Pan American Silver Corp. (NYSE: PAAS) (TSX: PAAS) ("Pan

American" or the "Company") provides an annual exploration update

and releases new exploration drill results for its Jacobina, El

Peñon, La Colorada, Huaron, Minera Florida and Timmins mines, as

well as its La Colorada Skarn project.

"The success of our exploration program highlights the potential

for long-term organic growth at many of our assets," said

Christopher Emerson, Vice President of Exploration and Geology at

Pan American. "Based on the results we were achieving in

exploration this year, we increased our drill budget to over

450,000 metres for 2024. This exploration update highlights these

results, and showcases the ongoing discovery of new mineralized

structures in and around our existing mining operations."

EXPLORATION HIGHLIGHTS:

All intercepts are reported as estimated true widths in metres

("m"), except for the La Colorada Skarn, which is a massive orebody

and intercepts are reported as drilled. Please refer to the Drill

Result Highlights Tables beginning on page four of this news

release for additional details.

- Jacobina - extensional and infill drilling in the

Maricota and the Morro do Vento zones demonstrate the potential for

future resource expansion. Significant results at grades higher

than the average resource grade include: 1.42m @ 116.41 g/t Au and

8.74m @ 5.86 g/t Au (Maricota - MRCEX00056); 12.75m @ 3.71 g/t Au,

incl. 8.35m @ 5.26 g/t Au (Maricota - MRCEX00052); 5.75m @ 5.24 g/t

Au, incl. 2.11m @ 11.68 g/t Au (Morro do Vento - MVTEX00223).

- El Peñon - drilling of the principal structures and

areas to the south continues to return high-grade intercepts that

are typical for this deposit. Significant results include: 1.05m @

18.89 g/t Au, 746 g/t Ag (Pampa Campamento - UIP0177); 1.09m @ 9.90

g/t Au, 97 g/t Ag (Pampa Sur - SEP0055); 4.10m @ 3.62 g/t Au and

1,592 g/t Ag (Dominadora - UEH0024); and 1.46m @ 0.44 g/t Au and

2,547 g/t Ag (Chiquilla Chica - UIH0049).

- La Colorada - 13 new veins have been discovered in the

eastern portion of the property, expanding the high-grade zone of

the mine. Significant results within the Mariana, NC2 splay and San

Geronimo veins show continued high-grade results, notably: S-104-24

with 0.95m @ 9,618 g/t Ag, 4.85% Pb, 4.82% Zn (Mariana vein);

S-154-24 with 2.32m @ 2,615 g/t Ag, 2.31% Pb, 5.16% Zn (NC2 vein);

and S-168-24 with 3.28m @ 308 g/t Ag, 10.18% Pb, 13.09% Zn

(Cristina vein).

- La Colorada Skarn project - infill drilling reinforced

confidence in the large, indicated mineral resource update as at

June 30, 2024. Notable intercepts include: 273.10m at 54 g/t Ag,

0.85% Pb, and 5.18% Zn, incl. 62.55m at 84 g/t Ag, 1.97% Pb, and

7.57% Zn (U-155-24); and 60.25m at 85 g/t Ag, 7.05% Pb, and 10.41%

Zn (U-19-24).

- Whitney Project (Timmins) - the increase in estimated

gold mineral resources provided in the June 30, 2024 mineral

reserve and mineral resource update highlights the potential of the

Whitney project, while ongoing drilling of the Bonetal/Hallnor and

Broulan reef has continued to yield high-grade results along the

mineralized trend, including 360 g/t Au over 2.4 metres

(TW24-793).

- Huaron - significant results from drilling focused on

the Horizonte zone include: DDH-U-111-24 with 2.10m @ 399 g/t Ag,

7.39% Pb and 14.58% Zn (Maria vein); DDH-U-113-24 with 1.50m @ 504

g/t Ag, 12.77% Pb and 19.97% Zn (Maria Vein); DDH-U-049-24 with

2.77m @ 768 g/t Ag, 1.85% Pb and 0.62% Zn (Cuerpo Andres);

- Minera Florida - exploration and infill drilling have

extended mineralization at several key mine structures. Significant

results include: 1.98m @ 16.11 g/t Au, 13 g/t Ag and 6.44% Zn and

1.97m @ 9.38 g/t Au, 23 g/t Ag, and 4.96% Zn (Maqui Norte vein -

ALH4638); and 2.57m @ 10.32 g/t Au, 12 g/t Ag, and 0.08% Zn (Mila

Sur vein - ALH4562).

SUMMARY OF EXPLORATION RESULTS

Jacobina mine, Brazil

The Jacobina mine is an underground paleo placer gold mine

located in the state of Bahia in northeastern Brazil. The mine has

a strong track record of mineral reserve and mineral resource

replacement and growth. The mine complex and resources extend over

eight kilometres with exploration targets extending over a 14

kilometre trend of conglomerate reefs hosting gold mineralization,

many of which remain open to depth and along strike.

- Brownfield exploration drilling totaled 35,583m, primarily

targeting the João Belo Sul, Morro do Vento, Maricota, Serra do

Corrego, and João Belo Norte zones. Exploratory drilling focused on

evaluating new near-mine targets down-dip and north of Maricota.

The recent exploration results continue to highlight the

significant potential for expanding mineral reserves and mineral

resources at Jacobina.

- Infill drilling at João Belo Sul confirmed gold mineralization

continuity, particularly in higher-grade zones proximal to existing

underground infrastructure at João Belo Norte mine. Notable

intercepts include: 3.26m @ 8.21 g/t Au (JBS00093); 2.07m @ 5.55

g/t Au and 5.70m @ 4.63 g/t Au (JBS00094).

- Infill and exploration drilling at Morro do Vento continued to

extend high-grade zones in the FW reef. Significant intercepts

include: 5.75m @ 5.24 g/t Au, incl. 2.11m @ 11.68 g/t Au

(MVTEX00223); and 6.90m @ 3.13 g/t Au, incl. 1.74m @ 9.06 g/t Au

(MVTEX00217). Exploration drilling further confirms continuity of

mineralization down dip within the FW reef, with 7.03m @ 2.62 g/t

Au, incl. 2.56m @ 5.08 g/t Au (MVTEX00220), extending

mineralization approximately 250m down-dip of the current indicated

mineral resources. Mineralization in this zone remains open to

depth.

