UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16

OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2024

Commission File Number: 001-40842

VALENS SEMICONDUCTOR LTD.

(Exact name of registrant as specified in its

charter)

8 Hanagar St. POB 7152

Hod Hasharon 4501309

Israel

(Address of principal executive office)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒

Form 40-F ☐

EXPLANATORY NOTE

The information in the attached Exhibit 99.1 is

being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as

amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated

by reference in any filing made by the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as otherwise

set forth herein or as shall be expressly set forth by specific reference in such a filing.

TABLE OF CONTENTS

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

VALENS SEMICONDUCTOR LTD. |

| |

|

|

|

| |

By: |

/s/ Gideon Ben-Zvi |

| |

|

Name: |

Gideon Ben-Zvi |

| |

|

Title: |

Chief Executive Officer |

Date: November 12, 2024

Exhibit 99.1

Valens Semiconductor to Host Investor Day on

November 12, 2024

Provides 2025 revenue guidance and long-term

financial goals

HOD HASHARON, Israel, November 12, 2024 -- Valens Semiconductor (NYSE:

VLN), a leader in high-performance connectivity, today will host its 2024 Investor Day in New York City where management will provide

an overview of the Company’s go-forward strategy, growth drivers, product innovation and long-term financial goals.

The event will be led by Gideon Ben-Zvi, Chief Executive Officer, and

will also feature presentations from Guy Nathanzon, Chief Financial Officer, and Dana Zelitzki, Senior Vice President of Marketing.

The Company will share its strategy and growth drivers in the Professional

Audio-Video, Video Conferencing, Industrial Machine Vision, Automotive, Medical markets, and through potential synergetic acquisitions.

Driven by these strategic initiatives, Valens Semiconductor’s

financial goals by the end of 2029 are as follows:

| ● | Total revenue is expected to be between $220 - $300 million, gross margin

of between 50% - 60%: |

| o | Professional Audio-Video revenues of between $90 - $100 million and gross margin between 65% - 75%. |

| o | Industrial Machine Vision revenues of between $35 -$50 million and gross margin between 55% - 65%. |

| o | Automotive revenues of between $65 - $110 million and gross margin between 35% -45%. |

| ● | Acquisitions are expected to contribute revenues of between $30 - $40 million

depending on potential acquisition opportunities. |

| ● | Adjusted EBITDA margin is expected to be between 15% - 20%1. |

| ● | In the following years, Valens expects: |

| o | Significant automotive revenue scale with ADAS deployment within the existing and new OEMs. |

| o | Potential upside from single use endoscopy. |

1

Although we provide guidance for Adjusted EBITDA margin, we are not able to provide guidance for projected Net profit (loss)

margin, the most directly comparable GAAP measures. Certain elements of Net profit (loss), including share-based compensation expenses

and warrant valuations, are not predictable due to the high variability and difficulty of making accurate forecasts. As a result, it

is impractical for us to provide guidance on Net profit (loss) margin or to reconcile our Adjusted EBITDA margin guidance without unreasonable

efforts. Consequently, no disclosure of projected Net profit (loss) margin is included. For the same reasons, we are unable to address

the probable significance of the unavailable information.

The Company will also provide revenue guidance for the full year 2025

of between $71 - $76 million or 25% - 33% YoY growth, as well as a few additional business goals.

Additionally, Valens will also update its full year 2024 revenue guidance

of $57.2 - $57.5 million to include the following breakdown:

| ● | Audio-video revenue is expected to be between $32.8 - $33.0 million. |

| ● | Automotive revenue is expected to be between $21.4 - $21.5 million. |

| ● | Acroname’s revenue is expected to be $3 million. |

Event Details

The Investor Day will begin at 12:00 pm ET and is expected to conclude

at 2:30 pm ET. Due to limited capacity, in-person attendance is by invitation only. A live broadcast of the event will be available starting

at 1:00 pm ET at https://valens.zoom.us/webinar/register/WN_t5qmtJrtTHa2Ubm-8RfvHQ.

A webcast replay will be available following the conclusion of the

event and related presentations will remain accessible in the investor relations section of the Company’s website.

