Pebblebrook Hotel Trust (NYSE: PEB) (the “Company”) today

provided an update on recent operating trends and information.

Please visit

https://investor.pebblebrookhotels.com/investor-presentations-1 to

view the updated presentation the Company issued on its

website.

Additionally, based upon an initial review of preliminary

operating and financial results, the Company has provided

preliminary fourth quarter and full year 2022 results as

follows:

Preliminary Q4 2022 Results(1)

(As of 1/20/2023)

Prior Q4 2022 Outlook (As of

12/20/2022)

Variance(2)

Low

High

Low

High

Low

High

($ and shares/units in millions,

except per share and RevPAR data)

Net loss

($41)

($39)

($40)

($36)

($1)

($3)

Adjusted EBITDAre(3)

$56

$58

$52

$56

$4

$2

Adjusted FFO(3)

$24

$26

$17

$21

$7

$5

Adjusted FFO per diluted share(3)

$0.19

$0.20

$0.13

$0.16

$0.06

$0.04

Same Property RevPAR(3)

$174

$174

$173

$175

$1

($1)

Same Property RevPAR variance vs.

2019(3)

(7.8%)

(7.8%)

(8.0%)

(7.0%)

0.2%

(0.8%)

Same Property RevPAR variance vs.

2021(3)

25.6%

25.6%

25.2%

26.6%

0.4%

(1.0%)

Same Property EBITDA(3)

$63.2

$65.2

$61.0

$65.0

$2.2

$0.2

Same Property EBITDA variance vs.

2019(3)

(29.1%)

(26.9%)

(31.6%)

(27.1%)

2.5%

0.2%

Preliminary Full Year 2022

Results(1) (As of 1/20/2023)

Prior Full Year 2022 Outlook

(As of 12/20/2022)

Variance(2)

Low

High

Low

High

Low

High

($ and shares/units in millions,

except per share and RevPAR data)

Net loss

($87)

($85)

($85)

($81)

($2)

($4)

Adjusted EBITDAre(3)

$355

$357

$351

$355

$4

$2

Adjusted FFO(3)

$220

$222

$212

$216

$8

$6

Adjusted FFO per diluted share(3)

$1.68

$1.69

$1.61

$1.64

$0.07

$0.05

Same Property RevPAR(3)

$193

$193

$193

$193

-

-

Same Property RevPAR variance vs.

2019(3)

(8.0%)

(8.0%)

(8.0%)

(7.75%)

-

(0.3%)

Same Property RevPAR variance vs.

2021(3)

67.0%

67.0%

67.2%

67.2%

(0.2%)

(0.2%)

Same Property EBITDA(3)

$389.0

$391.0

$386.8

$390.8

$2.2

$0.2

Same Property EBITDA variance vs.

2019(3)

(16.0%)

(15.5%)

(16.4%)

(15.6%)

0.4%

0.1%

(1) Preliminary results may differ materially

from actual results, which are not yet available.

(2) Any differences are a result of

rounding.

(3) See tables later in this press release

for a description of same-property information and reconciliations

from net income (loss) to non-GAAP financial measures, including

Earnings Before Interest, Taxes, Depreciation and Amortization

("EBITDA"), Adjusted EBITDAre, Adjusted Funds from Operations

("FFO") and Adjusted FFO per share.

For the details as to which hotels are

included in Same Property Revenue Per Available Room (“RevPAR”) and

Same Property EBITDA appearing in the table, refer to the Same

Property Inclusion Reference Table later in this press release.

Additionally, the Company announced that it had executed a

contract to sell the 151-room The Heathman Hotel in Portland,

Oregon for $45.0 million to a third party. The sale of The Heathman

Hotel is subject to normal closing conditions, and the Company

offers no assurances that this sale will be completed on these

terms, or at all. The sale is targeted to be completed later in the

first quarter of 2023.

