State Street Announces Three Additional Bank Partnerships to Support Minority Depository Institutions and Community Development Financial Institutions

20 December 2024 - 1:30AM

Business Wire

- Latest placements mark the completion of the firm’s $100

million initiative that launched earlier in 2024

State Street Corporation (NYSE: STT) today announced that it has

placed an additional round of deposits through three Minority

Depository Institutions (MDIs) and Community Development Financial

Institutions (CDFIs), Liberty Bank, Native American Bank and

Sunrise Banks. These placements also mark the completion of the

firm’s $100 million initiative that launched earlier in 2024 and

designed to expand access to financial services through MDIs and

CDFIs.

“Today marks a significant milestone in our commitment to foster

economic inclusion and drive positive change in communities across

the US,” said Kimberly DeTrask, executive vice president and

treasurer at State Street. “We are pleased to welcome three new

partner banks to our MDI and CDFI initiative, and to meet our $100

million investment target. State Street is proud to continue to

leverage its resources to help create opportunities and empower

communities for the long term.”

Earlier this year, State Street announced its goal to invest

$100 million to facilitate low-cost, stable deposit funding to MDIs

and CDFIs, to support the firm’s broader business strategy to

expand the financial market ecosystem and help unlock economic

potential by encouraging long term growth and job creation. This

program builds upon State Street’s actions to advance racial

equity. In 2020, State Street announced its 10 Actions to Address

Racism and Inequality, a 10-point action plan with the ultimate

goal of helping to end systemic racism in our communities.

Additionally, the firm completed an independent Civil Rights Audit,

which provided recommended actions to help establish State Street

as an industry leader in advancing civil rights and racial

equity.

Liberty Bank and Trust Company, chartered in New Orleans,

Louisiana in 1972, stands as the largest Black-owned financial

institution in the United States. With a footprint across 11 states

and assets of more than $1 billion, Liberty was founded to empower

possibility in underserved communities by providing equitable

access to quality financial services. Their efforts focus on

growing small businesses, facilitating homeownership, alleviating

debt burdens, generating job opportunities, and fostering

meaningful and lasting economic impact.

"We are grateful for State Street Corporation’s intentionality

in supporting Community Development Financial Institutions,” said

Todd McDonald, president of Liberty Bank and Trust Company. "This

partnership will help address community inequities and advance our

financial inclusion and economic empowerment mission at Liberty

Bank."

Native American Bank, N.A. was chartered as a national

community development focused bank. Committed to being a

self-sustaining CDFI, Native American Bank is the only national

American Indian owned community development bank in the country.

The bank proudly received an “outstanding” on the most recent

Community Reinvestment Act (CRA) exam. Their primary mission is to

assist Native American and Alaskan Native individuals, enterprises

and governments to reach their goals by providing affordable and

flexible banking and financial services.

“Native American Bank is particularly grateful for the

partnership with State Street,” said Tom Ogaard, president and CEO

of Native American Bank. “Their financial support will make a

significant difference in our mission to bring access to capital in

Indian Country.”

Sunrise Banks is no ordinary bank; it strives to be a

place where money and values meet for their customers and

communities. They do this by prioritizing social responsibility,

community impact and environmental sustainability alongside their

essential financial products and services. With locations in

Minneapolis/St. Paul, Minnesota and Sioux Falls, South Dakota,

Sunrise Banks seeks to build meaningful relationships, empower

financial wellness and drive positive change.

Sunrise Banks is certified by the U.S. Treasury as a Community

Development Financial Institution (CDFI), a designation earned by

approximately 100 banks nationwide. Sunrise Banks is also a member

of the Global Alliance for Banking on Values and a certified B Corp

for its demonstrated commitment to transparent corporate governance

and positive community impact.

“As a values-based bank, we strive to be a force for good for

our customers and communities every day,” says David Reiling,

president and CEO of Sunrise Banks. “With this mission-based

deposit through State Street, we will be able to invest in more

projects and initiatives designed to empower financial wellness,

foster inclusivity, and support economic growth. We appreciate the

trust State Street is putting into how Sunrise Banks builds and

uplifts these relationships so we can all make sustainable choices

for a better future.”

Click here to learn more about the ways in which State Street

has continued to advance this mission.

About State Street Corporation

State Street Corporation (NYSE: STT) is one of the world's

leading providers of financial services to institutional investors

including investment servicing, investment management and

investment research and trading. With $46.8 trillion in assets

under custody and/or administration and $4.7 trillion* in assets

under management as of September 30, 2024, State Street operates

globally in more than 100 geographic markets and employs

approximately 53,000 worldwide. For more information, visit State

Street's website at www.statestreet.com.

* Assets under management as of September 30, 2024 includes

approximately $83 billion of assets with respect to SPDR® products

for which State Street Global Advisors Funds Distributors, LLC

(“SSGA FD”) acts solely as the marketing agent. SSGA FD and State

Street Global Advisors are affiliated.

© 2024 State Street Corporation

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241219920174/en/

Media Contact: Brendan Paul Mobile: +1 401 644 9182

Bpaul2@statestreet.com

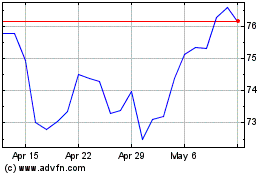

State Street (NYSE:STT)

Historical Stock Chart

From Nov 2024 to Dec 2024

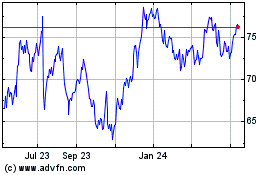

State Street (NYSE:STT)

Historical Stock Chart

From Dec 2023 to Dec 2024