McEwen Mining Closes Flow-Through Financing

15 December 2023 - 4:53AM

McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) is

pleased to announce the closing of the previously announced private

placement financing of 1,903,000 flow-through common shares for

total gross proceeds of

US$16.1 million

(Cdn$22,016,150).

The proceeds of this financing will be used

exclusively for qualifying Canadian Exploration Expenditures (CEE)

and Canadian Development Expenditures (CDE), within the meaning of

subsection 66(15) of the Income Tax Act (Canada), on

McEwen Mining’s properties in the Timmins region:

Part 1 (CEE) of the financing consists of a

US$7.3 million (Cdn$10,007,600) private placement of 788,000

flow-through common shares at a price of US$9.27 (Cdn$12.70);

and

Part 2 (CDE) of the financing consists of a

US$8.8 million (Cdn$12,008,550) private placement of 1,115,000

flow-through common shares at a price of US$7.86 (Cdn$10.77), (Part

1 and Part 2 together being the “Offering”).

Cantor Fitzgerald Canada Corporation and Roth

Capital Partners, LLC are acting as exclusive co-lead placement

agents for the Offering and PearTree Canada structured the

flow-through donation placement.

This press release is not an offer of common

shares for sale in the United States. The common shares may not be

offered or sold in the United States absent registration or an

available exemption from the registration requirements of the US.

Securities Act of 1933, as amended (the "U.S. Securities Act"), and

applicable U.S. state securities laws. McEwen will not make any

public offering of the securities in the United States. The common

shares have not been and will not be registered under the U.S.

Securities Act, or any state securities laws.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy, nor shall there be

any sale of these securities, in any jurisdiction in which such

offer, solicitation or sale would be unlawful.

CAUTION CONCERNING FORWARD-LOOKING

STATEMENTS

This news release contains certain

forward-looking statements and information, including

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995. The forward-looking

statements and information expressed, as at the date of this news

release, McEwen Mining Inc.'s (the "Company") estimates, forecasts,

projections, expectations or beliefs as to future events and

results. Forward-looking statements and information are necessarily

based upon a number of estimates and assumptions that, while

considered reasonable by management, are inherently subject to

significant business, economic and competitive uncertainties, risks

and contingencies, and there can be no assurance that such

statements and information will prove to be accurate. Therefore,

actual results and future events could differ materially from those

anticipated in such statements and information. Risks and

uncertainties that could cause results or future events to differ

materially from current expectations expressed or implied by the

forward-looking statements and information include, but are not

limited to, effects of the COVID-19 pandemic, fluctuations in the

market price of precious metals, mining industry risks, political,

economic, social and security risks associated with foreign

operations, the ability of the corporation to receive or receive in

a timely manner permits or other approvals required in connection

with operations, risks associated with the construction of mining

operations and commencement of production and the projected costs

thereof, risks related to litigation, the state of the capital

markets, environmental risks and hazards, uncertainty as to the

calculation of mineral resources and reserves, and other risks.

Readers should not place undue reliance on forward-looking

statements or information included herein, which speak only as of

the date hereof. The Company undertakes no obligation to reissue or

update forward-looking statements or information as a result of new

information or events after the date hereof except as may be

required by law. See McEwen Mining's Annual Report on Form 10-K for

the fiscal year ended December 31, 2022 and other filings with the

Securities and Exchange Commission, under the caption "Risk

Factors", for additional information on risks, uncertainties and

other factors relating to the forward-looking statements and

information regarding the Company. All forward-looking statements

and information made in this news release are qualified by this

cautionary statement.

The NYSE and TSX have not reviewed and do not accept

responsibility for the adequacy or accuracy of the contents of this

news release, which has been prepared by management of McEwen

Mining Inc.

ABOUT MCEWEN MINING

McEwen Mining is a gold and silver producer with

operations in Nevada, Canada, Mexico and Argentina. In addition, it

owns approximately 47.7% of McEwen Copper which owns the large,

advanced stage Los Azules copper project in Argentina. The

Company’s goal is to improve the productivity and life of its

assets with the objective of increasing its share price and

providing a yield. Rob McEwen, Chairman and Chief Owner has

personally provided the Company with $220 million and takes an

annual salary of $1.

|

WEB SITEwww.mcewenmining.comCONTACT

INFORMATION150 King Street West Suite 2800, PO Box

24 Toronto, ON, Canada M5H 1J9 Relationship with

Investors: (866)-441-0690 Toll

free (647)-258-0395 Mihaela

Iancu ext. 320 info@mcewenmining.com |

SOCIAL MEDIA |

|

| |

McEwen Mining |

|

Facebook:LinkedIn:Twitter:Instagram: |

facebook.com/mcewenmininglinkedin.com/company/mcewen-mining-inc- twitter.com/mcewenmininginstagram.com/mcewenmining |

| |

| |

McEwen Copper |

|

Facebook:LinkedIn:Twitter:Instagram: |

facebook.com/mcewencopperlinkedin.com/company/mcewencoppertwitter.com/mcewencopperinstagram.com/mcewencopper |

| |

| |

Rob

McEwen |

|

Facebook:LinkedIn:Twitter: |

facebook.com/mcewenrob linkedin.com/in/robert-mcewen-646ab24twitter.com/robmcewenmux |

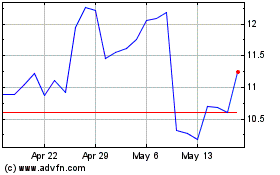

McEwen Mining (NYSE:MUX)

Historical Stock Chart

From Feb 2025 to Mar 2025

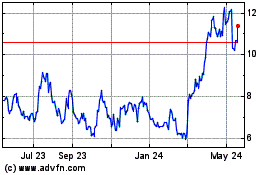

McEwen Mining (NYSE:MUX)

Historical Stock Chart

From Mar 2024 to Mar 2025