Medifast (NYSE: MED), the health and wellness company known for

its habit-based and coach-guided lifestyle solution,

OPTAVIA®, today reported results for the third quarter ended

September 30, 2024.

Third Quarter 2024

- Revenue of $140.2 million, with revenue per active earning

coach of $4,672

- Independent active earning OPTAVIA coaches of

30,000

- Net income of $1.1 million (non-GAAP adjusted net income of

$3.9 million)

- Income per diluted share of $0.10 (non-GAAP adjusted earnings

per share ("EPS") of $0.35)

- Cash, Cash Equivalents, and Investment Securities of $170.0

million with no debt

“Medical innovation has transformed the weight loss industry, so

at Medifast we’re creating a health and wellness business of the

future by meeting the unique needs of customers regardless of their

approach to their health goals,” said Dan Chard, Chairman &

CEO.

“We offer comprehensive support for medication users including

access to clinicians through LifeMD, as well as programs and

products to help maintain muscle and minimize side effects. We’re

developing customized solutions for those looking to maintain their

weight and build a healthier lifestyle beyond medication usage.

Importantly, our clinically-studied coach-led program remains a

powerful solution for those not using medications at all, combining

the community support, a habit-based approach and nutritional

products that are a hallmark of all our OPTAVIA programs, having

already helped over 3 million people achieve improved health.”

Chard concluded, “With tailored plans, personal solutions and a

focused approach to driving customer acquisition, we believe that

our strategy can drive sustainable growth in the quarters and years

ahead.”

Third Quarter 2024 Results

Third quarter 2024 revenue decreased 40.6% to $140.2 million

from $235.9 million for the third quarter of 2023 primarily driven

by a decrease in the number of active earning OPTAVIA

coaches and lower coach productivity. The total number of active

earning OPTAVIA coaches decreased 36.3% to 30,000 compared

to 47,100 for the third quarter of 2023. The average revenue per

active earning OPTAVIA coach was $4,672, compared to $5,008

for the third quarter last year, primarily driven by continued

pressure on customer acquisition.

Gross profit decreased 40.4% to $105.7 million from $177.4

million for the third quarter of 2023. The decrease in gross profit

was primarily due to lower revenue. Gross profit margin was 75.4%

compared to 75.2% in the third quarter of 2023.

Selling, general, and administrative expenses (“SG&A”)

decreased 31.8% to $103.6 million compared to $151.9 million for

the third quarter of 2023. The decrease in SG&A was primarily

due to a $38.2 million decrease in OPTAVIA coach

compensation on fewer active earning coaches and lower volumes and

$5.0 million of reduced costs for coach-related events, including

convention. As a percentage of revenue, SG&A increased 950

basis points year-over-year to 73.9% of revenue, as compared to

64.4% for the third quarter of 2023. The increase in SG&A as a

percentage of revenue was primarily due to approximately 590 basis

points of costs for Company-led customer acquisition initiatives

and 340 basis points attributable to the loss of leverage on fixed

costs due to lower sales volumes. Non-GAAP adjusted SG&A, which

excludes the final $1.7 million of expenses related to the

company’s overall $10 million collaboration with LifeMD, decreased

32.9% to $101.9 million and non-GAAP adjusted SG&A as a

percentage of revenue increased 830 basis points year-over-year to

72.7%.

The company's income from operations for the period was $2.1

million, a decrease of 91.7% from income from operations of $25.5

million in the prior year comparable period. As a percentage of

revenue, income from operations was 1.5% for the third quarter of

2024 compared to 10.8% in the prior-year period. Non-GAAP adjusted

income from operations decreased 85.3% to $3.8 million. Non-GAAP

adjusted income from operations as a percentage of revenue was

2.7%, a decrease of 810 basis points from the year-ago period.

The effective tax rate was 28.5% for the third quarter of 2024

compared to 12.9% in the prior-year period. The increase in the

effective tax rate for the three months ended September 30, 2024

was primarily driven by a decrease in the tax benefit for donations

of inventory compared to 2023. The non-GAAP effective tax rate was

26.0% as compared to 12.9% in the prior year period.

In the third quarter of 2024, the company's net income was $1.1

million, or $0.10 per diluted share, based on approximately 11.0

million shares of common stock outstanding. In the third quarter of

2023, net income was $23.1 million, or $2.12 per diluted share,

based on approximately 10.9 million shares of common stock

outstanding. In the third quarter 2024, non-GAAP adjusted net

income was $3.9 million, or $0.35 per diluted share.

