the Offer as dividends for U.S. federal income tax purposes, such amounts may also be subject to withholding under FATCA if such requirements are not met. In such case, any withholding under

FATCA may be credited against, and therefore reduce, any 30% or treaty-reduced rate of withholding as discussed above.

18

Backup Withholding. See Section 3 with respect to the application of backup

withholding on payments made to Stockholders.

The tax discussion set forth above is included for general information only. Each

Stockholder is urged to consult its own tax advisor to determine the particular tax consequences to it of the Offer, including the applicability and effect of state, local and foreign tax laws.

9. Selected Financial Information

The audited financial statements of the Fund for the twelve-month reporting period ended October 31, 2023 appear in the Fund’s Annual

Report to Stockholders for the year ended October 31, 2023. The Annual Report has previously been provided to stockholders of the Fund and is incorporated by reference herein. The unaudited, semi-annual financial statements of the Fund

for the period ended April 30, 2024 appear in the Fund’s Semi-Annual Report to Stockholders for the period ended April 30, 2024. The Semi-Annual Report has previously been provided to stockholders of the Fund and is incorporated by

reference herein. Copies of the Annual Report and the Semi-Annual Report can be obtained for free at the website of the Securities and Exchange Commission (the “SEC”) (http://www.sec.gov).

10. Certain Information Concerning the Fund, the Investment Manager and the Subadvisers

The Fund is a closed-end, non-diversified management investment