- Second quarter 2024 organic orders up 57% compared to second

quarter 2023, and up 37% on a trailing twelve-month basis

- Second quarter 2024 net sales of $1,953 million, 13% higher

than second quarter 2023 and organic net sales growth(1) of

14%

- Second quarter 2024 operating profit of $336 million, up 63%

from second quarter 2023, and adjusted operating profit(1) of $382

million, up 52% from second quarter 2023

- Adjusted operating margin(1) of 19.6%, up 510 basis points

compared to second quarter 2023

- Raising 2024 net sales guidance to $7,665 million at the

midpoint, $50 million higher than prior guidance

- Raising 2024 operating profit guidance to $1,256 million at the

midpoint and adjusted operating profit to $1,435 million at the

midpoint, an anticipated improvement of 36% compared to full year

2023

- Raising 2024 adjusted free cash flow guidance to $875 million

at the midpoint, $50 million higher than prior guidance

Vertiv Holdings Co (NYSE: VRT), a global provider of critical

digital infrastructure and continuity solutions, today reported

financial results for its second quarter ended June 30, 2024.

Vertiv reported second quarter 2024 net sales of $1,953 million, an

increase of $219 million, or 13%, compared to last year’s second

quarter. Organic orders (excluding foreign exchange) increased 57%

from last year’s second quarter and the book-to-bill ratio was 1.4x

in the second quarter. Orders for the trailing twelve-month period

ended June 30, 2024 were up 37% compared to the prior trailing

twelve-month period, demonstrating a strong market.

Second quarter 2024 operating profit of $336 million reflects an

increase of $130 million and adjusted operating profit of $382

million reflects an increase of $131 million, or 52%, compared to

second quarter 2023. Adjusted operating margin expanded 510 basis

points to 19.6% in the second quarter 2024 compared to second

quarter 2023, driven by benefits from increased volume, favorable

price-cost and manufacturing and procurement productivity partially

offset by investments in R&D and capacity to support

growth.

“Vertiv delivered another strong performance in the second

quarter with order growth again exceeding our expectations, rising

57% year-over-year and increasing 10% sequentially over an

exceptional first quarter,” said Giordano Albertazzi, Vertiv’s

Chief Executive Officer. “We continue to see increased scaling of

AI deployment and Vertiv has the capacity in place to seize this

pivotal moment while continuing to invest in capacity for the

future. Vertiv is the connective tissue between IT and facilities

in the data center, and we are just beginning to tap the tremendous

potential of our unique position in the industry as we leverage the

most complete portfolio of critical digital infrastructure

solutions across the entire thermal and power technology spectrum,

supported by over 3,750 field service engineers globally to help

our customers navigate this increasingly complex environment.”

Dave Cote, Vertiv’s Executive Chairman, added: “Significant

demand growth coupled with Vertiv’s unrelenting focus on

operational execution to benefit our customers is translating into

strong performance across the board with robust cash flow and

higher profitability, accelerating progress toward our long-term

target of 20%+ adjusted operating margin. These results reflect the

strides Gio and his team continue to make in instilling operational

excellence and a high-performance culture within the organization.

This is providing a strong foundation for continued growth and

long-term value creation for our shareholders.”

Adjusted Free Cash Flow(1) and

Liquidity

Net cash generated by operating activities in second quarter was

$378 million, an increase of $125 million from second quarter 2023

and adjusted free cash flow was $333 million, an increase of $106

million from second quarter 2023. Second quarter 2024 adjusted free

cash flow performance was driven by higher adjusted operating

profit and improvement in working capital management which were

partially offset by a $19 million increase in capital expenditures

to support growth.

Liquidity was $1.2 billion and borrowings under our ABL credit

facility remained at zero at the end of second quarter 2024. Net

leverage at the end of second quarter 2024 was 1.8x, within

Vertiv’s target net leverage range of 1.0x to 2.0x. Vertiv’s $2.1

billion term loan was repriced in June 2024, lowering our interest

rate by 61 basis points to Term SOFR + 200 basis points, resulting

in interest savings of approximately $13 million per year.

Updated Full Year and Third Quarter

2024 Guidance

Vertiv’s industry expertise, advanced technologies, global

capacity, scale, technology partnerships and service network are

key strengths that are uniquely aligned to the data center market

and AI acceleration. We believe Vertiv’s continued focus on

operational execution and high-performance culture will support our

outlook for 2024, which has been increased for all financial

measures.

Third Quarter 2024 Guidance

Net sales

$1,935M - $1,985M

Organic net sales growth(2)

12% - 16%

Adjusted operating profit(1)

$375M - $395M

Adjusted operating margin(2)

19.4% - 19.8%

Adjusted diluted EPS(1)

$0.65 - $0.69

Full Year 2024 Guidance

Net sales

$7,590M - $7,740M

Organic net sales growth(2)

12% - 14%

Adjusted operating profit(1)

$1,410M - $1,460M

Adjusted operating margin(2)

18.5% - 18.9%

Adjusted diluted EPS(1)

$2.47 - $2.53

Adjusted free cash flow(2)

$850M - $900M

(1)

This release contains certain non-GAAP

metrics. For reconciliations to the relevant GAAP measures and an

explanation of the non-GAAP measures and reasons for their use,

please refer to sections of this release entitled “Non-GAAP

Financial Measures” and “Reconciliation of GAAP and non-GAAP

Financial Measures.”

