- Third quarter GAAP revenues of $273.8 million; Adjusted

revenues of $280.7 million, up 1% from the prior year period

- GAAP revenues for the first nine months of 2024 were $755.8

million; Adjusted revenues of $762.8 million, up 18% from the prior

year period

- GAAP net income of $0.22 per share (diluted) for the third

quarter and $0.61 per share (diluted) for the first nine months of

2024; Adjusted net income of $0.22 per share (diluted) for the

third quarter and $0.63 per share (diluted) for the first nine

months of 2024

- Continued to execute on our growth strategy:

- Year-to-date, promoted seven advisory professionals to Managing

Director and hired eight Managing Directors, including one Biotech

Managing Director who will join the Firm next month

- Strong balance sheet with cash and short-term investments of

$297.7 million and no debt or goodwill

- Declared quarterly dividend of $0.60 per share

Moelis & Company (NYSE:MC) today reported financial results

for the quarter ended September 30, 2024. The Firm's third quarter

GAAP revenues were $273.8 million as compared with $272.2 million

in the prior year period. On an Adjusted basis, the Firm’s third

quarter revenues of $280.7 million increased 1% from the prior year

period. The Firm reported third quarter GAAP net income of $19.2

million, or $0.22 per share (diluted). On an Adjusted basis, the

Firm reported net income of $18.6 million and $0.22 per share

(diluted) for the third quarter of 2024, which compares with a net

loss of $11.3 million, or ($0.15) per share, in the prior year

period. GAAP and Adjusted net income in the third quarter of 2024

include net tax benefits of approximately $0.01 per share (diluted)

related to the settlement of share-based awards.

GAAP revenues for the first nine months of 2024 were $755.8

million. On an Adjusted basis, the Firm's first nine months

revenues of $762.8 million increased 18% from the prior year

period. The Firm reported GAAP net income of $51.6 million, or

$0.61 per share (diluted) for the first nine months of 2024. On an

Adjusted basis, the Firm reported net income of $51.4 million, or

$0.63 per share (diluted) in the first nine months of 2024, as

compared with a net loss of $10.1 million, or $(0.14) per share

(diluted), in the prior year period. GAAP and Adjusted net income

in the first nine months of 2024 include net tax benefits of

approximately $0.15 per share (diluted) related to the settlement

of share-based awards.

"I believe our franchise, talent and breadth of expertise has

never been stronger. We are well-positioned to drive long-term

growth," said Ken Moelis, Chairman and Chief Executive Officer.

The Firm’s revenues and net income can fluctuate materially

depending on the number, size and timing of completed transactions

as well as other factors. Accordingly, financial results in any

particular quarter may not be representative of future results over

a longer period of time.

Currently 92% of the operating partnership (Moelis & Company

Group LP) is owned by the corporate partner (Moelis & Company)

and is subject to corporate U.S. federal and state income tax. The

remaining 8% is owned by other partners of Moelis & Company

Group LP and is primarily subject to U.S. federal tax at the

partner level (certain state, local and foreign income taxes are

incurred at the company level). The Adjusted results included

herein apply certain adjustments from our GAAP results, including

the assumption that 100% of the Firm’s operating result was taxed

at our corporate effective tax rate. We believe the Adjusted

results, when presented together with comparable GAAP results, are

useful to investors to compare our performance across periods and

to better understand our operating results. A reconciliation

between our GAAP results and our Adjusted results is presented in

the Appendix to this press release.

