UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

Pursuant

to Rule 13a-16 or 15d-16

Under

the Securities Exchange Act of 1934

For

the month of January 2025

Commission

File Number: 001-35829

Vermilion

Energy Inc.

(Exact

name of registrant as specified in its charter)

3500,

520 – 3rd Avenue S.W., Calgary, Alberta T2P 0R3

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Exhibit

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

VERMILION

ENERGY INC.

| |

|

|

| By: |

|

/s/ Lars Glemser |

| Title: |

|

Lars Glemser, VP and Chief Financial Officer |

Date: January 2, 2025

Exhibit 99.1

| |

FORM 51-102F3 |

|

| |

|

|

| |

MATERIAL CHANGE REPORT |

|

| 1. | Name and Address of Company |

Vermilion Energy Inc. (“Vermilion” or

the “Company”)

3500, 520 3rd Avenue SW

Calgary, Alberta T2P 0R3

| 2. | Date of Material Change |

December 22, 2024.

The news release reporting the material change was disseminated

on December 23, 2024, through the services of Newswire and filed on the Company’s SEDAR+ profile at www.sedarplus.ca.

| 4. | Summary of Material Change |

Vermilion has entered

into an arrangement agreement (the “Arrangement Agreement”) with Westbrick Energy Ltd.

(“Westbrick”) and its majority shareholder (the “Majority Shareholder”) pursuant to which the

Company agreed, subject to the terms and conditions of the Arrangement Agreement, to acquire all of the issued and outstanding

shares of the company (“Westbrick Amalco”) to be formed upon the amalgamation (the “Westbrick

Amalgamation”) of Westbrick and a wholly-owned subsidiary of the Majority Shareholder, for total consideration of $1.075

billion, subject to certain adjustments (the “Transaction”).

| 5.1 | Full Description of Material Change |

Effective December 22, 2024,

Vermilion entered into the Arrangement Agreement with Westbrick and the Majority Shareholder pursuant to which, among other things:

(i) Westbrick will complete the Spinco Conveyance (as defined below); (ii) the Majority Shareholder will complete a return of

capital; (iii) the Westbrick Amalgamation will occur; (iii) all shares of Westbrick Amalco (the “Westbrick Amalco

Shares”), including any shares issuable upon the exercise of outstanding options to purchase Westbrick Amalco Shares

(“Options”) prior to or in conjunction with Closing (as defined below), will be transferred to Vermilion; and

(iv) holders of unexercised Options and certain other share-based awards will receive an amount of cash equal to the value of their

entitlement, whether or not vested. As noted above, the total consideration to be paid by Vermilion for all such purposes at Closing

is $1.075 billion, subject to certain adjustments set forth in the Arrangement Agreement.

The Arrangement Agreement contains

customary representations, warranties, interim operational covenants of each party and customary closing conditions, including receipt

of applicable shareholder, court and other regulatory approvals, including approval under the Competition Act (Canada). The Transaction

will be accomplished by way of a statutory plan of arrangement under the Business Corporations Act (Alberta) and is expected to

close mid-Q1 2025 (the “Closing”).

Pursuant to the Transaction, Vermilion

will add approximately 50,000 boe/d of stable production and approximately 1.1 million

(770,000 net) acres of land from which Vermilion has identified over 700 drilling locations, increasing the Company’s

estimated inventory of premium drilling locations to over 15 years on a pro forma basis. Pro-forma production is expected to total

approximately 135,000 boe/d with greater than 80% of its production derived from its global gas franchise, consisting of

liquids-rich gas in Alberta and BC and gas-weighted production in Ireland, Germany, Netherlands and Croatia. See

“Transaction Metrics” in this material change report.

Consideration

Pursuant to the Transaction, holders

of Westbrick Amalco Shares, including any shares issued upon the exercise of outstanding Options prior to or in conjunction with Closing,

will receive cash consideration for their Westbrick Amalco Shares, provided that such holders may elect to receive all or a portion of

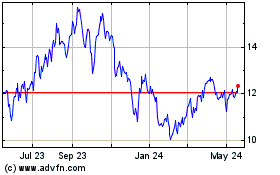

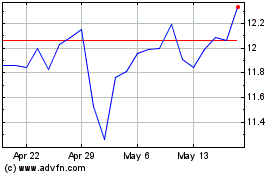

their consideration in common shares of Vermilion (the “Vermilion Shares”), up to a maximum of 1,700,000 Vermilion

Shares being issued in aggregate and subject to proration, at a deemed price per Vermilion Share of $12.831, being the volume weighted

average trading price of the Vermilion Shares on the Toronto Stock Exchange during the five business day period ending on December 20,

2024.

The Transaction will be funded through

Vermilion’s undrawn $1.35 billion revolving credit facility. In connection with the Transaction, Vermilion has also entered into

a new fully underwritten $250 million term loan maturing May 2028 through a debt commitment letter with TD Securities Inc. (“TD”),

acting as underwriter, and a new fully underwritten US$300 million bridge facility through a debt commitment letter with Royal Bank of

Canada and TD. Upon Closing, Vermilion is expected to have net debt(1) of $2.0 billion

with a pro forma year-end 2025 net debt to fund flows from operations (“FFO”) ratio(2)

of 1.5 times and liquidity of approximately $500 million. In addition to allocating a portion of free cash flow (“FCF”)

to debt reduction, Vermilion will also initiate a process to identify and execute non-core asset divestments in order to accelerate debt

reduction and further high-grade the portfolio, with the objective of reducing the net debt to FFO ratio to the targeted range of 1.0

times or less.

Spinco Conveyance

Under the Transaction, Westbrick

will convey its Cynthia Duvernay assets to TMax Energy Ltd. (“TMax”), a wholly- owned subsidiary of Westbrick on an

“as is, where is” basis, without representation and warranty, in consideration of, among other things, TMax assuming all of

the liabilities associated therewith (the “Spinco Conveyance”), subject to and in accordance with the terms of a conveyance

agreement to be dated on or before Closing (the “Conveyance Agreement”). All of the shares of TMax will be sold to

a third party prior to Closing or, if not sold, will be distributed to the existing shareholders of Westbrick at that time.

Voting Support Agreements

Certain shareholders of Westbrick

(the “Supporting Shareholders”), representing over 90% of the outstanding Westbrick common shares, have executed a

written resolution approving the Transaction. The Supporting Shareholders have also entered into lock-up and support agreements (the “Voting

Support Agreements”), agreeing to support the Transaction, except in certain circumstances.

Transaction

Metrics

| > |

Approximately 1.1 million (770,000 net) acres of land and four operated gas plants with total capacity of 102 mmcf/d in the southeast portion of the Deep Basin trend in Alberta. This footprint is contiguous and complementary to Vermilion’s legacy Deep Basin assets, providing operational and financial synergies, including capital efficiency improvements, infrastructure optimization, gas marketing opportunities, and other corporate synergies. The Transaction excludes undeveloped Duvernay rights on approximately 300,000 (290,000 net) acres of land pursuant to the Spinco Conveyance. |

| > |

Stable annual production of 50,000 boe/d (75% gas and 25% liquids) expected in 2025(3), based on Vermilion’s development plans. This production level represents 5% year-over-year growth and is forecast to generate more than $110 million of annual FCF(3,4) based on forward commodity prices(5). Revenue from the acquired assets will be derived approximately 50% from liquids and 50% from gas. |

| > |

2025E annual net operating

income of $275 million based on forward prices(5), translating into a net

operating income multiple of approximately 3.9x. The multiple compresses to 3.3x in 2026 as net operating income

is forecast to increase to $330 million based on forward pricing(5). |

| > |

Significant, high-quality drilling inventory adds over 700 locations in the Ellerslie, Notikewin, Rock Creek, Falher, Cardium, Wilrich and Niton formations, with half-cycle IRRs ranging from 40% to over 100% based on estimates provided by McDaniel & Associates Consultants Ltd (“McDaniel”)(6) and using three consultant average October 1, 2024 pricing assumptions(6). |

| > |

Proved developed producing (“PDP”) and proved plus probable (“2P”) reserves estimated at 92 million boe (75% gas) and 256 million boe (74% gas), respectively, based on McDaniel estimates(6). The Transaction price per boe of PDP reserves is $11.70, which translates to an implied recycle ratio of 1.3 times based on the operating netback noted above. Approximately 30% of the over 700 identified drilling locations have been included in the reserves estimates. |

| > |

Before-tax PDP reserve net present value at a 10% discount rate is estimated at $1.0 billion based on McDaniel estimates(6) and using three consultant average October 1, 2024 pricing assumptions(6). This value represents over 90% of the purchase price. |

