UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2024

--------------

Commission File Number: 001-38923

----------

Gaotu Techedu Inc.

5F, Gientech Building, 17 East Zone,

10 Xibeiwang East Road

Haidian District, Beijing 100193

People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ___X____ Form 40-F _________

Exhibit Index

Exhibit 99.1—Press Release

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

Gaotu Techedu Inc. |

|

|

|

|

|

|

|

|

|

|

|

|

By |

: |

/s/ Nan Shen |

Name |

: |

Nan Shen |

Title |

: |

Chief Financial Officer |

Date: December 4, 2024

Exhibit 99.1

Gaotu Techedu Announces Third Quarter 2024 Unaudited Financial Results

Beijing, China, December 4, 2024 —Gaotu Techedu Inc. (NYSE: GOTU) (“Gaotu” or the “Company”), a technology-driven education company and online large-class tutoring service provider in China, today announced its unaudited financial results for the third quarter ended September 30, 2024.

Third Quarter 2024 Highlights[1]

•Net revenues were RMB1,208.3 million, increased by 53.1% from RMB789.4 million in the same period of 2023.

•Gross billings[2] were RMB1,069.2 million, increased by 67.2% from RMB639.3 million in the same period of 2023.

•Loss from operations was RMB490.1 million, compared with loss from operations of RMB99.5 million in the same period of 2023.

•Net loss was RMB471.3 million, compared with net loss of RMB57.7 million in the same period of 2023.

•Non-GAAP net loss was RMB457.2 million, compared with non-GAAP net loss of RMB41.7 million in the same period of 2023.

•Net operating cash outflow was RMB714.4 million, compared with net operating cash outflow of RMB209.9 million in the same period of 2023.

Third Quarter 2024 Key Financial and Operating Data

(In thousands of RMB, except for percentages)

|

|

|

|

|

|

|

|

|

|

|

For the three months ended September 30, |

|

2023 |

|

|

2024 |

|

|

Pct. Change |

Net revenues |

|

789,413 |

|

|

|

1,208,253 |

|

|

53.1% |

Gross billings |

|

639,342 |

|

|

|

1,069,159 |

|

|

67.2% |

Loss from operations |

|

(99,541 |

) |

|

|

(490,107 |

) |

|

392.4% |

Net loss |

|

(57,663 |

) |

|

|

(471,273 |

) |

|

717.3% |

Non-GAAP net loss |

|

(41,729 |

) |

|

|

(457,195 |

) |

|

995.6% |

Net operating cash outflow |

|

(209,930 |

) |

|

|

(714,385 |

) |

|

240.3% |

[1] For a reconciliation of non-GAAP numbers, please see the table captioned "Reconciliations of non-GAAP measures to the most comparable GAAP measures" at the end of this press release. Non-GAAP income (loss) from operations and non-GAAP net income (loss) exclude share-based compensation expenses.

[2] Gross billings is a non-GAAP financial measure, which is defined as the total amount of cash received for the sale of course offerings in such period, net of the total amount of refunds in such period. See "About Non-GAAP Financial Measures" and "Reconciliations of non-GAAP measures to the most comparable GAAP measures" elsewhere in this press release.

Nine Months Ended September 30, 2024 Highlights

•Net revenues were RMB3,164.9 million, increased by 43.9% from RMB2,199.8 million in the same period of 2023.

•Gross billings were RMB3,452.2 million, increased by 67.5% from RMB2,060.6 million in the same period of 2023.

•Loss from operations was RMB1,032.6 million, compared with income from operations of RMB38.9 million in the same period of 2023.

•Net loss was RMB913.1 million, compared with net income of RMB112.4 million in the same period of 2023.

•Non-GAAP net loss was RMB872.2 million, compared with non-GAAP net income of RMB155.0 million in the same period of 2023.

•Net operating cash outflow was RMB525.6 million, compared with net operating cash outflow of RMB137.8 million in the same period of 2023.