GAAP and Adjusted (non-GAAP) Selected

Financial Data (Unaudited)

GAAP

Adjusted (non-GAAP)*

Three Months Ended September

30,

($ in thousands except per share

data)

2024

2023

Variance

2024

2023

Variance

Revenues

$

273,755

$

272,179

1

%

$

280,730

$

277,665

1

%

Income (loss) before income

taxes

26,659

(10,083)

N/M

26,659

(9,799)

N/M

Provision (benefit) for income taxes

7,419

1,286

477

%

8,018

1,518

428

%

Net income (loss)

19,240

(11,369)

N/M

18,641

(11,317)

N/M

Net income (loss) attributable to

noncontrolling interests

2,346

(637)

N/M

—

—

N/M

Net income (loss) attributable to Moelis

& Company

$

16,894

$

(10,732)

N/M

$

18,641

$

(11,317)

N/M

Diluted earnings (loss) per share

$

0.22

$

(0.16)

N/M

$

0.22

$

(0.15)

N/M

N/M = not meaningful

* See Appendix for a reconciliation of

GAAP to Adjusted (non-GAAP)

GAAP

Adjusted (non-GAAP)*

Nine Months Ended September

30,

($ in thousands except per share

data)

2024

2023

Variance

2024

2023

Variance

Revenues

$

755,826

$

639,870

18

%

$

762,801

$

645,207

18

%

Income (loss) before income

taxes

58,466

(24,943)

N/M

58,843

(14,018)

N/M

Provision (benefit) for income taxes

6,820

(3,891)

N/M

7,411

(3,890)

N/M

Net income (loss)

51,646

(21,052)

N/M

51,432

(10,128)

N/M

Net income (loss) attributable to

noncontrolling interests

5,025

(2,012)

N/M

—

—

N/M

Net income (loss) attributable to Moelis

& Company

$

46,621

$

(19,040)

N/M

$

51,432

$

(10,128)

N/M

Diluted earnings (loss) per share

$

0.61

$

(0.28)

N/M

$

0.63

$

(0.14)

N/M

N/M = not meaningful

* See Appendix for a reconciliation of

GAAP to Adjusted (non-GAAP)

Revenues

We earned GAAP revenues of $273.8 million in the third quarter

of 2024, as compared with $272.2 million in the prior year period.

On an Adjusted basis, we earned revenues of $280.7 million in the

third quarter of 2024, as compared with $277.7 million in the prior

year period, representing an increase of 1%. The increase in third

quarter revenues is attributable to an increase in M&A

revenues, partially offset by a modest decline in non-M&A

revenues as compared with the prior year period.

For the first nine months of 2024, we earned GAAP revenues of

$755.8 million, as compared with $639.9 million in the prior year

period. On an Adjusted basis, we earned revenues of $762.8 million,

in the first nine months of 2024, as compared with $645.2 million

in the prior year period, or an increase of 18%. The increase in

revenues during the first nine months of 2024 is attributable to an

increase in revenues and transaction completions across all major

product areas.

We continued to execute on our strategy of organic growth, and

since our last earnings release, we hired a Biotech Managing

Director who will join the firm next month.

Expenses

The following tables set forth information relating to the

Firm’s operating expenses.

GAAP

Adjusted (non-GAAP)*

Three Months Ended September

30,

($ in thousands)

2024

2023

Variance

2024

2023

Variance

Expenses:

Compensation and benefits

$

210,658

$

242,231

-13

%

$

210,576

$

241,489

-13

%

% of revenues

77.0

%

89.0

%

75.0

%

87.0

%

Non-compensation expenses

$

47,533

$

49,974

-5

%

$

47,533

$

49,974

-5

%

% of revenues

17.4

%

18.4

%

16.9

%

18.0

%

Total operating expenses

$

258,191

$

292,205

-12

%

$

258,109

$

291,463

-11

%

% of revenues

94.3

%

107.4

%

91.9

%

105.0

%

* See Appendix for a reconciliation of

GAAP to Adjusted (non-GAAP)

GAAP

Adjusted (non-GAAP)*

Nine Months Ended September

30,

($ in thousands)

2024

2023

Variance

2024

2023

Variance

Expenses:

