00002160852023FYfalse100002160852023-01-012023-12-310000216085us-gaap:CommonStockMember2023-01-012023-12-310000216085us-gaap:CommonClassAMember2023-01-012023-12-3100002160852023-06-30iso4217:USD0000216085us-gaap:CommonStockMember2024-02-27xbrli:shares0000216085us-gaap:CommonClassAMember2024-02-2700002160852023-12-3100002160852022-12-31iso4217:USDxbrli:shares0000216085us-gaap:CommonStockMember2022-12-310000216085us-gaap:CommonStockMember2023-12-310000216085us-gaap:CommonClassAMember2022-12-310000216085us-gaap:CommonClassAMember2023-12-3100002160852022-01-012022-12-3100002160852021-01-012021-12-310000216085us-gaap:CommonStockMember2022-01-012022-12-310000216085us-gaap:CommonStockMember2021-01-012021-12-310000216085us-gaap:CommonClassAMember2022-01-012022-12-310000216085us-gaap:CommonClassAMember2021-01-012021-12-310000216085us-gaap:CommonStockMemberus-gaap:CommonStockMember2022-12-310000216085us-gaap:CommonStockMemberus-gaap:CommonStockMember2021-12-310000216085us-gaap:CommonStockMemberus-gaap:CommonStockMember2020-12-310000216085us-gaap:CommonStockMemberus-gaap:CommonStockMember2023-01-012023-12-310000216085us-gaap:CommonStockMemberus-gaap:CommonStockMember2022-01-012022-12-310000216085us-gaap:CommonStockMemberus-gaap:CommonStockMember2021-01-012021-12-310000216085us-gaap:CommonStockMemberus-gaap:CommonStockMember2023-12-310000216085us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-12-310000216085us-gaap:CommonStockMemberus-gaap:CommonClassAMember2021-12-310000216085us-gaap:CommonStockMemberus-gaap:CommonClassAMember2020-12-310000216085us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-01-012023-12-310000216085us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-01-012022-12-310000216085us-gaap:CommonStockMemberus-gaap:CommonClassAMember2021-01-012021-12-310000216085us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-12-310000216085us-gaap:CommonClassAMember2021-12-310000216085us-gaap:TreasuryStockCommonMember2022-12-310000216085us-gaap:TreasuryStockCommonMember2021-12-310000216085us-gaap:TreasuryStockCommonMember2020-12-310000216085us-gaap:TreasuryStockCommonMember2023-01-012023-12-310000216085us-gaap:TreasuryStockCommonMember2022-01-012022-12-310000216085us-gaap:TreasuryStockCommonMember2021-01-012021-12-310000216085us-gaap:TreasuryStockCommonMember2023-12-310000216085us-gaap:AdditionalPaidInCapitalMember2022-12-310000216085us-gaap:AdditionalPaidInCapitalMember2021-12-310000216085us-gaap:AdditionalPaidInCapitalMember2020-12-310000216085us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310000216085us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310000216085us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310000216085us-gaap:AdditionalPaidInCapitalMember2023-12-310000216085us-gaap:RetainedEarningsMember2022-12-310000216085us-gaap:RetainedEarningsMember2021-12-310000216085us-gaap:RetainedEarningsMember2020-12-310000216085us-gaap:RetainedEarningsMember2023-01-012023-12-310000216085us-gaap:RetainedEarningsMember2022-01-012022-12-310000216085us-gaap:RetainedEarningsMember2021-01-012021-12-310000216085us-gaap:RetainedEarningsMember2023-12-310000216085us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310000216085us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310000216085us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310000216085us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310000216085us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310000216085us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310000216085us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-3100002160852021-12-3100002160852020-12-31hvt:storehvt:state0000216085us-gaap:BuildingMembersrt:MinimumMember2023-12-310000216085us-gaap:BuildingMembersrt:MaximumMember2023-12-310000216085us-gaap:BuildingImprovementsMembersrt:MinimumMember2023-12-310000216085us-gaap:BuildingImprovementsMembersrt:MaximumMember2023-12-310000216085us-gaap:FurnitureAndFixturesMembersrt:MinimumMember2023-12-310000216085srt:MaximumMemberus-gaap:FurnitureAndFixturesMember2023-12-310000216085us-gaap:EquipmentMembersrt:MinimumMember2023-12-310000216085us-gaap:EquipmentMembersrt:MaximumMember2023-12-31xbrli:pure0000216085hvt:BedroomFurnitureMember2023-01-012023-12-310000216085hvt:BedroomFurnitureMember2022-01-012022-12-310000216085hvt:BedroomFurnitureMember2021-01-012021-12-310000216085hvt:DiningRoomFurnitureMember2023-01-012023-12-310000216085hvt:DiningRoomFurnitureMember2022-01-012022-12-310000216085hvt:DiningRoomFurnitureMember2021-01-012021-12-310000216085hvt:OccasionalMember2023-01-012023-12-310000216085hvt:OccasionalMember2022-01-012022-12-310000216085hvt:OccasionalMember2021-01-012021-12-310000216085hvt:CaseGoodsMember2023-01-012023-12-310000216085hvt:CaseGoodsMember2022-01-012022-12-310000216085hvt:CaseGoodsMember2021-01-012021-12-310000216085hvt:UpholsteryMember2023-01-012023-12-310000216085hvt:UpholsteryMember2022-01-012022-12-310000216085hvt:UpholsteryMember2021-01-012021-12-310000216085hvt:MattressesMember2023-01-012023-12-310000216085hvt:MattressesMember2022-01-012022-12-310000216085hvt:MattressesMember2021-01-012021-12-310000216085hvt:AccessoriesAndOtherMember2023-01-012023-12-310000216085hvt:AccessoriesAndOtherMember2022-01-012022-12-310000216085hvt:AccessoriesAndOtherMember2021-01-012021-12-310000216085us-gaap:OtherCurrentAssetsMember2023-12-310000216085us-gaap:OtherCurrentAssetsMember2022-12-310000216085hvt:AccruedLiabilitiesCurrentMember2023-12-310000216085hvt:AccruedLiabilitiesCurrentMember2022-12-310000216085us-gaap:ShippingAndHandlingMember2023-01-012023-12-310000216085us-gaap:ShippingAndHandlingMember2022-01-012022-12-310000216085us-gaap:ShippingAndHandlingMember2021-01-012021-12-31hvt:segment0000216085us-gaap:LandAndLandImprovementsMember2023-12-310000216085us-gaap:LandAndLandImprovementsMember2022-12-310000216085us-gaap:BuildingAndBuildingImprovementsMember2023-12-310000216085us-gaap:BuildingAndBuildingImprovementsMember2022-12-310000216085us-gaap:FurnitureAndFixturesMember2023-12-310000216085us-gaap:FurnitureAndFixturesMember2022-12-310000216085us-gaap:EquipmentMember2023-12-310000216085us-gaap:EquipmentMember2022-12-310000216085us-gaap:ConstructionInProgressMember2023-12-310000216085us-gaap:ConstructionInProgressMember2022-12-310000216085us-gaap:RevolvingCreditFacilityMember2022-10-310000216085us-gaap:RevolvingCreditFacilityMember2022-10-012022-10-310000216085us-gaap:RevolvingCreditFacilityMember2023-12-310000216085srt:MinimumMember2023-12-310000216085srt:MaximumMember2023-12-310000216085us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-01-012023-12-310000216085us-gaap:SellingGeneralAndAdministrativeExpensesMember2022-01-012022-12-310000216085us-gaap:SellingGeneralAndAdministrativeExpensesMember2021-01-012021-12-31hvt:vote0000216085us-gaap:CommonStockMember2022-10-012022-12-310000216085us-gaap:CommonClassAMember2022-10-012022-12-310000216085us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2023-01-012023-12-310000216085us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2022-12-310000216085us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2021-12-310000216085us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2022-01-012022-12-310000216085us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2023-12-310000216085us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2021-01-012021-12-310000216085hvt:EmployeeSavingsRetirement401KPlanMember2023-01-012023-12-310000216085hvt:EmployeeSavingsRetirement401KPlanMember2022-01-012022-12-310000216085hvt:EmployeeSavingsRetirement401KPlanMember2021-01-012021-12-310000216085us-gaap:DeferredCompensationExcludingShareBasedPaymentsAndRetirementBenefitsMember2023-01-012023-12-310000216085us-gaap:DeferredCompensationExcludingShareBasedPaymentsAndRetirementBenefitsMember2022-01-012022-12-310000216085us-gaap:DeferredCompensationExcludingShareBasedPaymentsAndRetirementBenefitsMember2021-01-012021-12-310000216085us-gaap:OtherNoncurrentAssetsMemberus-gaap:DeferredCompensationExcludingShareBasedPaymentsAndRetirementBenefitsMember2023-12-310000216085us-gaap:OtherNoncurrentAssetsMemberus-gaap:DeferredCompensationExcludingShareBasedPaymentsAndRetirementBenefitsMember2022-12-310000216085us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:DeferredCompensationExcludingShareBasedPaymentsAndRetirementBenefitsMember2023-12-310000216085us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:DeferredCompensationExcludingShareBasedPaymentsAndRetirementBenefitsMember2022-12-310000216085us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2023-01-012023-12-310000216085us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2022-01-012022-12-310000216085us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2021-01-012021-12-310000216085us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-01-012023-12-310000216085us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-01-012022-12-310000216085us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-01-012021-12-31hvt:plan0000216085hvt:LongTermIncentivePlan2021Member2023-12-310000216085hvt:ServiceBasedRestrictedStockAwardsMember2020-12-310000216085hvt:PerformanceBasedRestrictedStockAwardsMember2020-12-310000216085hvt:ServiceBasedRestrictedStockAwardsMember2021-01-012021-12-310000216085hvt:PerformanceBasedRestrictedStockAwardsMember2021-01-012021-12-310000216085hvt:ServiceBasedRestrictedStockAwardsMember2021-12-310000216085hvt:PerformanceBasedRestrictedStockAwardsMember2021-12-310000216085hvt:ServiceBasedRestrictedStockAwardsMember2022-01-012022-12-310000216085hvt:PerformanceBasedRestrictedStockAwardsMember2022-01-012022-12-310000216085hvt:ServiceBasedRestrictedStockAwardsMember2022-12-310000216085hvt:PerformanceBasedRestrictedStockAwardsMember2022-12-310000216085hvt:ServiceBasedRestrictedStockAwardsMember2023-01-012023-12-310000216085hvt:PerformanceBasedRestrictedStockAwardsMember2023-01-012023-12-310000216085hvt:ServiceBasedRestrictedStockAwardsMember2023-12-310000216085hvt:PerformanceBasedRestrictedStockAwardsMember2023-12-310000216085hvt:ServiceBasedRestrictedStockAwardsMembersrt:MinimumMember2023-01-012023-12-310000216085hvt:ServiceBasedRestrictedStockAwardsMembersrt:MaximumMember2023-01-012023-12-310000216085us-gaap:SalesReturnsAndAllowancesMember2022-12-310000216085us-gaap:SalesReturnsAndAllowancesMember2023-01-012023-12-310000216085us-gaap:SalesReturnsAndAllowancesMember2023-12-310000216085us-gaap:SalesReturnsAndAllowancesMember2021-12-310000216085us-gaap:SalesReturnsAndAllowancesMember2022-01-012022-12-310000216085hvt:CancelledSalesAndAllowancesMember2020-12-310000216085hvt:CancelledSalesAndAllowancesMember2021-01-012021-12-310000216085hvt:CancelledSalesAndAllowancesMember2021-12-31

