false

0001981792

0001981792

2025-01-13

2025-01-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of

1934

Date of Report (Date of earliest event

reported): January 13, 2025

Howard Hughes Holdings Inc.

(Exact name of registrant as specified in its

charter)

Delaware

(State or other jurisdiction

of incorporation) |

001-41779

(Commission File Number) |

93-1869991

(IRS Employer

Identification No.) |

9950 Woodloch Forest Drive, Suite 1100

The Woodlands, Texas 77380

(Address of principal executive offices)

Registrant’s telephone number, including

area code: (281) 719-6100

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: |

|

Trading Symbol(s) |

|

Name of each exchange

on which

registered |

| Common

stock $0.01 par value per share |

|

HHH |

|

New

York Stock Exchange |

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01 |

Regulation FD Disclosure. |

On January 13, 2025, Howard Hughes Holdings Inc., a Delaware corporation

(the “Company”), issued a press release announcing that the Company’s board of directors (the “Board”) has

received a proposal from Pershing Square Capital Management LP (“Pershing Square”) under which Pershing Square has proposed

to acquire additional shares of the Company’s common stock in a merger transaction between the Company and a newly formed merger

subsidiary of Pershing Square Holdco, L.P., pursuant to which Pershing Square would own a majority of the Company’s common stock

as a result of such merger. Pershing Square currently beneficially owns approximately 37.6% of the Company's common stock.

As previously announced on August 8, 2024, the Board formed a

special committee (the “Special Committee”), comprised of independent directors, in response to interest expressed by Pershing

Square in exploring a possible transaction. The Special Committee will evaluate the proposal and determine the appropriate course of action

and process.

The proposal is conditioned on, among other things, the negotiation

and execution of a definitive agreement, as well as approval and recommendation of the proposal by the Special Committee and approval

by holders of a majority of the shares of the Company’s common stock not owned by Pershing Square or parties affiliated with or

advised by Pershing Square.

Copies of the press release and the Pershing Square proposal letter

are attached hereto as Exhibit 99.1 and Exhibit 99.2, respectively.

The information contained in this Current Report on Form 8-K pursuant

to this “Item 7.01 Regulation FD Disclosure” is being furnished. This information shall not be deemed to be filed for the

purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities

of that section or shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange

Act, unless specifically identified therein as being incorporated by reference.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

HOWARD HUGHES HOLDINGS INC. |

| |

|

| Date: January 13, 2025 |

By: |

/s/ Joseph Valane |

| |

Name: |

Joseph Valane |

| |

Title: |

General Counsel & Secretary |

Exhibit 99.1

Howard

Hughes Confirms Receipt of

Unsolicited Acquisition Proposal from Pershing Square

No Stockholder Action Required at this Time

THE WOODLANDS, Texas, Jan. 13, 2025 – Howard Hughes

Holdings Inc. (NYSE: HHH) (the “Company” or “HHH”) today confirmed the Board’s receipt of a proposal from

Pershing Square Capital Management LP (“Pershing Square”) under which Pershing Square has proposed to acquire additional shares

of the Company’s common stock in a merger transaction between the Company and a newly formed merger subsidiary of Pershing Square

Holdco, L.P., pursuant to which Pershing Square would own a majority of the Company’s common stock as a result of such merger. Pershing

Square currently beneficially owns approximately 37.6% of the Company's common stock.

As previously announced on August 8, 2024, the Howard Hughes Board

of Directors formed a Special Committee, comprised of independent directors, in response to interest expressed by Pershing Square in exploring

a possible transaction. The Special Committee will evaluate the proposal and determine the appropriate course of action and process. No

action is required by HHH stockholders at this time.

The proposal is conditioned on, among other things, the negotiation

and execution of a definitive agreement, as well as approval and recommendation of the proposal by the Special Committee and approval

by holders of a majority of the shares of the Company's common stock not owned by Pershing Square or parties affiliated with or advised

by Pershing Square.

There can be no assurance that the Company will pursue this proposed

transaction or any other strategic outcome, and HHH does not intend to comment further on this matter unless and until further disclosure

is determined to be appropriate or necessary.

The proposal letter is included as an exhibit to the Company’s

Form 8-K filed on January 13, 2025 available with the U.S. Securities and Exchange Commission.

Morgan Stanley & Co. LLC is acting as financial advisor to

the Special Committee, and Hogan Lovells US LLP and Richards, Layton & Finger, P.A. are acting as legal counsel.

About Howard Hughes Holdings Inc.

