Saudi Telecom Company’s STC Pay Digital

Mobile Wallet to have Western Union Cross-Border

Functionality

STC Pay, a subsidiary of Saudi Telecom Company (STC), Saudi

Arabia’s largest telco, and The Western Union Company (NYSE: WU), a

leader in cross-border and cross-currency money movement, today

entered into strategic discussions to embed Western Union’s

cross-border functionality into a new STC Pay led FinTech platform

offering financial services locally and globally.

Saudi Digital Payments Company, a subsidiary of Saudi Telecom

charged with pioneering leading edge FinTech capabilities, today

launched STC Pay digital mobile wallet available from Apple or

Android app stores. It will allow customers to seamlessly transact

a range of payments without the need of formal bank accounts.

The ceremonial launch today was hosted in Riyadh, Saudi Arabia

at midday U.S. EST, amid a distinguished gathering presided by Dr.

Ahmed Abdul Karim Alkholifey, Governor of Saudi Arabian Monetary

Authority (SAMA), His Royal Highness, Prince Mohammed Al Faisal Al

Saud, Group Chairman of Saudi Telecom Company and Nasser Al Nasser,

Chief Executive Officer of Saudi Telecom Company as well as other

dignitaries.

Western Union CEO and President Hikmet Ersek

announced the proposed cooperation agreement paving the way for

STC Pay Digital Mobile to go global, during his speech to the

gathering.

“It is a privilege to be in Riyadh in person and to announce our

discussions about adding Western Union’s cross-border financial

technology to STC Pay. This would pave the way for millions of

customers with or without bank accounts or credits cards to access

a suite of international finance tools, all available at a click of

a button,” said Ersek.

“Our platform is a connector. It can link even the smallest

micro-communities to international corporations. No matter how

urban, rural, or remote the community, no matter if the user has

access to regular bank accounts or credit cards, our platform is an

on-ramp to 200 countries and territories across the world.”

“The best way to bring these services to new populations and

modernize to meet the ever-changing desires of our customers, is

through collaboration with local entities and we are privileged to

be at the table with STC Pay,” he said.

In 2017, there were 6.4 million unbanked adults in Saudi Arabia,

out of a population of 21 million adults, according to the World

Bank. Saudi Arabia is host to millions of international workers and

is the world’s second largest remittance sending nation.

“The main aim of STC through STC Pay is to enable financial

inclusion and limit cash usage,” said Nasser Al Nasser, CEO, Saudi

Telecom Company.

“Under the proposed arrangement, STC Pay users can stay local

and still enjoy the benefits of a global marketplace, thanks to a

proposed integration with Western Union. They can shop local,

receive money, or send money to friends and family nearly anywhere

in the world. Once, such transactions were the privilege of

customers with bank accounts but under the proposed agreement, they

would be available at the touch of a button to anyone with a STC

Pay mobile wallet,” he said.

About Western Union’s Cross-Border Platform

Western Union’s cross-border, cross-currency platform –

including a robust digital footprint, settlement, treasury and

compliance infrastructure, and a vast global network of over half a

million locations, billions of consumer accounts and mobile wallets

– sets the standard for international money movement. With

operations in 200 countries and territories, Western Union’s

platform processes an average of 32 transactions every second and

moves $300 billion a year across 130 currencies.

Connecting the digital and physical worlds of money, Western

Union’s technology stack, APIs, foreign exchange and settlement

engine, agent network, anti-money laundering and fraud detection

capabilities make it one of the largest digital and physical money

movers for consumers around the globe.

WU-G

For more information, visit the Western Union newsroom at

www.westernunion.com/news.

About Western Union

The Western Union Company (NYSE: WU) is a global leader in

cross-border, cross-currency money movement. Our omnichannel

platform connects the digital and physical worlds and makes it

possible for consumers and businesses to send and receive money and

make payments with speed, ease, and reliability. As of June 30,

2018, our network included over 550,000 retail agent locations

offering Western Union, Vigo or Orlandi Valuta branded services in

more than 200 countries and territories, with the capability to

send money to billions of accounts. Additionally, westernunion.com,

our fastest growing channel in 2017, is available in 45 countries

and territories to move money around the world. In 2017, we moved

over $300 billion in principal in nearly 130 currencies and

processed 32 transactions every second across all our services.

With our global reach, Western Union moves money for better,

connecting family, friends and businesses to enable financial

inclusion and support economic growth. For more information, visit

www.westernunion.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181002005985/en/

Western UnionPia De Lima, +1

954-260-5732pia.delima@wu.comorJohn Derryberry, +1

415-203-8762john.derryberry@wu.com

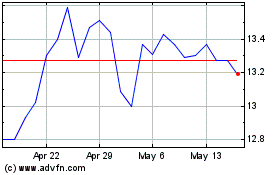

Western Union (NYSE:WU)

Historical Stock Chart

From Oct 2024 to Nov 2024

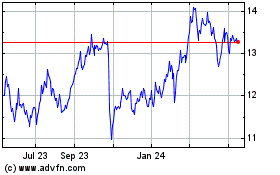

Western Union (NYSE:WU)

Historical Stock Chart

From Nov 2023 to Nov 2024