(2)

This is a forward-looking non-GAAP

financial measure that cannot be reconciled for those reasons set

forth under “Non-GAAP Financial Measures” of this release.

Second Quarter 2024 Earnings Conference

Call

Vertiv’s management team will discuss the Company’s results

during a conference call on Wednesday, July 24, starting at 11 a.m.

Eastern Time. The call will contain forward-looking statements and

other material information regarding Vertiv’s financial and

operating results. A webcast of the live conference call will be

available for interested parties to listen to by going to the

Investor Relations section of the Company’s website at

investors.vertiv.com. A slide presentation will be available before

the call and will be posted to the website, also at

investors.vertiv.com. A replay of the conference call will also be

available for 30 days following the webcast.

About Vertiv Holdings Co

Vertiv (NYSE: VRT) brings together hardware, software, analytics

and ongoing services to enable its customers’ vital applications to

run continuously, perform optimally and grow with their business

needs. Vertiv solves the most important challenges facing today’s

data centers, communication networks and commercial and industrial

facilities with a portfolio of power, cooling and IT infrastructure

solutions and services that extends from the cloud to the edge of

the network. Headquartered in Westerville, Ohio, USA, Vertiv does

business in more than 130 countries. For more information, and for

the latest news and content from Vertiv, visit vertiv.com.

Category: Financial News

Non-GAAP Financial

Measures

Financial information included in this release has been prepared

in accordance with Generally Accepted Accounting Principles

(“GAAP”). Vertiv has included certain non-GAAP financial measures

in this news release, as indicated above, that may not be directly

comparable to other similarly titled measures used by other

companies and therefore may not be comparable among companies.

These non-GAAP financial measures include organic net sales growth

(including on a segment basis), adjusted operating profit, adjusted

operating margin, adjusted diluted EPS and adjusted free cash flow,

which management believes provides investors with useful

supplemental information to evaluate the Company’s ongoing

operations and to compare with past and future periods. Management

also uses certain non-GAAP measures internally for forecasting,

budgeting and measuring its operating performance. These measures

should be viewed as supplementing, and not as an alternative or

substitute for, the Company's financial results prepared in

accordance with GAAP. Pursuant to the requirements of Regulation G,

Vertiv has provided reconciliations of non-GAAP financial measures

to the most directly comparable GAAP financial measures.

Information reconciling certain forward-looking GAAP measures to

non-GAAP measures related to third quarter and full-year 2024

guidance, including organic net sales growth, adjusted free cash

flow and adjusted operating margin, is not available without

unreasonable effort due to high variability, complexity and

uncertainty with respect to forecasting and quantifying certain

amounts that are necessary for such reconciliations. For those

reasons, we are unable to compute the probable significance of the

unavailable information, which could have a potentially

unpredictable, and potentially significant, impact on our future

GAAP financial results.

See “Reconciliation of GAAP and Non-GAAP Financial Measures” in

this release for Vertiv’s reconciliations of non-GAAP financial

measures to the most directly comparable GAAP financial

measures.

Cautionary Note Concerning

Forward-Looking Statements

This news release, and other statements that Vertiv may make in

connection therewith, may contain forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of 1995

with respect to Vertiv’s future financial or business performance,

strategies or expectations, and as such are not historical facts.

This includes, without limitation, statements regarding Vertiv’s

financial position, capital structure, indebtedness, business

strategy and plans, and objectives of Vertiv management for future

operations, as well as statements regarding growth, anticipated

demand for our products and services, and our business prospects

during 2024, as well as expected impacts from our pricing actions,

and our guidance for third quarter and full year 2024. These

statements constitute projections, forecasts and forward-looking

statements, and are not guarantees of performance. Vertiv cautions

that forward-looking statements are subject to numerous

assumptions, risks and uncertainties, which change over time. Such

statements can be identified by the fact that they do not relate

strictly to historical or current facts. When used in this news

release, words such as “anticipate,” “believe,” “continue,”

“could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,”

“possible,” “potential,” “predict,” “project,” “should,” “strive,”

“would” and similar expressions may identify forward-looking

statements, but the absence of these words does not mean that a

statement is not forward-looking.

The forward-looking statements contained in this release are

based on current expectations and beliefs concerning future

developments and their potential effects on Vertiv. There can be no

assurance that future developments affecting Vertiv will be those

that Vertiv has anticipated. Vertiv undertakes no obligation to

update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise, except as

may be required under applicable securities laws. These

forward-looking statements involve a number of risks, uncertainties

(some of which are beyond Vertiv’s control) or other assumptions

that may cause actual results or performance to be materially

different from those expressed or implied by these forward-looking

statements. Should one or more of these risks or uncertainties

materialize, or should any of the assumptions prove incorrect,

actual results may vary in material respects from those projected

in these forward-looking statements. Vertiv has previously

disclosed risk factors in its Securities and Exchange Commission

(“SEC”) reports, including those set forth in the Vertiv 2023

Annual Report on Form 10-K filed with the SEC on February 23, 2024.

