- Net income of $9.9 million and diluted

earnings per share of $0.98 -

- Record revenue and ending net receivables

driven by $73 million of sequential portfolio growth -

- Net credit loss rate of 10.8% was 430 basis

points better than the prior-year period -

- Continued expense discipline with an

operating expense ratio of 14.0%, an 80 basis point improvement

year-over-year -

Regional Management Corp. (NYSE: RM), a diversified consumer

finance company, today announced results for the fourth quarter

ended December 31, 2024.

“We are very pleased with how our team and company performed in

the fourth quarter,” said Robert W. Beck, President and Chief

Executive Officer of Regional Management Corp. “We generated strong

bottom-line results of $9.9 million of net income and 98 cents of

diluted earnings per share, a sharp improvement from the prior-year

period. We increased our investment in growth and grew our

portfolio by $73 million sequentially, or 16.0% on an annualized

basis, to nearly $1.9 billion, an all-time high for our company.

The portfolio generated record quarterly revenue of $155 million,

up 9.3% year-over-year. Our fourth quarter total revenue yield was

33.4%, 110 basis points higher than the prior-year period from

increased pricing, a mix shift to higher-margin loans, and

improving credit performance.”

“The loans in our front book continue to perform in line with

our expectations and are delivering at lower loss levels than our

stressed back book vintages,” added Mr. Beck. “Our 30+ day

delinquency and net credit loss rates improved 10 basis points and

110 basis points, respectively, compared to the prior-year period

after adjusting for the impacts of the fourth quarter 2023 special

loan sale. We have also held G&A expenses in check while

investing in growth, allowing us to leverage our improved scale to

increase our returns. Our fourth quarter operating expense ratio

was 14.0%, a 30 basis point improvement from the prior-year period

after adjusting for the fourth quarter 2023 restructuring.”

“The fourth quarter capped a strong 2024 in which we improved

our results from the prior year on nearly all lines,” continued Mr.

Beck. “Looking ahead to 2025, we expect to accelerate our growth

due to our confidence in our credit performance, improving consumer

health, and strengthening macroeconomic conditions. Assuming no

change in our expectations for the economy, we are committed to

both a minimum of 10% portfolio growth and a meaningful improvement

to our net income results in 2025. Over the long-term, we expect

that our returns will continue to normalize with the benefits of a

stable macroeconomic environment, further scale through disciplined

portfolio growth, a well-balanced product mix, and prudent expense

management.”

Fourth Quarter 2024 Highlights

- Net income for the fourth quarter of 2024 was $9.9 million and

diluted earnings per share was $0.98.

- Net income reflects the impact of $72.8 million of sequential

portfolio growth in the quarter, which required a $7.7 million

provision for credit losses, or $6.0 million after tax. The company

is required to reserve for expected lifetime credit losses at

origination of each loan, while the revenue benefits are recognized

over the life of the loan, highlighting the impact of portfolio

growth on our income statement.

- Record net finance receivables as of December 31, 2024 of $1.9

billion, an increase of $121.1 million, or 6.8%, from the

prior-year period, were driven by the strong execution of our

barbell strategy which balances our higher-quality, auto-secured

products with our higher-margin small loan portfolio.

- Large loan net finance receivables of $1.3 billion increased

$62.6 million, or 4.9%, from the prior-year period and represented

70.6% of the total loan portfolio, compared to 71.9% in the

prior-year period.

- Small loan net finance receivables of $554.7 million increased

$61.2 million, or 12.4%, from the prior-year period and represented

29.3% of the total loan portfolio, compared to 27.9% in the

prior-year period.

- Our auto-secured loan portfolio increased by $52.2 million, or

33.8%, from the prior-year period to $206.6 million. The

auto-secured loan portfolio represented 10.9% of the total loan

portfolio, compared to 8.7% in the prior-year period.

- Net finance receivables with annual percentage rates (APRs)

above 36% increased to 18.5% of the portfolio from 15.7% in the

prior-year period, driven by the increase in the higher-margin

small loan portfolio.

- Customer accounts increased by 6.9% from the prior-year

period.