Notes:

| (1) |

Net debt is a capital management measure most directly comparable to long-term debt and is comprised of long-term debt (excluding unrealized foreign exchange on swapped USD borrowings) plus adjusted working capital (defined as current assets less current liabilities, excluding current derivatives and current lease liabilities). |

| (2) |

Net debt to four quarter trailing fund flows from operations is a supplementary financial measure and is not a standardized financial measure under IFRS. It may not be comparable to similar measures disclosed by other issuers and is calculated using net debt (capital management measure) and FFO (total of segment measure). The measure is used to assess the ability to repay debt. |

| (3) |

Anticipated 2025 production and financial results from acquired assets, based on company estimates and full year average reference prices as at November 21, 2024 (see below). Results reflect full year production and cash flow estimates and may not align with Company guidance following the close of the Transaction, which will reflect post-close production and cash flow contributions. |

| (4) |

Free cash flow (FCF) and excess free cash flow (EFCF) are non-GAAP financial measures comparable to cash flows from operating activities. FCF is comprised of FFO less drilling and development and exploration and evaluation expenditures and EFCF is FCF less payments on lease obligations and asset retirement obligations settled. FCF and EFCF per basic share are non-GAAP supplementary financial measures and are not standardized financial measures under IFRS and may not be comparable to similar measures disclosed by other issuers. They are calculated using FCF or EFCF and weighted average basic shares outstanding. |

| (5) |

2025 forward strip pricing as at November 21, 2024: Brent US$72.31/bbl; WTI US$68.49/bbl; LSB = WTI less US$4.96/bbl; TTF $19.90/mmbtu; NBP $20.04/mmbtu; AECO $2.34/mcf; CAD/USD 1.40; CAD/EUR 1.48 and CAD/AUD 0.91. 2026 forward strip pricing as at November 21, 2024: Brent US$70.26/bbl; WTI US$66.25/bbl; LSB = WTI less US$6.18/bbl; TTF $15.83/mmbtu; NBP $15.92/mmbtu; AECO $3.16/mcf; CAD/USD 1.39; CAD/EUR 1.50 and CAD/AUD 0.90. |

| (6) |

Estimated gross proved,

developed and producing, total proved, and total proved plus probable reserves as evaluated by McDaniel in a report dated December

17, 2024, with an effective date of November 30, 2024 (the “McDaniel Reserves Report”). Net present value of

discounted cash flows as provided in the McDaniel Reserves Report. Three consultant average October 1, 2024 pricing assumptions used

in reserve estimates as follows: 2025 WTI US$72.00/bbl, AECO C$2.50/mmbtu, CAD/USD FX rate 0.747; 2026 WTI US$74.98/bbl, AECO

C$3.36/mmbtu, CAD/USD FX rate 0.753; 2027 WTI US$76.65/bbl, AECO C$3.62/mmbtu, CAD/USD FX rate 0.753. |

Additional Information

The foregoing descriptions of the

Arrangement Agreement, the Voting Support Agreements and the Conveyance Agreement are not complete and are qualified in their entirety

by reference to the full text of the Arrangement Agreement, which provides additional information. The Company has filed a copy of the

Arrangement Agreement on its SEDAR+ profile accessible at www.sedarplus.ca.

| 5.2 | Disclosure for Restructuring Transactions |

Not applicable.

| 6. | Reliance on subsection 7.1(2) of National Instrument 51-102 |

Not applicable.

No information has been omitted on the basis that it is confidential

information.

For inquiries regarding the material change and this report, please

contact:

Kyle Preston

Vice President, Investor Relations

(403) 269-4884 | 1-866-895-8101

January 2, 2025.

Forward Looking Information

Certain statements included or incorporated

by reference in this document may constitute forward-looking statements or information under applicable securities legislation. Such forward-looking

statements or information typically contain statements with words such as “anticipate”, “believe”, “expect”,

“plan”, “intend”, “estimate”, “propose”, or similar words suggesting future outcomes or

statements regarding an outlook. Forward looking statements or information in this document may include, but are not limited to: statements

regarding the terms of the Transaction and the expected timing and completion thereof; satisfaction or waiver of the closing conditions

in the Arrangement Agreement (including receipt of applicable shareholder, court and other regulatory approvals); the increase of drilling

inventory of over 15 years; the acquisition of 700 drilling locations; characteristics of the acquired assets, including expected pro

forma production and inventory in place; exploration and development plans and the timing thereof, including as a result of the Transaction

if it is completed; petroleum and natural gas sales, netbacks, and the expectation of generating strong free cash flow therefrom; the

effect of changes in crude oil and natural gas prices, and changes in exchange and inflation rates; Vermilion’s debt capacity, including

the availability of funds under financing arrangements that Vermilion has negotiated in connection with the Transaction and its ability

to meet draw down conditions applicable to such financing, and Vermilion’s ability to manage debt and leverage ratios and raise

additional debt; future production levels and the timing thereof; future production weighting, including weighting for product type or

geography; estimated volumes of reserves and resources, including with respect to those reserves and resources that may be acquired pursuant

to the Transaction; the flexibility of Vermilion’s capital program and operations; business strategies and objectives; operational

and financial performance, including the ability of Vermilion to realize synergies from the Transaction; significant declines in production

or sales volumes due to unforeseen circumstances; statements regarding the growth and size of Vermilion’s future project inventory,

including the number of future drilling locations expected to be available if the Transaction is completed; acquisition and disposition

plans and the economics and timing thereof; operating and other expenses, including the payment and amount of future dividends; and the

timing of regulatory proceedings and approvals.

Such forward-looking

statements or information are based on a number of assumptions, all or any of which may prove to be incorrect. In addition to any

other assumptions identified in this document, assumptions have been made regarding, among other things: the ability of Vermilion to

obtain equipment, services and supplies in a timely manner to carry out its activities in Canada and internationally; the ability of

Vermilion to market crude oil, natural gas liquids, and natural gas successfully to current and new customers; the timing and costs

of pipeline and storage facility construction and expansion and the ability to secure adequate product transportation; the timely

receipt of required regulatory approvals; the ability of Vermilion to obtain financing on acceptable terms; foreign currency

exchange rates and interest rates; future crude oil, natural gas liquids, and natural gas prices; management’s expectations

relating to the timing and results of exploration and development activities; the impact of Vermilion’s dividend policy on its

future cash flows; credit ratings; the ability of Vermilion to effectively maintain its hedging program; expected earnings/(loss)

and adjusted earnings/(loss); expected earnings/(loss) or adjusted earnings/(loss) per share; expected future cash flows and free

cash flow and expected future cash flow and free cash flow per share; estimated future dividends; financial strength and

flexibility; debt and equity market conditions; general economic and competitive conditions; ability of management to execute key

priorities; and the effectiveness of various actions resulting from the Vermilion’s strategic priorities.

Although Vermilion believes that

the expectations reflected in such forward-looking statements or information are reasonable, undue reliance should not be placed on forward

looking statements because Vermilion can give no assurance that such expectations will prove to be correct. Financial outlooks are provided

for the purpose of understanding Vermilion’s financial position and business objectives, and the information may not be appropriate

for other purposes. Forward looking statements or information are based on current expectations, estimates, and projections that involve

a number of risks and uncertainties which could cause actual results to differ materially from those anticipated by Vermilion and described

in the forward-looking statements or information. These risks and uncertainties include, but are not limited to: the timely receipt of

any required regulatory approvals and the satisfaction of all other conditions to the completion of the Transaction; the ability of Vermilion

to complete the Transaction; the ability of management to execute its business plan; the risks of the oil and gas industry, both domestically

and internationally, such as operational risks in exploring for, developing and producing crude oil, natural gas liquids, and natural

gas; risks and uncertainties involving geology of crude oil, natural gas liquids, and natural gas deposits; risks inherent in Vermilion’s

marketing operations, including credit risk; the uncertainty of reserves estimates and reserves life and estimates of resources and associated

expenditures; the uncertainty of estimates and projections relating to production and associated expenditures; potential delays or changes

in plans with respect to exploration or development projects; constraints at processing facilities and/or on transportation; Vermilion’s

ability to enter into or renew leases on acceptable terms; fluctuations in crude oil, natural gas liquids, and natural gas prices, foreign

currency exchange rates, interest rates and inflation; health, safety, and environmental risks and uncertainties related to environmental

legislation, hydraulic fracturing regulations and climate change; uncertainties as to the availability and cost of financing; the ability

of Vermilion to add production and reserves through exploration and development activities; the possibility that government policies or

laws may change or governmental approvals may be delayed or withheld; weather conditions, political events and terrorist attacks; uncertainty

in amounts and timing of royalty payments; risks associated with existing and potential future law suits and regulatory actions against

or involving Vermilion; and other risks and uncertainties described elsewhere in this document or in Vermilion’s other filings with

Canadian securities regulatory authorities.