These risk factors and those identified elsewhere in this release,

among others, could cause actual results to differ materially from

historical performance and include, but are not limited to: risks

relating to the continued growth of Vertiv’s customers’ markets;

disruption of Vertiv’s customers’ orders or Vertiv’s customers’

markets; less favorable contractual terms with large customers;

risks associated with governmental contracts; failure to mitigate

risks associated with long-term fixed price contracts; competition

in the infrastructure technologies industry; failure to obtain

performance and other guarantees from financial institutions;

failure to realize sales expected from Vertiv’s backlog of orders

and contracts; failure to properly manage Vertiv’s supply chain or

difficulties with third-party manufacturers; our ability to

forecast changes in prices, including due to inflation in material,

freight and/or labor costs, and timely implement measures necessary

to mitigate the impacts of any such changes; risks associated with

our significant backlog, including that the impacts of any measures

taken to mitigate inflation will not be reflected in our financial

statements immediately; failure to meet or anticipate technology

changes; risks associated with information technology disruption or

security; risks associated with the implementation and enhancement

of information systems; failure to realize the expected benefit

from any rationalization, restructuring and improvement efforts;

Vertiv’s ability to realize cost savings in connection with

Vertiv’s restructuring program; disruption of, or changes in,

Vertiv’s independent sales representatives, distributors and

original equipment manufacturers; changes to tax law; ongoing tax

audits; costs or liabilities associated with product liability; the

global scope of Vertiv’s operations; risks associated with Vertiv’s

sales and operations in emerging markets; risks associated with

future legislation and regulation of Vertiv’s customers’ markets

both in the United States and abroad; Vertiv’s ability to comply

with various laws and regulations and the costs associated with

legal compliance; adverse outcomes to any legal claims and

proceedings filed by or against Vertiv; risks associated with

current and potential litigation or claims against Vertiv; Vertiv’s

ability to protect or enforce its proprietary rights on which its

business depends; third party intellectual property infringement

claims; liabilities associated with environmental, health and

safety matters; failure to achieve environmental, social and

governance goals; failure to realize the value of goodwill and

intangible assets; exposure to fluctuations in foreign currency

exchange rates; exposure to increases in interest rates set by

central banking authorities; failure to maintain internal controls

over financial reporting; the unpredictability of Vertiv’s future

operational results, including the ability to grow and manage

growth profitably; potential net losses in future periods; Vertiv’s

level of indebtedness and the ability to incur additional

indebtedness; Vertiv’s ability to comply with the covenants and

restrictions contained in our credit agreements, including

restrictive covenants that restrict operational flexibility;

Vertiv’s ability to comply with the covenants and restrictions

contained in our credit agreements is not fully within our control;

Vertiv’s ability to access funding through capital markets; the

significant ownership and influence certain stockholders have over

Vertiv; resales of Vertiv’s securities may cause volatility in the

market price of our securities; Vertiv’s organizational documents

contain provisions that may discourage unsolicited takeover

proposals; Vertiv’s certificate of incorporation includes a forum

selection clause, which could discourage or limit stockholders’

ability to make a claim against it; the ability of Vertiv’s

subsidiaries to pay dividends; the ability of Vertiv to grow and

manage growth profitably, maintain relationships with customers and

suppliers and retain its management and key employees; Vertiv's

ability to manage the succession of its key employees; and factors

relating to the business, operations and financial performance of

Vertiv and its subsidiaries, including: global economic weakness

and uncertainty; Vertiv’s ability to attract, train and retain key

members of its leadership team and other qualified personnel; the

adequacy of Vertiv’s insurance coverage; a failure to benefit from

future corporate transactions; risks associated with Vertiv’s

limited history of operating as an independent company; and other

risks and uncertainties indicated in Vertiv’s SEC reports or

documents filed or to be filed with the SEC by Vertiv.

Forward-looking statements included in this news release speak

only as of the date of this news release or any earlier date

specified for such statements. All subsequent written or oral

forward-looking statements attributable to Vertiv or persons acting

on Vertiv’s behalf may be qualified in their entirety by this

Cautionary Note Concerning Forward-Looking Statements.

UNAUDITED CONDENSED

CONSOLIDATED STATEMENTS OF EARNINGS (LOSS)

Vertiv Holdings Co

(Dollars in millions except

for per share data)

Three months ended June 30,

2024

Three months ended June 30,

2023

Six months ended June 30,

2024

Six months ended June 30,

2023

Net sales

Net sales - products

$

1,555.2

$

1,360.4

$

2,825.5

$

2,546.9

Net sales - services

397.6

373.7

766.4

708.3

Net sales

1,952.8

1,734.1

3,591.9

3,255.2

Costs and expenses

Cost of sales - products

981.0

912.9

1,827.3

1,732.4

Cost of sales - services

230.6

227.2

457.0

433.3

Cost of sales

1,211.6

1,140.1

2,284.3

2,165.7

Operating expenses

Selling, general and administrative

expenses

363.8

327.6

677.8

636.3

Amortization of intangibles

45.8

45.4

91.8

90.6

Restructuring costs

(2.5

)