Compensation and benefits

$

573,006

$

536,264

7

%

$

572,612

$

535,522

7

%

% of revenues

75.8

%

83.8

%

75.1

%

83.0

%

Non-compensation expenses

$

141,386

$

134,609

5

%

$

141,386

$

134,189

5

%

% of revenues

18.7

%

21.0

%

18.5

%

20.8

%

Total operating expenses

$

714,392

$

670,873

6

%

$

713,998

$

669,711

7

%

% of revenues

94.5

%

104.8

%

93.6

%

103.8

%

* See Appendix for a reconciliation of

GAAP to Adjusted (non-GAAP)

Total operating expenses on a GAAP basis were $258.2 million for

the third quarter of 2024, as compared with $292.2 million in the

prior year period. On an Adjusted basis, operating expenses were

$258.1 million for the third quarter of 2024, as compared with

$291.5 million in the prior year period. For the first nine months

of 2024, total operating expenses on a GAAP basis were $714.4

million. On an Adjusted basis, operating expenses were $714.0

million for the first nine months of 2024 as compared with $669.7

million in the prior year period. The increase in operating

expenses in both current year periods is attributable to increased

compensation and benefits and non-compensation expenses, as

compared with the prior year periods.

Compensation and benefits expenses on a GAAP basis were $210.7

million for the third quarter of 2024, as compared with $242.2

million in the prior year period. Adjusted compensation and

benefits expenses were $210.6 million for the third quarter of

2024, as compared with $241.5 million in the prior year period. The

decline in compensation and benefits expenses in the third quarter

of 2024 is attributable to a lower bonus accrual as compared with

the prior year period. For the first nine months of 2024,

compensation and benefits expenses on a GAAP basis were $573.0

million, as compared with $536.3 million in the prior year period.

On an Adjusted basis, compensation and benefits expenses for the

first nine months of 2024 were $572.6 million, as compared with

$535.5 million in the prior year period. The increase in

compensation and benefits expenses during the first nine months of

2024 is primarily attributable to increased headcount and a higher

bonus accrual, as a result of higher revenues earned, as compared

with the prior year period.

Non-compensation expenses on a GAAP and Adjusted basis were

$47.5 million for the third quarter of 2024, as compared with GAAP

and Adjusted non-compensation expenses of $50.0 million in the

prior year period. The decline in non-compensation expenses in the

third quarter of 2024 is attributable to lower professional fees

directly connected to specific completed transactions as compared

with the prior year period. For the first nine months of 2024, GAAP

and Adjusted non-compensation expenses were $141.4 million as

compared with GAAP non-compensation expenses of $134.6 million and

Adjusted non-compensation expenses of $134.2 million in the prior

year period. The increase in non-compensation expenses in the first

nine months of 2024 is primarily attributable to increased

headcount as compared to the prior year period.

Other Income (Expenses)

GAAP

Adjusted (non-GAAP)*

Three Months Ended September

30,

($ in thousands)

2024

2023

Variance

2024

2023

Variance

Other income (expenses)

$

11,095

$

9,943

12

%

$

4,038

$

3,999

1

%

N/M = not meaningful

* See Appendix for a reconciliation of

GAAP to Adjusted (non-GAAP)

GAAP

Adjusted (non-GAAP)*

Nine Months Ended September

30,

($ in thousands)

2024

2023

Variance

2024

2023

Variance

Other income (expenses)

$

17,032

$

6,060

181

%

$10,040

$10,486

-4

%

N/M = not meaningful

* See Appendix for a reconciliation of

GAAP to Adjusted (non-GAAP)

Other income (expenses) on a GAAP basis was income of $11.1

million for the third quarter of 2024, as compared with $9.9

million in the prior year period. On an Adjusted basis, other

income for the third quarter of 2024 was income of $4.0 million, as

compared with $4.0 million in the prior year period. In the third

quarter of 2024, we recorded a gain to other income of $7.0 million

related to the sale of 5.0 million shares of our investment in MA

Financial Group Limited. The gains of $7.0 million are included

within Adjusted revenues and the adjustment did not impact our GAAP

or Adjusted earnings per share.

