UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of October, 2023

Commission File Number 001-15214

TRANSALTA

CORPORATION

(Translation of registrant's name into English)

110-12th Avenue S.W., Box 1900, Station “M”,

Calgary, Alberta, Canada, T2P 2M1

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ¨

Form 40-F þ

Signatures

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

TRANSALTA CORPORATION

| By: |

/s/ Todd Stack |

| |

Name: Todd Stack |

| |

Title: Chief Financial Officer |

Date: October 5, 2023

EXHIBIT INDEX

Exhibit 99.1

TransAlta Corporation Announces Closing of the

Acquisition of TransAlta Renewables Inc. and Final Pro Ration

CALGARY, AB, Oct. 5, 2023 /CNW/ - TransAlta Corporation

("TransAlta" or the "Company") (TSX: TA) (NYSE: TAC) and TransAlta Renewables Inc. ("RNW") (TSX: RNW) are

pleased to announce the completion of the acquisition of RNW by TransAlta pursuant to the terms of the previously announced arrangement

agreement between the parties (the "Arrangement"). Under the Arrangement, TransAlta acquired all of the outstanding common shares

of RNW (each, a "RNW Share") not already owned, directly or indirectly, by TransAlta and certain of its affiliates, resulting

in RNW becoming a wholly owned subsidiary of TransAlta.

"The closing of the acquisition of TransAlta

Renewables represents a key milestone for TransAlta with our simplified and unified corporate structure positioning the Company well for

future success," said John Kousinioris, President and Chief Executive Officer of TransAlta. "The combined company will unify

our assets, capital, and capabilities to enhance cash flow predictability while enhancing our ability to realize future growth."

The RNW Shares will be delisted from the Toronto Stock

Exchange and RNW will submit an application to cease to be a reporting issuer in each of the provinces of Canada under National Policy

11-206 Process for Cease to be a Reporting Issuer Applications promptly upon the delisting of the RNW Shares. Common shares of

TransAlta (the "TransAlta Shares") will continue to trade on both the New York Stock Exchange and the Toronto Stock Exchange

under the symbols "TAC" and "TA", respectively.

As a result of the Arrangement, certain RNW directors

have resigned, and TransAlta has appointed two of its employees to serve on the board of directors of RNW.

Results of RNW Shareholders Election

Prior to the Arrangement, TransAlta and its affiliates

collectively held 160,398,217 RNW Shares, representing 60.1% of the issued and outstanding RNW Shares, with the remaining 106,510,884

RNW Shares held by RNW Shareholders other than TransAlta and its affiliates.

The Arrangement was approved by RNW shareholders (the

"RNW Shareholders") at a special meeting of shareholders held on September 26, 2023, and by the Court of King's Bench of Alberta

on October 4, 2023. Under the Arrangement, the maximum aggregate amount of cash payable to holders of RNW Shares is $800 million and the

maximum aggregate number of TransAlta Shares issuable to RNW Shareholders is 46,441,779 (excluding any TransAlta Shares issuable in connection

with the settlement of deferred share units of RNW). Pursuant to the Arrangement, RNW Shareholders had the option to receive (i) 1.0337

TransAlta Shares; or (ii) $13.00 in cash, subject to the terms and conditions of the Arrangement, including pro-rationing.

RNW Shareholders holding 69,707,018 RNW Shares elected

(or were deemed to have elected) to receive an aggregate of 72,056,140 TransAlta Shares as consideration and will receive 46,441,764 TransAlta

Shares following pro-rationing; whereas RNW Shareholders holding 36,758,506 RNW Shares elected to receive aggregate cash consideration

of $477,860,578 and this will be increased to approximately $800 million following pro rationing.

The closing price of a TransAlta Share on the Toronto

Stock Exchange on the last trading day prior to the completion of the Arrangement was $12.01 per share.

Section 85 Election

TransAlta has agreed, in accordance with the procedures and within the time limits set out in the plan of arrangement, to make a joint

election (a "Joint Tax Election") under subsection 85(1) or subsection 85(2) of the Income Tax Act (Canada) (and any

similar provision of any applicable provincial tax legislation) with eligible RNW Shareholders who dispose of RNW Shares in exchange for

consideration that includes TransAlta Shares. For more information concerning the Joint Tax Election, please refer to the Management Information

Circular (the "Circular") that was filed and provided to RNW Shareholders in connection with the Arrangement (see the discussion

in the Circular under the heading, Certain Canadian Federal Income Tax Considerations - Joint Tax Election). The Circular can be

found at https://transaltarenewables.com/wp-content/uploads/sites/2/2023/08/TransAlta-Renewables-Transaction-Management-Information-Circular.pdf.