The forward-looking statements

or information contained in this document are made as of the date hereof, and Vermilion undertakes no obligation to update publicly or

revise any forward-looking statements or information, whether as a result of new information, future events or otherwise, unless required

by applicable securities laws.

Reserves and Drilling

Data

This document contains metrics commonly

used in the oil and gas industry. These oil and gas metrics do not have any standardized meaning or standard methods of calculation and,

therefore, may not be comparable to similar measures presented by other companies where similar terminology is used and should, therefore,

not be used to make comparisons. Natural gas volumes have been converted on the basis of six thousand cubic feet of natural gas to one

barrel of oil equivalent. Barrels of oil equivalent (boe) may be misleading, particularly if used in isolation. A boe conversion ratio

of six thousand cubic feet to one barrel of oil is based on an energy equivalency conversion method primarily applicable at the burner

tip and does not represent a value equivalency at the wellhead.

Estimates of Drilling Locations:

Unbooked drilling locations, including

those associated with the Transaction, are the internal estimates of Vermilion based on Vermilion’s prospective acreage, the acreage

that may be acquired pursuant to the Transaction, and an assumption as to the number of wells that can be drilled per section based on

industry practice and internal review. Unbooked locations do not have attributed reserves or resources (including contingent and prospective).

Unbooked locations have been identified by Vermilion’s management as an estimation of Vermilion’s multiyear drilling activities

based on evaluation of applicable geologic, seismic, engineering, production and reserves information, including expected activities if

the Transaction is completed. There is no certainty that Vermilion will drill all unbooked drilling locations, and if drilled, there is

no certainty that such locations will result in additional oil and natural gas reserves, resources or production. The drilling locations

on which Vermilion will actually drill wells, including the number and timing thereof is ultimately dependent upon completion of the Transaction,

the availability of funding, regulatory approvals, seasonal restrictions, oil and natural gas prices, costs, actual drilling results,

additional reservoir information that is obtained and other factors. While a certain number of the unbooked drilling locations have been

de-risked by Westbrick drilling existing wells in relative close proximity to such unbooked drilling locations, other unbooked drilling

locations are farther away from existing wells where management of Vermilion has less information about the characteristics of the reservoir

and, therefore, there is more uncertainty whether wells will be drilled in such locations and if drilled there is more uncertainty that

such wells will result in additional oil and gas reserves, resources or production.

Reserves Data:

There are numerous uncertainties

inherent in estimating quantities of crude oil, natural gas and NGL reserves, and the future cash flows attributed to such reserves. The

reserve and associated cash flow information incorporated in this release, including those relating to the reserves to be acquired pursuant

to the Transaction, are estimates only. Generally, estimates of economically recoverable crude oil, NGL and natural gas reserves (including

the breakdown of reserves by product type) and the future net cash flows from such estimated reserves are based upon a number of variable

factors and assumptions, such as historical production from the properties, production rates, ultimate reserve recovery, timing and amount

of capital expenditures, marketability of oil and natural gas, royalty rates, the assumed effects of regulation by governmental agencies

and future operating costs, all of which may vary materially from actual results. For those reasons, estimates of the economically recoverable

crude oil, NGL and natural gas reserves attributable to any particular group of properties, classification of such reserves based on risk

of recovery and estimates of future net revenues associated with reserves prepared by different engineers, or by the same engineers at

different times, may vary. Vermilion’s actual production, revenues, taxes and development and operating expenditures with respect

to its reserves will vary from estimates and such variations could be material.

Financial data contained within this document are reported

in Canadian dollars, unless otherwise stated.

Exhibit 99.2

ARRANGEMENT AGREEMENT

among

WESTBRICK ENERGY LTD.

and

[Name of party redacted]

and

VERMILION ENERGY INC.