For the first nine months of 2024, other income (expenses) on a

GAAP basis was $17.0 million as compared with income of $6.1

million in the prior year period. On an Adjusted basis, other

income for the first nine months of 2024 was $10.0 million as

compared with $10.5 million in the prior year period.

Provision for Income Taxes

The corporate partner (Moelis & Company) currently owns 92%

of the operating partnership (Moelis & Company Group LP) and is

subject to corporate U.S. federal and state income tax on its

allocable share of earnings. The remaining 8% of activity is

subject to certain state, local and foreign income taxes (including

New York City Unincorporated Business Tax), which is accounted for

at the partner level through the noncontrolling interests. For

Adjusted purposes, we have assumed that 100% of the Firm’s third

quarter 2024 operating results were taxed at our corporate

effective tax rate and together with the excess tax benefit of

approximately $1.1 million related to the delivery of equity-based

compensation, we have a net tax expense of $8.0 million.

Capital Management and Balance Sheet

Moelis & Company continues to maintain a strong financial

position, and as of September 30, 2024, we held cash and liquid

investments of $297.7 million and had no debt or goodwill on our

balance sheet.

The Board of Directors of Moelis & Company declared a

regular quarterly dividend of $0.60 per share. The $0.60 per share

will be paid on December 2, 2024 to common stockholders of record

on November 4, 2024.

Earnings Call

We will host a conference call beginning at 5:00pm ET on

Wednesday, October 23, 2024, accessible via telephone and the

internet. Ken Moelis, Chairman and Chief Executive Officer, and Joe

Simon, Chief Financial Officer, will review our third quarter 2024

financial results. Following the review, there will be a question

and answer session.

Investors and analysts may participate in the live conference

call by dialing 1-888-300-4150 (domestic) or 1-646-970-1530

(international) and using access code 8014191. Please dial in 15

minutes before the conference call begins. The conference call will

also be accessible as a listen-only audio webcast through the

Investor Relations section of the Moelis & Company website at

www.moelis.com.

For those unable to listen to the live broadcast, a replay of

the call will be available for one month via telephone starting

approximately one hour after the live call ends. The replay can be

accessed at 1-800-770-2030 (domestic) or 1-609-800-9909

(international); the conference number is 8014191.

About Moelis &

Company

Moelis & Company is a leading global independent investment

bank that provides innovative strategic advice and solutions to a

diverse client base, including corporations, governments and

financial sponsors. The Firm assists its clients in achieving their

strategic goals by offering comprehensive integrated financial

advisory services across all major industry sectors. Moelis &

Company’s experienced professionals advise clients on their most

critical decisions, including mergers and acquisitions,

recapitalizations and restructurings, capital markets transactions,

private fund raisings and secondary transactions and other

corporate finance matters. The Firm serves its clients from 23

locations in North and South America, Europe, the Middle East, Asia

and Australia. For further information, please visit:

www.moelis.com.

Forward-Looking

Statements

This press release contains forward-looking statements, which

reflect the Firm’s current views with respect to, among other

things, its operations and financial performance. You can identify

these forward-looking statements by the use of words such as

“outlook,” “believes,” “expects,” “potential,” “continues,” “may,”

“will,” “should,” “seeks,” “target,” “approximately,” “predicts,”

“intends,” “plans,” “estimates,” “anticipates” or the negative

version of these words or other comparable words. Such

forward-looking statements are based on certain assumptions and

estimates and subject to various risks and uncertainties.