Eligible RNW Shareholders who wish to make a Joint

Tax Election must submit the information and complete the documentation made available on TransAlta's website at www.transalta.com/RNWacquisition.

Upon receipt of a completed Joint Tax Election from TransAlta, the electing shareholder must sign the Joint Tax Election form and submit

the signed form to the relevant tax authorities within the time limits prescribed by the relevant tax legislation. The Joint Tax Elections

are required to be submitted to TransAlta on or before January 3, 2024. Eligible RNW Shareholders considering making a Joint Tax Election

should consult their investment and tax advisors. Additional information can be found at www.transalta.com/RNWacquisition.

About TransAlta Corporation

TransAlta owns, operates and develops a diverse fleet of electrical power generation assets in Canada, the United States and Australia

with a focus on long-term shareholder value. TransAlta provides municipalities, medium and large industries, businesses and utility customers

with clean, affordable, energy efficient and reliable power. Today, TransAlta is one of Canada's largest producers of wind power and Alberta's

largest producer of hydro-electric power. For over 111 years, TransAlta has been a responsible operator and a proud member of the communities

where we operate and where our employees work and live. TransAlta aligns its corporate goals with the UN Sustainable Development Goals

and its climate change strategy with CDP (formerly Climate Disclosure Project) and the Task Force on Climate-related Financial Disclosures

(TCFD) recommendations. TransAlta has achieved a 68 per cent reduction in GHG emissions or 22 million tonnes since 2015 and has received

scores of A- from CDP and AA from MSCI.

TransAlta was incorporated under the Canada Business

Corporations Act. Its head office is located at 1400, 1100 1st Street S.E., Calgary, Alberta T2G 1B1. RNW's head office is located at

1400, 1100 – 1st Street S.E. Calgary, Alberta T2G 1B1.

For more information about TransAlta, visit our

website at transalta.com.

Cautionary Statement Regarding Forward-Looking

Information

This news release contains "forward-looking information", within the meaning of applicable Canadian securities laws.

In some cases, forward-looking statements can be identified by terminology such as "plans", "expects", "proposed",

"will", "anticipates", "develop", "continue", and similar expressions suggesting future events

or future performance. In particular, this news release contains, without limitation, statements pertaining to the benefits of the Arrangement

and the post-closing RNW filings and the timing thereof. The forward-looking statements contained in this news release are based on many

assumptions and are subject to a number of significant risks, uncertainties and assumptions that could cause actual plans, performance,

results or outcomes to differ materially from current expectations. Factors that may adversely impact what is expressed or implied by

forward-looking statements contained in this news release include, but are not limited to risks and uncertainties discussed in the Company's

materials filed with the securities regulatory authorities from time to time and as also set forth in the Company's and TransAlta's MD&A

and Annual Information Form for the year ended December 31, 2022. Readers are cautioned not to place undue reliance on these forward-looking

statements, which reflect the Company's expectations only as of the date of this news release. The Company disclaims any intention or

obligation to update or revise these forward-looking statements, whether as a result of new information, future events or otherwise, except

as required by law.

Note: All financial figures are in Canadian dollars

unless otherwise indicated.

This press release includes information required under

section 3.1 of National Instrument 62-103 The Early Warning System and Related Take-Over Bid and Insider Reporting Issues. An early

warning report will be filed on RNW's SEDAR+ profile within two days of the closing of the Arrangement. A copy of the early warning report

can be obtained from RNW's SEDAR+ profile at www.sedarplus.ca or by contacting TransAlta's Investor Relations team at 1-800-387-3598.

View original content:https://www.prnewswire.com/news-releases/transalta-corporation-announces-closing-of-the-acquisition-of-transalta-renewables-inc-and-final-pro-ration-301948314.html

SOURCE TransAlta Corporation

View original content: http://www.newswire.ca/en/releases/archive/October2023/05/c4901.html

%CIK: 0001144800

For further information: Investor Inquiries: Phone: 1-800-387-3598

in Canada and U.S., Email: investor_relations@transalta.com; Media Inquiries: Phone: 1-855-255-9184, Email: ta_media_relations@transalta.com

CO: TransAlta Corporation

CNW 07:48e 05-OCT-23

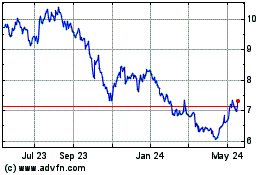

TransAlta (NYSE:TAC)

Historical Stock Chart

From Dec 2024 to Jan 2025

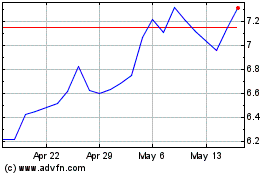

TransAlta (NYSE:TAC)

Historical Stock Chart

From Jan 2024 to Jan 2025