Capital Allocation and Balance Sheet

The company’s balance sheet remains strong with $170.0 million

in cash, cash equivalents and investment securities and no debt as

of September 30, 2024, compared to $150.0 million in cash, cash

equivalents and investment securities and no debt at December 31,

2023. As of September 30, 2024, the company maintained a $225

million credit facility. Given the company’s healthy cash position,

which is projected to be maintained through the expiration of the

credit facility, the company cancelled its credit agreement,

effective October 30, 2024. This action was made as part of the

Fuel for the Future initiative, as the company incurred

approximately $50 thousand of cash expenses related to the

termination and expects to achieve annual savings of approximately

$500 thousand in commitment fees. Unamortized debt issuance costs

totaling $419 thousand will be expensed in the fourth quarter of

2024. The credit agreement termination was done in accordance with

its terms. As of the date of termination, the company did not have

any borrowings under the credit agreement, and the company was in

compliance with all covenants. In addition, the company did not

incur any premium or early penalties in connection with the

termination.

Outlook

The company expects fourth quarter 2024 revenue to be in the

range of $100 million to $120 million and fourth quarter 2024

diluted loss per share to be in the range of $0.10 to $0.65. The

EPS range excludes any gains or losses from changes in the market

price of the company’s LifeMD common stock investment.

Conference Call Information

The conference call is scheduled for today, Monday, November 4,

2024 at 4:30 p.m. ET. The call will be broadcast live over the

Internet, hosted on the Investor Relations section of Medifast’s

website at www.MedifastInc.com or directly at

https://viavid.webcasts.com/starthere.jsp?ei=1691825&tp_key=981ddaa9cf

and will be archived online and available through February 4, 2025.

In addition, listeners may dial 201-389-0879 to join via

telephone.

A telephonic playback will be available from 7:30 p.m. ET,

November 4, 2024, through November 11, 2024. Participants can dial

412-317-6671 and enter passcode 13749320 to hear the playback.

About Medifast®:

Medifast (NYSE: MED) is the health and wellness company known

for its habit-based and coach-guided lifestyle solution

OPTAVIA®, which provides people with a simple yet

comprehensive approach to address obesity and support a healthy

lifestyle. OPTAVIA's holistic solution includes lifestyle

plans with clinically proven health benefits, scientifically

developed products, and a framework for habit creation – all

reinforced by independent coach support for customers on their

weight loss journeys. Through its collaboration with national

virtual primary care provider LifeMD® (Nasdaq: LFMD) and its

affiliated medical group, the holistic solution now includes access

to GLP-1 medications where clinically appropriate. Medifast remains

committed to its mission of offering Lifelong Transformation,

Making a Healthy Lifestyle Second Nature™. Visit the OPTAVIA

and Medifast websites for more information and follow @Medifast on

X and LinkedIn.

MED-F

Forward Looking Statements

Please Note: This release contains “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995, Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended.

These forward-looking statements generally can be identified by use

of phrases or terminology such as “intend,” “anticipate,” “expect”

or other similar words or the negative of such terminology.

Similarly, descriptions of Medifast’s objectives, strategies,

plans, goals, outlook or targets contained herein are also

considered forward-looking statements. These statements are based

on the current expectations of the management of Medifast and are

subject to certain events, risks, uncertainties and other factors.

Some of these factors include, among others, Medifast's inability

to maintain and grow the network of independent OPTAVIA

Coaches; Industry competition and new weight loss products,

including weight loss medications, or services; Medifast’s health

or advertising related claims by OPTAVIA customers;

Medifast's inability to continue to develop new products;

effectiveness of Medifast's advertising and marketing programs,

including use of social media by OPTAVIA Coaches; the

departure of one or more key personnel; Medifast's inability to

protect against online security risks and cyberattacks; risks

associated with Medifast's direct-to-consumer business model;

disruptions in Medifast's supply chain; product liability claims;