Accordingly, there are or will be important factors that could

cause actual outcomes or results to differ materially from those

indicated in these statements. We believe these factors include,

but are not limited to, those described under "Risk Factors"

discussed in our Annual Report on Form 10-K for the year ended

December 31, 2023, subsequent reports filed on Form 10-Q and our

other filings with the SEC. These factors should not be construed

as exhaustive and should be read in conjunction with the other

cautionary statements that are included in this release. In

addition, new risks and uncertainties emerge from time to time, and

it is not possible for us to predict all risks and uncertainties,

nor can we assess the impact of all factors on our business or the

extent to which any factor, or combination of factors, may cause

actual results to differ materially from those contained in any

forward-looking statements. Accordingly, you should not rely upon

forward-looking statements as a prediction of actual results. The

Firm undertakes no obligation to publicly update or review any

forward-looking statement, whether as a result of new information,

future developments or otherwise.

Non-GAAP Financial

Measures

The Company prepares its consolidated financial statements using

accounting principles generally accepted in the United States

(GAAP). From time to time, the Company may disclose certain

“non-GAAP financial measures” in the course of its earnings

releases, earnings conference calls, financial presentations and

otherwise. The Securities and Exchange Commission defines a

“non-GAAP financial measure” as a numerical measure of historical

or future financial performance, financial position, or cash flows

that is subject to adjustments that effectively exclude, or include

amounts from the most directly comparable measure calculated and

presented in accordance with GAAP. Non-GAAP financial measures

disclosed by the Company are provided as additional information to

analysts, investors and other stakeholders in order to provide them

with greater transparency about, or an alternative method for

assessing our financial condition, operating results, or capital

adequacy. Adjusted results are a non-GAAP financial measure which

provide additional information on management’s view of operating

results. These measures are not in accordance with, or a substitute

for GAAP, and may be different from or inconsistent with non-GAAP

financial measures used by other companies. Whenever we refer to a

non-GAAP financial measure, we will also generally define it or

present the most directly comparable financial measure calculated

and presented in accordance with GAAP, along with a reconciliation

of the differences between the non-GAAP financial measure we

reference and such comparable GAAP financial measure.

The Company’s Adjusted revenues includes amounts reflected

within other income (expenses) which are considered the equivalent

of revenues for compensation. Such adjustments may include gains on

founder investments where our employees and the Moelis advisory

platform contributed meaningfully to the value creation; or the

mark-to-market impact of equity instruments held by the Company

that were originally received as payment for our banking services

and included in revenues. We believe these adjustments are useful

to allow comparability of period-to-period operating performance

and compensation levels.

The Company’s Adjusted compensation and benefits expenses may

include adjustments reflected within other income (expenses)

associated with compensation awards forfeited or returned to the

Company by former employees. Management views the credits

associated with such forfeitures as an offset to compensation and

benefits expenses since the Firm will utilize the forfeited

economics to recruit and or retain talent. We believe the netted

presentation of forfeiture credits and compensation expenses is

useful to allow comparability of period-to-period operating

performance.

The Company’s Adjusted non-compensation expenses and other

income (expenses) may exclude certain one-time items that reduce

the comparability of our operating performance as well as the

amounts related to revenues and compensation and benefits expenses

discussed above and adjustments to our provision for income taxes

discussed below. Such adjustments increase the comparability of our

financial performance across reporting periods and versus our

peers.

The Company’s Adjusted provision (benefit) for income taxes is

adjusted to illustrate the result as if 100% of the Firm’s income

is being taxed at our corporate effective tax rates for the periods

presented. Adjusted provision (benefit) for income taxes

periodically includes the tax impact related to the settlement of

share-based awards, the reclassification of TRA liability

adjustments, or adjustments to our deferred tax assets and

liabilities that occur in connection with new tax legislation. Such

adjustments increase the comparability of our financial performance

across reporting periods and versus our peers.

The Company’s Adjusted basic and diluted shares of Class A

common stock outstanding is presented for each period as if all

outstanding Class A partnership units have been exchanged into

Class A common stock. The Adjusted presentation helps analysts,

investors, and other stakeholders understand the effect of the

Firm’s ownership structure on its results, including the impact of

all the Firm’s income becoming subject to corporate-level tax.

