Form S-4/A - Registration of securities, business combinations: [Amend]

14 February 2025 - 4:23AM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission on February 13, 2025

Registration No. 333-282558

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________

AMENDMENT NO. 5

TO

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

__________________________

RAFAEL HOLDINGS, INC.

(Exact Name of Registrant as Specified in Its Charter)

__________________________

|

Delaware

|

|

6719

|

|

82-2296593

|

|

(State or Other Jurisdiction of Incorporation or Organization)

|

|

(Primary Standard Industrial Classification Code Number)

|

|

(I.R.S. Employer

Identification Number)

|

520 Broad Street

Newark, New Jersey 07102

Telephone: (212) 658-1450

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

__________________________

William Conkling

Chief Executive Officer

520 Broad Street

Newark, New Jersey 07102

Telephone: (212) 658-1450

(Name, address, including zip code, and telephone number, including area code, of agent for service)

__________________________

With copies to:

|

Dov T. Schwell, Esq.

Schwell Wimpfheimer &

Associates LLP

37 W. 39th Street, Suite 505

New York, NY 10018

Telephone: (646) 328-0795

|

|

Alison Newman, Esq.

Sarah Hewitt, Esq.

Fox Rothschild LLP

101 Park Avenue, 17th Floor

New York, New York 10178

Telephone: (212) 878-7997

|

|

N. Scott Fine

Joshua M. Fine

Cyclo Therapeutics, Inc.

6714 NW 16th Street, Suite B

Gainesville, FL 32653

Telephone: (386) 418-8060

|

__________________________

Approximate date of commencement of the proposed sale of the securities to the public: As soon as practicable after this registration statement becomes effective and upon completion of the merger and transactions described in the enclosed proxy statement/prospectus.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, as amended, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

|

|

Large accelerated filer

|

|

☐

|

|

Accelerated filer

|

|

☐

|

| |

|

Non-accelerated filer

|

|

☒

|

|

Smaller reporting company

|

|

☒

|

| |

|

|

|

|

|

Emerging growth company

|

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ☐

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) ☐

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such dates as the Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

This

Pre-Effective Amendment No. 5 (this “Amendment”) to the Registration Statement on Form

S-4 of Rafael Holdings, Inc. (File No. 333-282558) (the

“Registration Statement”) is being filed as an exhibit-only filing to file the opinion of

Schwell Wimpfheimer & Associates LLP and consent for Schwell, Wimpfheimer & Associates (included in its opinion in Exhibit

5.1), filed herewith as Exhibit 5.1 and the consents of Cohn Reznick LLP filed herewith as Exhibits 23.2 and 23.3 (the

“Amendment”). Accordingly, this Amendment consists only of the facing page, this explanatory note, Item 21 of Part II

of the Registration Statement, the signature pages to the Registration Statement, the opinion filed herewith as Exhibit 5.1 and the consents filed herewith as Exhibits 23.2 and 23.3. The

prospectus and the balance of Part II of the Registration Statement are unchanged and have been omitted.

PART II

INFORMATION NOT REQUIRED IN THE PROSPECTUS

EXHIBIT INDEX

|

Exhibit No.

|

|

Description

|

|

2.1†**

|

|

Agreement and Plan of Merger, dated as of August 21, 2024, by and among Rafael, Cyclo, First Merger Sub and Second Merger Sub (attached as Annex A-1 to the joint proxy statement/prospectus, which is part of this registration statement and incorporated herein by reference)(1)

|

|

2.2**

|

|

Amendment to Agreement and Plan of Merger, dated as of December 18, 2024, by and among Rafael, Cyclo, First Merger Sub and Second Merger Sub (attached as Annex A-2 to the joint proxy statement/prospectus, which is part of this registration statement and incorporated herein by reference).

|

|

2.3**

|

|

Amendment No. 2 to Agreement and Plan of Merger, dated as of February 4, 2025, by and among Rafael, Cyclo, First Merger Sub and Second Merger Sub (attached as Annex A-3 to the joint proxy statement/prospectus, which is part of this registration statement and incorporated herein by reference).