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2023

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to _____

Commission file number: 1-14445

HAVERTY FURNITURE COMPANIES, INC.

| | | | | |

| Maryland | 58-0281900 |

| (State of Incorporation) | (IRS Employer Identification Number) |

| |

780 Johnson Ferry Road, Suite 800, Atlanta, Georgia 30342 |

| (Address of principal executive offices) |

| |

(404) 443-2900 |

| (Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock | HVT | NYSE |

| Class A Common Stock | HVTA | NYSE |

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” i Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | o | Accelerated filer | x |

| Non-accelerated filer | o | Smaller reporting company | o |

| | Emerging growth company | o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. x

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

As of June 30, 2023, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was $455,006,020 (based on the closing sale prices of the registrant’s two classes of common stock as reported by the New York Stock Exchange).

There were 14,864,697 shares of common stock and 1,281,395 shares of Class A common stock, each with a par value of $1.00 per share outstanding at February 27, 2024.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement for the Annual Meeting of Stockholders to be held May 6, 2024 are incorporated by reference into Part III of this Annual Report on Form 10-K.

HAVERTY FURNITURE COMPANIES, INC.

Annual Report on Form 10-K for the year ended December 31, 2023

FORWARD-LOOKING STATEMENTS

In addition to historical information, this document contains “forward-looking statements” – that is, statements related to future, not past, events. In this context, forward-looking statements often address our expected future business and financial performance and financial condition. These statements are within the meaning of Section 27A of the Securities Act of 1933 and Section 21F of the Securities Exchange Act of 1934.

Forward-looking statements include, but are not limited to:

•projections of sales or comparable store sales, gross profit, SG&A expenses, capital expenditures or other financial measures;

•descriptions of anticipated plans or objectives of our management for operations or products; including planned store openings and closures;

•forecasts of performance;

•anticipated impact on our business of macro-economic conditions; and

•assumptions regarding any of the foregoing.

Because these statements involve anticipated events or conditions, forward-looking statements often include words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” “project,” “target,” “can,” “could,” “may,” “should,” “will,” “would,” or similar expressions.

These forward-looking statements are based upon assessments and assumptions of management in light of historical results and trends, current conditions and potential future developments that often involve judgment, estimates, assumptions and projections. Forward-looking statements reflect current views about our plans, strategies and prospects, which are based on information currently available.