- Record total revenue for the fourth quarter of 2024 of $154.8

million, an increase of $13.2 million, or 9.3%, from the prior-year

period, primarily due to growth in average net finance receivables

and 100 basis points of higher interest and fee yield compared to

the prior-year period.

- The increase in interest and fee yield is attributable to

increased pricing, growth of the higher-margin small loan

portfolio, and improved credit performance.

- Large loan interest and fee yield increased by 80 basis points,

while the interest and fee yield of the small loan portfolio

increased by 110 basis points.

- Total revenue yield increased 80 basis points sequentially and

110 basis points year-over-year.

- Provision for credit losses for the fourth quarter of 2024 was

$57.6 million, a decrease of $11.3 million, or 16.3%, from the

prior-year period, driven by maintaining a tight credit box.

- Annualized net credit losses as a percentage of average net

finance receivables for the fourth quarter of 2024 were 10.8%, a

430 basis point improvement compared to 15.1% in the prior-year

period. The fourth quarter 2024 net credit loss rate is inclusive

of an estimated 20 basis point increase from year-over-year growth

of the higher-rate small loan portfolio. The fourth quarter 2023

net credit loss rate is inclusive of a 320 basis point impact from

$13.9 million of accelerated net credit losses from the sale of

certain non-performing loans.

- The allowance for credit losses was $199.5 million as of

December 31, 2024, or 10.5% of net finance receivables, a 10 basis

point improvement sequentially from 10.6%. The provision for credit

losses for the fourth quarter of 2024 included an allowance for

credit losses increase of $7.4 million, primarily related to

portfolio growth occurring during the fourth quarter of 2024.

- As of December 31, 2024, 30+ day contractual delinquencies

totaled $145.8 million, or 7.7% of net finance receivables, an 80

basis point increase sequentially and from the prior-year period.

The fourth quarter 2024 delinquency rate is inclusive of an

estimated 20 basis point impact from year-over-year growth of the

higher-rate small loan portfolio, while the prior-year period

delinquency rate is inclusive of a 90 basis point benefit from the

sale of certain non-performing loans.

- The delinquency rate of the large loan portfolio was 6.6% as of

the end of the fourth quarter of 2024, a 30 basis point increase

from the prior-year period. The prior-year period delinquency rate

is inclusive of a 60 basis point benefit from the sale of certain

non-performing loans.

- The delinquency rate of the small loan portfolio was 10.4% as

of the end of the fourth quarter of 2024, a 190 basis point

increase from the prior-year period. The fourth quarter delinquency

rate is inclusive of an estimated 130 basis point impact from

year-over-year growth of the higher-rate small loan portfolio,

while the prior-year period delinquency rate is inclusive of a 150

basis point benefit from the sale of certain non-performing

loans.

- General and administrative expenses for the fourth quarter of

2024 were $64.6 million, a decrease of $0.2 million, or 0.2%, from

the prior-year period. The operating expense ratio (annualized

general and administrative expenses as a percentage of average net

finance receivables) for the fourth quarter of 2024 was 14.0%, an

80 basis point improvement from 14.8% in the prior-year period. The

prior-year period included $2.0 million of restructuring expenses,

which increased the prior-year period operating expense ratio by 50

basis points.

- In the fourth quarter of 2024, the company repurchased 104,542

shares of its common stock at a weighted-average price of $33.83

per share under the company's $30 million stock repurchase

program.

First Quarter 2025 Dividend

The company’s Board of Directors has declared a dividend of

$0.30 per common share for the first quarter of 2025. The dividend

will be paid on March 13, 2025 to shareholders of record as of the

close of business on February 20, 2025. The declaration and payment

of any future dividend is subject to the discretion of the Board of

Directors and will depend on a variety of factors, including the

company’s financial condition and results of operations.

Liquidity and Capital Resources

As of December 31, 2024, the company had net finance receivables

of $1.9 billion and debt of $1.5 billion. The debt consisted

of:

- $219.3 million on the company’s $355 million senior revolving

credit facility,

- $96.6 million on the company’s aggregate $425 million revolving

warehouse credit facilities, and

- $1.2 billion through the company’s asset-backed

securitizations.