Howard Hughes Holdings Inc. owns, manages, and develops commercial,

residential, and mixed-use real estate throughout the U.S. Its award-winning assets include the country’s preeminent portfolio

of master planned communities, as well as operating properties and development opportunities including Downtown Columbia®

in Maryland; The Woodlands®, Bridgeland® and The Woodlands Hills® in the Greater Houston,

Texas area; Summerlin® in Las Vegas; Ward Village® in Honolulu, Hawaiʻi; and Teravalis™ in the

Greater Phoenix, Arizona area. The Howard Hughes portfolio is strategically positioned to meet and accelerate development based on market

demand, resulting in one of the strongest real estate platforms in the country. Dedicated to innovative placemaking, the company is recognized

for its ongoing commitment to design excellence and to the cultural life of its communities. Howard Hughes Holdings Inc. is traded on

the New York Stock Exchange as HHH. For additional information visit www.howardhughes.com.

Contacts:

Howard Hughes Holdings Inc.

Media Relations

Andrew Siegel / Lyle Weston / McRae Fried

Joele Frank

212-355-4449

Investor Relations

Eric Holcomb, 281-475-2144

Senior Vice President, Investor Relations

eric.holcomb@howardhughes.com

Exhibit 99.2

| Pershing Square Capital Management, L.P.

787 Eleventh Avenue, 9th Floor New York, NY 10019 T 212.813.3700 F 212.286.1133

January 13, 2025

The Board of Directors

Howard Hughes Holdings Inc.

9950 Woodloch Forest Drive, Suite 1100

The Woodlands, Texas 77380

Dear HHH Board,

While we are pleased with the substantial business progress Howard Hughes Holdings (“HHH”

or the “Company”) has made over the more than 14 years since it went public, we, like other

long-term shareholders and this board, have been displeased with the Company’s stock price

performance. For context, in November of 2010, we along with Brookfield, Blackstone, and

Fairholme initially capitalized the Company with a $250 million rights offering at $47.62 per

share. When we filed our 13D on August 6th of last year, HHH’s closing share price the previous

day was $61.46 per share. Including the market value of the Seaport Entertainment spinoff, this

$16.62 increase represents a 35% total return over the last 14 years, or a 2.2% compound annual

return, and the Company has paid no dividends since its inception.

The Company’s stock price performance is obviously extremely disappointing, particularly in

light of the high regard we have for this board and the Company’s superb management team led

by David O’Reilly and the nearly one thousand employees who work at Howard Hughes, many of

whom I have gotten to know over the last more than decade.

Ultimately, the lack of recognition by the stock market of HHH’s accomplishments led to our

decision in August of last year to consider taking the Company private. Since the filing of our

Schedule 13D announcing our potential plans, we have received feedback from shareholders who

have expressed interest in remaining long-term investors in the Company alongside Pershing

Square. This feedback has informed our thinking on a potential transaction for HHH that would

accomplish our objective of becoming a larger permanent owner of the Company, while also

creating a highly attractive cash alternative for shareholders who choose to exit, and

accommodating shareholders who wish to invest alongside us for the long term.

The Transaction

We are therefore hereby proposing a potential merger transaction (the “Transaction”) in which a

newly formed merger subsidiary of Pershing Square Holdco, L.P. (“Pershing Square Holdco”, the

parent company of the alternative investment manager which employs the entire Pershing Square

team and manages our investment funds) would merge (the “Merger”) with and into the

Company, with the Company as the surviving corporation in the Merger.

HHH stockholders would have the option of receiving more than a majority of their Merger

consideration in cash at $85.00 per share – representing a premium of 38.3% to the unaffected |

| -2-

stock price1

and a premium of 18.4% to the closing price this past Friday – and the balance in

stock of the post-merger company, the future business plan of which I describe in greater detail

below.

Pursuant to the Merger, the Company’s stockholders would benefit from a cash/stock election that

would enable them to elect to receive Merger consideration in cash at $85 per share, or to ‘roll-over’ all or a portion of their shares into the post-merger company (hereinafter referred to as

“HHH” or the “Company” as applicable). The cash/stock election would be subject to proration

intended to ensure that the Company maintains a public float of at least 13.6 million shares, or

30.8% of the Company’s then issued and outstanding share capital.

The Pershing Square Funds Would Roll-Over Their Shares

Pershing Square’s affiliated investment funds (Pershing Square Holdings, Ltd., Pershing Square,

L.P., and Pershing Square International, Ltd., together the “Pershing Square Funds”) would elect

to roll-over their 37.6% stake in the Company (which will not be subject to proration). We may

also invite a small consortium of strategic partners to join us in the Transaction who: (1) would

invest via a Pershing Square Holdco-controlled entity, (2) would provide additional balance sheet

resources to HHH and/or (3) acquire a portion of the Pershing Square Funds’ roll-over stake.

