Grant & Eisenhofer Files Class Action Lawsuit Against Target Corporation on Behalf of Pension Fund

01 February 2025 - 9:26AM

Business Wire

Institutional investor City of Riviera Beach Police Pension Fund

filed a class action lawsuit today against Target Corporation

(“Target” or the “Company”), Target’s CEO Brian C. Cornell, and

current and former members of Target’s Board of Directors, David P.

Abney, Douglas M. Baker, Jr., George S. Barrett, Gail K. Boudreaux,

Robert L. Edwards, Melanie L. Healey, Donald R. Knauss, Christine

A. Leahy, Monica C. Lozano, Grace Puma, Derica W. Rice, and Dmitri

L. Stockton.

The action alleges that they defrauded investors by issuing

false and misleading statements concerning certain conduct

undertaken pursuant to Target’s Environmental, Social, and

Governance (“ESG”) and Diversity, Equity, and Inclusion (“DEI”)

mandates.

The suit, brought in federal court in the United States District

Court for the Middle District of Florida, Fort Myers Division, was

filed by leading investor law firm Grant & Eisenhofer P.A.

The action is brought on behalf of all persons or entities who

purchased or acquired Target common stock from August 26, 2022

through November 19, 2024, inclusive (the “Class Period”). The

action is captioned City of Riviera Beach Police Pension Fund v.

Target, Corp., et al., No. 2:25-cv-00085 (M.D. Fla.). The action

has been marked as related to Craig v. Target Corp., et al., No.

2:23-cv-00599-JLB-KCD (M.D. Fla.).

The complaint alleges violations of Sections 10(b), 14(a), and

20(a) of the Securities Exchange Act of 1934. Specifically, Target

failed to warn investors of risks associated with its mandates

regarding its ESG/DEI initiatives. Target’s stock price was

artificially inflated as a result, and its Board members secured

re-election, causing additional damages.

In May 2023 these risks materialized as Target faced customer

backlash from one of its hallmark ESG/DEI initiatives – Target’s

LGBT-Pride Campaign (the “Campaign”). Certain of Target’s customers

responded to the Campaign by boycotting Target. Over time, the

market realized the scope of the consumer backlash and, from May

17, 2023 to June 14, 2023, Target’s stock declined from closing

prices of $160.96 to $124.12. Widespread consumer boycotts and news

related to their growth continued from June 2023 into 2024 causing

further stock price declines and additional damages.

On August 16, 2023, during Target’s Q2 2023 earnings report,

Target revealed that the Campaign had harmed the Company’s earnings

and other financial metrics. From the day prior to the Q2 2023

earnings report release, August 15, 2023, to October 6, 2023,

Target’s stock fell from closing prices of $125.05 to $105.01 per

share. The risks associated with the Campaign further materialized

on November 20, 2024 when Target announced that its GAAP-adjusted

earnings per share were $1.85, compared with $2.10 in the same

quarter of 2023, a decline of 11.9%. This news caused Target’s

stock to fall from a close of $156 on November 19, 2024 to a close

of $121.72 on November 20, 2024, a decline of 22%.

Investors who purchased or acquired Target common stock during

the Class Period are members of this proposed Class and may be able

to seek appointment as lead plaintiff, which is a court-appointed

representative of the Class, by complying with the relevant

provisions for the Private Securities Litigation Reform Act of 1995

(the “PSLRA”). See 15 U.S.C. Section 78u-4(a)(2)(A)(i)-(iv).

If you wish to serve as lead plaintiff, you must move the

Court by no later than April 1, 2025, which is the lead

plaintiff deadline that was established by publication of this

notice on January 31, 2025. You do not need to seek to become a

lead plaintiff in order to share in any possible recovery. You may

also retain counsel of your choice to represent you in this

action.

If you wish to discuss this action or have any questions

concerning this notice or your rights, please contact Caitlin M.

Moyna at Grant & Eisenhofer at 646-722-8513, or via email at

cmoyna@gelaw.com. You can also find more information at

gelaw.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250131721136/en/

Grant & Eisenhofer Caitlin M. Moyna 646-722-8513

cmoyna@gelaw.com

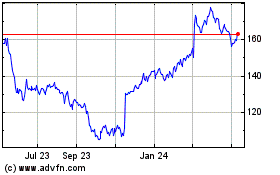

Target (NYSE:TGT)

Historical Stock Chart

From Jan 2025 to Feb 2025

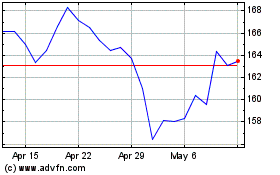

Target (NYSE:TGT)

Historical Stock Chart

From Feb 2024 to Feb 2025