UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13G

Under the Securities Exchange Act of 1934

(Amendment No. 4)*

OneConnect Financial Technology Co., Ltd.

(Name of Issuer)

Ordinary Shares, par value US$0.00001 per share

(Title of Class of Securities)

68248T204**

(CUSIP Number)

March 13, 2024

(Date of Event Which Requires Filing of this Statement)

Check the appropriate box

to designate the rule pursuant to which this Schedule is filed:

| | x | Rule

13d-1(b) |

| | o | Rule 13d-1(c) |

| | o | Rule 13d-1(d) |

*The remainder of this cover

page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities,

and for any subsequent amendment containing information which would alter the disclosures provided in a prior cover page.

** This CUSIP applies to the

American Depositary Shares (the “ADSs”), evidenced by American Depositary Receipts. Each ADS represents thirty (30) ordinary

shares. No CUSIP has been assigned to the ordinary shares.

The information required in

the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange

Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other

provisions of the Act (however, see the Notes).

Schedule 13G/A

| CUSIP

No. 68248T204 |

| 1 |

Names

of Reporting Person

Bo Yu Limited |

| 2 |

Check

the Appropriate Box if a Member of a Group

(a) ¨

(b) ¨ |

| 3 |

SEC

Use Only |

| 4 |

Citizenship

or Place of Organization

British Virgin Islands |

Number

of Shares

Beneficially

Owned by

Each Reporting

Person With |

5 |

Sole

Voting Power

353,077,356 (or 541,138,998 if including up to 188,061,642 ordinary shares that Bo Yu Limited has the right to acquire upon the exercise

of the Offshore Call Options (as defined below) at any time)1 |

| 6 |

Shared

Voting Power

0 |

| 7 |

Sole

Dispositive Power

353,077,356 (or 541,138,998 if including up to 188,061,642 ordinary shares that Bo Yu Limited has the right to acquire upon the

exercise of the Offshore Call Options at any time)1 |

| 8 |

Shared

Dispositive Power

0 |

| 9 |

Aggregate

Amount Beneficially Owned by Each Reporting Person

353,077,356 (or 541,138,998 if including up to 188,061,642 ordinary shares that Bo Yu Limited has the right to acquire upon the exercise

of the Offshore Call Options at any time)1 |

| 10 |

Check

if the Aggregate Amount in Row 9 Excludes Certain Shares

¨ |

| 11 |

Percent

of Class Represented by Amount in Row 9

30.2% (46.3% if including the ordinary shares that Bo Yu Limited has the right to acquire upon the exercise of the Offshore Call

Options at any time) 2 |

| 12 |

Type

of Reporting Person

FI |

| |

|

|

|

| 1. | The ordinary shares reported by Bo Yu Limited ("Bo Yu")

include (i) 353,077,356 ordinary shares of the Issuer held of record by Bo Yu, and (ii) up

to 188,061,642 ordinary shares of the Issuer that Bo Yu has the right to acquire upon exercise

of the Offshore Call Options (as defined below) at any time. |

Pursuant to the amended and restated option agreement dated

May 12, 2021 (the "Amended and Restated Option Agreement"), each of the shareholders of Yi Chuan Jin Limited ("Yi Chuan

Jin," a British Virgin Islands company that owns 100% of the equity interests in Sen Rong Limited, which held of record 188,061,642

ordinary shares of the Issuer as of March 31, 2024), has granted call options (the "Offshore Call

Options"), to Bo Yu over his or her respective 5,000 ordinary shares in the issued share capital of Yi Chuan Jin (representing 100%

of his/her shares in Yi Chuan Jin), and all securities in Yi Chuan Jin which are derived from such shares after the date of the Amended

and Restated Option Agreement and of which he/she is the beneficial owner or to which he/she is entitled from time to time. Bo Yu may

exercise the Offshore Call Options, in whole or in part, according to the following schedule: (a) up to 50% of the Offshore Call Options

may be exercised from the date of the Amended and Restated Option Agreement until the third anniversary thereof; and (b) 100% of the

Offshore Call Options may be exercised, during the period commencing immediately after the third anniversary of the date of the Amended

and Restated Option Agreement and ending on the tenth anniversary of the first day of such period, or such other period as extended by

Bo Yu. For additional information, see “Item 6E. Share Ownership” in the Issuer's annual report on Form 20-F for the

fiscal year ended December 31, 2023 filed with the Securities and Exchange Commission on April 23, 2024 (the "Form 20-F").

| 2. | Percentage is calculated based on 1,169,980,653 ordinary shares of

the Issuer issued and outstanding as of March 31, 2024, as reported by the Issuer on the

