Sixth Street Specialty Lending, Inc. (NYSE:TSLX) (“TSLX” or the

“Company”) announced today that it has priced an underwritten

public offering of $350.0 million in aggregate principal amount of

6.125% notes due 2029. The notes will mature on March 1, 2029 and

may be redeemed in whole or in part at TSLX’s option at any time at

par plus a “make-whole” premium, if applicable.

TSLX expects to use the net proceeds of the offering to pay down

outstanding debt under its revolving credit facility. However,

through re-borrowing under the revolving credit facility, TSLX

intends to make new investments in accordance with its investment

objectives and strategies outlined in the preliminary prospectus

supplement and the accompanying prospectus described below in

greater detail.

In connection with the offering, TSLX intends to enter into an

interest rate swap to better align the interest rates of its

liabilities with its investment portfolio, which consists of

predominately floating rate loans.

BofA Securities, Goldman Sachs & Co. LLC, J.P. Morgan and

SMBC Nikko are acting as joint book-running managers for this

offering. Morgan Stanley, RBC Capital Markets, HSBC, Wells Fargo

Securities, Citigroup, Truist Securities, Mizuho and MUFG are also

acting as book-running managers for this offering. Keefe, Bruyette

& Woods, A Stifel Company, Oppenheimer & Co., ICBC Standard

Bank, Raymond James, B. Riley Securities, Citizens Capital Markets,

Hovde Group, LLC, Ladenburg Thalmann and R. Seelaus & Co., LLC

are acting as co-managers for this offering. The offering is

expected to close on January 16, 2024, subject to customary closing

conditions.

Investors are advised to carefully consider the investment

objectives, risks, charges and expenses of the Company before

investing. The pricing term sheet dated January 8, 2024, the

preliminary prospectus supplement dated January 8, 2024 and the

accompanying prospectus dated December 22, 2023, each of which have

been or will be filed with the Securities and Exchange Commission

(“SEC”), contain this and other information about the Company and

should be read carefully before investing.

The information in the pricing term sheet, the preliminary

prospectus supplement, the accompanying prospectus and this press

release is not complete and may be changed. The pricing term sheet,

the preliminary prospectus supplement, the accompanying prospectus

and this press release are not offers to sell any securities of

TSLX and are not soliciting an offer to buy such securities in any

state or jurisdiction where such offer and sale is not

permitted.

A shelf registration statement relating to these securities

is on file with the SEC and is effective. The offering may be made

only by means of a preliminary prospectus supplement and an

accompanying prospectus, copies of which may be obtained from BofA

Securities, Inc., NC1-022-02-425, 201 North Tryon Street,

Charlotte, NC 28255-0001, attn: Prospectus Department, email:

dg.prospectus_requests@bofa.com, telephone: 1-800-294-1322.

About Sixth Street Specialty Lending, Inc.

TSLX is a specialty finance company focused on lending to

middle-market companies. The Company seeks to generate current

income primarily in U.S.-domiciled middle-market companies through

direct originations of senior secured loans and, to a lesser

extent, originations of mezzanine loans and investments in

corporate bonds and equity securities. The Company has elected to

be regulated as a business development company, or BDC, under the

Investment Company Act of 1940 and the rules and regulations

promulgated thereunder. TSLX is externally managed by Sixth Street

Specialty Lending Advisers, LLC, an SEC registered investment

adviser. TSLX leverages the deep investment, sector, and operating

resources of Sixth Street Partners, LLC, a global investment firm

with over $75 billion of assets under management and committed

capital.

Forward-Looking Statements

Statements included herein may constitute “forward-looking

statements,” which relate to future events or the Company’s future

performance or financial condition. These forward-looking

statements are not historical facts, but rather are based on

current expectations, estimates and projections about the Company,

its current and prospective portfolio investments, its industry,

its beliefs and opinions, and its assumptions. Words such as

“anticipates,” “expects,” “intends,” “plans,” “will,” “may,”

“continue,” “believes,” “seeks,” “estimates,” “would,” “could,”

“should,” “targets,” “projects,” “outlook,” “potential,” “predicts”

and variations of these words and similar expressions are intended

to identify forward-looking statements. These statements are not

guarantees of future performance and are subject to risks,

uncertainties and other factors, some of which are beyond the

Company’s control and difficult to predict and could cause actual

results to differ materially from those expressed or forecasted in

the forward-looking statements including, without limitation, the

risks, uncertainties and other factors identified in the Company’s

filings with the SEC. Investors should not place undue reliance on

these forward-looking statements, which apply only as of the date

on which the Company makes them. The Company does not undertake any

obligation to update or revise any forward-looking statements or

any other information contained herein, except as required by

applicable law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240108603066/en/

Investors: Cami VanHorn 469-621-2033 IRTSLX@sixthstreet.com

Media: Patrick Clifford 617-793-2004

pclifford@sixthstreet.com

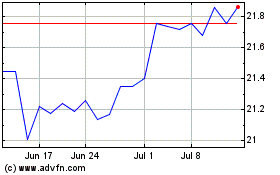

Sixth Street Specialty L... (NYSE:TSLX)

Historical Stock Chart

From Nov 2024 to Dec 2024

Sixth Street Specialty L... (NYSE:TSLX)

Historical Stock Chart

From Dec 2023 to Dec 2024