- Exploration and infill drilling results at Maricota confirm the

continuity of mineralization within multiple reefs (FW, HW, and

Main) where mineralization remains open for expansion down dip and

along strike to the north. Significant intercepts include: 12.75m @

3.71 g/t Au, incl. 8.35m @ 5.26 g/t Au, 4.31m @ 4.49 g/t Au and

2.54m @ 11.56 g/t Au (MRCEX00052); 5.98m @ 5.12 g/t Au, incl. 2.83m

@ 9.78 g/t Au and 7.46m @ 2.05 g/t Au, incl. 3.16m @ 3.50 g/t Au

(MRCEX00032); and 1.42m @ 116.41 g/t Au and 4.59m @ 5.45 g/t Au,

incl. 1.89m @ 10.08 g/t Au (MRCEX00056).

El Peñon, Chile

El Peñon is a large, high-grade gold-silver epithermal system

located in northern Chile.

- For the period from May 2024 to October 2024, exploration

drilling totaled 56,632 metres. This included 34,965 metres of

infill drilling aimed at converting inferred mineral resources to

the indicated category around the principal veins, including El

Valle, Pampa Campamento, Pampa Sur and Chiquilla Chica.

Additionally, 21,667 metres of exploration drilling were conducted

to delineate new inferred mineral resource.

- Highlights from El Valle include: 1.54m @ 8.55 g/t Au, 154 g/t

Ag (UIV0079); 1.20m @ 4.70 g/t Au, 257 g/t Ag (UIV0078); and 0.83m

@ 16.63 g/t Au, 721 g/t Ag (UIV0080). Mineralization remains open

to the north and down dip.

- Highlights from Pampa Campamento include: 1.05m @ 18.89 g/t Au,

746 g/t Ag (UIP0177); 0.76m @ 16.13 g/t Au, 258 g/t Ag (UIP0189);

1.71m @ 10.65 g/t Au, 186 g/t Ag (UIS0028); and 0.65m @ 15.33 g/t

Au, 297 g/t Ag (UIP0175).

- Key results for exploration and infill drilling at the Pampa

Sur vein include: 1.09m @ 9.90 g/t Au, 97 g/t Ag (SEP0055); 0.98m @

8.49 g/t Au, 156 g/t Ag (SIP0051); and 0.42m @ 18.80 g/t Au, 1,017

g/t Ag (SIP0064). Structures identified to the east of Pampa Sur

have also yielded positive results, notably 1.18m @ 6.50 g/t Au and

493 g/t Ag (SIP0067). Pampa Sur represents an important opportunity

to add mineral resources near to existing mine infrastructure.

- Chiquilla Chica is a silver-rich satellite deposit located

approximately 20 km southwest of El Peñon. Recent exploration

drilling has confirmed high silver grades, including: 1.46m @ 0.44

g/t Au and 2,547 g/t Ag (UIH0049) and 1.44m @ 1.29 g/t Au and 1,181

g/t Ag (UIH0050). The Dominadora vein, a new discovery northeast of

the main Chiquilla Chica structure, returned 4.10m @ 3.62 g/t Au

and 1,592 g/t Ag (UEH0024) and 1.20m @ 0.23 g/t Au, and 1,349 g/t

Ag (UEH0026) in initial drilling.

La Colorada mine, Mexico

The La Colorada mine is a silver-rich polymetallic operation

located in the state of Zacatecas, Mexico.

- For the period May 2024 to October 2024, the Company completed

47,883 metres of exploration drilling, successfully extending

mineralization to the east.

- Drilling on the east extension of the NC2 vein returned

silver-rich intercepts from the main structure and parallel Mariana

and NC2 splay veins. Notable drill highlights include: S-104-24

with 0.95m @ 9,618 g/t Ag, 4.85% Pb, 4.82% Zn (Mariana vein); 0.53m

@ 4,916 g/t Ag, 9.82% Pb, 1.02% Zn (NC2 Splay); S-154-24 with 2.51m

@ 1,189 g/t Ag, 0.82% Pb, 1.09% Zn (Mariana vein); and 2.32m @

2,615 g/t Ag, 2.31% Pb, 5.16% Zn (NC2 vein).

- Drilling on a new vein system discovered earlier in 2024,

located parallel to the NC2 vein in the southeast area of the mine,

confirms high-grade mineralization in the Cristina vein. Notable

drill results include: S-168-24 with 3.28m @ 308 g/t Ag, 10.18% Pb,

13.09% Zn and S-119-24 with 1.95m @ 1,470 g/t Ag, 3.15% Pb, 3.23%

Zn. These intersects now define a mineralized vein over an area

measuring 450m along strike by 550m vertical, and open in all

directions.

- The San Geronimo vein system is now defined by 19 drillholes

covering a mineralized area of 550m along the strike by 450m

vertical. Specific highlights include: S-115-24 with 1.08m @ 1,637

g/t Ag, 2.08% Pb, 3.35% Zn; S-161-24 with 5.59m @ 456 g/t Ag, 1.10%

Pb, 2.41% Zn; S-168-24 with 2.93m @ 528 g/t Ag, 3.04% Pb, 5.54% Zn;

S-172-24 with 4.08m @ 255 g/t Ag, 3.28% Pb, 7.33% Zn; and S-44-24

with 2.25m @ 1,420 g/t Ag, 2.04% Pb, 1.93%.

La Colorada Skarn project, Mexico

The La Colorada Skarn is a large silver-bearing polymetallic

deposit located below and adjacent to the producing vein system of

the La Colorada mine.

- Over 325,000 metres have been drilled at the Skarn project

since the deposit was discovered, with 11,000 metres drilled since

the mineral resource update as at June 30, 2024. The recent infill

drilling, focused on the 901, 902, and 903 Skarn zones, confirmed

grades and widths, as defined in the June 30, 2024 mineral resource

estimate. Highlight infill intercepts include: 273.10m at 54 g/t

Ag, 0.85% Pb, and 5.18% Zn, incl. 62.55m at 84 g/t Ag, 1.97% Pb and

7.57% Zn (U-155-24) and 60.25m at 85 g/t Ag, 7.05% Pb, and 10.41%

Zn (U-19-24).

