UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2023

(Commission File No. 1-03006)

PLDT Inc.

(Translation of registrant’s name into English)

Ramon Cojuangco Building

Makati Avenue

Makati City

Philippines

(Address of registrant’s principal executive office)

(Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.)

Form 20-F Form 40-F

(Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes No

(If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-____)

NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some information in this report may contain forward-looking statements within the meaning of Section 27A of the U.S. Securities Act of 1933 and Section 21E of the U.S. Securities Exchange Act of 1934. We have based these forward-looking statements on our current beliefs, expectations and intentions as to facts, actions and events that will or may occur in the future. Such statements generally are identified by forward-looking words such as “believe,” “plan,” “anticipate,” “continue,” “estimate,” “expect,” “may,” “will” or other similar words.

A forward-looking statement may include a statement of the assumptions or bases underlying the forward-looking statement. We have chosen these assumptions or bases in good faith. These forward-looking statements are subject to risks, uncertainties and assumptions, some of which are beyond our control. In addition, these forward-looking statements reflect our current views with respect to future events and are not a guarantee of future performance. Actual results may differ materially from information contained in the forward-looking statements as a result of a number of factors, including, without limitation, the risk factors set forth in “Item 3. Key Information – Risk Factors” in our annual report on Form 20-F for the fiscal year ended December 31, 2022. You should also keep in mind that any forward-looking statement made by us in this report or elsewhere speaks only as at the date on which we made it. New risks and uncertainties come up from time to time, and it is impossible for us to predict these events or how they may affect us. We have no duty to, and do not intend to, update or revise the statements in this report after the date hereof. In light of these risks and uncertainties, you should keep in mind that actual results may differ materially from any forward-looking statement made in this report or elsewhere.

1

EXHIBIT INDEX

EXHIBIT NUMBER PAGE

Copies of the disclosure letters that we filed today with the Philippine Stock Exchange, Philippine Securities and Exchange Commission, and the Philippine Dealing and Exchange Corporation regarding the following matters:

1.Press release regarding the unaudited consolidated financial results of PLDT Inc. (the “Company”) as at and for the nine (9) months ended September 30, 2023;

2.Declaration of a cash dividend of ₱12,285,000.00 on all of the outstanding shares of the Company’s Series IV Cumulative Non-Convertible Redeemable Preferred Stock;

3.Confirmation of appointment of officers;

4.Promotion of officers; and

5.Extension of the effective date of retirement of Atty. Marilyn A. Victorio-Aquino, incumbent Director, Chief Legal Counsel, and Corporate Secretary of the Company.

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly authorized and caused this report to be signed on its behalf by the undersigned.

|

|

|

|

PLDT Inc. |

|

|

|

By: |

/s/Mark David P. Martinez |

Name: |

Mark David P. Martinez |

Title: |

Assistant Corporate Secretary |

Date: November 7, 2023

3

Exhibit 99.1

EXHIBITS

|

|

|

Exhibit Number |

|

Page |

99.1 |

Copies of the disclosure letters that we filed today, with the Philippine Stock Exchange, Philippine Securities and Exchange Commission, and the Philippine Dealing and Exchange Corporation regarding the following matters: 1.Press release regarding the unaudited consolidated financial results of PLDT Inc. (the “Company”) as at and for the nine (9) months ended September 30, 2023; 2.Declaration of a cash dividend of ₱12,285,000.00 on all of the outstanding shares of the Company’s Series IV Cumulative Non-Convertible Redeemable Preferred Stock; 3.Confirmation of appointment of officers; 4.Promotion of officers; and 5.Extension of the effective date of retirement of Atty. Marilyn A. Victorio-Aquino, incumbent Director, Chief Legal Counsel, and Corporate Secretary of the Company. |

5 |

November 7, 2023

The Philippine Stock Exchange, Inc.

6/F Philippine Stock Exchange Tower

28th Street corner 5th Avenue

Bonifacio Global City, Taguig City

Attention: Ms. Alexandra D. Tom Wong

Officer-in-Charge – Disclosure Department

Securities & Exchange Commission

7907 Makati Avenue, Salcedo Village,

Barangay Bel-Air, Makati City

Attention: Mr. Vicente Graciano P. Felizmenio, Jr.

Director – Markets and Securities Regulation Department

Philippine Dealing & Exchange Corporation

29th Floor, BDO Equitable Tower

8751 Paseo de Roxas, Makati City 1226

Attention: Atty. Marie Rose M. Magallen-Lirio

Head - Issuer Compliance and Disclosure Department

Gentlemen:

In compliance with the PSE’s Revised Disclosure Rules, we submit herewith the press release of PLDT Inc. (the “Company”) in connection with the Company’s unaudited consolidated financial results for the nine (9) months ended September 30, 2023.

This submission shall also serve as our compliance with Section 17.1 of the Securities Regulation Code regarding the filing of reports on significant developments.

Very truly yours,

/s/Mark David P. Martinez

Mark David P. Martinez

Assistant Corporate Secretary

PLDT Inc.

COVER SHEET

|

|

|

|

|

|

|

|

|

|

|

SEC Registration Number |

P |

W |

- |

5 |

5 |

|

|

|

|

|

|

Company Name

Principal Office (No./Street/Barangay/City/Town/Province)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

R |

A |

M |

O |

N |

|

C |

O |

J |

U |

A |

N |

G |

C |

O |

|

B |

U |

I |

L |

D |

I |

N |

G |

|

|

|

|

|

|

|

M |

A |

K |

A |

T |

I |

|

A |

V |

E |

N |

U |

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

M |

A |

K |

A |

T |

I |

|

C |

I |

T |

Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form Type |

|

|

|

Department requiring the report |

|

|

|

Secondary License Type, If Applicable |

|

|

17 |

- |

C |

|

|

|

|

|

|

|

|

M |

S |

R |

D |

|

|

|

|

|

|

|

|

|

|

|

|

|

COMPANY INFORMATION

|

|

|

|

|

|

|

|

Company’s Email Address |

|

Company’s Telephone Number/s |

|

Mobile Number |

|

|

|

|

|

|

|

|

|

No. of Stockholders |

|

Annual Meeting

Month/Day |

|

Fiscal Year

Month/Day |

|

|

11,403 As of September 30, 2023 |

|

Every 2nd Tuesday of June |

|

December 31 |

|

CONTACT PERSON INFORMATION

The designated contact person MUST be an Officer of the Corporation

|

|

|

|

|

|

|

Name of Contact Person |

|

Email Address |

|

Telephone Number/s |

|

Mobile Number |

Marilyn A. Victorio-Aquino |

|

mvaquino@pldt.com.ph |

|

82500254 |

|

|

|

Contact Person’s Address |

MGO Building, Legaspi St. corner Dela Rosa St., Makati City |

Note: In case of death, resignation or cessation of office of the officer designated as contact person, such incident shall be reported to the Commission within thirty (30) calendar days from the occurrence thereof with information and complete contact details of the new contact person designated.