Medifast's planned growth into domestic markets including through

its collaboration with LifeMD, Inc.; adverse publicity associated

with Medifast's products; the impact of existing and future laws

and regulations on Medifast’s business; fluctuations of Medifast's

common stock market price; increases in litigation; actions of

activist investors; the consequences of other geopolitical events,

overall economic and market conditions and the resulting impact on

consumer sentiment and spending patterns; and Medifast's ability to

prevent or detect a failure of internal control over financial

reporting. Although Medifast believes that the expectations,

statements and assumptions reflected in these forward-looking

statements are reasonable, it cautions readers to always consider

all of the risk factors and any other cautionary statements

carefully in evaluating each forward-looking statement in this

release, as well as those set forth in its Annual Report on Form

10-K for the fiscal year ended December 31, 2023, and other filings

filed with the United States Securities and Exchange Commission,

including its quarterly reports on Form 10-Q and current reports on

Form 8-K. All of the forward-looking statements contained herein

speak only as of the date of this release.

MEDIFAST, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (UNAUDITED)

(U.S. dollars in thousands,

except per share amounts & dividend data)

Three months ended September

30,

Nine months ended September

30,

2024

2023

2024

2023

Revenue

$

140,163

$

235,869

$

483,460

$

881,039

Cost of sales

34,489

58,492

127,056

246,558

Gross profit

105,674

177,377

356,404

634,481

Selling, general, and administrative

103,568

151,868

354,235

516,755

Income from operations

2,106

25,509

2,169

117,726

Other (expense) income

Interest income

1,333

1,033

3,851

1,314

Other (expense) income

(1,861

)

7

(3,508

)

(45

)

(528

)

1,040

343

1,269

Income before provision for income

taxes

1,578

26,549

2,512

118,995

Provision for income taxes

449

3,418

1,222

25,615

Net income

$

1,129

$

23,131

$

1,290

$

93,380

Earnings per share - basic

$

0.10

$

2.12

$

0.12

$

8.58

Earnings per share - diluted

$

0.10

$

2.12

$

0.12

$

8.55

Weighted average shares

outstanding

Basic

10,937

10,892

10,928

10,881

Diluted

10,971

10,933

10,959

10,925

Cash dividends declared per share

$

—

$

1.65

$

—

$

4.95

MEDIFAST, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS (UNAUDITED)

(U.S. dollars in thousands,

except par value)

September 30,

2024

December 31,

2023

ASSETS

Current Assets

Cash and cash equivalents

$

115,307

$

94,440

Inventories, net

40,095

54,591

Investments

54,648

55,601

Income taxes, prepaid

8,229

8,727

Prepaid expenses and other current

assets

6,696

10,670

Total current assets

224,975

224,029

Property, plant and equipment - net of

accumulated depreciation

39,003

51,467

Right-of-use assets

12,290

15,645

Other assets

10,967

14,650

Deferred tax assets, net

4,002

4,117

TOTAL ASSETS

$

291,237

$

309,908

LIABILITIES AND STOCKHOLDERS'

EQUITY

Current Liabilities

Accounts payable and accrued expenses

$

66,270

$

86,415

Current lease obligations

6,106

5,885

Total current liabilities

72,376

92,300

Lease obligations, net of current lease

obligations

11,519

16,127

Total liabilities

83,895

108,427

Stockholders' Equity

Common stock, par value $0.001 per share:

20,000 shares authorized;

10,937 and 10,896 issued and

outstanding

at September 30, 2024 and December 31,

2023, respectively

11

11

Additional paid-in capital

31,005

26,573

Accumulated other comprehensive income

349

248

Retained earnings

175,977

174,649

Total stockholders' equity

207,342

201,481

TOTAL LIABILITIES AND STOCKHOLDERS'

EQUITY

$

291,237

$

309,908

Non-GAAP Financial Measures

In an effort to provide investors with additional information

regarding results, the company discloses various non-GAAP financial

measures in the quarterly earnings press release and other public

disclosures. The following GAAP financial measures have been

presented on an as adjusted basis: cost of sales, gross profit,

SG&A expenses, income from operations, other income (expense),

provision for income taxes, net income, effective tax rate, and

diluted earnings per share. Each of these non-GAAP financial

measures excludes the impact of certain amounts as further

identified below that the company believes are not indicative of

its core ongoing operational performance. A reconciliation of each

of these non-GAAP financial measures to its most comparable GAAP

financial measure is included below. These non-GAAP financial

measures are not intended to replace GAAP financial measures.