About Pebblebrook Hotel

Trust

Pebblebrook Hotel Trust (NYSE: PEB) is a publicly traded real

estate investment trust (“REIT”) and the largest owner of urban and

resort lifestyle hotels and resorts in the United States. The

Company owns 51 hotels and resorts, totaling approximately 12,800

guest rooms across 15 urban and resort markets. For more

information, visit www.pebblebrookhotels.com and follow us at

@PebblebrookPEB.

This press release contains certain “forward-looking statements”

made pursuant to the safe harbor provisions of the Private

Securities Reform Act of 1995. Forward-looking statements are

generally identifiable by the use of forward-looking terminology

such as “preliminary,” “targeted,” “may,” “will,” “should,”

“potential,” “intend,” “expect,” “seek,” “anticipate,” “estimate,”

“approximately,” “believe,” “could,” “project,” “predict,”

“forecast,” “continue,” “assume,” “plan,” references to “outlook”

or other similar words or expressions. Forward-looking statements

are based on certain assumptions and can include future

expectations, future plans and strategies, financial and operating

projections and forecasts and other forward-looking information and

estimates. Examples of forward-looking statements include the

preliminary operating and financial results for the quarter and

year ended December 31, 2022, and the timing of completion of the

hotel property sale. These forward-looking statements are subject

to various risks and uncertainties, many of which are beyond the

Company’s control, which could cause actual results to differ

materially from such statements. These risks and uncertainties

include, but are not limited to, potential additional impairment

charges relating to remediation and restoration of storm damage to

LaPlaya Beach Resort & Club, the state of the U.S. economy and

the supply of hotel properties, and other factors as are described

in greater detail in the Company’s filings with the SEC, including,

without limitation, the Company’s Annual Report on Form 10-K for

the year ended December 31, 2021. Unless legally required, the

Company disclaims any obligation to update any forward-looking

statements, whether as a result of new information, future events

or otherwise.

For further information about the Company’s business and

financial results, please refer to the "Management’s Discussion and

Analysis of Financial Condition and Results of Operations” and

“Risk Factors” sections of the Company’s filings with the U.S.

Securities and Exchange Commission, including, but not limited to,

its Annual Report on Form 10-K and Quarterly Reports on Form 10-Q,

copies of which may be obtained at the Investor Relations section

of the Company’s website at www.pebblebrookhotels.com.

All information in this press release is as of January 20, 2023.

The Company undertakes no duty to update the statements in this

press release to conform the statements to actual results or

changes in the Company’s expectations.

For additional information or to receive press

releases via email, please visit our website at

www.pebblebrookhotels.com

Pebblebrook Hotel Trust Reconciliation of Preliminary Q4

2022 and Preliminary Full Year 2022 Net Loss to FFO and Adjusted

FFO (in millions, except per share data)

(Unaudited) Preliminary - Three months

endedDecember 31, 2022 Preliminary - Year endedDecember 31,

2022 Low High Low High

Net loss

$

(41

)

$

(39

)

$

(87

)

$

(85

)

Adjustments: Real estate depreciation and amortization

60

60

239

239

(Gain) loss on sale of hotel properties

-

-

(6

)

(6

)

Impairment loss

4

4

90

90

FFO

$

23

$

25

$

236

$

238

Distribution to preferred shareholders and unit holders

(12

)

(12

)

(48

)

(48

)

Issuance costs of redeemed preferred shares

8

8

8

8

FFO available to common share and unit holders

$

19

$

21

$

196

$

198

Non-cash ground rent

2

2

8

8

Amortization of share-based compensation expense

3

3

11

11

Early extinguishment of debt

8

8

8

8

Issuance costs of redeemed preferred shares

(8

)

(8

)

(8

)

(8

)