SECURITIES AND EXCHANGE COMMISSION

CURRENT REPORT UNDER SECTION 17

OF THE SECURITIES REGULATION CODE

AND SRC RULE 17.1

Date of Report (Date of earliest event reported)

2.SEC Identification Number PW-55

3.BIR Tax Identification No. 000-488-793

Exact name of issuer as specified in its charter

5. PHILIPPINES 6.____________ (SEC Use Only)

Province, country or other jurisdiction Industry Classification Code

of Incorporation

7. Ramon Cojuangco Building, Makati Avenue, Makati City 1200

Address of principal office Postal Code

8. (632) 82500254

Issuer's telephone number, including area code

9. Not Applicable

Former name or former address, if changed since last report

10.Securities registered pursuant to Sections 8 and 12 of the Securities Regulation Code and Sections 4 and 8 of the Revised Securities Act

|

|

Title of Each Class |

Number of Shares of Common Stock Outstanding and Amount of Debt Outstanding |

________________________________________________________________

________________________________________________________________

________________________________________________________________

11. Item 9 (Other events)

We disclose that at the meeting of the Board of Directors of PLDT Inc. (respectively, the “Board” and the “Company”) held on November 7, 2023, the Board approved the Company’s unaudited consolidated financial statements for the nine (9) months ended September 30, 2023.

A copy of the press release is attached herewith.

Pursuant to the requirements of the Securities Regulation Code, the Company has duly authorized and caused this report to be signed on its behalf by the undersigned.

PLDT INC.

By:

/s/Mark David P. Martinez

Mark David P. Martinez

Assistant Corporate Secretary

November 7, 2023

PLDT pressrelease

GROSS SERVICE REVENUES ROSE 3% TO ₱149.8B

NET SERVICE REVENUES REACH ₱142.3B IN 9M23—ANOTHER HISTORIC HIGH;

3Q23 REVENUES AT ₱47.8B

EXPENSES LOWER BY 3% OR ₱1.7B FROM BROAD-BASED COST MANAGEMENT

EBITDA ROSE TO RECORD HIGHS OF ₱78.4B IN 9M23 AND ₱26.2B IN 3Q23;

9M23 AND 3Q23 MARGINS AT 52%

TELCO CORE INCOME UP 2% TO ₱26.1B TRACKING FY23 GUIDANCE

CAPEX INTENSITY RATIO AT 37%

DATA AND BROADBAND UP 4% TO ₱116.9B—

82% OF CONSOLIDATED SERVICE REVENUES

FIBER-ONLY REVENUES GREW 10% TO ALL-TIME HIGH ₱39.3B – 87% OF TOTAL HOME REVENUES,

NET ADDS RE-ACCELERATE TO 88 THOUSAND IN 3Q23

ENTERPRISE REVENUES AT RECORD-HIGH OF ₱34.8B

DRIVEN BY GROWTH IN ICT REVENUES FROM DATA SOLUTIONS, MULTI-CLOUD AND TECH SERVICES

WIRELESS CONSUMER MOBILE DATA REVENUES UP 5%

DATA NOW 86% OF INDIVIDUAL BUSINESS

SMART AHEAD OF COMPETITION WITH 55.2 M SUBSCRIBERS

AS OF END-SEPT 2023, TNT LEADING SIM BRAND

PLDT AMONG WORLD’S BEST COMPANIES 2023

ONLY PHILIPPINE TELCO, HIGHEST AMONG PHILIPPINE COMPANIES

IN TERMS OF SUSTAINABILITY – TIME MAGAZINE

MANILA, Philippines 7th November 2023 – Notwithstanding persistent macroeconomic challenges, PLDT Inc. (PLDT) (PSE: TEL) (NYSE: PHI) today announced that Gross Service Revenues grew 3% to ₱149.8 billion while Consolidated Service Revenues (net of interconnect costs) grew by ₱1.1 billion to an all-time high of ₱142.3 billion in the first

nine months of 2023. In the third quarter, Consolidated Service Revenues grew by ₱0.3 billion to ₱47.8 billion compared with the second quarter.

Data and broadband, which grew by 4%, or ₱4.1 billion, to ₱116.9 billion, contributed 82% of consolidated service revenues.

“Now more than ever, we are witnessing how the power of technology and digital services impact Filipinos’ standard of living, with innovations bringing convenience, comfort, productivity, and security to improve overall quality of life. Our mission at PLDT is to enable our countrymen with the tools and connectivity needed to enhance their digital lifestyles,” said Alfredo S. Panlilio, PLDT and Smart President and CEO.

Consolidated EBITDA grew by 4% or ₱2.8 billion year-on-year to ₱78.4 billion in the first nine months, also an all-time high, due to higher revenues and lower opex. EBITDA margin was at 52% for the period. Recording five consecutive quarters of improvement, consolidated EBITDA is trending to exceed again the ₱100-billion mark this year.

Telco Core Income, excluding the impact of asset sales and Maya Innovations Holdings (formerly Voyager Innovations Holdings), reached ₱26.1 billion, up ₱0.5 billion or 2% from the same period last year, in-line with guidance.

Reported Income reached ₱27.9 billion in the first nine months of 2023 up by 1% year-on-year.

Consolidated Net Debt at the end of the first nine months of 2023 amounted to ₱252.1 billion; net-debt-to-EBITDA stood at 2.44x, down from 2.48x as at the end of 2Q23. Gross Debt stood at ₱274.5 billion, with maturities well spread out. Only 15% of Gross Debt are denominated in U. S. dollars and 5% are unhedged. PLDT credit ratings from Moody’s and S&P Global remained at investment grade.

PLDT was also among companies cited in TIME Magazine’s list of World’s Best Companies 2023. It was the only Philippine telco on the list and ranked highest among the six cited Philippine companies in terms of Sustainability. Released by TIME Magazine and its analytics partner Statista, the inaugural list names 750 most outstanding companies from different industries around the world which were independently evaluated based on revenue growth, employee satisfaction surveys, and rigorous environmental, social, and governance (ESG) performance metrics.

For maintaining the highest ethical standards and best corporate governance practices, PLDT again garnered the 3-Golden Arrow Award at the ASEAN Corporate Governance Scorecard (ACGS) organized by the Institute of Corporate Directors (ICD).

PLDT also recently received a strong score in the 2023 Children’s Rights and Business Benchmark by the Global Child Forum (GCF), which has been benchmarking companies on how well they address children’s rights in their operations. Based on GCF’s

independent scoring, PLDT has achieved “Leader” status with an overall score of 8.9, topping Asia and ranking third best among the world’s telcos.