First Nine Months 2024 Key Financial and Operating Data

(In thousands of RMB, except for percentages)

|

|

|

|

|

|

|

|

|

|

|

For the nine months ended September 30, |

|

2023 |

|

|

2024 |

|

|

Pct. Change |

Net revenues |

|

2,199,799 |

|

|

|

3,164,935 |

|

|

43.9% |

Gross billings |

|

2,060,618 |

|

|

|

3,452,211 |

|

|

67.5% |

Income/(loss) from operations |

|

38,909 |

|

|

|

(1,032,559 |

) |

|

(2,753.8)% |

Net income/(loss) |

|

112,351 |

|

|

|

(913,120 |

) |

|

(912.7)% |

Non-GAAP net income/(loss) |

|

155,025 |

|

|

|

(872,196 |

) |

|

(662.6)% |

Net operating cash outflow |

|

(137,796 |

) |

|

|

(525,636 |

) |

|

281.5% |

Larry Xiangdong Chen, the Company’s founder, Chairman and CEO, commented, “During the past quarter, our core businesses continued to make steady progress, with gross billings increasing by 67.2% year-over-year to approximately RMB1.1 billion and revenue growing by 53.1% year-over-year to over RMB1.2 billion. This growth was attributed to our keen understanding of market trends and the continuous optimization of our strategy and execution. As our business scales rapidly and the product matrix gradually expands, we have ramped up investments with a particular focus on upgrading our educational systems, enhancing organizational capabilities, and improving management practices. We have also strengthened efforts in talent development and professional training, equipping our team with skills needed to navigate dynamic business environments and improve operational efficiency.

In this quarter, we allocated over RMB120 million for share buybacks, underscoring our strong commitment to shareholder returns. As of September 30, 2024, we had a total of over RMB3.3 billion in cash, cash equivalents, restricted cash, and short-term and long-term investments, providing a firm foundation for our strategic priorities and long-term growth.”

Shannon Shen, CFO of the Company, added, “In the past quarter, we capitalized on the robust market demand during the summer vacation period, successfully achieving our gross billing targets amid rapid business growth and driving meaningful increases in student enrollments and market share. With a continuous rise in student enrollments, growth in our top-line has accelerated sequentially in each of the past three quarters. In the third quarter, our revenue increased by 53.1% year-over-year and grew by approximately 10 percentage points sequentially. As of September 30, 2024, our deferred revenue balance increased by 89.0% year-over-year to over RMB1.4 billion. Looking ahead, we anticipate year-on-year revenue growth to peak in the fourth quarter, further consolidating our leading position in the market and laying a strong foundation for future growth.”

Financial Results for the Third Quarter of 2024

Net Revenues

Net revenues increased by 53.1% to RMB1,208.3 million from RMB789.4 million in the third quarter of 2023, which was mainly due to the continuous year-over-year growth of gross billings as a result of our sufficient and effective response to strong market demand. Furthermore, our high-quality educational products and learning services resulted in improved recognition of our product and service offerings.

Cost of Revenues

Cost of revenues increased by 97.1% to RMB429.8 million from RMB218.1 million in the third quarter of 2023. The increase was mainly due to expansion of instructors and tutors workforce, growing rental cost, as well as an increased cost of learning materials.

Gross Profit and Gross Margin

Gross profit increased by 36.3% to RMB778.5 million from RMB571.3 million in the third quarter of 2023. Gross profit margin decreased to 64.4% from 72.4% in the same period of 2023.

Non-GAAP gross profit increased by 36.3% to RMB780.7 million from RMB572.8 million in the third quarter of 2023. Non-GAAP gross profit margin decreased to 64.6% from 72.6% in the same period of 2023.

Operating Expenses

Operating expenses increased by 89.1% to RMB1,268.6 million from RMB670.8 million in the third quarter of 2023. The increase was primarily due to the expansion of employees workforce and a higher expenditure on marketing and branding activities.

•Selling expenses increased to RMB885.8 million from RMB434.4 million in the third quarter of 2023.

•Research and development expenses increased to RMB189.3 million from RMB130.6 million in the third quarter of 2023.