Form 20-F. |

| CUSIP

No. 68248T204 |

| 1 |

Names

of Reporting Person

Ping An Insurance (Group) Company of China, Ltd. |

| 2 |

Check

the Appropriate Box if a Member of a Group

(a) ¨

(b) ¨ |

| 3 |

SEC

Use Only |

| 4 |

Citizenship

or Place of Organization

The People’s Republic of China |

Number

of Shares

Beneficially

Owned by

Each Reporting

Person With: |

5 |

Sole

Voting Power

375,764,724 (or 563,826,366 if including up to 188,061,642 ordinary shares that the Bo Yu Limited has the right to acquire upon the

exercise of the Offshore Call Options at any time)1 |

| 6 |

Shared

Voting Power

0 |

| 7 |

Sole

Dispositive Power

375,764,724 (or 563,826,366 if including up to 188,061,642 ordinary shares that the Bo Yu Limited has the right to acquire upon

the exercise of the Offshore Call Options at any time)1 |

| 8 |

Shared

Dispositive Power

0 |

| 9 |

Aggregate

Amount Beneficially Owned by Each Reporting Person

375,764,724 (or 563,826,366 if including 188,061,642 ordinary shares that the Bo Yu Limited has the right to acquire upon the exercise

of the Offshore Call Options at any time)1 |

| 10 |

Check

if the Aggregate Amount in Row 9 Excludes Certain Shares

¨ |

| 11 |

Percent

of Class Represented by Amount in Row (9)

32.1% (48.2% if including the ordinary shares that Bo Yu Limited has the right to acquire upon the exercise of the Offshore Call

options at any time) 2 |

| 12 |

Type

of Reporting Person

HC-FI |

| |

|

|

|

| 1. | The ordinary shares reported by Ping

An Insurance (Group) Company of China, Ltd. ("Ping An") include (i) 353,077,356

ordinary shares of the Issuer held of record by Bo Yu, (ii) up to 188,061,642 ordinary shares

of the Issuer that Bo Yu has the right to acquire upon exercise of the Offshore Call Options

(as defined below) at any time, and (iii) 22,687,368 ordinary shares (in the form of 756,245.6

ADSs) of the Issuer held of record by China Ping An Insurance Overseas (Holding) Limited

("PAOH"). See “Item 6E. Share Ownership” in the “Form 20-F”. |

PAOH is a limited liability company incorporated in Hong

Kong with its registered business address at Suite 2318, 23rd Floor, Two International Finance Centre, 8 Finance Street, Central, Hong

Kong. Ping An ultimately wholly owns PAOH and Bo Yu. As such, Ping An is deemed as the beneficial owner of the ordinary shares of the

Issuer held by PAOH and Bo Yu.

| 2. | Percentage is calculated based on 1,169,980,653 ordinary shares of

the Issuer issued and outstanding as of March 31, 2024, as reported by the Issuer on the

Form 20-F. |

Schedule 13G/A

CUSIP 68248T204

Item 1.

(a)

Name of Issuer: OneConnect Financial Technology Co., Ltd.

(b)

Address of Issuer’s Principal Executive Offices: 21/24F, Ping An Financial Center, No. 5033 Yitian Road, Futian District,

Shenzhen, Guangdong, 518000, The People’s Republic of China

Item 2.

(a) Name

of Person Filing:

Bo Yu Limited

Ping An Insurance (Group) Company of China,

Ltd.

(each a “Reporting Person” and

collectively, the “Reporting Persons”)

The Reporting Persons have entered into

a Joint Filing Agreement, dated February 13, 2023, a copy of which is incorporated by reference as Exhibit 99.1 to this statement, pursuant

to which the Reporting Persons agreed to file the Schedule 13G and any amendments jointly in accordance with the provisions of Rule 13d-1(k)(1) under

the Act.

(b) Address

of Principal Business Office, or if None, Residence:

Bo Yu Limited: Maples Corporate Services

(BVI) Limited, Kingston Chambers, P.O. Box 173, Road Town, Tortola, British Virgin Islands

Ping An Insurance (Group) Company of China,

Ltd.: 47th, 48th, 109th, 110th, 111th, 112th Floors, Ping An Finance Center, No. 5033 Yitian Road, Futian District, Shenzhen, The People’s

Republic of China

(c) Citizenship:

Bo Yu Limited: British Virgin Islands

Ping An Insurance (Group) Company of China,

Ltd.: The People’s Republic of China

(d) Title

of Class of Securities: ordinary shares, par value US$0.00001 per share, of the Issuer

(e) CUSIP

Number: 68248T204

CUSIP number 68248T204 has been assigned

to the ADSs of the Issuer. Each ADS represents thirty (30) ordinary shares of the Issuer.