Home: Fiber revenues sustain double-digit growth

Demonstrating that opportunities to grow in this market remain, Home’s fiber-only service revenues grew by 10%, or ₱3.6 billion to an all-time high of ₱39.3 billion in the first nine months of 2023. Fiber-only revenues accounted for 87% of total Home revenues of ₱45.3 billion, which were 2% or ₱1.0 billion higher compared with the same period last year.

PLDT’s total fiber subscribers as of end-September 2023 stood at 3.14 million, with 210,000 fiber net additions for the first nine months. The third quarter saw an increase in net adds to about 88,000 from around 42,000 in the second quarter.

As of end-September 2023, PLDT’s total number of fiber ports rose to 6.15 million covering over 18,000 barangays nationwide. Working with city governments in various regions to boost productivity and hybrid learning among communities, PLDT deployed the fastest fiber connectivity in cities and municipalities including major tourism hubs in the country such as the Island Garden City of Samal in Davao, Siargao Island in Tacloban, Bantayan Island in Cebu, and Cagayan de Oro.

Enterprise: Data and ICT are key revenue drivers

During the first nine months of 2023, the B2B arm of the PLDT Group continued its growth trend, reaching an all-time high of ₱34.8 billion in service revenues, driven by a significant growth in its ICT business and its Fixed and Wireless solutions. Noteworthy in the ICT business-to-business space was a robust 28% growth in the Multi-Cloud and Tech Services space, while the Data Center segment continues its steady growth vs the same period last year, solidifying the PLDT group’s aspiration to the be the hyperscaler hub in Asia.

ePLDT, the ICT subsidiary of PLDT Group, continues to see a revenue increase largely driven by hyperscalers that have colocated in VITRO data centers, which is the Philippines’ widest data center network.

ePLDT’s 11th data center, VITRO Sta. Rosa (VSR), is on track for launch in Q2 of 2024, almost a year ahead of other planned data centers. Once fully operational, the Philippines’ largest hyperscale data center will have a total of 4500 racks and 50MW power capacity. VITRO Sta Rosa has already been receiving several colocation requests from a diverse range of industry leaders including hyperscalers, content delivery networks, banks, BPOs, carriers and government agencies.

On the multi-cloud front, ePLDT’s roster of innovative solutions for enterprises now includes artificial intelligence solutions such as Talkbots, which are capable of understanding and responding intelligently to 11 different languages. PLDT itself uses

conversational AI in, among other areas, customer collection where efficiencies have significantly improved.

ePLDT has also launched the ePLDT Pilipinas Cloud (ePPC), becoming the first Filipino corporation to offer a sovereign cloud. The ePPC infrastructure will host highly sensitive government data and applications in a trusted cloud environment to help fast-track the digital transformation of the country’s public sector, a priority of the current administration.

Driving the growth for the Fixed business pillar are managed networking solutions and global connectivity, contributing 21% increase vs the same period last year, mostly due to the substantial uptake of SD-WAN technology and increased adoption of private network connectivity.

On the Wireless business front, international messaging revenues increased 57%, buoyed by a recently finalized single aggregator partnership, solidifying a foothold in the growing international A2P space. Mobility solutions continue to spur optimism via a 20% increase in IoT connections, driven by increased use cases propelled by big ticket IoT partnerships with Toyota Connected Car, Maya POS and Foodpanda.

Individual Wireless: Posting growth with increased data usage among subs, new products

PLDT’s Individual Wireless segment posted revenues of ₱60.6 billion in the first nine months of 2023, higher year-on-year by ₱0.3 billion, as mobile data revenues grew by 5% to ₱52.4 billion for the period, driven by a 15% year-on-year increase in mobile data traffic to 3,630 Petabytes.

Quarter-on-quarter, the segment posted ₱0.1 billion growth, despite the third quarter being a traditionally slow quarter.

Wireless Consumer Mobile Data revenues now account for 86% of total Individual Wireless revenues.

The Individual business has started to manifest positive trends amidst a rational competitive environment, the recognized superiority of the PLDT group network and the results of various initiatives being implemented.

The improved performance after the SIM registration deadline has been driven by structural revenue optimization, marketing campaigns which increased data usage among subscribers, including those in support of the country’s recent hosting of the FIBA

Basketball World Cup, and sponsorships for musical events such as the staging of the Broadway hit Hamilton and concert of K-Pop girl group TWICE; and new product offers

such as Triple Data, Super Value Campaign and Plan 999+. During the quarter, Smart became the first Philippine telco to offer e-SIMs to both postpaid and prepaid customers.

Further improving the accessibility of essential digital services for Filipinos, Smart is also collaborating with Google Cloud to become one of the first communication services providers in the Asia Pacific region to adopt Telecom Subscriber Insights, Google Cloud’s AI-powered solution that ingests data from various sources, provides contextual insights on subscribers’ propensity to consume services, and presents personalized recommendations to their devices for activation.

As of the end of September, Smart has registered 55.2 million mobile subscribers, higher than its closest competitor, with TNT once again being the leading SIM brand.

Network: Philippines’ most extensive fiber footprint

The PLDT Group has further expanded its total fiber footprint to over 1.1 million cable kilometers, consisting of over 0.2 million cable kilometers of international fiber and about 0.9 million cable kilometers of domestic fiber as of end-September 2023. Homes passed reached more than 17.3 million homes in 69% of the country’s municipalities/towns.

PLDT’s fiber infrastructure supports Smart’s 73.8 thousand base stations deployed nationwide. Smart’s network covers around 97% of the population.

Capex for the first nine months of 2023 amounted to ₱55.3 billion, lower than the ₱67.3 billion for the same period last year. Capex intensity ratio (capex as a percentage of revenues) was at 37%, lower than the 46% for the same period last year. This is in line with the goal of reducing capex spend in the near- to medium-term, and attain positive free cash flow position as soon as practicable.

Guidance for the year remains at ₱80-85 billion, including approximately ₱11.0 billion of the ₱33.0 billion capex commitments from prior years, net of advances.

Tower sale and leaseback milestones

In connection with the sale and leaseback of 1,012 telecommunications towers and associated passive telecommunications infrastructure to Frontier Tower Associates Philippines Inc. on March 10, 2023, PLDT announced on October 5th the completion of the sale of the first 230 towers forming part of this portfolio. A corresponding cash consideration of ₱2.8 billion was

received by the PLDT Group.

The sale and leaseback of towers are in line with the PLDT Group’s strategy to push for an asset-light balance sheet, while providing superior network quality and an even

better customer experience. It further supports the government’s program of building a strong digital infrastructure program to allow Filipinos to access affordable and reliable internet services.

Including the ₱1.1 billion cash consideration received on November 3rd from the closing of another 91 towers, PLDT has received ₱77.9 billion in tower sales proceeds to date.

Maya's ecosystem fuels digital banking growth

Maya, the #1 digital bank and digital payment processor in the Philippines, is leading the way as it revolutionizes financial services in the country. Maya sets the industry benchmark with an astounding 2.6 million depositors, with deposits totaling ₱23.5 billion as of end-September 2023. Driving this remarkable growth is its high-engagement banking model that strategically leverages its payment ecosystem to deliver innovative services and unparalleled value to customers.