Although we believe that our plans, intentions and expectations as reflected in or suggested by any forward-looking statements are reasonable, they are not guarantees. Actual results may differ materially from our anticipated results described or implied in our forward-looking statements, and such differences may be due to a variety of factors. Our business could also be affected by additional factors that are presently unknown to us or that we currently believe to be immaterial to our business. Important factors which could cause our actual results to differ materially from the forward-looking statements in this report include, but are not limited to, the following items, in addition to those matters described in the Risk Factors and Management’s Discussion and Analysis of Financial Condition and Results of Operations sections of this report:

•Competition from national, regional and local retailers of home furnishings;

•Our failure to anticipate changes in consumer preferences;

•Our ability to successfully implement our growth and other strategies;

•Our ability to maintain and enhance our brand;

•Importing a substantial portion of our merchandise from foreign sources;

•Significant fluctuations and volatility in the cost of raw materials and components;

•Our dependence on third-party producers to meet our requirements;

•A failure by our vendors to meet our quality control standards or comply with changes to the legislative or regulatory framework regarding product safety;

•Risks in our supply chain, including price, availability and quality of raw materials and components utilized in the products we sell and our ability to forecast our supply chain needs;

•Our reliance on third-party transportation vendors for product shipments from our suppliers;

•The effects of labor disruptions or labor shortages; and our ability to attract and retain key employees;

•The rise of oil and gasoline prices;

•Increased transportation costs;

•Damage to one of our distribution centers;

•The vulnerability of our information technology infrastructure to cyber-attacks, breaches and other disruptions;

•Changes in general domestic and international economic conditions such as inflation rates, interest rates, tax rates, unemployment rates, higher labor and healthcare costs, recessions, and changing government policies, laws and regulations;

•Pending or unforeseen litigation; and

•Other risks and uncertainties as may be detailed from time to time in our public announcements and Securities and Exchange Commission filings.

Discussed elsewhere in further detail in this report are some important risks, uncertainties and contingencies which could cause our actual results, performance or achievements to be materially different from any forward-looking statements made or implied in this report.

Forward-looking statements are only as of the date they are made and they might not be updated to reflect changes as they occur after the forward-looking statements are made. We assume no obligations to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise. In evaluating forward-looking statements, you should consider these risks and uncertainties, together with the other risks described from time to time in our other reports and documents filed with the Securities and Exchange Commission, or SEC, and you should not place undue reliance on those statements.

We intend for any forward-looking statements to be covered by, and we claim the protection under, the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

PART I

ITEM 1. BUSINESS

Unless otherwise indicated by the context, we use the terms “Havertys,” “we,” “our,” or “us” when referring to the consolidated operations of Haverty Furniture Companies, Inc. and subsidiary.

Overview

Havertys is a specialty retailer of residential furniture and accessories. Our founder, J.J. Haverty began the business in 1885 in Atlanta, Georgia with one store and made deliveries using horse-drawn wagons. The Company grew to 18 stores and was incorporated in September 1929. Anticipating further growth, the Company accessed additional capital through its initial public offering in October 1929.

Havertys has grown to over 120 stores in 16 states in the Southern and Midwest regions. All of our retail locations are operated using the Havertys name, and we do not franchise our stores. Our brand recognition is very high in the markets we serve, and consumer surveys indicate Havertys is associated with a high level of quality, fashion, value, and service.

Customers

Havertys customers are typically well-educated women in middle to upper-to-middle income households. They generally own homes in the suburbs, and their diverse personalities are reflected in their unique sense of style. These consumers research and shop online and in-store, often engaging friends or family members in the purchasing process. They are discerning buyers, desiring furnishings that fit their style, but never sacrificing quality. Our marketing, merchandising, stores, online presence, and customer service are targeted to attract and meet the needs of our distinctive customers.

Merchandise and Revenues

We develop our merchandise selection with the diverse taste of our typical “on trend” customer in mind. A wide range of styles from traditional to contemporary are in our core assortment, and virtually all of the furniture merchandise we carry bears the Havertys brand. We also tailor our product offerings to the needs and tastes of the local markets we serve, emphasizing more “coastal,” “western” or “urban” looks as appropriate. Our custom upholstery programs and eclectic looks are an important part of our product mix and allow the on-trend consumer more self-expression.

We have avoided offering lower quality, promotional price-driven merchandise favored by many regional and national chains, which we believe would devalue the Havertys brand with the consumer. We carry nationally well-known mattress product lines such as Tempur-Pedic®, Serta®, Stearns and Foster®, Beautyrest®, and Sealy®.

Our customers use varying methods to purchase or finance their sales. As an added convenience to our customers, we offer financing by third-party finance companies. Sales financed by the third-party providers are not Havertys’ receivables; accordingly, we do not have any credit risk or servicing responsibility for these accounts, and there is no credit or collection recourse to Havertys. Slightly less than one-third of our sales are third-party-financed. The fees we pay to the third parties are included in our selling, general, and expenses (“SG&A”) as a selling expense.

We have a seasoned, commissioned-based sales team serving our customers. Their product knowledge is important in assisting customers in evaluating Havertys' merchandise as compared to our competitors. We also offer a free in-home design service to those customers seeking a more in-depth personalized experience. The average sales ticket for a customer that has a designer visit their home is generally twice that of our average in-store sales ticket. Approximately 28.5% of our sales in 2023 resulted from consultations with our in-home designers.

Stores

As of December 31, 2023, we operated 124 stores serving 86 cities in 16 states with approximately 4.4 million retail square feet. Our stores range in size from 15,000 to 60,000 selling square feet, with the average being approximately 35,000 square feet. We strive to have our stores reflect the distinctive style and comfort consumers expect to find when purchasing their home furnishings. The store’s location and curb appeal are important to the middle to upper-middle income consumer that we target, and attractive facades complement the quality and style of our merchandise. Interior details are also important for a pleasant and inviting shopping experience. We are very intentional in having open shopping spaces and our disciplined merchandise display ensures uniformity of presentations in-store, online and in our advertising.

Our goal, subject to market conditions and identifying suitable sites, is to open five new stores per year and to increase our retail square footage by approximately 2.8% in 2024. We are evaluating various "big box" former retail sites in the 30,000 to 32,000 square feet size range and other new locations for expansion. We currently have no plans to add stores outside our distribution footprint.

Online Presence

We consider our website an extension of our brick-and-mortar locations and not a separate segment of our business. Most customers will use the internet for inspiration and as a start to their shopping process to view products and prices. Our website features a variety of helpful tools including a design center with a 3-D room planner, upholstery customization, and inspired accessories. A large number of product reviews written by our customers are also provided, which some consumers find important in the decision-making process.

The next stop in the purchase journey for most consumers is a visit to a store to touch, sit, and see merchandise in person. Our sales consultants also use online tools to further engage our customers while they are in the store. Customers may make their purchase in the store or opt to return home and finalize their decisions, place their orders online and set delivery. We limit internet sales of our furniture to within our delivery network, and internet sales of a selection of our accessories to within the continental United States. Our total sales completed online for 2023 were approximately 3.3% of our total 2023 business.

We made significant investments in our website during 2022. The site was launched in the fourth quarter featuring a new design and replatformed on a suite of Adobe solutions allowing for better search functionality, navigation, and enriched product pages. At the beginning of 2023, we onboarded a new business partner with deep Adobe experience to further improve the overall customer experience by optimizing site performance and usability. We also added more conversion event, traffic and conversion variables in Adobe Analytics which has allowed more refined and sophisticated A/B testing and improved insight into customer behavior. We continue to fine-tune the content management system as well as find opportunities to add more AI driven automation in an effort to improve the customer experience and increase sales conversion rates through our website and increase traffic to our stores.

We believe offering a direct-to-customer business complements our retail store operations as we serve the customer in the method of their choosing and leverage the power of high-touch service and online capabilities.

Suppliers and Supply Chain

We buy our merchandise from numerous foreign and domestic manufacturers and importers, the largest ten of which accounted for approximately 40.2% of our product purchases during 2023. Most of our wood products, or “case goods,” are imported from Asia. Upholstered items are largely produced domestically, with the exception of our leather products which are primarily imported from Asia or Mexico.