9.1

(2.2

)

22.2

Foreign currency (gain) loss, net

0.2

7.5

3.4

10.6

Other operating expense (income)

(2.1

)

(1.4

)

(1.8

)

(6.3

)

Operating profit (loss)

336.0

205.8

538.6

336.1

Interest expense, net

44.8

46.9

83.8

93.7

Loss on extinguishment of debt

1.1

—

1.1

—

Change in fair value of warrant

liabilities

25.4

46.0

202.0

41.8

Income (loss) before income

taxes

264.7

112.9

251.7

200.6

Income tax expense (benefit)

86.6

29.7

79.5

67.1

Net income (loss)

$

178.1

$

83.2

$

172.2

$

133.5

Earnings (loss) per share:

Basic

$

0.48

$

0.22

$

0.46

$

0.35

Diluted

$

0.46

$

0.22

$

0.44

$

0.35

Weighted-average shares outstanding:

Basic

374,734,093

379,938,365

376,934,638

379,039,072

Diluted

384,488,069

382,351,210

387,001,428

381,116,189

UNAUDITED CONDENSED

CONSOLIDATED BALANCE SHEETS

Vertiv Holdings Co

(Dollars in millions)

June 30, 2024

December 31, 2023

ASSETS

Current assets:

Cash and cash equivalents

$

579.7

$

780.4

Accounts receivable, less allowances of

$26.9 and $29.1, respectively

2,218.8

2,118.1

Inventories

1,103.7

884.3

Other current assets

289.2

218.7

Total current assets

4,191.4

4,001.5

Property, plant and equipment,

net

571.1

560.1

Other assets:

Goodwill

1,321.9

1,330.3

Other intangible assets, net

1,577.6

1,672.9

Deferred income taxes

160.9

159.8

Right-of-use assets, net

180.0

173.5

Other

105.4

100.4

Total other assets

3,345.8

3,436.9

Total assets

$

8,108.3

$

7,998.5

LIABILITIES AND

EQUITY

Current liabilities:

Current portion of long-term debt

$

21.2

$

21.8

Current portion of warrant liabilities

397.0

—

Accounts payable

1,098.2

986.4

Deferred revenue

888.8

638.9

Accrued expenses and other liabilities

600.6

611.8

Income taxes

74.0

46.5

Total current liabilities

3,079.8

2,305.4

Long-term debt, net

2,913.7

2,919.1

Deferred income taxes

158.9

159.5

Warrant liabilities

—

195.0

Long-term lease liabilities

149.9

142.6

Other long-term liabilities

268.5

262.0

Total liabilities

6,570.8

5,983.6

Equity

Preferred stock, $0.0001 par value,

5,000,000 shares authorized, none issued and outstanding

—

—

Common stock, $0.0001 par value,

700,000,000 shares authorized, 375,113,127 and 381,788,876 shares

issued and outstanding at June 30, 2024 and December 31, 2023,

respectively

—

—

Additional paid-in capital

2,141.0

2,711.3

Accumulated deficit

(538.4

)

(691.9

)

Accumulated other comprehensive (loss)

income

(65.1

)

(4.5

)

Total equity

1,537.5

2,014.9

Total liabilities and equity

$

8,108.3

$

7,998.5

UNAUDITED CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

Vertiv Holdings Co

(Dollars in millions)

Three months ended June 30,

2024

Three months ended June 30,

2023

Six months ended June 30,

2024

Six months ended June 30,

2023

Cash flows from operating

activities:

Net income (loss)

$

178.1

$

83.2

$

172.2

$

133.5

Adjustments to reconcile net income (loss)

to net cash provided by (used for) operating activities:

Depreciation

20.1

18.0

39.9

35.7

Amortization

48.3

49.3

97.2

98.2

Deferred income taxes

4.8

(1.8

)

(2.8

)

1.6

Amortization of debt discount and issuance

costs

2.0

2.0

4.1

4.7

Change in fair value of warrant

liabilities

25.4

46.0

202.0

41.8

Changes in operating working capital

96.1

51.4

(3.6

)

(35.5

)

Stock-based compensation

8.5

6.8

17.7

12.3

Other

(4.9

)

(1.3

)

(10.8

)

3.3

Net cash provided by (used for)

operating activities

378.4

253.6

515.9

295.6

Cash flows from investing

activities:

Capital expenditures

(34.1

)

(25.8

)

(69.9

)

(53.6

)

Investments in capitalized software

(10.9

)

(0.5

)

(11.6

)

(2.5

)

Proceeds from disposition of property,

plant and equipment

—

—

—

12.4

Net cash provided by (used for)

investing activities

(45.0

)

(26.3

)

(81.5

)

(43.7

)

Cash flows from financing

activities:

Borrowings from ABL revolving credit

facility and short-term borrowings

80.0

59.5

270.0

159.7

Repayments of ABL revolving credit

facility and short-term borrowings

(80.0

)

(284.5

)

(270.0

)

(394.7

)

Repayment of long-term debt

(5.3

)

(5.5

)

(10.6

)

(16.4

)

Dividend payment

(9.4

)

—

(18.7

)

