Nordic American Tankers Ltd (NYSE: NAT) – Report as per June 30, 2024 – A dividend company with good prospects

29 August 2024 - 8:31PM

Thursday, August 29, 2024

Dear Shareholders and Investors,

Highlights:

Ninety day periods offer a short-term snapshot of a company.

However, it is more important to view the long-term picture. The

direction of NAT is unquestionably upward, with further room to

grow.

- For the second quarter of 2024, NAT produced a net profit of

$21.6 million, which is a substantial improvement compared with the

previous quarter (1Q24) with a net Profit of $15.1 million.

- The dividend for the second quarter is 12 cents ($0.12) per

share. This is our 108th consecutive quarterly cash dividend

payment. The dividend is payable November 26, 2024, to shareholders

on record as of September 26, 2024. NAT has paid an aggregate

dividend of more than $50 per share since NAT became stocklisted in

New York, September 15, 1995.

- During the second quarter of 2024 the total average NAT time

charter for all our ships was $36,600 per day per ship. The daily

operating costs per ship are about $9,000, leaving NAT with a solid

margin.

- There is a shortage of the type of ships that NAT is operating

and the ongoing hostilities in the Middle East are exacerbating

this situation.

- Oil demand continues to grow in Asia, creating more need for

our vessels. India, the most populous country on the planet, is the

world’s third largest importer of oil. China is also a key country

for NAT together with Japan and South Korea. NAT has not

transported Russian oil the last 3.5 years.

- The NAT fleet of versatile suezmax tankers offer flexibility in

loading and discharging ports. Through careful voyage planning and

adjustment of speed of our vessels, we reduce emissions. Each

individual ship in the NAT fleet is of excellent technical quality,

as demonstrated in the vetting performance, the score card

undertaken by our customers.Most of our business is with major oil

and energy companies.

Sincerely,

Herbjorn HanssonFounder, Chairman & CEO

Nordic American Tankers Ltd.

www.nat.bm

CAUTIONARY STATEMENT REGARDING

FORWARD-LOOKING STATEMENTS

Matters discussed in this press release may constitute

forward-looking statements. The Private Securities Litigation

Reform Act of 1995 provides safe harbor protections for

forward-looking statements in order to encourage companies to

provide prospective information about their business.

Forward-looking statements include statements concerning plans,

objectives, goals, strategies, future events or performance, and

underlying assumptions and other statements, which are other than

statements of historical facts.

The Company desires to take advantage of the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995

and is including this cautionary statement in connection with this

safe harbor legislation. The words “believe,” “anticipate,”

“intend,” “estimate,” “forecast,” “project,” “plan,” “potential,”

“will,” “may,” “should,” “expect,” “pending” and similar

expressions identify forward-looking statements.

The forward-looking statements in this press release are based

upon various assumptions, many of which are based, in turn, upon

further assumptions, including without limitation, our management’s

examination of historical operating trends, data contained in our

records and other data available from third parties. Although we

believe that these assumptions were reasonable when made, because

these assumptions are inherently subject to significant

uncertainties and contingencies which are difficult or impossible

to predict and are beyond our control, we cannot assure you that we

will achieve or accomplish these expectations, beliefs or

projections. We undertake no obligation to update any

forward-looking statement, whether as a result of new information,

future events or otherwise.

Important factors that, in our view, could cause actual results

to differ materially from those discussed in the forward-looking

statements include the strength of world economies and currencies,

general market conditions, including fluctuations in charter rates

and vessel values, changes in demand in the tanker market, as a

result of changes in OPEC’s petroleum production levels and

worldwide oil consumption and storage, changes in our operating

expenses, including bunker prices, drydocking and insurance costs,

the market for our vessels, availability of financing and

refinancing, changes in governmental rules and regulations or

actions taken by regulatory authorities, potential liability from

pending or future litigation, general domestic and international

political conditions, potential disruption of shipping routes due

to accidents or political events, vessels breakdowns and instances

of off-hires and other important factors described from time to

time in the reports filed by the Company with

the Securities and Exchange Commission, including the prospectus

and related prospectus supplement, our Annual Report on Form 20-F,

and our reports on Form 6-K.

Contacts:

Bjørn Giæver, CFO

Nordic American

Tankers Ltd

Tel: +1 888 755

8391

Alexander Kihle, Finance ManagerNordic American Tankers LtdTel:

+47 91 724 171

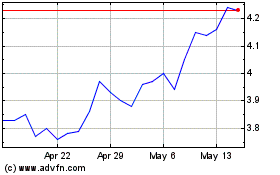

Nordic American Tankers (NYSE:NAT)

Historical Stock Chart

From Nov 2024 to Dec 2024

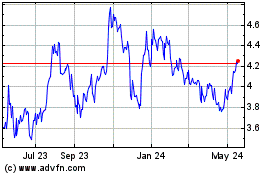

Nordic American Tankers (NYSE:NAT)

Historical Stock Chart

From Dec 2023 to Dec 2024