•General and administrative expenses increased to RMB193.5 million from RMB105.8 million in the third quarter of 2023.

Loss from Operations

Loss from operations was RMB490.1 million, compared with loss from operations of RMB99.5 million in the third quarter of 2023.

Non-GAAP loss from operations was RMB476.0 million, compared with non-GAAP loss from operations of RMB83.6 million in the third quarter of 2023.

Interest Income and Realized Gains from Investments

Interest income and realized gains from investments, on aggregate, were RMB21.7 million, compared with a total of RMB31.7 million in the third quarter of 2023.

Other Income, net

Other income, net was RMB4.0 million, compared with other income, net of RMB15.8 million in the third quarter of 2023.

Net Loss

Net loss was RMB471.3 million, compared with net loss of RMB57.7 million in the third quarter of 2023.

Non-GAAP net loss was RMB457.2 million, compared with non-GAAP net loss of RMB41.7 million in the third quarter of 2023.

Cash Flow

Net operating cash outflow in the third quarter of 2024 was RMB714.4 million.

Basic and Diluted Net Loss per ADS

Basic and diluted net loss per ADS were both RMB1.83 in the third quarter of 2024.

Non-GAAP basic and diluted net loss per ADS were both RMB1.78 in the third quarter of 2024.

Share Outstanding

As of September 30, 2024, the Company had 169,556,395 ordinary shares outstanding.

Cash, Cash Equivalents, Restricted Cash, Short-term and Long-term Investments

As of September 30, 2024, the Company had cash and cash equivalents, restricted cash, short-term and long-term investments of RMB3,310.0 million in aggregate, compared with a total of RMB3,953.5 million as of December 31, 2023.

Share Repurchase

In November 2022, the Company's board of directors authorized a share repurchase program under which the Company may repurchase up to US$30 million of its shares, effective until November 22, 2025. In November 2023, the Company's board of directors authorized modifications to the share repurchase program, increasing the aggregate value of shares that may be repurchased from US$30 million to US$80 million, effective until November 22, 2025.

As of December 3, 2024, the Company had cumulatively repurchased approximately 11.5 million ADSs for approximately US$37.5 million under the share repurchase program.

Business Outlook

Based on the Company's current estimates, total net revenues for the fourth quarter of 2024 are expected to be between RMB1,288 million and RMB1,308 million, representing an increase of 69.2% to 71.9% on a year-over-year basis. These estimates reflect the Company’s current expectations, which are subject to change.

Conference Call

The Company will hold an earnings conference call at 8:00 AM U.S. Eastern Time on Wednesday, December 4, 2024 (9:00 PM Beijing/Hong Kong Time on Wednesday, December 4, 2024). Dial-in details for the earnings conference call are as follows:

International: 1-412-317-6061

United States: 1-888-317-6003

Hong Kong: 800-963-976

Mainland China: 400-120-6115

Passcode: 7597303

A telephone replay will be available two hours after the conclusion of the conference call through December 11, 2024. The dial-in details are:

International: 1-412-317-0088

United States: 1-877-344-7529

Passcode: 1398008

Additionally, a live and archived webcast of this conference call will be available at http://ir.gaotu.cn/.

Safe Harbor Statement

This announcement contains forward-looking statements. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates” and similar statements. Among other things, the business outlook, as well as the Company’s strategic and operational plans, contain forward-looking statements. The Company may also make written or oral forward-looking statements in its reports filed with, or furnished to, the U.S. Securities and Exchange Commission, in its annual reports to shareholders, in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Statements that are not historical facts, including statements about the Company’s beliefs and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking statement, including but not limited to the following: the Company’s ability to continue to attract students to enroll in its courses; the Company’s ability to continue to recruit, train and retain qualified teachers; the Company’s ability to improve the content of its existing course offerings and to develop new courses; the Company’s ability to maintain and enhance its brand; the Company’s ability to maintain and continue to improve its teaching results; and the Company’s ability to compete effectively against its competitors. Further information regarding these and other risks is included in the Company’s reports filed with, or furnished to the U.S. Securities and Exchange Commission. All information provided in this press release and in the attachments is as of the date of this press release, and the Company undertakes no duty to update such information or any forward-looking statement, except as required under applicable law.