—

Repurchase of common stock

—

—

(599.9

)

—

Exercise of employee stock options

9.2

7.8

23.6

10.0

Employee taxes paid from shares

withheld

(15.0

)

(2.4

)

(18.0

)

(2.5

)

Net cash provided by (used for)

financing activities

(20.5

)

(225.1

)

(623.6

)

(243.9

)

Effect of exchange rate changes on cash

and cash equivalents

(5.7

)

(2.8

)

(11.7

)

(1.0

)

Increase (decrease) in cash, cash

equivalents and restricted cash

307.2

(0.6

)

(200.9

)

7.0

Beginning cash, cash equivalents and

restricted cash

280.5

280.8

788.6

273.2

Ending cash, cash equivalents and

restricted cash

$

587.7

$

280.2

$

587.7

$

280.2

Changes in operating working

capital

Accounts receivable

$

(125.0

)

$

(184.2

)

$

(115.1

)

$

(274.3

)

Inventories

(117.6

)

(17.0

)

(224.1

)

(96.5

)

Other current assets

0.8

154.0

(30.9

)

152.8

Accounts payable

120.5

25.7

130.3

(36.6

)

Deferred revenue

154.7

17.1

254.7

161.3

Accrued expenses and other liabilities

60.1

44.0

(8.4

)

27.5

Income taxes

2.6

11.8

(10.1

)

30.3

Total changes in operating working

capital

$

96.1

$

51.4

$

(3.6

)

$

(35.5

)

Reconciliation of GAAP and non-GAAP Financial

Measures

To supplement this news release, we have included certain

non-GAAP financial measures in the format of performance metrics.

Management believes these non-GAAP financial measures provide

investors with additional meaningful financial information that

should be considered when assessing our underlying business

performance and trends. Further, management believes these non-GAAP

financial measures also enhance investors' ability to compare

period-to-period financial results. Non-GAAP financial measures

should be viewed in addition to, and not as an alternative for, the

company's reported results prepared in accordance with GAAP. Our

non-GAAP financial measures do not represent a comprehensive basis

of accounting. Therefore, our non-GAAP financial measures may not

be comparable to similarly titled measures reported by other

companies. Reconciliations of each of these non-GAAP financial

measures to GAAP information are also included. Management uses

these non-GAAP financial measures in making financial, operating,

compensation and planning decisions and in evaluating the company's

performance. Disclosing these non-GAAP financial measures allows

investors and management to view our operating results excluding

the impact of items that are not reflective of the underlying

operating performance.

Vertiv’s non-GAAP financial measures include:

- Adjusted operating profit (loss), which represents operating

profit (loss), adjusted to exclude amortization of

intangibles;

- Adjusted operating margin, which represents adjusted operating

profit (loss) divided by net sales;

- Organic net sales growth, which represents the change in net

sales adjusted to exclude the impacts of foreign currency exchange

rate;

- Adjusted free cash flow, which represents net cash provided by

(used for) operating activities adjusted to exclude capital

expenditures, investments in capitalized software and include

proceeds from disposition of PP&E; and

- Adjusted diluted EPS, which represents diluted earnings per

share adjusted to exclude amortization of intangibles and change in

warranty liability.

Regional Segment Results

Three months ended June 30,

Six months ended June 30,

2024

2023

Δ

Δ%

Organic Δ%(2)

2024

2023

Δ

Δ%

Organic Δ%(2)

Net sales

(1)

Americas

$

1,121.1

$

959.4

$

161.7

16.9

%

17.2

%

$

2,046.1

$

1,821.7

$

224.4

12.3

%

12.4

%

APAC

409.1

395.8

13.3

3.4

%

5.7

%

741.4

708.8

32.6

4.6

%

7.2

%

EMEA

422.6

378.9

43.7

11.5

%

13.5

%

804.4

724.7

79.7

11.0

%

11.7

%

Total

$

1,952.8

$

1,734.1

$

218.7

12.6

%

13.7

%

$

3,591.9

$

3,255.2

$

336.7

10.3

%

11.1

%

Adjusted

operating profit (loss)(3)

Americas

$

285.1

$

191.7

$

93.4

48.7

%

$

472.9

$

337.5

$

135.4

40.1

%

APAC

32.3

38.2

(5.9

)

(15.4

)%

62.7

54.8

7.9

14.4

%

EMEA

109.5

79.9

29.6

37.0

%

179.8

126.0

53.8

42.7

%

Corporate (4)

(45.1

)

(58.6

)

13.5

(23.0

)%

(85.0

)

(91.6

)

6.6

(7.2

)%

Total

$

381.8

$

251.2

$

130.6

52.0

%

$

630.4

$

426.7

$

203.7

47.7

%

Adjusted

operating margins (5)

Americas

25.4

%

20.0

%

5.4

%

23.1

%

18.5

%

4.6

%

APAC

7.9

%

9.7

%

(1.8

)%

8.5

%

7.7

%

0.8

%

EMEA

25.9

%

21.1

%

4.8

%

22.4

%

17.4

%

5.0

%

Vertiv

19.6

%

14.5

%

5.1

%

17.6

%

13.1

%

4.5

%

(1)

Segment net sales are presented excluding

intercompany sales.