Other

-

-

5

5

Adjusted FFO available to common share and unit holders

$

24

$

26

$

220

$

222

FFO per common share - diluted

$

0.15

$

0.16

$

1.49

$

1.51

Adjusted FFO per common share - diluted

$

0.19

$

0.20

$

1.68

$

1.69

Weighted-average number of fully diluted common shares and

units

130.0

130.0

131.3

131.3

To supplement the Company’s presentation of preliminary

results of Net loss in accordance with U.S. GAAP, this press

release includes certain non-GAAP financial measures as defined

under SEC rules.These measures are not in accordance with, or an

alternative to, measures prepared in accordance with GAAP and may

be different from similarly titled non-GAAP financial measures used

by other companies. In addition, these non-GAAP financial measures

are not based on any comprehensive set of accounting rules or

principles. Non-GAAP financial measures have limitations in that

they do not reflect all of the amounts associated with the

Company’s results of operations determined in accordance with

GAAP.Funds from Operations (“FFO”) - FFO represents net income

(computed in accordance with GAAP), excluding gains or losses from

sales of properties, plus real estate-related depreciation and

amortization and after adjustments for unconsolidated partnerships.

The Company considers FFO a useful measure of performance for an

equity REIT because it facilitates an understanding of the

Company's operating performance without giving effect to real

estate depreciation and amortization, which assume that the value

of real estate assets diminishes predictably over time. Since real

estate values have historically risen or fallen with market

conditions, the Company believes that FFO provides a meaningful

indication of its performance. The Company also considers FFO an

appropriate performance measure given its wide use by investors and

analysts. The Company computes FFO in accordance with standards

established by the Board of Governors of Nareit in its March 1995

White Paper (as amended in November 1999 and April 2002), which may

differ from the methodology for calculating FFO utilized by other

equity REITs and, accordingly, may not be comparable to that of

other REITs. Further, FFO does not represent amounts available for

management’s discretionary use because of needed capital

replacement or expansion, debt service obligations or other

commitments and uncertainties, nor is it indicative of funds

available to fund the Company’s cash needs, including its ability

to make distributions. The Company presents FFO per diluted share

calculations that are based on the outstanding dilutive common

shares plus the outstanding Operating Partnership units for the

periods presented.The Company also evaluates its performance by

reviewing Adjusted FFO because it believes that adjusting FFO to

exclude certain recurring and non-recurring items described below

provides useful supplemental information regarding the Company's

ongoing operating performance and that the presentation of Adjusted

FFO, when combined with the primary GAAP presentation of net income

(loss), more completely describes the Company's operating

performance. The Company adjusts FFO for the following items, which

may occur in any period, and refers to this measure as Adjusted

FFO:- Non-cash ground rent: The Company excludes the non-cash

ground rent expense, which is primarily made up of the

straight-line rent impact from a ground lease.- Non-cash interest

expense: The Company excludes non-cash interest expense because the

Company believes that including this adjustment in FFO does not

reflect the underlying financial performance of the Company and its

hotels.- Amortization of share-based compensation expense: The

Company excludes the amortization of share-based compensation

expense because the Company believes that including this adjustment

in FFO does not reflect the underlying financial performance of the

Company and its hotels.- Early extinguishment of debt: The Company

excludes early extinguishment of debt because the Company believes

that including this adjustment in FFO does not reflect the

underlying financial performance of the Company and its hotels.-

Issuance costs of redeemed preferred shares: The Company excludes

issuance costs of redeemed preferred shares because the Company

believes that including this adjustment in FFO does not reflect the

underlying financial performance of the Company and its hotels.-

Other: The Company excludes other expenses, which include

transaction costs, management/franchise contract transition costs,

interest expense adjustment for acquired liabilities, finance lease

adjustment and non-cash amortization of acquired intangibles

because the Company believes that including these non-cash

adjustments in FFO does not reflect the underlying financial

performance of the Company and its hotels.The Company’s

presentation of FFO in accordance with the Nareit White Paper, and

as adjusted by the Company, should not be considered as an

alternative to net income (computed in accordance with GAAP) as an

indicator of the Company’s financial performance or to cash flow

from operating activities (computed in accordance with GAAP) as an

indicator of its liquidity.Any differences are a result of

rounding.

