Nerdy Announces Fourth Quarter 2024 Financial Results

28 February 2025 - 8:01AM

Business Wire

Nerdy delivers fourth quarter revenue of

$48.0 million and a non-GAAP adjusted EBITDA loss of $5.5 million,

both above the high end of guidance ranges

Nerdy Inc. (NYSE: NRDY) today announced financial results for

the fourth quarter and year ended December 31, 2024.

“Throughout 2024, Nerdy made substantial progress against our

key objectives, including unifying our platforms and enhancing our

marketplace technology, which has set the stage for our next phase

of growth. We’ve recently launched several AI-powered products on

our platform, and as we move into 2025, we’re excited to accelerate

our focus on AI innovation. These advancements are driving us

toward our vision of AI for HI®, or Artificial Intelligence for

Human Interaction, enabling us to deliver exceptional support to

Learners and Experts throughout their learning journey,” said Chuck

Cohn, Founder, Chairman and Chief Executive Officer of Nerdy

Inc.

Please visit the Nerdy investor relations website

https://investors.nerdy.com to view the Nerdy Q4 Shareholder Letter

on the Quarterly Results Page.

Fourth Quarter Financial Highlights:

- Revenue Beats Top End of Guidance Range – In the fourth

quarter, Nerdy delivered revenue of $48.0 million, above our

guidance range of $44 to $47 million, which represented a decrease

of 13% year-over-year from $55.1 million during the same period in

2023. Revenue declined primarily due to lower Institutional

revenue, coupled with lower ARPM and Active Members in our Consumer

business.

- Consumer Learning Memberships – Revenue recognized in

the fourth quarter from Learning Memberships was $39.2 million and

represented 82% of total Company revenue. There were 37.5K Active

Members as of December 31, 2024.

- Institutional Strategy – In the fourth quarter,

Institutional delivered revenue of $6.8 million and represented 14%

of total Company revenue. Varsity Tutors for Schools executed 91

contracts, yielding $4.6 million of bookings. During the quarter,

we successfully enabled access to the Varsity Tutors platform for

an additional 0.6 million students, bringing the total to 5.0

million students at over 1,100 school districts as of December 31,

2024. Our strategy to introduce school districts to the platform

and ultimately convert them to our fee-based offerings produced 43%

of paid contracts and 36% of total bookings value in the fourth

quarter.

- Gross Margin – Gross margin was 66.6% for the three

months ended December 31, 2024, compared to a gross margin of 71.3%

during the comparable period in 2023. The decrease in gross margin

was primarily due to lower ARPM coupled with higher utilization of

tutoring sessions across Learning Memberships in our Consumer

business. We also implemented new Expert incentives during the

fourth quarter that we believe will drive further engagement with

our platform, and customer retention improvements.

- Adjusted EBITDA Loss Beats Top End of Guidance Range –

Net loss was $15.7 million in the fourth quarter versus a net loss

of $9.2 million during the same period in 2023. Excluding non-cash

stock compensation expenses, which were treated as an adjustment

for non-GAAP measures, non-GAAP adjusted net loss was $7.0 million

for the fourth quarter of 2024 compared to non-GAAP adjusted net

earnings of $2.2 million in the fourth quarter of 2023. We reported

a non-GAAP adjusted EBITDA loss of $5.5 million for the fourth

quarter of 2024, above our guidance of negative $7.0 million to

negative $10.0 million in non-GAAP adjusted EBITDA. This compares

to non-GAAP adjusted EBITDA of $3.0 million in the same period one

year ago. Non-GAAP adjusted EBITDA improvements relative to

guidance were driven by higher revenues coupled with benefits from

AI enabled productivity and operating leverage improvements,

partially offset by lower gross margin due to higher utilization of

tutoring sessions across Learning Memberships in our Consumer

business. Compared to last year, Non-GAAP adjusted EBITDA was lower

primarily due to lower revenues and gross margin coupled with

investments in the Varsity Tutors for Schools sales organization

and product development to drive innovation and support our

growth.

- Liquidity and Capital Resources – With no debt and $52.5

million of cash on our balance sheet, we believe we have ample

liquidity to fund the business and pursue growth initiatives.

First Quarter and Full Year 2025 Outlook: We are

providing first quarter and full year revenue and adjusted EBITDA

guidance for 2025.

- Revenue Guidance: For the first quarter of 2025, we

expect revenue in a range of $45 to $47 million. For the full year,

we expect revenue in a range of $190 to $200 million.

- Non-GAAP Adjusted EBITDA Guidance: For the first quarter

of 2025, we expect adjusted EBITDA in a range of negative $6

million to negative $8 million. For the full year, we expect

adjusted EBITDA in a range of negative $8 million to negative $18

million.