The Transaction in Plain English

In economic substance, the Transaction is more easily understood as a purchase by Pershing

Square Holdco of 11,764,706 shares at $85 per share for $1 billion from non-Pershing Square

affiliate shareholders of HHH (the “Public Float shareholders” who today own 31,285,450

shares), and a simultaneous $500 million share repurchase by the Company at $85 per share for

up to 5,882,353 shares from the Public Float shareholders. The $500 million repurchase will be

financed by bonds newly issued by the Company. Based on the proposed structure and the likely

resulting capitalization, Jefferies LLC, our financial advisor, believes that the new financing

should be ratings neutral to the Company.

In that I own 44% of Pershing Square Holdco, other employees own 46%, and our strategic

investors own 10%, our $1 billion investment in HHH represents a ‘look-through’ cash

investment by me of $440 million, $460 million by other Pershing Square employees, and $100

million from a group of institutions, family offices, and CEOs and founders of other alternative

investment managers who purchased their 10% stake in Pershing Square Holdco in June of last

year for $1.05 billion.2

This $900 million purchase by Pershing Square employees is in addition to the value of other

‘look-through holdings’ of HHH owned by our employees by virtue of our employee and

1 The closing price on August 5, 2024, just prior to the public disclosure of Pershing Square’s most

recent amendment of its Schedule 13D with respect to the Company’s common stock.

2 https://www.businesswire.com/news/home/20240603875090/en/Pershing-Square-Capital-Management-L.P.-Announces-Sale-of-10-Common-Equity-Interest-for-1.05-Billion-to-Strategic-Investors |

| -3-

affiliates’ 28% ownership of the Pershing Square Funds, representing an additional investment in

HHH of $379 million at Friday’s closing price.

Put simply, we are all in, and we intend for Pershing Square Holdco’s investment in HHH to

be a permanent holding. In other words, we intend to hold HHH stock forever.

Comparing the Two Extremes of the Cash/Stock Election Alternatives

If holders of 17,647,059 (or more) shares (the math: $1.5 billion of total cash proceeds from

Pershing Square and the new bond financing divided by $85 per share) of the Public Float elect

the cash alternative, 56.4% of the Public Float will receive cash due to proration, and 5,882,353

shares will be repurchased and cancelled by the Company.

If none of the Public Float shareholders elect the cash alternative, 37.6% of the Public Float will

be exchanged for cash at $85 per share, and HHH’s balance sheet cash will increase by $500

million from the proceeds of the new bond financing.

Pershing Square’s Ownership, the Public Float, and Future Governance

After giving effect to the Transaction (before giving effect to any investment by strategic

partners), Pershing Square Holdco and its affiliates will own a minimum of 61.1% and a

maximum of 69.2% of the Company (if $500 million or more of Public Float shares are

exchanged for cash) with the increase in ownership due to the reduction in shares outstanding as a

result of the cancellation of 5,882,353 shares, i.e., 11.7% of shares outstanding, at $85 per share.

We would commit to maintain the Company’s listing on the New York Stock Exchange and

implement other “best-in-class” governance provisions to ensure that the Company represents a

compelling long-term investment opportunity for public stockholders. Consistent with this

principle, HHH would be governed by an independent board of directors, and Pershing Square’s

voting power would be contractually limited to less than 50% of shares outstanding despite our

substantially larger economic ownership.

HHH Management Post Transaction

Contemporaneous with the closing of the Transaction, the senior leadership team of Pershing

Square Holdco would assume executive leadership roles at HHH, but not at Howard Hughes

Corporation (“HHC”), the Company’s principal real estate subsidiary. The HHH senior leadership

team would be comprised of myself as Chairman and CEO, Ryan Israel as Chief Investment

Officer, Ben Hakim as President, Mike Gonnella as CFO, and Halit Coussin as Chief Legal

Officer who will continue to serve in the same roles at Pershing Square Holdco. See Appendix A

– Pershing Square Senior Leadership Biographies – for more information regarding the senior

leadership team.

Pershing Square Holdco’s Team and Resources Will Be Shared with HHH

We will also make available to the Company the full resources of Pershing Square Holdco

including the Pershing Square Investment Team, our transaction sourcing and execution

capabilities, our investment research and due diligence skills, our macro hedging strategy and

execution capabilities, our private and public capital raising capabilities, as well as our |

| -4-

accounting, finance, legal, technology, investor relations and administrative teams, office space,

and other resources.

