0000092380false00000923802024-12-052024-12-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 5, 2024

| | |

| SOUTHWEST AIRLINES CO. |

| (Exact name of registrant as specified in its charter) |

| | | | | | | | | | | | | | |

| Texas | | 1-7259 | | 74-1563240 |

| (State or other jurisdiction | | (Commission | | (I.R.S. Employer |

| of incorporation) | | File Number) | | Identification No.) |

| | | | | | | | | | | |

| P. O. Box 36611 | | |

| Dallas, | Texas | | 75235-1611 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant's telephone number, including area code: (214) 792-4000

| | |

| Not Applicable |

| Former name or former address, if changed since last report |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the

filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act

(17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17

CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the

Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the

Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock ($1.00 par value) | LUV | New York Stock Exchange |

| | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

Southwest Airlines Co. (the "Company") is providing updated guidance regarding selected financial trends. The following table presents updated selected financial guidance for fourth quarter 2024. These projections are based on current booking trends and the Company's current outlook, and actual results could differ materially.

| | | | | | | | | | | | | | | |

| | |

4Q 2024 Estimation | | Previous estimation |

| RASM (a), year-over-year | | | Up 5.5% to 7.0% | | Up 3.5% to 5.5% |

| ASMs (b), year-over-year | | | Down ~4% | | No change |

Economic fuel costs per gallon1 (c) | | | $2.35 to $2.45 | | $2.25 to $2.35 |

| Fuel hedging premium expense per gallon | | | $0.07 | | No change |

| Fuel hedging cash settlement gains per gallon | | | $0.01 | | No change |

| ASMs per gallon (fuel efficiency) | | | 81 to 82 | | No change |

CASM-X (d), year-over-year2,3 | | | Up 11% to 13% | | No change |

| Scheduled debt repayments (e) (millions) | | | ~$5 | | No change |

| Interest expense (millions) | | | ~$62 | | No change |

| Aircraft (f) | | | 797 | | 796 |

(a) Operating revenue per available seat mile ("RASM" or "unit revenues").

(b) Available seat miles ("ASMs" or "capacity"). The Company's flight schedule is published for sale through August 4, 2025. The Company continues to expect first quarter 2025 capacity to decrease in the range of 1 percent to 3 percent, year-over-year.

(c) Based on the Company's existing fuel derivative contracts and market prices as of December 3, 2024.

(d) Operating expenses per available seat mile, excluding fuel and oil expense, special items, and profitsharing ("CASM-X").

(e) Excludes the Company’s plan to redeem its $1.3 billion 5.25% Notes due 2025 in December 2024.

(f) Aircraft on property, end of period. The Company continues to plan for approximately 20 Boeing 737-8 ("-8") aircraft deliveries and now expects 40 aircraft retirements in 2024, comprised of 36 Boeing 737-700s ("-700") and four Boeing 737-800s ("-800").

The Company now expects fourth quarter 2024 unit revenues to increase in the range of 5.5 percent to 7.0 percent on a year-over-year basis, with capacity down approximately 4 percent, also on a year-over-year basis. The strong year-over-year unit revenue growth is driven by resilient travel demand along with the realization of benefits from the Company’s execution of tactical actions. Tactical actions include improving network optimization and capacity rationalization, marketing and distribution evolution, and continued efforts to advance revenue management techniques. The improvement in expectations relative to the previous fourth quarter 2024 unit revenue guidance range is driven by the combination of better than expected leisure travel demand and faster than expected benefits from actions taken to mature the Company's revenue management techniques and better optimize the booking curve. The Company is encouraged by recent revenue trends and forward bookings, including fourth quarter holiday travel, and currently expects strong revenue trends and tactical initiative performance to carry into 2025. This outlook supports the Company's confidence in the 'Southwest. Even Better.' plan, which was unveiled at Investor Day in September 2024.

Further, the Company is actively pursuing its fleet strategy, also announced at Investor Day 2024, and currently expects to complete an initial transaction by early 2025. This strategy is designed to realize value from the Company's current fleet and order book through aircraft sales and sale-leaseback transactions. The Company continues to plan for a balanced capital allocation approach utilizing funds generated from its fleet strategy, as well as excess cash from the balance sheet, to offset future capital expenditures, reduce outstanding debt obligations, and provide Shareholder returns. As such, the Company currently intends to launch an additional $750 million accelerated share repurchase ("ASR") program in first quarter 2025, following the completion of the $250 million ASR announced in October 2024. Subsequent to the launch of the $750 million ASR program, the Company will have $1.5 billion remaining under its $2.5 billion share repurchase program authorized by the Company's Board of Directors in September 2024.

The information furnished in this Item 7.01 shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific reference in such filing.

1Economic fuel cost projections do not reflect the potential impact of special items because the Company cannot reliably predict or estimate the hedge accounting impact associated with the volatility of the energy markets or the impact to its financial statements in future periods. Accordingly, the Company believes a reconciliation of non-GAAP financial measures to the equivalent GAAP financial measures for projected results is not meaningful or available without unreasonable effort.