Huaron mine, Peru

The Huaron mine is a polymetallic (Zn-Pb-Ag-Cu) deposit situated

in the Cerro de Pasco Department of central Peru.

- For the period May 2024 to October 2024, 58 drillholes totaling

14,714 metres were completed.

- High-grade mineralization within the Maria vein was extended by

100 metres and remains open at depth. Results include: DDH-U-111-24

with 2.10m @ 399 g/t Ag, 7.39% Pb, and 14.58% Zn and hole

DDH-U-113-24 with 1.50m @ 504 g/t Ag, 12.77% Pb, and 19.97%

Zn.

- Silver and polymetallic-rich mineralization on the east

extension of the Cuerpo Andres vein was confirmed with results

including: DDH-U-040-24 with 0.56m @ 722 g/t Ag, 6.06% Pb, and

1.90% Zn; DDH-U-075-24 with 0.55 m @ 701 g/t Ag, 13.64% Pb, and

8.83% Zn; and DDH-U-049-24 with 2.77m @ 768 g/t Ag, 1.85% Pb, and

0.62% Zn at depth.

- The Martin vein was extended 160 metres along strike, showing

good mineralization with DDH-U-041-24 intercepting 2.46m @ 369 g/t

Ag, 2.74 % Pb, and 2.01 % Zn; DDH-U-055-24 with 2.24m @ 683 g/t Ag,

10.65 % Pb, and 3.10 % Zn; and DDH-U-086-24 with 1.56m @ 535 g/t

Ag, 10.02 % Pb, and 2.31 % Zn at depth.

Minera Florida, Chile

Minera Florida is an epithermal Au-Ag-Zn underground mine

located in the coastal region of central Chile, southwest of

Santiago.

- For the period January 2024 to October 2024, a total of 58,658

metres of drilling was completed.

- Exploration and infill drilling have extended mineralization at

several key mine structures, particularly at Mila Sur, Maqui Norte,

Lorena-Peque-Bandolera, and Sorpresa-Lo Balta.

- The Maqui Norte vein is a significant contributor to

production, with potential for resource expansion to the north of

the current development and reserves. Significant intercepts

include: 1.98m @ 16.11g/t Au, 13g/t Ag, and 6.44% Zn and 1.97m @

9.38g/t Au, 23g/t Ag, and 4.96% Zn (ALH4638); 0.92m @ 20.61 g/t Au,

13 g/t Ag, and 0.09% Zn (ALH4701); and 1.19m @ 13.62 g/t Au, 11 g/t

Ag, and 3.81% Zn (ALH4588).

- Notable drill highlights at Mila Sur include: 2.57m @ 10.32 g/t

Au, 12 g/t Ag, and 0.08% Zn (ALH4562); 1.70m @ 8.29 g/t Au, 110 g/t

Ag, and 3.34% Zn (ALH4574); and 1.15m @ 6.52 g/t Au, 286 g/t Ag,

and 2.29% Zn (ALH4467).

- Key results at Sorpresa – Lo Balta include: 2.95m @ 8.79 g/t

Au, 10 g/t Ag, and 1.48% Zn (ALH4657); and 2.14m @ 5.84 g/t Au, 12

g/t Ag, and 1.35% Zn, 1.20m @ 5.99 g/t Au, 12 g/t Ag, and 2.07% Zn,

and 1.19m @ 7.29 g/t Au, 7 g/t Ag, and 1.48% Zn (ALH4426).

Whitney Project (Timmins), Canada

Pan American's Timmins West and Bell Creek mines are located

near Timmins, Ontario. The Whitney project is situated 4.5

kilometres south of the Bell Creek processing plant, adjacent to

the Pamour open pit operated by Newmont Corporation

("Newmont").

- For the period November 2023 to September 2024, drilling

totaled 16,941 metres. The drilling confirmed current resources at

Hallnor/Bonetal and historic resources at Broulan Reef, located 1.5

km to the west. The Hallnor/Bonetal and Broulan Reef zones are

referenced in Pan American's mineral reserves and mineral resources

update as at June 30, 2024, under the Whitney project, which is a

joint venture (83.27% Pan American / 16.73% Newmont) operated by

Pan American. The estimated mineral resources, as provided in the

June 30, 2024, mineral resource update, consist of 77,900 ounces of

gold in the indicated category and 477,700 ounces of gold in the

inferred category.

- Significant assays in the Hallnor/Bonetal zones include: 2.7m

at 19.89 g/t Au (TW24-758); 7.2m at 31.50 g/t Au (TW24- 771); 11.7m

at 3.28 g/t Au incl. 4.5m at 5.98 g/t Au (TW23-750); 13.7m at 2.11

g/t Au incl. 7.3m at 3.27 g/t Au (TW23-751).

- Significant assays from the drilling at Broulan Reef include:

2.4m at 360.18 g/t Au, incl. 0.4m at 1,940 g/t Au, 0.3m at 140 g/t

Au (TW24-793) and 0.8 at 28.4 g/t Au (TW23-749); 7.6m at 6.26 g/t

Au (TW24-786); 0.3m at 378.00 g/t Au (TW24-802); and 4.3m at 4.69

g/t Au (TW24-804).

DRILL RESULT HIGHLIGHTS TABLES

Jacobina, Brazil

The following table provides infill and exploration drill result

highlights for the Jacobina mine for the period May 2024 to October

2024. Full infill and exploration drill results not included in

this table, together with cross sections and plans, are available

at

https://panamericansilver.com/operations/gold-segment/jacobina/.

Hole No.

Sector

Reef

Incl.

From (m)

To (m)

Int. (m)

Est. True Width (m)

Au g/t

JBS00093

João Belo Sul

LMPC

381.45

385.00

3.55

3.26

8.21

JBS00094

João Belo Sul

MPC

378.17

380.50

2.33

2.07

5.55

SPC

404.20

410.64

6.44

5.70

4.63

JBS00095

João Belo Sul

LVLPC

342.23

347.50

5.27

4.72

3.10

JBEX00126

João Belo Norte

LVLPC

400.04

405.06

5.02

3.34

6.88

LVLPC

incl.

