Sixth Street Specialty Lending, Inc. Reports Second Quarter 2024 Earnings Results; Declares a Third Quarter Base Dividend Per Share of $0.46, and a Second Quarter Supplemental Dividend Per Share of $0.06

01 August 2024 - 6:05AM

Business Wire

Sixth Street Specialty Lending, Inc. (NYSE: TSLX, or the

“Company”) today reported financial results for the second quarter

ended June 30, 2024. Please view a printable version of the 2024

Second Quarter Results.

Conference Call Information:

A conference call to discuss the Company’s financial results

will be held at 8:30 a.m. Eastern Time on August 1, 2024. The

conference call will be broadcast live in listen-only mode on the

Investor Resources section of TSLX’s website at

https://sixthstreetspecialtylending.gcs-web.com/events-and-presentations.

The Events & Presentations page of the Investor Resources

section of TSLX’s website also includes a slide presentation that

complements the Earnings Conference Call. Please visit the website

to test your connection before the webcast.

Research analysts who wish to participate in the conference call

must first register at

https://register.vevent.com/register/BI46292d14404d4f17a64ea95eac508eef.

Upon registration, all telephone participants will receive a

confirmation email detailing how to join the conference call,

including the dial-in number along with a unique passcode and

registrant ID that can be used to access the call.

Replay Information:

A recorded version will be available under the same webcast link

(https://sixthstreetspecialtylending.gcs-web.com/events-and-presentations)

following the conclusion of the conference call.

Please direct any questions regarding the conference call to

TSLX Investor Relations, IRTSLX@sixthstreet.com.

About Sixth Street Specialty Lending

Sixth Street Specialty Lending is a specialty finance company

focused on lending to middle-market companies. The Company seeks to

generate current income primarily in U.S.-domiciled middle-market

companies through direct originations of senior secured loans and,

to a lesser extent, originations of mezzanine loans and investments

in corporate bonds and equity securities. The Company has elected

to be regulated as a business development company, or a BDC, under

the Investment Company Act of 1940 and the rules and regulations

promulgated thereunder. The Company is externally managed by Sixth

Street Specialty Lending Advisers, LLC, an affiliate of Sixth

Street and a Securities and Exchange Commission (“SEC”) registered

investment adviser. The Company leverages the deep investment,

sector, and operating resources of Sixth Street, a global

investment firm with over $78 billion in assets under management

and committed capital. For more information, visit the Company’s

website at https://sixthstreetspecialtylending.com.

About Sixth Street

Sixth Street is a global investment firm with over $78 billion

in assets under management and committed capital. The firm uses its

long-term flexible capital, data-enabled capabilities, and One Team

culture to develop themes and offer solutions to companies across

all stages of growth. Founded in 2009, Sixth Street has more than

600 team members including over 250 investment professionals around

the world. For more information, visit https://sixthstreet.com or

follow Sixth Street on LinkedIn.

Forward-Looking Statements

Statements included herein may constitute “forward-looking

statements,” within the meaning of the federal securities laws and

the Private Securities Litigation Reform Act of 1995, which relate

to future events or the Company’s future performance or financial

condition. These forward-looking statements can be identified by

the use of forward-looking terminology, such as “outlook,”

“indicator,” “believes,” “expects,” “potential,” “continues,”

“may,” “can,” “will,” “should,” “seeks,” “approximately,”

“predicts,” “intends,” “plans,” “estimates,” “anticipates”,

“confident,” “conviction,” “identified” or the negative versions of

these words or other comparable words thereof. These statements are

not guarantees of future performance, conditions or results and

involve a number of risks and uncertainties. Actual results may

differ materially from those in the forward-looking statements as a

result of a number of factors, including those described from time

to time in the Company’s filings with the SEC, which are accessible

on the SEC’s website at www.sec.gov. Except as otherwise required

by federal securities laws, the Company assumes no obligation to

update any such forward-looking statements, whether as a result of

new information, future developments or otherwise.

Non-GAAP Financial Measures

Adjusted net investment income and adjusted net income are each

non-GAAP financial measures, which represent net investment income

and net income, respectively, in each case less the impact of

accrued capital gains incentive fee expenses. The Company believes

that adjusted net investment income and adjusted net income provide

useful information to investors regarding the fundamental earnings

power of the business, and these figures are used by the Company to

measure its financial condition and results of operations. The

presentation of this additional information is not meant to be

considered in isolation or as a substitute for financial results

prepared in accordance with GAAP.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240731703941/en/

Investors: Cami VanHorn, 469-621-2033 Sixth Street Specialty

Lending IRTSLX@sixthstreet.com

Media: Patrick Clifford, 617-793-2004 Sixth Street

PClifford@sixthstreet.com

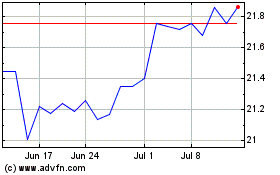

Sixth Street Specialty L... (NYSE:TSLX)

Historical Stock Chart

From Nov 2024 to Dec 2024

Sixth Street Specialty L... (NYSE:TSLX)

Historical Stock Chart

From Dec 2023 to Dec 2024