UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number: |

811-08266 |

| |

|

| Exact name of registrant as specified in charter: |

The India Fund, Inc. |

| |

|

| Address of principal executive offices: |

1900 Market Street, Suite 200 |

| |

Philadelphia, PA 19103 |

| |

|

| Name and address of agent for service: |

Ms. Sharon Ferrari |

|

abrdn Inc. |

|

1900 Market Street, Suite 200 |

|

Philadelphia, PA 19103 |

| |

|

| Registrant’s telephone number, including area code: |

800-522-5465 |

| |

|

| Date of fiscal year end: |

December 31 |

| |

|

| Date of reporting period: |

June 30, 2023 |

Item 1 - Reports to Stockholders.

(a) A copy of the report transmitted

to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (the “1940 Act”) is filed herewith.

The India Fund, Inc. (IFN)

Semi-Annual Report

June 30, 2023

Managed Distribution Policy

(unaudited)

The Board of Directors of The India Fund,

Inc. (the “Fund”) has authorized a managed distribution policy (“MDP”) of paying quarterly distributions at an annual rate, set once a year, that is a percentage of the average daily net asset

value (“NAV”) for the previous three months as of the month-end prior to declaration.

The Fund’s

distributions will be paid in newly issued shares of common stock of the Fund to all shareholders who have not otherwise elected to receive cash. Shareholders may request to be paid their quarterly distributions

in cash instead of shares of common stock by providing advance notice to the bank, brokerage or nominee who holds their shares if the shares are in “street name” or by filling out in advance an election

card received from Computershare Investor Services if the shares are in registered form.

With each distribution, the Fund will issue

a notice to shareholders and an accompanying press release which will provide detailed information regarding the amount and composition of the distribution and other information required by the Fund’s MDP

exemptive order. The Fund’s Board of Directors may amend or terminate the MDP at any time without prior notice to shareholders; however, at this time, there are no reasonably foreseeable circumstances that might

cause the termination of the MDP. You should not draw any conclusions about the Fund’s investment performance from the amount of distributions or from the terms of the Fund’s MDP.

Distribution Disclosure

Classification (unaudited)

The Fund’s policy is to provide

investors with a stable distribution rate. Each quarterly distribution will be paid out of current income, supplemented by realized capital gains and, to the extent necessary, paid-in capital.

The Fund is subject to U.S.

corporate, tax and securities laws. Under U.S. tax rules, the amount applicable to the Fund and character of distributable income for each fiscal period depends on the actual exchange rates during the entire year

between the U.S. Dollar and the currencies in which Fund assets are denominated and on the aggregate gains and losses realized by the Fund during the entire year.

Therefore, the exact amount

of distributable income for each fiscal year can only be determined as of the end of the Fund’s fiscal year, December 31. Under Section 19 of the Investment Company Act of

1940, as amended (the “1940

Act”), the Fund is required to indicate the sources of certain distributions to shareholders. The estimated distribution composition may vary from quarter to quarter because it may be materially impacted by

future income, expenses and realized gains and losses on securities and fluctuations in the value of the currencies in which Fund assets are denominated.

Based on generally accepted

accounting principles (GAAP), the Fund estimates the distributions for the fiscal year commenced January 1, 2023 through the distribution declared on August 9, 2023 consisted of 1% short-term capital gains and 99%

long-term capital gains.

In January 2024, a Form

1099-DIV will be sent to shareholders, which will state the final amount and composition of distributions and provide information with respect to their appropriate tax treatment for the 2023 calendar year.

Letter to Shareholders (unaudited)

Dear Shareholder,

We present the Semi-Annual

Report, which covers the activities of The India Fund, Inc. (the “Fund”), for the six-month period ended June 30, 2023. The Fund’s investment objective is long-term capital appreciation, which the

Fund seeks to achieve by investing primarily in the equity securities of Indian companies.

Total Investment Return1

For the six-month period

ended June 30, 2023, the total return to shareholders of the Fund based on the net asset value (“NAV”) and market price of the Fund, respectively, compared to the Fund’s benchmark is as follows:

| NAV2,3

| 8.20%

|

| Market Price2

| 18.16%

|

| MSCI India Index (Net Daily Total Return)4

| 5.11%

|

For more information about

Fund performance, please visit the Fund on the web at www.abrdnifn.com. Here, you can view quarterly commentary on the Fund's performance, monthly fact sheets, distribution and performance information, and other Fund

literature.

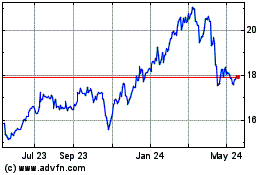

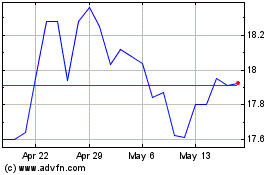

NAV, Market Price and

Premium(+)/Discount(-)

The below table represents

comparison from current six-month period end to prior fiscal year end of market price to NAV and associated Premium(+) and Discount(-).

|

|

|

|

| NAV

| Closing

Market

Price

| Premium(+)/

Discount(-)

|

| 6/30/2023

| $16.72

| $16.60

| -0.72%

|

| 12/31/2022

| $16.29

| $14.81

| -9.09%

|

During the six-month period

ended June 30, 2023, the Fund’s NAV was within a range of $15.15 to $16.72 and the Fund’s market price

traded within a range of $14.48 to $16.60.

During the six-month period ended June 30, 2023, the Fund’s shares traded within a range of a premium(+)/discount(-) of 0.03% to -7.00%.

Managed Distribution Policy

The Fund has a managed

distribution policy of paying quarterly distributions at an annual rate, set once a year, that is a percentage of the average daily NAV for the previous three months as of the month-end prior to declaration. In

February 2023, the Board determined the rolling distribution rate to be 10% for the 12-month period commencing with the distribution payable in March 2023. This policy will be subject to regular review by the Board.

The distributions will be made from current income, supplemented by realized capital gains and, to the extent necessary, paid-in capital, which is a nontaxable return of capital.

On August 9, 2023, the Fund

announced that it will pay on September 29, 2023, a stock distribution of US $0.41 per share to all shareholders of record as of August 24, 2023. This stock distribution will automatically be paid in newly issued

shares of the Fund unless otherwise instructed by the shareholder. Shares of common stock will be issued at the lower of the NAV per share or the market price per share with a floor for the NAV of not less than 95% of

the market price. Fractional shares will generally be settled in cash, except for registered shareholders with book entry accounts at Computershare Investor Services who will have whole and fractional shares added to

their account.

Shareholders may request to

be paid their quarterly distributions in cash instead of shares of common stock by providing advance notice to the bank, brokerage or nominee who holds their shares if the shares are in “street name” or by

filling out in advance an election card received from Computershare Investor Services if the shares are in registered form.

{foots1}

| 1

| Past performance is no guarantee of future results. Investment returns and principal value will fluctuate and shares, when sold, may be worth more or less than original cost. Current performance may be

lower or higher than the performance quoted. NAV return data include investment management fees, custodial charges and administrative fees (such as Director and legal fees) and assumes the reinvestment of all

distributions.

|

{foots1}

| 2

| Assuming the reinvestment of dividends and distributions.

|

{foots1}

| 3

| The Fund’s total return is based on the reported NAV for each financial reporting period end and may differ from what is reported on the Financial Highlights due to financial statement rounding or adjustments.

|

{foots1}

| 4

| The MSCI India Index (Net Daily Total Return) is designed to measure the performance of the large and mid-cap segments of the Indian market. With 113 constituents, the index covers approximately 85% of

the Indian equity universe. The Index is calculated net of withholding taxes, to which the Fund is generally subject. Indexes are unmanaged and have been provided for comparison purposes only. No fees or expenses are

reflected. You cannot invest directly in an index. Index performance is not an indication of the performance of the Fund itself. For more information about Fund performance, please visit http://www.abrdnifn.com.

|

Letter to Shareholders (unaudited) (concluded)

The Fund is covered under exemptive relief

received by the Fund’s investment manager from the U.S. Securities and Exchange Commission (“SEC”) that allows the Fund to distribute long-term capital gains as frequently as monthly in any one

taxable year.

