Today's Top Supply Chain and Logistics News From WSJ

06 October 2017 - 10:06PM

Dow Jones News

By Paul Page

Sign up: With one click, get this newsletter delivered to your

inbox.

The supply chain for beer in the U.S. increasingly begins in

Mexico. Constellation Brands Inc., the U.S. distributor of Corona

and Modelo, reported a 13% jump in beer sales last quarter as

market leaders Budweiser and Bud Light hemorrhage volume and even

craft beer popularity flattens out. Constellation says the results

show that the growth in U.S. beer imports really is concentrated in

the Mexican brands rather than the broader world of foreign

producers, the WSJ's Jennifer Maloney reports, and that the gains

will help the company step up plans to extend its distribution

network. Some 60% of Constellation's sales growth in the last

quarter came from expanded distribution, and Chief Executive Robert

Sands says the network isn't as big as "we ought to have." With

profits margins and revenues growing, the company should have the

resources to reach deeper into the U.S. and other markets.

Boeing Co. is pushing deeper into autonomous transportation

technology , but the move is likely to have an impact on the jet

maker's supply chain long before it produces self-flying planes.

Boeing is acquiring Virginia-based Aurora Flight Sciences Corp., a

maker of aerial drones and pilotless flying systems, the WSJ's Doug

Cameron reports, in a deal the company says could pave the way for

flying taxis. Aurora works on autonomous systems that allow

aircraft to be flown remotely, and has been working with Uber

Technologies Inc. on a new vehicle that would take off and land

like a helicopter. Other parts of the business could make a more

immediate contribution, however. The technology includes so-called

machine learning capability, which could be used to make industrial

operations more efficient. And Aurora produces composite parts for

aircraft and other vehicles, potentially a big attraction to Boeing

as it looks to take greater command of its supply chain.

The Trump administration has a new trade tool in its kit aimed

at reviving U.S. manufacturing. The U.S. International Trade

Commission approved a petition from Whirlpool that it is suffering

"serious injury" from competition from foreign washing machine

makers, the WSJ's Jacob M. Schlesinger and Andrew Tangel write,

opening the door to potential sanctions against South Korean rivals

Samsung Electronics Co. and LG Electronics Inc. in the near term

and potentially to more aggressive tactics in broader trade

battles. The ITC is due to send recommendations to the White House

on what tariffs or quotas it recommends and the administration

could decide early next year on import limits. Samsung and LG also

may make bigger decisions about their production of appliances.

Critics say the manufacturers have been hopping to different

countries to get around earlier trade sanctions. But LG's latest

stop is in Tennessee, where it is setting up its first-ever major

U.S. factory, a $250 million washing-machine plant.

COMMODITIES MARKETS

The U.S. may have reached peak shale.American shale drillers who

upended traditional oil markets by increasing production in the

face of lower prices are finally showing signs of slowing down. The

WSJ's Bradley Olson and Lynn Cook write that t he U.S. oil-rig

count grew 6% in the third quarter, a marked deceleration from

average growth of more than 20% in the previous four quarters. Last

month, the U.S. Energy Information Administration cut its forecast

for U.S. oil production this year to 9.69 million barrels a day,

still high enough to surpass a nearly 50-year record but down from

an earlier forecast of 9.82 million barrels. The impact is hitting

shipping markets that have benefited from growth in the Permian

Basin region, with volume of petroleum and petroleum products on

U.S. railroads down 17% year-over-year in September. Producers are

still working drills, but experts say growth forecasts now look

overly optimistic, with "no new shale plays" coming forward in

recent months.

QUOTABLE

IN OTHER NEWS

The U.S. trade deficit narrowed in August as imports by value

slipped 0.1% while exports expanded 0.4% from July. (WSJ)

The number of Americans filing applications for new unemployment

benefits fell in late September. (WSJ)

The Trump administration is proposing that cars be required to

have a set amount of U.S. content to qualify for Nafta tariff

breaks. (WSJ)

Fred Ehlers was promoted to chief information officer at Norfolk

Southern Corp. (WSJ)

TransCanada Corp. ended development of two energy pipelines

meant to help get oil and gas to markets in Europe and Asia.

(WSJ)

The U.S. Postal Service will skip retiree payments for the fifth

straight year and warned about its ability to raise prices.

(WSJ)

Wal-Mart de Mexico SAB's sales grew 10.2% in September as

emergency buys following an earthquake offset the impact of

temporary store closures. (WSJ)

A bankruptcy court approved retailer True Religion Apparel

Inc.'s reorganization plan. (WSJ)

Honeywell International Inc. is pursuing an acquisition of

water-filtration company Evoqua Water Technologies. (WSJ)

Japanese trading house Toyota Tsusho and Kindai University

started a project to export farmed Pacific bluefin beginning this

fall. (Nikkei Asian Review)

Amazon.com Inc. is testing a service handling delivery from the

warehouses of third-party sellers to consumers' homes.

(Bloomberg)

U.S. rail carload traffic fell 2.3% in September, including

steep declines in grain and petroleum volume. (Progressive

Railroading)

Port Houston may waive certain cargo charges for shippers

affected by Hurricane Harvey. (Houston Chronicle)

Oil company BP PLC is adding six newly-built liquefied natural

gas carriers to its fleet. (Lloyd's List)

The International Longshore and Warehouse Union is expanding its

drive to organize supervisors at port container terminals in

Southern California. (Journal of Commerce)

The Port of Virginia will use a $1.5 million federal grant to

help launch a truck-reservation system for container operations.

(Virginian-Pilot)

Amazon plans to place a distribution center near Tennessee's

Memphis International Airport. (Memphis Daily News)

Air France-KLM is testing the use of blockchain technology to

manage repair parts for its aircraft. (Aviation Today)

ABOUT US

Paul Page is deputy editor of WSJ Logistics Report. Follow him

at @PaulPage, and follow the entire WSJ Logistics Report team:

@brianjbaskin , @jensmithWSJ and @EEPhillips_WSJ. Follow the WSJ

Logistics Report on Twitter at @WSJLogistics.

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

October 06, 2017 06:51 ET (10:51 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

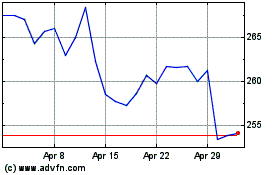

Constellation Brands (NYSE:STZ)

Historical Stock Chart

From Mar 2024 to May 2024

Constellation Brands (NYSE:STZ)

Historical Stock Chart

From May 2023 to May 2024