PulteGroup, Inc. (NYSE: PHM) (the “Company”) today announced the

pricing for its previously announced tender offers to purchase for

cash up to $300,000,000 aggregate principal amount (the “Aggregate

Tender Cap”) of the Company’s 5.500% Senior Notes due 2026 (the

“2026 Notes”) and 5.000% Senior Notes due 2027 (the “2027 Notes”

and, together with the 2026 Notes, the “Securities”).

Title of Security

CUSIP No./ ISIN No.

Principal Amount

Outstanding

Acceptance Priority

Level(1)

Aggregate Principal Amount

Tendered

Aggregate Principal Amount

Expected to Be Accepted

Early Tender

Payment(2)(3)

U.S. Treasury Reference

Security

Reference Yield(4)

Bloomberg Reference

Page

Fixed Spread

Total Consideration(5)

5.500% Senior Notes due

2026

745867AW1 / US745867AW12

$445,269,000

1

$193,402,000

$193,402,000

$50

4.875% UST due November 30,

2025

5.053%

FIT4

50 bps

$999.04

5.000% Senior Notes due

2027

745867AX9 / US745867AX94

$443,875,000

2

$185,172,000

$106,598,000

$50

4.625% UST due October 15,

2026

4.803%

FIT5

50 bps

$992.64

__________________________________________

1

The offers with respect to the Securities

are subject to the Aggregate Tender Cap of $300,000,000.

2

Per $1,000 principal amount.

3

The Total Consideration for Securities

validly tendered at or prior to 5:00 p.m., New York City time, on

May 30, 2024 (the “Early Tender Date”) and accepted for purchase is

calculated using the applicable Fixed Spread and is inclusive of

the Early Tender Payment.

4

The respective Reference Yields were

determined at 10:00 a.m., New York City time, on May 31, 2024.

5

Payable per each $1,000 principal amount

of each specified series of Securities validly tendered and not

validly withdrawn at or prior to the Early Tender Date and accepted

for purchase, inclusive of the applicable Early Tender Payment.

The tender offers are being made pursuant to an offer to

purchase, dated May 16, 2024 (as it may be amended or supplemented

from time to time, the “Offer to Purchase”), which sets forth the

terms and conditions of the tender offers. Tender offers are

scheduled to expire at 5:00 pm, New York City time, on June 14,

2024. Although the tender offers are scheduled to expire at 5:00

p.m., New York City time, on June 14, 2024, because the aggregate

principal amount of Securities validly tendered and not validly

withdrawn prior to or at the Early Tender Date exceeded the

Aggregate Tender Cap, there will be no Final Settlement Date (as

defined in the Offer to Purchase), and no Securities tendered after

the Early Tender Date will be accepted for purchase. Securities

tendered and not purchased on the Early Settlement Date will be

returned to holders promptly after the Early Settlement Date.

The consideration (the “Total Consideration”) to be paid per

$1,000 principal amount of the Securities of each series validly

tendered and accepted for purchase has been determined in the

manner described in the Offer to Purchase by reference to the

applicable “Fixed Spread” specified in the table above, plus the

applicable Reference Yield specified in the table above. Holders of

the Securities of each series that were validly tendered and not

validly withdrawn at or prior to the Early Tender Date and accepted

for purchase will receive the Total Consideration, which is

inclusive of an amount in cash equal to the amount set forth on the

table above under the heading “Early Tender Payment” (the “Early

Tender Payment”), plus accrued and unpaid interest on the

Securities of each series from the applicable last interest payment

date up to, but not including, the settlement date, payable on such

settlement date. It is anticipated that the settlement date for the

Securities that were validly tendered at or prior to the Early

Tender Date and accepted for purchase by the Company will be June

4, 2024 (the “Early Settlement Date”).

The tender offers are subject to the satisfaction or waiver by

the Company of certain conditions as set forth in the Offer to

Purchase. The tender offers are not conditioned upon the tender of

any minimum principal amount of the Securities, and neither of the

tender offers is conditioned on the consummation of the other

tender offer.

Information Relating to the Tender Offers

J.P. Morgan is the dealer manager for the tender offers.

Investors with questions regarding the tender offers may contact

J.P. Morgan at (866) 834-4666 (toll-free) or (212) 834-7489

(collect). Global Bondholder Services Corporation is the tender and

information agent for the tender offers and can be contacted at

(855) 654-2015 (toll-free) (bankers and brokers can call collect at

(212) 430-3774) or by email at contact@gbsc-usa.com.

None of the Company or its affiliates, their respective boards

of directors, the dealer managers, the tender and information agent

or the trustee with respect to any Securities is making any

recommendation as to whether holders should tender any Securities

in response to any of the tender offers, and neither the Company

nor any such other person has authorized any person to make any

such recommendation. Holders must make their own decision as to

whether to tender any of their Securities, and, if so, the

principal amount of Securities to tender.

Holders are urged to evaluate carefully all information in the

Offer to Purchase, including the documents incorporated by

reference therein, and to consult their own investment and tax

advisors. If a holder holds Securities through a custodian bank,

broker, dealer, commercial bank, trust company or other nominee, it

may contact such custodian or nominee.

The full details of the tender offers are included in the Offer

to Purchase. Holders are strongly encouraged to read carefully the

Offer to Purchase, including materials incorporated by reference

therein, because they contain important information. The Offer to

Purchase may be obtained from Global Bondholder Services

Corporation, free of charge, by calling toll-free at (855) 654-2015

(toll-free) (bankers and brokers can call collect at (212)

430-3774) or by email at contact@gbsc-usa.com.