Unclaimed Share Accounts

Please be advised that

abandoned or unclaimed property laws for certain states require financial organizations to transfer (escheat) unclaimed property (including Fund shares) to the state. Each state has its own definition of unclaimed

property, and Fund shares could be considered “unclaimed property” due to account inactivity (e.g., no owner-generated activity for a certain period), returned mail (e.g., when mail sent to

a shareholder is returned to the Fund’s transfer agent as undeliverable), or a combination of both. If your Fund shares are categorized as unclaimed, your financial advisor or the Fund’s

transfer agent will follow the applicable state’s statutory requirements to contact you, but if unsuccessful, laws may require that the shares be escheated to the appropriate state. If this happens, you will

have to contact the state to recover your property, which may involve time and expense. For more information on unclaimed property and how to maintain an active account, please contact your financial adviser or the

Fund’s transfer agent.

Open Market Repurchase Program

The Fund’s Board

approved an open market repurchase and discount management policy (the “Program”). The Program allows the Fund to purchase, in the open market, its outstanding common shares, with the amount and timing of

any repurchase determined at the discretion of the Fund’s investment manager. Such purchases may be made opportunistically at certain discounts to net asset value per share in the reasonable judgment of

management based on historical discount levels and current market conditions. If shares are repurchased, the Fund reports repurchase activity on the Fund's website on a monthly basis. For the six-month period

ended June 30, 2023, the Fund did not repurchase any shares through the Program.

On a quarterly basis, the

Fund’s Board will receive information on any transactions made pursuant to this policy during the prior quarter and management will post the number of shares repurchased on the Fund’s website on a monthly

basis. Under the terms of the Program, the Fund is permitted to repurchase up to 10% of its outstanding shares of common stock in the open market during any 12 month period.

Portfolio Holdings Disclosure

The Fund’s complete

schedule of portfolio holdings for the second and fourth quarters of each fiscal year are included in the Fund’s semi-annual and annual reports to shareholders. The Fund files its complete schedule of portfolio

holdings with the Securities

and Exchange Commission (the

“SEC”) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. These reports are available on the SEC’s website at http://www.sec.gov. The Fund makes the

information available to shareholders upon request and without charge by calling Investor Relations toll-free at 1-800-522-5465.

Proxy Voting

A description of the policies

and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities and information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12 month

period ended June 30 is available by August 31 of the relevant year: (1) upon request without charge by calling Investor Relations toll-free at 1-800-522-5465; and (2) on the SEC’s website at

http://www.sec.gov.

Investor Relations Information

As part of abrdn’s

commitment to shareholders, we invite you to visit the Fund on the web at www.abrdnifn.com. There, you can view monthly fact sheets, quarterly commentary, distribution and performance information, and other Fund

literature.

Enroll in abrdn’s email

services and be among the first to receive the latest closed-end fund news, announcements, videos, and other information. In addition, you can receive electronic versions of important Fund documents, including annual

reports, semi-annual reports, prospectuses and proxy statements. Sign up today at https://www.abrdn.com/en-us/cefinvestorcenter/contact-us/preferences

Contact Us:

| •

| Visit: https://www.abrdn.com/en-us/cefinvestorcenter

|

| •

| Email: Investor.Relations@abrdn.com; or

|

| •

| Call: 1-800-522-5465 (toll free in the U.S.).

|

Yours sincerely,

/s/ Alan Goodson

Alan Goodson

President

{foots1}

All amounts are U.S.

Dollars unless otherwise stated.

Total Investment Return (unaudited)

The following table summarizes

the average annual Fund performance compared to the Fund’s primary benchmark for the six-month (not annualized), 1-year, 3-year, 5-year and 10-year periods ended June 30, 2023.

|

| 6 Months

| 1 Year

| 3 Years

| 5 Years

| 10 Years

|

| Net Asset Value (NAV)

| 8.20%

| 12.69%

| 13.25%

| 5.08%

| 9.28%

|

| Market Price

| 18.16%

| 21.84%

| 18.32%

| 7.62%

| 10.94%

|

| MSCI India Index (Net Daily Total Return)

| 5.11%

| 14.15%

| 19.33%

| 8.76%

| 8.87%

|

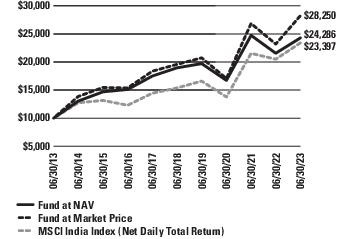

Performance of a $10,000

Investment (as of June 30, 2023)

This graph shows the change in

value of a hypothetical investment of $10,000 in the Fund for the period indicated. For comparison, the same investment is shown in the indicated index.

Returns represent past

performance. Total investment return at NAV is based on changes in the NAV of Fund shares and assumes reinvestment of dividends and distributions, if any, at market prices pursuant to the dividend reinvestment program

sponsored by the Fund’s transfer agent. All return data at NAV includes fees charged to the Fund, which are listed in the Fund’s Statement of Operations under “Expenses.” Total investment

return at market value is based on changes in the market price at which the Fund’s shares traded on the New York Stock Exchange ("NYSE") during the period and assumes reinvestment of dividends and distributions,

if any, at market prices pursuant to the dividend reinvestment program sponsored by the Fund’s transfer agent. The Fund’s total investment return is based on the reported NAV during the six-month period

ended June 30, 2023. Because the Fund’s shares trade in the stock market based on investor demand, the Fund may trade at a price higher or lower than its NAV. Therefore, returns are calculated based on both

market price and NAV. Past performance is no guarantee of future results. The performance information provided does not reflect the deduction of taxes that a shareholder would pay on distributions received

from the Fund. The current performance of the Fund may be lower or higher than the figures shown. The Fund’s yield, return, market price and NAV will fluctuate. Performance information current to the most recent

month-end is available at www.abrdnifn.com or by calling 800-522-5465.

The annualized net operating

expense ratio based on the six-month period ended June 30, 2023 was 1.47%.

Portfolio Composition (as a percentage of net assets) (unaudited)

As of June 30, 2023

The following table summarizes

the sector composition of the Fund’s portfolio, in S&P Global Inc.’s Global Industry Classification Standard (“GICS”) Sectors. Industry allocation is shown below for any sector

representing more than 25% of net assets.

| Sectors

|

|

| Financials

| 31.6%

|

| Banks

| 18.8%

|

| Financial Services

| 7.6%

|

| Insurance

| 5.2%

|

| Consumer Staples

| 13.1%

|

| Industrials

| 8.3%

|

| Information Technology

| 8.1%

|

| Consumer Discretionary

| 8.0%

|

| Materials

| 7.7%

|

| Health Care

| 7.4%

|

| Communication Services

| 6.8%

|

| Utilities

| 5.3%

|

| Real Estate

| 3.9%

|

| Energy

| 2.8%

|

| Short-Term Investment

| 0.1%

|

| Liabilities in Excess of Other Assets

| (3.1%)

|

|

| 100.0%

|

The following were the

Fund’s top ten holdings as of June 30, 2023:

| Top Ten Holdings

|

|

| ICICI Bank Ltd.

| 8.3%

|

| Hindustan Unilever Ltd.

| 6.9%

|

| Housing Development Finance Corp. Ltd.

| 6.8%

|

| UltraTech Cement Ltd.

| 4.6%

|

| Infosys Ltd.

| 4.6%

|

| Bharti Airtel Ltd.

| 4.6%

|

| Power Grid Corp. of India Ltd.

| 4.1%

|

| SBI Life Insurance Co. Ltd.

| 3.8%

|

| Kotak Mahindra Bank Ltd.

| 3.6%

|

| HDFC Bank Ltd.

| 3.6%

|

Portfolio of Investments (unaudited)

As of June 30, 2023

|

| Shares

| Value

|

| COMMON STOCKS—103.0%

|

|

| INDIA—103.0%

|

| Communication Services—6.8%

|

|

|

|

| Affle India Ltd.(a)

|

| 386,766

| $ 5,153,737

|

| Bharti Airtel Ltd.

|

| 2,135,010

| 22,934,150

|

| Info Edge India Ltd.

|

| 113,200

| 6,202,494

|

|

|

|

| 34,290,381

|

| Consumer Discretionary—8.0%

|

|

|

|

| Mahindra & Mahindra Ltd.

|

| 746,136

| 13,278,762

|

| Maruti Suzuki India Ltd.

|

| 129,552

| 15,478,357

|

| Titan Co. Ltd.

|

| 299,882

| 11,192,880

|

|

|

|

| 39,949,999

|

| Consumer Staples—13.1%

|

|

|

|

| Hindustan Unilever Ltd.

|

| 1,054,872

| 34,461,963

|

| ITC Ltd.

|

| 2,708,277

| 14,930,176

|

| Nestle India Ltd.

|

| 37,500

| 10,491,684

|

| Tata Consumer Products Ltd.

|

| 550,000

| 5,778,152

|

|

|

|

| 65,661,975

|

| Energy—2.8%

|

|

|

|

| Aegis Logistics Ltd.

|

| 3,595,288

| 14,197,331

|

| Financials—31.6%

|

|

|

|

| Aptus Value Housing Finance India Ltd.

|

| 1,423,402

| 4,319,913

|

| Axis Bank Ltd.

|

| 1,378,855

| 16,615,001

|

| HDFC Bank Ltd.

|

| 866,492

| 17,975,267

|

| Housing Development Finance Corp. Ltd.

|

| 990,188

| 34,143,585

|

| ICICI Bank Ltd.

|

| 3,647,684

| 41,735,472

|

| Kotak Mahindra Bank Ltd.

|

| 799,294

| 17,992,200

|

| PB Fintech Ltd.(a)

|

| 829,965

| 7,064,925

|

| SBI Life Insurance Co. Ltd.(b)

|

| 1,182,396

| 18,907,901

|

|

|

|

| 158,754,264

|

| Health Care—7.4%

|

|

|

|

| Fortis Healthcare Ltd.(a)

|

| 3,288,200

| 12,667,559

|

| JB Chemicals & Pharmaceuticals Ltd.

|

| 177,396

| 5,130,098

|

| Syngene International Ltd.(b)

|

| 1,166,661

| 10,884,551

|

| Vijaya Diagnostic Centre Pvt Ltd.

|

| 1,501,100

| 8,669,549

|

|

|

|

| 37,351,757

|

| Industrials—8.3%

|

|

|

|

| ABB India Ltd.

|

| 171,418

| 9,250,500

|

| Container Corp. Of India Ltd.

|

| 780,015

| 6,296,370

|

| KEI Industries Ltd.

|

| 222,500

| 6,284,086

|

| Larsen & Toubro Ltd.

|

| 498,407

| 15,067,229

|

| Siemens Ltd.

|

| 99,300

| 4,574,938

|

|

|

|

| 41,473,123

|

|

| Shares

| Value

|

|

|

|

|

|

| Information Technology—8.1%

|

|

|

|

| Infosys Ltd.

|

| 1,409,444

| $ 22,997,260

|

| Tata Consultancy Services Ltd.

|

| 438,538

| 17,699,484

|

|

|

|

| 40,696,744

|

| Materials—7.7%

|

|

|

|

| Asian Paints Ltd.

|

| 206,242

| 8,463,925

|

| Hindalco Industries Ltd.

|

| 1,335,673

| 6,886,969

|

| UltraTech Cement Ltd.

|

| 230,871

| 23,360,095

|

|

|

|

| 38,710,989

|

| Real Estate—3.9%

|

|

|

|

| Godrej Properties Ltd.(a)

|

| 554,915

| 10,646,502

|

| Prestige Estates Projects Ltd.

|

| 1,269,469

| 8,890,409

|

|

|

|

| 19,536,911

|

| Utilities—5.3%

|

|

|

|

| Power Grid Corp. of India Ltd.

|

| 6,634,184

| 20,588,445

|

| ReNew Energy Global PLC, Class A(a)

|

| 1,099,812

| 6,026,970

|

|

|

|

| 26,615,415

|

| Total India

|

| 517,238,889

|

| Total Common Stocks

|

| 517,238,889

|

| SHORT-TERM INVESTMENT—0.1%

|

|

| State Street Institutional U.S. Government Money Market Fund, Premier Class, 5.03%(c)

|

| 755,365

| 755,365

|

| Total Short-Term Investment

|

| 755,365

|

Total Investments

(Cost $324,365,656)—103.1%

| 517,994,254

|

| Liabilities in Excess of Other Assets(d)—(3.1%)

| (15,624,302)

|

| Net Assets—100.0%

| $502,369,952

|

| (a)

| Non-income producing security.

|

| (b)

| Denotes a security issued under Regulation S or Rule 144A.

|

| (c)

| Registered investment company advised by State Street Global Advisors. The rate shown is the 7 day yield as of June 30, 2023.

|

| (d)

| See accompanying Notes to Financial Statements for tax unrealized appreciation/(depreciation) of securities.

|

| PLC

| Public Limited Company

|

See accompanying Notes to Financial

Statements.

Statement of Assets and Liabilities (unaudited)

As of June 30, 2023

| Assets

|

|

| Investments, at value (cost $323,610,291)

| $517,238,889

|

| Short-term investments, at value (cost $755,365)

| 755,365

|

| Foreign currency, at value (cost $793,028)

| 793,004

|

| Interest and dividends receivable

| 1,236,465

|

| Prepaid expenses

| 74,447

|

| Total assets

| 520,098,170

|

| Liabilities

|

|

| Deferred foreign capital gains tax (Note 2g)

| 16,757,778

|

| Investment management fees payable (Note 3)

| 435,844

|

| Investor relations fees payable (Note 3)

| 71,996

|

| Administration fees payable (Note 3)

| 31,698

|

| Director fees payable

| 31,504

|

| Other accrued expenses

| 399,398

|

| Total liabilities

| 17,728,218

|

|

|

| Net Assets

| $502,369,952

|

| Composition of Net Assets

|

|

| Capital stock ($0.001 per share) (Note 5)

| $30,042

|

| Paid-in capital in excess of par

| 347,907,513

|

| Distributable earnings

| 154,432,397

|

| Net Assets

| $502,369,952

|

| Net asset value per share based on 30,042,030 shares issued and outstanding

| $16.72

|

See Notes to Financial

Statements.

Statement of Operations (unaudited)

For the Six-Month Period Ended June 30, 2023

| Net Investment Income

|

|

| Investment Income:

|

|

| Dividends and other income (net of foreign withholding taxes of $721,634)

| $3,124,876

|

| Total investment income

| 3,124,876

|

| Expenses:

|

|

| Investment management fee (Note 3)

| 2,575,675

|

| Administration fee (Note 3)

| 187,322

|

| Custodian’s fees and expenses

| 141,501

|

| Directors' fees and expenses

| 134,932

|

| Legal fees and expenses

| 94,022

|

| Insurance expense

| 78,775

|

| Investor relations fees and expenses (Note 3)

| 71,996

|

| Independent auditors’ fees and expenses

| 50,246

|

| Reports to shareholders and proxy solicitation

| 49,281

|

| Transfer agent’s fees and expenses

| 26,860

|

| Miscellaneous

| 34,443

|

| Net expenses

| 3,445,053

|

|

|

| Net Investment Income/(Loss)

| (320,177)

|

| Net Realized/Unrealized Gain/(Loss) from Investments and Foreign Currency Related Transactions:

|

|

| Net realized gain/(loss) from:

|

|

| Investment transactions (including $3,446,297 capital gains tax)

| 16,530,080

|

| Foreign currency transactions

| 284,481

|

|

| 16,814,561

|

| Net change in unrealized appreciation/(depreciation) on:

|

|

| Investments (including change in deferred capital gains tax of $1,906,664)

| 21,442,136

|

| Foreign currency translation

| 26,278

|

|

| 21,468,414

|

| Net realized and unrealized gain from investments and foreign currencies

| 38,282,975

|

| Change in Net Assets Resulting from Operations

| $37,962,798

|

See Notes to Financial

Statements.

Statements of Changes in Net Assets

|

| For the

Six-Month

Period Ended

June 30, 2023

(unaudited)

| For the

Year Ended

December 31, 2022

|

| Increase/(Decrease) in Net Assets:

|

|

|

| Operations:

|

|

|

| Net investment loss

| $(320,177)

| $(2,263,585)

|

| Net realized gain from investments and foreign currency transactions

| 16,814,561

| 53,391,477

|

| Net change in unrealized appreciation/(depreciation) on investments and foreign

currency translation

| 21,468,414

| (157,422,315)

|

| Net increase/(decrease) in net assets resulting from operations

| 37,962,798

| (106,294,423)

|

| Distributions to Shareholders From:

|

|

|

| Distributable earnings

| (24,186,212)

| (88,177,570)

|

| Net decrease in net assets from distributions

| (24,186,212)

| (88,177,570)

|

| Issuance of 735,879 and 2,401,576 shares of common stock, respectively due to stock

distribution (Note 5)

| 11,290,849

| 40,350,297

|

| Change in net assets

| 25,067,435

| (154,121,696)

|

| Net Assets:

|

|

|

| Beginning of period

| 477,302,517

| 631,424,213

|

| End of period

| $502,369,952

| $477,302,517

|

Amounts listed as

“–” are $0 or round to $0.

See Notes to Financial

Statements.

|

| For the

Six-Month

Period Ended

June 30,

| For the Fiscal Years Ended December 31,

|

|

| 2023

(unaudited)

| 2022

| 2021

| 2020

| 2019

| 2018

|

| PER SHARE OPERATING PERFORMANCE(a):

|

|

|

|

|

|

|

| Net asset value, beginning of period

| $16.29

| $23.47

| $22.99

| $22.60

| $23.84

| $29.50

|

| Net investment income/(loss)

| (0.01)

| (0.08)

| (0.12)

| (0.04)

| 0.03

| (0.04)

|

Net realized and unrealized gains/(losses) on

investments and foreign currency transactions

| 1.27

| (3.79)

| 3.81

| 2.38

| 1.06

| (1.25)

|

| Total from investment operations

| 1.26

| (3.87)

| 3.69

| 2.34

| 1.09

| (1.29)

|

| Distributions to common shareholders from:

|

|

|

|

|

|

|

| Net investment income

| (0.82)

| (1.17)

| (0.09)

| (1.10)

| (0.01)

| (0.77)

|

| Net realized gains

| –

| (2.02)

| (3.12)

| –

| (2.32)

| (3.73)

|

| Return of capital

| –

| –

| –

| (0.85)

| –

| –

|

| Total distributions

| (0.82)

| (3.19)

| (3.21)

| (1.95)

| (2.33)

| (4.50)

|

| Capital Share Transactions:

|

|

|

|

|

|

|

| Impact due to capital shares issued from stock distribution (Note 5)

| (0.01)

| (0.12)

| –

| –

| –

| –

|

| Impact due to open market repurchase policy

| –

| –

| –

| –

| –

| 0.13

|

| Total capital share transactions

| (0.01)

| (0.12)

| –

| –

| –

| 0.13

|

| Net asset value, end of period

| $16.72

| $16.29

| $23.47

| $22.99

| $22.60

| $23.84

|

| Market price, end of period

| $16.60

| $14.81

| $21.10

| $19.96

| $20.13

| $20.24

|

| Total Investment Return Based on(b):

|

|

|

|

|

|

|

| Market price

| 18.16%

| (15.32%)

| 21.89%

| 11.79%

| 10.90%

| (6.00%)

|

| Net asset value

| 8.20%

| (16.26%)

| 17.72%

| 14.69%

| 5.70%

| (1.94%)

|

| Ratio to Average Net Assets/Supplementary Data:

|

|

|

|

|

|

|

| Net assets, end of period (000 omitted)

| $502,370

| $477,303

| $631,424

| $618,431

| $607,988

| $642,079

|

| Average net assets applicable to common shareholders (000 omitted)

| $472,186

| $539,220

| $651,685

| $525,841

| $623,568

| $756,480

|

| Net expenses

| 1.47%(c)

| 1.43%

| 1.35%

| 1.43%

| 1.35%

| 1.32%

|

| Net Investment income (loss)

| (0.14%)(c)

| (0.42%)

| (0.48%)

| (0.20%)

| 0.13%

| (0.13%)

|

| Portfolio turnover

| 15%(d)

| 24%

| 22%

| 20%

| 14%

| 13%

|

| (a)

| Based on average shares outstanding.

|

| (b)

| Total investment return based on market value is calculated assuming that shares of the Fund’s common stock were purchased at the closing market price as of the beginning of the period, dividends,

capital gains and other distributions were reinvested as provided for in the Fund’s dividend reinvestment plan and then sold at the closing market price per share on the last day of the period. The computation

does not reflect any sales commission investors may incur in purchasing or selling shares of the Fund. The total investment return based on the net asset value is similarly computed except that the Fund’s net

asset value is substituted for the closing market value.

|

| (c)

| Annualized.

|

| (d)

| Not annualized.

|

Amounts listed as

“–” are $0 or round to $0.

See Notes to Financial

Statements.

Notes to Financial Statements (unaudited)

June 30, 2023

1. Organization

The India Fund, Inc. (the

“Fund”) was incorporated in Maryland on December 27, 1993 and commenced operations on February 23, 1994. The Fund is registered under the Investment Company Act of 1940, as amended (the “1940

Act”), as a non-diversified closed-end management investment company.

The Fund’s investment

objective is long-term capital appreciation, which it seeks to achieve by investing primarily in the equity securities of Indian companies.

2. Summary of Significant

Accounting Policies

The Fund is an investment

company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 Financial

Services-Investment Companies. The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. The policies conform to generally accepted accounting

principles ("GAAP") in the United States of America. The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure

of contingent assets and liabilities at the date of the financial statements, and the reported amounts of income and expenses for the period. Actual results could differ from those estimates. The accounting records of

the Fund are maintained in U.S. Dollars and the U.S. Dollar is used as both the functional and reporting currency.

a. Security Valuation:

The Fund values its

securities at current market value or fair value, consistent with regulatory requirements. "Fair value" is defined in the Fund's Valuation and Liquidity Procedures as the price that could be received to sell an asset

or paid to transfer a liability in an orderly transaction between willing market participants without a compulsion to transact at the measurement date. Pursuant to Rule 2a-5 under the 1940 Act, the Board of Directors

(the "Board") designated abrdn Asia Limited (“abrdn Asia” or the “Investment Manager”) as the valuation designee ("Valuation Designee") for the Fund to perform the fair value

determinations relating to Fund investments for which market quotations are not readily available.

In accordance with the

authoritative guidance on fair value measurements and disclosures under GAAP, the Fund discloses the fair value of its investments using a three-level hierarchy that classifies the inputs to valuation techniques used

to measure the fair value. The hierarchy assigns Level 1, the highest level, measurements to valuations based upon unadjusted quoted prices in active markets for identical assets, Level 2 measurements to valuations

based upon other significant observable inputs, including adjusted quoted prices in active markets for similar assets, and Level 3, the lowest level, measurements to valuations based upon unobservable inputs that

are

significant to the valuation. Inputs refer

broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk, for example, the risk inherent in a particular valuation technique used to measure

fair value including a pricing model and/or the risk inherent in the inputs to the valuation technique. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market

participants would use in pricing the asset or liability, which are based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting

entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances. A financial

instrument’s level within the fair value hierarchy is based upon the lowest level of any input that is significant to the fair value measurement. Open-end mutual funds are valued at the respective net asset

value (“NAV”) as reported by such company. The prospectuses for the registered open-end management investment companies in which the Fund invests explain the circumstances under which those companies will

use fair value pricing and the effects of using fair value pricing. Closed-end funds and exchange-traded funds (“ETFs”) are valued at the market price of the security at the Valuation Time (as defined

below). A security using any of these pricing methodologies is determined to be a Level 1 investment.

Equity securities that are

traded on an exchange are valued at the last quoted sale price or the official close price on the principal exchange on which the security is traded at the “Valuation Time” subject to application, when

appropriate, of the valuation factors described in the paragraph below. Under normal circumstances, the Valuation Time is as of the close of regular trading on the NYSE (usually 4:00 p.m. Eastern Time). In the absence

of a sale price, the security is valued at the mean of the bid/ask price quoted at the close on the principal exchange on which the security is traded. Securities traded on NASDAQ are valued at the NASDAQ official

closing price.

Foreign equity securities

that are traded on foreign exchanges that close prior to the Valuation Time are valued by applying valuation factors to the last sale price or the mean price as noted above. Valuation factors are provided by an

independent pricing service provider. These valuation factors are used when pricing the Fund's portfolio holdings to estimate market movements between the time foreign markets close and the time the Fund values such

foreign securities. These valuation factors are based on inputs such as depositary receipts, indices, futures, sector indices/ETFs, exchange rates, and local exchange opening and closing prices of each security. When

prices with the application of valuation factors are utilized, the value assigned to the foreign securities may not be the same as quoted or published prices of the securities on their primary markets. A security that

applies a valuation factor is determined to be a Level 2 investment because the exchange-traded price has been adjusted.

Notes to Financial Statements (unaudited) (continued)

June 30, 2023

Valuation factors are not utilized if the

independent pricing service provider is unable to provide a valuation factor or if the valuation factor falls below a predetermined threshold; in such case, the security is determined to be a Level 1 investment.

Short-term investments are

comprised of cash and cash equivalents invested in short-term investment funds which are redeemable daily. The Fund sweeps available cash into the State Street Institutional U.S. Government Money Market Fund,

which has elected to qualify as a “government money market fund” pursuant to Rule 2a-7 under the 1940 Act, and has an objective, which is not guaranteed, to maintain a $1.00 per share NAV. Registered

investment companies are valued at their NAV as reported by such company. Generally, these investment types are categorized as Level 1 investments.

In the event that a

security’s market quotations are not readily available or are deemed unreliable (for reasons other than because the

foreign exchange on which it trades closes

before the Valuation Time), the security is valued at fair value as determined by the Valuation Designee, taking into account the relevant factors and surrounding circumstances using valuation policies and procedures

approved by the Board. A security that has been fair valued by the Valuation Designee may be classified as Level 2 or Level 3 depending on the nature of the inputs.

The three-level hierarchy of

inputs is summarized below:

Level 1 - quoted prices in

active markets for identical investments;

Level 2 - other significant observable

inputs (including quoted prices for similar securities, interest rates, prepayment speeds, and credit risk); or

Level 3 - significant unobservable inputs

(including the Fund’s own assumptions in determining the fair value of investments).

A summary of standard

inputs is listed below:

| Security Type

| Standard Inputs

|

| Foreign equities utilizing a fair value factor

| Depositary receipts, indices, futures, sector indices/ETFs, exchange rates, and local

exchange opening and closing prices of each security.

|

The following is a

summary of the inputs used as of June 30, 2023 in valuing the Fund's investments and other financial instruments at fair value. The inputs or methodology used for valuing securities are not necessarily an indication

of the risk associated with investing in those securities. Please refer to the Portfolio of Investments for a detailed breakout of the security types:

| Investments, at Value

| Level 1 – Quoted

Prices

| Level 2 – Other Significant

Observable Inputs

| Level 3 – Significant

Unobservable Inputs

| Total

|

| Assets

|

|

|

| Investments in Securities

|

|

|

|

| Common Stocks

| $6,026,970

| $511,211,919

| $–

| $517,238,889

|

| Short-Term Investment

| 755,365

| –

| –

| 755,365

|

| Total Investments

| $6,782,335

| $511,211,919

| $–

| $517,994,254

|

| Total Assets

| $6,782,335

| $511,211,919

| $–

| $517,994,254

|

Amounts listed as

“–” are $0 or round to $0.

For the six-month

period ended June 30, 2023, there were no significant changes to the fair valuation methodologies.

b. Restricted

Securities:

Restricted securities are privately-placed

securities whose resale is restricted under U.S. securities laws. The Fund may invest in restricted securities, including unregistered securities eligible for resale without registration pursuant to Rule 144A and

privately-placed securities of U.S. and non-U.S. issuers offered outside the U.S. without registration pursuant to Regulation S under the Securities Act of 1933, as amended (the "1933 Act"). Rule 144A securities may

be freely traded among certain qualified institutional investors, such as the Fund, but resale of such securities in the U.S. is permitted only in limited circumstances.

c. Foreign Currency Translation:

Foreign securities,

currencies, and other assets and liabilities denominated in foreign currencies are translated into U.S. Dollars at the exchange rate of said currencies against the U.S. Dollar, as of the Valuation Time, as provided by

an independent pricing service approved by the Board.

Foreign currency amounts are

translated into U.S. Dollars on the following basis:

(i) market value of investment

securities, other assets and liabilities – at the current daily rates of exchange at the Valuation Time; and

Notes to Financial Statements (unaudited) (continued)

June 30, 2023

(ii) purchases and sales of investment

securities, income and expenses – at the relevant rates of exchange prevailing on the respective dates of such transactions.

The Fund does not isolate

that portion of gains and losses on investments in equity securities due to changes in the foreign exchange rates from the portion due to changes in market prices of equity securities. Accordingly, realized and

unrealized foreign currency gains and losses with respect to such securities are included in the reported net realized and unrealized gains and losses on investment transactions balances.

The Fund reports certain

foreign currency related transactions and foreign taxes withheld on security transactions as components of realized gains for financial reporting purposes, whereas such foreign currency related transactions are

treated as ordinary income for U.S. federal income tax purposes.

Net unrealized currency gains

or losses from valuing foreign currency denominated assets and liabilities at period end exchange rates are reflected as a component of net unrealized appreciation/depreciation in value of investments, and translation

of other assets and liabilities denominated in foreign currencies.

Net realized foreign exchange

gains or losses represent foreign exchange gains and losses from transactions in foreign currencies and forward foreign currency contracts, exchange gains or losses realized between the trade date and settlement date

on security transactions, and the difference between the amounts of interest and dividends recorded on the Fund’s books and the U.S. Dollar equivalent of the amounts actually received.

Foreign security and currency

transactions may involve certain considerations and risks not typically associated with those of domestic origin, including unanticipated movements in the value of the foreign currency relative to the U.S. Dollar.

Generally, when the U.S. Dollar rises in value against foreign currency, the Fund’s investments denominated in that foreign currency will lose value because the foreign currency is worth fewer U.S. Dollars; the

opposite effect occurs if the U.S. Dollar falls in relative value.

d. Security Transactions,

Investment Income and Expenses:

Security transactions are

recorded on the trade date. Realized and unrealized gains/(losses) from security and currency transactions are calculated on the identified cost basis. Dividend income is recorded on the ex-dividend date except for

certain dividends on foreign securities, which are recorded as soon as the Fund is informed after the ex-dividend date. Interest income and expenses are recorded on an accrual basis. Certain distributions received by

the Fund could represent a return of capital or capital gain. The Fund determines the components of these distributions subsequent to the ex-dividend date, based upon receipt of tax filings or other correspondence

relating

to the underlying investment. These

distributions are recorded as a reduction of cost of investments and/or as a realized gain.

e. Distributions:

The Fund has implemented a

managed distribution policy (“MDP”) to pay distributions from net investment income supplemented by net realized foreign exchange gains, net realized capital gains and return of capital

distributions, if necessary, on a quarterly basis. The MDP is subject to regular review by the Board.

The Fund records dividends

and distributions payable to its shareholders on the ex-dividend date. The amount of dividends and distributions from net investment income and net realized capital gains are determined in accordance with federal

income tax regulations, which may differ from GAAP. These book basis/tax basis differences are either considered temporary or permanent in nature. To the extent these differences are permanent in nature, such amounts

are reclassified within the capital accounts based on their federal tax basis treatment; temporary differences do not require reclassification.

Dividends and distributions

which exceed net investment income and net realized capital gains for tax purposes are reported as return of capital.

f. Federal Income Taxes:

The Fund intends to

continue to qualify as a “regulated investment company” by complying with the provisions available to certain investment companies, as defined in Subchapter M of the Internal Revenue Code of 1986, as

amended, and to make distributions of net investment income and net realized capital gains sufficient to relieve the Fund from all, or substantially all, federal income taxes. Therefore, no federal income tax

provision is required. The Fund recognizes the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. Management

of the Fund has concluded that there are no significant uncertain tax positions that would require recognition in the financial statements. Since tax authorities can examine previously filed tax returns, the

Fund’s U.S. federal and state tax returns for each of the most recent four fiscal years up to the most recent fiscal year ended December 31, 2022 are subject to such review.

g. Foreign Withholding

Tax:

Dividend and interest

income from non-U.S. sources received by the Fund are generally subject to non-U.S. withholding taxes and are recorded on the Statement of Operations. The Fund files for tax reclaims for the refund of such

withholdings taxes according to tax treaties. Tax reclaims that are deemed collectible are booked as tax reclaim receivable on the Statement of Assets and Liabilities.. In addition, the Fund may be subject to capital

gains tax in certain countries in which it invests. The above taxes may be reduced or

Notes to Financial Statements (unaudited) (continued)

June 30, 2023

eliminated under the terms of applicable

U.S. income tax treaties with some of these countries. The Fund accrues such taxes when the related income is earned.

In addition, when the Fund

sells securities within certain countries in which it invests, the capital gains realized may be subject to tax. Based on these market requirements and as required under GAAP, the Fund accrues deferred capital gains

tax on securities currently held that have unrealized appreciation within these countries. The amount of deferred capital gains tax accrued is reported on the Statement of Operations as part of the Net Change in

Unrealized Appreciation/Depreciation on Investments.

The Fund calculates Indian

capital gains tax for the long-term gains realized after April 1, 2018 at 10%. (See Deferred foreign capital gains tax on the Statement of Assets and Liabilities).

Effective April 1, 2020,

dividends from Indian companies are subject to a 20% withholding tax (plus surcharge and tax) (potentially reduced by treaty if applicable).

3. Agreements and Transactions

with Affiliates

a. Investment Manager:

abrdn Asia serves as the

Fund’s investment manager with respect to all investments. For its services, abrdn Asia receives fees at an annual rate of: (i) 1.10% for the first $500 million of the Fund’s average weekly Managed Assets;

(ii) 0.90% for the next $500 million of the Fund’s average weekly Managed Assets; (iii) 0.85% for the next $500 million of the Fund’s average weekly Managed Assets; and (iv) 0.75% for the Fund’s

average weekly Managed Assets in excess of $1.5 billion. Managed Assets is defined in the investment management agreement as net assets plus the amount of any borrowings for investment purposes. For the six-month

period ended June 30, 2023, abrdn Asia earned a gross management fee of $2,575,675.

b. Fund Administration:

abrdn Inc., an affiliate of

abrdn Asia, serves as the Fund’s administrator and receives a fee payable monthly by the Fund at an annual fee rate of 0.08% of the value of the Fund's average monthly net assets. During the six-month period

ended June 30, 2023, the Fund paid a total of $187,322 in administrative fees to abrdn Inc.

c. Investor Relations:

Under the terms of the

Investor Relations Services Agreement, abrdn Inc. provides and/or engages third parties to provide investor relations services to the Fund and certain other funds advised by abrdn Asia or its affiliates as part of an

Investor Relations Program. Under the Investor Relations Services Agreement, the Fund owes a portion of the fees related to the Investor Relations Program (the “Fund’s Portion”). However, investor

relations services fees are limited by abrdn Inc. so

that the Fund will only pay up to an annual

rate of 0.05% of the Fund’s average net assets per annum. Any difference between the capped rate of 0.05% of the Fund’s average net assets per annum and the Fund’s Portion is paid for by abrdn

Inc..

Pursuant to the terms of the

Investor Relations Services Agreement, abrdn Inc. (or third parties engaged by abrdn Inc.) among other things, provides objective and timely information to shareholders based on publicly-available information;

provides information efficiently through the use of technology while offering shareholders immediate access to knowledgeable investor relations representatives; develops and maintains effective communications with

investment professionals from a wide variety of firms; creates and maintains investor relations communication materials such as fund manager interviews, films and webcasts, publishes white papers, magazine articles

and other relevant materials discussing the Fund’s investment results, portfolio positioning and outlook; develops and maintains effective communications with large institutional shareholders; responds to

specific shareholder questions; and reports activities and results to the Board and management detailing insight into general shareholder sentiment.

During the six-month period

ended June 30, 2023, the Fund incurred investor relations fees of approximately $71,996. For the six-month period ended June 30, 2023, abrdn Inc. did not contribute to the investor relations fees for the Fund because

the Fund’s contribution was below 0.05% of the Fund’s average weekly net assets on an annual basis.

4. Investment Transactions

Purchases and sales of

investment securities (excluding short-term securities) for the six-month period ended June 30, 2023, were $73,402,750 and $112,297,455, respectively.

5. Capital

The authorized capital of

the Fund is 100 million shares of $0.001 par value per share of common stock. As of June 30, 2023, there were 30,042,030 shares of common stock issued and outstanding.

The following table shows the

shares issued by the Fund as a part of a quarterly distribution to shareholders during the six-month period ended June 30, 2023.

| Payment Date

| Shares Issued

|

| March 31, 2023

| 397,865

|

| June 30, 2023

| 338,014

|

6. Open Market Repurchase

Program

The Fund’s Board

approved an open market repurchase and discount management policy (the “Program”). The Program allows the Fund to purchase, in the open market, its outstanding common shares, with the amount and timing of

any repurchase determined at the discretion

Notes to Financial Statements (unaudited) (continued)

June 30, 2023

of the Investment Manager. Such purchases

may be made opportunistically at certain discounts to NAV per share in the reasonable judgment of management based on historical discount levels and current market conditions.

On a quarterly basis, the

Fund’s Board will receive information on any transactions made pursuant to this policy during the prior quarter and management will post the number of shares repurchased on the Fund’s website on a monthly

basis. Under the terms of the Program, the Fund is permitted to repurchase up to 10% of its outstanding shares of common stock in the open market during any 12 month period.

For the six-month period ended

June 30, 2023, the Fund did not repurchase any shares through this program.

7. Portfolio Investment

Risks

a. Equity Securities

Risk:

The stock or other security

of a company may not perform as well as expected, and may decrease in value, because of factors related to the company (such as poorer than expected earnings or certain management decisions) or to the industry in

which the company is engaged (such as a reduction in the demand for products or services in a particular industry). Holders of common stock generally are subject to more risks than holders of preferred stock or debt

securities because the right to repayment of common shareholders' claims is subordinated to that of preferred stock and debt securities upon the bankruptcy of the issuer.

b. Focus Risk:

The Fund may have elements

of risk not typically associated with investments in the United States due to focused investments in a limited number of countries or regions subject to foreign securities or currency risks. The Fund focuses its

investments in India, which subjects the Fund to more volatility and greater risk of loss than geographically diverse funds. Such focused investments may subject the Fund to additional risks resulting from political

or economic conditions in such countries or regions and the possible imposition of adverse governmental laws or currency exchange restrictions could cause the securities and their markets to be less liquid and their

prices to be more volatile than those of comparable U.S. securities.

c. Issuer Risk:

The value of a security may

decline for reasons directly related to the issuer, such as management performance, financial leverage and reduced demand for the issuer's goods or services.

d. Management Risk:

The Fund is subject to the

risk that the Investment Manager may make poor security selections. The Investment Manager, and its portfolio managers apply their own investment techniques and risk analyses in

making investment decisions for the Fund and

there can be no guarantee that these decisions will achieve the desired results for the Fund. In addition, the Investment Manager may select securities that underperform the relevant market or other funds with similar

investment objectives and strategies.

e. Market Events Risk:

Markets are affected by

numerous factors, including interest rates, the outlook for corporate profits, the health of the national and world economies, the fluctuation of other stock markets around the world, and financial, economic and other

global market developments and disruptions, such as those arising from war, terrorism, market manipulation, government interventions, defaults and shutdowns, political changes or diplomatic developments, public health

emergencies and natural/environmental disasters. Such events can negatively impact the securities markets and cause the Fund to lose value.

Policy and legislative

changes in countries around the world are affecting many aspects of financial regulation, and governmental and quasi-governmental authorities and regulators throughout the world have previously responded to serious

economic disruptions with a variety of significant fiscal and monetary policy changes.

The impact of these changes

on the markets, and the practical implications for market participants, may not be fully known for some time. In addition, economies and financial markets throughout the world are becoming increasingly interconnected.

As a result, whether or not the Fund invests in securities of issuers located in or with significant exposure to countries or sectors experiencing economic and financial difficulties, the value and liquidity of the

Fund’s investments may be negatively affected by such events.

For example, whether or not

the Fund invests in securities of issuers located in Europe (whether the EU, Eurozone or UK) or with significant exposure to European, EU, Eurozone or UK issuers or countries, the unavoidable uncertainties and events

related to the UK’s departure from the EU (“Brexit”) could negatively affect the value and liquidity of the Fund’s investments, increase taxes and costs of business and cause volatility in

currency exchange rates and interest rates. Brexit could adversely affect the performance of contracts in existence at the date of Brexit and European, UK or worldwide political, regulatory, economic or market

conditions and could contribute to instability in political institutions, regulatory agencies and financial markets. Brexit could also lead to legal uncertainty and politically divergent national laws and regulations

as a new relationship between the UK and EU is defined and as the UK determines which EU laws to replace or replicate. Any of these effects of Brexit, and others that cannot be anticipated, could adversely affect the

Fund’s business, results of operations and financial condition.

Notes to Financial Statements (unaudited) (continued)

June 30, 2023

f. Mid-Cap Securities Risk:

Securities of medium-sized

companies tend to be more volatile and less liquid than securities of larger companies.

g. Non-U.S. Taxation

Risk:

Income, proceeds and gains

received by the Fund from sources within foreign countries may be subject to withholding and other taxes imposed by such countries, which will reduce the return on those investments. Tax treaties between certain

countries and the United States may reduce or eliminate such taxes.

If, at the close of its

taxable year, more than 50% of the value of the Fund’s total assets consists of securities of foreign corporations, including for this purpose foreign governments, the Fund will be permitted to make an election

under the Code that will allow shareholders a deduction or credit for foreign taxes paid by the Fund. In such a case, shareholders will include in gross income from foreign sources their pro rata shares of such taxes.

A shareholder’s ability to claim an offsetting foreign tax credit or deduction in respect of such foreign taxes is subject to certain limitations imposed by the Code, which may result in the shareholder’s

not receiving a full credit or deduction (if any) for the amount of such taxes. Shareholders who do not itemize on their U.S. federal income tax returns may claim a credit (but not a deduction) for such foreign taxes.

If the Fund does not qualify for or chooses not to make such an election, shareholders will not be entitled separately to claim a credit or deduction for U.S. federal income tax purposes with respect to foreign taxes

paid by the Fund; in that case the foreign tax will nonetheless reduce the Fund’s taxable income. Even if the Fund elects to pass through to its shareholders foreign tax credits or deductions, tax-exempt

shareholders and those who invest in the Fund through tax-advantaged accounts such as IRAs will not benefit from any such tax credit or deduction.

h. Risks Associated with

Indian Markets:

The Indian securities

markets are, among other things, substantially smaller, less developed, less liquid and more volatile than the major securities markets in the United States. Consequently, acquisitions and dispositions of Indian

securities involve special risks and considerations not present with respect to U.S. securities.

India has undergone and may

continue to undergo rapid change and lack the social, political and economic stability of more developed countries. The value of the Fund’s assets may be adversely affected by political, economic, social and

religious factors, changes in Indian law or regulations and the status of India’s relations with other countries. In addition, the economy of India may differ favorably or unfavorably from the U.S. economy in

such respects as the rate of growth of gross domestic product, the rate of inflation, capital reinvestment, resource self-sufficiency and balance of payments position.

The Indian government has exercised and

continues to exercise significant influence over many aspects of the economy, and the number of public sector enterprises in India is substantial. Accordingly, Indian government actions in the future could have a

significant effect on the Indian economy, which could affect private sector companies and the Fund, market conditions, and prices and yields of securities in the Fund’s portfolio.

Economic growth in India is

constrained by inadequate infrastructure, a cumbersome bureaucracy, corruption, labor market rigidities, regulatory and foreign investment controls, the “reservation” of key products for small-scale

industries and high fiscal deficits. Changes in economic policies, or lack of movement toward economic liberalization, could negatively affect the general business and economic conditions in India, which could in turn

affect the Fund’s investments.

There is also the possibility

of nationalization, expropriation or confiscatory taxation, political changes, government regulation, social instability or diplomatic developments (including pandemic, war or terrorist attacks). All of these factors

could adversely affect the economy of India, make the prices of Indian securities generally more volatile than the prices of securities of companies in developed markets and increase the risk of loss to the Fund.

i. Sector Risk:

To the extent that the Fund

has a significant portion of its assets invested in securities of companies conducting business in a broadly related group of industries within an economic sector, the Fund may be more vulnerable to unfavorable

developments in that economic sector than funds that invest more broadly.

In particular, being invested

heavily in the financial sector may make the Fund vulnerable to risks and pressures facing companies in that sector, such as regulatory, consolidation, interest rate changes and general economic conditions.

Financial Sector Risk. To the extent that the financial sector represents a significant portion of the Fund's investments, the Fund will be sensitive to changes in, and its performance may depend to a greater

extent on, factors impacting this sector. Performance of companies in the financials sector may be adversely impacted by many factors, including, among others, government regulations, economic conditions, credit

rating downgrades, changes in interest rates, and decreased liquidity in credit markets. The impact of more stringent capital requirements, recent or future regulation of any individual financial company, or recent or

future regulation of the financials sector as a whole cannot be predicted. In recent years, cyber attacks and technology malfunctions and failures have become increasingly frequent in this sector and have caused

significant losses.

Notes to Financial Statements (unaudited) (concluded)

June 30, 2023

j. Small-Cap Securities Risk:

Securities of smaller

companies are usually less stable in price and less liquid than those of larger, more established companies. Therefore, they generally involve greater risk.

k. Valuation Risk:

The price that the Fund

could receive upon the sale of any particular portfolio investment may differ from the Fund’s valuation of the investment, particularly for securities that trade in thin or volatile markets or that are valued

using a fair valuation methodology or a price provided by an independent pricing service. As a result, the price received upon the sale of an investment may be less than the value ascribed by the Fund, and the Fund

could realize a greater than

expected loss or lower than expected gain

upon the sale of the investment. The Fund’s ability to value its investments may also be impacted by technological issues and/or errors by pricing services or other third-party service providers.

8. Contingencies

In the normal course of

business, the Fund may provide general indemnifications pursuant to certain contracts and organizational documents. The Fund's maximum exposure under these arrangements is dependent on future claims that may be made

against the Fund, and therefore, cannot be estimated; however, the Fund expects the risk of loss from such claims to be remote.

9. Tax

Information

The U.S. federal

income tax basis of the Fund’s investments (including derivatives, if applicable) and the net unrealized appreciation as of June 30, 2023, were as follows:

Tax Cost of

Securities

| Unrealized

Appreciation

| Unrealized

Depreciation

| Net

Unrealized

Appreciation/

(Depreciation)

|

| $358,285,849

| $203,741,320

| $(44,032,915)

| $159,708,405

|

10. Subsequent Events

Management has evaluated

the need for disclosures and/or adjustments resulting from subsequent events through the date the financial statements were issued. Based on this evaluation, no disclosures and/or adjustments were required to the

financial statements as of June 30, 2023, other than as noted below.

On August 9, 2023, the Fund announced that

it will pay on September 29, 2023, a stock distribution of US $0.41 per share to all shareholders of record as of August 24, 2023.

Supplemental Information (Unaudited)

Results of Annual Meeting of

Shareholders

The Annual Meeting of

Shareholders was held on May 25, 2023. The description of each proposal and number of shares voted at the meeting are as follows:

To elect two Class II Directors

to the Board of Directors:

| Nominee

| Votes For

| Votes Against

| Votes Abstained

|

| Luis F. Rubio

| 19,209,091

| 751,368

| 359,438

|

| Nisha Kumar

| 19,264,023

| 706,537

| 349,337

|

To approve the continuation of

the term for one Director under the Corporate Governance Policies:

| Nominee

| Votes For

| Votes Against

| Votes Abstained

|

| Jeswald W. Salacuse

| 19,178,293

| 768,369

| 373,235

|

Dividend Reinvestment and Optional Cash Purchase

Plan (Unaudited)

The Fund intends to distribute to

shareholders substantially all of its net investment income and to distribute any net realized capital gains at least annually. Net investment income for this purpose is income other than net realized long-term and

short-term capital gains net of expenses. Pursuant to the Dividend Reinvestment and Optional Cash Purchase Plan (the “Plan”), shareholders whose shares of common stock are registered in their own names

will be deemed to have elected to have all distributions automatically reinvested by Computershare Trust Company N.A. (the “Plan Agent”) in the Fund shares pursuant to the Plan, unless such shareholders

elect to receive distributions in cash. Shareholders who elect to receive distributions in cash will receive such distributions paid by check in U.S. Dollars mailed directly to the shareholder by the Plan Agent, as

dividend paying agent. In the case of shareholders such as banks, brokers or nominees that hold shares for others who are beneficial owners, the Plan Agent will administer the Plan on the basis of the number of shares

certified from time to time by the shareholders as representing the total amount registered in such shareholders’ names and held for the account of beneficial owners that have not elected to receive

distributions in cash. Investors that own shares registered in the name of a bank, broker or other nominee should consult with such nominee as to participation in the Plan through such nominee and may be required to

have their shares registered in their own names in order to participate in the Plan. Please note that the Fund does not issue certificates so all shares will be registered in book entry form. The Plan Agent serves as

agent for the shareholders in administering the Plan. If the Directors of the Fund declare an income dividend or a capital gains distribution payable either in the Fund’s common stock or in cash, nonparticipants

in the Plan will receive cash and participants in the Plan will receive common stock, to be issued by the Fund or purchased by the Plan Agent in the open market, as provided below. If the market price per share (plus

expected per share fees) on the valuation date equals or exceeds NAV per share on that date, the Fund will issue new shares to participants at NAV; provided, however, that if the NAV is less than 95% of the market

price on the valuation date, then such shares will be issued at 95% of the market price. The valuation date will be the payable date for such distribution or dividend or, if that date is not a trading day on the NYSE,

the immediately preceding trading date. If NAV exceeds the market price of Fund shares at such time, or if the Fund should declare an income dividend or capital gains distribution payable only in cash, the Plan Agent

will, as agent for the participants, buy Fund shares in the open market, on the NYSE or elsewhere, for the participants’ accounts on, or shortly after, the payment date. If, before the Plan Agent has completed

its purchases, the market price exceeds the NAV of a Fund share, the average per share purchase price paid by the Plan Agent may exceed the NAV of the Fund’s shares, resulting in the acquisition of fewer shares

than if the distribution had been paid in shares issued by the Fund on the dividend payment date. Because of the foregoing

difficulty with respect to open-market

purchases, the Plan provides that if the Plan Agent is unable to invest the full dividend amount in open-market purchases during the purchase period or if the market discount shifts to a market premium during the

purchase period, the Plan Agent will cease making open-market purchases and will receive the uninvested portion of the dividend amount in newly issued shares at the close of business on the last purchase date.

Participants have the option

of making additional cash payments of a minimum of $50 per investment (by check, one-time online bank debit or recurring automatic monthly ACH debit) to the Plan Agent for investment in the Fund’s common stock,

with an annual maximum contribution of $250,000. The Plan Agent will wait up to three business days after receipt of a check or electronic funds transfer to ensure it receives good funds. Following confirmation of

receipt of good funds, the Plan Agent will use all such funds received from participants to purchase Fund shares in the open market on the 25th day of each month or the next trading day if the 25th is not a trading

day.

If the participant sets up

recurring automatic monthly ACH debits, funds will be withdrawn from his or her U.S. bank account on the 20th of each month or the next business day if the 20th is not a banking business day and invested on the next

investment date. The Plan Agent maintains all shareholder accounts in the Plan and furnishes written confirmations of all transactions in an account, including information needed by shareholders for personal and tax

records. Shares in the account of each Plan participant will be held by the Plan Agent in the name of the participant, and each shareholder’s proxy will include those shares purchased pursuant to the Plan. There

will be no brokerage charges with respect to common shares issued directly by the Fund. However, each participant will pay a per share fee of $0.02 incurred with respect to the Plan Agent’s open market purchases

in connection with the reinvestment of dividends, capital gains distributions and voluntary cash payments made by the participant. Per share fees include any applicable brokerage commissions the Plan Agent is required

to pay.

Participants also have the

option of selling their shares through the Plan. The Plan supports two types of sales orders. Batch order sales are submitted on each market day and will be grouped with other sale requests to be sold. The price will