We purchase our furniture merchandise produced in Asia through sourcing companies and also buy direct from manufacturers. We have dedicated quality control specialists on-site during production to ensure the items meet our specifications. Our direct import team works with industry designers and manufacturers in some of the best factories throughout Asia. Approximately 19.4% of our case goods sales and 9.2% of our upholstery sales in 2023 were generated by our direct imports.

The longer lead times required for deliveries from overseas factories and the production of merchandise exclusively for Havertys makes it imperative for us to have both warehousing capabilities and end-to-end supply chain visibility. Our merchandising team provides input to the automated procurement process in an effort to maintain overall inventory levels within an appropriate range and reduce the number of written sales awaiting product delivery. We use real-time information to closely follow our import orders from the manufacturing plant through each stage of transit and using this data can more accurately set customer delivery dates prior to receipt of product.

Distribution

We believe that our distribution and delivery system is one of the best in the retail furniture industry and provides us with a significant competitive advantage. Our distribution system uses a combination of three distribution centers (“DCs”) and four home delivery centers (“HDCs”). The DCs receive both domestic product and containers of imported merchandise. A warehousing management system, using radio frequency scanners, tracks each piece of inventory in real time and allows for random storage in the warehouse and efficient scheduling and changing of the workflow. The DCs are also designed to shuttle prepped merchandise up to 250 miles for next-day home deliveries and serve HDCs within a 500-mile radius. The HDCs provide service to markets within an additional 250 miles. We use third parties to handle over-the-road delivery of product from the DCs to the HDCs and market areas. We use Havertys team members for executing home delivery, and have branded this service “Top Drawer Delivery,” an important function serving as the last contact with our customers in the purchase process. Operating standards in our warehouse and delivery functions provide measurements for determining staffing needs and increasing productivity.

Time between purchase and delivery averages 3 to 5 days for in-stock items and 5 to 7 weeks for special order items.

Human Capital Resources

As of December 31, 2023, Havertys’ total workforce was 2,574: 1,561 in our retail store operations, 779 in our warehouse and delivery points, 177 in our corporate operations, and 57 in our customer-service call centers. None of our team members is a party to a union contract.

Health and Safety

We care about our teammates, customers, and the communities we serve. We believe a hazard-free environment is a critical enabler for the success of our business. We have a strong safety program that focuses on implementing policies and training programs to ensure our team members can leave their job and return home safely every day.

Culture and Engagement

Integrity and teamwork are two of our core values. These drive our approach in our everyday operations with our customers, suppliers and teammates and we believe that the best results happen when we work together. At Havertys, we see strength in America’s many faces, cultures, and colors. Each person offers a unique point of view and presents a fresh perspective integral to supporting innovation. We are committed to differing perspectives across all levels of our workforce to improve our business and reflect the vibrant and thriving diversity of the communities in which we live and work.

We periodically conduct an Employee Engagement Survey (the “Survey”) as a means of measuring employee engagement and satisfaction and offering employees the chance to feel heard.

Retention and Development

Our compensation programs are designed to attract, retain, and motivate team members to achieve superior results. Havertys’ total compensation for teammates comprises a variety of components, including competitive pay consistent with positions, skill levels, experience, and knowledge. We also offer competitive benefits, including access to healthcare plans, financial and physical wellness programs, paid time off, parental leave and retirement benefits.

We are committed to supporting our teammates’ continuous development of professional, technical and leadership skills through corporate training programs, access to digital learning resources and through partnerships with local technical learning institutions. In 2023, Havertys team members consumed approximately 93,000 hours of learning. We also offer the opportunity for team members to pursue degree programs, professional certificates, and individual courses in strategic fields of study through our tuition reimbursement program.

Competition

The retail sale of home furnishings is a highly fragmented and competitive business. There has been growth in the e‑commerce channel both from internet only retailers, from start-up furniture retailers and larger more established retailers, and those with a brick-and-mortar presence. The degree and sources of brick-and-mortar retail competition varies by geographic area. We compete with numerous individual retail furniture stores as well as national and regional chains. Retail stores opened or operated by furniture manufacturers in an effort to control and protect the distribution prospects of their branded merchandise compete with us in certain markets. Mass merchants, certain department stores, and some electronics and appliance retailers also have limited furniture product offerings.

We believe Havertys is uniquely positioned in the marketplace, with a targeted mix of merchandise that appeals to customers who are somewhat more affluent than those of promotional price-oriented furniture stores. Our online presence provides most elements of a seamless, omni-channel approach that many of our competitors do not have or cannot replicate. We consider our custom order capabilities, free in-home design service, the tailoring of merchandise on a local market basis, and the ability to make prompt delivery of orders through maintenance of inventory to be significant competitive advantages.

Seasonality

Our business is affected by traditional retail seasonality, advertising and promotion programs, and general economic trends. We historically achieve our smallest quarter by revenues in the second quarter and the largest in the fourth quarter. The “nesting” response generated by COVID-19 created outsized demand beginning in the second quarter of 2020 and, when combined with the strong housing market contributed to the strong sales levels we experienced through 2021. During 2022, our business began reverting to its more historical patterns, with a return to increased shopping on weekends and during traditional extended holiday periods.

Trademarks and Domain Names

We have registered our various logos, trademarks and service marks. We believe that our trademark position is adequately protected in all markets in which we do business. In addition, we have registered and maintain numerous internet domain names including “havertys.com.” Collectively, the logos, trademarks, service marks and domain names that we hold are of material importance to us.

Available Information

Our internet website address is www.havertys.com. In addition to the information about us contained in this 2023 Form 10-K, information about us can be found on our Investor Relations website at www.ir.havertys.com. This website contains a significant amount of information about us, including our corporate governance principles and practices and financial and other information. We are not including this or any other information on our website as a part of, nor incorporating it by reference into, this 2023 Form 10-K or any of our other filings with the Securities and Exchange Commission ("SEC").

Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports are available free of charge on our website at www.ir.havertys.com as soon as reasonably practicable after such material is electronically filed with, or furnished to, the SEC. The SEC also maintains a website that contains our SEC filings at www.sec.gov.

ITEM 1A. RISK FACTORS

The following discussion of risk factors contains forward-looking statements. These risk factors may be important to understanding any statement in this annual report on Form 10-K or elsewhere. The following information should be read in conjunction with Part II, Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” (MD&A), and the consolidated financial statements and related notes in Part II, Item 8. “Financial Statements and Supplementary Data” of this annual report on Form 10-K.

We routinely encounter and address risks, some of which may cause our future results to be different – sometimes materially different – than we presently anticipate. The following factors, as well as others described elsewhere in this report or in our other filings with the SEC, that could materially affect our business, financial condition or operating results should be carefully considered. Below, we describe certain important operational and strategic risks and uncertainties, but they are not the only risks we face. Our reactions to material future developments, as well as our competitors’ reactions to those developments, may also impact our business operations or financial results. If any of the following risks actually occur, our business, financial condition or operating results may be adversely affected.

Risks Related to Our Business

We face significant competition from national, regional and local retailers of home furnishings.