About PulteGroup

PulteGroup, Inc. (NYSE: PHM), based in Atlanta, Georgia, is one

of America’s largest homebuilding companies with operations in more

than 45 markets throughout the country. Through its brand portfolio

that includes Centex, Pulte Homes, Del Webb, DiVosta Homes,

American West and John Wieland Homes and Neighborhoods, the company

is one of the industry’s most versatile homebuilders able to meet

the needs of multiple buyer groups and respond to changing consumer

demand. PulteGroup’s purpose is building incredible places where

people can live their dreams.

For more information about PulteGroup, Inc. and PulteGroup

brands, go to pultegroup.com; pulte.com; centex.com; delwebb.com;

divosta.com; jwhomes.com; and americanwesthomes.com.

Forward-Looking Statements

This communication contains “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. These forward-looking statements reflect the views of the

Company’s management regarding current expectations and projections

about future events and are based on currently available

information. Actual results could differ materially from those

contained in these forward-looking statements for a variety of

reasons, including, but not limited to, those discussed in the

Company’s Annual Report on Form 10-K for the year ended December

31, 2023, Part I, ITEM 1A, “Risk Factors,” as well as those

discussed in the Offer to Purchase. Risks such as interest rate

changes and the availability of mortgage financing; the impact of

any changes to our strategy in responding to the cyclical nature of

the industry or deteriorations in industry changes or downward

changes in general economic or other business conditions, including

any changes regarding our land positions and the levels of our land

spend; economic changes nationally or in our local markets,

including inflation, deflation, changes in consumer confidence and

preferences and the state of the market for homes in general; labor

supply shortages and the cost of labor; the availability and cost

of land and other raw materials used by us in our homebuilding

operations; a decline in the value of the land and home inventories

we maintain and resulting possible future writedowns of the

carrying value of our real estate assets; competition within the

industries in which we operate; governmental regulation directed at

or affecting the housing market, the homebuilding industry or

construction activities, slow growth initiatives and/or local

building moratoria; the availability and cost of insurance covering

risks associated with our businesses, including warranty and other

legal or regulatory proceedings or claims; damage from improper

acts of persons over whom we do not have control or attempts to

impose liabilities or obligations of third parties on us; weather

related slowdowns; the impact of climate change and related

governmental regulation; adverse capital and credit market

conditions, which may affect our access to and cost of capital; the

insufficiency of our income tax provisions and tax reserves,

including as a result of changing laws or interpretations; the

potential that we do not realize our deferred tax assets; our

inability to sell mortgages into the secondary market; uncertainty

in the mortgage lending industry, including revisions to

underwriting standards and repurchase requirements associated with

the sale of mortgage loans, and related claims against us; risks

related to information technology failures, data security issues

and the effect of cybersecurity incidents and threats; the impact

of negative publicity on sales; failure to retain key personnel;

the impairment of our intangible assets; the disruptions associated

with the COVID-19 pandemic (or another epidemic or pandemic or

similar public threat or fear of such an event), and the measures

taken to address it; and other factors of national, regional and

global scale, including those of a political, economic, business

and competitive nature could have a material adverse effect on our

business, financial condition and results of operations. Other

unknown or unpredictable factors also could have a material adverse

effect on the Company’s business, financial condition and results

of operations. Accordingly, readers should not place undue reliance

on these forward-looking statements. The use of words such as

believe,” “expect,” “intend,” “estimate,” “anticipate,” “plan,”

“project,” “may,” “can,” “could,” “might,” “should,” “will” and

similar expressions, among others, generally identify

forward-looking statements; however, these words are not the

exclusive means of identifying such statements. In addition, any

statements that refer to expectations, projections or other

characterizations of future events or circumstances are

forward-looking statements. These forward-looking statements are

inherently subject to uncertainties, risks and changes in

circumstances that are difficult to predict. Accordingly, you

should not place undue reliance on those statements. The Company is

not under any obligation to, and does not intend to, publicly

update or review any forward-looking statement or other statement

in this communication, the Offer to Purchase or in any related

supplement the Company prepares or authorizes or in any documents

incorporated by reference into the Offer to Purchase, whether as a

result of new information, future events or otherwise, even if

experience or future events make it clear that any expected results

expressed or implied by these forward-looking statements will not

be realized. Please carefully review and consider the various

disclosures made in this communication, the Offer to Purchase and

in the Company’s reports filed with the SEC that attempt to advise

interested parties of the risks and factors that may affect the

Company’s business, prospects and results of operations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240531179451/en/

Jim Zeumer 404-978-6434 jim.zeumer@pultegroup.com

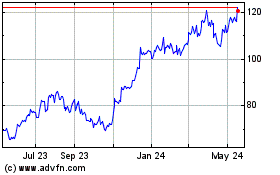

PulteGroup (NYSE:PHM)

Historical Stock Chart

From Dec 2024 to Jan 2025

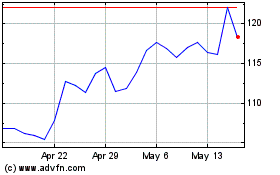

PulteGroup (NYSE:PHM)

Historical Stock Chart

From Jan 2024 to Jan 2025