For consumer banking, Maya has offered depositors higher interest rates credited daily, boosted based on wallet transactions. With depositors and borrowers transacting 2 to 4 times more than payment-only users, enterprise partners like Smart have started harnessing Maya's high-engagement banking to drive transactions and propel growth.

Through Maya Business, Maya enables merchants to accept all forms of digital payments like cards and QR in the Philippines. Maya Business is the leading online and offline payment processor for cards and QRPh transactions by number of transactions processed in the Philippines as of end-September 2023. Maya now provides the MSME segment with banking products like savings accounts and working capital loans.

As part of its commitment to drive financial services adoption, Maya has significantly ramped up its lending initiatives, introducing Maya Credit and Maya Personal Loans for consumers, Negosyo Advance and Negosyo InstaCash for MSMEs, alongside Maya Flexi Loans for small and medium enterprises (SMEs), all fueled by transactional data within Maya's ecosystem. As of end-September 2023, Maya has disbursed ₱16 billion in loans for the past twelve months.

Sustainability: Reinforced commitment to doing business responsibly

In the third quarter, the PLDT Group continued to reinforce its commitment to embed sustainability into its business.

PLDT remains committed to implementing decarbonization measures across the whole group. This includes PLDT’s existing decarbonization roadmap which aims to reduce

Scopes 1 and 2 emissions by 40% by 2030. Initiatives focused on the use of renewables, green technology in the network and energy efficiency achieve twin-goals of cost

optimization and reduction of GHG emissions while maintaining the quality of our products and services.

In support of UN SDG 13 (Climate Action) and SDG 15 (Life on Land), PLDT continues to pursue efforts focused on biodiversity conservation leveraging on partnerships (UN SDG 17) to achieve progress. These include tree planting and reforestation activities supporting Maynilad Water Services, Inc., the water and wastewater services provider of cities and municipalities that form the West Zone of the Greater Manila Area. PLDT is also collaborating with various stakeholders for the conservation of a nature-based climate solution, the Agusan Marsh Wildlife Sanctuary (peatlands), a carbon-sink that has been identified as a RAMSAR Wetlands of International Importance.

The use of electronic devices is closely related to the provision of telco services, and electronic waste or e-waste an area of environmental concern. With waste management having been identified by PLDT’s stakeholders as one of the company’s key material ESG topics, PLDT launched ‘Be Kind. Recycle.’, a recycling and waste management program focusing on the collection, treatment and proper disposal of e- waste. Initially piloted with employees during the celebration of Environmental, Health and Safety Week, the Group has expanded the program to include e-waste collection activities in HOME sales blitzes, deployment of e-waste bins in selected Smart mall stores, and programs with Enterprise customers. Supporting circularity at the community level, the PLDT Group has also recently teamed up with the United Nations Industrial Development Organization (UNIDO), the Department of Environment and Natural Resources, Ecowaste Coalition, Integrated Resources Inc., and the city of Baguio, for a Treatment, Storage and Disposal (TSD) facility in Baguio City – the first local government initiated TSD outside Metro Manila. This initiative supports UN SDG 12 (Responsible Consumption and Production) and UN SDG 17 (Partnerships).

The PLDT Group is also leading the way in opening discussions on advanced technology like artificial intelligence in the home. In an event held as one of the highlights of the Philippine Digital Convention 2023 organized by PLDT Enterprise, a session centered around “Family Perspectives on Smart Home and Artificial Intelligence” brought together thought leaders on technology and parenting and emphasized the importance of fostering meaningful connections and responsible use of technology, in line with UN SDG 9 (Industry, Innovation and Infrastructure) SDG 16 (Peace, Justice and Strong Institutions) and SDG 17 (Partnerships).

In connection with its commitment to create a safe online environment for its customers, PLDT and Smart continue to undertake measures focused on data privacy and cybersecurity. Among its customers, the group continues to be a leading champion of child online safety, having pursued a multi-pronged approach that includes collaboration with legislators, law enforcement, child protection advocates and investment in a custom-built platform that detects and blocks child sexual abusive and exploitative material (CSAEM). In 2022 alone, PLDT and Smart prevented 1.3 billion user attempts to access

online CSAEM. PLDT and Smart count UNICEF, the Internet Watch Foundation, and the Canadian Centre for Child Protection, among its partners.

Enabling community-based reporting, the group, through its B2B arm PLDT Enterprise, has also helped the Council for the Welfare of Children set up the MAKABATA 1383 Helpline for the reporting of child abuse and child rights violations. PLDT and SMART have also collaborated with the local government units of Angeles City in Pampanga, General Santos City, Cagayan de Oro City, and Iligan City on efforts to develop local ordinances and expand grassroots programs on anti-OSAEC (Online Sexual Abusive and Exploitative Content) measures.

PLDT and Smart have also supported the local government of Siargao by donating solar lights to light up the island’s Catangan Bridge.

PLDT and Smart also continue to play an active role in building disaster-resilient Filipino communities through the nationwide rollout of the Ligtas Kit, an all-in-one communications package that extends emergency communications support to communities during disasters. PLDT and Smart also continue to foster a culture of innovation alongside academic and professional excellence through the Smart Wireless Engineering Education Program or SWEEP, the first and longest-running industry-academe linkage in the Philippines, now on its 20th year.

Championing inclusivity, PLDT and Smart, with ATRIEV, continue to train more persons with visual impairment in using the Android Accessibility Suite program to aid them in maximizing the use of their smartphones and help improve the quality of life of the visually impaired sector through inclusive technology. PLDT and Smart also continue to partner with leading tech platforms for ‘eBiznovation’, a digital upskilling-to-ecommerce program for local entrepreneurs, MSMEs and coops, including those in the agricultural and fishery sector. To date, PLDT has trained over 10,000 MSMEs and cooperatives, and successfully onboarded 100 MSMEs to e-commerce platforms Shopee and TikTok Shop.

As part of transforming each employee into a sustainability champion, PLDT continues to conduct educational sessions to ensure a common understanding of ESG. One such program was the Community Learning Series titled “Beyond Going Green: “Sustainability Everyday for Everyone”. The webinar discussed what sustainability is (“debunking the myths”) and how each can support the overall PLDT goal of attaining ESG leadership.

Outlook

PLDT Chairman Manuel V Pangilinan maintains a positive view about PLDT’s performance for the full 2023 amidst a tough economic environment.

“The Company has done reasonably well against a tough inflationary environment, relatively high interest rates, and a slowing economic growth. In this regard, we are guiding full year Core Net Income of ₱34.0 billion, compared with ₱33.3 billion in 2022,” Pangilinan said.