As of December 31, 2024, the company’s unused capacity to fund

future growth on its revolving credit facilities (subject to the

borrowing base) was $466 million, or 59.8%, and the company had

available liquidity of $136.9 million, including unrestricted cash

on hand and immediate availability to draw down cash from its

revolving credit facilities. As of December 31, 2024, the company’s

fixed-rate debt as a percentage of total debt was 79%, with a

weighted-average coupon of 4.1% and a weighted-average revolving

duration of 1.3 years.

In November, the company closed a $250 million asset-backed

securitization transaction at a weighted-average coupon of 5.34%,

an 85 basis point improvement over the company’s second quarter

2024 securitization transaction. The Class A notes of the

securitization received a top rating of “AAA” from Standard &

Poor’s and Morningstar DBRS, and the company experienced

significant demand across all classes of notes, including from new

investors, again demonstrating the strength of its ABS

platform.

The company had a funded debt-to-equity ratio of 4.1 to 1.0 and

a stockholders’ equity ratio of 18.7%, each as of December 31,

2024. On a non-GAAP basis, the company had a funded

debt-to-tangible equity ratio of 4.4 to 1.0, as of December 31,

2024. Please refer to the reconciliations of non-GAAP measures to

comparable GAAP measures included at the end of this press

release.

Conference Call Information

Regional Management Corp. will host a conference call and

webcast today at 5:00 PM ET to discuss these results.

The dial-in number for the conference call is (855) 327-6837

(toll-free) or (631) 891-4304 (direct). Please dial the number 10

minutes prior to the scheduled start time.

*** A supplemental slide presentation will be made available

on Regional’s website prior to the earnings call at

www.RegionalManagement.com. ***

In addition, a live webcast of the conference call will be

available on Regional’s website at www.RegionalManagement.com.

A webcast replay of the call will be available at

www.RegionalManagement.com for one year following the call.

About Regional Management Corp.

Regional Management Corp. (NYSE: RM) is a diversified consumer

finance company that provides attractive, easy-to-understand

installment loan products primarily to customers with limited

access to consumer credit from banks, thrifts, credit card

companies, and other lenders. Regional Management operates under

the name “Regional Finance” online and in branch locations in 19

states across the United States. Most of its loan products are

secured, and each is structured on a fixed-rate, fixed-term basis

with fully amortizing equal monthly installment payments, repayable

at any time without penalty. Regional Management sources loans

through its multiple channel platform, which includes branches,

centrally managed direct mail campaigns, digital partners, and its

consumer website. For more information, please visit

www.RegionalManagement.com.

Forward-Looking Statements

This press release may contain various “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements are not statements

of historical fact but instead represent Regional Management

Corp.’s expectations or beliefs concerning future events.

Forward-looking statements include, without limitation, statements

concerning financial outlooks or future plans, objectives, goals,

projections, strategies, events, or performance, and underlying

assumptions and other statements related thereto. Words such as

“may,” “will,” “should,” “likely,” “anticipates,” “expects,”

“intends,” “plans,” “projects,” “believes,” “estimates,” “outlook,”

and similar expressions may be used to identify these

forward-looking statements. Such forward-looking statements speak

only as of the date on which they were made and are about matters

that are inherently subject to risks and uncertainties, many of

which are outside of the control of Regional Management. As a

result, actual performance and results may differ materially from

those contemplated by these forward-looking statements. Therefore,

investors should not place undue reliance on forward-looking

statements.

Factors that could cause actual results or performance to differ

from the expectations expressed or implied in forward-looking

statements include, but are not limited to, the following: managing

growth effectively, implementing Regional Management’s growth

strategy, and opening new branches as planned; Regional

Management’s convenience check strategy; Regional Management’s

policies and procedures for underwriting, processing, and servicing

loans; Regional Management’s ability to collect on its loan

portfolio; Regional Management’s insurance operations; exposure to

credit risk and repayment risk, which risks may increase in light

of adverse or recessionary economic conditions; the implementation

of evolving underwriting models and processes, including as to the

effectiveness of Regional Management's custom scorecards; changes

in the competitive environment in which Regional Management

operates or a decrease in the demand for its products; the

geographic concentration of Regional Management’s loan portfolio;