Dated as of December 22, 2024

| |

TABLE OF CONTENTS |

|

| |

|

|

| |

|

Page |

| |

|

|

| |

ARTICLE 1 |

|

| |

DEFINITIONS AND INTERPRETATION |

|

| |

|

|

| 1.1 |

Definitions. |

2 |

| 1.2 |

Interpretation |

30 |

| 1.3 |

Schedules |

31 |

| 1.4 |

Interpretation if Closing Does Not Occur |

31 |

| 1.5 |

Knowledge |

31 |

| 1.6 |

Construction |

32 |

| |

|

|

| |

ARTICLE 2 |

|

| |

ARRANGEMENT |

|

| |

|

|

| 2.1 |

Plan of Arrangement and Westbrick Board Recommendation |

32 |

| 2.2 |

Arrangement Resolution |

32 |

| 2.3 |

Interim and Final Order. |

33 |

| 2.4 |

Notice of Written Resolution |

34 |

| 2.5 |

Court Proceedings. |

35 |

| 2.6 |

Initial Arrangement Transactions |

36 |

| 2.7 |

Closing |

38 |

| 2.8 |

Determination of Aggregate Adjusted Consideration |

38 |

| 2.9 |

Payment of Consideration |

41 |

| 2.10 |

Purchaser’s Right to Withhold |

41 |

| 2.11 |

Applicable U.S. Securities Laws |

42 |

| |

|

|

| |

ARTICLE 3 |

|

| |

REPRESENTATIONS

AND WARRANTIES OF [NAME OF PARTY REDACTED] |

|

| |

|

|

| 3.1 |

Organization and Corporate Power |

42 |

| 3.2 |

Subsidiaries |

42 |

| 3.3 |

Due Authorization and Enforceability of Obligations |

42 |

| 3.4 |

Solvency |

43 |

| 3.5 |

Legal Proceedings |

43 |

| 3.6 |

No Contravention |

43 |

| 3.7 |

Consents and Approvals |

44 |

| 3.8 |

Capitalization; Right to Sell |

44 |

| 3.9 |

[Name redacted] Holdco Indebtedness |

45 |

| 3.10 |

No Material Contracts |

45 |

| 3.11 |

Equity Monetization Plans |

45 |

| 3.12 |

Corporate Records |

45 |

| 3.13 |

Residence

of [name of party redacted] and [name redacted] Holdco |

45 |

| 3.14 |

No Conduct of Business |

45 |

| 3.15 |

Tax Matters |

46 |

| 3.16 |

Transaction Expenses |

48 |

| |

|

|

| |

TABLE OF CONTENTS |

|

| |

(continued) |

|

| |

|

Page |

| |

|

|

| |

ARTICLE 4 |

|

| |

REPRESENTATIONS AND WARRANTIES OF WESTBRICK |

|

| |

|

|

| 4.1 |

Incorporation, Corporate Power and Registration |

48 |

| 4.2 |

Subsidiaries |

48 |

| 4.3 |

Capitalization |

48 |

| 4.4 |

Due Authorization and Enforceability of Obligations |

49 |

| 4.5 |

No Contravention |

49 |

| 4.6 |

Consents and Approvals |

50 |

| 4.7 |

Solvency |

50 |

| 4.8 |

Taxable Canadian Corporation - Westbrick |

50 |

| 4.9 |

Title |

50 |

| 4.10 |

Licences |

50 |

| 4.11 |

No Defaults under Leases and Agreements |

51 |

| 4.12 |

No Encumbrances |

51 |

| 4.13 |

No Preferential Purchase Rights |

52 |

| 4.14 |

No Reduction of Interests |

52 |

| 4.15 |

Production Penalties |

52 |

| 4.16 |

Operation of PNG Assets |

52 |

| 4.17 |

Area of Mutual Interest |

53 |

| 4.18 |

Off-Set Obligations |

53 |

| 4.19 |

Royalties, Rentals and Taxes Paid |

53 |

| 4.20 |

AFEs |

53 |

| 4.21 |

Capex Projects |

53 |

| 4.22 |

Reserves |

53 |

| 4.23 |

Hedging Transactions |

54 |

| 4.24 |

Financial Statements |

54 |

| 4.25 |

No Undisclosed Liabilities |

54 |

| 4.26 |

Absence of Changes |

55 |

| 4.27 |

Government Incentives |

55 |

| 4.28 |

Aboriginal Groups |

55 |

| 4.29 |

Material Contracts |

56 |

| 4.30 |

Equity Monetization Plans |

56 |

| 4.31 |

Duvernay Spinco Transaction |

56 |

| 4.32 |

Legal Proceedings |

57 |

| 4.33 |

Compliance with Applicable Laws |

57 |

| 4.34 |

Environmental Matters |

58 |

| 4.35 |

Employee Matters |

59 |

| 4.36 |

Employee Benefit Plans |

61 |

| 4.37 |

Non Arm’s Length Transactions |

62 |

| 4.38 |

Tax Matters |

63 |

| 4.39 |

Insurance |

65 |

| 4.40 |

Intellectual Property |

65 |

| 4.41 |

Books and Records, Corporate Records |

66 |

| 4.42 |

Anti-Corruption; Anti-Money Laundering |

66 |

| |

|

|

| |

TABLE OF CONTENTS |

|

| |

(continued) |

|

| |

|

|

| |

|

Page |

| |

|

|

| 4.43 |

Directive 067 |

66 |

| 4.44 |

No Broker |

67 |

| 4.45 |

Net Debt |

67 |

| 4.46 |

Information Provided |

67 |

| |

|

|

| |

ARTICLE 5 |

|

| |

REPRESENTATIONS AND WARRANTIES OF PURCHASER |

|

| |

|

|

| 5.1 |

Organization and Corporate Power |

67 |

| 5.2 |

Due Authorization and Enforceability of Obligations |

67 |

| 5.3 |

No Contravention |

68 |

| 5.4 |

Consents and Approvals |

68 |

| 5.5 |

Solvency |

68 |

| 5.6 |

AER Directive 067 |

68 |

| 5.7 |

Legal Proceedings |

69 |

| 5.8 |

Investment Canada Act |

69 |

| 5.9 |

Taxable Canadian Corporation - Purchaser |

69 |

| 5.10 |

Sufficiency of Funds |

69 |

| 5.11 |

Capitalization |

70 |

| 5.12 |

Issuance of Purchaser Shares |

70 |

| 5.13 |

Purchaser Financial Statements |

71 |

| 5.14 |

No Undisclosed Liabilities |

71 |

| 5.15 |

Absence of Changes |

71 |

| 5.16 |

Compliance with Applicable Laws |

71 |

| 5.17 |

Legal Proceedings |

72 |

| 5.18 |

Anti-Corruption; Anti-Money Laundering |

72 |

| 5.19 |

Reporting Issuer Status |

72 |

| 5.20 |

No Broker |

73 |

| 5.21 |

Principal |

73 |

| 5.22 |

Independent Investigation |

73 |

| |

|

|

| |

ARTICLE 6 |

|

| |

COVENANTS |

|

| |

|

|

| 6.1 |

Access and Information, Integration |

73 |

| 6.2 |

Financing Cooperation |

76 |

| 6.3 |

Conduct of Business of Westbrick |

77 |

| 6.4 |

Conduct of Business of Purchaser |

82 |

| 6.5 |

Additional Covenants of Purchaser |

83 |

| 6.6 |

Regulatory Approvals and Consents |

85 |

| 6.7 |

Westbrick Employee Matters |

88 |

| 6.8 |

Additional Shareholders, Options and Awards |

88 |

| 6.9 |

Additional

[name of party redacted] Covenants |

88 |

| 6.10 |

Purchaser Financing |

89 |

| 6.11 |

Pre-Closing

Reorganization of [name of party redacted] |

91 |

| |

TABLE OF CONTENTS |

|

| |

(continued) |

|

| |

|

|

| |

|

Page |

| |

|

|

| |

ARTICLE 7 |

|

| |

CONDITIONS TO CLOSING AND CLOSING DELIVERIES |

|

| |

|

|

| 7.1 |

Mutual Conditions Precedent |

91 |

| 7.2 |

Conditions to the Obligations of Purchaser |

92 |

| 7.3 |

Conditions

to the Obligations of the Company and [name of party redacted]. |

93 |

| 7.4 |

Covenant to Satisfy Closing Conditions. |

94 |

| 7.5 |

Deliveries by Purchaser. |

94 |

| 7.6 |

Deliveries

by [name of party redacted]. |

94 |

| 7.7 |

Deliveries by Westbrick |

95 |

| |

|

|

| |

ARTICLE 8 |

|

| |

TERMINATION |

|

| |

|

|

| 8.1 |

Termination by Mutual Consent. |

95 |

| 8.2 |

Termination by Any Party. |

95 |

| 8.3 |

Termination by Purchaser. |

96 |

| 8.4 |

Termination

by [name of party redacted] or the Company |

96 |

| 8.5 |

Effect of Termination |

97 |

| |

|

|

| |

ARTICLE 9 |

|

| |

ADDITIONAL COVENANTS |

|

| |

|

|

| 9.1 |

Preservation of Records. |

97 |

| 9.2 |

Stub Period Returns and Other Tax Matters. |

98 |

| 9.3 |

Confidentiality and Public Announcements. |

100 |

| 9.4 |

D&O Insurance and Continuance of Directors’ and Officers’ Indemnification |

103 |

| 9.5 |

Environmental Matters. |

104 |

| 9.6 |

Privacy Matters. |

105 |

| 9.7 |

Insurance |

106 |

| |

|

|

| |

ARTICLE 10 |

|

| |

NO SHOP, NON-SOLICIT |

|

| |

|

|

| 10.1 |

No Shop |

106 |

| 10.2 |

Non-Solicitation |

108 |

| |

|

|

| |

ARTICLE 11 |

|

| |

MISCELLANEOUS |

|

| |

|

|

| 11.1 |

No Survival |

109 |

| 11.2 |

No Other Representation or Warranties |

110 |

| 11.3 |

Notices. |

111 |

| 11.4 |

Disclosure Schedules |

113 |

| 11.5 |

Amendment; Waiver |

114 |

| 11.6 |

Binding Effect; Assignment |

114 |

| 11.7 |

Third Party Beneficiaries |

114 |

| 11.8 |

Entire Agreement |

115 |

| 11.9 |

Fulfillment of Obligations |

115 |

| 11.10 |

Specific Performance and Remedies |

115 |

| |

TABLE OF CONTENTS |

|

| |

(continued) |

|

| |

|

|

| |

|

Page |

| |

|

|

| 11.11 |

Expenses. |

116 |

| 11.12 |

Governing Law; Submission to Jurisdiction; Selection of Forum. |

116 |

| 11.13 |

Resolution of Disputes |

117 |

| 11.14 |

Further Assurances. |

117 |

| 11.15 |

Excluded Privileged Communications |

117 |

| 11.16 |

Counterparts. |

118 |

| 11.17 |

Time of the Essence |

118 |

| 11.18 |

Severability. |

118 |

SCHEDULES

SCHEDULES

| Schedule “A” |

Plan of Arrangement |

| Schedule “B” |

Arrangement Resolution |

| Schedule “C” |

[Escrow Agreement redacted] |

THIS ARRANGEMENT AGREEMENT dated as

of December 22, 2024

AMONG:

WESTBRICK

ENERGY LTD., a corporation formed under the laws of Alberta (“Westbrick” or the “Company”)

-and-

[Name of party redacted], a company

formed under the laws of the Netherlands (“[Name of party redacted]”)

-and-

VERMILION ENERGY INC., a corporation

incorporated under the laws of Alberta (“Purchaser”)

