UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2025

Commission File Number: 001-14642

ING Groep N.V.

(Translation of registrant's name into English)

Bijlmerdreef 106

1102 CT Amsterdam

The Netherlands

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F [ X ] Form 40-F [ ]

On February 6, 2025, the Registrant issued a press release, a copy of which is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

(c) Exhibit 99.1. Press release dated February 6, 2025

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | ING Groep N.V. |

| | | (Registrant) |

| | | |

| | | |

| Date: February 6, 2025 | | /s/ Raymond Vermeulen |

| | | Raymond Vermeulen |

| | | Head of Media Relations & Issue Management |

| | | |

Exhibit 99.1

ING posts full - year 2024 net profit of €6,392 million and outstanding commercial growth Full - year profit before tax of €9,300 million, supported by growing customer base and increase in lending and deposits • Mobile primary customer base rises by 1.1 million in 2024 to 14.4 million • Net core lending growth of €28 billion, or 4%, and net core deposits growth of €47 billion (7%) • Total income of €22.6 billion; double - digit growth in fee income, surpassing €4 billion for the first time • Full - year return on equity of 13.0%; proposed final cash dividend of €0.71 per share 4Q2024 profit before tax of €1,771 million with a CET1 ratio of 13.6% • Increase of 434,000 mobile primary customers in the fourth quarter, with growth in all markets • Total income resilient year - on - year, supported by continuously strong fee income • Risk costs remain below our through - the - cycle average, reflecting strong asset quality • CET1 ratio decreases to 13.6% following the shareholder distribution announced in October CEO statement “In 2024 , we have made very good progress in the implementation of our strategy . We have accelerated growth, diversified our income, provided superior value to customers and continued to play a leading role in supporting our clients’ sustainable transition,” said ING CEO Steven van Rijswijk . “We’re pleased with our strong results and are on track to make the targets as communicated on our Capital Markets Day in June . We have continued to invest in the growth of our business, resulting in a larger customer base and higher revenues, while continuously executing our plans to drive operational efficiencies . "We have increased the number of our mobile primary customers by 1.1 million, resulting in a total of 14.4 million mobile primary customers, with Germany, the Netherlands, Spain and Poland especially contributing to the growth. Core lending has also grown across all markets, by €28 billion, with particularly strong growth of €19 billion in our mortgage portfolio, especially in Germany and the Netherlands. Our deposit base has risen by €47 billion, again with contributions from all Retail countries and our Wholesale business. In Wholesale Banking, we have seen strong results from Financial Markets and we have continued investing in our front office and building our product foundations. “Total income has increased to a record €22.6 billion and we have posted a net result of €6.4 billion, maintaining a high level after a very strong 2023. Fee income has increased 11% year - on - year, following an increase in both assets under management and in customer trading activity in Retail. Fee income growth in Wholesale Banking was mainly driven by a higher number of capital markets issuance deals for our clients. “Sustainability is a priority for our clients and for ING. We have increased our sustainable volume mobilised to €130 billion, up from €115 billion in 2023, showing strong progress against our 2027 target of €150 billion per annum. During the year, we have engaged with more than 1,600 of our Wholesale Banking clients on their transition plans. In Retail Banking, including in Germany, the Netherlands and Australia, we have supported our customers with sustainable mortgages, renovation loans and digital tools, allowing them to identify possible energy upgrades to their homes and connecting them with accredited home renovators. “For the coming year, we remain vigilant as we foresee ongoing geopolitical volatility and a fragmented economic outlook. We are confident that we have the right strategy to deliver value to all of our stakeholders by growing our customer base, continuing to diversify our income and supporting clients in their sustainable transitions. I would like to take this opportunity to thank our shareholders for their continued support, our clients for their continued trust and our employees for their hard work and collaboration.” Press release ING Corporate Communications Amsterdam, 6 February 2025 Investor enquiries E: investor.relations@ing.com Press enquiries T: +31 (0)20 576 5000 E: media.relations@ing.com Analyst call 6 February 2025 at 9:00 am CET +31 20 708 5074 (NL) +44 330 551 0202 (UK) (Registration required via invitation) Live audio webcast at www.ing.com Media call 6 February 2025 at 11:00 am CET +31 20 708 5073 (NL) +44 330 551 0200 (UK) (Quote ING Media Call 4Q2024 when prompted by the operator) Live audio webcast at www.ing.com

Net core lending growth €27.7 bln +4% vs customer lending 4Q2023 Net core deposits growth €47.4 bln +7% vs customer deposits 4Q2023 Profit before tax €9,300 mln - 11% vs 2023 Fee income €4,008 mln +11% vs 2023 CET1 ratio 13.6% - 1.1% vs 4Q2023 Return on equity full - year 13.0% - 1.8% vs 2023 Superior value for customers NPS score Retail Banking: Ranked #1 in 5 of 10 retail markets Mobile primary customers 1) : +1.1 million in 2024 NPS score Wholesale Banking: 74 in 2024 vs 72 in 2023 Sustainability Volume mobilised 2) : €130 bln in 2024 vs €115 bln in 2023 ING Press Release 4Q2024 2 Sustainability deals supported by ING: 835 in 2024 vs 792 in 2023 Business Highlights In Retail Banking, we continued to capture the retrofitting opportunity in our residential mortgage portfolio to make our customers' homes more sustainable. In Germany and Australia, we launched a renovation loan that enables customers to finance renovation measures that can make their homes more energy - efficient. In the Netherlands, we launched a digital tool that supports customers in their retrofitting journey by helping identify which energy upgrades are possible to their homes, estimating the potential energy bill savings and getting quotes from trusted and accredited installers, all in one place. In Wholesale Banking, we have made significant progress towards our 2027 sustainable volume mobilised target, with €130 billion of sustainable volume mobilised in 2024. In 2024, we assessed Client Transition Plans for the first time, enabling data - driven dialogues with 1,600 of our clients during the year. ING acted as Sole Sustainability Coordinator for Sonnedix, a global renewable energy producer, in the execution and closing of a €2.5 billion transaction. This supports Sonnedix's existing operating portfolio of solar assets in Spain, Italy, and France, and the growth of the company’s pipeline in Europe, including energy storage and hybrid projects. ING was awarded 'Best Bank of the Netherlands' by The Banker. The jury recognised ING's development of innovative tools such as ESG.X, which collects our Wholesale Banking clients' publicly disclosed data on their climate transition plans. Society is transitioning to a low - carbon economy. So are our clients, and so is ING. We finance a lot of sustainable activities, but we still finance more that’s not. See how we’re progressing at ing.com/climate. Throughout 2024, we continued to provide superior customer value. We added 1.1 million mobile primary customers during the year to a total of 14.4 million mobile primary customers. Mobile primary customers now make up 89% of our 16.2 million primary customers, out of nearly 40 million retail customers in total. We saw growth in all retail markets, with Germany, the Netherlands, Spain and Poland being the main contributors, in addition to a remarkable percentage growth in Italy. We have launched several customer acquisition campaigns offering a range of incentives. Such campaigns in the Netherlands, Belgium, Germany, Spain, Poland, Türkiye, and Romania supported our strong commercial growth during the year. Throughout the year we continued to introduce measures to prevent fraud. In the Netherlands, we have recently introduced interactive fraud notifications, allowing customers to respond to fraud alerts directly in the app if a transaction has been denied or their debit card has been blocked. In the Netherlands and Spain, we have successfully introduced a GenAI chatbot for retail customers . It answers common daily banking questions, enabling quicker response rates and improving the customer experience . In Private Banking, we have expanded our private markets offering to include more investment strategies in the Netherlands and Belgium. In Business Banking, we have introduced several features throughout the year to improve efficiency in onboarding across several markets, including Belgium and Türkiye. Such measures enable clients to be onboarded in a matter of minutes. In Wholesale Banking, our NPS score further increased to 74, up from 72 in 2023, with clients recognising our sector expertise, global reach, and local experts. 1) Includes private individuals only 2) See our Annual Report for definition