the failure of third-party service providers, including those

providing information technology products; changes in economic

conditions in the markets Regional Management serves, including

levels of unemployment and bankruptcies; the ability to achieve

successful acquisitions and strategic alliances; the ability to

make technological improvements as quickly as competitors; security

breaches, cyber-attacks, failures in information systems, or

fraudulent activity; the ability to originate loans; reliance on

information technology resources and providers, including the risk

of prolonged system outages; changes in current revenue and expense

trends, including trends affecting delinquencies and credit losses;

any future public health crises, including the impact of such

crisis on our operations and financial condition; changes in

operating and administrative expenses; the departure, transition,

or replacement of key personnel; the ability to timely and

effectively implement, transition to, and maintain the necessary

information technology systems, infrastructure, processes, and

controls to support Regional Management’s operations and

initiatives; changes in interest rates; existing sources of

liquidity may become insufficient or access to these sources may

become unexpectedly restricted; exposure to financial risk due to

asset-backed securitization transactions; risks related to

regulation and legal proceedings, including changes in laws or

regulations or in the interpretation or enforcement of laws or

regulations; changes in accounting standards, rules, and

interpretations and the failure of related assumptions and

estimates; the impact of changes in tax laws and guidance,

including the timing and amount of revenues that may be recognized;

risks related to the ownership of Regional Management’s common

stock, including volatility in the market price of shares of

Regional Management’s common stock; the timing and amount of future

cash dividend payments; and anti-takeover provisions in Regional

Management’s charter documents and applicable state law.

The foregoing factors and others are discussed in greater detail

in Regional Management’s filings with the Securities and Exchange

Commission. Regional Management will not update or revise

forward-looking statements to reflect events or circumstances after

the date of this press release or to reflect the occurrence of

unanticipated events or the non-occurrence of anticipated events,

whether as a result of new information, future developments, or

otherwise, except as required by law. Regional Management is not

responsible for changes made to this document by wire services or

Internet services.

Regional Management Corp. and

Subsidiaries

Consolidated Statements of

Income

(Unaudited)

(dollars in thousands, except

per share amounts)

Better (Worse)

Better (Worse)

4Q 24

4Q 23

$

%

FY 24

FY 23

$

%

Revenue

Interest and fee income

$

138,246

$

126,190

$

12,056

9.6

%

$

528,894

$

489,698

$

39,196

8.0

%

Insurance income, net

11,792

10,985

807

7.3

%

40,695

44,529

(3,834

)

(8.6

)%

Other income

4,794

4,484

310

6.9

%

18,914

17,172

1,742

10.1

%

Total revenue

154,832

141,659

13,173

9.3

%

588,503

551,399

37,104

6.7

%

Expenses

Provision for credit losses

57,626

68,885

11,259

16.3

%

212,200

220,034

7,834

3.6

%

Personnel

40,549

42,024

1,475

3.5

%

153,789

156,872

3,083

2.0

%

Occupancy

6,748

6,268

(480

)

(7.7

)%

25,823

25,029

(794

)

(3.2

)%

Marketing

4,777

4,474

(303

)

(6.8

)%

19,006

15,774

(3,232

)

(20.5

)%

Other

12,572

12,030

(542

)

(4.5

)%

49,080

45,444

(3,636

)

(8.0

)%

Total general and administrative

64,646

64,796

150

0.2

%

247,698

243,119

(4,579

)

(1.9

)%

Interest expense

19,805

17,510

(2,295

)

(13.1

)%

74,530

67,463

(7,067

)

(10.5

)%

Income (loss) before income taxes

12,755

(9,532

)

22,287

233.8

%

54,075

20,783

33,292

160.2

%

Income taxes

2,841

(1,958

)

(4,799

)

(245.1

)%

12,848

4,825

(8,023

)

(166.3

)%

Net income (loss)

$

9,914

$

(7,574

)

$

17,488

230.9

%

$

41,227

$

15,958

$

25,269

158.3

%

Net income (loss) per common share:

Basic

$

1.02

$

(0.80

)

$

1.82

227.5

%

$

4.28

$

1.70

$

2.58

151.8

%

Diluted

$

0.98

$

(0.80

)

$

1.78

222.5

%

$

4.14

$

1.66

$

2.48

149.4

%

Weighted-average common shares

outstanding:

Basic

9,691

9,437

(254

)