Appendix

GAAP Consolidated Statement of Operations (Unaudited)

Reconciliation of GAAP to Adjusted (non-GAAP) Financial

Information (Unaudited)

Moelis & Company GAAP

Consolidated Statement of Operations Unaudited

(dollars in thousands, except for share and per share

data)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Revenues

$

273,755

$

272,179

$

755,826

$

639,870

Expenses

Compensation and benefits

210,658

242,231

573,006

536,264

Occupancy

7,409

7,181

21,571

19,887

Professional fees

8,445

13,525

20,571

25,378

Communication, technology and information

services

12,874

11,709

37,108

33,758

Travel and related expenses

8,781

8,394

29,255

28,575

Depreciation and amortization

2,802

2,014

7,611

6,023

Other expenses

7,222

7,151

25,270

20,988

Total Expenses

258,191

292,205

714,392

670,873

Operating income (loss)

15,564

(20,026)

41,434

(31,003)

Other income (expenses)

11,095

9,943

17,032

6,060

Income (loss) before income

taxes

26,659

(10,083)

58,466

(24,943)

Provision (benefit) for income taxes

7,419

1,286

6,820

(3,891)

Net income (loss)

19,240

(11,369)

51,646

(21,052)

Net income (loss) attributable to

noncontrolling interests

2,346

(637)

5,025

(2,012)

Net income (loss) attributable to Moelis

& Company

$

16,894

$

(10,732)

$

46,621

$

(19,040)

Weighted-average shares of Class A common

stock outstanding

Basic

72,325,050

68,752,061

71,612,206

68,260,558

Diluted

76,906,271

68,752,061

76,147,357

68,260,558

Net income (loss) attributable to holders

of shares of Class A common stock per share

Basic

$

0.23

$

(0.16)

$

0.65

$

(0.28)

Diluted

$

0.22

$

(0.16)

$

0.61

$

(0.28)

Moelis & Company Reconciliation

of GAAP to Adjusted (non-GAAP) Financial Information

Unaudited (dollars in thousands, except share and per

share data)

Three Months Ended September

30, 2024

Adjusted items

GAAP

Adjustments

Adjusted (non-GAAP)

Revenues

$

273,755

$

6,975

(a)

$

280,730

Compensation and benefits

210,658

(82

)

(b)

210,576

Non-compensation expenses

47,533

—

47,533

Other income (expenses)

11,095

(7,057

)

(a)(b)

4,038

Income (loss) before income taxes

26,659

—

26,659

Provision (benefit) for income taxes

7,419

599

(c)

8,018

Net income (loss)

19,240

(599

)

18,641

Net income (loss) attributable to

noncontrolling interests

2,346

(2,346

)

(d)

—

Net income (loss) attributable to Moelis

& Company

$

16,894

$

1,747

$

18,641

Weighted-average shares of Class A common

stock outstanding

Basic

72,325,050

6,060,135

(d)

78,385,185

Diluted

76,906,271

6,060,135

(d)

82,966,406

Net income (loss) attributable to holders

of shares of Class A common stock per share

Basic

$

0.23

$

0.24

Diluted

$

0.22

$

0.22

(a)

Reflects a reclassification of $7.0

million of other income to revenues related to a gain associated

with the Firm's sale of 5.0 million shares of MA Financial Group

Limited.

(b)

Reflects a reclassification of $0.1

million of other income (expenses) to compensation and benefits

associated with the forfeiture or return of compensation by former

employees.

(c)

An adjustment has been made to illustrate

the result as if 100% of the Firm’s income is being taxed at our

corporate effective tax rate for the period stated; together with

the tax benefit related to the settlement of share-based awards of

$1.1 million, we have a net tax expense of $8.0 million.

(d)

Assumes all outstanding Class A

partnership units have been exchanged into Class A common

stock.