|

|

3.1

|

|

Amended and Restated Certificate of Incorporation of Rafael Holdings, Inc.(2)

|

|

3.2

|

|

Third Amended and Restated By-Laws of Rafael Holdings, Inc.(3)

|

|

5.1*

|

|

Opinion of Schwell Wimpfheimer & Associates LLP

|

|

10.1+

|

|

2021 Equity Incentive Plan, as amended and restated(4)

|

|

10.2

|

|

Form of Lock-Up Agreement (attached as Annex B to the joint proxy statement/prospectus, which is part of this registration statement and incorporated herein by reference)(5)

|

|

10.3

|

|

Form of Support Agreement (attached as Annex C to the joint proxy statement/prospectus, which is part of this registration statement and incorporated herein by reference)(6)

|

|

10.4

|

|

Form of Voting Agreement (attached as Annex D to the joint proxy statement/prospectus, which is part of this registration statement and incorporated herein by reference)(7)

|

|

10.5**

|

|

Form of Rafael Public Warrant Agreement

|

|

10.6+**

|

|

Amended and Restated Executive Employment Agreement between Cyclo Therapeutics Inc. and N. Scott Fine, dated January 30, 2025.

|

|

10.7+**

|

|

Amended and Restated Executive Employment Agreement between Cyclo Therapeutics Inc. and Joshua Fine, dated January 30, 2025.

|

|

10.8+**

|

|

Amended and Restated Executive Employment Agreement between Cyclo Therapeutics Inc. and Michael Lisjak, dated January 30, 2025.

|

|

21.1

|

|

Subsidiaries of the Registrant(8)

|

|

23.1*

|

|

Consent for Schwell, Wimpfheimer & Associates (included in its opinion in Exhibit 5.1)

|

|

23.2*

|

|

Consent of CohnReznick LLP as to Rafael Holdings, Inc.

|

|

23.3*

|

|

Consent of CohnReznick LLP as to Cornerstone Pharmaceuticals, Inc.

|

|

23.4**

|

|

Consent of WithumSmith+Brown, PC as to Cyclo Therapeutics, Inc.

|

|

24.1**

|

|

Power of Attorney (included on signature page of this registration statement filed with the SEC on October 9, 2024).

|

|

99.1**

|

|

Opinion of Cassel Salpeter & Co LLC (attached as Annex E to the joint proxy statement/prospectus)

|

|

99.2**

|

|

Form of Proxy Card of Rafael Holdings, Inc.

|

|

99.3**

|

|

Form of Proxy Card of Cyclo Therapeutics, Inc.

|

|

99.4**

|

|

Letter of Transmittal

|

|

99.5**

|

|

Financial Statements of Cornerstone Pharmaceuticals, Inc. (formerly Rafael Pharmaceuticals Inc.) as of and for the six months ended January 31, 2024 and 2023.

|

|

99.6**

|

|

Consent of Cassel Salpeter & Co LLC

|

|

107**

|

|

Filing Fee Table

|

II-1

II-2

SIGNATURES

Pursuant to the requirements of the Securities Act, the registrant has duly caused this Amendment No. 5 to registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Newark, State of New Jersey, on February 13, 2025.

|

|

|

RAFAEL HOLDINGS, INC.

|

| |

|

By:

|

|

/s/ William Conkling

|

| |

|

Name:

|

|

William Conkling

|

| |

|

Title:

|

|

Chief Executive Officer

|

Pursuant to the requirements of the Securities Act of 1933, as amended, this Amendment No. 5 to registration statement has been signed by the following persons in the capacities and on the dates indicated below.

|

Signature

|

|

Titles

|

|

Date

|

|

/s/ William Conkling

|

|

President and Chief Executive Officer

|

|

February 13, 2025

|

|

William Conkling

|

|

(Principal Executive Officer)

|

|

|

|

/s/ David Polinsky

|

|

Chief Financial Officer

|

|

February 13, 2025

|

|

David Polinsky

|

|

(Principal Financial Officer and Principal Accounting Officer)

|

|

|

|

*

|

|

Director, Chairman of the Board and

|

|

February 13, 2025

|

|

Howard S. Jonas

|

|

Executive Chairman

|

|

|

|

*

|

|

Director

|

|

February 13, 2025

|

|

Susan Bernstein

|

|

|

|

|

|

*

|

|

Director

|

|

February 13, 2025

|

|

Stephen Greenberg

|

|

|

|

|

|

*

|

|

Director

|

|

February 13, 2025

|

|

Dr. Mark Stein

|

|

|

|

|

|

*

|

|

Director

|

|

February 13, 2025

|

|

Dr. Michael J. Weiss

|

|

|

|

|

|

* By:

|

|

/s/ William Conkling

|

|

|

| |

|

William Conkling,

Attorney-in-fact

|

|

|

II-3

Exhibit 5.1

February 13, 2025

Rafael Holdings, Inc.