Pebblebrook Hotel Trust Reconciliation of

Preliminary Q4 2022 and Preliminary Full Year 2022 Net Loss to

EBITDA, EBITDAre and Adjusted EBITDAre (in millions)

(Unaudited) Preliminary - Three months

endedDecember 31, 2022 Preliminary - Year endedDecember 31,

2022 Low High Low High

Net loss

$

(41

)

$

(39

)

$

(87

)

$

(85

)

Adjustments: Interest expense and income tax expense

28

28

100

100

Depreciation and amortization

60

60

239

239

EBITDA

$

47

$

49

$

252

$

254

(Gain) loss on sale of hotel properties

-

-

(6

)

(6

)

Impairment loss

4

4

90

90

EBITDAre

$

51

$

53

$

336

$

338

Non-cash ground rent

2

2

8

8

Amortization of share-based compensation expense

3

3

11

11

Other

-

-

-

-

Adjusted EBITDAre

$

56

$

58

$

355

$

357

To supplement the Company’s presentation of preliminary

results of Net loss in accordance with U.S. GAAP, this press

release includes certain non-GAAP financial measures as defined

under SEC rules.These measures are not in accordance with, or an

alternative to, measures prepared in accordance with GAAP and may

be different from similarly titled non-GAAP financial measures used

by other companies. In addition, these non-GAAP financial measures

are not based on any comprehensive set of accounting rules or

principles. Non-GAAP financial measures have limitations in that

they do not reflect all of the amounts associated with the

Company’s results of operations determined in accordance with

GAAP.Earnings before Interest, Taxes, and Depreciation and

Amortization ("EBITDA") - The Company believes that EBITDA provides

investors a useful financial measure to evaluate its operating

performance, excluding the impact of our capital structure

(primarily interest expense) and our asset base (primarily

depreciation and amortization).Earnings before Interest, Taxes, and

Depreciation and Amortization for Real Estate ("EBITDAre") - The

Company believes that EBITDAre provides investors a useful

financial measure to evaluate its operating performance, and the

Company presents EBITDAre in accordance with the National

Association of Real Estate Investment Trusts ("Nareit") guidelines,

as defined in its September 2017 white paper "Earnings Before

Interest, Taxes, Depreciation and Amortization for Real Estate."

EBITDAre adjusts EBITDA for the following items, which may occur in

any period, and refers to these measures as Adjusted EBITDAre: (1)

gains or losses of on the disposition of depreciated property,

including gains or losses on change of control; (2) impairment

write-downs of depreciated property and of investments in

unconsolidated affiliates caused by a decrease in value of

depreciated property in the affiliate; and (3) adjustments to

reflect the entity's share of EBITDAre of unconsolidated

affiliates.The Company also evaluates its performance by reviewing

Adjusted EBITDAre because it believes that adjusting EBITDAre to

exclude certain recurring and non-recurring items described below

provides useful supplemental information regarding the Company's

ongoing operating performance and that the presentation of Adjusted

EBITDAre, when combined with the primary GAAP presentation of net

income (loss), more completely describes the Company's operating

performance. The Company adjusts EBITDAre for the following items,

which may occur in any period, and refers to these measures as

Adjusted EBITDAre:- Non-cash ground rent: The Company excludes the

non-cash ground rent expense, which is primarily made up of the

straight-line rent impact from a ground lease.- Amortization of

share-based compensation expense: The Company excludes amortization

of share-based compensation expense because the Company believes

that including this non-cash adjustment in EBITDAre does not

reflect the underlying financial performance of the Company and its

hotels.- Other: The Company excludes other expenses, which include

transaction costs, management/franchise contract transition costs

and non-cash amortization of acquired intangibles because the

Company believes that including these non-cash adjustments in

EBITDAre does not reflect the underlying financial performance of

the Company and its hotels.The Company’s presentation of EBITDAre,

and as adjusted by the Company, should not be considered as an

alternative to net income (computed in accordance with GAAP) as an

indicator of the Company’s financial performance or to cash flow

from operating activities (computed in accordance with GAAP) as an

indicator of its liquidity.Any differences are a result of

rounding.

