State Street Global Advisors Forms Strategic Relationship With Bridgewater Associates

19 November 2024 - 11:35PM

Business Wire

Together, these asset management leaders seek to widen

investor access to alternative investment strategies

State Street Global Advisors, the asset management business of

State Street Corporation (NYSE: STT), announced today that it is

joining forces with Bridgewater Associates, LP, one of the world’s

preeminent asset managers, seeking to widen access to core

alternative investment strategies.

“Bridgewater is known for its 40-year history of delivering

resilient, diversified portfolios and insights to many

sophisticated institutional global investors, including innovative

approaches to strategic asset allocation. We are excited that this

strategic relationship will now bring that portfolio construction

expertise to retail investors as well,” said Anna Paglia, chief

business officer at State Street Global Advisors.

State Street Global Advisors pioneered the ETF industry in 1993

and has a history of providing investors with access to liquid and

transparent solutions to meet essential goals, including income

generation, diversification, and wealth accumulation. Since 1975,

Bridgewater Associates has been building a deep understanding of

markets and economies that has allowed the firm to innovate in

multiple areas of portfolio construction. These two industry

trailblazers are now coming together to help a broader range of

investors gain access to core alternative investment

strategies.

“At Bridgewater, we see global investors increasingly focused on

portfolio resiliency and desiring durable client portfolios amidst

a coming investing era that is likely to be very different from the

last. We believe a diversified asset allocation is a great step in

preparing for the future, and we are excited to broaden access to

our approach with an innovative organization like State Street

Global Advisors,” said Karen Karniol-Tambour, Co-CIO of Bridgewater

Associates.

“Over the last couple of decades, investors have been rewarded

through traditional approaches to asset allocation, with abundant

liquidity, persistent disinflation and geopolitical stability.

Going forward, a wide range of economic environments could

materialize. We believe enhancing diversification and resilience to

a range of outcomes through alternative investment approaches will

be a critical wealth management tool in the decades ahead,” she

added.

Alternatives continue to be a popular option for investors

seeking sources of diversification. According to State Street

Global Advisors ETF Impact Report, 45% of institutional investors

globally plan to increase allocations to alternative investments in

the next 12 months. Moreover, 41% of US financial advisors plan to

advise clients to increase their allocations.1

About Bridgewater Associates

Bridgewater Associates is a premier asset management firm,

focused on delivering unique insight and partnership for the most

sophisticated global institutional investors. As a global

macro-investment manager, we take a diversified approach spanning

more than 150 different markets. With deep expertise in portfolio

construction and risk management, we develop insights and design

strategies to deliver value to our clients through any economic

environment. Founded in 1975, we are a community of independent

thinkers who share a commitment for excellence. By fostering a

culture of openness, transparency, and inclusion, we strive to

unlock the most complex questions in investment strategy,

management, and corporate culture.

About State Street Global Advisors

For over four decades, State Street Global Advisors has served

the world’s governments, institutions, and financial advisors. With

a rigorous, risk-aware approach built on research, analysis, and

market-tested experience, and as pioneers in index and ETF

investing, we are always inventing new ways to invest. As a result,

we have become the world’s fourth-largest asset manager* with US

$4.73 trillion† under our care.

*Pensions & Investments Research Center, as of 12/31/23.

†This figure is presented as of September 30, 2024 and includes ETF

AUM of $1,515.67 billion USD of which approximately $82.59 billion

USD in gold assets with respect to SPDR products for which State

Street Global Advisors Funds Distributors, LLC (SSGA FD) acts

solely as the marketing agent. SSGA FD and State Street Global

Advisors are affiliated. Please note all AUM is unaudited.

1 State Street Global Advisors ETF Impact Report 2024-2025; The

Next Wave of Innovation

Important Risk Information

Investing involves risk including the risk of loss of

principal.

The information provided does not constitute investment advice

and it should not be relied on as such. It should not be considered

a solicitation to buy or an offer to sell a security. It does not

take into account any investor's particular investment objectives,

strategies, tax status or investment horizon. You should consult

your tax and financial advisor.

Diversification does not ensure a profit or guarantee against

loss.

State Street Global Advisors, 1 Iron Street, Boston, MA

02210-1641

© 2024 State Street Corporation

All Rights Reserved.

7177994.1.1.AM.RTL Exp. Date: 11/30/2025

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241118278354/en/

Deborah Heindel +1 617 662 9927 DHEINDEL@StateStreet.com

Bridgewater Media media@bwater.com

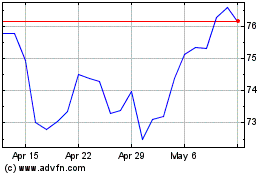

State Street (NYSE:STT)

Historical Stock Chart

From Nov 2024 to Dec 2024

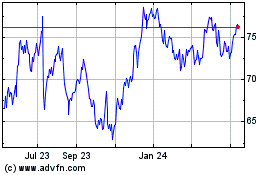

State Street (NYSE:STT)

Historical Stock Chart

From Dec 2023 to Dec 2024