About Valens Semiconductor

Valens Semiconductor (NYSE:VLN) is a leader in high-performance connectivity,

enabling customers to transform the digital experiences of people worldwide. Valens’ chipsets are integrated into countless devices from

leading customers, powering state-of-the-art audio-video installations, next-generation videoconferencing, and enabling the evolution

of ADAS and autonomous driving. Pushing the boundaries of connectivity, Valens sets the standard everywhere it operates, and its technology

forms the basis for the leading industry standards such as HDBaseT® and MIPI A-PHY. For more information, visit https://www.valens.com/.

Forward-Looking-Statements

This press release includes “forward-looking

statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform

Act of 1995. Forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,”

“forecast,” “intend,” “will,” “expect,” “anticipate,” “believe,” “seek,”

“target” or other similar expressions that predict or indicate future events or trends or that are not statements of historical

matters. These forward-looking statements include, but are not limited to, statements regarding our anticipated future results, including

financial results such as financial goals for 2029, potential acquisition opportunities, currency exchange rates, and contract wins, and

future economic and market conditions. These statements are based on various assumptions, whether or not identified in this press release,

and on the current expectations of Valens Semiconductor’s (“Valens”) management and are not predictions of actual performance.

These forward-looking statements are provided for illustrative purposes only and are not intended to serve as and must not be relied on

by any investor as a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances

are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of

Valens Semiconductor. These forward-looking statements are subject to a number of risks and uncertainties, including the cyclicality of

the semiconductor industry; the effect of inflation and a rising interest rate environment on our customers and industry; the ability

of our customers to absorb inventory; competition in the semiconductor industry, and the failure to introduce new technologies and products

in a timely manner to compete successfully against competitors; if Valens fails to adjust its supply chain volume due to changing market

conditions or fails to estimate its customers’ demand; disruptions in relationships with any one of Valens’ key customers; any difficulty

selling Valens’ products if customers do not design its products into their product offerings; Valens’ dependence on winning selection

processes; even if Valens succeeds in winning selection processes for its products, Valens may not generate timely or sufficient net sales

or margins from those wins; sustained yield problems or other delays or quality events in the manufacturing process of products; our ability

to effectively manage, invest in, grow, and retain our sales force, research and development capabilities, marketing team and other key

personnel; our ability to timely adjust product prices to customers following price increase by the supply chain; our ability to adjust

our inventory level due to reduction in demand due to inventory buffers accrued by customers; our expectations regarding the outcome of

any future litigation in which we are named as a party; our ability to adequately protect and defend our intellectual property and other

proprietary rights; our ability to successfully integrate or otherwise achieve anticipated benefits from acquired businesses; the market

price and trading volume of the Valens ordinary shares may be volatile and could decline significantly; political, economic, governmental

and tax consequences associated with our incorporation and location in Israel; and those factors discussed in Valens’ Form 20-F filed

with the SEC on February 28, 2024 under the heading “Risk Factors,” and other documents of Valens filed, or to be filed, with

the SEC. If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results

implied by these forward-looking statements. There may be additional risks that Valens does not presently know or that Valens currently

believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition,

forward-looking statements reflect Valens’ expectations, plans or forecasts of future events and views as of the date of this press release.

Valens anticipates that subsequent events and developments may cause Valens’ assessments to change. However, while Valens may elect to

update these forward-looking statements at some point in the future, Valens specifically disclaims any obligation to do so. These forward-looking

statements should not be relied upon as representing Valens’ assessment as of any date subsequent to the date of this press release. Accordingly,

undue reliance should not be placed upon the forward-looking statements.

Investor Contacts:

Michal Ben Ari

Investor Relations Manager

Valens Semiconductor Ltd.

Michal.Benari@valens.com

Lisa Fortuna

Senior Vice President

Financial Profiles, Inc.

ValensIR@finprofiles.com

SOURCE Valens Semiconductor

3

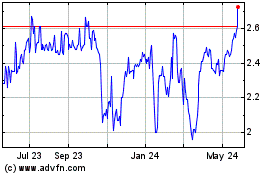

Valens Semiconductor (NYSE:VLN)

Historical Stock Chart

From Jan 2025 to Feb 2025

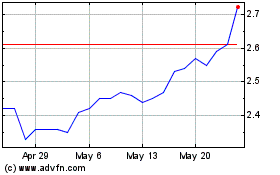

Valens Semiconductor (NYSE:VLN)

Historical Stock Chart

From Feb 2024 to Feb 2025