(2.7

)%

9,640

9,398

(242

)

(2.6

)%

Diluted

10,128

9,437

(691

)

(7.3

)%

9,957

9,593

(364

)

(3.8

)%

Return on average assets (annualized)

2.1

%

(1.7

)%

2.3

%

0.9

%

Return on average equity (annualized)

11.1

%

(9.3

)%

12.0

%

5.0

%

Regional Management Corp. and

Subsidiaries

Consolidated Balance

Sheets

(Unaudited)

(dollars in thousands, except

par value amounts)

Increase (Decrease)

4Q 24

4Q 23

$

%

Assets

Cash

$

3,951

$

4,509

$

(558

)

(12.4

)%

Net finance receivables

1,892,535

1,771,410

121,125

6.8

%

Unearned insurance premiums

(48,068

)

(47,892

)

(176

)

(0.4

)%

Allowance for credit losses

(199,500

)

(187,400

)

(12,100

)

(6.5

)%

Net finance receivables, less unearned

insurance premiums and allowance for credit losses

1,644,967

1,536,118

108,849

7.1

%

Restricted cash

131,684

124,164

7,520

6.1

%

Lease assets

38,442

34,303

4,139

12.1

%

Intangible assets

24,524

15,846

8,678

54.8

%

Restricted available-for-sale

investments

21,712

22,740

(1,028

)

(4.5

)%

Property and equipment

13,677

13,787

(110

)

(0.8

)%

Deferred tax assets, net

9,286

13,641

(4,355

)

(31.9

)%

Other assets

20,866

29,419

(8,553

)

(29.1

)%

Total assets

$

1,909,109

$

1,794,527

$

114,582

6.4

%

Liabilities and Stockholders’

Equity

Liabilities:

Debt

$

1,478,336

$

1,399,814

$

78,522

5.6

%

Unamortized debt issuance costs

(6,338

)

(4,578

)

(1,760

)

(38.4

)%

Net debt

1,471,998

1,395,236

76,762

5.5

%

Lease liabilities

40,579

36,576

4,003

10.9

%

Accounts payable and accrued expenses

39,454

40,442

(988

)

(2.4

)%

Total liabilities

1,552,031

1,472,254

79,777

5.4

%

Stockholders’ equity:

Preferred stock ($0.10 par value, 100,000

shares authorized, none issued or outstanding)

—

—

—

—

Common stock ($0.10 par value, 1,000,000

shares authorized, 14,921 shares issued and 10,010 shares

outstanding at December 31, 2024 and 14,566 shares issued and 9,759

shares outstanding at December 31, 2023)

1,492

1,457

35

2.4

%

Additional paid-in capital

130,725

121,752

8,973

7.4

%

Retained earnings

378,482

349,579

28,903

8.3

%

Accumulated other comprehensive income

(loss)

62

(372

)

434

116.7

%

Treasury stock (4,911 shares at December

31, 2024 and 4,807 shares at December 31, 2023)

(153,683

)

(150,143

)

(3,540

)

(2.4

)%

Total stockholders’ equity

357,078

322,273

34,805

10.8

%

Total liabilities and stockholders’

equity

$

1,909,109

$

1,794,527

$

114,582

6.4

%

Regional Management Corp. and

Subsidiaries

Selected Financial

Data

(Unaudited)

(dollars in thousands, except

per share amounts)

Net Finance

Receivables

4Q 24

3Q 24

QoQ $ Inc (Dec)

QoQ % Inc (Dec)

4Q 23

YoY $ Inc (Dec)

YoY % Inc (Dec)

Large loans

$

1,336,780

$

1,293,410

$

43,370

3.4

%

$

1,274,137

$

62,643

4.9

%

Small loans

554,686

524,826

29,860

5.7

%

493,473

61,213

12.4

%

Retail loans

1,069

1,520

(451

)

(29.7

)%

3,800

(2,731

)

(71.9

)%

Total net finance receivables

$

1,892,535

$

1,819,756

$

72,779

4.0

%

$

1,771,410

$

121,125

6.8

%

Number of branches at period end

344

340

4

1.2

%

346

(2

)