Moelis & Company Reconciliation

of GAAP to Adjusted (non-GAAP) Financial Information

Unaudited (dollars in thousands, except share and per

share data)

Three Months Ended September

30, 2023

Adjusted items

GAAP

Adjustments

Adjusted (non-GAAP)

Revenues

$

272,179

$

5,486

(a)

$

277,665

Compensation and benefits

242,231

(742

)

(b)

241,489

Non-compensation expenses

49,974

—

49,974

Other income (expenses)

9,943

(5,944

)

(a)(b)(c)

3,999

Income (loss) before income taxes

(10,083

)

284

(9,799

)

Provision (benefit) for income taxes

1,286

232

(c)(d)

1,518

Net income (loss)

(11,369

)

52

(11,317

)

Net income (loss) attributable to

noncontrolling interests

(637

)

637

(e)

—

Net income (loss) attributable to Moelis

& Company

$

(10,732

)

$

(585

)

$

(11,317

)

Weighted-average shares of Class A common

stock outstanding

Basic

68,752,061

6,286,214

(e)

75,038,275

Diluted

68,752,061

6,286,214

(e)

75,038,275

Net income (loss) attributable to holders

of shares of Class A common stock per share

Basic

$

(0.16

)

$

(0.15

)

Diluted

$

(0.16

)

$

(0.15

)

(a)

Reflects a reclassification of $5.5

million of other income to revenues related to shares received as

partial payment for advisory services provided on certain

transactions.

(b)

Reflects a reclassification of $0.7

million of other income to compensation and benefits expense

associated with the forfeiture or return of compensation by former

employees.

(c)

Tax Receivable Agreement liability related

adjustments are made to other income (expenses) for GAAP purposes.

The adjustment of $0.3 million is reclassified to the provision for

income taxes line.

(d)

An adjustment has been made to illustrate

the result as if 100% of the Firm’s income is being taxed at our

corporate effective tax rate. Our adjusted tax provision excludes

any benefits or costs related to the adjustment to the TRA

liability originated from past partnership unit exchanges; such

adjustment for this period was a net expense of $0.3 million, which

is not included in the corporate tax provision for the period

presented.

(e)

Assumes all outstanding Class A

partnership units have been exchanged into Class A common

stock.

Moelis & Company Reconciliation

of GAAP to Adjusted (non-GAAP) Financial Information

Unaudited (dollars in thousands, except share and per

share data)

Nine Months Ended September

30, 2024

Adjusted items

GAAP

Adjustments

Adjusted (non-GAAP)

Revenues

$

755,826

$

6,975

(a)

$

762,801

Compensation and benefits

573,006

(394)

(b)

572,612

Non-compensation expenses

141,386

—

141,386

Other income (expenses)

17,032

(6,992)

(a)(b)(c)

10,040

Income (loss) before income taxes

58,466

377

58,843

Provision (benefit) for income taxes

6,820

591

(c)(d)

7,411

Net income (loss)

51,646

(214)

51,432

Net income (loss) attributable to

noncontrolling interests

5,025

(5,025)

(e)

—

Net income (loss) attributable to Moelis

& Company

$

46,621

$

4,811

$

51,432

Weighted-average shares of Class A common

stock outstanding

Basic

71,612,206

6,121,966

(e)

77,734,172

Diluted

76,147,357

6,121,966

(e)

82,269,323

Net income (loss) attributable to holders

of shares of Class A common stock per share

Basic

$

0.65

$

0.66

Diluted

$

0.61

$

0.63

(a)

Reflects a reclassification of $7.0

million of other income to revenues related to a gain associated

with the Firm's sale of 5.0 million shares of MA Financial Group

Limited.

(b)

Reflects a reclassification of $0.4

million of other income (expenses) to compensation and benefits

associated with the forfeiture or return of compensation by former

employees.

(c)

Tax Receivable Agreement liability related

adjustments are made to other income (expenses) for GAAP purposes.