2Projections do not reflect the potential impact of fuel and oil expense, special items, and profitsharing because the Company cannot reliably predict or estimate those items or expenses or their impact to its financial statements in future periods, especially considering the significant volatility of the fuel and oil expense line item. Accordingly, the Company believes a reconciliation of non-GAAP financial measures to the equivalent GAAP financial measures for projected results is not meaningful or available without unreasonable effort.

3Excludes any potential impact from the Company's fleet strategy.

Cautionary Statement Regarding Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Specific forward-looking statements include, without limitation, statements related to (i) the Company's financial outlook, goals, plans, expectations, and projected results of operations, including factors and assumptions underlying the Company's expectations and projections; (ii) the Company’s plans and expectations with respect to capacity; (iii) the Company's expectations with respect to its fuel costs, premium expenses, hedging gains, fuel efficiency, and the Company's related management of risks associated with changing jet fuel prices, including factors underlying the Company's expectations; (iv) the Company’s plans and expectations related to repayment of debt and interest expense; (v) the Company’s fleet plans and expectations, including with respect to expected fleet deliveries and retirements, and including factors and assumptions underlying the Company's plans and expectations; (vi) the Company’s expectations with respect to bookings and passenger demand; (vii) the Company’s plans and expectations with respect to its fleet strategy; (viii) the Company’s capital allocation plans and expectations; and (ix) the Company’s plans and expectations associated with returning value to Shareholders, including with respect to share repurchases. These forward-looking statements are based on the Company's current estimates, intentions, beliefs, expectations, goals, strategies, and projections for the future and are not guarantees of future performance. Forward-

looking statements involve risks, uncertainties, assumptions, and other factors that are difficult to predict and that could cause actual results to vary materially from those expressed in or indicated by them. Factors include, among others, (i) the impact of fears or actual outbreaks of diseases, extreme or severe weather and natural disasters, actions of competitors (including, without limitation, pricing, scheduling, capacity, and network decisions, and consolidation and alliance activities), consumer perception, economic conditions, banking conditions, fears or actual acts of terrorism or war, sociodemographic trends, and other factors beyond the Company's control, on consumer behavior and the Company's results of operations and business decisions, plans, strategies, and results; (ii) the Company's ability to timely and effectively implement, transition, operate, and maintain the necessary information technology systems and infrastructure to support its operations and initiatives, including with respect to revenue management; (iii) the Company’s ability to obtain and maintain adequate infrastructure and equipment to support its operations and initiatives; (iv) the impact of fuel price changes, fuel price volatility, volatility of commodities used by the Company for hedging jet fuel, and any changes to the Company's fuel hedging strategies and positions, on the Company's business plans and results of operations; (v) the Company's dependence on Boeing and Boeing suppliers with respect to the Company's aircraft deliveries, fleet and capacity plans, operations, maintenance, strategies, and goals; (vi) the Company's dependence on Boeing and the Federal Aviation Administration with respect to the certification of the Boeing MAX 7 aircraft; (vii) the Company's dependence on other third parties, in particular with respect to its technology plans, its plans and expectations related to revenue management, operational reliability, fuel supply, maintenance, Global Distribution Systems, and the impact on the Company's operations and results of operations of any third party delays or non-performance; (viii) the Company’s ability to timely and effectively prioritize its initiatives and focus areas and related expenditures; (ix) the impact of labor matters on the Company's business decisions, plans, strategies, and results; (x) the impact of governmental regulations and other governmental actions on the Company's business plans, results, and operations; (xi) the Company's dependence on its workforce, including its ability to employ and retain sufficient numbers of qualified Employees with appropriate skills and expertise to effectively and efficiently maintain its operations and execute the Company’s plans, strategies, and initiatives; (xii) the cost and effects of the actions of activist shareholders; and (xiii) other factors, as described in the Company's filings with the Securities and Exchange Commission, including the detailed factors discussed under the heading "Risk Factors" in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2023. Caution should be taken not to place undue reliance on the Company’s forward-looking statements, which represent the Company’s views only as of the date this report is filed. The Company undertakes no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future events, or otherwise.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| SOUTHWEST AIRLINES CO. |

| | |

| December 5, 2024 | By: | /s/ Tammy Romo |

| | |

| | Tammy Romo |

| | Executive Vice President & Chief Financial Officer |

| | (Principal Financial and Accounting Officer) |

| | |

| | |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

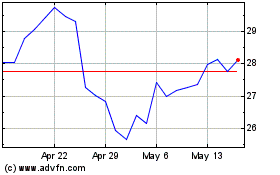

Southwest Airlines (NYSE:LUV)

Historical Stock Chart

From Nov 2024 to Dec 2024

Southwest Airlines (NYSE:LUV)

Historical Stock Chart

From Dec 2023 to Dec 2024