X X X

PLDT INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

As at September 30, 2023 and December 31, 2022

(in million pesos)

|

|

|

|

|

|

|

|

|

|

|

September 30,

2023 |

|

|

December 31,

2022 |

|

|

|

(Unaudited) |

|

|

(Audited) |

|

ASSETS |

|

Noncurrent Assets |

|

|

|

|

|

|

Property and equipment |

|

|

315,436 |

|

|

|

292,745 |

|

Right-of-use assets |

|

|

29,950 |

|

|

|

28,863 |

|

Investments in associates and joint ventures |

|

|

49,246 |

|

|

|

51,546 |

|

Financial assets at fair value through profit or loss |

|

|

567 |

|

|

|

432 |

|

Debt instruments at amortized cost – net of current portion |

|

|

395 |

|

|

|

596 |

|

Investment properties |

|

|

1,008 |

|

|

|

1,015 |

|

Goodwill and intangible assets |

|

|

64,390 |

|

|

|

64,549 |

|

Deferred income tax assets – net |

|

|

13,187 |

|

|

|

17,636 |

|

Derivative financial assets – net of current portion |

|

|

93 |

|

|

|

81 |

|

Prepayments – net of current portion |

|

|

70,519 |

|

|

|

81,053 |

|

Contract assets – net of current portion |

|

|

516 |

|

|

|

662 |

|

Other financial assets – net of current portion |

|

|

3,541 |

|

|

|

3,489 |

|

Other non-financial assets – net of current portion |

|

|

157 |

|

|

|

166 |

|

Total Noncurrent Assets |

|

|

549,005 |

|

|

|

542,833 |

|

Current Assets |

|

|

|

|

|

|

Cash and cash equivalents |

|

|

21,472 |

|

|

|

25,211 |

|

Short-term investments |

|

|

272 |

|

|

|

383 |

|

Trade and other receivables |

|

|

25,269 |

|

|

|

26,255 |

|

Inventories and supplies |

|

|

2,465 |

|

|

|

3,568 |

|

Current portion of contract assets |

|

|

1,475 |

|

|

|

1,571 |

|

Current portion of derivative financial assets |

|

|

591 |

|

|

|

— |

|

Current portion of debt instruments at amortized cost |

|

|

200 |

|

|

|

— |

|

Current portion of prepayments |

|

|

15,145 |

|

|

|

14,696 |

|

Current portion of other financial assets |

|

|

306 |

|

|

|

206 |

|

Current portion of other non-financial assets |

|

|

1,684 |

|

|

|

668 |

|

|

|

|

68,879 |

|

|

|

72,558 |

|

Assets classified as held-for-sale |

|

|

14,829 |

|

|

|

8,771 |

|

Total Current Assets |

|

|

83,708 |

|

|

|

81,329 |

|

TOTAL ASSETS |

|

|

632,713 |

|

|

|

624,162 |

|

|

|

|

|

|

|

|

EQUITY AND LIABILITIES |

|

Equity |

|

|

|

|

|

|

Non-voting serial preferred stock |

|

|

360 |

|

|

|

360 |

|

Voting preferred stock |

|

|

150 |

|

|

|

150 |

|

Common stock |

|

|

1,093 |

|

|

|

1,093 |

|

Treasury stock |

|

|

(6,505 |

) |

|

|

(6,505 |

) |

Capital in excess of par value |

|

|

130,312 |

|

|

|

130,312 |

|

Retained earnings |

|

|

23,300 |

|

|

|

18,799 |

|

Other comprehensive loss |

|

|

(36,570 |

) |

|

|

(35,482 |

) |

Total Equity Attributable to Equity Holders of PLDT |

|

|

112,140 |

|

|

|

108,727 |

|

Noncontrolling interests |

|

|

5,149 |

|

|

|

5,234 |

|

TOTAL EQUITY |

|

|

117,289 |

|

|

|

113,961 |

|

PLDT INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION (continued)

As at September 30, 2023 and December 31, 2022

(in million pesos)

|

|

|

|

|

|

|

|

|

|

|

September 30,

2023 |

|

|

December 31,

2022 |

|

|

|

(Unaudited) |

|

|

(Audited) |

|

Noncurrent Liabilities |

|

|

|

|

|

|

Interest-bearing financial liabilities – net of current portion |

|

|

242,910 |

|

|

|

217,288 |

|

Lease liabilities – net of current portion |

|

|

32,839 |

|

|

|

31,958 |

|

Deferred income tax liabilities – net |

|

|

167 |

|

|

|

204 |

|

Derivative financial liabilities – net of current portion |

|

|

119 |

|

|

|

190 |

|

Customers’ deposits |

|

|

2,230 |

|

|

|

2,313 |

|

Pension and other employee benefits |

|

|

2,348 |

|

|

|

1,745 |

|

Deferred credits and other noncurrent liabilities |

|

|

9,719 |

|

|

|

9,501 |

|

Total Noncurrent Liabilities |

|

|

290,332 |

|

|

|

263,199 |

|

Current Liabilities |

|

|

|

|

|

|

Accounts payable |

|

|

87,379 |

|

|

|

105,187 |

|

Accrued expenses and other current liabilities |

|

|

90,386 |

|

|

|

93,545 |

|

Current portion of interest-bearing financial liabilities |

|

|

29,344 |

|

|

|

32,292 |

|

Current portion of lease liabilities |

|

|

11,121 |

|

|

|

10,477 |

|

Dividends payable |

|

|

1,911 |

|

|

|

1,821 |

|

Current portion of derivative financial liabilities |

|

|

44 |

|

|

|

960 |

|

Income tax payable |

|

|

2,364 |

|

|

|

982 |

|

|

|

|

222,549 |

|

|

|

245,264 |

|

Liabilities associated with assets classified as held-for-sale |

|

|

2,543 |

|

|

|

1,738 |

|

Total Current Liabilities |

|

|

225,092 |

|

|

|

247,002 |

|

TOTAL LIABILITIES |

|

|

515,424 |

|

|

|

510,201 |

|

TOTAL EQUITY AND LIABILITIES |

|

|

632,713 |

|

|

|

624,162 |

|

PLDT INC. AND SUBSIDIARIES

CONSOLIDATED INCOME STATEMENTS

For the Nine Months Ended September 30, 2023 and 2022

(in million pesos, except earnings per common share amounts which are in pesos)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Nine Months Ended |

