false000169903900016990392025-03-032025-03-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): March 3, 2025

| | | | | | | | |

| Ranger Energy Services, Inc. |

| (Exact Name of Registrant as Specified in Charter) |

| | |

| Delaware | 001-38183 | 81-5449572 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | |

10350 Richmond, Suite 550 Houston, Texas 77042 (Address of Principal Executive Offices) |

| | |

| Registrant’s telephone number, including area code: (713) 935-8900 |

Check the appropriate box below if the Form 8K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A Common Stock, $0.01 par value | | RNGR | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the ExchangexActx☐

Item 2.02 Results of Operations and Financial Condition

On March 3, 2025, Ranger Energy Services, Inc. (the “Company”) announced its results for the quarter ending December 31, 2024. A copy of the Company’s press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and incorporated by reference herein.

Item 8.01 Other Events

On March 3, 2025, the Board of Directors declared a quarterly cash dividend of $0.06 per share payable March 28, 2025 to common stockholders of record at the close of business on March 14, 2024. The declaration of any future dividends is subject to the Board of Directors’ discretion and approval.

Item 9.01 Financial Statements and Exhibits

Exhibits. | | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | | |

| 104 | | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

THE INFORMATION FURNISHED UNDER ITEM 2.02 OF THIS CURRENT REPORT, INCLUDING EXHIBIT 99.1 ATTACHED HERETO, SHALL NOT BE DEEMED “FILED” FOR THE PURPOSES OF SECTION 18 OF THE SECURITIES AND EXCHANGE ACT OF 1934, NOR SHALL IT BE DEEMED INCORPORATED BY REFERENCE INTO ANY REGISTRATION STATEMENT OR OTHER FILING PURSUANT TO THE SECURITIES ACT OF 1933, EXCEPT ASxOTHERWISExEXPRESSLYxSTATEDxINxSUCHxFILING.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. | | | | | | | | |

| Ranger Energy Services, Inc. | | |

| | |

| | |

| /s/ Melissa Cougle | | March 3, 2025 |

| Melissa Cougle | | Date |

| Chief Financial Officer | | |

| (Principal Financial Officer) | | |

Ranger Energy Services, Inc. Announces Q4 2024 and Full Year 2024 Results

HOUSTON, TX--(March 3, 2025) - Ranger Energy Services, Inc. (NYSE: RNGR) (“Ranger” or the “Company”) announced today its fourth quarter and full year 2024 results, highlighting record performance in High-Specification Rigs, growth in Ancillary Services, and significant shareholder returns for the year through both dividends and share repurchases. Ranger also announced an increase of its quarterly dividend by 20% to $0.06 per share, reflecting continued confidence in the underlying strength and future cash flow of the business.

.

Financial & Operational Highlights

–Full year 2024 revenue of $571.1 million and net income of $18.4 million, or $0.81 per fully diluted share

–Full year 2024 Adjusted EBITDA(1) of $78.9 million with 13.8% Adjusted EBITDA margin compared to $84.4 million for full year 2023 with 13.3% Adjusted EBITDA margin

–Adjusted EBITDA(1) of $21.9 million in the fourth quarter with 15.3% Adjusted EBITDA margin compared to $25.1 million in the third quarter of 2024 and $18.4 million in fourth quarter of 2023

–Full year 2024 Free Cash Flow(2) of $50.4 million, or $2.24 per share, with fourth quarter and year end cash of $40.9 million with $112.1 million of total liquidity

–Returned over 40% of 2024 Free Cash Flow(2) through dividends and repurchases far exceeding minimum commitment

–Increase of 20% in the Company’s dividend to $0.06 per share going forward, reflecting continued confidence in the underlying strength and future cash flow of the business

–High-Specification Rigs delivered record performance reaching new highs and reinforcing Ranger’s leadership in the sector

1 “Adjusted EBITDA” is not presented in accordance with generally accepted accounting principles in the United States (“U.S. GAAP”). The Company defines Adjusted EBITDA as net income or loss before net income expense, income tax provision or benefit, depreciation and amortization, equity-based compensation, acquisition-related, severance and reorganization costs, gain or loss on disposal of property and equipment, and certain other non-cash items that we do not view as indicative of our ongoing performance. A Non-GAAP supporting schedule is included with the statements and schedules attached to this press release and can also be found on the Company's website at: www.rangerenergy.com.

2 “Free Cash Flow” is not presented in accordance with U.S. GAAP and should be considered in addition to, rather than as a substitute for, net income as a measure of our performance or net cash provided by operating activities as a measure of our liquidity. The Company defines Free Cash Flow as net cash provided by operating activities before purchase of property and equipment. A Non-GAAP supporting schedule is included with the statements and schedules attached to this press release and can also be found on the Company's website at www.rangerenergy.com.

