UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of

Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of December, 2024

Commission File Number: 001-15276

Itaú Unibanco Holding S.A.

(Exact name of registrant as specified in its charter)

Itaú Unibanco Holding S.A.

(Translation of Registrant’s Name into English)

Praça

Alfredo Egydio de Souza Aranha, 100-Torre Conceicao

CEP

04344-902 São Paulo, SP, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F

or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation

S-T Rule 101(b)(1):

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by

Regulation S-T Rule 101(b)(7):

Yes ☐ No ☒

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ☐ No ☒

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

82–

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

Date: December 9, 2024.

|

|

|

| Itaú Unibanco Holding S.A. |

|

|

| By: |

|

/s/ Gustavo Lopes Rodrigues |

| Name: |

|

Gustavo Lopes Rodrigues |

| Title: |

|

Investor Relations Officer. |

|

|

REMUNERATION POLICY FOR ADMINISTRATORS

ITAÚ UNIBANCO HOLDING S.A. CNPJ 60.872.504/0001-23 Publicly-Held Company NIRE 35300010230 REMUNERATION POLICY

FOR ADMINISTRATORS (BRAZIL) 1. TARGET AUDIENCE This remuneration policy1 (“Remuneration Policy”) consolidates the principles

and practices of remuneration of administrators2 adopted by Itaú Unibanco Holding SA (“Itaú Unibanco Holding”)

and by the companies controlled by it (“Itau Unibanco Conglomerate”), especially those that adhered to the single Remuneration

Committee of Itaú Unibanco Holding, with all companies adhering to the Remuneration Policy herein referred to as “Itaú

Unibanco Conglomerate”. 2. GOALS The Remuneration Policy aims to attract, retain and reward in a meritocratic manner the deliveries

made by the administrators, in addition to encouraging them to maintain prudent levels of risk exposure in the short, medium and long-term

strategies in the conduct of their business, in line with shareholders' interests and the organization's culture, so that the Itaú

Unibanco Conglomerate can achieve sustainable results. 3. PRINCIPLES The Itaú Unibanco Conglomerate recognizes that the way in

which the remuneration model is structured is of great importance for the conduct and sustainability of the business. In this sense, variable

remuneration must take into account the risks involved, in order to encourage administrators to seek results that are perceived in the

short, medium and long term, discouraging attitudes and decision making that involve excessive risk. This practice aims to align the interests

of the administrators, the Itaú Unibanco Conglomerate and the shareholders. For this reason, administrators must be subject to

the equity variations resulting from the fluctuation in the value of shares, and any mechanism, whether direct or indirect, through any

person or entity, that implies limiting, locking, or transferring the risk related to their shares, including operations through options,

swaps, forward sales, embedded derivatives, merchant commission, and mandate, is prohibited. 1 Remuneration considers payments made in

cash, shares, share-based instruments and other assets, in retribution for the work provided to the institution by administrators, comprising

fixed remuneration, represented by salaries, fees and commissions, and variable remuneration, constituted by bonus, profit sharing in

the form of § 1 of art. 152 of Law No. 6,404, of December 15, 1976, and other incentives associated with performance. 2 Statutory

directors and members of the Board of Directors are considered Administrators. In addition, variable remuneration

must take into account the individual performance and results of the business department in which the administrator operates and/or the

results of Itaú Unibanco Holding, and must be deferred over time and subject to the application of the clawback3 and/or malus adjustment

by account of the performance of the business department and/or Itaú Unibanco Holding. The Itaú Unibanco Conglomerate recognizes

that remuneration is an important tool for acknowledging the performance of administrators, and it must be based on the organizational

culture reflecting not only the performance obtained, but also the way in which the results were achieved. These behaviors translate what

attitudes are expected from the administrators of that organization. They address, among other aspects, ownership, partnership, integrity,

agility and ethics. The remuneration model must be designed in such a way as to attract and retain the best professionals in the market

and prevent any form of discrimination, particularly those based on sex, sexual orientation, gender identity, ethnicity, race, color,

age, or religion, among others. In this sense, deliveries made above expectations, both in terms of results and in terms of form, must

be remunerated differently in relation to the market, always within what is permitted by applicable legislation and respecting the rules

of the model. 4. GOVERNANCE In view of the importance of the administrator compensation structure, the topic is dealt with at the highest

levels of management of the Itaú Unibanco Conglomerate, in a governance structure that allows all decisions to be taken collectively

at different levels. The governance of the variable remuneration of the Itaú Unibanco Conglomerate is described in the Governance

Policy of Variable Remuneration of Itaú Unibanco Holding, applicable to all companies belonging to the Itaú Unibanco Conglomerate.