About Gaotu Techedu Inc.

Gaotu is a technology-driven education company and online large-class tutoring service provider in China. The Company offers learning services and educational content & digitalized learning products. Gaotu adopts an online live large-class format to deliver its courses, which the Company believes is the most effective and scalable model to disseminate scarce high-quality teaching resources to aspiring students in China. Big data analytics permeates every aspect of the Company's business and facilitates the application of the latest technology to improve teaching delivery, student learning experience, and operational efficiency.

About Non-GAAP Financial Measures

The Company uses gross billings, non-GAAP gross profit, non-GAAP income (loss) from operations and non-GAAP net income (loss), each a non-GAAP financial measure, in evaluating its operating results and for financial and operational decision-making purposes.

The Company defines gross billings for a specific period as the total amount of cash received for the sale of course offerings in such period, net of the total amount of refunds in such period. The Company's management uses gross billings as a performance measurement because the Company generally bills its students for the entire course fee at the time of sale of its course offerings and recognizes revenue proportionally as the classes are delivered. For some courses, the Company continues to provide students with 12 months to 36 months access to the pre-recorded audio-video courses after the online live courses are delivered. The Company believes that gross billings provides valuable insight into the sales of its course packages and the performance of its business. As gross billings have material limitations as an analytical metrics and may not be calculated in the same manner by all companies, it may not be comparable to other similarly titled measures used by other companies.

Non-GAAP gross profit, non-GAAP income (loss) from operations and non-GAAP net income (loss) exclude share-based compensation expenses. The Company believes that these non-GAAP financial measures provide meaningful supplemental information regarding its performance and liquidity by excluding share-based expenses that may not be indicative of its operating performance from a cash perspective. The Company believes that both management and investors benefit from these non-GAAP financial measures in assessing its performance and when planning and forecasting future periods. These non-GAAP financial measures also facilitate management’s internal comparisons to the Company’s historical performance. A limitation of using non-GAAP measures is that these non-GAAP measures exclude share-based compensation charges that have been and will continue to be for the foreseeable future a significant recurring expense in the Company’s business.

The presentation of these non-GAAP financial measures is not intended to be considered in isolation from or as a substitute for the financial information prepared and presented in accordance with GAAP. For more information on these non-GAAP financial measures, please see the table captioned “Reconciliations of non-GAAP measures to the most comparable GAAP measures” set forth at the end of this release.

The accompanying tables have more details on the reconciliations between GAAP financial measures that are most directly comparable to non-GAAP financial measures.

Exchange Rate

The Company’s business is primarily conducted in China and a significant majority of revenues generated are denominated in Renminbi ("RMB"). This announcement contains currency conversions of RMB amounts into U.S. dollars ("USD") solely for the convenience of the reader. Unless otherwise noted, all translations from RMB to USD are made at a rate of RMB7.0176 to USD1.0000, the effective noon buying rate for September 30, 2024 as set forth in the H.10 statistical release of the Federal Reserve Board. No representation is made that the RMB amounts could have been, or could be, converted, realized or settled into USD at that rate on September 30, 2024, or at any other rate.

For further information, please contact:

Gaotu Techedu Inc.

Investor Relations

E-mail: ir@gaotu.cn

Christensen

In China

Ms. Vivian Wang

Phone: +852-2232-3978

E-mail: gotu@christensencomms.com

In the US

Ms. Linda Bergkamp

Phone: +1-480-614-3004

Email: linda.bergkamp@christensencomms.com

Gaotu Techedu Inc.

Unaudited condensed consolidated balance sheets

(In thousands of RMB and USD, except for share, per share and per ADS data)

|

|

|

|

|

|

|

|

|

|

|

|

|

As of December 31, |

|

|

As of September 30, |

|

|

2023 |

|

|

2024 |

|

|

2024 |

|

|

RMB |

|

|

RMB |

|

|

USD |

|

ASSETS |

|

|

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

636,052 |

|

|

|

855,815 |

|

|

|

121,953 |

|

Restricted cash |

|

33,901 |

|

|

|

6,874 |

|

|

|

980 |

|

Short-term investments |

|

2,253,910 |

|

|

|

1,482,924 |

|

|

|

211,315 |

|

Inventory, net |

|

24,596 |

|

|

|

53,404 |

|

|

|

7,610 |

|

Prepaid expenses and other current assets, net |

|

638,248 |

|

|

|

555,722 |

|

|

|

79,190 |

|

Total current assets |

|

3,586,707 |

|

|

|

2,954,739 |

|

|

|

421,048 |

|

|

|

|

|

|

|

|

|

|

Non-current assets |

|

|

|

|

|

|

|

|

Operating lease right-of-use assets |

|

189,662 |

|

|

|

574,743 |

|

|

|

81,900 |

|

Property, equipment and software, net |

|

533,531 |

|

|

|

626,880 |

|

|

|

89,330 |

|

Land use rights, net |

|

26,568 |

|

|

|

25,964 |

|

|

|

3,700 |

|

Long-term investments |

|

1,029,632 |

|

|

|

964,363 |

|

|

|

137,421 |

|

Deferred tax assets |

|

11,312 |

|

|

|

- |

|

|

|

- |

|

Rental deposit |

|

17,742 |

|

|

|

43,751 |

|

|

|

6,234 |

|

Other non-current assets |

|

18,155 |

|

|

|

17,920 |

|

|

|

2,553 |

|

TOTAL ASSETS |

|

5,413,309 |

|

|

|

5,208,360 |

|

|

|

742,186 |

|

|

|

|

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

|

|

Accrued expenses and other current liabilities

(including accrued expenses and other current

liabilities of the consolidated VIE without

recourse to the Group of RMB484,222

and RMB667,944 as of December 31, 2023

and September 30, 2024, respectively) |

|

805,032 |

|

|

|

1,070,433 |

|

|

|

152,536 |

|

Deferred revenue, current portion of the

consolidated VIE without recourse to the Group |

|

1,113,480 |

|

|

|

1,223,614 |

|

|

|

174,364 |

|

Operating lease liabilities, current portion

(including current portion of operating lease

liabilities of the consolidated VIE without

recourse to the Group of RMB34,401 and

RMB123,783 as of December 31, 2023 and

September 30, 2024, respectively) |

|

50,494 |

|

|

|

164,178 |

|

|

|

23,395 |

|

Income tax payable (including income tax

payable of the consolidated VIE without

recourse to the Group of RMB4,210 and

RMB102 as of December 31, 2023 and

September 30, 2024, respectively) |

|

4,278 |

|

|

|

133 |

|

|

|

19 |

|

Total current liabilities |

|

1,973,284 |

|

|

|

2,458,358 |

|

|

|

350,314 |

|

Gaotu Techedu Inc.

Unaudited condensed consolidated balance sheets

(In thousands of RMB and USD, except for share, per share and per ADS data)