–Ancillary Services expanded profitability meaningfully with strong growth in Plugging and Abandonment (P&A), Rentals and Torrent underpinned by improved execution

Management Comments

Stuart Bodden, Ranger’s Chief Executive Officer, commented, “Ranger again demonstrated its resilience and execution excellence, with strong performance despite the challenges presented in the broader market. We posted our highest fourth quarter profitability ever, reflecting the ongoing strength and potential of our Company in spite of a challenging market backdrop the past two years. In addition to record profitability levels, we also achieved our best Total Recordable Incident Rate (“TRIR”) on record. Our achievements in 2025 prove the effectiveness of our production-focused business model with record revenue levels in our core business and supporting service lines in the face of declining rig and frac crew counts. This performance allowed us to pursue aggressive stock buybacks at very attractive prices and allocate capital to high return projects. Our confidence in the business and our commitment to capital returns is best illustrated by the announcement today of an increase in our quarterly dividend.

The Ranger team is able to achieve new heights consistently when we live our “Leads the Way” mantra. Our core High Specification Rigs business once again exceeded expectations, delivering another record quarter of revenue with robust asset utilization through the holiday season. This continued strength underscores the effectiveness of our production focus, quality assets and exceptional execution in a competitive industry.

“Our Ancillary Services segment also continues to perform very well, supported by increased operational activity in key service lines such as P&A, Torrent, and Rentals. All three of these service lines posted significantly improved margins for the year driving incremental profitability. We expect to see both the P&A and Torrent service lines continue to grow revenue meaningfully in 2025 as market conditions remain supportive for this work.

Mr. Bodden continued, “As anticipated, our Wireline Services segment experienced typical seasonal decline during the fourth quarter, driven by our Northern operations exposure with a reduction in operating leverage pressuring margins. The unusually cold weather thus far in 2025 will keep this segment depressed in the first quarter before an expected rebound in the second quarter. The more production-focused conventional wireline product line grew revenues by 10% year-over-year and we intend to build on this growth in 2025.

“Looking ahead, we remain confident in Ranger’s ability to drive growth and create value. Despite a largely flat industry backdrop expected this year, we expect key service lines will achieve modest year-over-year growth, reflecting the strength of our differentiated offerings and disciplined execution. Through these opportunities, we will continue to prioritize safety, operational excellence, cost control, and service quality. The dedication of the Ranger team is unmatched and we look forward to continuing to Lead the Way in 2025.”

CAPITAL RETURNS AND GOVERNANCE UPDATE

Ranger exceeded its commitment of returning at least 25% of Free Cash Flow(2) to shareholders this year. In 2024, the Company repurchased 1,520,300 shares of stock for a total value of $15.5 million, net of tax at an average price of $10.11 per share. Since the share repurchase program’s inception in 2023, the Company has repurchased a total of 3,325,800 shares, representing over 15% of shares outstanding as of December 31, 2024, for a total value of $34.8 million, at an average price of $10.37 per share. The Board

of Directors has increased the quarter cash dividend to $0.06 per share formally declared and payable March 28, 2025 to common stockholders of record at the close of business on March 14, 2025. With this increase, Ranger’s annualized dividend now stands at $0.24 per share, reflecting management’s confidence in its sustained free cash flow generation.

PERFORMANCE SUMMARY

For the fourth quarter of 2024, revenue was $143.1 million, a decrease from the third quarter of $153.0 million and a decrease from $151.5 million in the prior year period. Quarter over quarter decreases in revenue are attributable to reduced activity in wireline service lines. Cost of services for the fourth quarter of 2024 was $116.8 million, or 82% of revenue, compared to $129.7 million, or 86% of revenue in the prior year period. The decrease in cost of services as a percentage of revenue from the prior year quarter was primarily attributable to increased operational efficiencies and higher margin service line growth primarily within Processing Solutions and Ancillary Services segment. General and administrative expenses were $7.1 million for the fourth quarter of 2024, flat with the prior quarter and slightly higher than $6.8 million in the prior year period.

Net income totaled $5.8 million for the fourth quarter of 2024 compared to $8.7 million in the prior quarter and $2.1 million in the prior year period. Fully diluted earnings per share was $0.25 for the fourth quarter of 2024 compared to $0.39 in the prior quarter and $0.09 in the prior year period.

Adjusted EBITDA of $21.9 million for the fourth quarter of 2024 decreased $3.2 million from $25.1 million in the prior quarter and increased $3.5 million from $18.4 million in the prior year period. Quarter over quarter decreases were driven by decreased margins within the Wireline Services segment. The year over year increases were driven by stronger revenue and margins in High-Specification Rigs and Processing Solutions and Ancillary Services.

BUSINESS SEGMENT FINANCIAL RESULTS

High Specification Rigs

High Specification Rigs segment revenue was $87.0 million in the fourth quarter of 2024, an increase of $0.3 million relative to prior quarter revenue of $86.7 million and an increase of $8.0 million relative to the prior year period. Rig hours decreased by 1% to 115,900 from 116,900 in the prior quarter and increased from 107,900 in the prior year period. Hourly rig rates increased by 1% to $751 from $741 per hour in the prior quarter, due to asset mix reflecting relatively consistent pricing levels quarter over quarter. Hourly rig rates increased by 3% from $733 in the prior year period largely due to the addition of ancillary equipment attached rig packages that are included in base rig hourly rates in 2024.