520 Broad Street

Newark, NJ 07102

| |

Re: |

Rafael Holdings, Inc. —Registration Statement on Form

S-4 (Registration No. 333-282558) |

Ladies and Gentlemen:

We have acted as counsel to Rafael Holdings, Inc.,

a Delaware corporation (the “Company”), in connection with the preparation and filing with the Securities and Exchange Commission

(the “Commission”) of a Registration Statement on Form S-4 (Registration No. 333-282558) (the “Registration Statement”),

relating to the registration of shares (the “Registered Shares”) of the Company’s Class B common stock, par value $0.01

per share (the “Class B Common Stock”), warrants to purchase shares of Class B Common Stock (the “Warrants”) and

shares of Class B Common Stock underlying the Warrants (the “Warrant Shares”). The Registered Shares, the Warrants and the

Warrant Shares are to be issued pursuant to the terms of the Agreement and Plan of Merger, dated as of August 21, 2024, as amended as

of December 18, 2024 and February 4, 2025 (the “Merger Agreement”), by and among the Company; Tandem Therapeutics, Inc., a

Nevada corporation and a wholly-owned subsidiary of the Company (“First Merger Sub”); Tandem Therapeutics, LLC, a Nevada limited

liability company and a wholly-owned subsidiary of the Company (“Second Merger Sub”); and Cyclo Therapeutics, Inc., a Nevada

corporation (“Cyclo”) which provides, among other things, for the merger of First Merger Sub with and into Cyclo followed

by the merger of Cyclo (as the surviving company of the merger with First Merger Sub) with and into Second Merger Sub with Second Merger

Sub being the surviving entity (collectively, the “Merger”). As a result of the Merger, Cyclo is intended to become a wholly-owned limited

liability company subsidiary of the Company. The Registered Shares consist of shares of Class B Common Stock issuable at the effective

time of the Merger (each, a “Merger Share”) pursuant to Section 1.5 of the Merger Agreement in exchange for shares of Cyclo

common stock outstanding at the effective time of the Merger. The Warrants consist of outstanding public warrants of Cyclo being amended

to be exercisable for shares of Class B Common Stock and assumed by the Company in the Merger pursuant to Section 1.6 of the Meger Agreement,

and the Warrant Shares consist of shares of Class B Common Stock underlying the Warrants.

In connection with the opinions rendered herein,

we have examined instruments, documents, certificates and records which we have deemed relevant and necessary for the basis of our opinions

hereinafter expressed including (1) the Registration Statement, (2) the Merger Agreement, (3) the Form of Warrant, (4) the Company’s

Amended and Restated Certificate of Incorporation, (5) the Company’s Third Amended and Restated Bylaws, (6) certain resolutions

of the Board of Directors of the Company and (7) such other documents, corporate records, and instruments as we have deemed necessary

solely for purposes of enabling us to render the opinions set forth herein.

In our examination, we have assumed the genuineness

of all signatures, including signatures made and/or transmitted using electronic signature technology (e.g., via DocuSign or similar electronic

signature technology), that any such signed electronic record shall be valid and as effective to bind the party so signing as a paper

copy bearing such party’s handwritten signature, the legal capacity of all natural persons, the authenticity of all documents submitted

to us as originals, the conformity to the original documents of all documents submitted to us as certified, photocopies or digital copies,

the authenticity of the originals of such latter documents, the accuracy and completeness of all documents and records reviewed by us,

the accuracy, completeness and authenticity of each certificate issued by any government official, office or agency and the absence of

change in the information contained therein from the effective date of any such certificate. As to certain matters of fact, both expressed

and implied, we have relied upon representations, statements or certificates of officers of the Company.

On the basis of such examination, we are of the

opinion that:

| 1. | Each Merger Share will be validly issued, fully paid and non-assessable when (i) the Registration Statement, as finally amended (including

any necessary post-effective amendments), shall have become effective under the Securities Act of 1933, as amended (the “Securities

Act”), (ii) the Merger shall have become effective under the Nevada Business Corporation Act (“NBCA”) and (iii) a certificate

representing such Merger Share shall have been duly executed, countersigned, registered and delivered to the person entitled thereto or,

if the Merger Share is to be issued in uncertificated form, the Company’s books shall reflect the issuance of such Merger Share

to the person entitled thereto, in each case in accordance with the terms of the Merger Agreement. |

| 2. | Each Warrant will be validly issued and constitute a binding obligation of the Company when (i) the Registration Statement, as finally

amended (including any necessary post-effective amendments), shall have become effective under the Securities Act, (ii) the Merger shall

have become effective under the NBCA and (iii) a certificate representing such Warrant shall have been duly executed, registered and delivered

to the person entitled thereto or the Warrant Agent (as such term is defined in the Warrant). |

| 3. | Each Warrant Share, if, as and when issued in accordance with the terms of a Warrant, will be validly issued, fully paid and non-assessable

when (i) the Registration Statement, as finally amended (including any necessary post-effective amendments), shall have become effective

under the Securities Act, (ii) the Merger shall have become effective under the NBCA, and (iii) a certificate representing such Warrant