|

|

For the Three Months Ended |

|

|

|

September 30, |

|

|

September 30, |

|

|

|

2023 |

|

|

2022(1) |

|

|

2023 |

|

|

2022(1) |

|

|

|

(Unaudited) |

|

|

(Unaudited) |

|

CONTINUING OPERATIONS |

|

|

|

|

|

|

|

|

|

|

|

|

REVENUES FROM CONTRACTS WITH CUSTOMERS |

|

|

|

|

|

|

|

|

|

|

|

|

Service revenues |

|

|

149,752 |

|

|

|

145,715 |

|

|

|

50,501 |

|

|

|

49,215 |

|

Non-service revenues |

|

|

6,604 |

|

|

|

6,419 |

|

|

|

1,817 |

|

|

|

2,132 |

|

|

|

|

156,356 |

|

|

|

152,134 |

|

|

|

52,318 |

|

|

|

51,347 |

|

EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative expenses |

|

|

58,889 |

|

|

|

64,737 |

|

|

|

19,056 |

|

|

|

19,934 |

|

Depreciation and amortization |

|

|

36,044 |

|

|

|

52,756 |

|

|

|

12,094 |

|

|

|

12,061 |

|

Cost of sales and services |

|

|

10,902 |

|

|

|

10,059 |

|

|

|

3,212 |

|

|

|

3,654 |

|

Interconnection costs |

|

|

7,463 |

|

|

|

4,557 |

|

|

|

2,743 |

|

|

|

1,709 |

|

Asset impairment |

|

|

3,289 |

|

|

|

3,858 |

|

|

|

1,142 |

|

|

|

1,513 |

|

|

|

|

116,587 |

|

|

|

135,967 |

|

|

|

38,247 |

|

|

|

38,871 |

|

|

|

|

39,769 |

|

|

|

16,167 |

|

|

|

14,071 |

|

|

|

12,476 |

|

OTHER INCOME (EXPENSES) – NET |

|

|

(2,225 |

) |

|

|

19,596 |

|

|

|

(1,301 |

) |

|

|

1,616 |

|

INCOME BEFORE INCOME TAX FROM CONTINUING OPERATIONS |

|

|

37,544 |

|

|

|

35,763 |

|

|

|

12,770 |

|

|

|

14,092 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PROVISION FOR INCOME TAX |

|

|

9,533 |

|

|

|

7,865 |

|

|

|

3,295 |

|

|

|

3,232 |

|

NET INCOME FROM CONTINUING OPERATIONS |

|

|

28,011 |

|

|

|

27,898 |

|

|

|

9,475 |

|

|

|

10,860 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET LOSS FROM DISCONTINUED OPERATIONS |

|

|

(13 |

) |

|

|

(125 |

) |

|

|

16 |

|

|

|

(64 |

) |

NET INCOME |

|

|

27,998 |

|

|

|

27,773 |

|

|

|

9,491 |

|

|

|

10,796 |

|

ATTRIBUTABLE TO: |

|

|

|

|

|

|

|

|

|

|

|

|

Equity holders of PLDT |

|

|

27,879 |

|

|

|

27,499 |

|

|

|

9,428 |

|

|

|

10,713 |

|

Noncontrolling interests |

|

|

119 |

|

|

|

274 |

|

|

|

63 |

|

|

|

83 |

|

|

|

|

27,998 |

|

|

|

27,773 |

|

|

|

9,491 |

|

|

|

10,796 |

|

Earnings Per Share Attributable to Common Equity Holders of PLDT |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

128.83 |

|

|

|

127.08 |

|

|

|

43.56 |

|

|

|

49.52 |

|

Diluted |

|

|

128.83 |

|

|

|

127.08 |

|

|

|

43.56 |

|

|

|

49.52 |

|

Earnings Per Share from Continuing Operations Attributable to

Common Equity Holders of PLDT |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

128.89 |

|

|

|

127.65 |

|

|

|

43.49 |

|

|

|

49.81 |

|

Diluted |

|

|

128.89 |

|

|

|

127.65 |

|

|

|

43.49 |

|

|

|

49.81 |

|

(1) Certain amounts for the nine months ended September 30, 2022 were adjusted to reflect the loss of control of Pacific Global One Aviation Company, Inc., or PG1, effective February 28, 2022, and the discontinued operations of certain ePLDT subsidiaries.

|

|

|

|

|

|

|

|

PLDT Consolidated |

|

|

|

Nine Months |

|

(Php in mn) |

|

2023 |

2022 (a) |

% Change |

|

|

|

|

|

|

|

Total revenues |

|

156,356 |

152,134 |

3% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Service revenues (b) |

|

149,752 |

145,715 |

3% |

|

|

|

|

|

|

|

Expenses (c) |

|

116,587 |

135,967 |

(14%) |

|

|

|

|

|

|

|

EBITDA, exMRP |

|

78,364 |

75,517 |

4% |

|

EBITDA Margin |

|

52% |

52% |

|

|

|

|

|

|

|

|

Income before Income Tax |

|

37,544 |

35,763 |

5% |

|

|

|

|

|

|

|

Provision for Income Tax |

|

9,533 |

7,865 |

21% |

|

|

|

|

|

|

|

Net Income - Attributable to Equity Holders of PLDT |

|

27,879 |

27,499 |

1% |

|

|

|

|

|

|

|

Telco Core Income (d) |

|

26,076 |

25,618 |

2% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) Certain amounts for the nine months ended September 30, 2022 were adjusted to reflect the loss of control of PG1 effective February 28, 2022, and the discontinued operations of certain ePLDT subsidiaries |

(b) Service Revenues, gross of interconnection costs |

|

|

|

|

|

Service Revenues, gross of interconnection costs |

|

149,752 |

145,715 |

3% |

|

Interconnection costs |

|

7,463 |

4,557 |

64% |

|

Service Revenues, net of interconnection costs |

|

142,289 |

141,158 |

1% |

|

|

|

|

|

|

|

(c) Expenses includes Interconnection Costs and MRP expenses |

(d) Net income as adjusted for the net effect of gain/loss on FX, derivative transactions, Asset Impairment on noncurrent assets, MRP and share in Maya Innovations Holdings losses |

This press release may contain some statements which constitute “forward-looking statements” that are subject to a number of risks and opportunities that could affect PLDT’s business and results of operations. Although PLDT believes that expectations reflected in any forward-looking statements are reasonable, it can give no guarantee of future performance, action or events.

For further information, please contact:

|

|

Melissa V. Vergel de Dios |

Cathy Y. Yang |

pldt_ir_center@pldt.com.ph |

cyyang@pldt.com.ph |

About PLDT

PLDT is the Philippines’ largest integrated telco company. Through its principal business groups – from fixed line to wireless – PLDT offers a wide range of telecommunications and digital services across the Philippines’ most extensive fiber optic backbone, and fixed line and cellular networks.

PLDT is listed on the Philippine Stock Exchange (PSE:TEL) and its American Depositary Shares are listed on the New York Stock Exchange (NYSE:PHI). PLDT has one of the largest market capitalizations among Philippine-�listed companies.

Further information can be obtained by visiting www.pldt.com

November 7, 2023

The Philippine Stock Exchange, Inc.