WHEREAS [name

of party redacted] is the registered and beneficial owner of all of the issued and outstanding shares of [Name redacted] Holdco

(the “Holdco Shares”) and [Name redacted] Holdco is the registered and beneficial owner of certain Westbrick

Shares as further set out in the Disclosure Schedules (the “[Name redacted] Shares”);

AND WHEREAS the

remainder of the Westbrick Shares not comprised of the [name redacted] Shares (the “Additional Shares”) are

held by those Persons as further set out under the heading “Additional Shareholders” in the Disclosure Schedules (the “Additional

Shareholders”);

AND WHEREAS Purchaser,

Westbrick and [name redacted] Holdco and the other Westbrick Supporting Shareholders desire to complete an arrangement under section

193 of the ABCA in respect of Westbrick;

AND WHEREAS upon

Closing, and pursuant to the Arrangement: (i) [name redacted] Holdco intends to return capital to [name of party redacted]

with the [Name redacted] Holdco Note; (ii) [name redacted] Holdco and Westbrick intend to amalgamate (the “Amalgamation”);

(iii) upon the Amalgamation, [name of party redacted] and the Additional Shareholders shall receive shares in the amalgamated company

(“Westbrick Amalco”) in exchange for the Holdco Shares and the Additional Shares, respectively; and (iv) all shares

of Westbrick Amalco will be transferred to the Purchaser and the [name redacted] Holdco Note will be repaid;

AND WHEREAS concurrently

with the execution of this Agreement, the Westbrick Supporting Shareholders have entered into the Lock-Up Agreements and the Westbrick

Supporting Shareholders that hold Westbrick Shares have executed the Written Resolution and the Lock-Up Agreements;

AND WHEREAS the

Westbrick Supporting Shareholders hold, in the aggregate, not less than two-thirds of the issued and outstanding Westbrick Shares;

AND WHEREAS, prior

to completion of the Arrangement, Westbrick intends to complete the Duvernay Conveyance and either sell the Duvernay Spinco Shares or

complete the Duvernay Alternative Transaction;

NOW, THEREFORE,

in consideration of the foregoing, the mutual representations, warranties, covenants and agreements contained herein, and other good and

valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties covenant and agree as follows:

Article 1

DEFINITIONS AND INTERPRETATION

In this Agreement, including the recitals,

this Section 1.1, and the Schedules, the following capitalized terms shall have the following meanings:

“11-22 Gas Handling and Transportation

Agreement” means that Gas Handling and Transportation Agreement to be entered into on or prior Closing between Westbrick and

Duvernay Spinco, in form substantially as attached to the Disclosure Schedules.

“Abandonment and Reclamation Liabilities”

means all past, present and future obligations of Westbrick to:

| (a) | abandon wells and close, decommission, dismantle and remove structures, foundations, buildings, pipelines,

equipment and other facilities, including those located on the Lands or lands pooled or unitized therewith or used or previously used

in respect of Petroleum Substances: (i) produced or previously produced from the Lands or lands pooled or unitized therewith; or (ii)

stored or previously stored within, upon or under the Lands or lands pooled or unitized therewith; and |

| (b) | restore, remediate and reclaim the surface locations of wells and tangible assets and equipment including

the Wells and Tangibles and lands used to gain access thereto, including all such obligations relating to tangibles and equipment that

were abandoned or decommissioned prior to the Closing Date whether located on or off the Lands or lands pooled or unitized therewith or

that were located on other lands and used in respect of Petroleum Substances: (i) produced or previously produced from the Lands or lands

pooled or unitized therewith or other lands; or (ii) stored or previously stored within, upon or under the Lands or lands pooled or unitized

therewith or other lands. |

“ABCA”

means the Business Corporations Act (Alberta), as may be amended from time to time.

“Aboriginal Group”

means any “band” (within the meaning of the Indian Act (Canada)), First Nations, Métis, tribal council or other

indigenous groups or communities

“Acquisition Debt

Confirmations” means the certificate of the Purchaser dated as of the date of this Agreement certifying (i) that the Purchaser

has availability under the Purchaser Credit Agreement and the Purchaser Bridge Loan Facility to borrow amounts that are more than sufficient

in order to (A) pay all the Cash Consideration payable under the Plan of Arrangement, (B) fund the repayment and cancellation of the Credit

Facilities at the Closing Time, and (C) repay all Indebtedness of the Purchaser that matures prior to May 30, 2025 (collectively, the

“Required Funds”), subject to the terms and conditions of the Purchaser Credit Agreement and the Purchaser Bridge Loan

Facility, which include the funding conditions which are customary for (A) a revolving loan facility (in the case of the Purchaser Revolving

Loan Facility), (B) an acquisition term loan facility (in the case of the Purchaser Term Loan Facility) (except there are no “limited

conditionality” provisions in the funding conditions in the Purchaser Term Loan Facility since there are no such provisions in the

Purchaser Revolving Loan Facility) and (C) a “high yield” bridge loan facility (in the case of the Purchaser Bridge Loan Facility)

(ii) that the Purchaser has no reason to believe that it will be unable to satisfy, on a timely basis, any term or condition of any definitive

document related to the Debt Financing, and (iii) the amount available to be to drawn down under each of the Purchaser Credit Agreement

and the Purchaser Bridge Loan Facility as of the date of this Agreement.

“Acquisition Proposal”

means, (other than the transactions contemplated by this Agreement, the Duvernay Conveyance and Duvernay Share Purchase Agreement), any

proposal, expression of interest, inquiry or offer from, or public announcement of an intention by, any Person, or group of Persons “acting

jointly or in concert” within the meaning of National Instrument 62-104- Take-Over Bids and Issuer Bids, whether or not in

writing and whether or not delivered to a Party’s shareholders and whether or not subject to due diligence or other conditions,

or whether in one transaction or a series of transactions, that relates to, or may reasonably be expected to relate to:

| (a) | any direct or indirect sale, issuance or acquisition of shares or other securities (or securities convertible

or exercisable for shares or other securities) of Westbrick that, when taken together with the shares and other securities of Westbrick

held by the proposed acquiror and any Person acting jointly or in concert with such acquiror, represent 20% or more of any class of equity

or voting securities of Westbrick or rights or interests therein and thereto; |

| (b) | any direct or indirect acquisition or purchase of 20% or more of the assets or contributing 20% or more

of the consolidated revenue (or any joint venture, lease, long-term supply agreement or other arrangement having the same economic effect

as an acquisition or purchase) of Westbrick and its subsidiaries taken as a whole; |

| (c) | an amalgamation, arrangement, share exchange, merger, business combination, , consolidation, recapitalization,

liquidation, dissolution, winding-up, reorganization or other similar transaction involving Westbrick; or |

| (d) | any take-over bid, issuer bid, exchange offer or similar transaction involving a Party or its subsidiaries

that, if consummated, would result in a Person or group of Persons acting jointly or in concert with such Person acquiring beneficial

ownership of 20% or more of any class of equity or voting securities of such Party. |

“Additional Shareholders”

has the meaning given to that term in the recitals.

“Additional Shares”

has the meaning given to that term in the recitals and, as the context requires, the shares received in exchange for the Additional Shares

on the Amalgamation.

“Adjusted Inventory” means

such inventory of Westbrick listed in Schedule 1.1 of the Disclosure Schedules under the heading “Adjusted Inventory”.

“AFEs”

means authorities for expenditure, cash calls, operations notices, amounts budgeted pursuant to joint operating agreements, unit agreements,

mail ballots and similar notices and calls for funds.

“Affiliate”

has the meaning ascribed thereto in the Securities Act (Alberta). Notwithstanding the foregoing, in all cases except in Sections

7.1(e), 8.5 and 9.3, in respect of [name of party redacted] and Westbrick, the definition of “Affiliate” shall be deemed

to exclude any direct or indirect operating or portfolio company, investment vehicle, co-invest vehicle, investment fund (including any

limited or general partner thereof) or investee company of any fund managed or advised by [names redacted] or any Persons controlled

thereby, excluding [name of party redacted], [name redacted] Holdco and Westbrick and any of its subsidiaries as at the

date of this Agreement and from time to time. For purposes of this definition, [name redacted] Holdco and Westbrick shall be deemed

to be Affiliates of [name of party redacted] for the time period ending immediately prior to Closing, and Westbrick Amalco shall

be deemed to be an Affiliate of Purchaser for the time period from after Closing.