(2)

Organic basis is adjusted to exclude

foreign currency exchange rate impact.

(3)

Adjusted operating profit (loss) is only

adjusted at the Corporate segment. There are no adjustments at the

reportable segment level between operating profit (loss) and

adjusted operating profit (loss).

(4)

Corporate costs consist of headquarters

management costs, stock-based compensation, other incentive

compensation, asset impairments and costs that support centralized

global functions including Finance, Treasury, Risk Management,

Strategy & Marketing, and Legal.

(5)

Adjusted operating margins calculated as

adjusted operating profit (loss) divided by net sales.

Sales by product and service

offering

Three months ended June 30,

2024

2023

Δ

Δ %

Americas:

Products(1)

$

892.1

$

751.5

$

140.6

18.7

%

Services & spares

229.0

207.9

21.1

10.1

%

$

1,121.1

$

959.4

$

161.7

16.9

%

Asia Pacific:

Products(1)

$

293.1

$

285.7

$

7.4

2.6

%

Services & spares

116.0

110.1

5.9

5.4

%

$

409.1

$

395.8

$

13.3

3.4

%

EMEA:

Products(1)

$

332.1

$

292.7

$

39.4

13.5

%

Services & spares

90.5

86.2

4.3

5.0

%

$

422.6

$

378.9

$

43.7

11.5

%

Total:

Products(1)

$

1,517.3

$

1,329.9

$

187.4

14.1

%

Services & spares

435.5

404.2

31.3

7.7

%

$

1,952.8

$

1,734.1

$

218.7

12.6

%

(1) Refer to Exhibit 99.2 to

Vertiv’s current report on Form 8-K filed on February 21, 2024 for

a fiscal year 2023 summary of changes made to conform with the

current year presentation of sales by product and service

offering.

Six months ended June 30,

2024

2023

Δ

Δ %

Americas:

Products(1)

$

1,608.2

$

1,425.4

$

182.8

12.8

%

Services & spares

437.9

396.3

41.6

10.5

%

$

2,046.1

$

1,821.7

$

224.4

12.3

%

Asia Pacific:

Products(1)

$

517.1

$

494.6

$

22.5

4.5

%

Services & spares

224.3

214.2

10.1

4.7

%

$

741.4

$

708.8

$

32.6

4.6

%

EMEA:

Products(1)

$

629.4

$

560.4

$

69.0

12.3

%

Services & spares

175.0

164.3

10.7

6.5

%

$

804.4

$

724.7

$

79.7

11.0

%

Total:

Products(1)

$

2,754.7

$

2,480.4

$

274.3

11.1

%

Services & spares

837.2

774.8

62.4

8.1

%

$

3,591.9

$

3,255.2

$

336.7

10.3

%

(1) Refer to Exhibit 99.2 to Vertiv’s

current report on Form 8-K filed on February 21, 2024 for a fiscal

year 2023 summary of changes made to conform with the current year

presentation of sales by product and service offering.

Organic growth by product and service

offering

Three months ended June 30,

2024

Net Sales Δ

FX Δ

Organic growth

Organic Δ %(1)

Americas:

Products(2)

$

140.6

$

5.9

$

146.5

19.5

%

Services & spares

21.1

(2.8

)

18.3

8.8

%

$

161.7

$

3.1

$

164.8

17.2

%

Asia Pacific:

Products(2)

$

7.4

$

6.9

$

14.3

5.0

%

Services & spares

5.9

2.2

8.1

7.4

%

$

13.3

$

9.1

$

22.4

5.7

%

EMEA:

Products(2)

$

39.4

$

3.8

$

43.2

14.8

%

Services & spares

4.3

3.6

7.9

9.2

%

$

43.7

$

7.4

$

51.1

13.5

%

Total:

Products(2)

$

187.4

$

16.6

$

204.0

15.3

%

Services & spares

31.3

3.0

34.3

8.5

%

$

218.7

$

19.6

$

238.3

13.7

%

(1) Organic growth percentage

change is calculated as organic growth divided by net sales for the

three months ended June 30, 2023.

(2) Refer to Exhibit 99.2 to

Vertiv’s current report on Form 8-K filed on February 21, 2024 for

a fiscal year 2023 summary of changes made to conform with the

current year presentation of sales by product and service

offering.

Six months ended June 30,

2024

Net Sales Δ

FX Δ

Organic growth

Organic Δ %(1)

Americas:

Products(2)

$

182.8

$

6.4

$

189.2

13.3

%

Services & spares

41.6

(4.7

)

36.9

9.3

%

$

224.4

$

1.7

$

226.1

12.4

%

Asia Pacific:

Products(2)

$

22.5

$

13.0

$

35.5

7.2

%

Services & spares

10.1

5.4

15.5

7.2

%

$

32.6

$

18.4

$

51.0

7.2

%

EMEA:

Products(2)

$

69.0

$

(0.9

)

$

68.1

12.2

%

Services & spares

10.7

6.1

16.8

10.2

%

$

79.7

$

5.2

$

84.9

11.7

%

Total:

Products(2)

$

274.3

$

18.5

$

292.8

11.8

%

Services & spares

62.4

6.8

69.2

8.9

%

$

336.7

$

25.3

$

362.0

11.1

%

(1) Organic growth percentage

change is calculated as organic growth divided by net sales for the

six months ended June 30, 2023.