401.00

403.72

2.72

1.81

12.12

MRCEX00025

Maricota

HW

140.66

141.50

0.84

0.70

19.22

MRCEX00026

Maricota

FW

561.50

571.50

10.00

4.18

2.41

EMB

677.52

680.00

2.48

1.44

7.74

MRCEX00031

Maricota

BAS

647.00

664.78

17.78

10.07

2.08

BAS

incl.

651.50

657.05

5.55

3.14

2.58

MRCEX00032

Maricota

MR

379.92

387.50

7.58

5.98

5.12

MR

incl.

379.92

383.50

3.58

2.83

9.78

FW

403.05

412.50

9.45

7.46

2.05

FW

incl.

404.50

408.50

4.00

3.16

3.50

MRCEX00034

Maricota

HW

488.00

498.69

10.69

5.16

3.92

HW

incl.

488.00

493.50

5.50

2.70

6.80

MRCEX00037

Maricota

FW

541.38

550.50

9.12

6.56

2.75

MRCEX00038

Maricota

MR

236.00

239.70

3.70

2.46

5.66

MRCEX00041

Maricota

HW

173.15

177.50

4.35

3.27

6.87

MRCEX00044

Maricota

HW

152.00

154.76

2.76

2.19

13.00

MRCEX00049

Maricota

FW

173.50

175.00

1.50

1.07

10.54

MRCEX00052

Maricota

FW

299.50

307.00

7.50

4.31

4.49

FW

314.50

319.00

4.50

2.54

11.56

FW

327.88

351.55

23.67

12.75

3.71

FW

incl.

328.50

344.00

15.50

8.35

5.26

MRCEX00053

Maricota

LU

137.00

141.00

4.00

3.27

3.11

MRCEX00056

Maricota

HW

94.00

95.50

1.50

1.42

116.41

HW

106.15

111.00

4.85

4.59

5.45

HW

incl.

107.00

109.00

2.00

1.89

10.08

FW

129.00

138.20

9.20

8.74

5.86

FW

incl.

130.00

133.50

3.50

3.33

13.35

MRCEX00059

Maricota

HW

115.50

118.50

3.00

2.96

10.23

MRCEX00061

Maricota

HW

134.39

136.50

2.11

1.95

9.16

MRCEX00062

Maricota

MR

177.50

179.50

2.00

1.59

7.43

FW

202.01

205.00

2.99

2.38

4.81

MVTEX00205

Morro do Vento

FW

213.00

228.68

15.68

14.11

1.17

FW

243.50

246.00

2.50

2.20

4.86

MVTEX00207

Morro do Vento

OFF_ R

192.00

196.35

4.35

3.62

3.02

MVTEX00216

Morro do Vento

FW

439.50

449.50

10.00

6.74

2.65

FW

incl.

443.50

449.00

5.50

3.70

3.13

MVTEX00217

Morro do Vento

FW

327.50

339.50

12.00

6.90

3.13

FW

incl.

329.21

332.24

3.03

1.74

9.06

MVTEX00219

Morro do Vento

MU

256.00

259.50

3.50

2.27

3.32

MVTEX00220

Morro do Vento

FW

494.50

513.00

18.50

7.03

2.62

FW

incl.

499.76

506.50

6.74

2.56

5.08

MVTEX00222

Morro do Vento

FW

172.00

178.50

6.50

3.93

2.76

MVTEX00223

Morro do Vento

FW

543.29

555.50

12.21

5.75

5.24

FW

incl.

551.00

555.50

4.50

2.11

11.68

MVTEX00228

Morro do Vento

FW

243.00

250.60

7.60

5.50

3.75

FW

incl.

247.67

250.60

2.93

1.90

8.52

El Peñon Chile

The following table provides infill and exploration drill result

highlights for the El Peñon mine for the period May 2024 to October

2024. Full infill and exploration drill results not included in

this table, together with longitudinal sections and plans, are

available at:

https://panamericansilver.com/operations/gold-segment/el-penon/.

Hole No.

Vein

From (m)

To (m)

Int. (m)

Est. True Width (m)

Au (g/t)

Ag (g/t)

SIH0021

Chiquilla Chica (C1)

184.30

185.90

1.60

0.88

0.77

1019

UIH0049

Chiquilla Chica (C1)

40.05

41.70

1.65

1.46

0.44

2547

UIH0050

Chiquilla Chica (C1)

72.60

75.30

2.70

1.44

1.29

1181

UIH0056

Chiquilla Chica (C1)

85.60

87.10

1.50

0.95

0.22

578

UEH0024

Dominadora

106.15

135.00

28.85

4.10

3.62

1592

UEH0026

Dominadora

50.77

55.67

4.90

1.20

0.23

1349

UIV0077

El Valle

260.20

262.20

2.00

1.38

4.70

183

UIV0078

El Valle

256.30

257.50

1.20

1.20

4.70

257

UIV0079

El Valle

259.95

262.00

2.05

1.54

8.55

154

UIV0080

El Valle

231.20

232.15

0.95

0.83

16.63

721

UIV0083

El Valle

270.15

270.93

0.78

0.76

10.11

30

UIU0052

La Paloma

114.69

116.50

1.81

1.31

10.88

26

SIE0015

Esmeralda

248.60

249.50

0.90

0.54

10.10

1139

UIP0174

Pampa Campamento

351.13

352.10

0.97

0.52

9.50

664

UIP0176

Pampa Campamento

389.88

390.25

0.37

0.32

26.50

42

UIP0177

Pampa Campamento

291.53

293.60

2.07

1.05

18.89

746

UIP0178

Pampa Campamento

213.94

215.49

1.55

0.52

9.50

420

UIP0175

Pampa Campamento (-35)

184.95

186.15

1.20

0.65

15.33

297

UIP0189

Pampa Campamento Diagonal sur

134.70

135.52

0.82

0.76

16.13

258

UIS0028

Pampa Campamento Diagonal sur

60.38

62.19

1.81

1.71

10.65

186

SEP0055

Pampa Sur

374.00

376.00

2.00

1.09

9.90

97

SEP0072

Pampa Sur

464.00

465.00

1.00

0.69

5.50

403

SIP0051

Pampa Sur

364.18

365.70

1.52

0.98

8.49

156

SIP0056

Pampa Sur

398.07

399.29

1.22

0.92

4.76

359

SIP0063

Pampa Sur

410.53

411.44

0.91

0.67

5.63

405

SIP0064

Pampa Sur

352.12

352.60

0.48

0.42

18.80

1017

SIP0067

Pampa Sur (+50)

328.00

330.00

2.00

1.18

6.50

493

SIP0080

Pampa Sur (+50)

358.50

360.00

1.50

0.79

13.90

716

SIP0073

Pampa Sur Este

378.68

379.38

0.70

0.36

16.00

1651

SES0036

Sorpresa

333.80

334.20

0.40

0.30

22.00

838

UIS0023

Sorpresa

199.30

200.90

1.60

1.30

4.29

133

La Colorada, Mexico

The following table provides the drill result highlights for the

La Colorada mine for the period May 2024 to October 2024. Full

drill results not included in this table, together with cross

sections and plans, are available at:

https://panamericansilver.com/operations/silver-segment/la-colorada/.