HHC Would Remain Unchanged and Would Be Managed by the Current Team

The Howard Hughes Corporation Master Planned Communities (“MPC”) historical line of

business would remain entirely unchanged. HHC would continue to pursue its long-term

strategic objectives and would be managed by the current senior leadership team led by David

O’Reilly as CEO.

We do not intend to make any changes to the HHC organization, its employees, or its long-term strategy. We would expect all HHH current employees to remain employed as a result

of the Transaction.

Post Merger Howard Hughes Holdings Business Plan and Operations

While HHC would remain unchanged, HHH, the holding company to HHC, would become a

diversified holding company. As a result, we would expect that HHH and its HHC subsidiary

would operate largely independently with oversight from the HHH board and its new senior

leadership team. With apologies to Mr. Buffett, HHH would become a modern-day Berkshire

Hathaway that would acquire controlling interests in operating companies.

Based on our analysis, we believe that HHC is on the path to soon begin to generate substantial

excess cash resources above and beyond investments in new property developments and

amenities, including the capital expenditures and other investments necessary and desirable to

maintain and enhance the continued growth, quality of life, and overall attraction of HHC’s

nationally recognized, perennially award-winning Master Planned Communities.

HHH would invest the excess cash resources of its HHC subsidiary – with additional resources

including potential cash from the Transaction and the financial resources generated from HHH’s

access to public company capital – in new companies and assets with the long-term goal of

growing HHH’s per-share intrinsic value at a high compound rate of return.

In summary, Pershing Square’s management team and resources would be contributed to HHH,

and HHH would invest the excess cash and other financial resources of the Company to diversify

its business through the acquisition of new operating companies and other assets. Importantly, the

Pershing Square team also brings expertise in hedging macro and other risks, capabilities that can

be used to help mitigate HHC’s real estate and MPC businesses’ exposure to interest rate risk,

commodity price risk (due to its large Houston real estate exposures), as well as other market,

economic, and geopolitical risks.

The Pershing Square Investment Strategy

For the last 21 years, Pershing Square has managed investment funds that have pursued one

principal strategy that by mandate has been limited to the purchase of public securities. Our core

equity strategy has been to acquire long-term, large minority stakes in high-quality,

predominantly North American-listed, large-capitalization companies at attractive valuations

which have simple, predictable, free-cash-flow-generative business models, strong balance |

| -5-

sheets, and exceptional management and governance, in industries with significant barriers to

entry and limited exposure to extrinsic factors that we cannot control.

We have a long-term track record in assisting our portfolio companies in accelerating growth,

increasing efficiency, improving capital allocation, managing through crises and otherwise

improving performance in order to generate long-term shareholder value.

The Pershing Square Hedging Strategy

We complement our core investment strategy by opportunistically utilizing hedges both to protect

our funds’ portfolios against specific macroeconomic risks – including interest rate, market,

commodity price, credit, geopolitical, and other risks – and to capitalize on market volatility. We

structure these hedges using asymmetric instruments, such as options and credit default swaps,

which offer the opportunity for large gains if potential risks occur, without exposing our funds to

significant costs or meaningful losses if these risks do not occur.

We believe that the Transaction and the addition of Pershing Square’s senior leadership, hedging

experience, and our other resources to HHH will better enable the Company to manage through

the inevitable volatility of the macro and global economy.

During the last three bear markets – the Great Financial Crisis of 2008/2009, the Covid 19 crisis

which began in 2020, and the inflation and interest-rate-hike-driven bear market of 2022 – HHH

and its former parent General Growth Properties (“GGP”) suffered severe economic

consequences:

During the Great Financial Crisis, prior to the spinoff of HHC, GGP went bankrupt due to the

shutdown of the CMBS and credit markets and the decline in the housing market.

During the Covid 19 crisis, HHH stock declined by 71% – from $129.35 on February 20, 2020 to

$37.44 on March 23rd – and the Company thereafter determined that it was prudent to launch an

equity offering that, at the request of the board, was backed by Pershing Square, in which we

purchased $500 million of the $600 million of stock sold to investors.

In 2022, as the Federal Reserve began to aggressively raise rates, HHH stock declined by 46%

from $101.78 to $55.39,3

and its shares remained depressed until Pershing Square began an

aggressive buying program which included an above-market tender offer.

In contrast, during each of these bear markets, the Pershing Square Funds generated strong

returns with the benefit of our hedging strategies which we outline in greater detail below:4

3

Reflects share price decline from December 31, 2021 to September 30, 2022.

4

The performance data for the hedging strategies is extracted from the overall performance of an

investment in PSLP/PSH. We would be pleased to provide more complete hedging performance

data upon request. |

| -6-

The hedging instruments we have deployed – index credit default swaps, interest rate swaptions,

commodity and currency options – are extremely liquid and can be executed in enormous size.

While there is by no means any guarantee that we will foresee and hedge every future bear

market, Pershing Square’s experience and track record in deploying macro hedges will be helpful

to HHH and its HHC real estate subsidiary in mitigating risk and facilitating potential

reinvestment opportunities.

The substantial majority of Pershing Square’s profits from hedging activities have come at

opportune times, that is, when markets decline. During each of the three bear markets that

occurred during Pershing Square’s 21-year history, we have been able to opportunistically invest

the large hedging gains we generated into the purchase of additional investments in our portfolio

companies at bear market valuations. We look forward to assisting HHH and HHC in mitigating

risk and expanding opportunities for reinvestment.

Pershing Square’s Long-Term Investment Performance

Pershing Square has generated highly attractive returns for our investors. Over the last 21 years,

an investment in Pershing Square, L.P. (“PSLP”), our first investment fund, at its inception on

January 1, 2004, which was transferred to Pershing Square Holdings, Ltd. (“PSH”), our

permanent capital fund, at its launch on December 31, 2012, has generated a 19.4% compound

annual return, a 4,017% cumulative return, and a 41.2 times multiple of capital (net of our 1.5%

per annum management fees but gross of performance fees).5 |

| -7-

Pershing Square’s returns have been substantially greater than those achieved by investing in the

broad stock market indices over the same period. An investment in the S&P 500 over the same

period generated a 10.4% compound annual return, 694% cumulative return, and a 7.9 times

multiple of capital.

PSLP/PSH (1.5% Mgmt Fee) vs S&P 500 - ITD5

5 An investment in PSLP at its inception on January 1, 2004, transferred to PSH at its launch on

December 31, 2012, has generated a 16.1% compound annual return, a 2,185% cumulative return,

and a 22.8 times multiple of capital (net of management fees and performance fees). During the

“Permanent Capital Era” of Pershing Square, PSH generated a 22.9% compound return, a 324%

cumulative return, and a 4.2 multiple of capital (net of management fees and performance fees).

The table provides performance information for an investment in PSLP/PSH to facilitate an

understanding of our results of operations for the periods presented. It represents the cumulative

net returns after management fees and other expenses incurred by each fund (for tables that

represent such cumulative net returns also after performance fees, please see Appendix B). There

can be no assurance that any of our funds will achieve comparable or greater results in the future,

or that any of our funds will be able to implement their investment strategy or achieve their

investment objective. Our funds’ portfolio includes different underlying investments than the ones

that would be made by HHH as a diversified holding company. If such funds were operated as a

diversified holding company their respective returns might have been lower and their ability to

undertake certain transactions or investments may have been restricted.

The S&P 500 is an unmanaged capitalization-weighted index that measures the performance of the

large-capitalization segment of the U.S. market. The volatility of the S&P 500 presented may be

materially different from that of the performance of our funds. In addition, the S&P 500 employs

different guidelines and criteria than our funds; as a result, the holdings in our funds may differ

significantly from the securities that comprise the S&P 500. The S&P 500 allows for comparison |

| -8-

Pershing Square’s Permanent Capital Era

For the last seven calendar years beginning January 1, 2018, the period which began what we

refer to as the “Permanent Capital Era” of Pershing Square (when we stopped raising open end

hedge fund capital), PSH generated a 25.7% compound return, a 397% cumulative return, and a

5.0 multiple of capital (net of our 1.5% per annum management fees but gross of performance

fees) versus a 13.8%, 147%, and 2.5 multiple respectively, for the S&P 500 over the same

period.5

PSH (1.5% Mgmt Fee) vs S&P 500 – Permanent Capital Era5

The Transaction Would Enable HHH to Leverage Pershing Square’s Deal Sourcing and

Execution Capabilities in the Private and Controlled Company Markets

While Pershing Square’s investment strategy has been constrained by the Pershing Square Funds’

mandate which limits our investments to public securities, we have historically identified and

received many inbound investment opportunities in private and controlled company situations

that we are structurally, currently unable to pursue. The Transaction would empower HHH to

leverage Pershing Square’s transaction sourcing and execution capabilities in the private and

controlled company markets and enable Pershing Square to pursue these opportunities via its

substantial investment in HHH.

of our funds’ performance with that of a well-known, appropriate and widely recognized index;

the S&P 500 is not intended to be reflective or indicative of our funds’ past or future performance. |

| -9-

We Believe the Transaction Will Be Well Received by HHH Shareholders

We believe the Transaction presents the Company’s stockholders with a compelling opportunity

to realize a substantial cash premium to the trading price of their shares and/or to retain an

ongoing equity interest in the next stage of the Company’s evolution alongside Pershing Square.