“Aggregate Adjusted

Consideration” has the meaning ascribed to it in Section 2.8(b);

“Aggregate Base

Consideration” has the meaning ascribed to it in Section 2.8(a);

“Agreement”

means this Arrangement Agreement, including the recitals, this Article 1, and all Schedules attached hereto, as the same may be amended

or supplemented from time to time in accordance with the terms hereof.

“Amalgamation”

has the meaning set forth in the Recitals hereto.

“Applicable Canadian

Securities Laws” means, collectively, and as the context may require, the applicable securities legislation of each of the Provinces

of Canada, and the rules, regulations, instruments, orders and policies published and/or promulgated thereunder, as such may be amended

from time to time prior to the Closing Date.

“Applicable U.S.

Securities Laws” means, collectively, the federal and state securities legislation of the United States and all rules, regulations

and orders promulgated thereunder, as amended from time to time prior to the Closing Date.

“Applicable Laws”

means, in relation to any Person, asset, transaction, event or circumstance, any and all applicable provisions of laws, statutes, common

law, rule of law, rules, regulations, ordinances, by-laws, treaties, published guidelines, standards, codes of practice and orders of,

and the terms of all judgments, orders, decisions, directives, ruling, awards and decrees issued by, any Governmental Authority by which

such Person is bound or having application to the asset, transaction, event or circumstance in question.

“Area of Mutual

Interest” means a designated geographical area in respect of which Westbrick is obligated by contract to offer to one or more

Third Parties the right to participate in an acquisition of petroleum and natural gas rights, oil and gas facilities or pipelines or other

material infrastructure related to the exploration and development of petroleum and natural gas rights.

“Arrangement”

means the arrangement in respect of Westbrick and involving its securityholders, Duvernay Spinco, [name of party redacted], Purchaser

and [name redacted]Holdco under the provisions of section 193 of the ABCA on the terms and conditions set out in the Plan of Arrangement,

as supplemented, or modified in accordance with the provisions of this Agreement and the Plan of Arrangement, or amended or made at the

direction of the Court in the Final Order (with the consent of Westbrick, [name of party redacted] and Purchaser, each acting reasonably).

“Arrangement Resolution”

means the special resolution of Westbrick Shareholders approving the Arrangement, in the form of the Written Resolution or such other

form as agreed to by the Parties.

“Articles of Arrangement”

means the articles of arrangement in respect of the Arrangement required under section 193(4.1) of the ABCA to be filed with the Registrar.

“Assets”

means, collectively, all properties and assets of Westbrick of every kind and description (whether real, personal, tangible or intangible)

wherever located and includes the PNG Assets, but does not include the Duvernay Assets.

“Award”

has the meaning set forth in the Omnibus Plan.

“Award Agreements”

means, collectively, the agreements entered into by each of the holders of Awards and Westbrick in connection with the grant of Awards,

and each such agreement is an “Award Agreement”.

“Benefit Plan”

means any pension, retirement, deferred compensation, profit-sharing, registered retirement savings plan, savings, disability, medical,

dental, health, life, death benefit, stock option, stock purchase, bonus, incentive, vacation entitlement and pay, change of control,

termination and severance pay or other employee benefit plan, trust, arrangement, Contract, agreement, policy or commitment, whether funded

or unfunded, insured or uninsured, written or oral, in each case (a) for the benefit of Westbrick Employees or former employees, or current

or former officers or directors of Westbrick, or other Persons who are receiving or have received remuneration for work or services provided

to Westbrick, or in all cases any of their eligible spouses, dependents, survivors or beneficiaries, and (b)(i) to which Westbrick is

a party or by which Westbrick is bound or (ii) with respect to which Westbrick has any Liability, but in all cases does not include Statutory

Plans.

“Books and Records”

means the books and records of Westbrick, [name redacted] Holdco, and Westbrick Amalco, including financial, corporate, operations

and sales books, records, books of account, sales and purchase records, lists of suppliers and customers, formulae, business reports,

plans and projections and all other documents, surveys, plans, files, records, assessments, correspondence, and other data and information,

financial or otherwise, including all data, information and databases stored on computer-related or other electronic media.

“Business”

means the exploration and development of oil and liquids-rich natural gas as presently conducted by Westbrick, including the operation

of the Assets and, except where expressly stated otherwise, includes the Duvernay Business.

“Business Day”

means any day (other than a Saturday, a Sunday or a statutory holiday) on which banks in Calgary, Alberta and New York, New York are generally

open for commercial banking business during normal banking hours.

“Capex Plan” means the capital

program and budget of Westbrick for the period from the date hereof until March 31, 2025 [redacted], a copy of which is included

in the Disclosure Schedule.

“Capital Expenditure” means

an expenditure that is required to be capitalized in accordance with IFRS in a manner consistent with the Financial Statements.

“Cash Consideration”

has the meaning set forth in the Plan of Arrangement.

“Cause” means a conviction

for a criminal act of fraud, theft, misappropriation, embezzlement or other indictable offence or any action taken by a Westbrick Employee

or Westbrick Contractor in bad faith that could be reasonably expected to damage or negatively impact the business, operations, reputation

or financial condition of the Purchaser or Westbrick in a material manner or otherwise amounts to just cause at common law.

[Definition redated]

[Definition redated]

“Claim”

means any claim, demand, lawsuit, action, proceeding, notice of non-compliance or violation, audit, order or direction, arbitration or

governmental proceeding or investigation.

“Closing”

means the filing of the Articles of Arrangement, payment of the Consideration, repayment of the [name redacted] Holdco Note and

delivery of all other items and consideration required to be delivered on or prior to the Closing Date hereunder to consummate the Transaction.

“Closing Date”

has the meaning set forth in Section 2.7.

“Closing Date Statement”

has the meaning ascribed to it in Section 2.8(d).

“Closing Time”

has the meaning set forth in Section 2.7.

[Definition redacted]

“Commissioner”

means the Commissioner of Competition appointed under section 7(1) of the Competition Act and includes any Person designated by the Commissioner

to act on his or her behalf.

“Competition Act”

means the Competition Act (Canada).

“Competition Act

Approval” means the occurrence of either of the following:

| (a) | the issuance to Purchaser of an advance ruling certificate by the Commissioner under section 102(1) of

the Competition Act with respect to the completion of the Transaction; or |

| (b) | both of (i) the applicable waiting period, including any extension thereof, under section 123 of the Competition

Act shall have expired or been terminated or the obligation to provide a pre-merger notification in accordance with Part IX of the Competition

Act shall have been waived by the Commissioner pursuant to paragraph 113(c) of the Competition Act (a “Waiver”), and

(ii) the Commissioner shall have advised the Purchaser in writing that the Commissioner does not, at that time, intend to make an application

under section 92 of the Competition Act in respect of the completion of the Transaction (a “No-Action Letter”). |

“Conditions Satisfaction

Date” means the date on which the last of the conditions set forth in Section 7.1, 7.2 and 7.3 (other than those conditions

that by their nature are to be satisfied at or immediately prior to the Closing) have been satisfied or waived.

“Confidentiality

Agreement” means the Confidentiality Agreement dated as of September 26, 2024 between Purchaser and Westbrick.

“Consideration”

means, collectively, the Cash Consideration and Share Consideration payable pursuant to the Plan of Arrangement to Westbrick Shareholders.

“Continuing Contractor”

has the meaning set forth in Section 6.7(c).

“Continuing Employee”

has the meaning set forth in Section 6.7(c).

“Contract”

means, with respect to any Person, any contract, lease, deed, mortgage, license, undertaking, indenture, agreement, instrument or other

legally binding commitment or arrangement to which such Person is a party or under which it has rights or obligations, whether written

or oral, and includes authorizations for expenditure issued or approved by such Person under any of the foregoing.

“Court”

means the Court of King’s Bench of Alberta.

[Definition redacted]

“Credit Facilities”

means the credit facilities established by the Third Amended and Restated Credit Agreement dated May 31, 2024 among the Company and the

lender parties thereto.

“Credit Support”

means any guarantee, letter of credit, surety or performance bond or any other similar agreement or arrangement (including any security

or collateral furnished in connection therewith).