Item 3. If this statement

is filed pursuant to Rule 13d-1(b), or 13d-2(b) or (c), check whether the person filing is:

| |

(a) |

¨ |

A broker or dealer registered under Section 15

of the Act (15 U.S.C. 78o). |

| |

(b) |

¨ |

A bank as defined in Section 3(a)(6) of the

Act (15 U.S.C. 78c). |

| |

(c) |

¨ |

An insurance company as defined in Section 3(a)(19)

of the Act (15 U.S.C. 78c). |

| |

(d) |

¨ |

An investment company registered under Section 8

of the Investment Company Act of 1940 (15 U.S.C. 80a-8). |

| |

(e) |

¨ |

An investment adviser in accordance with §

240.13d-1(b)(1)(ii)(E); |

| |

(f) |

¨ |

An employee benefit plan or endowment fund in accordance

with § 240.13d-1(b)(1)(ii)(F); |

| |

(g) |

¨ |

A parent holding company or control person in accordance

with § 240.13d-1(b)(1)(ii)(G); |

| |

(h) |

¨ |

A savings association as defined in Section 3(b) of

the Federal Deposit Insurance Act (12 U.S.C. 1813); |

| |

(i) |

¨ |

A church plan that is excluded from the definition

of an investment company under section 3(c)(14) of the Investment Company Act of 1940 (15 U.S.C. 80a-3); |

| |

(j) |

x |

A non-U.S. institution in accordance with §

240.13d-1(b)(1)(ii)(J); |

| |

(k) |

¨ |

A group, in accordance with §

240.13d-1(b)(1)(ii)(J). |

If filing as a non-U.S. institution

in accordance with § 240.13d-1(b)(1)(ii)(J), please specify the type of institution:

Ping An Insurance (Group)

Company of China, Ltd. is a functional equivalent of an insurance company as defined in Section 3(a)(19) of the Act, given that Ping

An Insurance (Group) Company of China, Ltd. is subject to a regulatory scheme that is substantially comparable to the regulatory scheme

applicable to the equivalent U.S. institution.

Bo Yu Limited is a wholly

owned offshore investment company controlled by an insurance company incorporated in the People's Republic of China, Ping An Insurance

(Group) Company of China, Ltd., and is thus considered a functional equivalent of an insurance company as defined in Section 3(a)(19)

of the Act and/or an investment company registered under Section 8 of the Investment Company Act of 1940.

Item 4. Ownership.

| (a) | Amount beneficially owned: |

See the response to Item 9 on each cover page.

See the responses to Item 11 on each cover page.

| (c) | Number of shares as to

which the person has: |

| (i) | Sole

power to vote or to direct the vote: |

See the responses to Item 5 on each cover page.

| (ii) | Shared

power to vote or to direct the vote: |

See the responses to Item 6 on each cover page.

| (iii) | Sole

power to dispose or to direct the disposition of: |

See the responses to Item 7 on each cover page.

| (iv) | Shared

power to vote or to direct the disposition of: |

See the responses to Item 8 on each cover page.

Item 5. Ownership of Five

Percent or Less of a Class.

If this statement is being

filed to report the fact that as of the date hereof each of the Reporting Persons has ceased to be the beneficial owner of more than

five percent of the class of securities, check the following o.

Item 6. Ownership of More

than Five Percent on Behalf of Another Person.

Not applicable.

Item 7. Identification

and Classification of the Subsidiary Which Acquired the Security Being Reported on by the Parent Holding Company.

See Exhibit 99.2.

Item 8. Identification

and Classification of Members of the Group.

Not applicable.

Item 9. Notice of Dissolution

of Group.

Not applicable.

Item 10. Certifications.

Each of the Reporting Persons

hereby makes and the following certification:

By signing below I certify

that, to the best of my knowledge and belief, (i) the securities referred to above were acquired and are held in the ordinary course

of business and were not acquired and are not held for the purpose or with the effect of changing or influencing control of the Issuer

of the securities and were not acquired and are not held in connection with or as a participant in any transaction having that purpose

or effect, other than activities solely in connection with nomination under Section 240.14a-11; and (ii) the foreign regulatory scheme

applicable to the non-U.S. institutions as mentioned in the response to Item 3 is substantially comparable to the regulatory scheme applicable

to the functionally equivalent U.S institution(s). I also undertake to furnish to the Commission staff, upon request, information that

would otherwise be disclosed in a Schedule 13D.

SIGNATURE

After reasonable inquiry and to the best of my

knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: November 5, 2024

| |

Bo Yu Limited |

| |

|

| |

By: |

/s/ Yanmei Dong |

| |

|

Name: Yanmei Dong |

| |

|

Title: Director |

| |

|

| |

Ping An Insurance (Group) Company of China, Ltd. |

| |

|

| |

By: |

/s/ Michael Guo |

| |

|

Name: Michael Guo |

| |

|

Title: Director |

Exhibit Index

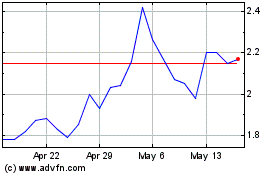

OneConnect Financial Tec... (NYSE:OCFT)

Historical Stock Chart

From Nov 2024 to Dec 2024

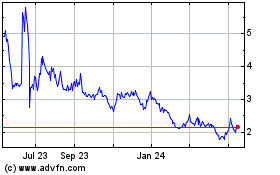

OneConnect Financial Tec... (NYSE:OCFT)

Historical Stock Chart

From Dec 2023 to Dec 2024