Allied Closes Sale of UDC Portfolio, Reaffirms Mission and Fortifies Balance Sheet

17 August 2023 - 12:18AM

Allied Properties Real Estate Investment Trust ("Allied") (TSX:

"AP.UN") today announced that it has closed the sale of its UDC

portfolio in Downtown Toronto (the “Portfolio”) to KDDI Canada,

Inc., a wholly owned subsidiary of KDDI Corporation, for $1.35

billion.

The Portfolio was comprised of freehold

interests in 151 Front Street West and 905 King Street West and a

leasehold interest in 250 Front Street West. The Portfolio was

unencumbered and did not include 20 York Street and Skywalk, the

2.5-acre site for Union Centre that is now zoned for just over 1.3

million square feet of urban workspace.

The sale of the Portfolio will result in a

significant increase in taxable income for fiscal 2023, requiring

Allied to declare and pay a special distribution to all Unitholders

of record as at December 31, 2023. Allied will determine how best

to make the special distribution as the year unfolds.

Use of Proceeds

Allied used $755 million of the proceeds from

the sale of the Portfolio to repay all amounts drawn on its

unsecured credit facility (the “Facility”). Allied also set aside

$200 million of the proceeds to repay a secured promissory note

payable on December 31, 2023, and another $49 million to repay its

remaining first mortgages on fully owned properties next year.

Allied will use the balance of the proceeds to fund its development

and upgrade activity over the remainder of 2023 and into 2024.

Reaffirmation of Mission

Allied is an owner-operator of distinctive urban

workspace in Canada’s major cities. Allied’s mission is to serve

knowledge-based organizations ever more successfully over time. The

sale of the Portfolio enables Allied to reaffirm its mission and to

pursue continued growth in NOI and IFRS value in a more focused and

prudent manner.

Over the past two decades, Allied assembled the

largest and most concentrated portfolio of economically-productive,

underutilized urban land in Canada (frequently referred to today as

“covered land”), one that affords extraordinary mixed-use

intensification potential in major cities going forward. Allied

believes deeply in the continued success of Canadian cities and has

the operating platform and the breadth of funding relationships

necessary to drive value from its existing portfolio in the coming

years and decades for the benefit of its constituents.

Fortification of Balance

Sheet

Allied has demonstrated commitment to the

balance sheet over its life as a public real estate entity. With

the completion of the sale of the Portfolio and the utilization of

the proceeds as described above, Allied expects that its net debt

as a multiple of Annualized Adjusted EBITDA at the end of the third

quarter will be approximately 8.0x. Allied also expects that its

net debt as a multiple of Annualized Adjusted EBITDA will decline

steadily over the next three years as the current large-scale

developments are completed and generate material amounts of

EBITDA.

Allied is nearing completion of the large-scale

development and upgrade activity to which it is committed and does

not expect to initiate new activity in the near-term. Accordingly,

Allied does not expect to use the Facility to any material extent

in the coming five years, with the result that it will have

approximately $900 million in liquidity through that timeframe.

Allied has a favourable debt-maturity schedule and an unencumbered,

income-producing portfolio valued in excess of $8.4 billion.

Cautionary Statements

NOI and net debt as a multiple of Annualized

Adjusted EBITDA are not financial measures defined by International

Financial Reporting Standards (“IFRS” or “GAAP”). Non-GAAP measures

do not have any standardized meaning prescribed under IFRS, and

therefore, may not be comparable to similarly titled measures

presented by other publicly traded entities, and should not be

construed as alternatives to net income or cash flow from operating

activities calculated in accordance with IFRS. Refer to the

Non-GAAP Measures section in Allied’s most recent MD&A for an

explanation of the non-GAAP measures used in this press release,

their usefulness for readers in assessing Allied’s performance and

their reconciliation to financial measures defined by IFRS as

presented in Allied’s most recent financial statements. Such

explanation is incorporated by reference herein. These statements,

together with accompanying notes and MD&A are available on

SEDAR+, www.sedarplus.ca, and are also available on Allied’s

website, www.alliedreit.com.

This press release may contain forward-looking

statements with respect to (i) Allied, (ii) its operations,

strategy, financial performance and condition and (iii) the

expected impact of the transactions contemplated in this press

release. These statements generally can be identified by use of

forward-looking words such as “may”, “will”, “expect”, “estimate”,

“anticipate”, “intends”, “believe” or “continue” or the negative

thereof or similar variations. The actual results and performance

of Allied discussed herein could differ materially from those

expressed or implied by such statements. Such statements are

qualified in their entirety by the inherent risks and uncertainties

surrounding future expectations, including that the transactions

contemplated herein have the expected impact on funding and

earnings. Important factors that could cause actual results to

differ materially from expectations include, among other things,

general economic and market conditions, competition, changes in

government regulations and the factors described under “Risk

Factors” in Allied’s Annual Information Form, which is available at

www.sedarplus.ca. These cautionary statements qualify all

forward-looking statements attributable to Allied and persons

acting on Allied’s behalf. Unless otherwise stated, all

forward-looking statements speak only as of the date of this press

release and Allied has no obligation to update such statements.

About Allied

Allied is a leading owner-operator of

distinctive urban workspace in Canada’s major cities. Allied’s

mission is to provide knowledge-based organizations with workspace

that is sustainable and conducive to human wellness, creativity,

connectivity and diversity. Allied’s vision is to make a continuous

contribution to cities and culture that elevates and inspires the

humanity in all people.

FOR FURTHER INFORMATION, PLEASE

CONTACT:

Michael EmoryFounder and Executive Chair(416)

977-9002memory@alliedreit.com

Cecilia WilliamsPresident and Chief Executive Officer(416)

977-9002cwilliams@alliedreit.com

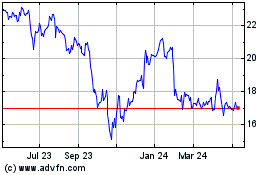

Allied Properties Real E... (TSX:AP.UN)

Historical Stock Chart

From Dec 2024 to Jan 2025

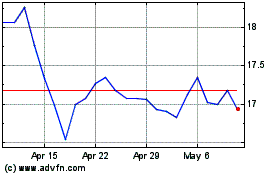

Allied Properties Real E... (TSX:AP.UN)

Historical Stock Chart

From Jan 2024 to Jan 2025