6/F Philippine Stock Exchange Tower

28th Street corner 5th Avenue

Bonifacio Global City, Taguig City

Attention: Ms. Alexandra D. Tom Wong

Officer-in-Charge – Disclosure Department

Securities & Exchange Commission

7907 Makati Avenue, Salcedo Village,

Barangay Bel-Air, Makati City

Attention: Mr. Vicente Graciano P. Felizmenio, Jr.

Director – Markets and Securities Regulation Department

Philippine Dealing & Exchange Corporation

29th Floor, BDO Equitable Tower

8751 Paseo de Roxas, Makati City 1226

Attention: Atty. Marie Rose M. Magallen-Lirio

Head – Issuer Compliance and Disclosure Department

Gentlemen:

In compliance with Section 17.1 (b) of the Securities Regulation Code and SRC Rule 17.1.1.1.3(b).2, PLDT Inc. (the “Company”) hereby submits a copy of SEC Form 17-C regarding the declaration of a cash dividend of ₱12,285,000.00 on all of the outstanding shares of the Company’s Series IV Cumulative Non-Convertible Redeemable Preferred Stock.

Very truly yours,

/s/Mark David P. Martinez

Mark David P. Martinez

Assistant Corporate Secretary

PLDT Inc.

COVER SHEET

|

|

|

|

|

|

|

|

|

|

|

SEC Registration Number |

P |

W |

- |

5 |

5 |

|

|

|

|

|

|

Company Name

Principal Office (No./Street/Barangay/City/Town/Province)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

R |

A |

M |

O |

N |

|

C |

O |

J |

U |

A |

N |

G |

C |

O |

|

B |

U |

I |

L |

D |

I |

N |

G |

|

|

|

|

|

|

|

M |

A |

K |

A |

T |

I |

|

A |

V |

E |

N |

U |

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

M |

A |

K |

A |

T |

I |

|

C |

I |

T |

Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form Type |

|

|

|

Department requiring the report |

|

|

|

Secondary License Type, If Applicable |

|

|

17 |

- |

C |

|

|

|

|

|

|

|

|

M |

S |

R |

D |

|

|

|

|

|

|

|

|

|

|

|

|

|

COMPANY INFORMATION

|

|

|

|

|

|

|

|

Company’s Email Address |

|

Company’s Telephone Number/s |

|

Mobile Number |

|

|

|

|

88168553 |

|

|

|

|

|

|

|

|

|

|

|

No. of Stockholders |

|

Annual Meeting

Month/Day |

|

Fiscal Year

Month/Day |

|

|

11,403 As of September 30, 2023 |

|

Every 2nd Tuesday of June |

|

December 31 |

|

CONTACT PERSON INFORMATION

The designated contact person MUST be an Officer of the Corporation

|

|

|

|

|

|

|

Name of Contact Person |

|

Email Address |

|

Telephone Number/s |

|

Mobile Number |

Marilyn A. Victorio-Aquino |

|

mvaquino@pldt.com.ph |

|

82500254 |

|

|

|

Contact Person’s Address |

MGO Building, Legaspi St. corner Dela Rosa St., Makati City |

Note: In case of death, resignation or cessation of office of the officer designated as contact person, such incident shall be reported to the Commission within thirty (30) calendar days from the occurrence thereof with information and complete contact details of the new contact person designated.

SECURITIES AND EXCHANGE COMMISSION

CURRENT REPORT UNDER SECTION 17

OF THE SECURITIES REGULATION CODE

AND SRC RULE 17.1

1. November 7, 2023

Date of Report (Date of earliest event reported)

2. SEC Identification Number PW-55

3. BIR Tax Identification No. 000-488-793

4. PLDT Inc.

Exact name of issuer as specified in its charter

5. Philippines 6.____________ (SEC Use Only)

Province, country or other jurisdiction Industry Classification Code

of Incorporation

7. Ramon Cojuangco Building, Makati Avenue, Makati City

Address of principal office Postal Code

8. (632) 8250-0254

Issuer's telephone number, including area code

9. Not Applicable

Former name or former address, if changed since last report

10. Securities registered pursuant to Sections 8 and 12 of the Securities Regulation Code and

Sections 4 and 8 of the Revised Securities Act

|

|

Title of Each Class |

Number of Shares of Common Stock Outstanding and Amount of Debt Outstanding |

________________________________________________________________

________________________________________________________________

________________________________________________________________

11. Item 9 (Other Events)

We disclose that at the meeting of the Board of Directors of PLDT Inc. (respectively, the “Board” and the “Company”) held on November 7, 2023, the Board declared a cash dividend of ₱12,285,000.00 on all of the outstanding shares of the Company’s Series IV Cumulative Non-Convertible Redeemable Preferred Stock for the quarter ending December 15, 2023 and payable on December 15, 2023 to the holder of record as of November 22, 2023.

The cash dividend was declared out of the unaudited unrestricted retained earnings of the Company as at June 30, 2023, which are sufficient to cover the total amount of dividends declared.

Pursuant to the requirements of the Securities Regulation Code, the Company has duly authorized and caused this report to be signed on its behalf by the undersigned.

PLDT Inc.

By:

/s/Mark David P. Martinez

Mark David P. Martinez

Assistant Corporate Secretary

November 7, 2023

November 7, 2023

The Philippine Stock Exchange, Inc.

6/F Philippine Stock Exchange Tower

28th Street corner 5th Avenue

Bonifacio Global City, Taguig City

Attention: Ms. Alexandra D. Tom Wong

Officer-in-Charge – Disclosure Department

Securities & Exchange Commission

7907 Makati Avenue, Salcedo Village,

Barangay Bel-Air, Makati City

Attention: Mr. Vicente Graciano P. Felizmenio, Jr.

Director – Markets and Securities Regulation Department

Philippine Dealing & Exchange Corporation

29th Floor, BDO Equitable Tower

8751 Paseo de Roxas, Makati City 1226

Attention: Atty. Marie Rose M. Magallen-Lirio

Head – Issuer Compliance and Disclosure Department

Gentlemen:

In compliance with Section 17.1 (b) of the Securities Regulation Code and SRC Rule 17.1.1.1.3(b).2, PLDT Inc. (the “Company”) hereby submits a copy of SEC Form 17-C regarding the following matters:

1.Confirmation of appointment of officers;

2.Promotion of officers; and

3.Extension of the effective date of retirement of Atty. Marilyn A. Victorio-Aquino, incumbent Director, Chief Legal Counsel, and Corporate Secretary of the Company.

Very truly yours,

/s/Mark David P Martinez

Mark David P. Martinez

Assistant Corporate Secretary

PLDT Inc.

