- Second Quarter Net Income of $112 Million and Earnings Per

Share of $11.63

- First Half Petroleum Additives Operating Profit of $299

Million

- First Half AMPAC Results Consistent with Pre-Acquisition

Expectations

- Debt Reduction of $171 Million Since AMPAC

Acquisition

NewMarket Corporation (NYSE:NEU) Chairman and Chief Executive

Officer, Thomas E. Gottwald, released the following earnings report

of the Company’s operations for the second quarter and first half

of 2024.

Net income for the second quarter of 2024 was $111.6 million, or

$11.63 per share, compared to net income of $99.6 million, or

$10.36 per share, for the same period last year. For the first half

of 2024, net income was $219.4 million, or $22.87 per share,

compared to $197.2 million, or $20.45 per share, for the same

period in 2023.

Petroleum additives sales for the second quarter of 2024 were

$669.8 million, compared to $684.0 million for the same period in

2023. Petroleum additives operating profit for the second quarter

of 2024 was $147.8 million, compared to $132.1 million for the

second quarter of 2023. The increase in petroleum additives

operating profit was mainly due to lower raw material and operating

costs as well as increased shipments, partially offset by lower

selling prices. Shipments increased approximately 1% when comparing

the second quarter of 2024 to the same period in 2023.

Petroleum additives sales for the first half of 2024 were $1.3

billion, compared to $1.4 billion in the first half of 2023.

Petroleum additives operating profit for the first half of 2024 was

$298.7 million, compared to $264.2 million in the same period last

year. The drivers for the increase in operating profit between

these periods were consistent with those affecting the second

quarter comparison discussed above. Shipments increased 2.7% when

comparing the first half of 2024 with the same period in 2023, with

increases in both lubricant additives and fuel additives

shipments.

We are pleased with the strong performance of our petroleum

additives business during the first half of 2024. We are seeing the

favorable results of our ongoing focus on margin management.

Managing our operating costs, our inventory levels, and our

portfolio profitability will remain priorities throughout 2024.

We completed the acquisition of American Pacific Corporation

(AMPAC) on January 16, 2024. The financial results of our AMPAC

business since the date of acquisition are included in our

specialty materials segment. Specialty materials sales for the

second quarter of 2024 were $38.0 million. Specialty materials

operating profit for the second quarter of 2024 was $5.0 million,

compared to a loss of $5.0 million in the first quarter of

2024.

For the first half of 2024, the specialty materials segment

reported sales of $55.1 million and operating profit slightly above

breakeven. The specialty materials second quarter and first half

2024 results reflect the sale of AMPAC finished goods inventory

that we acquired at closing. This inventory was recorded at fair

value on the acquisition date and, when sold during the first half

of 2024, generated no margin. We expect to see substantial

variation in quarterly results for AMPAC due to the nature of its

business, and we anticipate full year 2024 results to be consistent

with our pre-acquisition expectations.

We generated solid cash flows from operations during the first

half of 2024, we funded capital expenditures of $28.5 million, and

we paid dividends of $48.0 million. Since the AMPAC acquisition, we

have made payments of $171 million on our revolving credit

facility. As of June 30, 2024, our Net Debt to EBITDA ratio was

1.6, which is within our target operating range of 1.5 to 2.0.

We anticipate continued strength in our petroleum additives

segment. We also look forward to the ongoing integration of AMPAC

into the NewMarket family of companies. We continue to make

decisions to promote long-term value for our shareholders and

customers, and we remain focused on our long-term objectives. We

believe the fundamentals of how we run our business - a long-term

view, safety-first culture, customer-focused solutions,

technology-driven product offerings, and world-class supply chain

capability - will continue to be beneficial for all our

stakeholders.

Sincerely,

Thomas E. Gottwald

The petroleum additives segment consists of the North America

(the United States and Canada), Latin America (Mexico, Central

America, and South America), Asia Pacific, and Europe/Middle

East/Africa/India (Europe or EMEAI) regions. The specialty

materials segment, which consists of the AMPAC business, operates

primarily in North America.

The Company has disclosed the non-GAAP financial measures

EBITDA, Net Debt, and Net Debt to EBITDA, as well as the related

calculations in the schedules included with this earnings release.

EBITDA is defined as income from continuing operations before the

deduction of interest and financing expenses, income taxes,

depreciation (on property, plant, and equipment) and amortization

(on intangibles and lease right-of-use assets). Net Debt is defined

as long-term debt, including current maturities, less cash and cash

equivalents. Net Debt to EBITDA is defined as Net Debt divided by

EBITDA for the rolling four quarters ended as of the specified

date. The Company believes that even though these items are not

required by or presented in accordance with United States generally

accepted accounting principles (GAAP), these additional measures

enhance understanding of the Company’s performance and period to

period comparability. The Company believes that these items should

not be considered an alternative to our results determined under

GAAP.