Operating income was $13.4 million in the fourth quarter of 2024, a decrease of $0.4 million, or 3% compared to $13.8 million in the prior quarter, and an increase of $3.4 million, or 34% compared to $10.0 million in the prior year period. Adjusted EBITDA was $19.0 million in the fourth quarter, down from $19.2 million in the prior quarter and up from $15.4 million in the prior year period.

Wireline Services

Wireline Services segment revenue was $22.6 million in the fourth quarter of 2024, down $7.7 million, or 25% compared to $30.3 million in the prior quarter and down $18.9 million, or 46% compared to $41.5 million in the prior year period. Wireline Completions service line reported completed stage counts of 1,800, a decrease of 28% compared to 2,500 for the prior quarter and 64% compared to 5,000 in the prior

year period. The decrease in revenue and stage count from the prior year periods is indicative of lower operational activity as the Company adjusted its service mix in response to market conditions.

Revenue Breakdown by Service Line, in millions:

| | | | | | | | | | | | |

| Year Ended December 31, |

| Service Line | 2022 Revenue | 2023 Revenue | | 2024 Revenue |

| Wireline Completions | $143.6 | $134.7 | | $43.7 |

| Wireline Production | 36.8 | 42.1 | | 46.6 |

| Wireline Pump Down | 16.6 | 22.3 | | 19.9 |

| Total Wireline Segment Revenue | $197.0 | $199.1 | | $110.2 |

Operating loss was $3.0 million in the fourth quarter, down $3.0 million from break-even levels in the prior quarter and down $1.2 million, from an operating loss of $1.8 million in the prior year period. Adjusted EBITDA was $0.2 million, down from $2.7 million for the prior quarter and down from $2.8 million in the prior year period. Losses are reflective of pricing pressures within the service line and negative operating leverage from activity declines.

Processing Solutions and Ancillary Services

Processing Solutions and Ancillary Services segment revenue was $33.5 million in the fourth quarter of 2024, down $2.5 million, or 7% from $36.0 million in the prior quarter and up $2.5 million, or 8% from $31.0 million for the prior year period. The decrease from the prior quarter was largely attributable to decreased operational activity in our P&A service line due to typical seasonality. The increase from the prior year period was largely attributable to increased operational activity in several service lines with the largest contribution coming from the Torrent business.

Operating income in this segment was $5.5 million in the fourth quarter, down from $6.6 million in the prior quarter and up from $3.4 million in the prior year period. Adjusted EBITDA was $8.0 million, a decrease compared to $8.8 million in the prior quarter and and increase compared to $5.3 million in the prior year period.

BALANCE SHEET, CASH FLOW AND LIQUIDITY

As of December 31, 2024, the Company had $112.1 million of liquidity, consisting of $71.2 million of capacity on its revolving credit facility and $40.9 million of cash on hand. This compares to the prior year period end of December 31, 2023 when the Company had $85.1 million of liquidity, consisting of $69.4 million of capacity on its revolving credit facility and $15.7 million of cash on hand.

Cash provided by Operating Activities for 2024 is $84.5 million, compared to $90.8 million in 2023. The Company’s Free Cash Flow(2) of $50.4 million for 2024 is a slight decrease from Free Cash Flow(2) of $54.3 million in the prior year period primarily due to a reduction in wireline revenues and profitability.

In 2024, the Company had capital expenditures of $34.1 million, down from $36.5 million in 2023 including approximately $10 million of growth related purchases for newer generation and ancillary equipment. These investments enhance our service capabilities, strengthen our customer relationships and provide improved returns in future periods.

Conference Call and Investor Meetings

The Company will host a conference call to discuss its fourth quarter 2024 results on Tuesday, March 4, 2025, at 9:00 a.m. Central Time (10:00 a.m. Eastern Time). To join the conference call from within the United States, participants may dial 1-833-255-2829, or participants may dial 1-412-902-6710 from outside the United States. To listen via live webcast, please visit the Investor Relations section of the Company’s website, www.rangerenergy.com. Participants are encouraged to login to the webcast or dial in to the conference call prior to the start time. An audio replay of the conference call will be available shortly after the conclusion of the call and will remain available for approximately seven days through the Investor Relations section of the Company’s website.

Ranger Management will be participating in the following upcoming industry and investor conferences and welcome the opportunity to meet with investors.

•Daniel Energy Partners THRIVE Energy Conference – March 4-6

•Sidoti Small-Cap Virtual Conference – March 20

•Piper Sandler 25th Annual Energy Conference – March 17-19

About Ranger Energy Services, Inc.

Ranger is one of the largest providers of high specification mobile rig well services, cased hole wireline services, and ancillary services in the U.S. oil and gas industry. Our services facilitate operations throughout the lifecycle of a well, including the completion, production, maintenance, intervention, workover and abandonment phases.

Cautionary Statement Concerning Forward-Looking Statements

Certain statements contained in this press release constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical fact included in this press release, regarding our strategy, future operations, financial position, estimated revenue and losses, projected costs, prospects, plans and objectives of management are forward-looking statements. When used in this press release, the words “may,” “should,” “intend,” “could,” “believe,” “anticipate,” “estimate,” “expect,” “outlook,” “project” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements represent Ranger’s expectations or beliefs concerning future events, and it is possible that the results described in this press release will not be achieved. These forward-looking statements are subject to risks, uncertainties and other factors, many of which are outside of Ranger’s control. Should one or more of these risks or uncertainties described occur, or should underlying assumptions prove incorrect, our actual results and plans could differ materially from those expressed in any forward-looking statements.

Our future results will depend upon various other risks and uncertainties, including, but not limited to, those detailed in our current and past filings with the U.S. Securities and Exchange Commission (“SEC”). These documents are available through our website or through the SEC’s Electronic Data Gathering and Analysis Retrieval system at www.sec.gov. These risks include, but are not limited to, the risks described under “Part I, Item 1A, Risk Factors” in our Annual Report on 10-K filed with the SEC on March 4, 2024, and those set forth from time-to-time in other filings by the Company with the SEC.

All forward looking statements, expressed or implied, included in this press release are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that we or persons acting on our behalf may issue. Except as otherwise required by applicable law any forward-looking statement speaks only as of the date on which is it made. We disclaim any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this cautionary statement, to reflect events or circumstances after the date of this press release.

Company Contact:

Melissa Cougle

Chief Financial Officer

(713) 935-8900

InvestorRelations@rangerenergy.com

RANGER ENERGY SERVICES, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in millions, except share and per share amounts) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Three Months Ended December 31, | | | | Year Ended December 31, |

| | 2024 | | 2024 | | 2023 | | | | 2024 | | 2023 |

| Revenue | | | | | | | | | | | | |

| High Specification Rigs | | $ | 86.7 | | | $ | 87.0 | | | $ | 79.0 | | | | | $ | 336.1 | | | $ | 313.3 | |

| Wireline Services | | 30.3 | | | 22.6 | | | 41.5 | | | | | 110.2 | | | 199.1 | |

| Processing Solutions and Ancillary Services | | 36.0 | | | 33.5 | | | 31.0 | | | | | 124.8 | | | 124.2 | |

| Total revenue | | 153.0 | | | 143.1 | | | 151.5 | | | | | 571.1 | | | 636.6 | |

| | | | | | | | | | | | |

| Operating expenses | | | | | | | | | | | | |

| Cost of services (exclusive of depreciation and amortization): | | | | | | | | | | | | |

| High Specification Rigs | | 67.2 | | | 68.3 | | | 63.6 | | | | | 267.1 | | | 249.2 | |

| Wireline Services | | 27.6 | | | 22.9 | | | 40.4 | | | | | 107.3 | | | 180.7 | |

| Processing Solutions and Ancillary Services | | 27.2 | | | 25.6 | | | 25.7 | | | | | 98.4 | | | 101.8 | |

| Total cost of services | | 122.0 | | | 116.8 | | | 129.7 | | | | | 472.8 | | | 531.7 | |

| General and administrative | | 7.1 | | | 7.1 | | | 6.8 | | | | | 27.8 | | | 29.5 | |

| Depreciation and amortization | | 11.1 | | | 10.8 | | | 10.6 | | | | | 44.1 | | | 39.9 | |

| Impairment of fixed assets | | — | | | — | | | — | | | | | — | | | 0.4 | |

| Gain on sale of assets | | (0.1) | | | (0.5) | | | (0.2) | | | | | (2.2) | | | (1.8) | |

| Total operating expenses | | 140.1 | | | 134.2 | | | 146.9 | | | | | 542.5 | | | 599.7 | |

| | | | | | | | | | | | |

| Operating income | | 12.9 | | | 8.9 | | | 4.6 | | | | | 28.6 | | | 36.9 | |

| | | | | | | | | | | | |

| Other expenses | | | | | | | | | | | | |

| Interest expense, net | | 0.7 | | | 0.5 | | | 0.7 | | | | | 2.6 | | | 3.5 | |

| Loss on debt retirement | | — | | | — | | | — | | | | | — | | | 2.4 | |

| | | | | | | | | | | | |

| Total other expenses, net | | 0.7 | | | 0.5 | | | 0.7 | | | | | 2.6 | | | 5.9 | |

| | | | | | | | | | | | |

| Income before income tax expense | | 12.2 | | | 8.4 | | | 3.9 | | | | | 26.0 | | | 31.0 | |

| Income tax expense | | 3.5 | | | 2.6 | | | 1.8 | | | | | 7.6 | | | 7.2 | |

| Net income | | 8.7 | | | 5.8 | | | 2.1 | | | | | 18.4 | | | 23.8 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Income per common share: | | | | | | | | | | | | |

| Basic | | $ | 0.39 | | | $ | 0.26 | | | $ | 0.09 | | | | | $ | 0.82 | | | $ | 0.97 | |

| Diluted | | $ | 0.39 | | | $ | 0.25 | | | $ | 0.09 | | | | | $ | 0.81 | | | $ | 0.95 | |

| Weighted average common shares outstanding | | | | | | | | | | | | |

| Basic | | 22,241,847 | | | 22,250,468 | | | 24,129,081 | | | | | 22,518,726 | | | 24,600,151 | |

| Diluted | | 22,494,453 | | | 22,920,235 | | | 24,537,046 | | | | | 22,852,632 | | | 24,991,494 | |

RANGER ENERGY SERVICES, INC.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(in millions, except share and per share amounts) | | | | | | | | | | | | | | |

| | December 31, 2024 | | December 31, 2023 |

| Assets | | | | |

| Cash and cash equivalents | | $ | 40.9 | | | $ | 15.7 | |

| Accounts receivable, net | | 68.4 | | | 85.4 | |

| Contract assets | | 16.7 | | | 17.7 | |

| Inventory | | 5.7 | | | 6.4 | |

| Prepaid expenses | | 11.4 | | | 9.6 | |

| Assets held for sale | | 0.8 | | | 0.6 | |

| Total current assets | | 143.9 | | | 135.4 | |

| | | | |

| Property and equipment, net | | 224.3 | | | 226.3 | |

| Intangible assets, net | | 5.6 | | | 6.3 | |

| Operating leases, right-of-use assets | | 7.0 | | | 9.0 | |

| Other assets | | 0.8 | | | 1.0 | |

| Total assets | | $ | 381.6 | | | $ | 378.0 | |

| | | | |

| Liabilities and Stockholders' Equity | | | | |

| Accounts payable | | 27.2 | | | 31.3 | |

| Accrued expenses | | 28.2 | | | 29.6 | |

| Other financing liability, current portion | | 0.7 | | | 0.6 | |

| Long-term debt, current portion | | — | | | 0.1 | |

| Short-term lease liability | | 8.7 | | | 7.3 | |

| Other current liabilities | | 0.4 | | | 0.1 | |

| Total current liabilities | | 65.2 | | | 69.0 | |

| | | | |

| Long-term lease liability | | 14.1 | | | 14.9 | |

| Other financing liability | | 10.3 | | | 11.0 | |

| | | | |

| Deferred tax liability | | 18.2 | | | 11.3 | |

| | | | |

| Total liabilities | | $ | 107.8 | | | $ | 106.2 | |

| | | | |

| Commitments and contingencies | | | | |

| | | | |

| Stockholders' equity | | | | |

Preferred stock, $0.01 per share; 50,000,000 shares authorized; no shares issued and outstanding as of December 31, 2024 and December 31, 2023 | | — | | | — | |

Class A Common Stock, $0.01 par value, 100,000,000 shares authorized; 26,130,574 shares issued and 22,252,946 shares outstanding as of December 31, 2024; 25,756,017 shares issued and 23,398,689 shares outstanding as of December 31, 2023 | | 0.3 | | | 0.3 | |

Class B Common Stock, $0.01 par value, 100,000,000 shares authorized; no shares issued or outstanding as of December 31, 2024 and December 31, 2023 | | — | | | — | |

Less: Class A Common Stock held in treasury at cost; 3,877,628 treasury shares as of December 31, 2024 and 2,357,328 treasury shares as of December 31, 2023 | | (38.6) | | | (23.1) | |

| Retained earnings | | 42.2 | | | 28.4 | |

| Additional paid-in capital | | 269.9 | | | 266.2 | |

| Total controlling stockholders' equity | | 273.8 | | | 271.8 | |

| Total liabilities and stockholders' equity | | $ | 381.6 | | | $ | 378.0 | |

RANGER ENERGY SERVICES, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

(in millions)

| | | | | | | | | | | | | | |

| | Year Ended December 31, |

| | 2024 | | 2023 |

| Cash Flows from Operating Activities | | | | |

| Net income | | $ | 18.4 | | | $ | 23.8 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | |

| Depreciation and amortization | | 44.1 | | | 39.9 | |

| Equity based compensation | | 5.8 | | | 4.8 | |

| Gain on disposal of property and equipment | | (2.2) | | | (1.8) | |

| Impairment of fixed assets | | — | | | 0.4 | |

| | | | |

| Deferred income tax expense | | 6.9 | | | 6.6 | |

| Loss on debt retirement | | — | | | 2.4 | |

| Other expense, net | | 1.3 | | | 2.3 | |

| Changes in operating assets and liabilities | | | | |

| Accounts receivable | | 16.7 | | | 5.3 | |

| Contract assets | | 1.0 | | | 9.2 | |

| Inventory | | 0.4 | | | (0.9) | |

| Prepaid expenses and other current assets | | (1.8) | | | (0.4) | |

| Other assets | | 2.1 | | | 2.1 | |

| Accounts payable | | (3.7) | | | 6.6 | |

| Accrued expenses | | (2.4) | | | (7.2) | |

| Other current liabilities | | (2.6) | | | 0.3 | |

| Other long-term liabilities | | 0.5 | | | (2.6) | |

| Net cash provided by operating activities | | 84.5 | | | 90.8 | |

| | | | |

| Cash Flows from Investing Activities | | | | |

| Purchase of property and equipment | | (34.1) | | | (36.5) | |

| Proceeds from disposal of property and equipment | | 3.0 | | | 6.8 | |

| | | | |

| Net cash used in investing activities | | (31.1) | | | (29.7) | |

| | | | |

| Cash Flows from Financing Activities | | | | |

| Borrowings under Revolving Credit Facility | | 27.3 | | | 325.2 | |

| Principal payments on Revolving Credit Facility | | (27.3) | | | (327.7) | |

| Principal payments on Eclipse M&E Term Loan Facility | | — | | | (10.4) | |

| | | | |

| | | | |

| Principal payments on Secured Promissory Note | | — | | | (6.2) | |

| Principal payments on financing lease obligations | | (5.7) | | | (5.4) | |

| Principal payments on other financing liabilities | | (0.6) | | | (0.8) | |

| Dividends paid to Class A Common Stock shareholders | | (4.5) | | | (2.4) | |

| Shares withheld for equity compensation | | (1.8) | | | (1.0) | |

| Payments on Other Installment Purchases | | (0.1) | | | (0.4) | |

| Repurchase of Class A Common Stock | | (15.5) | | | (19.3) | |

| Deferred financing costs on Wells Fargo | | — | | | (0.7) | |

| Net cash used in financing activities | | (28.2) | | | (49.1) | |

| | | | |

| Increase (decrease) in cash and cash equivalents | | 25.2 | | | 12.0 | |

| Cash and cash equivalents, Beginning of Period | | 15.7 | | | 3.7 | |

| Cash and cash equivalents, End of Period | | $ | 40.9 | | | $ | 15.7 | |

| | | | |

| Supplemental Cash Flow Information | | | | |

| Interest paid | | $ | 2.0 | | | $ | 1.4 | |

| Supplemental Disclosure of Non-cash Investing and Financing Activities | | | | |

| Capital expenditures included in accounts payable and accrued liabilities | | $ | 0.4 | | | $ | (0.5) | |

| Additions to fixed assets through installment purchases and financing leases | | $ | (8.6) | | | $ | (10.0) | |

| Additions to fixed assets through asset trades | | $ | (4.6) | | | $ | (1.1) | |

RANGER ENERGY SERVICES, INC.

SUPPLEMENTAL NON-GAAP FINANCIAL MEASURES

(UNAUDITED)

Note Regarding Non‑GAAP Financial Measure

The Company utilizes certain non-GAAP financial measures that management believes to be insightful in understanding the Company’s financial results. These financial measures, which include Adjusted EBITDA and Free Cash Flow, should not be construed as being more important than, or as an alternative for, comparable U.S. GAAP financial measures. Detailed reconciliations of these Non-GAAP financial measures to comparable U.S. GAAP financial measures have been included below and are available in the Investor Relations sections of our website at www.rangerenergy.com. Our presentation of Adjusted EBITDA and Free Cash Flow should not be construed as an indication that our results will be unaffected by the items excluded from the reconciliations. Our computations of these Non-GAAP financial measures may not be identical to other similarly titled measures of other companies.

Adjusted EBITDA

We believe Adjusted EBITDA is a useful performance measure because it allows for an effective evaluation of our operating performance when compared to our peers, without regard to our financing methods or capital structure. We exclude the items listed below from net income or loss in arriving at Adjusted EBITDA because these amounts can vary substantially within our industry depending upon accounting methods, book values of assets, capital structures and the method by which the assets were acquired. Certain items excluded from Adjusted EBITDA are significant components in understanding and assessing a company’s financial performance, such as a company’s cost of capital and tax structure, as well as the historic costs of depreciable assets, none of which are reflected in Adjusted EBITDA.

We define Adjusted EBITDA as net income or loss before net interest expense, income tax provision or benefit, depreciation and amortization, equity‑based compensation, acquisition-related, severance and reorganization costs, gain or loss on disposal of property and equipment, and certain other non-cash items that we do not view as indicative of our ongoing performance.

The following tables are a reconciliation of net income or loss to Adjusted EBITDA for the respective periods, in millions:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | High Specification Rigs | | Wireline Services | | Processing Solutions and Ancillary Services | | Other | | Total |

| | Three Months Ended December 31, 2024 |

| Net income (loss) | | $ | 13.4 | | | $ | (3.0) | | | $ | 5.5 | | | $ | (10.1) | | | $ | 5.8 | |

| Interest expense, net | | — | | | — | | | — | | | 0.5 | | | 0.5 | |

| Income tax expense | | — | | | — | | | — | | | 2.6 | | | 2.6 | |

| Depreciation and amortization | | 5.3 | | | 2.7 | | | 2.4 | | | 0.4 | | | 10.8 | |

| EBITDA | | 18.7 | | | (0.3) | | | 7.9 | | | (6.6) | | | 19.7 | |

| | | | | | | | | | |

| Equity based compensation | | — | | | — | | | — | | | 1.8 | | | 1.8 | |

| | | | | | | | | | |

| Gain on disposal of property and equipment | | — | | | — | | | — | | | (0.5) | | | (0.5) | |

| | | | | | | | | | |

| Severance and reorganization costs | | 0.2 | | | 0.5 | | | 0.1 | | | — | | | 0.8 | |

| Acquisition related costs | | 0.1 | | | — | | | — | | | — | | | 0.1 | |

| | | | | | | | | | |

| Adjusted EBITDA | | $ | 19.0 | | | $ | 0.2 | | | $ | 8.0 | | | $ | (5.3) | | | $ | 21.9 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | High Specification Rigs | | Wireline Services | | Processing Solutions and Ancillary Services | | Other | | Total |

| | Three Months Ended September 30, 2024 |

| Net income (loss) | | $ | 13.8 | | | $ | — | | | $ | 6.6 | | | $ | (11.7) | | | $ | 8.7 | |

| Interest expense, net | | — | | | — | | | — | | | 0.7 | | | 0.7 | |

| Income tax expense | | — | | | — | | | — | | | 3.5 | | | 3.5 | |

| Depreciation and amortization | | 5.7 | | | 2.7 | | | 2.2 | | | 0.5 | | | 11.1 | |

| EBITDA | | 19.5 | | | 2.7 | | | 8.8 | | | (7.0) | | | 24.0 | |

| | | | | | | | | | |

| Equity based compensation | | — | | | — | | | — | | | 1.4 | | | 1.4 | |

| | | | | | | | | | |

| Gain on disposal of property and equipment | | — | | | — | | | — | | | (0.1) | | | (0.1) | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Legal fees and settlements | | (0.3) | | | — | | | — | | | 0.1 | | | (0.2) | |

| Adjusted EBITDA | | $ | 19.2 | | | $ | 2.7 | | | $ | 8.8 | | | $ | (5.6) | | | $ | 25.1 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | High Specification Rigs | | Wireline Services | | Processing Solutions and Ancillary Services | | Other | | Total |

| | Three Months Ended December 31, 2023 |

| Net income (loss) | | $ | 10.0 | | | $ | (1.8) | | | $ | 3.4 | | | $ | (9.5) | | | $ | 2.1 | |

| Interest expense, net | | — | | | — | | | — | | | 0.7 | | | 0.7 | |

| Income tax expense | | — | | | — | | | — | | | 1.8 | | | 1.8 | |

| Depreciation and amortization | | 5.4 | | | 2.9 | | | 1.9 | | | 0.4 | | | 10.6 | |

| EBITDA | | 15.4 | | | 1.1 | | | 5.3 | | | (6.6) | | | 15.2 | |

| | | | | | | | | | |

| Equity based compensation | | — | | | — | | | — | | | 1.2 | | | 1.2 | |

| | | | | | | | | | |

| Gain on disposal of property and equipment | | — | | | — | | | — | | | (0.2) | | | (0.2) | |

| | | | | | | | | | |

| Severance and reorganization costs | | — | | | 1.7 | | | — | | | — | | | 1.7 | |

| Acquisition related costs | | — | | | — | | | — | | | 0.5 | | | 0.5 | |

| | | | | | | | | | |

| Adjusted EBITDA | | $ | 15.4 | | | $ | 2.8 | | | $ | 5.3 | | | $ | (5.1) | | | $ | 18.4 | |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | High Specification Rigs | | Wireline Services | | Processing Solutions and Ancillary Services | | Other | | Total |

| | Year Ended December 31, 2024 |

| Net income (loss) | | $ | 46.8 | | | $ | (8.5) | | | $ | 17.8 | | | $ | (37.7) | | | $ | 18.4 | |

| Interest expense, net | | — | | | — | | | — | | | 2.6 | | | 2.6 | |

| Income tax expense | | — | | | — | | | — | | | 7.6 | | | 7.6 | |

| Depreciation and amortization | | 22.2 | | | 11.4 | | | 8.6 | | | 1.9 | | | 44.1 | |

| EBITDA | | 69.0 | | | 2.9 | | | 26.4 | | | (25.6) | | | 72.7 | |

| | | | | | | | | | |

| Equity based compensation | | — | | | — | | | — | | | 5.8 | | | 5.8 | |

| | | | | | | | | | |

| Gain on disposal of property and equipment | | — | | | — | | | — | | | (2.2) | | | (2.2) | |

| | | | | | | | | | |

| Severance and reorganization costs | | 0.9 | | | 0.6 | | | 0.2 | | | 0.1 | | | 1.8 | |

| Acquisition related costs | | 0.4 | | | — | | | — | | | 0.1 | | | 0.5 | |

| Legal fees and settlements | | 0.2 | | | — | | | — | | | 0.1 | | | 0.3 | |

| Adjusted EBITDA | | $ | 70.5 | | | $ | 3.5 | | | $ | 26.6 | | | $ | (21.7) | | | $ | 78.9 | |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | High Specification Rigs | | Wireline Services | | Processing Solutions and Ancillary Services | | Other | | Total |

| | Year Ended December 31, 2023 |

| Net income (loss) | | $ | 44.0 | | | $ | 7.1 | | | $ | 15.5 | | | $ | (42.8) | | | $ | 23.8 | |

| Interest expense, net | | — | | | — | | | — | | | 3.5 | | | 3.5 | |

| Income tax expense | | — | | | — | | | — | | | 7.2 | | | 7.2 | |

| Depreciation and amortization | | 20.1 | | | 11.3 | | | 6.9 | | | 1.6 | | | 39.9 | |

| EBITDA | | 64.1 | | | 18.4 | | | 22.4 | | | (30.5) | | | 74.4 | |

| Impairment of fixed assets | | — | | | — | | | — | | | 0.4 | | | 0.4 | |

| Equity based compensation | | — | | | — | | | — | | | 4.8 | | | 4.8 | |

| Loss on retirement of debt | | — | | | — | | | — | | | 2.4 | | | 2.4 | |

| Gain on disposal of property and equipment | | — | | | — | | | — | | | (1.8) | | | (1.8) | |

| | | | | | | | | | |

| Severance and reorganization costs | | — | | | 1.7 | | | — | | | 0.4 | | | 2.1 | |

| Acquisition related costs | | — | | | — | | | — | | | 2.1 | | | 2.1 | |

| | | | | | | | | | |

| Adjusted EBITDA | | $ | 64.1 | | | $ | 20.1 | | | $ | 22.4 | | | $ | (22.2) | | | $ | 84.4 | |

| | | | | | | | | | |

Free Cash Flow

We believe Free Cash Flow is an important financial measure for use in evaluating the Company’s financial performance, as it measures our ability to generate additional cash from our business operations. Free Cash Flow should be considered in addition to, rather than as a substitute for, net income as a measure of our performance or net cash provided by operating activities as a measure of our liquidity. Additionally, our definition of Free Cash Flow is limited and does not represent residual cash flows available for discretionary expenditures due to the fact that the measure does not deduct the payments required for debt service and other obligations or payments made for business acquisitions. Therefore, we believe it is important to view Free Cash Flow as supplemental to our entire statement of cash flows.

The following table is a reconciliation of consolidated operating cash flows to Free Cash Flow for the respective periods, in millions:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Year Ended | | |

| | December 31, 2024 | | December 31, 2023 | | December 31, 2024 | | December 31, 2023 | | | | | |

| Net cash provided by operating activities | | $ | 32.7 | | | $ | 37.7 | | | $ | 84.5 | | | $ | 90.8 | | | | | | |

| Purchase of property and equipment | | (5.4) | | | (8.6) | | | (34.1) | | | (36.5) | | | | | | |

| Free Cash Flow | | $ | 27.3 | | | $ | 29.1 | | | $ | 50.4 | | | $ | 54.3 | | | | | | |

| | | | | | | | | | | | | |

Add back:

Purchase of property and equipment related to asset acquisition | | — | | | 1.5 | | | — | | | 8.7 | | | | | | |

| Modified Free cash Flow | | $ | 27.3 | | | $ | 30.6 | | | $ | 50.4 | | | $ | 63.0 | | | | | | |

| | | | | | | | | | | | | |

| Adjusted EBITDA | | $ | 21.9 | | | $ | 18.4 | | | $ | 78.9 | | | $ | 84.4 | | | | | | |

| Free cash Flow conversion - Free cash flow as a percentage of EBITDA | | 125 | % | | 158 | % | | 64 | % | | 64 | % | | | | | |

Modified Free cash Flow conversion -

Modified Free cash Flow as a percentage of EBITDA | | 125 | % | | 166 | % | | 64 | % | | 75 | % | | | | | |

Cover

|

Mar. 03, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

|

| Entity Registrant Name |

Ranger Energy Services, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-38183

|

| Entity Tax Identification Number |

81-5449572

|

| Entity Address, Address Line One |

10350 Richmond

|

| Entity Address, Address Line Two |

Suite 550

|

| Entity Address, City or Town |

Houston

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77042

|

| City Area Code |

Registrant’s telephone number, including area code: (713) 935-8900

|

| Local Phone Number |

Registrant’s telephone number, including area code: (713) 935-8900

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A Common Stock, $0.01 par value

|

| Trading Symbol |

RNGR

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001699039

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

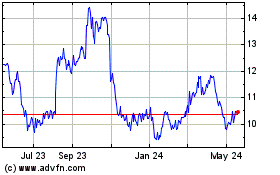

Ranger Energy Services (NYSE:RNGR)

Historical Stock Chart

From Feb 2025 to Mar 2025

Ranger Energy Services (NYSE:RNGR)

Historical Stock Chart

From Mar 2024 to Mar 2025