These non-GAAP financial measures are used internally to

evaluate and manage the company's operations because the company

believes they provide useful supplemental information regarding the

company's on-going economic performance. The company has chosen to

provide this information to investors to enable them to perform

more meaningful comparisons of operating results and as a means to

emphasize the results of on-going operations.

The following tables reconcile the non-GAAP financial measures

included in this release:

MEDIFAST, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED

NON-GAAP (UNAUDITED)

(U.S. dollars in thousands,

except per share amounts)

Three Months Ended September

30, 2024

GAAP

Unrealized Loss on Investment

in LifeMD Common Stock

LifeMD Prepaid Services

Amortization

Non-GAAP

Cost of sales

$

34,489

$

—

$

—

$

34,489

Gross profit

105,674

—

—

105,674

Selling, general, and administrative

103,568

—

(1,652

)

101,916

Income from operations

2,106

—

1,652

3,758

Other income (expense)

(528

)

1,984

—

1,456

Provision for income taxes

449

496

413

1,358

Net income

1,129

1,488

1,239

3,856

Diluted earnings per share(1)

0.10

0.14

0.11

0.35

Three Months Ended September

30, 2023

GAAP

Unrealized Loss on Investment

in LifeMD Common Stock

LifeMD Prepaid Services

Amortization

Non-GAAP

Cost of sales

$

58,492

$

—

$

—

$

58,492

Gross profit

177,377

—

—

177,377

Selling, general, and administrative

151,868

—

—

151,868

Income from operations

25,509

—

—

25,509

Other income

1,040

—

—

1,040

Provision for income taxes

3,418

—

—

3,418

Net income

23,131

—

—

23,131

Diluted earnings per share(1)

2.12

—

—

2.12

Nine Months Ended September

30, 2024

GAAP

Supply Chain Optimization and

Restructuring of External Manufacturing Agreements

OPTAVIA Convention

Cancellation

Unrealized Loss on Investment

in LifeMD Common Stock

LifeMD Prepaid Services

Amortization

Non-GAAP

Cost of sales

$

127,056

$

(2,579

)

$

—

$

—

$

—

$

124,477

Gross profit

356,404

2,579

—

—

—

358,983

Selling, general, and administrative

354,235

(12,502

)

(3,000

)

(5,000

)

333,733

Income from operations

2,169

15,081

3,000

—

5,000

25,250

Other income

343

—

—

3,734

—

4,077

Provision for income taxes

1,222

3,770

750

934

1,250

7,926

Net income

1,290

11,311

2,250

2,800

3,750

21,400

Diluted earnings per share(1)

0.12

1.03

0.21

0.26

0.34

1.95

Nine Months Ended September

30, 2023

GAAP

Supply Chain Optimization and

Restructuring of External Manufacturing Agreements

OPTAVIA Convention

Cancellation

Unrealized Loss on Investment

in LifeMD Common Stock

LifeMD Prepaid Services

Amortization

Non-GAAP

Cost of sales

$

246,558

$

—

$

—

$

—

$

—

$

246,558

Gross profit

634,481

—

—

—

—

634,481

Selling, general, and administrative

516,755

—

—

—

—

516,755

Income from operations

117,726

—

—

—

—

117,726

Other income

1,269

—

—

—

—

1,269

Provision for income taxes

25,615

—

—

—

—

25,615

Net income

93,380

—

—

—

—

93,380

Diluted earnings per share(1)

8.55

—

—

—

—

8.55

(1) The weighted-average diluted shares

outstanding used in the calculation of these non-GAAP financial

measures are the same as the weighted-average shares outstanding

used in the calculation of the reported per share amounts.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241104875720/en/

Investor Contact: Medifast, Inc. Steven Zenker

InvestorRelations@medifastinc.com (443) 379-5256

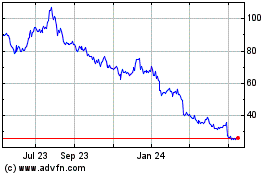

Medifast (NYSE:MED)

Historical Stock Chart

From Feb 2025 to Mar 2025

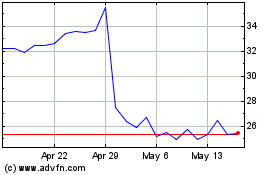

Medifast (NYSE:MED)

Historical Stock Chart

From Mar 2024 to Mar 2025