The adjustment of $0.4 million is reclassified to the provision for

income taxes line.

(d)

An adjustment has been made to illustrate

the result as if 100% of the Firm’s income is being taxed at our

corporate effective tax rate for the period stated, together with

the tax benefit related to the settlement of share-based awards of

$12.7 million, we have a net tax expense of $7.4 million. Our

Adjusted tax provision excludes any benefits or costs related to

the adjustment to the step-up in tax basis in Group LP assets and

TRA liabilities in connection with past partnership unit exchanges;

such adjustment for this period was a net expense of $0.4 million,

which is not included in the corporate tax provision for the period

presented.

(e)

Assumes all outstanding Class A

partnership units have been exchanged into Class A common

stock.

Moelis & Company Reconciliation

of GAAP to Adjusted (non-GAAP) Financial Information

Unaudited (dollars in thousands, except share and per

share data)

Nine Months Ended September

30, 2023

Adjusted items

GAAP

Adjustments

Adjusted (non-GAAP)

Revenues

$

639,870

$

5,337

(a)

$

645,207

Compensation and benefits

536,264

(742)

(b)

535,522

Non-compensation expenses

134,609

(420)

(c)

134,189

Other income (expenses)

6,060

4,426

(a)(b)(c)(d)

10,486

Income (loss) before income taxes

(24,943)

10,925

(14,018)

Provision (benefit) for income taxes

(3,891)

1

(d)(e)

(3,890)

Net income (loss)

(21,052)

10,924

(10,128)

Net income (loss) attributable to

noncontrolling interests

(2,012)

2,012

(f)

—

Net income (loss) attributable to Moelis

& Company

$

(19,040)

$

8,912

$

(10,128)

Weighted-average shares of Class A common

stock outstanding

Basic

68,260,558

6,222,685

(f)

74,483,243

Diluted

68,260,558

6,222,685

(f)

74,483,243

Net income (loss) attributable to holders

of shares of Class A common stock per share

Basic

$

(0.28)

$

(0.14)

Diluted

$

(0.28)

$

(0.14)

(a)

Reflects a reclassification of $5.3

million of other income to revenues related to shares received as

partial payment for advisory services provided on certain

transactions.

(b)

Reflects a reclassification of $0.7

million of other income to compensation and benefits expense

associated with the forfeiture or return of compensation by former

employees.

(c)

Reflects adjustments of $10.4 million for

expenses related to a regulatory settlement with the U.S.

Securities and Exchange Commission.

(d)

Tax Receivable Agreement liability related

adjustments are made to other income (expenses) for GAAP purposes.

The adjustment of $0.5 million is reclassified to the provision for

income taxes line.

(e)

An adjustment has been made to illustrate

the result as if 100% of the Firm’s income is being taxed at our

corporate effective tax rate for the period stated; together with

the tax benefit related to the settlement of share-based awards of

$3.6 million, we have a net tax benefit of $3.9 million. Our

adjusted tax provision excludes any benefits or costs related to

the adjustment to the TRA liability originated from past

partnership unit exchanges; such adjustment for this period was a

net expense of $0.5 million, which is not included in the corporate

tax provision for the period presented.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241023590953/en/

Investor Contact: Matt Tsukroff Moelis & Company t: +

1 212 883 3800 m: +1 917 526 2340 matthew.tsukroff@moelis.com

Media Contact: Alyssa Castelli Moelis & Company t: +

1 212 883 3802 m: +1 929 969 2918 alyssa.castelli@moelis.com

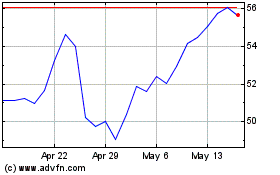

Moelis (NYSE:MC)

Historical Stock Chart

From Oct 2024 to Nov 2024

Moelis (NYSE:MC)

Historical Stock Chart

From Nov 2023 to Nov 2024