Hole No.

Vein

From (m)

To (m)

Interval (m)

Est. True Width (m)

Ag g/t

Au (g/t)

Pb %

Zn %

S-104-24

Mariana Vein

621.50

622.60

1.10

0.95

9618

0.89

4.85

4.82

and

NC2 Splay

795.95

796.70

0.75

0.53

4916

0.08

9.82

1.02

S-115-24

San Geronimo Vein System

461.10

463.65

2.55

1.08

1637

1.22

2.08

3.35

S-119-24

Cristina Vein

596.00

599.40

3.40

1.95

1470

0.03

3.15

3.23

S-138-24

NC2 Vein

695.60

701.60

6.00

4.60

666

0.90

1.32

2.74

S-146-24

Mariana Vein

701.05

704.55

3.50

2.47

1846

0.41

2.66

3.95

S-154-24

Mariana Vein

466.30

469.85

3.55

2.51

1189

0.24

0.82

1.09

and

NC2 Vein

540.25

544.30

4.05

2.32

2615

0.34

2.31

5.16

S-161-24

San Geronimo Splay

703.15

710.45

7.30

5.59

456

0.94

1.10

2.41

S-168-24

Cristina Vein

361.90

367.00

5.10

3.28

308

4.55

10.18

13.09

and

San Geronimo Vein

597.10

602.95

5.85

2.93

528

0.50

3.04

5.54

S-172-24

San Geronimo Splay

670.60

678.75

8.15

4.08

255

0.23

3.28

7.33

S-44-24

San Geronimo Splay

558.60

562.10

3.50

2.25

1420

0.60

2.04

1.93

S-47-24

NC2 Vein

771.85

783.65

11.80

5.90

837

0.39

2.97

8.01

S-75-24

Mariana Vein

616.40

620.00

3.60

1.80

3025

0.49

4.21

3.10

S-81-24

NC2 Splay

678.30

679.75

1.45

1.36

7634

1.83

1.46

3.62

U-09-24

Sofia Vein

268.55

269.40

0.85

0.74

4914

1.34

6.69

0.03

U-151-24

CRD

66.05

84.50

18.45

17.34

110

0.23

2.20

7.96

U-158-24

Jenni Vein

45.95

49.35

3.40

1.70

1825

1.05

2.35

6.16

U-96-24

Real Vein

252.55

255.60

3.05

2.76

749

0.63

13.01

8.97

La Colorada Skarn, Mexico

The following table provides infill and exploration drill result

for the La Colorada Skarn deposit May 2024 to October 2024. Full

drill results not included in this table, together with cross

sections and plans, are available at:

https://panamericansilver.com/operations/silver-segment/la-colorada-skarn/.

Hole No.

From (m)

To (m)

Interval (m)(1)

Ag g/t

Cu %

Pb %

Zn %

D-71-12-24

1102.45

1250.60

148.15

39

0.07

1.68

3.12

U-155-24

724.00

997.10

273.10

54

0.17

0.85

5.18

Incl.

872.50

935.05

62.55

84

0.31

1.97

7.57

U-19-24

503.95

564.20

60.25

85

0.08

7.05

10.41

U-58-24

791.75

869.45

77.70

36

0.08

2.88

4.58

U-74-24

629.70

843.90

214.20

33

0.05

2.69

3.21

U-92-24

527.40

582.40

55.00

103

0.06

4.10

5.75

and

806.40

929.65

123.25

134

0.07

1.02

4.38

(1) True widths of the mineralized

intervals are unknown at this time.

Huaron, Peru

The following table provides infill and exploration drill result

highlights from the medium, lower and Horizonte sectors of the

Huaron mine for the period May 2024 to October 2024. Full drill and

channel sampling results not included in this table, together with

cross sections and plans, are available at:

https://panamericansilver.com/operations/silver-segment/huaron/.

Hole No

Vein

Zone

From (m)

To (m)

Interval (m)

Est. True Width (m)

Ag g/t

Cu%

Pb%

Zn%

DDH-U-040-24

Cuerpo Andres

Horizonte

51.65

52.30

0.65

0.56

722

0.12

6.06

1.90

and

Labor Este

Horizonte

184.10

186.55

2.45

1.70

123

0.06

3.06

5.98

DDH-U-041-24

Martin Ramal

Middle

198.30

200.90

2.60

2.46

369

0.15

2.74

2.01

DDH-U-049-24

Cuerpo Andres

Horizonte

59.95

63.55

3.60

2.77

768

0.02

1.85

0.62

DDH-U-051-24

Martin Ramal

Middle

236.30

237.20

0.90

0.58

409

0.13

9.27

15.82

DDH-U-055-24

Martin Ramal

Middle

176.20

178.45

2.25

2.24

683

0.17

10.65

3.10

DDH-U-056-24

Cuerpo Andres

Horizonte

48.35

53.00

4.65

3.90

162

0.04

4.02

6.06

DDH-U-064-24

Labor Este

Horizonte

186.60

188.25

1.65

1.43

181

0.04

4.34

4.73

DDH-U-065-24

Cometa Ramal

Horizonte

390.80

394.80

4.00

3.04

133

0.13

2.19

4.65

DDH-U-068-24

Cuerpo Andres

Horizonte

56.75

57.60

0.85

0.65

459

0.07

9.43

6.72

and

Labor Este

Horizonte

202.35

205.25

2.90

1.98

243

0.06

3.54

5.20

DDH-U-071-24

Labor Este

Horizonte

141.20

144.00

2.80

2.56

201

0.03

4.81

4.13

DDH-U-073-24

Labor Este

Horizonte

140.10

143.55

3.45

3.21

74

0.03

2.31

2.16

DDH-U-075-24

Cuerpo Andres

Horizonte

39.85

40.45

0.60

0.55

701

0.09

13.64

8.83

DDH-U-084-24

Cuerpo Andres

Horizonte

60.55

63.00

2.45

1.70

61

0.08

1.97

12.73

DDH-U-086-24

Martin Ramal

Middle

12.60

14.20

1.60

1.56

535

0.20

10.02

2.31

DDH-U-088-24

Cometa Ramal

Horizonte

398.85

404.20

5.35

3.66

114

0.10

1.83

3.55

DDH-U-100-24

Cuerpo Andres

Horizonte

264.85

267.25

2.40

1.64

115

0.04

2.85

3.89

DDH-U-105-24

Cuerpo Andres

Horizonte

54.90

56.65

1.75

1.40

87

0.06

1.77

8.47

DDH-U-108-24

Cometa Ramal

Horizonte

489.95

493.00

3.05

1.65

304

0.08

1.86

2.18

DDH-U-110-24

Maria Ramal

Horizonte

66.00

73.15

7.15

4.10

140

0.04

3.10

5.91

DDH-U-111-24

Maria Ramal

Horizonte

47.70

50.55

2.85

2.10

399

0.04

7.39

14.58

DDH-U-113-24

Maria Ramal

Horizonte

37.35

39.00

1.65

1.50

504

0.04

12.77

19.97

DDH-U-114-24

Maria Ramal

Horizonte

36.10

38.80

2.70

2.50

272

0.03

6.06

10.39

DDH-U-116-24

Maria Ramal

Horizonte

48.60

49.65

1.05

0.80

357

0.07

13.66

12.73

Minera Florida, Chile

The following table provides infill and exploration drill result

highlights for the Minera Florida mine for January 2024 to October

2024. Full drill results not included in this table, together with

cross sections and plans, are available at:

https://panamericansilver.com/operations/gold-segment/minera-florida/.

Hole

Vein

From (m)

To (m)

Interval (m)

Est. True Width (m)

Au (g/t)

Ag (g/t)

Zn %

ALH4578

Aurora

115.25

116.10

0.85

0.71

12.62

47

0.46

ALH4598

Bandolera

86.50

88.80

2.30

2.19

4.84

4

3.01

ALH4607

Bandolera

109.05

110.65

1.60

1.25

11.15

6

2.61

ALH4482

Central superior 1

119.85

124.65

4.80

2.68

8.80

410

0.20

ALH4426

Cipres_1

143.17

145.08

1.91

1.19

7.29

7

1.48

ALH4460

Cipres_1

138.90

140.05

1.15

0.72

17.92

15

1.14

ALH4421

Don Leopoldo sur

91.45

93.65

2.20

1.53

6.34

9

4.79

ALH4623

Don Leopoldo sur

116.60

118.20

1.60

1.28

8.29

7

0.40

ALH4505

Gasparín Superior

173.65

175.30

1.65

0.90

10.23

13

0.31

ALH4406

Manda Norte

148.40

149.30

0.90

0.62

29.68

13

0.04

ALH4687

Maqui CII

84.45

85.85

1.40

1.16

5.40

173

2.16

ALH4638

Maqui CII

128.85

132.25

3.40

1.97

9.38

23

4.96

ALH4690

Maqui CII

73.35

75.15

1.80

1.64

4.95

28

2.24

ALH4556

Maqui CIII

54.75

56.05

1.30

1.05

5.62

21

12.52

ALH4580

Maqui CIII

58.20

59.55

1.35

1.03

9.10

22

7.10

ALH4588

Maqui CIII

68.75

70.50

1.75

1.19

13.62

11

3.81

ALH4631

Maqui CIII

52.50

53.20

0.70

0.61

12.68

35

18.07

ALH4638

Maqui CIII

111.15

115.30

4.15

1.98

16.11

13

6.44

ALH4673

Maqui CIII

81.40

83.65

2.25

1.28

9.58

15

5.58

ALH4592

Maqui Norte

107.85

110.10

2.25

1.59

10.23

31

5.57

ALH4562

Mila

113.00

117.40

4.40

2.57

10.32

12

0.08

ALH4574

Mila

191.80

196.20

4.40

1.70

8.29

110

3.34

ALH4467

Mila

129.90

132.55

2.65

1.15

6.52

286

2.29

ALH4476

Peque

67.05

68.25

1.20

0.78

10.68

8

10.05

ALH4481

Peque

80.30

81.55

1.25

0.91

12.53

43

8.31

ALH4496

Peque

55.00

57.30

2.30

1.82

4.74

35

1.26

ALH4577

Peque

101.30

103.75

2.45

1.11

11.57

23

7.61

ALH4644

Peque

59.35

60.20

0.85

0.83

13.77

77

1.54

ALH4715

Peque

202.75

207.85

5.10

1.48

10.71

13

2.74

ALH4729

Rafael II

56.35

59.65

3.30

1.95

4.74

415

3.86

ALH4701

Sat. 1 Maqui

152.55

154.40

1.85

0.92

20.61

13

0.09

ALH4424

Satelite Mila Sur 1

371.85

373.35

1.50

1.41

2.62

627

1.44

ALH4534

Satélite Valeria 1

111.35

112.60

1.25

0.92

14.06

27

0.04

ALH4549

Satélite Valeria 1

107.25

109.90

2.65

1.88

9.05

11

0.09

ALH4594

Satélite Valeria 1

166.35

167.70

1.35

0.85

16.60

17

2.09

ALH4516

Satélite Valeria 8

72.65

73.90

1.25

1.05

3.39

1645

0.18

ALH4521

Satélite Valeria 8

91.00

92.15

1.15

0.82

11.64

55

2.60

ALH4617

Satélite Valeria 8

61.75

62.95

1.20

1.18

15.05

15

0.83

ALH4436

Satélite VCS 21

51.50

52.65

1.15

0.68

15.53

56

0.81

ALH4426

Sorpresa

41.85

44.20

2.35

2.14

5.84

12

1.35

ALH4449

Sorpresa

43.60

46.30

2.70

1.82

5.05

7

0.97

ALH4600

Sorpresa

20.90

26.50

5.60

2.93

5.34

18

3.40

ALH4657

Sorpresa

21.70

28.10

6.40

2.95

8.79

10

1.48

ALH4672

Sorpresa

13.25

15.00

1.75

1.34

6.67

13

1.61

Whitney Project (Timmins), Canada

The following table provides infill and exploration drill result

highlights from the Hallnor/Bonetal and Broulan Reef deposits of

the Whitney Project for the period November 2023 to September 2024.

Full infill and exploration drill results not included in this

table, together with cross sections and plans, are available at:

https://panamericansilver.com/operations/gold-segment/timmins/.

Hole No.

Zone

From (m)

To (m)

Int (m)

Est. True Width (m)

Au g/t

TW23-749

Broulan Reef

61.0

62.0

1.0

0.8

28.40

TW23-750

Hallnor

444.2

462.0

17.8

11.7

3.28

Incl.

454.0

461.0

7.0

4.5

5.98

TW23-751

Hallnor

411.2

430.0

18.8

13.7

2.11

Incl.

415.0

425.0

10.0

7.3

3.27

TW23-754

Hallnor

548.0

561.0

13.0

10.1

3.33

TW23-756

Hallnor

319.0

320.0

1.0

0.6

65.30

408.5

428.0

19.5

10.8

2.91

Incl.

409.0

415.0

6.0

3.3

6.07

TW24-758

Hallnor

472.7

476.9

4.2

2.7

19.89

TW24-759A

Hallnor

500.0

508.0

8.0

5.1

5.15

TW24-765

Hallnor

118.0

119.0

1.0

0.8

58.20

TW24-770

Hallnor

99.0

117.0

18.0

14.5

3.42

Incl.

99.0

110.0

11.0

8.8

4.58

and

99.7

102.0

2.3

1.8

14.40

TW24-771

Hallnor

120.5

130.0

9.5

7.2

31.50

Incl.

122.0

123.0

1.0

0.8

284.00

TW24-772

Bonetal

132.0

133.0

1.0

0.8

71.40

TW24-776

Bonetal

110.0

112.0

2.0

1.5

21.75

TW24-780

Bonetal

193.0

194.0

1.0

0.8

67.80

TW24-782

Bonetal

125.0

140.0

15.0

11.4

3.78

TW24-783

Bonetal

115.0

127.0

12.0

9.8

2.74

139.0

152.0

13.0

10.6

3.37

TW24-786

Broulan Reef

169.5

180.5

11.0

7.6

6.26

Incl.

175.0

176.0

1.0

0.7

11.80

also incl.

178.6

179.1

0.5

0.3

86.30

TW24-793

Broulan Reef

197.1

200.0

2.9

2.4

360.18

Incl.

197.6

198.1

0.5

0.4

1940.00

also incl.

198.1

198.5

0.4

0.3

140.00

also incl.

198.5

199.0

0.5

0.4

31.40

TW24-802

Broulan Reef

116.8

117.2

0.4

0.3

378.00

TW24-804

Broulan Reef

138.5

144.3

5.8

4.3

4.69

Incl.

140.5

141.0

0.5

0.4

41.20

General Notes with Respect to Technical Information

Grades are shown as contained metal before mill recoveries are

applied. The Company has undertaken a verification process with

respect to the data disclosed in this news release.

Samples are analyzed at a variety of laboratories, including by

in-house staff at the mine (Jacobina and La Colorada), mine

laboratories operated by third party independent commercial labs

(Huaron), and commercial laboratories off-site (La Colorada, El

Peñon, Minera Florida, Whitney and Jacobina). All the assay data

reported in this news release has been subjected to the industry

standard quality assurance and quality control ("QA/QC") program

including the submission of certified standards, blanks, and

duplicate samples. The results are reviewed on a monthly and

quarterly basis by management. In general, the assay analytical

technique for silver, lead, zinc and copper is acid digestion with

either ICP or atomic absorption finish. The analytical technique

for gold uses fire assay and atomic absorption spectrometry (AAS)

finish. A gravimetric finish would be used if the gold assay

exceeds > 10 g/t (or >5 g/t at El Peñon). The results of the

QA/QC samples submitted for the resource databases demonstrate

acceptable accuracy and precision. The offsite commercial

laboratories are independent from Pan American and certified by ISO

17025:2017.

The Qualified Persons are of the opinion that the sample

preparation, analytical, and security procedures followed for the

samples are sufficient and reliable for the purpose of this news

release and for the purpose of any future mineral resource and

mineral reserve estimates. There were no limitations on the

Qualified Persons' verification process. Pan American is not aware

of any drilling, sampling, recovery or other factors that could

materially affect the accuracy or reliability of the data reported

herein.

Mineral resources and mineral reserves are as defined by the

Canadian Institute of Mining, Metallurgy and Petroleum.

See the Company’s Annual Information Form dated March 26, 2024,

available at www.sedarplus.com, or the Company’s most recent Form

40-F filed with the United States Securities and Exchange

Commission (the "SEC") for further information on the Company’s

material mineral properties, including detailed information

concerning associated QA/QC and data verification matters, the key

assumptions, parameters and methods used by the Company to estimate

mineral reserves and mineral resources, and for a detailed

description of known legal, political, environmental, and other

risks that could materially affect the Company’s business and the

potential development of the Company’s mineral reserves and mineral

resources.

Technical information contained in this news release with

respect to Pan American has been reviewed and approved by

Christopher Emerson, FAusIMM, Vice President Exploration and

Geology, and Martin Wafforn, P.Eng., Senior Vice President

Technical Services and Process Optimization, each of whom is a

Qualified Person for the purposes of National Instrument 43-101 -

Standards of Disclosure for Mineral Projects (‘‘NI 43-101’’). Pan

American is authorized by The Association of Professional Engineers

and Geoscientists of the Province of British Columbia to engage in

Reserved Practice under Permit to Practice number 1001470.

Cautionary Note to US Investors

This news release has been prepared in accordance with the

requirements of Canadian NI 43-101 and the Canadian Institute of

Mining, Metallurgy and Petroleum Definition Standards, which differ

from the requirements of U.S. securities laws. NI 43-101 is a rule

developed by the Canadian Securities Administrators that

establishes standards for all public disclosure an issuer makes of

scientific and technical information concerning mineral

projects.

Canadian public disclosure standards, including NI 43-101,

differ significantly from the requirements of the SEC, and

information concerning mineralization, deposits, mineral reserve

and mineral resource information contained or referred to herein

may not be comparable to similar information disclosed by U.S.

companies. The requirements of NI 43-101 for identification of

“reserves” are not the same as those of the SEC and may not qualify

as “reserves” under SEC standards. Under U.S. standards,

mineralization may not be classified as a “reserve” unless the

determination has been made that the mineralization could be

economically and legally produced or extracted at the time the

reserve determination is made. U.S. investors should also

understand that “inferred mineral resources” have a great amount of

uncertainty as to their existence and great uncertainty as to their

economic and legal feasibility. Under Canadian securities laws,

estimated “inferred mineral resources” may not form the basis of

feasibility or pre-feasibility studies except in rare cases.

About Pan American Silver

Pan American Silver is a leading producer of silver and gold in

the Americas, operating mines in Canada, Mexico, Peru, Brazil,

Bolivia, Chile and Argentina. We also own the Escobal mine in

Guatemala that is currently not operating, and we hold interests in

exploration and development projects. We have been operating in the

Americas for three decades, earning an industry-leading reputation

for sustainability performance, operational excellence and prudent

financial management. We are headquartered in Vancouver, B.C. and

our shares trade on the New York Stock Exchange and the Toronto

Stock Exchange under the symbol "PAAS".

Learn more at panamericansilver.com

Follow us on LinkedIn

Cautionary Note Regarding Forward-Looking Statements and

Information

Certain of the statements and information in this news release

constitute "forward-looking statements" within the meaning of the

United States Private Securities Litigation Reform Act of 1995 and

"forward-looking information" within the meaning of applicable

Canadian provincial securities laws. All statements, other than

statements of historical fact, are forward-looking statements or

information. Forward-looking statements or information in this news

release relate to, among other things: the extent of, and success

related to any future exploration or development programs,

including with respect to its Jacobina, El Peñon, La Colorada,

Minera Florida, Huaron and Timmins properties and for its La

Colorada Skarn and Whitney projects, and the potential impact of

any such drill results on the Company’s mineral reserves or mineral

resources.

These forward-looking statements and information reflect Pan

American’s current views with respect to future events and are

necessarily based upon a number of assumptions that, while

considered reasonable by Pan American, are inherently subject to

significant operational, business, economic and regulatory

uncertainties and contingencies. These assumptions include: tonnage

of ore to be mined and processed; ore grades and recoveries; prices

for silver, gold and base metals remaining as estimated; currency

exchange rates remaining as estimated; capital, decommissioning and

reclamation estimates; our mineral reserve and resource estimates

and the assumptions upon which they are based; prices for energy

inputs, labour, materials, supplies and services (including

transportation); no labour-related disruptions at any of our

operations; no unplanned delays or interruptions in scheduled

production; all necessary permits, licenses and regulatory

approvals for our operations are received in a timely manner; our

ability to secure and maintain title and ownership to properties

and the surface rights necessary for our operations; and our

ability to comply with environmental, health and safety laws. The

foregoing list of assumptions is not exhaustive.

Pan American cautions the reader that forward-looking statements

and information involve known and unknown risks, uncertainties and

other factors that may cause actual results and developments to

differ materially from those expressed or implied by such

forward-looking statements or information contained in this news

release and Pan American has made assumptions and estimates based

on or related to many of these factors. Such factors include,

without limitation: fluctuations in silver, gold and base metal

prices; fluctuations in prices for energy inputs, labour,

materials, supplies and services (including transportation);

fluctuations in currency markets (such as the PEN, MXN, ARS, BOB,

GTQ, CAD, CLP, and BRL versus the USD); operational risks and

hazards inherent with the business of mining (including

environmental accidents and hazards, industrial accidents,

equipment breakdown, unusual or unexpected geological or structural

formations, cave-ins, flooding and severe weather); risks relating

to the credit worthiness or financial condition of suppliers,

refiners and other parties with whom Pan American does business;

inadequate insurance, or inability to obtain insurance, to cover

these risks and hazards; employee relations; relationships with,

and claims by, local communities and indigenous populations; our

ability to obtain all necessary permits, licenses and regulatory

approvals in a timely manner; changes in laws, regulations and

government practices in the jurisdictions where we operate,

including environmental, export and import laws and regulations;

changes in national and local government, legislation, taxation,

controls or regulations and political, legal or economic

developments, including legal restrictions relating to mining,

risks relating to expropriation, and risks relating to the

constitutional court-mandated ILO 169 consultation process in

Guatemala; diminishing quantities or grades of mineral reserves as

properties are mined; increased competition in the mining industry

for equipment and qualified personnel; the duration and effects any

pandemics on our operations and workforce; and those factors

identified under the caption “Risks Related to Pan American’s

Business” in Pan American’s most recent form 40-F and Annual

Information Form filed with the United States Securities and

Exchange Commission and Canadian provincial securities regulatory

authorities, respectively. Although Pan American has attempted to

identify important factors that could cause actual results to

differ materially, there may be other factors that cause results

not to be as anticipated, estimated, described or intended.

Investors are cautioned against undue reliance on forward-looking

statements or information. Forward-looking statements and

information are designed to help readers understand management’s

current views of our near and longer term prospects and may not be

appropriate for other purposes. Pan American does not intend, nor

does it assume any obligation to update or revise forward-looking

statements or information, whether as a result of new information,

changes in assumptions, future events or otherwise, except to the

extent required by applicable law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241209583019/en/

For more information contact: Siren Fisekci VP, Investor

Relations & Corporate Communications Ph: 604-806-3191 Email:

ir@panamericansilver.com

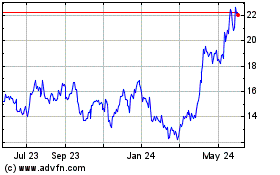

Pan American Silver (NYSE:PAAS)

Historical Stock Chart

From Jan 2025 to Feb 2025

Pan American Silver (NYSE:PAAS)

Historical Stock Chart

From Feb 2024 to Feb 2025