As a reminder, a conference call and webcast is scheduled for

3:00 p.m. ET on Tuesday, July 30, 2024, to review second quarter

2024 financial results. You can access the conference call live by

dialing 1-888-506-0062 (domestic) or 1-973-528-0011 (international)

and requesting the NewMarket conference call. To avoid delays,

callers should dial in five minutes early. A teleconference replay

of the call will be available until August 6, 2024, at 3:00 p.m. ET

by dialing 1-877-481-4010 (domestic) or 1-919-882-2331

(international). The replay passcode number is 50848. The call will

also be broadcast via the internet and can be accessed through the

Company’s website at www.newmarket.com or

www.webcaster4.com/Webcast/Page/2001/50848. A webcast replay will

be available for 30 days.

NewMarket Corporation is a holding company operating through its

subsidiaries, Afton Chemical Corporation (Afton), Ethyl Corporation

(Ethyl), and American Pacific Corporation (AMPAC). The Afton and

Ethyl companies develop, manufacture, blend, and deliver chemical

additives that enhance the performance of petroleum products. AMPAC

is a manufacturer of specialty materials primarily used in solid

rocket motors for the aerospace and defense industries. The

NewMarket family of companies has a long-term commitment to its

people, to safety, to providing innovative solutions for its

customers, and to making the world a better place.

Some of the information contained in this press release

constitutes forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. Although

NewMarket’s management believes its expectations are based on

reasonable assumptions within the bounds of its knowledge of its

business and operations, there can be no assurance that actual

results will not differ materially from expectations.

Factors that could cause actual results to differ materially

from expectations include, but are not limited to, the availability

of raw materials and distribution systems; disruptions at

production facilities, including single-sourced facilities; hazards

common to chemical businesses; the ability to respond effectively

to technological changes in our industries; failure to protect our

intellectual property rights; sudden, sharp, or prolonged raw

material price increases; competition from other manufacturers;

current and future governmental regulations; the loss of

significant customers; termination or changes to contracts with

contractors and subcontractors of the U.S. government or directly

with the U.S. government; failure to attract and retain a

highly-qualified workforce; an information technology system

failure or security breach; the occurrence or threat of

extraordinary events, including natural disasters, terrorist

attacks, wars and health-related epidemics; risks related to

operating outside of the United States; political, economic, and

regulatory factors concerning our products; the impact of

substantial indebtedness on our operational and financial

flexibility; the impact of fluctuations in foreign exchange rates;

resolution of environmental liabilities or legal proceedings;

limitation of our insurance coverage; our inability to realize

expected benefits from investment in our infrastructure or from

acquisitions, or our inability to successfully integrate

acquisitions into our business; the underperformance of our pension

assets resulting in additional cash contributions to our pension

plans; and other factors detailed from time to time in the reports

that NewMarket files with the Securities and Exchange Commission,

including the risk factors in Item 1A. “Risk Factors” of our Annual

Report on Form 10-K for the year ended December 31, 2023, which is

available to shareholders at www.newmarket.com.

You should keep in mind that any forward-looking statement made

by NewMarket in the foregoing discussion speaks only as of the date

on which such forward-looking statement is made. New risks and

uncertainties arise from time to time, and it is impossible for us

to predict these events or how they may affect us. We have no duty

to, and do not intend to, update or revise the forward-looking

statements in this discussion after the date hereof, except as may

be required by law. In light of these risks and uncertainties, you

should keep in mind that the events described in any

forward-looking statement made in this discussion, or elsewhere,

might not occur.

NEWMARKET CORPORATION AND

SUBSIDIARIES

SEGMENT RESULTS AND OTHER FINANCIAL

INFORMATION

(In thousands, except per-share amounts,

unaudited)

Second Quarter Ended

June 30,

Six Months Ended June

30,

2024

2023

2024

2023

Net Sales:

Petroleum additives

$

669,826

$

683,969

$

1,347,090

$

1,383,960

Specialty materials

38,010

0

55,057

0

All other

2,392

1,161

4,817

3,959

Total

$

710,228

$

685,130

$

1,406,964

$

1,387,919

Segment operating profit:

Petroleum additives

$

147,819

$

132,138

$

298,728

$

264,206

Specialty materials

4,972

0

5

0

All other

(1,374

)

(1,022

)

(1,455

)

(1,997

)

Segment operating profit

151,417

131,116

297,278

262,209

Corporate unallocated expense

(3,985

)

(6,810

)

(9,542

)

(13,301

)

Interest and financing expenses

(15,910

)

(10,255

)

(31,564

)

(21,028

)

Other income (expense), net

11,472

10,659

24,515

21,978

Income before income tax

expense

$

142,994

$

124,710

$

280,687

$

249,858

Net income

$

111,620

$

99,624

$

219,352

$

197,207

Earnings per share - basic and

diluted

$

11.63

$

10.36

$

22.87

$

20.45

NEWMARKET CORPORATION AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

INCOME

(In thousands, except per-share

amounts, unaudited)

