Form 8-K - Current report

23 January 2025 - 8:13AM

Edgar (US Regulatory)

0000860748false00008607482025-01-222025-01-220000860748us-gaap:CommonStockMember2025-01-222025-01-220000860748kmpr:A5875FixedRateResetJuniorSubordinatedDebenturesDue2062Member2025-01-222025-01-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 22, 2025

Kemper Corporation

(Exact name of registrant as specified in its charter)

Commission File Number: 001-18298

| | | | | | | | |

| | |

| DE | | 95-4255452 |

(State or other jurisdiction

of incorporation) | | (IRS Employer

Identification No.) |

200 E. Randolph Street, Suite 3300, Chicago, IL 60601

(Address of principal executive offices, including zip code)

312-661-4600

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions (see General Instruction A.2.below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.10 per share | KMPR | NYSE |

| 5.875% Fixed-Rate Reset Junior Subordinated Debentures due 2062 | KMPB | NYSE |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| | | | | | | | |

| Emerging Growth Company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of

the Exchange Act. ¨

Section 7 – Regulation FD

| | | | | |

| Item 7.01. | Regulation FD Disclosure. |

On January 22, 2025, Kemper Corporation (“Kemper” or the “Registrant”) issued a press release announcing the schedule for its fourth quarter 2024 earnings release and its preliminary estimated catastrophe losses attributable to the California wildfires for the first quarter of 2025 through the date of filing. The press release is attached as Exhibit 99.1 to this report and is incorporated herein by reference.

Section 9 – Financial Statements and Exhibits

| | | | | |

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

| | | | | |

Exhibit Number | Exhibit Description |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | |

| | | | Kemper Corporation |

| | |

| Date: | January 22, 2025 | | | /s/ C. Thomas Evans, Jr. |

| | | | C. Thomas Evans, Jr. |

| | | | Executive Vice President, Secretary and General Counsel |

| | | | | |

| Kemper Corporation 200 East Randolph Street Suite 3300 Chicago, IL 60601 kemper.com

|

|

|

|

| Press Release | |

Kemper Announces Schedule for Fourth Quarter 2024 Earnings Release

Provides Initial Insight on 1Q2025 California Wildfire Losses

CHICAGO, January 22, 2025 — Kemper Corporation (NYSE: KMPR) today announced that after the markets close on Wednesday, February 5, Kemper intends to issue its fourth quarter 2024 earnings release and financial supplement. The company expects to file its annual report on Form 10-K with the Securities and Exchange Commission shortly thereafter. Following their publication, these documents will be available in the investor section of kemper.com.

Catastrophe Losses - First Quarter 2025 Wildfires

Kemper has limited exposure to the California wildfires. Preliminary estimated losses attributable to the wildfires incurred to date in the first quarter 2025 are less than $1 million.

CONFERENCE CALL DETAILS

Kemper will host its conference call to discuss fourth quarter 2024 results on Wednesday, February 5, at 5:00 pm Eastern (4:00 pm Central). The conference call will be accessible via the internet and telephone at 888.259.6580, Conference ID 79586. To listen via webcast, register online at the investor section of kemper.com at least 15 minutes before the webcast to install any necessary software. A replay of the webcast will be available online at the investor section of kemper.com.

About Kemper

The Kemper family of companies is one of the nation's leading specialized insurers. With approximately $13 billion in assets, Kemper is improving the world of insurance by providing affordable and easy-to-use personalized solutions to individuals, families and businesses through its Kemper Auto and Kemper Life brands. Kemper serves over 4.8 million policies, is represented by 22,200 agents and brokers, and has 7,500 associates dedicated to meeting the ever-changing needs of its customers. Learn more about Kemper.

Contacts

Investors: Michael Marinaccio, 312.661.4930, investors@kemper.com

News Media: Barbara Ciesemier, 312.661.4521, bciesemier@kemper.com

v3.24.4

Document and Entity Information

|

Jan. 22, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 22, 2025

|

| Entity Registrant Name |

Kemper Corporation

|

| Entity Central Index Key |

0000860748

|

| Amendment Flag |

false

|

| Entity File Number |

001-18298

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

95-4255452

|

| Entity Address, Address Line One |

200 E. Randolph Street

|

| Entity Address, Address Line Two |

Suite 3300

|

| Entity Address, City or Town |

Chicago

|

| Entity Address, State or Province |

IL

|

| Entity Address, Postal Zip Code |

60601

|

| City Area Code |

312

|

| Local Phone Number |

661-4600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock |

|

| Cover [Abstract] |

|

| Title of 12(b) Security |

Common Stock, par value $0.10 per share

|

| Trading Symbol |

KMPR

|

| Security Exchange Name |

NYSE

|

| Entity Listings [Line Items] |

|

| Trading Symbol |

KMPR

|

| Security Exchange Name |

NYSE

|

| Title of 12(b) Security |

Common Stock, par value $0.10 per share

|

| 5.875% Fixed-Rate Reset Junior Subordinated Debentures due 2062 |

|

| Cover [Abstract] |

|

| Title of 12(b) Security |

5.875% Fixed-Rate Reset Junior Subordinated Debentures due 2062

|

| Trading Symbol |

KMPB

|

| Security Exchange Name |

NYSE

|

| Entity Listings [Line Items] |

|

| Trading Symbol |

KMPB

|

| Security Exchange Name |

NYSE

|

| Title of 12(b) Security |

5.875% Fixed-Rate Reset Junior Subordinated Debentures due 2062

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityListingsLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=kmpr_A5875FixedRateResetJuniorSubordinatedDebenturesDue2062Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

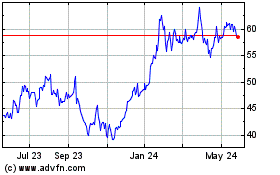

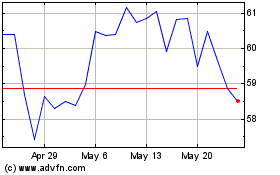

Kemper (NYSE:KMPR)

Historical Stock Chart

From Dec 2024 to Jan 2025

Kemper (NYSE:KMPR)

Historical Stock Chart

From Jan 2024 to Jan 2025