- Liquidity and Capital Resources: We expect to end the

year with no debt and cash in the range of $35 to $40 million.

Webcast and Earnings Conference Call

Nerdy’s management will host a conference call to discuss its

financial results on Thursday, February 27, 2025 at 5:00 p.m.

Eastern Time. Interested parties in the U.S. may listen to the call

by dialing 1-833-470-1428. International callers can dial

1-404-975-4839. The Access Code is 716743.

A live webcast of the call will also be available on Nerdy’s

investor relations website at https://investors.nerdy.com. A replay

of the webcast will be available on Nerdy’s website for one year

following the event and a telephonic replay of the call will be

available until March 6, 2025 by dialing 1-866-813-9403 from the

U.S. or 1-929-458-6194 from all other locations, and entering the

Access Code: 501480.

About Nerdy Inc.

Nerdy (NYSE: NRDY) is a leading platform for live online

learning, with a mission to transform the way people learn through

technology. The Company’s purpose-built proprietary platform

leverages technology, including AI, to connect learners of all ages

to experts, delivering superior value on both sides of the network.

Nerdy’s comprehensive learning destination provides learning

experiences across thousands of subjects and multiple

formats—including Learning Memberships, one-on-one instruction,

small group tutoring, large format classes, and adaptive

assessments. Nerdy’s flagship business, Varsity Tutors, is one of

the nation’s largest platforms for live online tutoring and

classes. Its solutions are available directly to students and

consumers, as well as through schools and other institutions. Learn

more about Nerdy at https://www.nerdy.com.

Forward-looking Statements

All statements contained herein that do not relate to matters of

historical fact should be considered forward-looking statements,

including, without limitation, statements regarding our strategic

priorities, including those related to enhancing the Learning

Membership experience; continued improvements in sales and

marketing leverage; gross margin and operating leverage; the growth

of our Institutional business; changes to our marketplace

infrastructure systems; simplifying our operations model while

growing our business; the sufficiency of our cash to fund future

operations; and our anticipated quarterly and full year 2025

outlook; as well as statements that include the words “expect,”

“plan,” “believe,” “project,” and “may,” and similar statements of

a future or forward-looking nature.

The forward-looking statements made herein relate only to events

as of the date on which the statements are made. We undertake no

obligation to update any forward-looking statements to reflect

events or circumstances after the date of this press release or to

reflect new information or the occurrence of unanticipated events,

except as required by law. We may not actually achieve the plans,

intentions, or expectations disclosed in our forward-looking

statements, and you should not place undue reliance on our

forward-looking statements.

There are a significant number of factors that could cause

actual results to differ materially from statements made herein or

in connection herewith, including but not limited to, our offerings

continue to evolve, which makes it difficult to predict our future

financial and operating results; our history of net losses and

negative operating cash flows, which could require us to need other

sources of liquidity; risks associated with our ability to acquire

and retain customers, operate, and scale up our Consumer and

Institutional businesses; risks associated with our intellectual

property, including claims that we infringe on a third-party’s

intellectual property rights; risks associated with our

classification of some individuals and entities we contract with as

independent contractors; risks associated with the liquidity and

trading of our securities; risks associated with payments that we

may be required to make under the tax receivable agreement;

litigation, regulatory and reputational risks arising from the fact

that many of our Learners are minors; changes in applicable law or

regulation; the possibility of cyber-related incidents and their

related impacts on our business and results of operations; risks

associated with the development and use of artificial intelligence

and related regulatory uncertainty; the possibility that we may be

adversely affected by other economic, business, and/or competitive

factors; and risks associated with managing our rapid growth.

Our actual results could differ materially from those stated or

implied in forward-looking statements due to a number of factors,

including but not limited to, risks detailed in our filings with

the SEC, including our Annual Report on Form 10-K filed on February

27, 2025, as well as other filings that we may make from time to

time with the SEC.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250227303890/en/

Investor Relations investors@nerdy.com

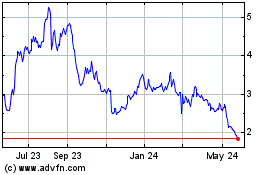

Nerdy (NYSE:NRDY)

Historical Stock Chart

From Feb 2025 to Mar 2025

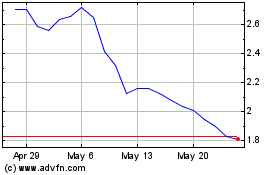

Nerdy (NYSE:NRDY)

Historical Stock Chart

From Mar 2024 to Mar 2025