(2) Refer to Exhibit 99.2 to

Vertiv’s current report on Form 8-K filed on February 21, 2024 for

a fiscal year 2023 summary of changes made to conform with the

current year presentation of sales by product and service

offering.

Segment operating profit (loss)

Operating profit

(loss)

Three months ended June 30,

2024

Three months ended June 30,

2023

Six months ended June 30,

2024

Six months ended June 30,

2023

Americas

$

285.1

$

191.7

$

472.9

$

337.5

Asia Pacific

32.3

38.2

62.7

54.8

EMEA

109.5

79.9

179.8

126.0

Total reportable segments

426.9

309.8

715.4

518.3

Foreign currency gain (loss)

(0.2

)

(7.5

)

(3.4

)

(10.6

)

Corporate and other

(44.9

)

(51.1

)

(81.6

)

(81.0

)

Total corporate, other and

eliminations

(45.1

)

(58.6

)

(85.0

)

(91.6

)

Amortization of intangibles

(45.8

)

(45.4

)

(91.8

)

(90.6

)

Operating profit (loss)

$

336.0

$

205.8

$

538.6

$

336.1

Reconciliation of net cash provided by

(used for) operating activities to adjusted free cash flow

Three months ended June 30,

2024

Three months ended June 30,

2023

Six months ended June 30,

2024

Six months ended June 30,

2023

Net cash provided by (used for) operating

activities

$

378.4

$

253.6

$

515.9

$

295.6

Capital expenditures

(34.1

)

(25.8

)

(69.9

)

(53.6

)

Investments in capitalized software

(10.9

)

(0.5

)

(11.6

)

(2.5

)

Proceeds from disposition of PP&E

—

—

—

12.4

Adjusted free cash flow

$

333.4

$

227.3

$

434.4

$

251.9

Reconciliation from operating profit

(loss) to adjusted operating profit (loss)

Three months ended June 30,

2024

Three months ended June 30,

2023

Six months ended June 30,

2024

Six months ended June 30,

2023

Operating profit (loss)

$

336.0

$

205.8

$

538.6

$

336.1

Amortization of intangibles

45.8

45.4

91.8

90.6

Adjusted operating profit

(loss)

$

381.8

$

251.2

$

630.4

$

426.7

Reconciliation from operating margin to

adjusted operating margin

Three months ended June 30,

2024

Three months ended June 30,

2023

Δ

Six months ended June 30,

2024

Six months ended June 30,

2023

Δ

Vertiv net sales

$

1,952.8

$

1,734.1

$

218.7

$

3,591.9

$

3,255.2

$

336.7

Vertiv operating profit (loss)

336.0

205.8

130.2

538.6

336.1

202.5

Vertiv operating margin

17.2

%

11.9

%

5.3

%

15.0

%

10.3

%

4.7

%

Amortization of intangibles

$

45.8

$

45.4

$

0.4

$

91.8

$

90.6

$

1.2

Vertiv adjusted operating profit

(loss)

381.8

251.2

130.6

630.4

426.7

203.7

Vertiv adjusted operating

margin

19.6

%

14.5

%

5.1

%

17.6

%

13.1

%

4.5

%

Reconciliation of Diluted EPS to Adjusted Diluted EPS

Three months

ended June 30, 2024

Operating profit

(loss)

Interest expense, net

Loss on extinguishment of

debt

Change in warrant

liability

Income tax expense

(benefit)

Net income (loss)

Diluted EPS (1)

GAAP

$

336.0

$

44.8

$

1.1

$

25.4

$

86.6

$

178.1

$

0.46

Amortization of intangibles

45.8

—

—

—

—

45.8

0.12

Change in warrant liability

—

—

—

(25.4

)

(9.1

)

34.5

0.09

Non-GAAP Adjusted

$

381.8

$

44.8

$

1.1

$

—

$

77.5

$

258.4

$

0.67

Diluted Shares (in millions)

384.5

(1)

Diluted EPS and adjusted diluted EPS is

based on 384.5 million shares (includes 374.7 million basic shares

and 9.8 million potential dilutive stock options and restricted

stock units). We believe that this presentation is more

representative of operating results by removing the impact of

warrant liability accounting and the associated impact on diluted

EPS.

Three months

ended June 30, 2023

Operating profit

(loss)

Interest expense, net

Change in warrant

liability

Income tax expense

Net income (loss)

Diluted EPS (1)

GAAP

$

205.8

$

46.9

$

46.0

$

29.7

$

83.2

$

0.22

Amortization of intangibles

45.4

—

—

—

45.4

0.12

Change in warrant liability

—

—

(46.0

)

—

46.0

0.12

Non-GAAP Adjusted

$

251.2

$

46.9

$

—

$

29.7

$

174.6

$

0.46

Diluted Shares (in millions)

382.4

(1)

Diluted EPS and adjusted diluted EPS based

on 382.4 million shares (includes 379.9 million basic shares and

2.4 million potential dilutive stock options and restricted stock

units). We believe that this presentation is more representative of

operating results by removing the impact of warrant liability

accounting and the associated impact on diluted EPS.