“Data Room”

means, collectively the two Firmex virtual data rooms established by or on behalf of Westbrick entitled “Buffalo Due Diligence”

and “Westbrick Energy” respectively, as they existed at 11:00 AM on December 21, 2024 (and Company will, as soon as reasonably

practicable after the date hereof, download the contents of the two virtual data rooms onto two USBs and deliver them to the Purchaser

or its Representatives).

“Debt Financing”

means the aggregate debt financing available to Purchaser under the Purchaser Credit Agreement and the Purchaser Bridge Loan Facility,

as described in the Acquisition Debt Confirmations, and where the context requires includes the definitive documents creating and governing

the Purchaser Credit Agreement and the Purchaser Bridge Loan Facility.

“Debt Financing

Sources” means the parties to the Purchaser Credit Agreement and the Purchaser Bridge Loan Facility (other than the Purchaser

and its Affiliates) and the Affiliates of such parties and, where the context permits, includes their respective former, current or future

general or limited partners, stockholders, managers, members, representatives, directors, officers, employees, agents, successors or assigns.

“December 31 Accounting

Principles” means those accounting methodologies and procedures (including classifications, judgments and estimation methodologies)

applied by Westbrick to arrive at the calculations set forth in Section 4.45 of the Disclosure Schedules consistent with the supporting

excel spreadsheet provided by Company to Purchaser concurrent with the execution of this Agreement and the earlier versions thereof that

were provided by Company to Purchaser.

“Depositary”

means Odyssey Trust Company, or such other Person that may be appointed by the Parties in connection with the Arrangement for the purpose

of receiving and paying the Consideration to the Westbrick Shareholders and receiving deposits of certificates formerly representing the

Purchased Shares.

“Depositary Agreement”

means the depositary agreement dated on or before the Closing Date between the Purchaser, the Company and the Depositary.

“Disclosure Date” has the

meaning ascribed to it in Section 7.2(b)(i).

“Disclosure Schedules”

has the meaning set forth in Article 3.

“Disputed Amount” has the

meaning set forth in Section 2.8(f).

“Dissent Rights”

means the right of a registered Westbrick Shareholder to dissent to the Arrangement Resolution and to be paid the fair value of the Westbrick

Shares in respect of which the holder dissents, all in accordance with section 191 of the ABCA, the Final Order and the Plan of Arrangement.

“Duvernay Alternative

Transaction” means the distribution of the Duvernay Spinco Shares to the Westbrick Shareholders and other matters ancillary

thereto as further set forth in Section 1.1 of the Disclosure Schedules under the heading “Duvernay Alternative Transaction”

and as provided for in the Plan of Arrangement.

“Duvernay Assets”

has the meaning set forth in the Duvernay Spinco Conveyance Agreement.

“Duvernay Assumed

Liabilities” has the meaning set forth in the Duvernay Spinco Conveyance Agreement.

“Duvernay Business” means

the ownership and operation by Westbrick of the Duvernay Assets, as currently conducted.

“Duvernay Conveyance”

means the transactions contemplated by the Duvernay Spinco Conveyance Agreement.

“Duvernay Deposit”

means the deposit paid to the Company pursuant to the Duvernay Share Purchase Agreement, if any.

“Duvernay Net Proceeds”

means the total amount of cash consideration under the Duvernay Share Purchase Agreement received by Westbrick, including for greater

certainty, the full amount of the Duvernay Deposit.

“Duvernay Share

Purchase Agreement” means a purchase and sale agreement which may be entered into by Westbrick and another Person for the acquisition

by such other Person prior to Closing of all of the Duvernay Spinco Shares.

“Duvernay Spinco”

means TMax Energy Ltd., a wholly-owned subsidiary of Westbrick.

“Duvernay Spinco

Conveyance Agreement” means the conveyance agreement to be dated on or before the Closing Date effecting the sale of the Duvernay

Assets to Duvernay Spinco in consideration for Duvernay Spinco Shares and the assumption by Duvernay Spinco of all of the Duvernay Assumed

Liabilities.

“Duvernay Spinco

Shares” means the common shares of Duvernay Spinco.

“Duvernay Spin-Out

Event” means: (a) the full amount of the Duvernay Net Proceeds have not been received by the Depositary by the second Business

Day prior to the date on which Closing is scheduled to occur, or there remain any closing conditions outstanding on the transactions under

the Duvernay Share Purchase Agreement as of such date (which are not capable of being satisfied on or prior to the Closing Date); or (b)

Westbrick and [name of party redacted] determine to pursue the Duvernay Alternative Transaction prior to the date on which Closing

is scheduled to occur.

“Duvernay Transaction

Expenses” means, without duplication (and without duplication to the Transaction Expenses), any out of pocket fees and expenses

incurred or payable by Westbrick, whether payable before or after Closing, in connection with (a) the Duvernay Conveyance and the Duvernay

Share Purchase Agreement (or the Duvernay Alternative Transaction), or relating to the negotiation, preparation, or execution of Duvernay

Conveyance Agreement and/or the Duvernay Share Purchase Agreement, or any documents or agreements contemplated by such agreements or the

performance or consummation of the transactions contemplated thereby, including the following to the extent incurred in connection with

such transactions (i) brokers’ or finders’ fees (including those of RBC and Scotiabank), and (ii) fees and expenses of professional

advisors, counsel (including Osler, Hoskin & Harcourt LLP), advisors, consultants, investment bankers, Tax advisors, accountants,

and auditors, (b) escrow agent fees and expenses; and (c) third party costs and expenses related to due diligence, including set up and

maintenance of the data room in respect of the Duvernay Assets, and diligence conducted by Westbrick, in respect of the purchaser, its

business, assets and operations; provided further, however, that the term “Duvernay Transaction Expenses” shall exclude (A)

all such fees and expenses that have already been paid on or before December 31, 2024; (B) any GST payable by Westbrick in connection

with any of the foregoing, and (C) any amounts included in the calculation of Net Debt or Transaction Expenses; and provided, however,

that Duvernay Transaction Expenses shall be increased by an amount equal to (i) [amount redacted] for each [amount redacted]

of proceeds under the Duvernay Share Purchase Agreement received by Westbrick prior to Closing (without adjustments for proceeds which

are above a [amount redacted] increment) or, (ii) to the extent a Duvernay Alternative Transaction is implemented pursuant to Section

2.6(b)(iv), [percentage redacted] of the Duvernay Spinco Shares Value (as defined in the Plan of Arrangement), rounded down to

the nearest [amount redacted], that are distributed to the Westbrick Shareholders.

“Employee Obligations”

means the obligations of Westbrick to pay any amounts to its Westbrick Employees for accrued and unpaid salary, wages, bonus, vacation

pay or benefits, and any amounts payable as a result of the termination of Westbrick Employees in accordance with this Agreement before

or immediately prior to Closing, including all change of control, termination and severance amounts under contract, statute and common

law.

“Encumbrance”

means any lien, pledge, charge, encumbrance, royalty, mortgage, hypothecation, title retention or other Security Interest or other adverse

claim, or any option, right of first refusal or other restriction on transfer.

“Entitlement Calculation”

means, in the case where (i) the Insurance Claim is settled prior to Closing, [percentage redacted] of the Insurance Recovery Amount;

or (ii) the Insurance Claim is settled following Closing, [percentage redacted] of the Insurance Recovery Amount.

“Entitlement Schedule” has

the meaning set forth in the Plan of Arrangement.

“Environment”

means the components of the earth, alone or in combination, and includes ambient air, land, surface and sub-surface strata, groundwater,

surface water, all layers of the atmosphere, all organic and inorganic matter and living organisms, including plants, animals and humans,

and the interacting natural systems that include such components, and any derivative thereof shall have a corresponding meaning.

“Environmental Law”

means all Applicable Laws concerning the protection of the Environment or the impact on the Environment of any use, storage, recycling,

treatment, generation, transportation, processing, handling, labeling, management, control, Release or threatened Release, emission, discharge

or disposal of any Hazardous Material, or pollution, contamination, reclamation or remediation of the Environment.