|

|

|

|

|

|

|

|

|

|

|

|

|

As of December 31, |

|

|

As of September 30, |

|

|

2023 |

|

|

2024 |

|

|

2024 |

|

|

RMB |

|

|

RMB |

|

|

USD |

|

Non-current liabilities |

|

|

|

|

|

|

|

|

Deferred revenue, non-current portion of

the consolidated VIE without recourse

to the Group |

|

124,141 |

|

|

|

215,603 |

|

|

|

30,723 |

|

Operating lease liabilities, non-current

portion (including non-current portion

of operating lease liabilities of the

consolidated VIE without recourse

to the Group of RMB121,277 and

RMB382,747 as of December 31, 2023

and September 30, 2024, respectively) |

|

137,652 |

|

|

|

397,466 |

|

|

|

56,638 |

|

Deferred tax liabilities (including deferred

tax liabilities of the consolidated VIE

without recourse to the Group of

RMB71,850 and RMB70,524 as of

December 31, 2023 and September 30,

2024, respectively) |

|

71,967 |

|

|

|

70,664 |

|

|

|

10,070 |

|

TOTAL LIABILITIES |

|

2,307,044 |

|

|

|

3,142,091 |

|

|

|

447,745 |

|

|

|

|

|

|

|

|

|

|

SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

Ordinary shares |

|

116 |

|

|

|

116 |

|

|

|

17 |

|

Treasury stock, at cost |

|

(85,178 |

) |

|

|

(216,494 |

) |

|

|

(30,850 |

) |

Additional paid-in capital |

|

7,987,957 |

|

|

|

7,994,101 |

|

|

|

1,139,150 |

|

Accumulated other comprehensive loss |

|

(33,209 |

) |

|

|

(34,913 |

) |

|

|

(4,975 |

) |

Statutory reserve |

|

50,225 |

|

|

|

50,225 |

|

|

|

7,157 |

|

Accumulated deficit |

|

(4,813,646 |

) |

|

|

(5,726,766 |

) |

|

|

(816,058 |

) |

TOTAL SHAREHOLDERS’ EQUITY |

|

3,106,265 |

|

|

|

2,066,269 |

|

|

|

294,441 |

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND TOTAL

SHAREHOLDERS’ EQUITY |

|

5,413,309 |

|

|

|

5,208,360 |

|

|

|

742,186 |

|

Gaotu Techedu Inc.

Unaudited condensed consolidated statements of operations

(In thousands of RMB and USD, except for share, per share and per ADS data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended September 30, |

|

|

For the nine months ended September 30, |

|

|

2023 |

|

|

2024 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2024 |

|

|

RMB |

|

|

RMB |

|

|

USD |

|

|

RMB |

|

|

RMB |

|

|

USD |

|

Net revenues |

|

789,413 |

|

|

|

1,208,253 |

|

|

|

172,175 |

|

|

|

2,199,799 |

|

|

|

3,164,935 |

|

|

|

451,000 |

|

Cost of revenues |

|

(218,126 |

) |

|

|

(429,791 |

) |

|

|

(61,245 |

) |

|

|

(562,488 |

) |

|

|

(1,014,638 |

) |

|

|

(144,585 |

) |

Gross profit |

|

571,287 |

|

|

|

778,462 |

|

|

|

110,930 |

|

|

|

1,637,311 |

|

|

|

2,150,297 |

|

|

|

306,415 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling expenses |

|

(434,428 |

) |

|

|

(885,769 |

) |

|

|

(126,221 |

) |

|

|

(1,035,514 |

) |

|

|

(2,227,547 |

) |

|

|

(317,423 |

) |

Research and development expenses |

|

(130,618 |

) |

|

|

(189,305 |

) |

|

|

(26,976 |

) |

|

|

(325,997 |

) |

|

|

(503,013 |

) |

|

|

(71,679 |

) |

General and administrative expenses |

|

(105,782 |

) |

|

|

(193,495 |

) |

|

|

(27,573 |

) |

|

|

(236,891 |

) |

|

|

(452,296 |

) |

|

|

(64,452 |

) |

Total operating expenses |

|

(670,828 |

) |

|

|

(1,268,569 |

) |

|

|

(180,770 |

) |

|

|

(1,598,402 |

) |

|

|

(3,182,856 |

) |

|

|

(453,554 |

) |

(Loss)/income from operations |

|

(99,541 |

) |

|

|

(490,107 |

) |

|

|

(69,840 |

) |

|

|

38,909 |

|

|

|

(1,032,559 |

) |

|

|

(147,139 |

) |

Interest income |

|

24,153 |

|

|

|

15,661 |

|

|

|

2,232 |

|

|

|

57,226 |

|

|

|

55,608 |

|

|

|

7,924 |

|

Realized gains from investments |

|

7,579 |

|

|

|

6,001 |

|

|

|

855 |

|

|

|

25,961 |

|

|

|

20,285 |

|

|

|

2,891 |

|

Other income, net |

|

15,782 |

|

|

|

3,964 |

|

|

|

565 |

|

|

|

21,695 |

|

|

|

52,220 |

|

|

|

7,441 |

|

(Loss)/income before provision for income tax and share of results of equity investees |