Share shall have been duly executed, countersigned, registered and delivered to the person entitled thereto or, if the Warrant Share is

to be issued in uncertificated form, the Company’s books shall reflect the issuance of such Warrant Share to the person entitled

thereto, in each case in accordance with the terms of the Merger Agreement and the Warrant. |

The opinion set forth above is subject to the following

exceptions, limitations and qualifications: (i) the effect of bankruptcy, insolvency, reorganization, fraudulent conveyance, moratorium

or other similar laws now or hereafter in effect relating to or affecting the rights and remedies of creditors; (ii) the effect of general

principles of equity, whether enforcement is considered in a proceeding in equity or at law, and the discretion of the court before which

any proceeding therefor may be brought; (iii) the unenforceability under certain circumstances under law or court decisions of provisions

providing for the indemnification of, or contribution to, a party with respect to a liability where such indemnification or contribution

is contrary to public policy; and (iv) we express no opinion concerning the enforceability of any waiver of rights or defenses with respect

to stay, extension or usury laws. Our opinion is limited to the General Corporation Law of the State of Delaware and the federal laws

of the United States, and we express no opinion with respect to the laws of any other jurisdiction.

Please note that we are opining only as to the

matters expressly set forth herein, and no opinion should be inferred as to any other matters. This opinion is based upon currently existing

statutes, rules, regulations and judicial decisions, and we disclaim any obligation to advise you of any change in any of these sources

of law or subsequent legal or factual developments which might affect any matters or opinions set forth herein after the Registration

Statement has been declared effective by the Commission.

We hereby consent to the filing of this opinion

with the Commission as an exhibit to the Registration Statement in accordance with the requirements of Item 601(b)(5) of Regulation S-K

under the Securities Act. In giving such consent, we do not hereby admit that we are in the category of persons whose consent is required

under Section 7 of the Securities Act or the rules and regulations of the Commission.

| |

Very truly yours,

|

| |

|

| |

/s/Schwell Wimpfheimer and Associates LLP |

| |

Schwell Wimpfheimer and Associates LLP |

Exhibit 23.2

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in this Amendment No.

5 to the Registration Statement on Form S-4 (File No. 333-282558) and related Prospectus of Rafael Holdings, Inc., of our report dated

November 6, 2024, except for Notes 1 and 27, as to which the date is December 19, 2024, with respect to the consolidated financial statements

of Rafael Holdings, Inc. as of July 31, 2024 and 2023 and for the years then ended, which report is included in the amended Annual Report

on Form 10-K/A of Rafael Holdings, Inc. for the year ended July 31, 2024, filed with the Securities and Exchange Commission on December

20, 2024.

We also consent to the reference to our firm under the caption “Experts.”

/s/ CohnReznick LLP

New York, New York

February

13, 2025

Exhibit 23.3

CONSENT OF INDEPENDENT AUDITORS

We consent to the incorporation by reference in this Amendment

No.5 to the Registration Statement on Form S-4 (File No. 333-282558) and related Prospectus of Rafael Holdings, Inc., of our report

dated May 16, 2024, with respect to the consolidated financial statements of Cornerstone Pharmaceuticals, Inc. as of July 31, 2023 and

2022 and for the years then ended, which report is included in the Form 8-K/A of Rafael Holdings, Inc., filed with the Securities and

Exchange Commission on May 23, 2024. Our audit report includes an emphasis-of-matter paragraph related to Cornerstone Pharmaceuticals,

Inc’s ability to continue as a going concern.

We also consent to the reference to our firm under the caption “Experts.”

/s/

CohnReznick LLP

New York, New York

February 13, 2025

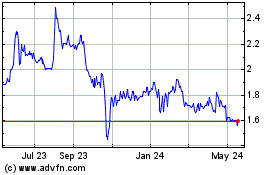

Rafael (NYSE:RFL)

Historical Stock Chart

From Feb 2025 to Mar 2025

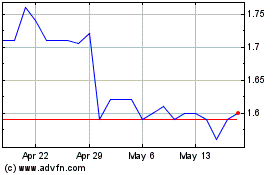

Rafael (NYSE:RFL)

Historical Stock Chart

From Mar 2024 to Mar 2025