Stifel Reports November 2024 Operating Data

20 December 2024 - 8:15AM

Stifel Financial Corp. (NYSE: SF) today reported selected operating

results for November 30, 2024 in an effort to provide timely

information to investors on certain key performance metrics. Due to

the limited nature of this data, a consistent correlation to

earnings should not be assumed.

Ronald J. Kruszewski, Chairman

and Chief Executive Officer, said, “In November, total client

assets under management climbed to a record $514 billion, including

a record $197 billion in fee-based assets. This represents a 4%

increase from the prior month, driven by strong equity markets and

financial advisor recruiting. Client money market and insured

product balances increased 3% from October as growth in sweep

deposits and Smart Rate balances were comparable. The operating

environment for our Institutional Group continues to improve as

both client activity levels and investment banking pipelines

increased.”

|

|

|

Selected Operating Data (Unaudited) |

|

|

As of |

|

% Change |

|

(millions) |

11/30/2024 |

11/30/2023 |

10/31/2024 |

|

11/30/2023 |

10/31/2024 |

|

Total client assets |

$513,931 |

$427,843 |

$493,469 |

|

20% |

4% |

| Fee-based client assets |

$197,333 |

$157,488 |

$189,326 |

|

25% |

4% |

| Private Client Group fee-based

client assets |

$172,527 |

$138,296 |

$165,530 |

|

25% |

4% |

| Bank loans, net (includes

loans held for sale) |

$20,727 |

$20,300 |

$20,722 |

|

2% |

0% |

| Client

money market and insured product (1) |

$28,558 |

$25,526 |

$27,613 |

|

12% |

3% |

| |

|

|

|

|

|

|

(1) Includes Smart Rate deposits,

Sweep deposits, Third-party Bank Sweep Program, and Other Sweep

cash.

Company Information

Stifel Financial Corp. (NYSE: SF) is a financial

services holding company headquartered in St. Louis, Missouri, that

conducts its banking, securities, and financial services business

through several wholly owned subsidiaries. Stifel’s broker-dealer

clients are served in the United States through Stifel, Nicolaus

& Company, Incorporated, including its Eaton Partners and

Miller Buckfire business divisions; Keefe, Bruyette & Woods,

Inc.; and Stifel Independent Advisors, LLC; in Canada through

Stifel Nicolaus Canada Inc.; and in the United Kingdom and Europe

through Stifel Nicolaus Europe Limited. The Company’s broker-dealer

affiliates provide securities brokerage, investment banking,

trading, investment advisory, and related financial services to

individual investors, professional money managers, businesses, and

municipalities. Stifel Bank and Stifel Bank & Trust offer a

full range of consumer and commercial lending solutions. Stifel

Trust Company, N.A. and Stifel Trust Company Delaware, N.A. offer

trust and related services. To learn more about Stifel, please

visit the Company’s website at www.stifel.com. For global

disclosures, please visit

www.stifel.com/investor-relations/press-releases.

Media Contact: Neil Shapiro (212) 271-3447 |

Investor Contact: Joel Jeffrey (212) 271-3610 |

www.stifel.com/investor-relations

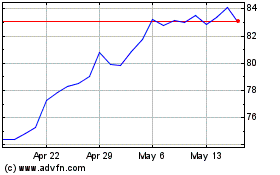

Stifel Financial (NYSE:SF)

Historical Stock Chart

From Nov 2024 to Dec 2024

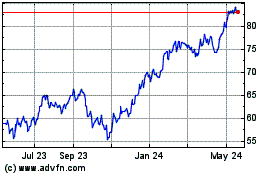

Stifel Financial (NYSE:SF)

Historical Stock Chart

From Dec 2023 to Dec 2024