(0.6

)%

Net finance receivables per branch

$

5,502

$

5,352

$

150

2.8

%

$

5,120

$

382

7.5

%

Averages and Yields

4Q 24

3Q 24

4Q 23

Average Net Finance

Receivables

Average Yield (1)

Average Net Finance

Receivables

Average Yield (1)

Average Net Finance

Receivables

Average Yield (1)

Large loans

$

1,315,375

26.8

%

$

1,279,720

26.7

%

$

1,273,268

26.0

%

Small loans

536,163

37.4

%

511,294

37.8

%

477,615

36.3

%

Retail loans

1,300

15.4

%

1,795

16.3

%

4,356

16.3

%

Total interest and fee yield

$

1,852,838

29.8

%

$

1,792,809

29.9

%

$

1,755,239

28.8

%

Total revenue yield

$

1,852,838

33.4

%

$

1,792,809

32.6

%

$

1,755,239

32.3

%

(1) Annualized interest and fee income as

a percentage of average net finance receivables.

Components of Increase in

Interest and Fee Income

4Q 24 Compared to 4Q

23

Increase (Decrease)

Volume

Rate

Volume & Rate

Total

Large loans

$

2,733

$

2,599

$

86

$

5,418

Small loans

5,317

1,290

158

6,765

Retail loans

(124

)

(9

)

6

(127

)

Product mix

(909

)

894

15

—

Total increase in interest and fee

income

$

7,017

$

4,774

$

265

$

12,056

Loans Originated (1)

4Q 24

3Q 24

QoQ $ Inc (Dec)

QoQ % Inc (Dec)

4Q 23

YoY $ Inc (Dec)

YoY % Inc (Dec)

Large loans

$

281,632

$

251,563

$

30,069

12.0

%

$

233,415

$

48,217

20.7

%

Small loans

194,268

174,632

19,636

11.2

%

174,394

19,874

11.4

%

Total loans originated

$

475,900

$

426,195

$

49,705

11.7

%

$

407,809

$

68,091

16.7

%

(1) Represents the principal balance of

loan originations and refinancings.

Other Key Metrics

4Q 24

3Q 24

4Q 23

Net credit losses

$

50,226

$

47,649

$

66,385

Percentage of average net finance

receivables (annualized)

10.8

%

10.6

%

15.1

%

Provision for credit losses

$

57,626

$

54,349

$

68,885

Percentage of average net finance

receivables (annualized)

12.4

%

12.1

%

15.7

%

Percentage of total revenue

37.2

%

37.1

%

48.6

%

General and administrative expenses

$

64,646

$

62,468

$

64,796

Percentage of average net finance

receivables (annualized)

14.0

%

13.9

%

14.8

%

Percentage of total revenue

41.8

%

42.7

%

45.7

%

Same store results (1):

Net finance receivables at period-end

$

1,880,251

$

1,815,187

$

1,718,367

Net finance receivable growth rate

6.1

%

3.7

%

1.5

%

Number of branches in calculation

337

337

333

(1)

Same store sales reflect the change in

year-over-year sales for the comparable branch base. The comparable

branch base includes those branches open for at least one year.

Contractual

Delinquency

4Q 24

3Q 24

4Q 23

Allowance for credit losses

$

199,500

10.5

%

$

192,100

10.6

%

$

187,400

10.6

%

Current

1,590,381

84.0

%

1,529,171

84.1

%

1,493,341

84.3

%

1 to 29 days past due

156,312

8.3

%

164,568

9.0

%

155,196

8.8

%

Delinquent accounts:

30 to 59 days

36,948

1.9

%

35,300

1.9

%

34,756

1.9

%

60 to 89 days

35,242

1.9

%

27,704

1.5

%

31,212

1.8

%

90 to 119 days

28,085

1.5

%

23,964

1.4

%

27,107

1.5

%

120 to 149 days

23,987

1.3

%

22,544

1.2

%

15,317

0.9

%

150 to 179 days

21,580

1.1

%

16,505

0.9

%

14,481

0.8

%

Total contractual delinquency

$

145,842

7.7

%

$

126,017

6.9

%

$

122,873

6.9

%

Total net finance receivables

$

1,892,535

100.0

%

$

1,819,756

100.0

%

$

1,771,410

100.0

%

1 day and over past due

$

302,154

16.0

%

$

290,585

15.9

%

$

278,069

15.7

%

Contractual Delinquency by

Product

4Q 24

3Q 24

4Q 23

Large loans

$

88,054

6.6

%

$

76,435

5.9

%

$

80,136

6.3

%

Small loans

57,595

10.4

%

49,351

9.4

%

42,151

8.5

%

Retail loans

193

18.1

%

231

15.2

%

586

15.4

%

Total contractual delinquency

$

145,842

7.7

%

$

126,017

6.9

%

$

122,873

6.9

%

Income Statement Quarterly

Trend

4Q 23

1Q 24

2Q 24

3Q 24

4Q 24

QoQ $ B(W)

YoY $ B(W)

Revenue

Interest and fee income

$

126,190

$

128,818

$

127,898

$

133,932

$

138,246

$

4,314

$

12,056

Insurance income, net

10,985

10,974

10,507

7,422

11,792

4,370

807

Other income

4,484

4,516

4,620

4,984

4,794

(190

)

310

Total revenue

141,659

144,308

143,025

146,338

154,832

8,494

13,173

Expenses

Provision for credit losses

68,885

46,423

53,802

54,349

57,626

(3,277

)

11,259

Personnel

42,024

37,820

37,097

38,323

40,549

(2,226

)

1,475

Occupancy

6,268

6,375

6,149

6,551

6,748

(197

)

(480

)

Marketing

4,474

4,315

4,836

5,078

4,777

301

(303

)

Other

12,030

11,938

12,054

12,516

12,572

(56

)

(542

)

Total general and administrative

64,796

60,448

60,136

62,468

64,646

(2,178

)

150

Interest expense

17,510

17,504

17,865

19,356

19,805

(449

)

(2,295

)

Income (loss) before income taxes

(9,532

)

19,933

11,222

10,165

12,755

2,590

22,287

Income taxes

(1,958

)

4,728

2,777

2,502

2,841

(339

)

(4,799

)

Net income (loss)

$

(7,574

)

$

15,205

$

8,445

$

7,663

$

9,914

$

2,251

$

17,488

Net income (loss) per common share:

Basic

$

(0.80

)

$

1.59

$

0.88

$

0.79

$

1.02

$

0.23

$

1.82

Diluted

$

(0.80

)

$

1.56

$

0.86

$

0.76

$

0.98

$

0.22

$

1.78

Weighted-average shares outstanding:

Basic

9,437

9,569

9,613

9,683

9,691

(8

)

(254

)

Diluted

9,437

9,746

9,863

10,090

10,128

(38

)

(691

)

Balance Sheet & Other Key

Metrics Quarterly Trends

4Q 23

1Q 24

2Q 24

3Q 24

4Q 24

QoQ $ Inc (Dec)

YoY $ Inc (Dec)

Total assets

$

1,794,527

$

1,756,748

$

1,789,052

$

1,821,831

$

1,909,109

$

87,278

$

114,582

Net finance receivables

$

1,771,410

$

1,744,286

$

1,773,743

$

1,819,756

$

1,892,535

$

72,779

$

121,125

Allowance for credit losses

$

187,400

$

187,100

$

185,400

$

192,100

$

199,500

$

7,400

$

12,100

Debt

$

1,399,814

$

1,358,795

$

1,378,449

$

1,395,892

$

1,478,336

$

82,444

$

78,522

Interest and fee yield (annualized)

28.8

%

29.3

%

29.3

%

29.9

%

29.8

%

(0.1

)%

1.0

%

Efficiency ratio (1)

45.7

%

41.9

%

42.0

%

42.7

%

41.8

%

(0.9

)%

(3.9

)%

Operating expense ratio (2)

14.8

%

13.7

%

13.8

%

13.9

%

14.0

%

0.1

%

(0.8

)%

30+ contractual delinquency

6.9

%

7.1

%

6.9

%

6.9

%

7.7

%

0.8

%

0.8

%

Net credit loss ratio (3)

15.1

%

10.6

%

12.7

%

10.6

%

10.8

%

0.2

%

(4.3

)%

Book value per share

$

33.02

$

34.10

$

33.96

$

34.72

$

35.67

$

0.95

$

2.65

(1)

General and administrative expenses as a

percentage of total revenue.