The retail market for home furnishings is highly fragmented and intensely competitive. We currently compete against a diverse group of retailers, including internet-only retailers, regional or independent specialty stores, dedicated franchises of furniture manufacturers and national department stores. In addition, there are few barriers to entry into our current and contemplated markets, and new competitors may enter our current or future markets at any time. Our existing competitors or new entrants into our industry may use a number of different strategies to compete against us, including aggressive advertising, pricing and marketing, social media campaigns and extension of credit to customers on terms more favorable than we offer. Furthermore, some of our competitors have greater financial resources and larger customer bases than we have, and as a result may have a more advanced multichannel platform, be able to adapt quicker to changes in consumer behavior, have attractive customer loyalty programs, and maintain higher profitability in an aggressive low-pricing environment. Rapidly evolving technologies are altering the manner in which retailers communicate and transact with customers, led by internet-based and multichannel retailers that have made significant investments in recent years, including with pricing technology and shipping capabilities.

Competition from any of these sources could cause us to lose market share, revenues and customers; increase expenditures; or reduce prices, any of which could have a material adverse effect on our results of operations.

If we fail to successfully anticipate or respond to changes in consumer preferences in a timely manner, our sales may decline.

Our products must appeal to our target consumers whose preferences, tastes and trends cannot be predicted with certainty and are subject to change. We continuously monitor changes in home design trends through attendance at international industry events and fashion shows, internal marketing research, and regular communication with our retailers and design professionals who provide valuable input on consumer tendencies. However, as with all retailers, our business is susceptible to changes in consumer tastes and trends. Our success depends upon our ability to anticipate and respond in a timely manner to fashion trends relating to home furnishings. If we fail to successfully identify and respond to these changes, our sales may decline.

Our future success is largely dependent on our ability to successfully implement our growth and other strategies.

Our future success, including our ability to achieve growth and increased profitability, is dependent on the ability of our management team to execute on our long-term business strategy, which includes increasing our retail footprint, expanding our online presence, increasing the efficiency and profitability of our operations, introducing new products in the marketplace and driving increased traffic to our retail stores and e-commerce site through updated marketing efforts. If any of these initiatives are not successful, or require extensive investment, our growth may be limited, and we may be unable to achieve or maintain expected levels of growth and profitability. Furthermore, our ability to expand our retail footprint is dependent on our ability to identify, secure and develop new retail locations, which involves factors outside of our control.

Inability to maintain and enhance our brand may materially adversely impact our business.

Maintaining and enhancing our brand is critical to our ability to retain and expand our base of customers and may require us to make substantial investments. Our advertising campaigns utilize digital, television, and social media to maintain and enhance our existing brand equity. We cannot provide assurance that our marketing, advertising, and other efforts to promote and maintain awareness of our brand will be successful and we may incur substantial costs in such efforts. Furthermore, our brand and reputation could be harmed by negative media, including social media, attention, negative online reviews, cybersecurity incidents, product liability or safety concerns or other matters. If our marketing, advertising, and other efforts are unsuccessful or our brand or reputation is damaged, our business, operating results and financial condition could be materially adversely affected.

We import a substantial portion of our merchandise from foreign sources. This exposes us to certain risks that include political and economic conditions. Changes in exchange rates or tariffs could impact the price we pay for these goods, resulting in potentially higher retail prices and/or lower gross profit on these goods.

Based on product costs, approximately 61% of our total furniture purchases (which exclude accessories and mattresses) in 2023 were for goods that were not produced domestically. All our purchases are denominated in U.S. dollars. As exchange rates between the U.S. dollar and certain other currencies become unfavorable, the likelihood of price increases from our vendors increases. Some of the products we purchase are also subject to tariffs. If tariffs are imposed on additional products or the tariff rates are increased, our vendors may increase their prices. Such changes, if they occur, could have one or more of the following impacts:

•we could be forced to raise retail prices so high that we are unable to sell the products at current unit volumes;

•if we are unable to raise retail prices commensurately with the cost increases, gross profit as recognized under our LIFO inventory accounting method could be negatively impacted; or

•we may be forced to find alternative sources of comparable product, which may be more expensive than the current product or of lower quality, or the vendor may be unable to meet our requirements for quality, quantities, delivery schedules or other key terms.

We are dependent upon the ability of our third-party producers to meet our requirements; any failures by these producers, or the unavailability of suitable suppliers at reasonable prices or limitations on our ability to source from third-party producers may negatively impact our ability to deliver quality merchandise to our customers on a timely basis or result in higher costs or reduced net sales.

We source substantially all of our products from non-exclusive, third-party producers, many of which are located in foreign countries. Although we have long-term relationships with many of our suppliers, we must compete with other companies for the production capacity of these independent manufacturers. We regularly depend upon the ability of third-party producers to secure a sufficient supply of raw materials, develop a skilled workforce, adequately finance the production of goods ordered and maintain sufficient manufacturing and shipping capacity. Although we monitor production and quality in many third-party manufacturing locations, we cannot be certain that we will not experience operational difficulties with our manufacturers, such as the reduction of availability of production capacity, errors in complying with product specifications, insufficient quality control, failures to meet production deadlines or increases in manufacturing costs. Such difficulties may negatively impact our ability to deliver quality products to our customers on a timely basis, which may, in turn, have a negative impact on our customer relationships and result in lower net sales.

We also require third-party producers to meet certain standards in terms of working conditions, environmental protection and other matters before placing business with them. As a result of costs relating to compliance with these standards, we may pay higher prices than some of our competitors for products. In addition, failure by our independent manufacturers to adhere to ethical labor or other laws or business practices, and the potential litigation, negative publicity and political pressure relating to any of these events, could disrupt our operations or harm our reputation.

Our vendors might fail in meeting our quality control standards or reacting to changes to the legislative or regulatory framework regarding product safety.

All of our vendors must comply with applicable product safety laws and regulations, and we are dependent on them to ensure that the products we buy comply with all safety standards as well applicable quality standards. Any actual, potential or perceived product safety concerns could expose us to government enforcement action or private litigation and could result in recalls and other liabilities. Such exposure could harm our brand’s image and negatively affect our business and operating results. Furthermore, concerns around the quality of the products we sell could damage our reputation and result in loss of future revenues.

Significant fluctuations in the price, availability and quality of raw materials and components could adversely affect our profits.

The primary materials our vendors use to produce and manufacture our products are various woods and wood products, resin, steel, leather, cotton, and certain oil-based products. On a global and regional basis, the sources and prices of those materials and components are susceptible to significant price fluctuations due to supply/demand trends, transportation costs, government regulations and tariffs, changes in currency exchange rates, price controls, the economic and political climate, and other unforeseen circumstances. While the global supply chain challenges experienced as a result of the COVID-19 pandemic lessened over the past two years, there can be no assurance that further challenges, including shutdowns and shipping delays, will not occur. Such supply chain disruptions could materially adversely impact the ability of our suppliers to fulfil our orders in a timely manner, if at all, and could lead to increased prices, which we may not be able to pass through to our customers.

Our revenue can be adversely affected by our ability to successfully forecast our supply chain needs and our foreign manufacturers’ ability to comply with international trade rules and regulations.

Optimal product flow is dependent on demand planning and forecasting, supplier production according to such planning, and timely transportation. We often make commitments to purchase products from our vendors in advance of proposed production dates. Significant deviation from the projected demand for products that we sell may have an adverse effect on our results of operations and financial condition, either from lost sales or lower margins resulting from inventory-driven price reductions. Disruptions to our supply chain could result in late product arrivals. Increased levels of out-of-stock merchandise and loss of confidence by customers in our ability to deliver goods as promised could negatively affect sales.