Pebblebrook Hotel Trust 2022 Same-Property

Inclusion Reference Table Hotels Q1 Q2

Q3 Q4 Hotel Monaco Washington DC X X X X

Skamania Lodge X X X X Le Méridien Delfina Santa Monica X X X X

Sofitel Philadelphia at Rittenhouse Square X X Argonaut Hotel X X X

X The Westin San Diego Gaslamp Quarter X X X X Hotel Monaco Seattle

X X X X Mondrian Los Angeles X X X X W Boston X X X X Hotel Zetta

San Francisco X X X X Hotel Vintage Seattle X X X X Hotel Vintage

Portland X X W Los Angeles - West Beverly Hills X X X X Hotel Zelos

San Francisco X X X X Embassy Suites San Diego Bay - Downtown X X X

X The Hotel Zags X X X X Hotel Zephyr Fisherman's Wharf X X X X

Hotel Zeppelin San Francisco X X X X The Nines, a Luxury Collection

Hotel, Portland X X X X Hotel Colonnade Coral Gables, Autograph

Collection X X X X Hotel Palomar Los Angeles Beverly Hills X X X X

Revere Hotel Boston Common X X X X LaPlaya Beach Resort & Club

X X X Hotel Zoe Fisherman's Wharf X X X X 1 Hotel San Francisco The

Marker San Francisco X Hotel Spero X X Harbor Court Hotel San

Francisco X X X X Chaminade Resort & Spa X X X X Viceroy Santa

Monica Hotel X X X X Le Parc Suite Hotel X X X X Montrose West

Hollywood X X X X Chamberlain West Hollywood Hotel X X X X Hotel

Ziggy X X X X The Westin Copley Place, Boston X X X X The Liberty,

a Luxury Collection Hotel, Boston X X X X Hyatt Regency Boston

Harbor X X X X George Hotel X X X X Viceroy Washington DC X X X X

Hotel Zena Washington DC X X X X Paradise Point Resort & Spa X

X X X Hilton San Diego Gaslamp Quarter X X X X L'Auberge Del Mar X

X X X San Diego Mission Bay Resort X X X X Solamar Hotel X X X X

The Heathman Hotel X X X X Southernmost Beach Resort X X X X The

Marker Key West Harbor Resort X X X X Hotel Chicago Downtown,

Autograph Collection X X X X The Westin Michigan Avenue Chicago X X

X X Jekyll Island Club Resort X X X X Margaritaville Hollywood

Beach Resort X X X X Estancia La Jolla Hotel & Spa X X X X Inn

on Fifth X X X Newport Harbor Island Resort X X

Notes: A property marked with an "X" in a specific

quarter denotes that the same-property operating results of that

property are included in the Same-Property Statistical Data and in

the Schedule of Same-Property Results.The Company's estimates and

assumptions for Same Property RevPAR, RevPAR Growth, Total RevPAR,

Total RevPAR Growth, ADR, Occupancy, Revenues, Expenses, EBITDA and

EBITDA Margin for the fourth quarter of 2022 include all of the

hotels the Company owned as of December 31, 2022, except for 1

Hotel San Francisco for Q4 2022, 2021 and 2019 due to its closure

for renovation during Q4 2021, and LaPlaya Beach Resort & Club

for Q4 2022, 2021 and 2019 due to its closure following Hurricane

Ian during Q4 2022.Operating statistics and financial results may

include periods prior to the Company's ownership of the hotels.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230120005065/en/

Raymond D. Martz, Chief Financial Officer, Pebblebrook Hotel

Trust - (240) 507-1330

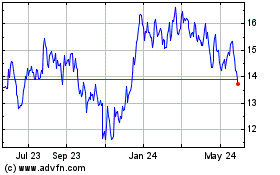

Pebblebrook Hotel (NYSE:PEB)

Historical Stock Chart

From Oct 2024 to Nov 2024

Pebblebrook Hotel (NYSE:PEB)

Historical Stock Chart

From Nov 2023 to Nov 2024