Six months ended

June 30, 2024

Operating profit

(loss)

Interest expense, net

Loss on extinguishment of

debt

Change in warrant

liability

Income tax expense

(benefit)

Net income (loss)

Diluted EPS (1)

GAAP

$

538.6

$

83.8

$

1.1

$

202.0

$

79.5

$

172.2

$

0.44

Amortization of intangibles

91.8

—

—

—

—

91.8

0.24

Change in warrant liability

—

—

—

(202.0

)

38.8

163.2

0.42

Non-GAAP Adjusted

$

630.4

$

83.8

$

1.1

$

—

$

118.3

$

427.2

$

1.10

Diluted Shares (in millions)

387.0

(1)

Diluted EPS and adjusted diluted EPS is

based on 387.0 million shares (includes 376.9 million basic shares

and 10.1 million potential dilutive stock options and restricted

stock units). We believe that this presentation is more

representative of operating results by removing the impact of

warrant liability accounting and the associated impact on diluted

EPS.

Six months ended

June 30, 2023

Operating profit

(loss)

Interest expense, net

Change in warrant

liability

Income tax expense

(benefit)

Net income (loss)

Diluted EPS (1)

GAAP

$

336.1

$

93.7

$

41.8

$

67.1

$

133.5

$

0.35

Amortization of intangibles

90.6

—

—

—

90.6

0.24

Change in warrant liability

—

—

(41.8

)

—

41.8

0.11

Non-GAAP Adjusted

$

426.7

$

93.7

$

—

$

67.1

$

265.9

$

0.70

Diluted Shares (in millions)

381.1

(1)

Diluted EPS and adjusted diluted EPS based

on 381.1 million shares (includes 379.0 million basic shares and

2.1 million potential dilutive stock options and restricted stock

units). We believe that this presentation is more representative of

operating results by removing the impact of warrant liability

accounting and the associated impact on diluted EPS.

Vertiv Holdings Co

2024 Adjusted Guidance

Reconciliation of Diluted EPS

to Adjusted Diluted EPS (1)

Third Quarter 2024

Operating profit

(loss)

Interest expense, net

Income tax expense

Net income (loss)

Diluted EPS (2)

GAAP

$

341.0

$

41.0

$

104.0

$

196.0

$

0.51

Amortization of intangibles

44.0

—

—

44.0

0.11

Change in warrant liability

—

—

(20.0

)

20.0

0.05

Non-GAAP Adjusted

$

385.0

$

41.0

$

84.0

$

260.0

$

0.67

Diluted Shares (in millions)

385.0

Full Year 2024

Operating profit

(loss)

Interest expense, net

Change in warrant

liability

Income tax expense

Net income (loss)

Diluted EPS (3)

GAAP

$

1,256.0

$

165.0

$

202.0

$

301.0

$

588.0

$

1.52

Amortization of intangibles

179.0

—

—

—

179.0

0.46

Change in warrant liability

—

—

(202.0

)

—

202.0

0.52

Non-GAAP Adjusted

$

1,435.0

$

165.0

$

—

$

301.0

$

969.0

$

2.50

Diluted Shares (in millions)

387.0

(1)

Information reconciling certain

forward-looking GAAP measures to non-GAAP measures related to FY

2024 guidance, including organic net sales growth, adjusted

operating margin and adjusted free cash flow, is not available

without unreasonable effort due to high variability, complexity and

uncertainty with respect to forecasting and quantifying certain

amounts that are necessary for such reconciliations. For the same

reasons, we are unable to compute the probable significance of the

unavailable information, which could have a potentially

unpredictable, and potentially significant, impact on our future

GAAP financial results.

(2)

Diluted EPS and adjusted diluted EPS based

on 385.0 million shares (includes 375.0 million basic shares and a

weighted average 10.0 million potential dilutive stock options and

restricted stock units).

(3)

Diluted EPS and adjusted diluted EPS based

on 387.0 million shares (includes 377.0 million basic shares and a

weighted average 10.0 million potential dilutive stock options and

restricted stock units).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240723199943/en/

For investor inquiries, please contact: Lynne Maxeiner

Vice President, Global Treasury & Investor Relations Vertiv T

+1 614-841-6776 E: lynne.maxeiner@vertiv.com

For media inquiries, please contact: Peter Poulos

FleishmanHillard for Vertiv T +1 646-284-4991 E:

peter.poulos@fleishman.com

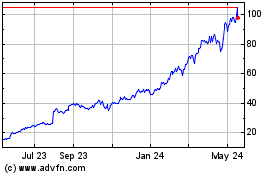

Vertiv (NYSE:VRT)

Historical Stock Chart

From Dec 2024 to Jan 2025

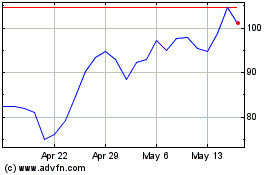

Vertiv (NYSE:VRT)

Historical Stock Chart

From Jan 2024 to Jan 2025