“Environmental Liabilities”

means all past, present and future Losses and Liabilities of Westbrick of whatsoever nature or kind, whether arising under contract, tort

(based on negligence or strict liability), Applicable Laws or otherwise, arising from or associated with: (a) Abandonment and Reclamation

Liabilities; (b) any past, present or future operations conducted on or related to the Assets resulting in any damage to, contamination

of or other adverse situations pertaining to the Environment, howsoever and by whomsoever caused, and regardless of whether such damage,

contamination or other adverse situations occur or arise in whole or in part prior to, on or subsequent to the Closing Time; (c) the presence,

collection, accumulation, use, holding, storage, assessment, recycling, treatment, generation, transportation, processing, stabilization,

handling, labeling, management, Release or threatened Release, emission, discharge or disposal of Hazardous Materials; (d) compliance

with or the consequences of any non-compliance with, or violation or breach of, any Environmental Law or otherwise, whether occurring

before, on or after the Closing Time; (e) sampling, monitoring or assessing the Environment or any potential impacts thereon from any

past, present or future activities or operations; or (f) the protection, reclamation, remediation or restoration of the Environment, in

each case, to the extent relating or arising by virtue of the Assets or the ownership or operation thereof, or any past, present or future

operations and activities conducted in connection therewith or on or in respect of the lands upon which any of the Assets or any structures,

foundations, buildings, facilities, pipelines, equipment and other physical assets used or previously used in connection with the Assets

are or were located and any other lands which are or were used to gain access thereto, but, for certainty, in each case, excluding all

such past, present and future obligations of Westbrick, Westbrick Amalco, Duvernay Spinco, or otherwise attributable to the Duvernay Assets.

“Field Contractors”

means those Westbrick Contractors set forth in Section 2.6(b) of the Disclosure Schedules.

“Final Order”

means the final order of the Court approving the Arrangement pursuant to section 193(4) of the ABCA approving the Arrangement, as such

order may be amended, modified, supplemented or varied by the Court (with the consent of each of the Purchaser, [name of party redacted]

and the Company, acting reasonably) at any time prior to the Closing Date or, if appealed, then unless such appeal is withdrawn or denied,

as affirmed or as amended (provided that such amendment is satisfactory to each of the Purchaser, [name of party redacted] and

the Company, acting reasonably) on appeal.

“Financial Statements”

means, collectively:

| (a) | the audited balance sheet of Westbrick as at December 31, 2021, December 31, 2022 and December 31, 2023

and the audited statements of income and cash flows for the 12-months ended on December 31, 2021, December 31, 2022 and December 31, 2023;

and |

| (b) | the unaudited balance sheet of Westbrick (the “Balance Sheet”) as at September 30,

2024 (the “Balance Sheet Date”) and the unaudited statements of income and cash flows for the three and nine months

ended on September 30, 2024. |

“Fraud” means with respect

to any Person, means an intentional and willful misrepresentation by such Person that constitutes common law fraud under the laws of the

Province of Alberta. For the avoidance of doubt, Fraud will not include any fraud claim based on constructive knowledge, negligent misrepresentation,

recklessness or a similar theory or any equitable fraud, promissory fraud, or unfair dealing fraud.

“Governmental Authority”

means, in relation to any Person, transaction or event, any: (a) federal, provincial, municipal, state or local governmental body (whether

administrative, legislative, executive or otherwise), both domestic and foreign, (b) agency, authority, commission, instrumentality, regulatory

body, court, central bank or other entity exercising executive, legislative, judicial, taxing, regulatory or administrative powers or

functions of or pertaining to government, (c) court, arbitrator, commission or body exercising judicial, quasi-judicial, administrative

or similar functions, or (d) other body or entity created under the authority of or otherwise subject to the jurisdiction of any of the

foregoing, including any stock or other securities exchange (including the TSX and NYSE), in each case having, purporting to have, exercising,

or entitled to exercise, jurisdiction over such Person, transaction or event.

“GST” means

the goods and services tax and/or harmonized sales tax levied under the Excise Tax Act (Canada) and any analogous provision of

any comparable Applicable Law of any province or territory of Canada.

“Hazardous Materials”

means any waste, chemical, material or other substance that is listed, defined, designated or classified as hazardous, radioactive or

toxic or a pollutant or a contaminant under any Environmental Law, including petroleum and all derivatives thereof, asbestos or asbestos-containing

materials in any form or condition, and polychlorinated biphenyls.

“Hedging Transaction”

means: (a) any transaction which is a rate swap transaction, basis swap, forward rate transaction, commodity loan, commodity consignment,

commodity lease, commodity swap, commodity option, a commodity forward or futures Contract and whether settled by physical or financial

delivery, equity or equity index swap, equity or equity index option, bond option, interest rate option, foreign exchange transaction,

cap transaction, floor transaction, collar transaction, currency swap transaction, cross-currency rate swap transaction, currency option,

transaction to buy, sell, borrow or lend securities or any other similar transaction (including any option with respect to any of these

transactions); and (b) any derivative or combination of these transactions.

“Holdco Shares”

has the meaning set forth in the Recitals.

“Insurance Claim” means

the business interruption claim made by Westbrick as set forth in Section 4.39 the Disclosure Schedule.

“Insurance Payment” has

the meaning ascribed thereto in Section 9.7.

“Insurance Recovery Amount”

means [percentage redacted] of any amounts recovered by Westbrick in respect of the Insurance Claim.

“IFRS”

means International Financial Reporting Standards as issued by the International Accounting Standards Board, as at the relevant

time in question, as the context requires.

“Indebtedness” means, with

respect to any Person, without duplication, (a) indebtedness of such person for borrowed money, secured or unsecured, (b) every obligation

of such Person evidenced by bonds, debentures, notes, derived obligations or other similar instruments, (c) every obligation of such Person

to pay the deferred purchase price of property or services, except trade accounts payable and other current liabilities arising in the

ordinary course of business, (d) every obligation of such Person under purchase money, mortgages, conditional sales agreements, or other

similar instruments, relating to purchased property or assets, (e) every capitalized or non-consolidated lease obligation of such Person,

(f) every obligation of such Person under Hedging Transactions (valued at the termination value thereof), (g) every obligation of such

Person, contingent or otherwise, under acceptance credit, letters of credit or similar facilities, and (h) every obligation of the type

referred to above of any other Person, the payment of which such Person has guaranteed or which Person is otherwise responsible or liable.

“Independent Accountant”

has the meaning ascribed thereto in Section 2.8(f).

“Intellectual Property”

means any and all proprietary or industrial rights, whether registered or not, owned, licensed, used by a Person, provided under patent

laws, copyright laws, trade-mark laws, design patent or industrial design laws, semi-conductor chip, layout, architecture, topology or

mask work laws, trade secret laws or any other Applicable Laws that provides a right in intellectual property or the expression or use

of intellectual property and the goodwill associated therewith or symbolized thereby, and any applications, registrations or any other

evidence of a right in any of the foregoing.

“Interim Order”

means the interim order of the Court pursuant to section 193(4) of the ABCA containing declarations and directions with respect to the

Arrangement, as such order may be amended, modified, supplemented or varied by the Court (with the consent of each of the Purchaser, [name

of party redacted] and the Company, acting reasonably) or, if appealed, then unless such appeal is withdrawn or denied, as affirmed

or as amended (provided that such amendment is satisfactory to each of the Purchaser, [name of party redacted] and the Company,

acting reasonably) on appeal.

“IRC” means the U.S. Internal

Revenue Code of 1986, as amended.

“Key Executives” means those

individuals listed in Section 1.1 of the Disclosure Schedule under the heading “Key Executives.”

“Key Regulatory

Approval” means Competition Act Approval.

“[Name redacted]Holdco”

means [name redacted].

“[Name redacted]

Holdco Note” means a non-interest bearing promissory note, the form of which is attached in Section 1.1 of the Disclosure

Schedule under the heading “[name redacted] Holdco Note.”

“[Name redacted]

Shares” has the meaning set forth in the Recitals.

“[Name of party redacted]”

has the meaning set forth in the preamble.

“[name redacted]

Westbrick Amalco Shares” means the common shares issued to [name of party redacted] in exchange for the Holdco Shares

on the Amalgamation.

“Lands”

means all lands and formations set out in the Land Schedule and includes, unless the context otherwise requires, the surface of such Lands

and, subject to the exceptions noted in the Land Schedule, the Petroleum Substances within, upon or under those lands.

“Landlord Consents”

means, collectively: