Form 8-K - Current report

22 November 2024 - 8:27AM

Edgar (US Regulatory)

false 0001611052 0001611052 2024-11-21 2024-11-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 21, 2024

Procore Technologies, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

| Delaware |

|

001-40396 |

|

73-1636261 |

| (State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

| 6309 Carpinteria Avenue, Carpinteria, CA |

|

93013 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (866) 477-6267

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common stock, $0.0001 par value |

|

PCOR |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01 |

Regulation FD Disclosure. |

On November 21, 2024, Procore Technologies, Inc. (the “Company”) hosted its 2024 Investor Day, which was held in person and virtually via live webcast. A copy of the Company’s Investor Day presentation is furnished as Exhibit 99.1. A replay of the webcast will be available on the Investor Relations page of the Company’s website at http://investors.procore.com.

The information in each item of this Current Report on Form 8-K and the exhibit attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

The exhibit listed below is being furnished with this Current Report on Form 8-K.

1

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Procore Technologies, Inc. |

|

|

|

|

| Date: November 21, 2024 |

|

|

|

By: |

|

/s/ Benjamin C. Singer |

|

|

|

|

|

|

Benjamin C. Singer |

|

|

|

|

|

|

Chief Legal Officer and Corporate Secretary |

2

Exhibit 99.1

Capital Allocation Capital Allocation Priorities The first lever and

investment priority continues to be organic 1. Payment and efficient revenue growth. + Organic & We have significant opportunity as the technology leader + Bul Efficient Growth s serving Construction. Our sufficient capital enables us to fund

business objectives and continue generating free cash flow. The second lever is investment in M&A. 2. Payments Our M&A strategy primarily focuses on accelerating our + M&A product roadmap with smaller, tuck in companies that are + Bullet

two typically from our App Marketplace and already integrated in the Procore platform. + Bullet three 3. The third lever is returning capital to shareholders. Payment Our guiding principle is to repurchase shares to provide Capital Return notable

accretion to per-share targets and optimize s long-term shareholder value. 76 Note: “FCFˮ refers to free cash flow. Free cash flow is a non-GAAP measure. Refer to the appendix for the definition of free cash flow and for a reconciliation

of non-GAAP measures to the most directly comparable GAAP measures.

Capital Allocation + $300M stock repurchase authorization

+ 1 year term + To be deployed opportunistically depending on market conditions + Represents approx 40% of our cash, cash Stock 1 equivalents, and marketable securities balance Repurchase + Represents 3% of our

market capitalization as of November 15, 2024 Our guiding principle is notable accretion to per share targets to optimize long-term shareholder value 1 Balance as of September 30, 2024. Note: The program does not obligate Procore to acquire any

particular amount of stock, and may be suspended or discontinued at any time at Procoreʼs discretion. 77

Capital Allocation Go-To-Market Investment Cadence Typical GTM

Investment Cadence FY25 Pull Forward of GTM Investment The GTM operating model transition will pull forward the investment we would have made in FY26, however, we intend to offset this investment with other efficiencies, therefore, FY25 S&M as a

% of revenue is expected to be similar or lower than FY24 and this should position us for further efficiency gains in FY26 Note: Examples are illustrative 78

Operational Efficiency Operational Efficiency Non-GAAP Operating

Non-GAAP Operating Margin Profit/Loss Note: Operating profit/loss and margin are non-GAAP measures. FY24E uses the high end of our guidance range. FY25E is based on our initial FY25 guidance. Shows fiscal year non-GAAP operating profit/(loss) and

non-GAAP operating profit/(loss) as a % of revenue. Non-GAAP operating expenses and operating margin are calculated as operating expenses excluding stock-based compensation, amortization of acquired intangible assets, employer payroll tax related to

employee stock transactions, and acquisition-related expenses. Refer to the appendix for a reconciliation of non-GAAP financial measures to the most directly comparable GAAP financial measures. 79

Operational Efficiency Progression of Efficiency 40% FCF

Margins Commitment to margin Best in class vertical margins expansion, disciplined equity management and 25% FCF Margins ultimately free cash flow per Realize further efficiencies via thoughtful onshore and offshore initiatives share

improvement GAAP Profitability Equity discipline combined with operating efficiency Capital Return Program Return excess cash opportunistically based on market conditions to optimize FCF per share Non-GAAP Profitability Prioritizing operating

efficiency in addition to top line growth Equity Management Shift compensation towards less equity; maintain dilution rates of 1%3% depending on revenue growth Consistent Free Cash Flow Obtain scale in both GTM and operating efficiency;

business begins to consistently generate excess cash Note: The top three gray bars (referring to 40% FCF margins, 25% FCF margins, and GAAP Profitability) refer to forward-looking goals, and are not financial guidance. We have no

timeline for when we may achieve any of these goals, and there is no assurance that we will achieve any or all of these goals. “FCFˮ refers to free cash flow. Free cash flow is a non-GAAP measure. Refer to the 80 appendix for the

definition of free cash flow and for a reconciliation of non-GAAP measures to the most directly comparable GAAP measures.

Key Takeaways Construction is Massive Category Leader Financial

Improvement Significant digitization Our leading platform and We are committed to opportunity provides industry partnership will efficiency and per share durable long-term growth continue to deliver improvement 1 for a projected $15T strong customer

ROI industry 1 Source: Oxford Economics: Future of Construction September 2021) estimated global construction spend in 2030. 81

References and Definitions ANNUAL CONSTRUCTION VOLUME

ACV When we refer to ACV with respect to our customers, we define ACV as the annual construction volume that our customers have contracted to run on the Procore platform. When we refer to ACV with respect to a geographic location

(such as a region or a country), we define ACV as the actual or projected annual construction volume spend in that particular location. Our estimates of the construction industryʼs ACV with respect to a specific geographic location are

calculated by us using data from the U.S. Census Bureau, international government statistics agencies, advisory firms, Oxford Economics estimates, and D&B Hoovers data, and are limited to the following countries: Australia (as of Q1

2024, Canada (as of October 2023, France (as of 2023, Germany (as of 2023, Ireland (as of 2023, New Zealand (as of June 2024, Saudi Arabia (as of 2023, Spain (as of 2023, United Arab

Emirates (as of 2022, United Kingdom (as of 2022, United States (as of July 2024. Please note that more countries are served than are represented by our data. When we refer to Rest of World ROW ACV, we define

ACV as the projected global construction ACV as of 2030 (see definition of TAM for details about how this is calculated), minus projected ACV for our active go-to-market countries (which are countries where we are actively pursuing new customers and

which do not include countries where we only sell via inbound demand). ANNUAL RECURRING REVENUE ARR We define ARR at the end of a particular period as the annualized dollar value of our subscriptions from the specified customer or

customers as of such period end date. For multi-year subscriptions, ARR at the end of a particular period is measured by using the stated contractual subscription fees as of the period end date on which ARR is measured. For example, if ARR is

measured during the first year of a multi-year contract, the first-year subscription fees are used to calculate ARR. ARR at the end of a particular period includes the annualized dollar value of subscriptions for which the term has not ended, and

subscriptions for which we are negotiating a subscription renewal. ARR should be viewed independently of revenue determined in accordance with GAAP and does not represent our U.S. GAAP revenue on an annualized basis. ARR is not intended to be a

replacement or forecast of revenue. ANNUALIZED REVENUE RUN RATE Annualized Revenue Run Rate is measured by multiplying Procoreʼs quarterly revenue as of a given date by the number four. 85

References and Definitions CUSTOMER COUNT We define the number of

customers at the end of a particular period as the number of entities that have entered into one or more subscriptions with us that have recurring charges for which the term has not ended, or with which we are negotiating a subscription renewal. An

entity with multiple subsidiaries, segments, or divisions, is defined and counted as a single customer, even if there are multiple separate subscriptions. Customer count metrics exclude customers acquired from business combinations that do not have

standard Procore annual contracts. FREE CASH FLOW FCF We define free cash flow as net cash provided by operating activities, less purchases of property and equipment and capitalized software development costs. We believes free cash

flow is an important liquidity measure of the cash (if any) that is available, after our operating activities and capital expenditures. We use free cash flow in conjunction with traditional GAAP measures to assess our liquidity and evaluate the

effectiveness of our business strategies. GROSS RETENTION RATE GRR To calculate our GRR at the end of a particular period, we first calculate the ARR from the cohort of active customers at the end of the period 12 months prior to the

end of the period selected. We then calculate the value of ARR from any customers whose subscriptions terminated and were not renewed during the 12 months preceding the end of the period selected, which we refer to as cancellations. To calculate

GRR, we divide (a) the total prior period ARR minus cancellations by (b) the total prior period ARR. TOTAL ADDRESSABLE MARKET TAM We view the construction industryʼs ACV as the primary factor informing our TAM because our

revenue is driven by the value of the ACV that our customers have contracted to run on the Procore platform, and because changes in ACV are generally correlated with our revenue and growth opportunity. Our estimate of global construction ACV as of

2030 is based on a projection developed by Oxford Economics (see Oxford Economics: Future of Construction September 2021, estimated global construction spend in 2030. Refer to the definition of Annual Construction Volume

ACV) for more information about how we calculate ACV with respect to a particular region or country. TOTAL ANNUAL RECURRING REVENUE TOTAL ARR We define Total ARR as the aggregate ARR across all given customer contracts in a

referenced customer cohort. 86

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

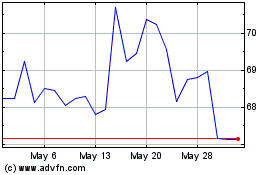

Procore Technologies (NYSE:PCOR)

Historical Stock Chart

From Oct 2024 to Nov 2024

Procore Technologies (NYSE:PCOR)

Historical Stock Chart

From Nov 2023 to Nov 2024