Algoma Central Corp. Reports Operating Results for the Three & Nine Months Ended September 30, 2019 & a 10% Increase in Quar...

06 November 2019 - 11:00PM

Business Wire

Algoma Central Corporation (“Algoma” or “the Company”) (TSX:

ALC), a leading provider of marine transportation services, today

announced its results for the three and nine months ended September

30, 2019.

All amounts reported below are in thousands of Canadian dollars,

except for per share data and unless otherwise noted. Third quarter

2019 highlights include:

- The Product Tanker segment earnings grew 262% driven by higher

rates and having two additional vessels operating in the quarter

compared to last year. The two new tankers enabled us to meet

customer demand with our own vessels, replacing chartered capacity

used in prior periods.

- The Ocean Self-Unloader segment is continuing to experience

strong performance as a result of steady customer demand. This,

combined with three additional ships acquired late in the second

quarter, resulted in 20% earnings growth.

- The Domestic Dry-Bulk segment earnings increased by 3% as a

result of higher freight rates on improved contract terms,

partially offset by fewer ships operating in the fleet compared to

last year and vessel out of service time.

- The Global Short Sea Shipping segment contributed $3,031 to

earnings compared to $1,988 last year. Improved earnings from

cement and gains from vessel sales are the primary drivers.

- Basic earnings per share in the 2019 third quarter were $0.55

compared to $0.51 for the same period in 2018.

EBITDA was $58,448 in the 2019 third quarter versus $49,057 for

the same period in 2018. EBITDA increased in Product Tankers and in

Ocean Self-Unloaders, partially offset by decreases in Domestic

Dry-Bulk and in Global Short Sea Shipping.

Three Months Ended

Nine Months Ended

For the periods ended September 30

2019

2018

2019

2018

Net earnings

$

21,049

$

19,639

$

20,362

$

24,941

Depreciation and amortization

22,365

18,335

62,485

50,159

Interest and taxes

14,792

9,204

19,909

14,754

Other

242

1,879

1,463

(1,932

)

Consolidated EBITDA

$

58,448

$

49,057

$

104,219

$

87,922

"Last year at this time we talked about reviewing options to add

capacity. Fast forward a year and we have added six vessels to

operations that are now fully integrated and contributing to

earnings," said Gregg Ruhl, President & CEO of the Company. "We

are also experiencing steady improvements in freight rates across

our core businesses and look forward to continued improvement in

the fourth quarter," added Mr. Ruhl.

Consolidated revenue for the 2019 third quarter was $167,901, an

increase of 6% compared to $158,729 reported for the same period in

2018. The increase was primarily a result of having additional

tankers and ocean self-unloaders in the fleet supported by improved

rates and strong customer demand in those segments. Revenue

decreased in the Domestic Dry-Bulk segment as a result of the

smaller fleet size and out of service time on two vessels, offset

by higher freight rates and improved contract terms.

There was an increase in net earnings in the quarter to $21,049,

as our core businesses and joint ventures both saw improvements in

operating earnings. This was offset by an increase in interest

expense.

Three Months Ended

Nine Months Ended

For the periods ended September 30

2019

2018

2019

2018

Revenue

$

167,901

$

158,729

$

398,923

$

358,658

Expenses

Operations

(109,589

)

(110,168

)

(291,938

)

(268,039

)

Selling, general and administrative

(7,491

)

(6,751

)

(23,072

)

(21,027

)

(117,080

)

(116,919

)

(315,010

)

(289,066

)

50,821

41,810

83,913

69,592

Depreciation and amortization

(19,227

)

(14,243

)

(50,827

)

(40,927

)

Interest expense

(5,777

)

(4,624

)

(14,361

)

(9,658

)

Interest income

220

1,891

979

2,441

Foreign currency (loss) gain

(372

)

(1,819

)

(976

)

1,521

25,665

23,015

18,728

22,969

Income Tax Expense

(7,758

)

(5,050

)

(1,528

)

(4,148

)

Net Earnings of Joint Ventures

3,142

1,674

3,162

6,120

Net Earnings

$

21,049

$

19,639

$

20,362

$

24,941

Basic earnings per share

$

0.55

$

0.51

$

0.53

$

0.65

Diluted earnings per share

$

0.52

$

0.49

$

0.53

$

0.65

The third quarter MD&A includes further details.

Full three and nine months ended September 30, 2019 results can

be found on the Company’s website at www.algonet.com/investor-relations and on SEDAR at

www.sedar.com.

Normal Course Issuer Bid

During the third quarter of 2019 and nine months ended September

30, 2019, 31,200 and 259,100 shares, respectively, were purchased

for cancellation.

Cash Dividends

The Company’s Board of Directors on November 5, 2019 authorized

payment of a quarterly dividend to shareholders of $0.11 per common

share. The dividend is payable on December 2, 2019 to shareholders

of record on November 18, 2019.

Use of Non-GAAP Measures

There are measures included in this press release that do not

have a standardized meaning under generally accepted accounting

principles (GAAP). The Company includes these measures because it

believes certain investors use these measures as a means of

assessing financial performance. EBITDA is a non-GAAP measure that

does not have any standardized meaning prescribed by IFRS and may

not be comparable to similar measures presented by other companies.

Please refer to the Management’s Discussions and Analysis for the

three and nine months ended September 30, 2019 for further

information regarding non-GAAP measures.

About Algoma Central

Algoma owns and operates the largest fleet of dry and liquid

bulk carriers operating on the Great Lakes - St. Lawrence Waterway,

including self-unloading dry-bulk carriers, gearless dry-bulk

carriers and product tankers. Algoma also owns ocean self-unloading

dry-bulk vessels operating in international markets and a 50%

interest in NovaAlgoma, which owns and operates a diversified

portfolio of dry-bulk fleets serving customers internationally.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20191106005323/en/

Gregg A. Ruhl President & CEO 905-687-7890

Peter D. Winkley Chief Financial Officer

905-687-7897

www.algonet.com or www.sedar.com

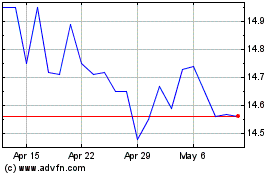

Algoma Central (TSX:ALC)

Historical Stock Chart

From Nov 2024 to Dec 2024

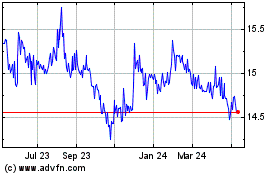

Algoma Central (TSX:ALC)

Historical Stock Chart

From Dec 2023 to Dec 2024