In addition, there is a risk that compliance lapses by our foreign manufacturers could occur which could lead to investigations by U.S. government agencies responsible for international trade compliance. Resulting penalties or enforcement actions could delay future imports or otherwise negatively impact our business. There also remains a risk that one or more of our foreign manufacturers will not adhere to applicable legal requirements or our compliance standards such as fair labor standards, the prohibition on child labor and other product safety or manufacturing safety standards. The violation of applicable legal requirements, including labor, manufacturing and safety laws, by any of our manufacturers, the failure of any of our manufacturers to adhere to our global compliance standards or the divergence of the labor practices followed by any of our manufacturers from those generally accepted in the U.S. could disrupt our supply of products from our manufacturers, could result in potential liability to us or could harm our reputation and brand, any of which could negatively affect our business and operating results.

We rely on third party transportation providers for substantially all of our product shipments from our vendors.

We rely on third party service providers for substantially all of our product shipments from our vendors, both domestic and foreign, to our DCs and also to handle over-the-road delivery of product from the DCs to our HDCs and some market areas. Our and our vendors’ utilization of these shipping services is subject to risks that are outside of our control, including increases in fuel prices and labor costs, employee strikes, labor shortages, strikes and union organizing activity, delays in shipping (including congestion at domestic and foreign ports), delays in unloading cargo from ships, availability of adequate trucking or railway providers, adverse weather, natural disasters, possible acts of terrorism and outbreaks of disease. All of these risks may impact our ability to receive products from our vendors to necessary points in our distribution system in a cost-effective and timely manner.

Any increases in these shipping costs may result in higher costs to us, and we may be unsuccessful in passing along these costs to our customers, negatively impacting our margins and profitability. Furthermore, any delays in receiving products may negatively impact our ability to deliver these products to our customers in a timely manner. Failure to make timely customer deliveries or long lead times for products could cause customers to cancel their orders or not place orders, which, could damage our brand and reputation and negatively impact our business, financial condition, operating results and prospects.

Because of our limited number of distribution centers, our operating results could suffer if one is damaged.

We utilize three large distribution centers to flow our merchandise from the vendor to the consumer. This system is very efficient for reducing inventory requirements but makes us operationally vulnerable should one of these facilities become damaged or experience significant business interruption. If such an interruption were to occur, our ability to deliver our products in a timely manner would likely be impacted.

We rely extensively on information technology systems to process transactions, summarize results, and manage our business. Disruptions in our information technology systems could adversely affect our business and operating results.

Our ability to operate our business from day to day, in particular our ability to manage our point-of-sale, distribution system and payment information, largely depends on the efficient operation of our computer hardware and software systems. We use management information systems to communicate customer information, provide real-time inventory information, and to handle all facets of our distribution system from receipt of goods in the DCs to delivery to our customers’ homes. These systems are subject to damage or interruption from power outages, computer and telecommunications failures, viruses, phishing attempts, cyber‑attacks, malware and ransomware attacks, security breaches, severe weather, natural disasters, and errors by employees.

The failure of these systems to operate effectively, problems with integrating various data sources, challenges in transitioning to upgraded or replacement systems, difficulty in integrating new systems, or a breach in security of these systems could adversely impact the operations of our business. Though losses arising from some of these issues would be covered by insurance, interruptions of our critical business information technology systems or failure of our back-up systems could result in longer production times or negatively impact customers resulting in damage to our reputation and a reduction in sales. If our critical information technology systems or back-up systems were damaged or ceased to function properly, we might have to make a significant investment to repair or replace them.

Successful cyber-attacks and the failure to maintain adequate cyber-security systems and procedures could materially harm our business.

Cyber threats are rapidly evolving, and those threats and the means for obtaining access to information in digital and other storage media are becoming increasingly sophisticated. Cyber threats and cyber-attackers, including ransomware attacks, can be sponsored by countries or sophisticated criminal organizations or be the work of single “hackers” or small groups of “hackers.”

We invest in industry standard security technology to protect the Company’s data and business processes against risk of data security breach and cyber-attack. Our data security management program includes identity, trust, vulnerability and threat management business processes as well as adoption of standard data protection policies. We measure our data security effectiveness through industry accepted methods. We are continuously installing new and upgrading existing information technology systems. We use employee awareness training around phishing, malware, and other cyber risks to ensure that the Company is protected, to the greatest extent possible, against cyber risks and security breaches. We are regularly the target of attempted cyber and other security threats and must continuously monitor and develop our information technology networks and infrastructure to prevent, detect, address and mitigate the risk of unauthorized access, misuse, computer viruses and other events that could have a security impact. Insider or employee cyber and security threats are increasingly a concern for all companies, including ours. Additionally, we certify our major technology suppliers and any outsourced services through accepted security certification standards.

Nevertheless, as cyber threats evolve, change and become more difficult to detect and successfully defend against, one or more cyber-attacks might defeat our or a third-party service provider’s security measures in the future and could result in the leak of personal information of customers, employees or business partners. Employee error or other irregularities may also result in a failure of our security measures and a breach of information systems. Moreover, hardware, software or applications we use may have inherent defects of design, manufacture or operations or could be inadvertently or intentionally implemented or used in a manner that could compromise information security. A security breach and loss of information may not be discovered for a significant period of time after it occurs. While we have no knowledge of a material security breach to date, any compromise of data security could result in a violation of applicable privacy and other laws or standards, the loss of valuable business data, or a disruption of our business. In addition, the costs to eliminate or alleviate network security problems, bugs, viruses, worms, malicious software programs and security vulnerabilities could be significant, and our efforts to address these problems may not be successful and could result in potential theft, loss, destruction or corruption of information we store electronically, as well as unexpected interruptions, delays or cessation of service, any of which could cause harm to our business operations.

Moreover, a security breach involving the misappropriation, loss or other unauthorized disclosure of sensitive or confidential information could give rise to unwanted media attention, materially damage our customer relationships and reputation, and result in litigation or fines, fees, or potential liabilities, which may not be covered by our insurance policies, each of which could have a material adverse effect on our business, results of operations and financial condition.

We may be unable to attract, train, engage and retain key teammates.

Our long-term success and ability to implement our strategic and business planning goals depends on our ability to attract, motivate and retain a sufficient number of store and other employees who understand and appreciate our corporate culture and customers. Turnover in the retail industry is generally high. Excessive employee turnover will result in higher employee costs associated with finding, hiring and training new store employees. Furthermore, labor shortages and competition may make it more difficult for us to adequately staff our retail stores and distribution operations and may result in increased labor expenses to us. If we are unable to hire and retain store and other personnel capable of consistently providing a high level of customer service, our ability to open new stores and service the needs of our customers may be impaired, the performance of our existing and new stores and operations could be materially adversely affected and our brand image may be negatively impacted.

We must also be able to attract, motivate and retain the teammates who staff our distribution centers, customer service centers, and deliver product to our customers, and professionals to implement our technology and other strategic initiatives. Our ability to meet our labor needs while controlling labor costs is subject to numerous external factors, including market pressures with respect to prevailing wage rates, equity compensation, unemployment levels, and health and other insurance costs; the impact of legislation or regulations governing labor and employee relations, immigration, federal and state minimum wage requirements, and benefit costs; changing demographics; and our reputation within the labor market. If we are

unable to attract and retain a workforce that meets our needs, our operations, service levels, support functions, and competitiveness could suffer and our results could be adversely affected.