Consolidated results Change FY2023 FY2024 Change 3Q2024 Change 4Q2023 4Q2024 Profit or loss (in € million) - 6.0% 15,976 15,023 - 0.2% 3,689 - 5.0% 3,875 3,680 Net interest income 11.5% 3,595 4,008 - 0.8% 1,009 13.9% 879 1,001 Net fee and commission income - 86.3% 95 13 - 221.2% 52 - 24 - 63 Investment income 22.7% 2,910 3,572 - 32.0% 1,160 16.2% 679 789 Other income 0.2% 22,575 22,615 - 8.5% 5,909 0.0% 5,408 5,407 Total income 6.8% 10,522 11,239 6.1% 2,816 8.4% 2,758 2,989 Expenses excl. regulatory costs - 15.4% 1,042 882 294.3% 88 9.5% 317 347 Regulatory costs 1) 4.8% 11,564 12,121 14.9% 2,904 8.5% 3,075 3,337 Operating expenses - 4.7% 11,011 10,494 - 31.1% 3,004 - 11.3% 2,333 2,070 Gross result 129.6% 520 1,194 - 11.0% 336 247.7% 86 299 Addition to loan loss provisions - 11.4% 10,492 9,300 - 33.6% 2,668 - 21.2% 2,247 1,771 Result before tax - 10.8% 2,970 2,650 - 25.1% 724 - 12.6% 620 542 Taxation 9.8% 235 258 13.8% 65 8.8% 68 74 Non - controlling interests - 12.3% 7,287 6,392 - 38.6% 1,880 - 25.9% 1,558 1,154 Net result 2) Profitability and efficiency 1.56% 1.45% 1.41% 1.54% 1.40% Interest margin 51.2% 53.6% 49.2% 56.9% 61.7% Cost/income ratio 8 18 20 5 18 Risk costs in bps of average customer lending - 3.4% 2.05 1.98 - 37.3% 0.59 - 17.8% 0.45 0.37 Net result per share (in euros) 14.8% 13.0% 15.3% 12.6% 9.4% Return on equity based on IFRS - EU equity 3) 14.7% 13.6% 14.3% 14.7% 13.6% ING Group common equity Tier 1 ratio 4.5% 319.2 333.7 1.6% 328.5 4.5% 319.2 333.7 Risk - weighted assets (end of period, in € billion) Customer balances (in € billion) 5.9% 648.0 686.1 1.7% 674.5 5.9% 648.0 686.1 Customer lending 6.4% 650.3 691.7 - 1.0% 698.4 6.4% 650.3 691.7 Customer deposits 8.6 27.7 8.5 7.2 7.2 Net core lending growth (in € billion) 4) 10.6 47.4 2.9 - 0.9 16.4 Net core deposits growth (in € billion) 4) 1) Regulatory costs comprise bank taxes and contributions to the deposit guarantee schemes (‘DGS’) and resolution funds. 2) Net result reflects the net result attributable to shareholders of the parent. 3) Annualised net result divided by average IFRS - EU shareholders' equity excluding reserved profits not included in CET1 capital. 4) Net core lending growth represents the development in loans and advances to customers excluding provisions for loan losses, adjusted for currency impacts, Treasury and run - off portfolios. Net core deposits growth represents customer deposits adjusted for currency impacts, Treasury and run - off portfolios. Total income Total income in 4Q2024 was €5,407 million and was stable year - on - year. Continued strong growth in customer balances and significantly higher fee income fully offset the impact of normalising liability margins and lower Treasury - related income. On a full - year basis, total income slightly exceeded that of 2023, thereby reaching a new all - time high. In the fourth quarter of 2024, Retail Banking again recorded strong commercial growth. Net core lending growth was €7.0 billion. This mainly reflects a further increase of our residential mortgages portfolio across almost all countries. Net core lending growth in Wholesale Banking was €0.2 billion. On a full - year basis, net core lending growth was high at €27.7 billion, or 4% of customer lending, of which €25.9 billion was in Retail Banking. This was particularly driven by a continued expansion of our mortgage portfolio, coupled with an increase of our business lending and consumer lending portfolios. In Wholesale Banking, net core lending growth for the year was limited to €1.8 billion due to our ongoing capital - optimisation initiatives. We were again successful in attracting deposits, both in Retail and in Wholesale Banking. Our net core deposits growth was a substantial €16.4 billion in 4Q2024. The quarterly growth in Retail Banking amounted to €12.4 billion, with a net inflow in most markets and particularly in the Netherlands, Poland and Spain. Net core deposits growth in Wholesale Banking was €4.0 billion, driven by successful initiatives in Payments & Cash Management and in Money Markets. For the full - year 2024, net core deposits growth totalled €47.4 billion, the highest annual growth ever, with strong contributions from both Retail and Wholesale Banking. Net interest income (in € million) and net interest margin (in %) Total net interest income (NII) decreased year - on - year, as the favourable impact of volume growth was more than offset by a normalising liability margin and the impact of accounting ING Press Release 4Q2024 3 Consolidated Results

asymmetry. NII from liability products decreased to €1,630 million (from €1,810 million in 4Q2023) as the average liability margins for Retail Banking in Germany and Belgium and for Payments & Cash Management in Wholesale Banking have come down from their peak levels in 2023. Accounting asymmetry had an impact on NII of € - 317 million in 4Q2024 compared with € - 277 million in 4Q2023, as higher interest rates led to an increase in funding costs for Financial Markets, while the higher revenues from related positions are reflected in other income. Lending NII was slightly up at €2,119 million, reflecting higher average balances at stable margins. Other NII (when excluding the accounting asymmetry) amounted to €248 million and was broadly stable year - on - year. A € - 51 million impact from the pay - out of incentives in Germany, following a successful campaign to attract new customers, was compensated by higher NII in Treasury. Sequentially, NII was stable. Strong volume growth, as well as a lower accounting asymmetry impact and higher NII in Treasury, offset the impact of normalising liability margins and the aforementioned pay - out of incentives. The net interest margin came out at 1.40% in 4Q2024, which is one basis point lower than it was in 3Q2024. The average lending margin was stable at 1.28%, while the average liability margin declined to 1.00% from 1.12% in 3Q2024. Total net fee and commission income in the fourth quarter increased 14% year - on - year in line with our ambition to diversify our income, and again exceeded €1 billion in one quarter. In Retail Banking, fee income from investment products was up significantly, reflecting an increase in both assets under management and customer trading activity. Daily banking fees rose on the back of strong customer growth and updated pricing for payment packages. In addition, Retail Banking grew its fee income from lending and insurance products. The increase in fee income for Wholesale Banking was mainly attributable to higher fees in Lending. Sequentially, net fee and commission income decreased slightly. In Retail Banking, fee income held up well, taking into account that 4Q2024 included the pay - out of incentives in Belgium after a successful campaign that attracted new customers for investment products. Wholesale Banking fee income slightly declined as higher fees from Lending could not fully compensate for a lower deal flow in Corporate Finance and Global Capital Markets. On a full - year basis, net fee and commission income rose 11% to over €4 billion. Investment income amounted to € - 63 million compared with € - 24 million in 4 Q 2023 and € 52 million in 3 Q 2024 , which had included a € 101 million annual dividend from our stake in the Bank of Beijing . Other income rose by €110 million, or 16% year - on - year. This was mainly driven by Financial Markets due to a larger impact from accounting asymmetry, whereas 4Q2023 had negatively been impacted by a €60 million reserve increase. Sequentially, other income dropped because of lower results from Treasury and seasonally weaker trading results in Financial Markets in the fourth quarter, while 3Q2024 had included €77 million as our share in the one - off profit of an associate in Belgium. Operating expenses Total operating expenses were € 3 , 337 million, including € 347 million of regulatory costs and € 109 million of incidental cost items . Expenses excluding regulatory costs and incidental items amounted to €2,881 million and rose 9.0% year - on - year, mainly attributable to the impact of inflation on staff expenses and the implementation of the ‘Danske Bank’ ruling on VAT in the Netherlands. In Retail Banking, this was coupled with higher client acquisition expenses. Wholesale Banking expenses also reflect front office growth in Capital Markets & Advisory and Transaction Services, as well as investments to enhance the digital customer experience and the scalability of our systems. Sequentially, the growth in expenses excluding regulatory costs and incidental items was 3.2%, attributable to higher staff and client acquisition expenses. Operating expenses (in € million) Regulatory costs in 4Q2024 were €347 million, including €246 million of annual Dutch bank tax, which is always fully recorded in the fourth quarter. Year - on - year, regulatory costs rose by €30 million, as the impact of a higher tariff for the Dutch bank tax in 2024 was partly offset by a lower contribution to deposit guarantee funds. ING Press Release 4Q2024 4 Incidental expense items in 4Q2024 amounted to €109 million. This includes €65 million of restructuring costs, €22 million for a one - off CLA - related payment to our staff in the Netherlands and €21 million of hyperinflation accounting impacts on expenses in Türkiye (due to accounting requirements of IAS 29). The total €109 million of incidental cost items in 4Q2024 compares with €114 million of incidental items in 4Q2023 and €24 million in 3Q2024. Addition to loan loss provisions Net additions to loan loss provisions amounted to €299 million. This is equivalent to 18 basis points of average customer lending, and below our through - the - cycle average of 20 basis points. Total net additions to Stage 3 provisions in 4Q2024 were €311 million, down from the previous quarter, and mainly related to individual Stage 3 provisioning. This was largely connected to a number of new and existing Stage 3 files in Wholesale Banking, partly offset by releases of existing provisions due to repayments and recoveries. Total Stage 1 and 2 risk costs were € - 11 million, including a partial release of management overlays. Consolidated Results

Addition to loan loss provisions (in € million) Risk costs for Retail Banking were €158 million, or 13 basis points of average customer lending. Net additions were mainly related to business and consumer lending, while risk costs for mortgages continued to be very low. Wholesale Banking recorded €141 million of risk costs, or 29 basis points of average customer lending. Net result The net result in 4Q2024 was €1,154 million compared with €1,558 million in 4Q2023 and €1,880 million in the previous quarter. This brings the net result for full - year 2024 to €6,392 million, the second - best annual result after the €7,287 million recorded for 2023. The full - year effective tax rate was 28.5% versus 28.3% in 2023. For 4Q2024 the effective tax rate was 30.6%, reflecting higher non - deductible expenses and several one - off tax charges. This compares to an effective tax rate of 27.6% in 4Q2023 and 27.1% in 3Q2024. Return on equity ING Group (in %) Our strong performance for the year was reflected in a 13.0% return on equity for 2024. ING’s return on equity is calculated using average IFRS - EU shareholders' equity after excluding 'reserved profit not included in CET1 capital', which amounted to €2,152 million at the end of 2024. This reflects 50% of the resilient net profit in 2024, which has been reserved for distribution in line with our policy, minus the interim dividend over 2024 that was paid in August. Resilient net profit is defined as net profit adjusted for significant items that are not linked to the normal course of business. In line with this definition, and consistent with previous quarters, the impact of hyperinflation accounting has been excluded. Therefore, resilient net profit was €32 million higher than net profit in 4Q2024 and €156 million higher on a full - year basis. ING Press Release 4Q2024 5 Dividend In line with our dividend policy, the Board proposes to pay a final dividend over 2024 of €2.2 billion, subject to the approval by the Annual General Meeting on 22 April 2025. The proposed final dividend over 2024 amounts to €0.71 per ordinary share and will be paid in cash shortly after approval by the Annual General Meeting. An interim dividend of €0.35 per ordinary share for the year 2024 was paid in August 2024. This will bring the total cash dividend over 2024 to €3.3 billion. This is in addition to €0.5 billion of additional cash distribution and €4.5 billion of share buybacks as announced in 2024. 2025 Outlook 1) Based on current assumptions and scenarios, total income in 2025 is expected to end up at roughly the same level as in 2024, supported by volume growth and a targeted 5 - 10% increase in fee income. Total expenses are foreseen to increase to around €12.5 - €12.7 billion (excluding incidental items). The CET1 ratio is expected to converge towards our ~12.5% target by the end of 2025 and the return on equity is expected to exceed 12%. The outlook excludes the impact of the announced intended sale of ING’s business in Russia to Global Development JSC, where we expect a negative P&L impact of around €0.7 billion post tax. It also excludes potential other significant incidental items and/or one - offs. We expect a negligible impact from the implementation of Basel IV and other model updates in 1Q2025. Consolidated Results 1) The targets, outlook and trends discussed in this 2025 Outlook section are forward - looking statements that are based on management’s current expectations and are subject to change, including as a result of the factors described under the section entitled ‘Important Legal Information’ in this document. ING assumes no obligation to publicly update or revise these forward - looking statements, whether as a result of new information or for any other reason.

ING Press Release 4Q2024 6 Consolidated balance sheet 31 Dec. 23 30 Sep. 24 31 Dec. 24 30 Sep. 24 31 Dec. 23 31 Dec. 24 in € million 23,257 650,267 221,773 334,287 92,154 2,053 94,638 37,220 2,019 55,400 15,167 124,670 15,401 16,684 698,377 221,000 346,211 127,951 3,215 100,552 38,775 1,797 59,981 13,190 150,942 17,488 16,723 691,661 227,827 354,560 107,695 1,579 86,900 35,255 2,101 49,543 13,707 142,367 17,878 Liabilities Deposits from banks Customer deposits – current accounts / overnight deposits – savings accounts – time deposits – other customer deposits Financial liabilities at fair value through profit or loss – trading liabilities – non - trading derivatives – designated as at fair value through profit or loss Other liabilities Debt securities in issue Subordinated loans 100,118 90,214 22,947 16,709 150,149 123,015 78,114 60,229 1,558 2,028 4,961 5,775 65,516 54,983 45,577 41,116 2,359 1,885 42,061 38,281 1,156 951 47,950 48,313 668,498 642,402 674,531 648,023 - 6,033 - 5,621 1,658 1,509 2,413 2,399 1,296 1,198 8,864 8,708 70,353 21,770 137,580 72,897 2,463 5,740 56,481 46,389 2,562 42,219 1,608 50,273 680,233 686,066 - 5,833 1,679 2,434 1,334 8,499 Assets Cash and balances with central banks Loans and advances to banks Financial assets at fair value through profit or loss – trading assets – non - trading derivatives – designated as at fair value through profit or loss – mandatorily at fair value through profit or loss Financial assets at fair value through OCI – equity securities fair value through OCI – debt securities fair value through OCI – loans and advances fair value through OCI Securities at amortised cost Loans and advances to customers – customer lending – provision for loan losses Investments in associates and joint ventures Property and equipment Intangible assets Other assets 923,400 997,235 969,236 Total liabilities 51,240 944 51,294 941 50,314 995 Equity Shareholders' equity Non - controlling interests 52,184 52,235 51,309 Total equity 975,583 1,049,470 1,020,545 Total liabilities and equity 1,049,470 975,583 1,020,545 Total assets Balance sheet In 4Q2024, ING’s balance sheet decreased by €29 billion to €1,021 billion, including €6 billion of positive currency impacts resulting from a weakening of the euro. The decrease in assets was mainly visible in cash and balances with central banks and in financial assets at fair value through profit or loss. These decreases were partly offset by a €12 billion increase in customer lending, largely driven by volume growth in residential mortgages and currency impacts. In liabilities, the main decreases were recorded in financial liabilities at fair value through profit or loss, mirroring the development on the asset side of the balance sheet, and in debt securities in issue. Customer deposits for Retail and Wholesale Banking rose strongly, by €16 billion, but on total level declined by €7 billion due to a decrease in Treasury deposits. Compared with year - end 2023, ING’s balance sheet grew by €45 billion, including €6 billion of positive currency impacts. The balance sheet increase was largely driven by €38 billion growth in customer lending, which was mainly attributable to Retail Banking. Increases in financial assets at fair value through profit or loss, in financial assets at fair value through OCI and in loans and advances to banks were largely offset by lower cash and balances with central banks. In liabilities, the main increase was €41 billion in customer deposits, with contributions from all Retail countries and from our Wholesale business. Debt securities in issue also rose, but this was offset by a decrease in financial liabilities at fair value through profit and loss and by lower deposits from banks. Shareholders’ equity Shareholders’ equity decreased by €926 million in 2024, primarily reflecting a distribution to shareholders of €8,624 million, consisting of €3,626 million of cash dividends paid in 2024 (€2,497 million of final dividend over 2023 and €1,129 million interim dividend over 2024), €498 million of additional cash distribution paid in January 2025 and €4,500 million of share buybacks (of which €2,500 million was announced in May 2024 and €2,000 million announced in October 2024, and recorded as a change in treasury shares). This was largely offset by the €6,392 million net result recorded for the full - year 2024, €541 million of currency impacts, €461 million of unrealised gains on fair value through OCI and a €365 million increase in the cashflow hedge reserve. Shareholders’ equity per share increased to €16.25 on 31 December 2024 from €15.32 on 31 December 2023. Change in shareholders’ equity FY2024 4Q2024 in € million 51,240 51,294 Shareholders' equity beginning of period 6,392 1,154 Net result for the period 461 67 (Un)realised gains/losses fair value through OCI 3 0 (Un)realised other revaluations 365 - 94 Change in cashflow hedge reserve - 46 - 15 Change in liability credit reserve - 16 - 32 Defined benefit remeasurement 541 433 Exchange rate differences - 4,541 - 2,001 Change in treasury shares (incl. share buybacks) 45 9 Change in employee stock options and share plans - 4,124 - 498 Dividend - 5 - 4 Other changes - 926 - 980 Total changes 50,314 50,314 Shareholders' equity end of period Consolidated Balance Sheet

ING Press Release 4Q2024 7 ING Group: Capital position 30 Sep. 2024 31 Dec. 2024 in € million 51,294 50,314 Shareholders' equity (parent) - 1,559 - 2,152 Reserved profits not included in CET1 capital - 2,911 - 2,902 Other regulatory adjustments 46,824 45,260 Available common equity Tier 1 capital 7,805 7,965 Additional Tier 1 securities 59 66 Regulatory adjustments additional Tier 1 54,689 53,291 Available Tier 1 capital 9,822 9,852 Supplementary capital - Tier 2 bonds 46 50 Regulatory adjustments Tier 2 64,557 63,194 Available Total capital 328,458 333,708 Risk - weighted assets 14.3% 13.6% Common equity Tier 1 ratio 16.7% 16.0% Tier 1 ratio 19.7% 18.9% Total capital ratio 4.7% 4.7% Leverage ratio Capital ratios The CET1 ratio at the end of 2024 was 13.6% compared with 14.3% for 3Q2024. This decrease mainly reflects the €2.5 billion deduction from capital for the additional distributions as announced on 31 October 2024, partly offset by the inclusion of €0.6 billion from the quarterly net profit after dividend reserving. The development of both the Tier 1 and Total capital ratios mirrors trends in the CET1 ratio. As from 4Q2024, the AT1 and Tier 2 instruments are reported at carrying value, in line with the EBA monitoring report. The leverage ratio remained stable at 4.7%. Risk - weighted assets (RWA) The increase in total RWA in 4Q2024 mainly reflects higher credit RWA. ING Group: Composition of RWA 30 Sep. 2024 31 Dec. 2024 in € billion 276.7 282.1 Credit RWA 38.5 38.5 Operational RWA 13.2 13.1 Market RWA 328.5 333.7 Total RWA Excluding a €+3.0 billion FX impact, credit RWA increased by €2.4 billion compared with the end of 3Q2024. This was mainly due to business growth (€+3.4 billion) and model changes (€ - 1.3 billion). Operational RWA remained flat and market RWA decreased by €0.2 billion. Distribution ING has reserved €593 million of the 4Q2024 net profit for distribution. Resilient net profit in 4Q2024, which is defined as net profit adjusted for significant items not linked to the normal course of business, was €1,186 million. This includes a positive adjustment to the reported net result of €32 million, which is related to hyperinflation accounting according to IAS 29 in the consolidation of our subsidiary in Türkiye. In line with our distribution policy of a 50% pay - out ratio on resilient net profit, the Board proposes to pay a final cash dividend over 2024 of €0.71 per ordinary share. This is subject to the approval by shareholders at the Annual General Meeting on 22 April 2025. On 31 October 2024, ING announced the start of a share buyback programme under which it plans to repurchase ordinary shares of ING Group for a maximum total amount of €2.0 billion. At the end of 2024, approximately 50.5 million shares for a total consideration of around €0.8 billion had already been repurchased. In addition, ING has distributed an amount of €500 million in cash to shareholders, for which €0.161 per share has been paid on 16 January 2025. CET1 requirement ING targets a CET1 ratio of around 12.5%, which is comfortably above the prevailing CET1 ratio requirement (including buffer requirements) of 10.76%. This requirement increased compared with 3Q2024 (10.71%) due to a higher countercyclical buffer requirement in Belgium. ING’s fully loaded CET1 requirement was 10.88% at the end of 4Q2024. The increase versus 3Q2024 (10.87%) was mainly caused by the activation of a countercyclical buffer in Spain, which was announced in 4Q2024. This buffer will be phased in over the next 12 months. Capital, Liquidity and Funding

ING Press Release 4Q2024 8 MREL and TLAC requirements Minimum Required Eligible Liabilities (MREL) and Total Loss Absorbing Capacity (TLAC) requirements apply to ING Group at the consolidated level of the resolution group. The available MREL and TLAC capacity consists of own funds and senior debt instruments issued by ING Group. ING’s MREL requirement (including buffer requirements) is 29.08% of RWA and 7.32% of leverage exposure. The MREL capacity increased in 4Q2024 due to the issuance of two HoldCo Senior instruments, of €1 billion and £0.5 billion. This was partly offset by a lower CET1 capital as well as the redemption of a €1.25 billion Senior HoldCo instrument. The increase in MREL capacity is reflected in a higher surplus based on leverage exposure. The MREL surplus based on RWA declined, as the increase in MREL capacity was more than offset by a higher RWA. The prevailing TLAC requirements (including buffer requirements) are 23.33% of RWA and 6.75% of leverage exposure. ING Group: MREL and TLAC requirements 30 Sep. 2024 31 Dec. 2024 in € million 110,993 111,247 MREL / TLAC capacity 33.8% 33.3% MREL / TLAC (as a % of RWA) 9.6% 9.8% MREL / TLAC (as a % of leverage exposure) 26,231 28,554 MREL surplus based on LR requirement 15,646 14,198 MREL surplus based on RWA requirement 32,831 34,993 TLAC surplus based on LR requirement 34,532 33,386 TLAC surplus based on RWA requirement Ratings The ratings and outlook from S&P, Moody’s and Fitch remained unchanged during the quarter. Liquidity and funding In 4Q2024, the 12 - month moving average Liquidity Coverage Ratio (LCR) decreased to 143%. LCR 12 - month moving average 30 Sep. 2024 31 Dec. 2024 in € billion 184.8 184.1 Level 1 3.1 3.2 Level 2A 6.4 7.0 Level 2B 194.3 194.3 Total HQLA 232.2 234.6 Outflow 98.6 98.5 Inflow 146% 143% LCR At the end of 4Q2024, the Net Stable Funding Ratio of ING stood at 133%, comfortably above the regulatory minimum of 100%. In our funding mix, the share of customer deposits from private individuals increased to 53%, reflecting strong deposits growth in Retail Banking in 4Q2024. ING Group: Loan - to - deposit ratio and funding mix 30 Sep. 2024 31 Dec. 2024 0.96 0.98 Loan - to - deposit ratio Funding mix 50% 53% Customer deposits (private individuals) 23% 22% Customer deposits (other) 7% 5% Lending / repurchase agreements 2% 2% Interbank 6% 5% CD/CP 11% 11% Long - term senior debt 2% 2% Subordinated debt 100% 100% Total 1) 1) Liabilities excluding trading securities and IFRS equity. ING’s long - term debt position (excluding AT1) increased by €1.8 billion versus 3Q2024. The change was mainly caused by the following issuances in 4Q2024: a €1.0 billion Green HoldCo Senior, a £0.5 billion HoldCo Senior, and an AUD 1.0 billion covered bond by ING Australia. This was partly offset by redemptions amounting to €0.9 billion. Long - term debt maturity ladder per currency, 31 December 2024 >2029 2029 2028 2027 2026 2025 Total in € billion 38 10 10 7 9 5 79 EUR 9 1 3 5 4 0 23 USD 3 3 2 2 3 1 13 Other 50 14 15 14 16 6 115 Total Credit ratings of ING on 5 February 2025 Fitch Moody's S&P ING Groep N.V. Issuer rating A+ n/a A - Long - term F1 n/a A - 2 Short - term Stable Positive 1) Stable Outlook A+ Baa1 A - Senior unsecured rating ING Bank N.V. Issuer rating AA - A1 A+ Long - term F1+ P - 1 A - 1 Short - term Stable Positive Stable Outlook AA - A1 A+ Senior unsecured rating 1) Outlook refers to the senior unsecured rating. Capital, Liquidity and Funding

ING Group: Total credit outstandings 1) Stage 3 ratio Stage 3 Stage 2 ratio Stage 2 Credit outstandings 31 Dec. 30 Sep. 2024 2024 in € million 30 Sep. 2024 31 Dec. 2024 30 Sep. 2024 31 Dec. 2024 30 Sep. 2024 31 Dec. 2024 30 Sep. 2024 31 Dec. 2024 0.9% 0.9% 3,251 3,313 7.3% 8.4% 25,360 29,392 345,760 350,023 Residential mortgages 0.5% 0.5% 540 591 11.9% 12.7% 14,233 15,382 119,446 121,484 of which Netherlands 2.7% 2.7% 1,205 1,187 9.8% 9.7% 4,340 4,324 44,344 44,588 of which Belgium 0.6% 0.6% 525 561 2.9% 3.4% 2,704 3,225 94,848 96,150 of which Germany 1.1% 1.1% 981 975 4.7% 7.4% 4,083 6,461 87,122 87,800 of which Rest of the world 4.6% 4.8% 1,209 1,273 9.3% 11.5% 2,438 3,081 26,308 26,702 Consumer lending 3.0% 3.0% 3,314 3,251 11.8% 11.9% 12,933 13,092 109,237 109,655 Business lending 1.8% 1.6% 685 616 12.1% 12.9% 4,643 5,059 38,488 39,170 of which business lending Netherlands 3.2% 3.2% 1,617 1,598 9.5% 9.1% 4,787 4,597 50,506 50,620 of which business lending Belgium 0.3% 0.5% 204 230 0.8% 1.5% 489 736 63,945 48,080 Other retail banking 0.0% 0.0% 0.0% 0.3% 14 111 58,738 43,053 of which retail - related treasury 1.5% 1.5% 7,979 8,067 7.6% 8.7% 41,221 46,301 545,250 534,460 Retail Banking 2.5% 2.7% 4,317 4,426 7.2% 11.8% 12,275 19,004 159,273 161,151 Lending 1.4% 1.0% 785 591 6.5% 7.4% 3,632 4,372 55,500 59,171 Daily Banking & Trade Finance 0.0% 0.0% 4.0% 9.7% 919 962 22,808 9,897 Financial Markets 0.4% 0.4% 123 118 0.9% 0.9% 282 291 32,180 30,848 Treasury & Other 1.9% 2.0% 5,224 5,135 6.3% 9.4% 17,109 24,630 269,762 261,067 Wholesale Banking 1.6% 1.7% 13,203 13,202 7.2% 8.9% 58,329 70,931 815,012 795,527 Total loan book ING Press Release 4Q2024 9 1) Lending and money market credit outstandings, including guarantees and letters of credit but excluding undrawn committed exposures (off - balance positions) and Corporate Line. Credit risk management Total credit outstandings decreased in 4Q2024 following a decline in cash and balances with central banks (reflected in Treasury and Financial Markets), as well as in Wholesale Banking Lending. This was partially offset by increases primarily in residential mortgages and in Wholesale Banking Daily Banking & Trade Finance. Stage 2 credit outstandings rose, mainly in Wholesale Banking Lending and in residential mortgages. In Wholesale Banking Lending, the higher Stage 2 ratio primarily reflects the reclassification of low - default portfolios for which provisioning overlays have been taken, and some movements in the watchlist portfolio. The increase in Stage 2 outstandings for residential mortgages was, next to regular movements in the portfolio, due to the implementation of an enhanced early - warning system in various Retail Other countries. The stock of provisions decreased slightly due to lower Stage 3 provisions. The Stage 3 coverage ratio declined to 34.0% from 35.3% in the previous quarter. The total loan portfolio consists predominantly of asset - based and secured loans, including residential mortgages, project - and asset - based finance, and real estate finance, with generally low loan - to - value ratios. ING Group: Stock of provisions 1) Change 30 Sep. 2024 31 Dec. 2024 in € million - 17 427 409 Stage 1 - 12 - month ECL 2 1,127 1,130 Stage 2 - Lifetime ECL not credit impaired - 165 4,674 4,509 Stage 3 - Lifetime ECL credit impaired 2) - 180 6,228 6,049 Total recognised as liabilities. 1) At the end of December 2024, the stock of provisions included provisions for loans and advances to customers (€5,833 million), loans and advances to central banks (€14 million), loans and advances to banks (€22 million), financial assets at FVOCI (€19 million), securities at amortised cost (€15 million) and ECL provisions for off - balance - sheet exposures (€146 million) 2) Stage 3 includes purchased originated credit impaired (POCI). Market risk The average Value - at - Risk (VaR) for the trading portfolio increased to €16 million from €15 million in 3Q2024. ING Group: Consolidated VaR trading books Quarter - end Average in € million 2 2 Foreign exchange 6 5 Equities 11 11 Interest rate 3 4 Credit spread - 6 - 7 Diversification 16 16 Total VaR Non - financial risk As previously disclosed, after our September 2018 settlement with Dutch authorities concerning Anti - Money Laundering matters, and in the context of significantly increased attention to the prevention of financial economic crime, ING has experienced heightened scrutiny by authorities in various countries. The interactions with such regulatory and judicial authorities have included, and can be expected to continue to include, onsite visits, information requests, investigations and other enquiries. Such interactions, as well as ING’s internal assessments in connection with its global enhancement programme, have in some cases resulted in satisfactory outcomes. Some have also resulted in, and may continue to result in, findings or other conclusions which may require appropriate remedial actions by ING, or may have other consequences. We intend to continue to work in close cooperation with authorities as we work to improve our management of non - financial risks. Risk Management

ING Press Release 4Q2024 10 Retail Banking: Consolidated profit or loss account Change FY2023 FY2024 Change 3Q2024 Change 4Q2023 4Q2024 In € million Profit or loss - 0.1% 11,459 11,449 - 2.2% 2,853 - 0.2% 2,795 2,789 Net interest income 15.3% 2,337 2,694 - 1.0% 688 16.2% 586 681 Net fee and commission income 1 - 73 - 48 - 19 - 40 Investment income - 6.7% 1,271 1,186 - 52.1% 482 - 30.4% 332 231 Other income 1.2% 15,069 15,256 - 7.9% 3,975 - 0.9% 3,693 3,661 Total income 6.1% 6,938 7,361 3.7% 1,834 3.5% 1,836 1,901 Expenses excl. regulatory costs - 13.4% 771 668 190.1% 71 - 0.5% 207 206 Regulatory costs 4.2% 7,709 8,030 10.7% 1,904 3.1% 2,043 2,107 Operating expenses - 1.8% 7,360 7,226 - 25.0% 2,071 - 5.8% 1,650 1,554 Gross result - 6.8% 607 566 9.0% 145 83.7% 86 158 Addition to loan loss provisions - 1.4% 6,753 6,660 - 27.5% 1,926 - 10.8% 1,565 1,396 Result before tax Key financial metrics 9.7 25.9 6.4 3.8 7.0 Net core lending growth (in € billion) 18.5 31.6 1.0 2.5 12.4 Net core deposits growth (in € billion) 51.2% 52.6% 47.9% 55.3% 57.5% Cost/income ratio 13 12 12 8 13 Risk costs in bps of average customer lending 24.8% 24.3% 28.1% 23.2% 19.8% Return on equity based on 12.5% CET1 1) 7.0% 154.4 165.2 2.2% 161.6 7.0% 154.4 165.2 Risk - weighted assets (end of period, in € billion) 1) Annualised after - tax return divided by average equity based on 12.5% of RWA. Retail Banking Retail Banking had another excellent year, with a result before tax of €6,660 million and a return on equity of 24.3%, almost equal to the record level achieved in 2023. Retail Banking maintained strong commercial momentum in 2024. The mobile primary customer base increased by 1.1 million, and this was coupled with a record growth in customer lending and an exceptionally high growth in customer deposits. Net core lending growth (which excludes currency impacts, Treasury and run - off portfolios) was €25.9 billion. This was particularly driven by a further increase of our mortgage portfolio across all markets. We also further grew our consumer lending and business lending portfolios. We were very successful in attracting deposits in 2024. Net core deposits growth (which is the increase in customer deposits excluding FX impacts and movements in Treasury deposits) was €31.6 billion. All of our countries contributed, with the largest increases coming from Germany and Belgium following successful campaigns. Total net interest income was resilient in 2024. The strong increase in lending and deposit volumes, in combination with improved liability margins outside the eurozone, had a favourable impact on our NII. This compensated for the impact of normalising liability margins in the eurozone. Net commission and fee income rose 15% to €2,694 million. This strong increase was mainly attributable to higher fee income from daily banking services and investment products. We benefited from more customers choosing ING for their banking products, from an updated pricing for payment packages, as well as from growth in assets under management and in the number of brokerage trades. In addition, we also recorded double - digit growth in fee income from lending and insurance products. Other income decreased 6.7% to €1,186 million, reflecting a drop in Treasury - related other income. This was partly offset by €77 million for our share in the one - off profit of an associate in Belgium, recorded in 3Q2024. Operating expenses amounted to €8,030 million and were up 4.2%. Regulatory costs were €103 million lower year - on - year, mainly because no contribution to the eurozone’s Single Resolution Fund was required in 2024 and because the Dutch deposit guarantee fund reached its target level in 2024. Expenses in 2024 included €86 million of incidental items (largely related to restructuring provisions) compared with €131 million of incidental items in 2023. Expenses excluding regulatory costs and incidental items rose 6.9%, mainly attributable to higher staff and client acquisition expenses, as well as to higher VAT costs after the implementation of the ‘Danske ruling’. Net additions to loan loss provisions for Retail Banking declined to €566 million in 2024 and were 12 basis points of average customer lending. Risk costs were positively impacted by continued strong asset quality, a partial release of management overlays and a strong improvement in the housing markets. Segment Reporting: Retail Banking

ING Press Release 4Q2024 11 Retail Banking Market Leaders: Consolidated profit or loss account Retail Banking Belgium Retail Banking Netherlands FY2023 FY2024 4Q2023 3Q2024 4Q2024 FY2023 FY2024 4Q2023 3Q2024 4Q2024 In € million Profit or loss 2,063 1,959 511 478 428 3,096 3,027 700 718 775 Net interest income 502 603 129 153 144 959 1,049 242 270 266 Net fee and commission income 5 - 13 1 - 19 0 6 - 25 1 - 16 - 16 Investment income 112 202 17 128 37 939 860 247 291 200 Other income 2,683 2,751 658 740 610 5,001 4,910 1,190 1,263 1,224 Total income 1,642 1,605 425 402 397 1,923 2,011 494 506 523 Expenses excl. regulatory costs 211 206 30 - 1 32 212 114 72 0 73 Regulatory costs 1,852 1,811 456 401 429 2,135 2,124 566 506 595 Operating expenses 830 941 202 338 180 2,866 2,786 624 756 629 Gross result 169 134 28 43 25 5 - 8 - 35 9 26 Addition to loan loss provisions 661 807 174 296 155 2,861 2,793 660 747 603 Result before tax Key financial metrics 1.4 3.7 1.1 0.0 0.3 2.3 9.6 0.7 3.1 3.1 Net core lending growth (in € billion) - 1.3 6.4 0.1 2.4 1.6 - 1.6 5.0 0.4 - 0.4 4.0 Net core deposits growth (in € billion) 69.1% 65.8% 69.3% 54.2% 70.5% 42.7% 43.3% 47.5% 40.1% 48.6% Cost/income ratio 18 14 12 18 10 0 0 - 9 2 6 Risk costs in bps of average customer lending 11.2% 13.7% 13.2% 21.9% 10.0% 33.4% 32.1% 30.7% 34.4% 27.1% Return on equity based on 12.5% CET1 1) 34.6 36.2 34.6 35.0 36.2 50.7 52.6 50.7 51.6 52.6 Risk - weighted assets (end of period, in € billion) 1) Annualised after - tax return divided by average equity based on 12.5% of RWA. Retail Netherlands Net interest income from both lending and liabilities increased year - on - year, supported by continued growth in the mortgage portfolio and higher savings volumes. Sequentially, a lower margin on liabilities could largely be offset by further growth in customer balances. Treasury - related interest income was up on both comparable quarters, partly due to a reduced impact from accounting asymmetry (with an offset in other income). Fee income rose strongly year - on - year, driven by growth in the number of customers, higher fees for payment packages and an increase in assets under management. Sequentially, fee income declined slightly, as the third quarter had included seasonally higher fees during the summer holidays. Net core lending growth was €3.1 billion in 4Q2024, as a continued increase in mortgages was coupled with an expansion of the business lending portfolio. Net core deposits growth was €4.0 billion, including an inflow in savings and deposits from both private individuals and business clients. Expenses excluding regulatory costs increased both year - on - year and sequentially. This was mainly the result of higher staff expenses (due to CLA impact) and higher client acquisition expenses, partly offset by savings on external staff costs. The fourth quarter of 2024 had €11 million of incidental item costs for restructuring and a €12 million release from a provision. Regulatory costs in the fourth quarter included the annual booking of the Dutch bank tax. Year - on - year, the impact of a higher tariff for the bank tax was offset by a lower contribution to the deposit guarantee fund. Risk costs amounted to €26 million in 4Q2024 and were primarily related to business lending. Retail Belgium (including Luxembourg) Net interest income declined both year - on - year and sequentially, primarily due to an increase in average deposit costs. Fee income increased significantly year - on - year. The fourth quarter of 2024 included the pay - out of incentives after a successful campaign that attracted new customers for investment products. This fully explains the decline in fee income sequentially. Other income fell compared with 3Q2024, which included €77 million for our share in the one - off profit of an associate. Net core lending growth was €0.3 billion and was mostly driven by mortgages. Net core deposits growth was €1.6 billion, thanks to higher current account balances in Business Banking and an inflow of savings from private individuals. Expenses included €4 million of costs related to restructuring compared with €30 million of such costs in 4Q2023 and €21 million in 3Q2024. Expenses excluding regulatory and restructuring costs declined slightly year - on - year, as the impact of automatic salary indexation was offset by FTE reductions; but expenses rose sequentially, mainly due to higher client acquisition expenses. Regulatory costs in 4Q2024 reflect the allocation of the annual Dutch bank tax. Risk costs amounted to €25 million in 4Q2024 and were primarily related to consumer lending and business lending. Segment Reporting: Retail Banking

ING Press Release 4Q2024 12 Retail Banking Challengers & Growth Markets: Consolidated profit or loss account Retail Banking Other Retail Banking Germany FY2023 FY2024 4Q2023 3Q2024 4Q2024 FY2023 FY2024 4Q2023 3Q2024 4Q2024 In € million Profit or loss 3,437 3,817 875 967 965 2,862 2,647 709 690 621 Net interest income 519 609 131 164 152 357 433 84 102 118 Net fee and commission income 2 - 12 - 4 1 - 16 - 13 - 22 - 17 - 15 - 8 Investment income 275 275 75 81 77 - 54 - 151 - 7 - 17 - 83 Other income 4,233 4,688 1,077 1,212 1,179 3,152 2,906 769 760 648 Total income 2,227 2,532 608 624 655 1,147 1,215 309 301 326 Expenses excl. regulatory costs 252 261 79 43 82 96 88 26 29 19 Regulatory costs 2,479 2,792 687 667 737 1,243 1,303 335 330 345 Operating expenses 1,754 1,896 390 545 442 1,909 1,604 434 430 303 Gross result 313 291 68 37 78 119 149 25 56 28 Addition to loan loss provisions 1,441 1,605 322 508 363 1,790 1,455 409 375 275 Result before tax Key financial metrics 4.3 8.2 1.6 2.0 2.3 1.7 4.4 0.3 1.3 1.3 Net core lending growth (in € billion) 12.9 12.7 4.6 1.6 6.6 8.5 7.5 - 2.5 - 2.5 0.2 Net core deposits growth (in € billion) 58.6% 59.6% 63.8% 55.0% 62.5% 39.4% 44.8% 43.5% 43.4% 53.2% Cost/income ratio 29 26 25 13 27 12 14 10 21 10 Risk costs in bps of average customer lending 20.1% 20.6% 18.3% 25.5% 17.9% 33.3% 30.1% 30.2% 28.8% 22.1% Return on equity based on 12.5% CET1 1) 45.1 49.8 45.1 49.2 49.8 24.0 26.6 24.0 25.7 26.6 Risk - weighted assets (end of period, in € billion) 1) Annualised after - tax return divided by average equity based on 12.5% of RWA. Retail Germany Net interest income decreased on both comparable periods due to a lower liability margin and the € - 51 million impact of the pay - out of incentives, following a successful campaign to attract new customers. In 2024, the total number of customers increased by more than 500,000. Fee income increased year - on - year, fuelled by growth in the number of customers, a higher number of trades in investment products, and higher fees from mortgage brokerage and daily banking. Sequentially, fee income also rose, mainly driven by higher fees from investment products as the number of trades increased. Other income decreased both year - on - year and sequentially, reflecting lower Treasury - related income. Net core lending growth in 4Q2024 was €1.3 billion and largely driven by mortgages. The net core deposits growth was €0.2 billion, with a small net inflow from both private individuals and Business Banking clients. Expenses excluding regulatory costs in 4Q2024 reflect higher client acquisition expenses, mainly for the successful campaigns to attract new customers and for further investments in business growth. Staff expenses were also higher, particularly year - on - year due to annual salary increases. Operating expenses in 4Q2023 had included €20 million of incidental item costs. Regulatory costs decreased compared with 4Q2023, owing to lower contributions to the deposit guarantee scheme. Risk costs were €28 million and primarily related to consumer lending and business lending. Retail Other Net interest income increased strongly year - on - year, supported by continued growth in lending and deposit volumes, coupled with higher margins. Sequentially, net interest income remained stable as volume growth and higher Treasury - related interest income compensated for some normalisation of liability margins. Fee income rose year - on - year, mainly driven by higher fees from investment products, which were fuelled by net inflows and market impact. This was combined with higher fee income from insurance and daily banking, reflecting an increase in the number of customers as well as an updated pricing for daily banking services. Sequentially, fee income decreased, primarily because the third quarter had included seasonally higher fees during the summer holidays. Investment income decreased on both comparable quarters due to realised losses on the sale of bonds in 4Q2024. Net core lending growth amounted to €2.3 billion in 4Q2024, mainly reflecting higher mortgage volumes in almost all countries. Net core deposits growth was €6.6 billion and largely driven by net inflows in Poland and Spain, the latter thanks to a successful campaign. The fourth quarter of 2024 included €17 million of incidental costs related to restructuring compared with €36 million of restructuring costs and impairments in 4Q2023. Expenses excluding regulatory and incidental items increased year - on - year due to inflationary pressure (particularly in Türkiye), higher client acquisition expenses, and investments in further business growth. Sequentially, expenses excluding regulatory costs and incidental items rose 2.2% due to higher client acquisition expenses. Risk costs were €78 million with net additions mainly in Poland and Australia. Segment Reporting: Retail Banking

ING Press Release 4Q2024 13 Wholesale Banking: Consolidated profit or loss account Change FY2023 FY2024 Change 3Q2024 Change 4Q2023 4Q2024 In € million Profit or loss 1.7% 3,224 3,278 5.4% 785 2.7% 805 827 Lending - 9.2% 2,153 1,954 - 2.6% 492 - 10.6% 536 479 Daily Banking & Trade Finance 10.7% 1,280 1,417 - 19.7% 376 53.3% 197 302 Financial Markets - 17.2% 401 332 - 45.1% 91 - 12.3% 57 50 Treasury & Other - 1.1% 7,057 6,981 - 5.0% 1,744 3.9% 1,595 1,657 Total income 10.0% 3,043 3,346 6.8% 841 12.3% 800 898 Expenses excl. regulatory costs - 21.8% 271 212 729.4% 17 28.2% 110 141 Regulatory costs 7.4% 3,313 3,558 21.0% 858 14.1% 910 1,038 Operating expenses - 8.6% 3,744 3,423 - 30.1% 886 - 9.6% 685 619 Gross result - 92 627 - 26.2% 191 - 1 141 Addition to loan loss provisions - 27.1% 3,836 2,796 - 31.2% 695 - 30.3% 686 478 Result before tax Key financial metrics - 1.2 1.8 2.1 3.5 0.2 Net core lending growth (in € billion) - 7.9 15.8 1.8 - 3.5 4.0 Net core deposits growth (in € billion) 47.0% 51.0% 49.2% 57.1% 62.6% Cost/income ratio 462 458 454 425 437 Income over average risk - weighted assets (in bps) 1) - 5 33 40 0 29 Risk costs in bps of average customer lending 15.4% 11.0% 11.2% 11.4% 7.3% Return on equity based on 12.5% CET1 2) 1.3% 150.3 152.2 0.8% 151.0 1.3% 150.3 152.2 Risk - weighted assets (end of period, in € billion) 1) Annualised total income divided by average RWA. 2) Annualised after - tax return divided by average equity based on 12.5% of RWA. In 2024, Wholesale Banking achieved a gross result of €3,423 million. This is attributable to resilient income, supported by increased lending and deposit volumes and strong results in Financial Markets, which compensated for margin compression in Payments & Cash Management (PCM). Expenses rose, reflecting the impact of collective labour agreements, inflation and front office growth in Capital Markets & Advisory and Transaction Services, as well as investments to enhance the digital customer experience and the scalability of our systems. We remained disciplined in capital management, with a modest increase of €1.9 billion in risk - weighted assets, fully due the strengthening of the US dollar, and income over average risk - weighted assets was resilient at 458 basis points. The result before tax declined to € 2 , 796 million, mainly due to higher risk costs versus a net release in 2023 . The return on equity came out at 11 . 0 % in 2024 . The fourth - quarter result before tax was €478 million. Income grew year - on - year, mainly in Financial Markets, but declined sequentially due to Treasury. Higher investment costs for future business growth also impacted quarterly earnings. Expenses in 4Q2024 included €10 million of incidental items (restructuring costs) compared with €17 million of incidental items in 4Q2023. Risk costs were 29 basis points of average customer lending, mainly from Stage 3 provisions for a number of unrelated files, partly offset by releases from collective provisions in Stage 2. Net core lending growth was €0.2 billion, with an increase in Working Capital Solutions and Trade & Commodity Finance (part of Daily Banking & Trade Finance), mostly offset by our ongoing efforts to optimise capital usage. Net customer deposits increased by €4.0 billion, reflecting continued momentum in strategic initiatives in PCM and Money Markets. Lending income in the fourth quarter grew by €22 million on the previous year, driven by strong fee income and higher other income. Net interest income declined from slightly lower average volumes. Sequentially, Lending income increased, supported by growth in fee income and higher interest income. Income from Daily Banking & Trade Finance declined year - on - year, reflecting lower PCM income from reduced margins, partly offset by higher income at Bank Mendes Gans (BMG). Furthermore, 4Q2023 had included a gain on the sale of an equity stake. Compared with 3Q2024, income declined due to further margin compression in PCM and softer results for Trade & Commodity Finance. This was partly compensated by successful initiatives to attract more deposit balances, as well as by higher average volumes for BMG. Financial Markets income increased significantly year - on - year, driven by a strong performance in Forex, Non - Linear and Global Securities Finance products, whereas 4Q2023 had been negatively impacted by a €60 million reserve increase. Quarter - on - quarter, income declined due to lower market and client activity towards year - end, affecting especially Capital Markets issuance, Money Markets and Non - Linear products. Treasury & Other income declined both year - on - year and sequentially, mainly reflecting negative revaluations and hedge ineffectiveness in Treasury, whereas 4Q2023 had benefited from valuation gains in Corporate Investments. Segment Reporting: Wholesale Banking

ING Press Release 4Q2024 14 Corporate Line: Consolidated profit or loss account of which IAS 29 impact 1) Total Corporate Line FY2023 FY2024 4Q2023 3Q2024 4Q2024 FY2023 FY2024 4Q2023 3Q2024 4Q2024 In € million Profit or loss 26 35 8 0 22 489 315 117 94 110 Net interest income 5 4 2 0 3 - 1 - 3 - 2 - 2 1 Net fee and commission income 0 0 0 0 0 100 104 0 101 0 Investment income - 210 - 156 - 25 - 31 - 36 - 138 - 38 5 - 4 - 23 Other income - 179 - 117 - 16 - 31 - 11 450 378 120 189 89 Total income 48 34 12 2 20 542 532 122 141 191 Expenses excl. regulatory costs 0 1 0 0 1 0 1 0 0 1 Regulatory costs 48 35 12 3 21 542 533 122 142 192 Operating expenses - 228 - 152 - 28 - 34 - 32 - 92 - 155 - 2 48 - 103 Gross result 5 1 2 0 0 5 1 2 0 0 Addition to loan loss provisions - 233 - 152 - 30 - 34 - 32 - 97 - 156 - 4 47 - 103 Result before tax of which: 0 0 0 0 0 161 32 65 12 15 Income on capital surplus 0 0 0 0 0 465 506 106 128 118 Foreign currency ratio hedging 0 0 0 0 0 - 110 - 261 - 58 - 42 - 60 Other Group Treasury 0 0 0 0 0 516 277 114 98 74 Group Treasury 0 0 0 0 0 185 202 22 125 28 Asian stakes - 233 - 152 - 30 - 34 - 32 - 798 - 635 - 140 - 176 - 205 Other Corporate Line - 233 - 152 - 30 - 34 - 32 - 97 - 156 - 4 47 - 103 Result before tax 1 4 2 2 0 Taxation - 234 - 156 - 32 - 36 - 32 Net result 1) Hyperinflation accounting (IAS 29) has become applicable for ING’s subsidiary in Türkiye since 2Q2022 with retrospective application from 1 January 2022. Total income decreased by €31 million year - on - year. This was mostly due to a decline in income from capital surplus, partly offset by an increase from foreign currency ratio hedging. Compared with 3Q2024, total income declined by €100 million due to the annual dividend from our stake in the Bank of Beijing that was recorded in 3Q2024 (€101 million). Operating expenses in 4Q2024 included €25 million of restructuring costs, €22 million for a one - off CLA - related payment to our staff in the Netherlands and a €21 million IAS 29 impact. This compares to a €12 million IAS 29 impact in 4Q2023. Expenses in 3Q2024 included a €21 million litigation provision and €3 million IAS 29 impact. Segment Reporting: Corporate Line