COVER SHEET

|

|

|

|

|

|

|

|

|

|

|

SEC Registration Number |

P |

W |

- |

5 |

5 |

|

|

|

|

|

|

Company Name

Principal Office (No./Street/Barangay/City/Town/Province)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

R |

A |

M |

O |

N |

|

C |

O |

J |

U |

A |

N |

G |

C |

O |

|

B |

U |

I |

L |

D |

I |

N |

G |

|

|

|

|

|

|

|

M |

A |

K |

A |

T |

I |

|

A |

V |

E |

N |

U |

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

M |

A |

K |

A |

T |

I |

|

C |

I |

T |

Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form Type |

|

|

|

Department requiring the report |

|

|

|

Secondary License Type, If Applicable |

|

|

17 |

- |

C |

|

|

|

|

|

|

|

|

M |

S |

R |

D |

|

|

|

|

|

|

|

|

|

|

|

|

|

COMPANY INFORMATION

|

|

|

|

|

|

|

|

Company’s Email Address |

|

Company’s Telephone Number/s |

|

Mobile Number |

|

|

|

|

88168553 |

|

|

|

|

|

|

|

|

|

|

|

No. of Stockholders |

|

Annual Meeting

Month/Day |

|

Fiscal Year

Month/Day |

|

|

11,403 As of September 30, 2023 |

|

Every 2nd Tuesday of June |

|

December 31 |

|

CONTACT PERSON INFORMATION

The designated contact person MUST be an Officer of the Corporation

|

|

|

|

|

|

|

Name of Contact Person |

|

Email Address |

|

Telephone Number/s |

|

Mobile Number |

Marilyn A. Victorio-Aquino |

|

mvaquino@pldt.com.ph |

|

82500254 |

|

|

|

Contact Person’s Address |

MGO Building, Legaspi St. corner Dela Rosa St., Makati City |

Note: In case of death, resignation or cessation of office of the officer designated as contact person, such incident shall be reported to the Commission within thirty (30) calendar days from the occurrence thereof with information and complete contact details of the new contact person designated.

SECURITIES AND EXCHANGE COMMISSION

CURRENT REPORT UNDER SECTION 17

OF THE SECURITIES REGULATION CODE

AND SRC RULE 17.1

Date of Report (Date of earliest event reported)

2.SEC Identification Number PW-55

3.BIR Tax Identification No. 000-488-793

Exact name of issuer as specified in its charter

5.Philippines 6.____________ (SEC Use Only)

Province, country or other jurisdiction Industry Classification Code

of Incorporation

7. Ramon Cojuangco Building, Makati Avenue, Makati City 1200

Address of principal office Postal Code

8. (632) 8250-0254

Issuer's telephone number, including area code

9. Not Applicable

Former name or former address, if changed since last report

10.Securities registered pursuant to Sections 8 and 12 of the Securities Regulation Code and Sections 4 and 8 of the Revised Securities Act

|

|

Title of Each Class |

Number of Shares of Common Stock Outstanding and Amount of Debt Outstanding |

________________________________________________________________

________________________________________________________________

________________________________________________________________

11. Item 4 (Election or Appointment of Director or Officer)

We disclose that at the meeting of the Board of Directors of PLDT Inc. (respectively, the “Board” and the “Company”) held on November 7, 2023:

1.The Board confirmed the appointment of the following new officers to the positions, and effective on the dates, indicated opposite their respective names:

|

|

|

Name |

Position |

Date of Effectivity |

Darlene Stephanie D. Chiong |

First Vice President/Quality Management Head |

April 1, 2023 |

Ivan G. Pablo |

Vice President/People Advisor for Revenue & Operations Groups |

January 1, 2023 |

Ms. Darlene Stephanie D. Chiong

Ms. Darlene Stephanie D. Chiong was appointed as the First Vice President/Quality Management Head of the Company effective April 1, 2023. Prior to her appointment, she served as the Channel Strategy Consultant of Smart Communications, Inc. from October 2022 to March 2023 and as the Director of Business Partnerships of Cobena Business Analytics and Strategy Inc. from February 2018 to August 2022.

Ms. Chiong obtained her Bachelor’s Degree in Legal Management in 1997 from the Ateneo de Manila University.

Mr. Ivan G. Pablo

Mr. Ivan G. Pablo was appointed as the Vice President/People Advisor for Revenue & Operations of the Company effective January 1, 2023. Prior to his appointment, Mr. Pablo served as the HR Director, Head of People Operations and Shared Services for Fujitsu Global Delivery from October 2020 to December 2022.

Mr. Pablo obtained his Bachelor’s Degree in Psychology in 2003 from the Ateneo de Manila University.

2.The Board approved the promotion of the following incumbent officers of the Company to higher officer ranks, and effective on the dates, indicated opposite their respective names:

|

|

|

|

Name |

Former Position |

New Position |

Date of Effectivity |

Anna Karina V. Rodriguez |

Vice President |

First Vice President /Horizon Planning & Integration |

November 7, 2023 |

Loreevi Gail O. Mercado |

Vice President |

First Vice President /Talent |

November 7, 2023 |

3.The Board approved the promotion of the following executives of the Company as officers, to the positions, and on the effective dates, indicated opposite their respective names:

|

|

|

|

Name |

Former Position |

New Position |

Date of Effectivity |

Emerson C. Roque |

Assistant Vice President |

Vice President |

November 7, 2023 |

|

|

|

|

|

|

/Enterprise Insights and Strategic Programs |

|

Jerone H. Tabanera |

Assistant Vice President |

Vice President /Financial Reporting |

November 7, 2023 |

Regina P. Pineda |

Assistant Vice President |

Vice President /Home Acquisition Marketing |

November 7, 2023 |

Rona M. Erfe-Aringay |

Assistant Vice President |

Vice President /People Advisor for Technology |

November 7, 2023 |

Ruby S. Montoya |

Assistant Vice President |

Vice President /Enterprise Strategic Accounts Management |

November 7, 2023 |

4.The Board approved the extension of the effective date of retirement of Atty. Marilyn A. Victorio-Aquino, incumbent Director, Chief Legal Counsel, and Corporate Secretary of the Company from January 1, 2024 to December 31, 2024.

Pursuant to the requirements of the Securities Regulation Code, the Company has duly authorized and caused this report to be signed on its behalf by the undersigned.

-Signature page follows -

PLDT Inc.

By:

/s/Mark David P. Martinez

Mark David P. Martinez

Assistant Corporate Secretary

November 7, 2023

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

PLDT Inc. |

By |

: |

/s/Mark David P. Martinez |

Name |

: |

Mark David P. Martinez |

Title |

: |

Assistant Corporate Secretary |

Date: November 7, 2023

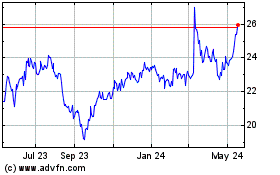

PLDT (NYSE:PHI)

Historical Stock Chart

From Nov 2024 to Dec 2024

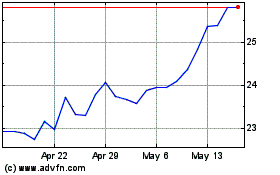

PLDT (NYSE:PHI)

Historical Stock Chart

From Dec 2023 to Dec 2024