A failure to recruit, develop and retain effective leaders or the loss or shortage of personnel with key capacities and skills could impact our strategic growth plans and jeopardize our ability to meet our business performance expectations and growth targets.

Our ability to continue to grow our business depends substantially on the contributions and abilities of our executive leadership team and other key management personnel. Changes in senior management could expose us to significant changes in strategic direction and initiatives. A failure to maintain appropriate organizational capacity and capability to support our strategic initiatives or to build adequate bench strength with key skillsets required for seamless succession of leadership, could jeopardize our ability to meet our business performance expectations and growth targets. If we are unable to attract, develop, retain and incentivize sufficiently experienced and capable management personnel, our business and financial results may suffer.

General Risks

An overall decline in the health of the economy and consumer spending may affect consumer purchases of discretionary items, which could reduce demand for our products and materially harm our sales, profitability and financial condition.

Our business depends on consumer demand for our products and, consequently, is sensitive to a number of factors that influence general consumer spending on discretionary items in particular. Factors influencing consumer spending include general economic conditions, consumer disposable income, fuel prices, inflation, recession and fears of recession, unemployment, inclement weather, availability of consumer credit, consumer debt levels, conditions in the housing market, interest rates, sales tax rates and rate increases, sustained periods of inflation, civil disturbances and terrorist activities, foreign currency exchange rate fluctuations, consumer confidence in future economic and political conditions, natural disasters, and consumer perceptions of personal well‑being and security, including health epidemics or pandemics, such as the COVID-19 pandemic. Prolonged or pervasive economic downturns could slow the pace of new store openings or cause current stores

to temporarily or permanently close. Adverse changes in factors affecting discretionary consumer spending have reduced and may continue to further reduce consumer demand for our products, thus reducing our sales and harming our business and operating results.

Historically, because customers consider home furnishings to be postponable purchases, the home furnishings industry has been subject to cyclical variations in the general economy and to uncertainty regarding future economic prospects.

The rise of oil and gasoline prices could affect our profitability.

A significant increase in oil and gasoline prices could adversely affect our profitability. In addition, governmental efforts to combat climate change through reduction of greenhouse gases may result in higher fuel costs through taxation or other means. Our distribution system, which utilizes three DCs and multiple home delivery centers is very transportation dependent and includes the use of third-party providers to reach the 22 states and the District of Columbia that we serve from our stores across 16 Southern and Midwestern states. Merchandise is delivered to customers' homes by Havertys delivery teams. If transportation costs exceed amounts we are able to effectively pass on to the consumer, either by higher prices and/or higher delivery charges, then our profitability will suffer.

ESG risks could adversely affect our reputation and shareholder, employee, customer and third-party relationships and may negatively affect our stock price.

Businesses face increasing public scrutiny related to environmental, social and governance (“ESG”) activities. We risk damage to our brand and reputation if we fail to act responsibly in a number of areas, such as environmental stewardship, including with respect to climate change, human capital management, support for our local communities, corporate governance and transparency, or fail to consider ESG factors in our business operations.

Additionally, investors and shareholder advocates are placing ever increasing emphasis on how corporations address ESG issues in their business strategy when making investment decisions and when developing their investment theses and proxy recommendations. We may incur meaningful costs with respect to our ESG efforts and if such efforts are negatively perceived, our reputation and stock price may suffer.

Pending or unforeseen litigation and the potential for adverse publicity associated with litigation could have a material adverse effect on us.

We are involved from time to time in various legal proceedings arising in the ordinary course of our business, including commercial, consumer safety, product liability, employment and intellectual property claims. We currently do not expect the outcome of any pending matters to have a material adverse effect on our consolidated results of operations, financial position or cash flows. Litigation, however, is inherently unpredictable, and it is possible that the ultimate outcome of one or more pending claims asserted against us, or claims that may be asserted in the future that we are currently not aware of, or adverse publicity resulting from any such litigation, could adversely impact our business, reputation, sales, profitability, cash flows and financial condition.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 1C. Cybersecurity

Risk management and strategy

We have processes in place to identify, assess and monitor material risks from cybersecurity threats. These processes are part of our overall enterprise risk management process and are part of our operating procedures, internal controls, and information systems. These risks include, among other things, operational risks; fraud; extortion; harm to employees or customers; violation of privacy or security laws and other litigation and legal risk; and reputational risks. We have developed and implemented a cybersecurity framework intended to assess, identify and manage risks from threats to the security of our information, systems, and network using a risk-based approach. The framework is informed in part by the National Institute of Standards and Technology (NIST) Cybersecurity Framework, although this does not imply that we meet all technical standards, specifications or requirements under the NIST.

Our key cybersecurity processes include the following:

•Risk-based controls for information systems and information on our networks: We seek to maintain an information technology infrastructure that implements physical, administrative and technical controls that are calibrated based on risk and designed to protect the confidentiality, integrity and availability of our information systems and information stored on our networks, including customer and employee information.

•Cybersecurity incident response plan and testing: We have a cybersecurity incident response plan and dedicated teams to respond to cybersecurity incidents. When a cybersecurity incident occurs or we identify a vulnerability, we have cross-functional teams that are responsible for leading the initial assessment of priority and severity, and external experts may also be engaged as appropriate. Our cybersecurity teams assist in responding to incidents depending on severity levels and seek to improve our cybersecurity incident management plan through periodic tabletops or simulations.

•Training: We provide security awareness training to help our employees understand their information protection and cybersecurity responsibilities. We also provide additional training to some employees based their roles.

•Supplier risk assessments: Our processes also address cybersecurity threat risks associated with our use of third-party service providers, including those in our supply-chain or who have access to our customer and employee data on our systems. Third-party risks are included within our risk management assessment program, as well as our cybersecurity-specific risk identification program. These considerations affect the selection and access to our systems, data, or facilities. We also seek contractual commitments from key suppliers to appropriately secure and maintain their information technology systems and protect our information that is processed on their systems.

•Third-party assessments: We have third-party cybersecurity companies engaged to periodically assess our cybersecurity posture, to assist in identifying and remediating risks from cybersecurity threats. We have implemented several cybersecurity processes, technologies, and controls to aid in our efforts to assess, identify, and manage such risks.

As part of the above processes, we regularly engage with consultants, auditors, and other third-parties, including reviewing our cybersecurity program to help identify areas for continued focus, improvement and/or compliance.

To date, risks from cybersecurity threats or incidents have not materially affected the Company. However, the sophistication of and risks from cybersecurity threats and incidents continues to increase, and the preventative actions we have taken and continue to take to reduce these risks and protect our systems and information may not successfully protect against all cybersecurity threats and incidents. For more information on how cybersecurity risk could materially affect our business strategy, results of operations, or financial condition, please refer to Item 1A Risk Factors.

Cybersecurity Governance

The board of directors, as a whole, has oversight responsibility for our strategic and operational risks. The audit committee regularly reviews and discusses with management the strategies, processes and controls pertaining to the management of our information technology operations, including cyber risks and cybersecurity. Our Chief Information Officer (CIO) and other internal members of our technology team provide regular reports to the audit committee regarding the evolving cybersecurity landscape, including emerging risk, as well as our processes, program and initiatives for managing these risks. The audit committee, in turn, periodically reports on its review with the board of directors.