ING Press Release 4Q2024 15 Share information 4Q2023 1Q2024 2Q2024 3Q2024 4Q2024 3,343.6 3,460.9 154.6 3,302.5 3,309.5 195.7 3,239.7 3,275.4 63.7 3,161.7 3,200.6 141.7 3,096.3 3,130.0 51.1 Shares (in millions, end of period) Shares outstanding Average number of shares outstanding Treasury shares Share price (in euros) 13.53 15.25 15.96 16.27 15.13 End of period 13.74 15.25 16.57 17.09 16.16 High 11.79 11.92 14.67 14.78 14.44 Low 0.45 0.48 0.54 0.59 0.37 Net result per share (in euros) 15.32 16.09 15.48 16.22 16.25 Shareholders' equity per share (end of period in euros) 0.756 - 0.35 - 0.71 Dividend per share (in euros) 6.6 7.3 7.9 7.9 7.7 Price/earnings ratio 1) 0.88 0.95 1.03 1.00 0.93 Price/book ratio 1) Four - quarter rolling average. Financial calendar Thursday 6 March 2025 Publication 2024 ING Group Annual Report Tuesday 22 April 2025 2025 Annual General Meeting Thursday 24 April 2025 Ex - date for final dividend 2024 (Euronext Amsterdam) 1) Friday 25 April 2025 Record date for final dividend 2024 entitlement (Euronext Amsterdam) 1) Friday 25 April 2025 Record date for final dividend 2024 entitlement (NYSE) 1) Friday 2 May 2025 Publication results 1Q2025 Friday 2 May 2025 Payment date for final dividend 2024 (Euronext Amsterdam) 1) Friday 9 May 2025 Payment date for final dividend 2024 (NYSE) 1) Thursday 31 July 2025 Publication results 2Q2025 Monday 4 August 2025 Ex - date for interim dividend 2025 (Euronext Amsterdam) 1) Tuesday 5 August 2025 Record date for interim dividend 2025 entitlement (Euronext Amsterdam) 1) Monday 11 August 2025 Record date for interim dividend 2025 entitlement (NYSE) 1) Monday 11 August 2025 Payment date for interim dividend 2025 (Euronext Amsterdam) 1) Monday 25 August 2025 Payment date for interim dividend 2025 (NYSE) 1) 1) Only if any dividend is paid All dates are provisional ING profile ING is a global financial institution with a strong European base, offering banking services through its operating company ING Bank. The purpose of ING Bank is: empowering people to stay a step ahead in life and in business. ING Bank’s more than 60,000 employees offer retail and wholesale banking services to customers in over 100 countries. ING Group shares are listed on the exchanges of Amsterdam (INGA NA, INGA.AS), Brussels and on the New York Stock Exchange (ADRs: ING US, ING.N). ING aims to put sustainability at the heart of what we do. Our policies and actions are assessed by independent research and ratings providers, which give updates on them annually. ING's ESG rating by MSCI was reconfirmed by MSCI as 'AA' in August 2024 for the fifth year. As of December 2023, in Sustainalytics’ view, ING’s management of ESG material risk is ‘Strong’. Our current ESG Risk Rating, is 17.2 (Low Risk). ING Group shares are also included in major sustainability and ESG index products of leading providers. Here are some examples: Euronext, STOXX, Morningstar and FTSE Russell. Further information For more on results publications, go to the quarterly results publications page on www.ing.com . For more on investor information, go to www.ing.com/investors . For news updates, go to the newsroom on www.ing.com or via X (@ING_news feed) . For ING photos such as board members, buildings, go to Flickr .

ING Press Release 4Q2024 16 Important legal information Elements of this press release contain or may contain information about ING Groep N.V. and/ or ING Bank N.V. within the meaning of Article 7(1) to (4) of EU Regulation No 596/2014 (‘Market Abuse Regulation’). ING Group’s annual accounts are prepared in accordance with International Financial Reporting Standards as adopted by the European Union (‘IFRS - EU’). In preparing the financial information in this document, except as described otherwise, the same accounting principles are applied as in the 2023 ING Group consolidated annual accounts. The Financial statements for 2024 are in progress and may be subject to adjustments from subsequent events. All figures in this document are unaudited. Small differences are possible in the tables due to rounding. Certain of the statements contained herein are not historical facts, including, without limitation, certain statements made of future expectations and other forward - looking statements that are based on management’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Actual results, performance or events may differ materially from those in such statements due to a number of factors, including, without limitation: (1) changes in general economic conditions and customer behaviour, in particular economic conditions in ING’s core markets, including changes affecting currency exchange rates and the regional and global economic impact of the invasion of Russia into Ukraine and related international response measures (2) changes affecting interest rate levels (3) any default of a major market participant and related market disruption (4) changes in performance of financial markets, including in Europe and developing markets (5) fiscal uncertainty in Europe and the United States (6) discontinuation of or changes in ‘benchmark’ indices (7) inflation and deflation in our principal markets (8) changes in conditions in the credit and capital markets generally, including changes in borrower and counterparty creditworthiness (9) failures of banks falling under the scope of state compensation schemes (10) non - compliance with or changes in laws and regulations, including those concerning financial services, financial economic crimes and tax laws, and the interpretation and application thereof (11) geopolitical risks, political instabilities and policies and actions of governmental and regulatory authorities, including in connection with the invasion of Russia into Ukraine and the related international response measures (12) legal and regulatory risks in certain countries with less developed legal and regulatory frameworks (13) prudential supervision and regulations, including in relation to stress tests and regulatory restrictions on dividends and distributions (also among members of the group) (14) ING’s ability to meet minimum capital and other prudential regulatory requirements (15) changes in regulation of US commodities and derivatives businesses of ING and its customers (16) application of bank recovery and resolution regimes, including write down and conversion powers in relation to our securities (17) outcome of current and future litigation, enforcement proceedings, investigations or other regulatory actions, including claims by customers or stakeholders who feel misled or treated unfairly, and other conduct issues (18) changes in tax laws and regulations and risks of non - compliance or investigation in connection with tax laws, including FATCA (19) operational and IT risks, such as system disruptions or failures, breaches of security, cyber - attacks, human error, changes in operational practices or inadequate controls including in respect of third parties with which we do business and including any risks as a result of incomplete, inaccurate, or otherwise flawed outputs from the algorithms and data sets utilized in artificial intelligence (20) risks and challenges related to cybercrime including the effects of cyberattacks and changes in legislation and regulation related to cybersecurity and data privacy, including such risks and challenges as a consequence of the use of emerging technologies, such as advanced forms of artificial intelligence and quantum computing (21) changes in general competitive factors, including ability to increase or maintain market share (22) inability to protect our intellectual property and infringement claims by third parties (23) inability of counterparties to meet financial obligations or ability to enforce rights against such counterparties (24) changes in credit ratings (25) business, operational, regulatory, reputation, transition and other risks and challenges in connection with climate change and ESG - related matters, including data gathering and reporting (26) inability to attract and retain key personnel (27) future liabilities under defined benefit retirement plans (28) failure to manage business risks, including in connection with use of models, use of derivatives, or maintaining appropriate policies and guidelines (29) changes in capital and credit markets, including interbank funding, as well as customer deposits, which provide the liquidity and capital required to fund our operations, and (30) the other risks and uncertainties detailed in the most recent annual report of ING Groep N.V. (including the Risk Factors contained therein) and ING’s more recent disclosures, including press releases, which are available on www.ING.com. This document may contain ESG - related material that has been prepared by ING on the basis of publicly available information, internally developed data and other third - party sources believed to be reliable. ING has not sought to independently verify information obtained from public and third - party sources and makes no representations or warranties as to accuracy, completeness, reasonableness or reliability of such information. Materiality, as used in the context of ESG, is distinct from, and should not be confused with, such term as defined in the Market Abuse Regulation or as defined for Securities and Exchange Commission (‘SEC’) reporting purposes. Any issues identified as material for purposes of ESG in this document are therefore not necessarily material as defined in the Market Abuse Regulation or for SEC reporting purposes. In addition, there is currently no single, globally recognized set of accepted definitions in assessing whether activities are “green” or “sustainable.” Without limiting any of the statements contained herein, we make no representation or warranty as to whether any of our securities constitutes a green or sustainable security or conforms to present or future investor expectations or objectives for green or sustainable investing. For information on characteristics of a security, use of proceeds, a description of applicable project(s) and/or any other relevant information, please reference the offering documents for such security. This document may contain inactive textual addresses to internet websites operated by us and third parties. Reference to such websites is made for information purposes only, and information found at such websites is not incorporated by reference into this document. ING does not make any third parties. ING specifically disclaims any liability with respect to any information found at websites operated by third parties. ING cannot guarantee that websites operated by third parties remain available following the publication of this document, or that any information found at such websites will not change following the filing of this document. Many of those factors are beyond ING’s control. Any forward - looking statements made by or on behalf of ING speak only as of the date they are made, and ING assumes no obligation to publicly update or revise any forward - looking statements, whether as a result of new information or for any other reason. This document does not constitute an offer to sell, or a solicitation of an offer to purchase, any securities in the United States or any other jurisdiction.

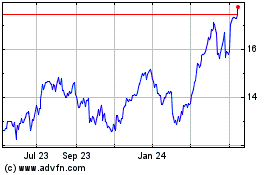

ING Groep NV (NYSE:ING)

Historical Stock Chart

From Jan 2025 to Feb 2025

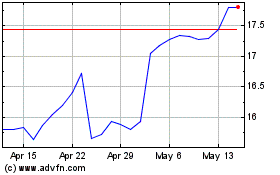

ING Groep NV (NYSE:ING)

Historical Stock Chart

From Feb 2024 to Feb 2025