Masco Corporation Recommends Shareholders Reject the Below-Market Mini-Tender Offer by TRC Capital Investment Corporation

13 June 2024 - 7:21AM

Business Wire

Masco Corporation (NYSE: MAS) today announced that it has

received notice of an unsolicited mini-tender offer by TRC Capital

Investment Corporation of Ontario, Canada to purchase up to 2

million outstanding shares of Masco common stock at a price of

$64.00 per share in cash. TRC Capital Investment’s offer price of

$64.00 per share is approximately 4.68 percent lower than the

$67.14 closing share price of Masco’s common stock on June 10,

2024, the last trading day prior to the date of the offer. The

offer is for approximately 0.92 percent of the shares of Masco

common stock outstanding as of the June 11, 2024 offer date.

Masco does not endorse TRC Capital Investment’s unsolicited

mini-tender offer and recommends that stockholders do not tender

their shares in response to TRC Capital Investment’s offer because

the offer is at a price below the current market price for Masco’s

shares and subject to numerous conditions. Masco is not affiliated

or associated in any way with TRC Capital Investment, its

mini-tender offer or its offer documentation.

TRC Capital Investment has made many similar mini-tender offers

for shares of other companies. Mini-tender offers seek to acquire

less than 5 percent of a company’s shares outstanding, thereby

avoiding many disclosure and procedural requirements of the U.S.

Securities and Exchange Commission (SEC) that apply to offers for

more than 5 percent of a company’s shares outstanding. As a result,

mini-tender offers do not provide investors with the same level of

protections as provided for larger tender offers under U.S.

securities laws.

The SEC has cautioned investors that some bidders making

mini-tender offers at below-market prices are “hoping that they

will catch investors off guard if the investors do not compare the

offer price to the current market price.” More on the SEC’s

guidance to investors on mini-tender offers is available at

www.sec.gov/investor/pubs/minitend.htm.

Masco urges investors to obtain current market quotations for

their shares, to consult with their broker or financial advisor and

to exercise caution with respect to TRC Capital Investment’s offer.

Masco recommends that stockholders who have not responded to TRC

Capital Investment’s offer take no action. Stockholders who have

already tendered their shares may withdraw them at any time prior

to the expiration of the offer, in accordance with TRC Capital

Investment’s offer documentation. The offer is currently scheduled

to expire at 11:59 p.m., New York City time, on July 11, 2024. TRC

Capital Investment may extend the offering period at its

discretion.

Masco encourages brokers and dealers, as well as other market

participants, to review the SEC’s letter regarding broker-dealer

mini-tender offer dissemination and disclosure at

www.sec.gov/divisions/marketreg/minitenders/sia072401.htm.

Masco requests that a copy of this news release be included with

all distributions of materials relating to TRC Capital Investment’s

mini-tender offer related to shares of Masco common stock.

About Masco Corporation

Headquartered in Livonia, Michigan, Masco Corporation is a

global leader in the design, manufacture and distribution of

branded home improvement and building products. Our portfolio of

industry-leading brands includes Behr® paint; Delta® and hansgrohe®

faucets, bath and shower fixtures; Kichler® decorative and outdoor

lighting; Liberty® branded decorative and functional hardware; and

HotSpring® spas. We leverage our powerful brands across product

categories, sales channels and geographies to create value for our

customers and shareholders. For more information about Masco

Corporation, visit www.masco.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240612287585/en/

Investor Contact Robin Zondervan Vice President, Investor

Relations and FP&A 313.792.5500 robin_zondervan@mascohq.com

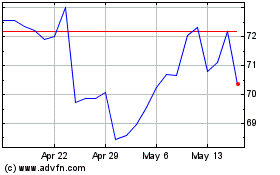

Masco (NYSE:MAS)

Historical Stock Chart

From Oct 2024 to Nov 2024

Masco (NYSE:MAS)

Historical Stock Chart

From Nov 2023 to Nov 2024