|

(52,027 |

) |

|

|

(464,481 |

) |

|

|

(66,188 |

) |

|

|

143,791 |

|

|

|

(904,446 |

) |

|

|

(128,883 |

) |

Income tax (expenses)/benefits |

|

(656 |

) |

|

|

(6,792 |

) |

|

|

(968 |

) |

|

|

(22,275 |

) |

|

|

(8,674 |

) |

|

|

(1,236 |

) |

Share of results of equity investees |

|

(4,980 |

) |

|

|

- |

|

|

|

- |

|

|

|

(9,165 |

) |

|

|

- |

|

|

|

- |

|

Net (loss)/income |

|

(57,663 |

) |

|

|

(471,273 |

) |

|

|

(67,156 |

) |

|

|

112,351 |

|

|

|

(913,120 |

) |

|

|

(130,119 |

) |

Net (loss)/income attributable to Gaotu Techedu Inc.'s ordinary shareholders |

|

(57,663 |

) |

|

|

(471,273 |

) |

|

|

(67,156 |

) |

|

|

112,351 |

|

|

|

(913,120 |

) |

|

|

(130,119 |

) |

Net (loss)/income per ordinary share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

(0.33 |

) |

|

|

(2.75 |

) |

|

|

(0.39 |

) |

|

|

0.65 |

|

|

|

(5.30 |

) |

|

|

(0.76 |

) |

Diluted |

|

(0.33 |

) |

|

|

(2.75 |

) |

|

|

(0.39 |

) |

|

|

0.63 |

|

|

|

(5.30 |

) |

|

|

(0.76 |

) |

Net (loss)/income per ADS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

(0.22 |

) |

|

|

(1.83 |

) |

|

|

(0.26 |

) |

|

|

0.43 |

|

|

|

(3.54 |

) |

|

|

(0.50 |

) |

Diluted |

|

(0.22 |

) |

|

|

(1.83 |

) |

|

|

(0.26 |

) |

|

|

0.42 |

|

|

|

(3.54 |

) |

|

|

(0.50 |

) |

Weighted average shares used in net (loss)/income per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

174,631,114 |

|

|

|

171,135,287 |

|

|

|

171,135,287 |

|

|

|

174,107,221 |

|

|

|

172,165,794 |

|

|

|

172,165,794 |

|

Diluted |

|

174,631,114 |

|

|

|

171,135,287 |

|

|

|

171,135,287 |

|

|

|

179,488,050 |

|

|

|

172,165,794 |

|

|

|

172,165,794 |

|

Note: Three ADSs represent two ordinary shares.

Gaotu Techedu Inc.

Reconciliations of non-GAAP measures to the most comparable GAAP measures

(In thousands of RMB and USD, except for share, per share and per ADS data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended September 30, |

