Filed Pursuant to Rule 424(b)(3)

Registration No. 333-269571

PROSPECTUS SUPPLEMENT NO. 1

(to Prospectus dated August 1, 2024)

Getaround, Inc.

127,505,604 Shares of Common Stock

11,616,667 Warrants to Purchase Shares of Common Stock

16,791,642 Shares of Common Stock Underlying Warrants

This prospectus supplement (this “Prospectus Supplement”) supplements the prospectus dated August 1, 2024 (as supplemented or amended from time to time, the “Prospectus”), which forms part of our registration statement on Form S-1 (File No. 333-269571). This Prospectus Supplement is being filed to update and supplement the information included in the Prospectus with the information contained in our Current Report on Form 8-K, filed with the Securities and Exchange Commission on August 6, 2024 (the “Report”). Accordingly, we have attached the Report to this Prospectus Supplement.

This Prospectus Supplement updates and supplements the information in the Prospectus and is not complete without, and may not be delivered or utilized except in combination with, the Prospectus, including any amendments or supplements thereto. This Prospectus Supplement should be read in conjunction with the Prospectus, and if there is any inconsistency between the information in the Prospectus and this Prospectus Supplement, you should rely on this Prospectus Supplement.

Our common stock and public warrants are quoted on the OTC Pink Market under the symbols “GETR” and “GETRW,” respectively. On August 5, 2024, the last reported sales price of our common stock and public warrants on the over-the-counter market were $0.08 per share and $0.0125 per warrant, respectively.

We are an “emerging growth company” as defined Jumpstart Our Business Startups Act of 2012 and, as such, have elected to comply with certain reduced public company reporting requirements.

Investing in our securities involves risks. See the section entitled “Risk Factors” beginning on page 11 of the Prospectus to read about factors you should consider before buying our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this Prospectus Supplement or the Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this Prospectus Supplement is August 6, 2024.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): July 31, 2024 |

Getaround, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-40152 |

85-3122877 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

PO Box 24173 |

|

Oakland, California |

|

94623 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 415 295-5725 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

N/A |

|

N/A |

|

N/A |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

As previously disclosed, on July 9, 2024, Getaround, Inc. (the “Company”) received notice the New York Stock Exchange (“NYSE”) suspended trading of its common stock on the NYSE effective immediately and started the process to delist the Company's common stock from the NYSE. The start of the delisting process followed the NYSE’s determination under Rule 802.01B of the NYSE Listed Company Manual that the Company did not meet the continued listing standard that requires listed companies to maintain an average global market capitalization of at least $15 million over a period of 30 consecutive trading days. The Company had a right to appeal the determination to delist its common stock and filed a written request for such a review on July 23, 2024. On August 02, 2024, the Company notified NYSE that it determined to officially withdraw its request for a hearing.

On August 5, 2024, NYSE filed a Form 25 with the Securities and Exchange Commission to delist the Company’s common stock from listing and registration on NYSE effective on August 16, 2024.

The Company’s common stock and public warrants are quoted on the OTC Pink Market under the symbols “GETR” and “GETRW,” respectively.

Item 5.07 Submission of Matters to a Vote of Security Holders.