We Have the Financial Resources to Consummate the Transaction

Pershing Square Holdco has the capital required to fund its $1 billion cash investment from its

current balance sheet. We have also received the enclosed letter from Jefferies LLC indicating

that it is highly confident that the $500 million of bond financing will be available to complete

the transaction. The Transaction would not be subject to any financing contingency, and we

would obtain any necessary financing commitments prior to the execution of definitive

transaction documents. The Transaction should not require any regulatory approvals that would

delay our expected timing to consummation.

Pershing Square is Not Subject to the Change in Control Provisions in HHH’s Debt

Our ability to offer a significant cash premium is enhanced by Pershing Square’s unique ability to

complete a transaction that keeps in place the Company’s highly favorable existing debt structure.

This would not be possible for a buyer (or group of buyers) other than Pershing Square because

the terms of the indentures governing the Company’s outstanding bonds enable bondholders to

“put” their bonds back to the Company at a premium upon a change of control to a buyer other

than Pershing Square and its affiliated funds, and the interest rates of the Company’s corporate

debt are substantially lower than current market interest rates.

We May Include Certain Strategic Investors in the Transaction

As previously noted, we may invite a small consortium of strategic partners to join us in the

Transaction. Capital invested by these investors would be available to increase HHH’s balance

sheet cash at closing for future investment and/or reduce a portion of the Pershing Square Funds’

ownership of the Company’s common stock. The additional investment by strategic partners

would not affect Pershing Square Holdco’s investment in the Company or impact HHH’s post-closing public float.

Pershing Square Holdco intends for its investment in the Company to be a permanent one.

Strategic partners that we would include in the Transaction would invest through an entity

controlled by Pershing Square, which will require its investors to be subject to a multi-year

lockup agreement.

We Believe That Many HHH Shareholders Will Prefer to Retain Their Shares in HHH

Rather than Elect the Transaction Cash Alternative

While we anticipate that the cash premium reflected in our offer will be compelling for some

stockholders, we believe that many if not most HHH shareholders will prefer to roll-over their

shareholdings into the post-closing company, as we believe HHH will become a highly attractive,

long-term investment for continuing shareholders:

x HHH will become Pershing Square’s long-term platform for acquiring controlling

interests in public and private operating companies. Continuing shareholders will be able |

| -10-

to invest alongside Pershing Square and benefit from Pershing Square’s long-term track

record, hedging capabilities, and experience.

x HHH will benefit from the managerial and investment expertise of Bill Ackman as

Chairman and Chief Executive Officer, Ryan Israel as Chief Investment Officer, Ben

Hakim as President, Mike Gonnella as Chief Financial Officer, and Halit Coussin as

Chief Legal Officer, all long-term, highly experienced members of the Pershing Square

management team who are making a $900 million investment in the Company. The

Pershing Square leadership team joining HHH will receive no cash or equity

compensation as employees of HHH.

x We expect that HHH’s and HHC’s access to capital will improve substantially by virtue

of Pershing Square’s investment in and leadership of HHH. In addition to the other $17

billion of assets we currently manage, of which 90% are in a publicly traded permanent

capital vehicle – the second largest equity closed end fund in the world – Pershing Square

has extensive relationships with a wide array of long-term investors including sovereign

wealth funds, pension funds, corporations, family offices, and other institutional investors

that we can access for equity and debt capital, and as potential co-investors.

x Pershing Square has a long-term track record in raising equity capital from institutional

and retail investors in public vehicles including: (1) Pershing Square Holdings, Ltd., the

largest permanent capital hedge fund in the world, (2) the largest SPAC ever, which we

took public in a $4 billion IPO during the Covid 19 crisis, (3) Pershing Square SPARC

Holdings, Ltd., a new and highly flexible and scalable public acquisition company, as

well as numerous other innovative capital markets transactions since our inception.

x HHH will benefit from Pershing Square’s entire organizational team, resources, and best-in-class advisory and management capabilities through an evergreen services agreement,

subject to termination for cause with customary cure rights.6

In consideration for services

rendered, Pershing Square Holdco will receive a fee of 1.5 percent per annum of the

equity market capitalization of the Company, paid quarterly.

x HHH will not pay any promote, performance allocation or other performance-based fees

to Pershing Square or its employees.