|

|

For the nine months ended September 30, |

|

|

2023 |

|

|

2024 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2024 |

|

|

RMB |

|

|

RMB |

|

|

USD |

|

|

RMB |

|

|

RMB |

|

|

USD |

|

Net revenues |

|

789,413 |

|

|

|

1,208,253 |

|

|

|

172,175 |

|

|

|

2,199,799 |

|

|

|

3,164,935 |

|

|

|

451,000 |

|

Less: other revenues(1) |

|

26,319 |

|

|

|

60,581 |

|

|

|

8,633 |

|

|

|

62,675 |

|

|

|

117,081 |

|

|

|

16,684 |

|

Add: VAT and surcharges |

|

47,542 |

|

|

|

72,056 |

|

|

|

10,268 |

|

|

|

134,492 |

|

|

|

192,049 |

|

|

|

27,367 |

|

Add: ending deferred revenue |

|

761,301 |

|

|

|

1,439,217 |

|

|

|

205,087 |

|

|

|

761,301 |

|

|

|

1,439,217 |

|

|

|

205,087 |

|

Add: ending refund liability |

|

47,631 |

|

|

|

77,869 |

|

|

|

11,096 |

|

|

|

47,631 |

|

|

|

77,869 |

|

|

|

11,096 |

|

Less: beginning deferred revenue |

|

922,576 |

|

|

|

1,582,135 |

|

|

|

225,452 |

|

|

|

959,333 |

|

|

|

1,237,621 |

|

|

|

176,360 |

|

Less: beginning refund liability |

|

57,650 |

|

|

|

85,520 |

|

|

|

12,187 |

|

|

|

60,597 |

|

|

|

67,157 |

|

|

|

9,570 |

|

Gross billings |

|

639,342 |

|

|

|

1,069,159 |

|

|

|

152,354 |

|

|

|

2,060,618 |

|

|

|

3,452,211 |

|

|

|

491,936 |

|

Note (1): Include miscellaneous revenues generated from services other than courses.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended September 30, |

|

|

For the nine months ended September 30, |

|

|

2023 |

|

|

2024 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2024 |

|

|

RMB |

|

|

RMB |

|

|

USD |

|

|

RMB |

|

|

RMB |

|

|

USD |

|

Gross profit |

|

571,287 |

|

|

|

778,462 |

|

|

|

110,930 |

|

|

|

1,637,311 |

|

|

|

2,150,297 |

|

|

|

306,415 |

|

Share-based compensation expenses(1) in cost of revenues |

|

1,522 |

|

|

|

2,265 |

|

|

|

323 |

|

|

|

9,097 |

|

|

|

4,543 |

|

|

|

647 |

|

Non-GAAP gross profit |

|

572,809 |

|

|

|

780,727 |

|

|

|

111,253 |

|

|

|

1,646,408 |

|

|

|

2,154,840 |

|

|

|

307,062 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Loss)/income from operations |

|

(99,541 |

) |

|

|

(490,107 |

) |

|

|

(69,840 |

) |

|

|

38,909 |

|

|

|

(1,032,559 |

) |

|

|

(147,139 |

) |

Share-based compensation expenses(1) |

|

15,934 |

|

|

|

14,078 |

|

|

|

2,006 |

|

|

|

42,674 |

|

|

|

40,924 |

|

|

|

5,832 |

|

Non-GAAP (loss)/income from operations |

|

(83,607 |

) |

|

|

(476,029 |

) |

|

|

(67,834 |

) |

|

|

81,583 |

|

|

|

(991,635 |

) |

|

|

(141,307 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss)/income |

|

(57,663 |

) |

|

|

(471,273 |

) |

|

|

(67,156 |

) |

|

|

112,351 |

|

|

|

(913,120 |

) |

|

|

(130,119 |

) |

Share-based compensation expenses(1) |

|

15,934 |

|

|

|

14,078 |

|

|

|

2,006 |

|

|

|

42,674 |

|

|

|

40,924 |

|

|

|

5,832 |

|

Non-GAAP net (loss)/income |

|

(41,729 |

) |

|

|

(457,195 |

) |

|

|

(65,150 |

) |

|

|

155,025 |

|

|

|

(872,196 |

) |

|

|

(124,287 |

) |

Note (1): The tax effects of share-based compensation expenses adjustments were nil.

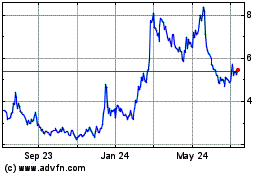

Gaotu Techedu (NYSE:GOTU)

Historical Stock Chart

From Dec 2024 to Jan 2025

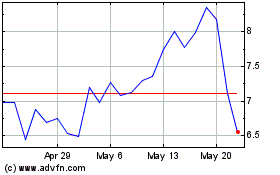

Gaotu Techedu (NYSE:GOTU)

Historical Stock Chart

From Jan 2024 to Jan 2025