Second Quarter Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Net sales

$

710,228

$

685,130

$

1,406,964

$

1,387,919

Cost of goods sold

491,773

489,492

972,144

994,237

Gross profit

218,455

195,638

434,820

393,682

Selling, general, and administrative

expenses

42,840

37,438

87,205

77,285

Research, development, and testing

expenses

28,663

33,958

59,863

67,114

Operating profit

146,952

124,242

287,752

249,283

Interest and financing expenses, net

15,910

10,255

31,564

21,028

Other income (expense), net

11,952

10,723

24,499

21,603

Income before income tax

expense

142,994

124,710

280,687

249,858

Income tax expense

31,374

25,086

61,335

52,651

Net income

$

111,620

$

99,624

$

219,352

$

197,207

Earnings per share - basic and

diluted

$

11.63

$

10.36

$

22.87

$

20.45

Cash dividends declared per

share

$

2.50

$

2.25

$

5.00

$

4.35

NEWMARKET CORPORATION AND

SUBSIDIARIES

CONSOLIDATED BALANCE

SHEETS

(In thousands, except share

amounts, unaudited)

June 30, 2024

December 31,

2023

ASSETS

Current assets:

Cash and cash equivalents

$

87,632

$

111,936

Trade and other accounts receivable, less

allowance for credit losses

495,516

432,349

Inventories

492,638

456,234

Prepaid expenses and other current

assets

39,455

39,051

Total current assets

1,115,241

1,039,570

Property, plant, and equipment, net

759,357

654,747

Intangibles (net of amortization) and

goodwill

763,467

124,642

Prepaid pension cost

385,363

370,882

Operating lease right-of-use assets,

net

73,867

70,823

Deferred charges and other assets

52,776

48,207

Total assets

$

3,150,071

$

2,308,871

LIABILITIES AND SHAREHOLDERS'

EQUITY

Current liabilities:

Accounts payable

$

270,789

$

231,137

Accrued expenses

85,114

76,546

Dividends payable

21,410

19,212

Income taxes payable

15,097

6,131

Operating lease liabilities

14,866

15,074

Other current liabilities

12,240

16,064

Total current liabilities

419,516

364,164

Long-term debt

1,172,732

643,622

Operating lease liabilities -

noncurrent

58,009

55,058

Other noncurrent liabilities

264,466

168,966

Total liabilities

1,914,723

1,231,810

Shareholders' equity:

Common stock and paid-in capital (with no

par value; issued and outstanding shares - 9,594,110 at June 30,

2024 and 9,590,086 at

December 31, 2023)

2,052

2,130

Accumulated other comprehensive loss

(34,097

)

(21,071

)

Retained earnings

1,267,393

1,096,002

Total shareholders' equity

1,235,348

1,077,061

Total liabilities and shareholders'

equity

$

3,150,071

$

2,308,871

NEWMARKET CORPORATION AND

SUBSIDIARIES

SELECTED CONSOLIDATED CASH

FLOW DATA

(In thousands, unaudited)

Six Months Ended June

30,

2024

2023

Net income

$

219,352

$

197,207

Depreciation and amortization

55,130

40,558

Cash pension and postretirement

contributions

(5,781

)

(5,020

)

Working capital changes

(40,696

)

52,494

Deferred income tax benefit

(7,461

)

(11,301

)

Capital expenditures

(28,533

)

(26,006

)

Acquisition of business, net of cash

acquired

(681,479

)

0

Net borrowings (repayments) under

revolving credit facility

279,000

(88,000

)

Proceeds from term loan

250,000

0

Dividends paid

(47,972

)

(41,879

)

Debt issuance costs

(2,251

)

0

Repurchases of common stock

0

(42,864

)

All other

(13,613

)

(12,978

)

(Decrease) increase in cash and cash

equivalents

$

(24,304

)

$

62,211

NEWMARKET CORPORATION AND

SUBSIDIARIES

NON-GAAP FINANCIAL

INFORMATION

(In thousands, unaudited)

Earnings Before

Interest, Taxes, Depreciation, and Amortization

(EBITDA)

Second Quarter Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Net Income

$

111,620

$

99,624

$

219,352

$

197,207

Add:

Interest and financing expenses, net

15,910

10,255

31,564

21,028

Income tax expense

31,374

25,086

61,335

52,651

Depreciation and amortization

28,938

19,897

54,193

39,863

EBITDA

$

187,842

$

154,862

$

366,444

$

310,749

Net Debt to EBITDA

June 30,

December 31,

2024

2023

Long-term debt, including current

maturities

$

1,172,732

$

643,622

Less: Cash and cash equivalents

87,632

111,936

Net Debt

$

1,085,100

$

531,686

Rolling Four Quarters

Ended

June 30,

December 31,

2024

2023

Net Income

$

411,009

$

388,864

Add:

Interest and financing expenses, net

47,895

37,359

Income tax expense

108,782

100,098

Depreciation and amortization

90,950

76,620

EBITDA-Rolling Four Quarters

$

658,636

$

602,941

Net Debt to EBITDA

1.6

0.9

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240725012672/en/

William J. Skrobacz Investor Relations Phone: 804.788.5555 Fax:

804.788.5688 investorrelations@newmarket.com

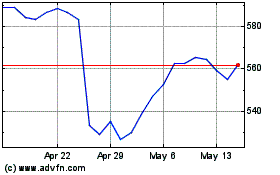

NewMarket (NYSE:NEU)

Historical Stock Chart

From Oct 2024 to Nov 2024

NewMarket (NYSE:NEU)

Historical Stock Chart

From Nov 2023 to Nov 2024