x The Company will be governed consistent with Pershing Square’s longstanding

commitment to the highest standards of corporate excellence and public company

governance, with a board comprised of a majority of independent directors including

directors from the current board. The HHH Board will maintain a fully independent Audit

Committee, and the Compensation and Nominating and Governance Committees will be

comprised of a majority of independent directors. Pershing Square’s initial

representatives on the Board of Directors will be Bill Ackman, Ryan Israel, Ben Hakim,

and Halit Coussin.

x In addition to continuing to pursue HHC’s long-term strategic objectives, the Company

will become a cash generative platform for Pershing Square to pursue investments in

controlling interests in operating companies. HHH’s investments in controlling stakes in

6

No offer is being made with respect to the investment advisory services of Pershing Square. |

| -11-

operating companies within non-real estate verticals will generally be implemented

through one or more other subsidiaries of the Company either on its own or with co-investments from other Pershing Square funds and investment vehicles.

x HHC, the Company’s principal real estate operating subsidiary, will continue to operate

effectively unchanged with the same long-term strategy, management team, and

employees. We envision no changes in the employees at HHC including its accounting

team, which we expect will continue to prepare the Company’s SEC and other financial

reports.

x Pershing Square will maintain the Company’s NYSE listing and commit to not reduce the

Company’s public float, whether through acquisition of additional shares or a “squeeze-out” of the minority stockholders without the approval of the unaffiliated members of the

Company’s Board of Directors.

x The Pershing Square Funds will waive any management fees associated with HHH shares

they retain post-Transaction to avoid charging our clients duplicative fees.

x The Pershing Square funds are buy-and-hold investors as demonstrated by our long-term

relationship and investment in the Company where we have continuously remained the

largest stockholder since Howard Hughes Corporation’s public offering in November

2010.

Transaction Approvals and Due Diligence

The Transaction would be subject to the approval of the Board of Directors of the Company, the

negotiation and execution of mutually acceptable definitive transaction documents, and the

completion of limited confirmatory due diligence (which we expect could be completed

expeditiously in light of our preexisting knowledge of the Company).

The Transaction Will Be Structured To Preserve the Board’s Ability to Use Its Business

Judgment

We understand that the Board of Directors has appointed a Special Committee of independent

directors to consider any proposal we may make. We are prepared to subject the Transaction to

the prior approval of the Special Committee as well as to a non-waivable condition requiring the

approval of holders of a majority of the common stock of the Company not owned by Pershing

Square or parties affiliated with or advised by Pershing Square.

In considering this proposal, you should know that if the Special Committee chooses not to

recommend, or the public stockholders of the Company do not approve, the Transaction, our

relationship with the Company would not be adversely affected. We would expect to remain a

long-term shareholder of the Company subject to the duties we owe to our investment advisory

clients.

Timing

As a result of our long-term involvement with the Company and its predecessor, we already have

a detailed understanding of the Company, its business and assets, and its directors and senior

management, which will enable us to move quickly to negotiate and execute mutually acceptable

definitive transaction documentation. |

| -12-

We are also prepared to promptly complete confirmatory due diligence, which can be achieved

with minimal disruption to the business, once information is made available to us. We are

prepared to share draft definitive documents and negotiate them in parallel with our due

diligence. We expect negotiation of transaction documents, public stockholder voting, and other

customary matters to be completed as promptly as practicable to facilitate a timely closing. Our

financial advisor, Jefferies LLC, and our legal advisor, Sullivan & Cromwell LLP, will assist us in

completing the Transaction.

As with any transaction of this importance and sensitivity, time is of the essence. We would

therefore welcome the opportunity to meet with the Special Committee and its advisors, and, as

appropriate, other members of the Board of Directors and senior management when you are ready

to discuss our proposal.

********************

Over the last 14 years, I have come to understand that HHH is a forever company that has an

effectively unlimited opportunity over the next untold number of decades to develop communities

that will become important large-scale cities for future generations. As we have been sadly

reminded in light of the recent tragic events in California that remain ongoing, proper

management and governance of cities are critical to the short- and long-term health, safety, and

wellbeing of its residents, and to the preservation of their homes and other assets.

As a result of these important obligations, Howard Hughes Corporation and the MPCs that it

manages deserve a well-capitalized, diversified, long-term owner and manager who understands

not just its fiduciary obligation to shareholders, but also its obligations to the hundreds of

thousands of current residents and the millions in the future, who will live, work, study, marry,

build and grow families, and play in our communities.

For all of the above reasons, we strongly believe that we are the right long-term owner for HHH.