On July 31, 2024, at the Annual Meeting of Stockholders (the “Annual Meeting”) of Getaround, Inc. (the “Company”), the stockholders of the Company in attendance, constituting a quorum under the Amended and Restated Bylaws of the Company, voted on the following proposals (collectively, the “Proposals”) described in the Company’s definitive proxy statement filed with the Securities and Exchange Commission on July 3, 2024 (the “Proxy Statement”), to: (i) elect two Class I directors and two Class II directors to the Company’s Board of Directors (the “Board”); (ii) ratify the appointment of dbbmckennon as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024; (iii) approve an amendment to the Company’s Second Amended and Restated Certificate of Incorporation to effect a reverse stock split of the Company’s issued and outstanding common stock at a ratio of not less than 1-for-10 and not greater than 1-for-50, with the exact ratio and effective time of the reverse stock split, if any, to be determined in the sole discretion of the Board (the “Reverse Stock Split Proposal”); (iv) approve, for purposes of the rules of the New York Stock Exchange, the potential issuance of more than 19.99% of the Company’s outstanding common stock upon the conversion of the Company’s outstanding convertible notes following an adjustment to the conversion rate of the convertible notes (the “Convertible Note Share Issuance Proposal”); (v) approve, for purposes of the rules of the New York Stock Exchange, the potential issuance of more than 19.99% of the Company’s outstanding common stock upon the exercise of certain outstanding inducement grants (the “Inducement Grant Share Issuance Proposal”); (vi) approve the amendment and restatement of the Getaround, Inc. 2022 Equity Incentive Plan to, among other things, increase the number of shares of common stock reserved for issuance thereunder by 4,000,000 shares and increase the annual evergreen percentage increase to the number of shares of common stock reserved for issuance thereunder (the “Equity Incentive Plan Proposal”); and (vii) authorize and approve a repricing of certain stock options issued under the Getaround, Inc. Amended and Restated 2010 Stock Plan and 2022 Equity Incentive Plan that are held by eligible service providers (the “Stock Option Repricing Proposal”).

At the Annual Meeting, all nominated directors were elected, and the stockholders also voted to ratify the appointment of dbbmckennon as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024, and to approve the Reverse Stock Split Proposal and the Convertible Note Share Issuance Proposal. The Inducement Grant Share Issuance Proposal, the Equity Incentive Plan Proposal and the Stock Option Repricing Proposal were not approved by the stockholders.

The final voting results with respect to each Proposal is as set forth below.

|

|

|

|

|

|

|

|

For |

Against |

Abstain / Withhold |

Broker

Non-Votes |

1. |

Election of Directors |

|

|

|

|

|

Class I Nominees |

|

|

|

|

|

Bruno Bowden |

17,332,228 |

— |

30,636,823 |

11,873,244 |

|

Ravi Narula |

17,402,141 |

— |

30,566,910 |

11,873,244 |

|

Class II Nominees |

|

|

|

|

|

Eduardo Iniguez |

40,733,544 |

— |

7,235,507 |

11,873,244 |

|

Jason Mudrick |

40,821,044 |

— |

7,148,007 |

11,873,244 |

|

|

|

|

|

|

2. |

Ratification of Appointment of dbbmckennon |

57,031,607 |

2,768,221 |

42,467 |

— |

|

|

|

|

|

|

3. |

Reverse Stock Split Proposal |

49,867,737 |

9,702,597 |

271,961 |

— |

|

|

|

|

|

|

4. |

Convertible Note Share Issuance Proposal |

45,860,693 |

2,082,442 |

25,916 |

11,873,244 |

|

|

|

|

|

|

|

|

|

|

|

|

5. |

Inducement Grant Share Issuance Proposal |

15,594,121 |

31,700,407 |

674,523 |

11,873,244 |

|

|

|

|

|

|

6. |

Equity Incentive Plan Proposal |

21,439,247 |

25,843,186 |

686,618 |

11,873,244 |

|

|

|

|

|

|

7. |

Stock Option Repricing Proposal |

21,426,423 |

26,501,610 |

41,018 |

11,873,244 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

GETAROUND, INC. |

|

|

|

|

Date: |

August 6, 2024 |

By: |

/s/ Spencer Jackson |

|

|

Name: Title: |

Spencer Jackson

General Counsel & Secretary |

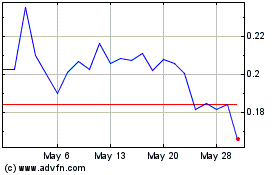

Getaround (NYSE:GETR)

Historical Stock Chart

From Oct 2024 to Nov 2024

Getaround (NYSE:GETR)

Historical Stock Chart

From Nov 2023 to Nov 2024