Especially with regard to the Remuneration Committee, its functioning and responsibilities are included in its internal regulations. 5.

FACTORS The Itaú Unibanco Conglomerate has some factors that guide this policy in order to ensure the alignment between the interests

of the administrators, the Itaú Unibanco Conglomerate itself and its shareholders. Administrators' remuneration must be compatible

with the nature, size, complexity, structure, risk profile, and business model of the Itaú Unibanco Conglomerate, as well as with

the risk management policy and must be formulated in such a way as not to encourage behaviors that increase risk exposure above the levels

considered prudent in the short, medium and long-term strategies adopted by the institution. As a way of avoiding conflicts of interest,

the remuneration of administrators in the areas of internal control and risk management, those responsible for activities related to the

compliance function, and members of the internal audit team, must be adequate to attract 3 The provisions about clawback are set out in

the annex to this policy (Clawback Policy). qualified and experienced professionals, and must be based on the achievement

of the objectives of their own functions and not on the performance of the departments of businesses controlled or evaluated by them.

The Remuneration Committee and the Risk Committee will jointly evaluate the remuneration incentives created by this Remuneration Policy

for Administrators.5.1 Measurement factors of the global amount of variable remuneration To calculate the global amount and the allocation

between the business departments, the following factors are taken into account, among others: a) current and potential risks, as defined

in the applicable regulations; b) the overall result of the companies belonging to the Itaú Unibanco Conglomerate; c) Itaú

Unibanco Holding's ability to generate cash flows; d) the economic environment in which the Itaú Unibanco Conglomerate operates

and its trends; e) long-term sustainable financial bases and adjustments to future payments based on the risks assumed, fluctuations in

the cost of capital and liquidity projections; and f) The performance of the Itaú Unibanco Conglomerate as a whole. 5.2 Variable

remuneration measurement factors To calculate the variable remuneration of administrators, the following criteria are considered, at least:

a) individual performance; b) the performance of the business department; c) the performance of companies belonging to the Itaú

Unibanco Conglomerate; and d) the relationship between the performances mentioned above and the risks assumed. The performance considered

must include economic-financial metrics and qualitative aspects. For cases of variable remuneration payment to administrators during the

Garden Leave/Non-Compete period mentioned in item 7.2. of this Remuneration Policy, the amount to be paid will disregard individual performance.

The proportion between fixed and variable remuneration paid in cash, deferred in shares, share-based instruments, or other assets must

be balanced, considering the Company's risk management policy, in order to enable the reduction, including the full reduction, of the

variable remuneration portion, according to the analysis of the variable remuneration measurement Factors carried out by the Remuneration

Committee. Variable remuneration may be paid in cash, shares, share-based instruments or other assets. In cases

where payments are made with shares, share-based instruments or other assets, deliveries must be made considering the valuations of any

of the assets at fair value. Therefore, there should not be any form of compensation in cases where there is depreciation of such assets.

At least 70% (seventy percent) of the variable remuneration must be paid in shares or instruments based on shares, compatible with the

creation of long-term value and with the time horizon of the risk, and must be deferred for future payment of, at minimum, three years

and staggered in installments proportional to the deferral period. In the event of a significant reduction in realized recurring income4

or in the event of a negative result of Itaú Unibanco Holding or the business department during the deferral period, the deferred

installments not yet paid will be reversed in proportion to the decrease in the result. In addition, the guarantee of payment of a minimum

amount of variable remuneration or other incentives to administrators occurs only on an exceptional basis, upon hiring or transferring

administrators to another department, city or company of the Itaú Unibanco Conglomerate, limited to the first year after the fact

that gives rise to the payment guarantee. If contracts are signed with payment clauses in excess of those provided for in the legislation,

linked to the dismissal of administrators, they must be compatible with the creation of value with long-term risk management and performance

achieved over time. 5.2.1 Remuneration linked to ESG issues Environmental, social and governance issues affect the variable remuneration

of administrators involved in activities, businesses and commitments related to the ESG agenda, through performance indicators, projects

and initiatives present in the individual performance criteria. The topics presented are connected to the Itaú Unibanco Conglomerate's

ESG strategy, which is represented by positive impact commitments. In addition to that, in order to mobilize the work of the departments

in search of the best experience for the customer, all administrators have in the individual performance criterion the Customer Goal,

which aims to monitor and measure, through indicators, the sustainability of the products and services offered by the organization. 6.

REGULATORY ENVIRONMENT Itaú Unibanco Holding is a publicly traded financial institution and, as such, is subject to the rules applicable

to publicly-held companies and financial companies. 4 Realized recurring income is considered to be the accounting net income for the

period adjusted for unrealized results and free from the effects of non-recurring events controllable by the institution In this context, pursuant to Resolution No. 5,177 of the National Monetary Council, of September 26, 2024 (“CMN Resolution

No. 5,177/24”), Itaú Unibanco Holding implements this Remuneration Policy. 7. SCOPE The Remuneration Policy applies to financial

institutions and other institutions authorized to operate by the Central Bank of Brazil belonging to the Itaú Unibanco Conglomerate,

as well as other companies of the Itaú Unibanco Conglomerate, at the discretion of the HR Department. The guidelines of the Remuneration

Policy will also be applicable to companies of the Itaú Unibanco Conglomerate abroad, adapted to specific and local laws and markets,

at the discretion of the HR Department. 8. APPROVED BY This Remuneration Policy was prepared by the Remuneration Committee, is reviewed

annually by the aforementioned Committee and was approved by the Board of Directors at a meeting held on 10/22/2012 and updated at meetings

held on 2/28/2013, 2/27/2014, 2/26/2015, 2/25/2016, 6/3/2016, 12/9/2016, 2/23/2017, 3/30/2017 and 2/22/2018, 12/14/2018, 2/6/2020, 4/30/2020,

2/23/2021, 2/24/2022, 3/02/2023, 2/29/2024, 8/29/2024 and 10/31/2024. ANNEX TO THE REMUNERATION POLICY FOR ADMINISTRATORS

CLAWBACK POLICY 1. POLICY In accordance with the applicable rules of The New York Stock Exchange (“NYSE”) Listed Company Manual

(the “NYSE Rules”), and Section 10D and Rule 10D-1 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”) (“Rule 10D-1”), the Board of Directors (the “Board”) of Itaú Unibanco Holding S.A. (the “Company”)

has adopted this Clawback Policy (this “Clawback Policy”) as a supplement to the Company’s Administrator Compensation

Policy / Stock Option Plan, in order to provide for the recovery of erroneously awarded incentive-based compensation from Officers of

the Company. 2. APPLICABILITY This Clawback Policy applies to all current or former “Officers” of the Company (as defined

below) who received Excess Incentive Compensation (as defined below) during the Recoupment Period (as defined below). For purposes of

this Clawback Policy, “Officers” means each individual who is or was during the Recoupment Period designated by the Company’s

compensation committee the (the “Committee”) as an “officer” of the Company as defined in Rule 16a-1(f) under

the Exchange Act. It is expected that the individuals identified as being members of the Company’s Executive Committee (as disclosed

in the Company’s 20-F for an applicable fiscal year) will constitute the Officers under this Clawback Policy. 3. RECOUPMENT/CLAWBACK

In the event of a Restatement (as defined below), the Board shall require a current or former Officer to reimburse, repay or forfeit any

Excess Incentive Compensation (as defined below) received by such Officer at any time during the three completed fiscal years immediately

preceding a Restatement Determination (as defined below) (such period, the “Recoupment Period”). For purposes of this Clawback

Policy, Incentive Compensation is deemed “received” during the Company’s fiscal period during which the financial reporting

measure specified in the Incentive Compensation award is attained, even if the payment or grant of the Incentive Compensation occurs after

the end of that period. “Excess Incentive Compensation” means, as determined on a pre-tax basis, that amount of Incentive

Compensation that was received by the Officer during the Recoupment Period and following the effective date of this Clawback Policy, based

on the incorrectly reported financial results of the Company, over the Incentive Compensation that would have been received by the Officer

if such amount(s) had been determined based on the financial results of the Company set forth or reflected in the Restatement, in each

case and on an individual basis, as determined by the Board. If the Board cannot reasonably determine the amount of Excess Incentive Compensation

received by the Officer based on the information set forth or reflected in the Restatement, then it will make its determination based on a reasonable estimate of the effect of the Restatement on the Company. “Financial Reporting Measures”

means measures that are determined and presented in accordance with the accounting principles used in preparing the Company’s financial

statements, and any measures that are derived wholly or in part from such measures. Stock price and total shareholder return are financial

reporting measures for purposes of this Clawback Policy. A financial reporting measure need not be presented within the financial statements

or included in a filing with the SEC. “Incentive Compensation” means any cash, equity-based or equity-linked compensation

to the extent the amount is paid, earned, vested or granted based wholly or in part on the attainment of Financial Reporting Measures.

“Restatement” means an accounting restatement (i) due to the material noncompliance of the Company with any financial reporting

requirement under the securities laws, including any required accounting restatement to correct an error in previously issued financial

restatements that is material to the previously issued financial statements, or (ii) that corrects an error that is not material to previously

issued financial statements, but would result in a material misstatement if the error were not corrected in the current period or left

uncorrected in the current period. “Restatement Determination” means the earlier to occur of (i) the date the Board, the Committee

and/or management concludes (or reasonably should have concluded) that a Restatement is required, or (ii) the date a regulator, court

or other legally authorized entity directs the Company to prepare a Restatement of a previously issued financial statement. In the event

of a Restatement, the Board shall promptly determine the amount of any Excess Incentive Compensation for each Officer in connection with

such Restatement and shall promptly thereafter provide each Officer with a written notice containing the amount of Excess Incentive Compensation

and a demand for repayment or return, as applicable. The Board shall have discretion to determine the appropriate means of recovery of

Excess Incentive Compensation based on all applicable facts and circumstances and taking into account the time value of money and the

cost to shareholders of delaying recovery. The right of recovery under this Clawback Policy shall run in favor of the Company and its

parents and subsidiaries, to the extent not enforced by the Company. 4. ADMINISTRATION OF CLAWBACK POLICY Administration of this Clawback

Policy is incumbent on the Board and the Committee. The Board is authorized to interpret and construe this Clawback Policy and to make

all determinations necessary, appropriate, or advisable for the administration of this Clawback Policy and for the Company’s compliance

with the NYSE Rules, Section 10D, Rule 10D-1 and any other applicable law, regulation, rule or interpretation of the SEC or NYSE promulgated

or issued in connection therewith. Any determinations made by the Board shall be final and binding on all affected individuals. Notwithstanding anything set forth herein to the contrary, the Company shall not be required to seek recovery of compensation

under this Clawback Policy (i) if the Board reasonably determines that the direct expenses to be paid to a third party to recover the

Excess Incentive Compensation would exceed the amount of the compensation to be recovered, making recovery impracticable, and provides

all required information to NYSE, (ii) if recovery would be in violation of any home country law applicable to the Company or an Officer

which law was adopted prior to November 28, 2022, provided that, before determining that it would be impracticable to recover any amount

of Excess Incentive Compensation based on violation of home country law, the Company has obtained an opinion of home country counsel,

acceptable to NYSE, that recovery would result in such a violation and a copy of the opinion is provided to NYSE, or (iii) to the extent

applicable, if recovery would likely cause an otherwise tax-qualified retirement plan, under which benefits are broadly available to employees

of the Company, to fail to meet the requirements of 26 U.S.C. 401(a)(13) or 26 U.S.C. 411(a) and regulations thereunder. In connection

with the foregoing, the Board must also make a determination that, as a result of any or all of the foregoing, recovery under this Clawback

Policy would be impracticable. 5. NO INDEMNIFICATION None of the Company or any of its subsidiaries shall be permitted to indemnify or

insure any Officer against (i) the loss of any Excess Incentive Compensation that is repaid, returned or recovered pursuant to the terms

of this Clawback Policy, or (ii) any claims relating to the Company’s enforcement of its rights under this Clawback Policy. Any

and all payments by or on account of an Officer that is repaid, returned or recovered pursuant to the terms of this Clawback Policy shall

be made without deduction or withholding for any taxes. The Excess Incentive Compensation is determined on a pretax basis and shall be

reimbursed, repaid or forfeited on a pre-tax basis. 6. OTHER RECOVERY RIGHTS This Clawback Policy shall be binding and enforceable against

all Officers and, to the extent required by applicable law or guidance from the SEC or NYSE, their beneficiaries, heirs, executors, administrators

or other legal representatives. The Board intends that this Clawback Policy will be applied to the fullest extent required by applicable

law. Any employment agreement, equity award agreement, compensatory plan or any other agreement or arrangement with an Officer shall be

deemed to include, as a condition to the grant of any benefit thereunder, an agreement by the Officer to abide by the terms of this Clawback

Policy. Any right of recovery under this Clawback Policy is in addition to, and not in lieu of, any other remedies or rights of recovery

that may be available to the Company under applicable law, regulation or rule or pursuant to the terms of any policy of the Company or

any provision in any employment agreement, equity award agreement, compensatory plan, agreement or other arrangement. 7. EFFECTIVENESS

OF CLAWBACK POLICY This Clawback Policy will become effective on the date of its approval by the Company’s

Board, and will thereafter remain in effect for an indefinite period of time, provided, however, that this Clawback Policy may be suspended

or terminated by the Board.

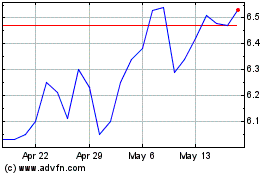

Itau Unibanco (NYSE:ITUB)

Historical Stock Chart

From Nov 2024 to Dec 2024

Itau Unibanco (NYSE:ITUB)

Historical Stock Chart

From Dec 2023 to Dec 2024