With reference to Howard Hughes Holdings’ namesake – one of the world’s greatest aviators and

entrepreneurs – let’s give this bird some wings.

Sincerely,

William A. Ackman

Chief Executive Officer |

| -13-

APPENDIX A

Pershing Square Senior Leadership Biographies

William A. Ackman has served as our Founder and Chief Executive Officer since founding Pershing

Square Capital Management, L.P. (“PSCM LP”) in 2003, and as Chairman of our board of directors since

June 2024. Prior to founding PSCM LP, Mr. Ackman co-founded and co-managed Gotham Partners

Management Co., LLC (‘‘Gotham Partners’’), an investment adviser that managed public and private

equity hedge fund portfolios, until 2003. Prior to forming Gotham Partners, Mr. Ackman was a principal

with Ackman Brothers & Singer, Inc., now known as the Ackman Ziff Real Estate Group, where he

arranged and structured equity and debt financing for real estate investors and developers. Mr. Ackman is a

member of the board of directors of Universal Music Group N.V. and is also a member of the Investment

Advisory Committee on Financial Markets of the Federal Reserve Bank of New York. Mr. Ackman also

serves as the Chairman and Chief Executive Officer of Pershing Square SPARC Holdings, Ltd.

(“SPARC”). In addition, Mr. Ackman serves on the boards of Dean’s Advisors of the Harvard Business

School and the Pershing Square Foundation, a charitable family foundation that he founded in 2006. Mr.

Ackman previously served as Chairman of Howard Hughes Holdings Inc. and as Chief Executive Officer

and Chairman of Pershing Square Tontine Holdings, Ltd. Mr. Ackman received a Master in Business

Administration from the Harvard Business School and a Bachelor of Arts magna cum laude from Harvard

College.

Ryan Israel has served as our Chief Investment Officer since August 2022 and as a member of our board

of directors since June 2024. Mr. Israel joined our investment team in 2009. Mr. Israel was previously an

analyst at The Goldman Sachs Group, Inc. in the Technology, Media and Telecom group. Mr. Israel served

as a director of Element Solutions Inc., an NYSE-listed company, from October 2013 through January

2019. Mr. Israel received his Bachelor of Science from the Wharton School at the University of

Pennsylvania, where he graduated summa cum laude and beta gamma sigma in 2007.

Ben Hakim has served as our President since June 2024. Mr. Hakim joined our investment team in 2012.

He also serves as President of SPARC and as a member of the board of directors of Howard Hughes

Holdings Inc., and previously served as President of Pershing Square Tontine Holdings, Ltd. Mr. Hakim

was previously a Partner and Senior Managing Director at Blackstone Inc., where he worked in the

Mergers & Acquisitions group for 13 years. Mr. Hakim received his Bachelor of Science from Cornell

University in 1997.

Michael Gonnella has served as our Chief Financial Officer since March 2017. Mr. Gonnella also serves

as the Chief Financial Officer of SPARC, and previously served as Chief Financial Officer of Pershing

Square Tontine Holdings, Ltd. Prior to his appointment as our Chief Financial Officer, Mr. Gonnella served

as Senior Controller since joining Pershing Square in 2005. Mr. Gonnella received his Bachelor of Science

from Seton Hall University in 2002. Mr. Gonnella is a certified public accountant.

Halit Coussin has served as our Chief Legal Officer and Chief Compliance Officer since September 2015

and as a member of our board of directors since June 2024 and a director of PSH since November 2024.

Prior to joining our company in 2007, Ms. Coussin served as an associate attorney at Schulte, Roth & Zabel

LLP, where her practice focused on advising hedge fund managers on a variety of regulatory and

compliance matters. Ms. Coussin received her LL.M. from New York University in 2000 and her LL.B.

magna cum laude from Tel Aviv University in 1998.

|

| -14-

APPENDIX B

PSLP/PSH Net Returns (Net of Management Fees and Performance Fees)

PSLP/PSH vs S&P 500 - ITD

PSH vs S&P 500 – Permanent Capital Era |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

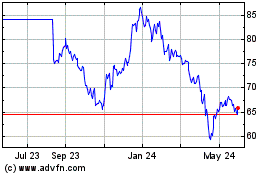

Howard Hughes (NYSE:HHH)

Historical Stock Chart

From Dec 2024 to Jan 2025

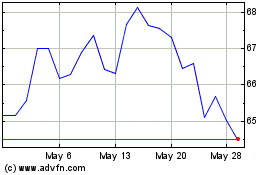

Howard Hughes (NYSE:HHH)

Historical Stock Chart

From Jan 2024 to Jan 2025