Management is responsible for day-to-day assessment and management of cybersecurity risks. Our cybersecurity risk management and strategy processes are led by our CIO, VP Information Technology, and Manager of Security. Such individuals have collectively over 50 years of work experience in various roles managing information security, developing cybersecurity strategy, and implementing effective information and cybersecurity programs.

The CIO also presents at least annually to the Board an overview of our cybersecurity threat risk management and strategy processes covering topics such as data security posture, results of third-party assessments, our incident response plan, and cybersecurity threat risks or incidents and developments, as well as the steps management has taken to respond to such risks.

ITEM 2. PROPERTIES

Stores

Our retail store space at December 31, 2023 totaled approximately 4.4 million square feet for 124 stores. The following table sets forth the number of stores we operated at December 31, 2023 by state:

| | | | | | | | | | | | | | |

| State | Number of Stores | | State | Number of Stores |

| Florida | 30 | | Maryland | 4 |

| Texas | 21 | | Arkansas | 3 |

| Georgia | 15 | | Louisiana | 3 |

| North Carolina | 10 | | Ohio | 3 |

| Virginia | 10 | | Kentucky | 2 |

| South Carolina | 7 | | Missouri | 2 |

| Alabama | 6 | | Indiana | 1 |

| Tennessee | 6 | | Kansas | 1 |

The 39 retail locations which we owned at December 31, 2023 had a net book value for land and buildings of $65.0 million. The remaining 85 locations are leased by us with various termination dates through 2035 plus renewal options.

Distribution Facilities

All of our distribution facilities at December 31, 2023 were leased except for the Florida and Virginia properties. Our regional distribution facilities are in the following locations:

| | | | | |

Location | Approximate Square Footage |

| Braselton, Georgia | 808,000 |

| Coppell, Texas | 409,000 |

| Lakeland, Florida | 335,000 |

| Colonial Heights, Virginia | 129,000 |

| Fairfield, Ohio | 72,000 |

| Theodore, Alabama | 42,000 |

| Memphis, Tennessee | 30,000 |

Corporate Facilities

We lease approximately 48,000 square feet on two floors of a suburban mid-rise office building located at 780 Johnson Ferry Road, Suite 800, Atlanta, Georgia.

We believe that our facilities are suitable and adequate for present purposes, and that the productive capacity in such facilities is substantially being utilized. For additional information, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in this report under Item 7 of Part II.

ITEM 3. LEGAL PROCEEDINGS

The Company is subject to various claims and legal proceedings covering a wide range of matters, including with respect to product liability and personal injury claims, that arise in the ordinary course of its business activities. We currently have no pending claims or legal proceedings that we believe would be reasonably likely to have a material adverse effect on our financial condition, results of operations or cash flows. However, there can be no assurance that either future litigation or an unfavorable outcome in existing claims will not have a material impact on our business, reputation, financial position, cash flows or results of operations.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

INFORMATION ABOUT OUR EXECUTIVE OFFICERS

Our executive officers are elected or appointed annually by the Board of Directors for terms of one year or until their successors are elected and qualified, subject to removal by the Board at any time. The following are the names, ages and current positions of our executive officers and, if they have not held those positions for the past five years, their former positions during that period with Havertys or other companies.

| | | | | | | | | | | | | | |

| Name, age and office (as of March 1, 2024) and year elected to office | Principal occupation during last five years other than office of the Company currently held |

| Clarence H. Smith | 73 | Chairman of the Board Chief Executive Officer | 2012

2002 | President and Chief Executive Officer, 2002-March 1, 2021 |

| | Director | 1989 | |

| Steven G. Burdette | 62 | President | 2021 | Executive Vice President, Operations 2017-March 1, 2021

Executive Vice President, Stores, 2008-2017 |

| J. Edward Clary | 63 | Executive Vice President, and Chief Information Officer | 2015 | Has held this position for the last five years. |

| John L. Gill | 60 | Executive Vice President, Merchandising | 2019 | Senior Vice President, Merchandising 2018-2019;

Vice President, Merchandising 2017-2018 |

| Richard B. Hare | 57 | Executive Vice President and Chief Financial Officer | 2017 | Has held this position for the last five years. |

| Helen B. Bautista | 57 | Senior Vice President, Marketing | 2021 | Vice President, Marketing for Havertys, 2019-March 1, 2021;

Senior Vice President Group Account Director, 2018-2019 for Fitzco, a McCann World Group Agency |

| Kelley A. Fladger | 54 | Senior Vice President and Chief Human Resources Officer | 2019 | Vice President, Human Resource Services, 2016-2019 and Chief Diversity and Inclusion Officer, 2017-2019 for Perdue Farms, Inc. |

| | | | |

| Jenny Hill Parker | 65 | Senior Vice President, Finance, and Corporate Secretary | 2019 | Senior Vice President, Finance, Treasurer and Corporate Secretary

2010-2019 |

| Janet E. Taylor | 62 | Senior Vice President, General Counsel | 2010 | Has held this position for the last five years |

Clarence H. Smith and one of our directors, Rawson Haverty, Jr., are first cousins.

PART II

ITEM 5. MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

Our stock began trading publicly in October 1929. We have two classes of common stock which trade on The New York Stock Exchange ("NYSE") under the symbol HVT for our common stock ("Common Stock") and HVT.A for our Class A Common stock ("Class A Common Stock").

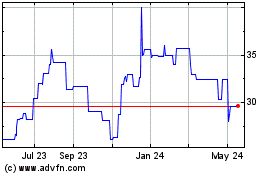

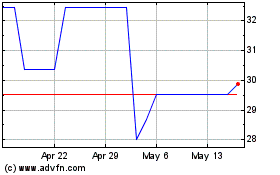

Stock Performance Graph

The following graph compares the performance of Havertys’ Common Stock and Class A Common Stock against the cumulative return of the NYSE/AMEX/Nasdaq Home Furnishings & Equipment Stores Index (SIC Codes 5700 – 5799) and the S&P SmallCap 600 Index for the period of five years commencing December 31, 2018 and ending December 31, 2023. The graph assumes an initial investment of $100 on January 1, 2018 and reinvestment of dividends. NOTE: Prepared by Zacks Investment Research, Inc. Used with permission. All rights reserved. Copyright 1980-2024. Index Data: Copyright Standard and Poor’s, Inc. Used with permission. All rights reserved.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2018 | | 2019 | | 2020 | | 2021 | | 2022 | | 2023 |

| | | | | | | | | | | |

| HVT | $ | 100.00 | | | $ | 111.59 | | | $ | 170.53 | | | $ | 205.69 | | | $ | 215.60 | | | $ | 274.78 | |

| HVT-A | $ | 100.00 | | | $ | 113.83 | | | $ | 180.99 | | | $ | 204.99 | | | $ | 221.09 | | | $ | 272.82 | |

| S&P SmallCap 600 Index | $ | 100.00 | | | $ | 122.78 | | | $ | 136.64 | | | $ | 173.29 | | | $ | 145.39 | | | $ | 168.73 | |

| SIC Codes 5700-5799 | $ | 100.00 | | | $ | 150.35 | | | $ | 205.18 | | | $ | 277.11 | | | $ | 182.77 | | | $ | 212.77 | |

Stockholders

Based on the number of individual participants represented by security position listings, there are approximately 11,400 holders of our common stock and 200 holders of our Class A common stock as of February 5, 2024.

Dividends