(2)

Annualized general and administrative

expenses as a percentage of average net finance receivables.

(3)

Annualized net credit losses as a

percentage of average net finance receivables.

Averages and Yields

FY 24

FY 23

Average Net Finance

Receivables

Average Yield

Average Net Finance

Receivables

Average Yield

Large loans

$

1,278,683

26.4

%

$

1,242,529

26.1

%

Small loans

507,584

37.6

%

462,116

35.6

%

Retail loans

2,214

16.1

%

6,522

17.3

%

Total interest and fee yield

$

1,788,481

29.6

%

$

1,711,167

28.6

%

Total revenue yield

$

1,788,481

32.9

%

$

1,711,167

32.2

%

Components of Increase in

Interest and Fee Income

FY 24 Compared to FY

23

Increase (Decrease)

Volume

Rate

Volume & Rate

Total

Large loans

$

9,424

$

4,262

$

124

$

13,810

Small loans

16,202

9,065

892

26,159

Retail loans

(746

)

(80

)

53

(773

)

Product mix

(2,754

)

3,086

(332

)

—

Total increase in interest and fee

income

$

22,126

$

16,333

$

737

$

39,196

Loans Originated (1)

FY 24

FY 23

FY $ Inc (Dec)

FY % Inc (Dec)

Large loans

$

973,048

$

928,499

$

44,549

4.8

%

Small loans

681,463

606,412

75,051

12.4

%

Retail loans

—

146

(146

)

(100.0

)%

Total loans originated

$

1,654,511

$

1,535,057

$

119,454

7.8

%

(1) Represents the principal balance of

loan originations and refinancings.

Other Key Metrics

FY 24

FY 23

Net credit losses

$

200,100

$

211,434

Percentage of average net finance

receivables

11.2

%

12.4

%

Provision for credit losses

$

212,200

$

220,034

Percentage of average net finance

receivables

11.9

%

12.9

%

Percentage of total revenue

36.1

%

39.9

%

General and administrative expenses

$

247,698

$

243,119

Percentage of average net finance

receivables

13.8

%

14.2

%

Percentage of total revenue

42.1

%

44.1

%

Non-GAAP Financial Measures

In addition to financial measures presented in accordance with

generally accepted accounting principles (“GAAP”), this press

release contains certain non-GAAP financial measures. The company’s

management utilizes non-GAAP measures as additional metrics to aid

in, and enhance, its understanding of the company’s financial

results. Tangible equity and the funded debt-to-tangible equity

ratio are non-GAAP measures that adjust GAAP measures to exclude

intangible assets. Management uses these equity measures to

evaluate and manage the company’s capital and leverage position.

The company also believes that these equity measures are commonly

used in the financial services industry and provide useful

information to users of the company’s financial statements in the

evaluation of its capital and leverage position.

This non-GAAP financial information should be considered in

addition to, not as a substitute for or superior to, measures of

financial performance prepared in accordance with GAAP. In

addition, the company’s non-GAAP measures may not be comparable to

similarly titled non-GAAP measures of other companies. The

following tables provide a reconciliation of GAAP measures to

non-GAAP measures.

4Q 24

Debt

$

1,478,336

Total stockholders' equity

357,078

Less: Intangible assets

24,524

Tangible equity (non-GAAP)

$

332,554

Funded debt-to-equity ratio

4.1

x

Funded debt-to-tangible equity ratio

(non-GAAP)

4.4

x

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250205247580/en/

Investor Relations Garrett Edson, (203) 682-8331

investor.relations@regionalmanagement.com

Regional Management (NYSE:RM)

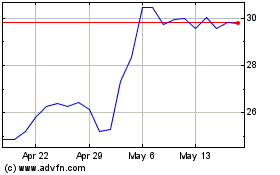

Historical Stock Chart

From Jan 2025 to Feb 2025

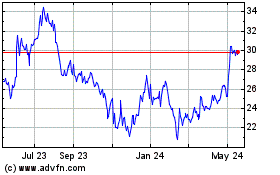

Regional Management (NYSE:RM)

Historical Stock Chart

From Feb 2024 to Feb 2025